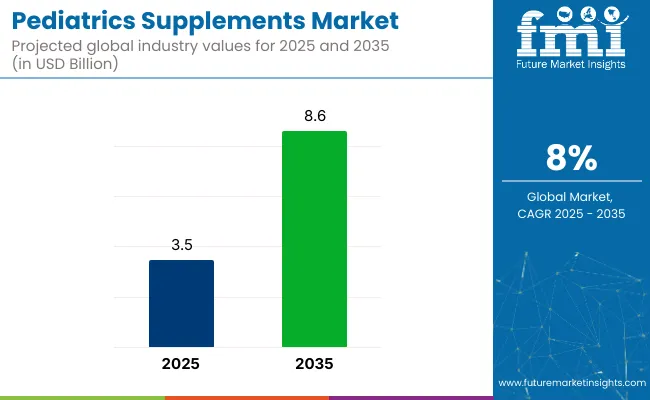

The global pediatric supplement market is valued at USD 3.5 billion in 2025 and is poised to reach USD 8.6 billion by 2035, which shows a CAGR of 8.0%. This growth is expected to be driven by rising concerns over child malnutrition, increasing preference for clean-label products, and technological advancements in supplement formulation. Additionally, manufacturers are anticipated to focus on easy-to-consume products targeting picky eaters, thereby boosting market penetration globally.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 3.5 billion |

| Forecast Value (2035) | USD 8.6 billion |

| CAGR (2025 to 2035) | 8.0% |

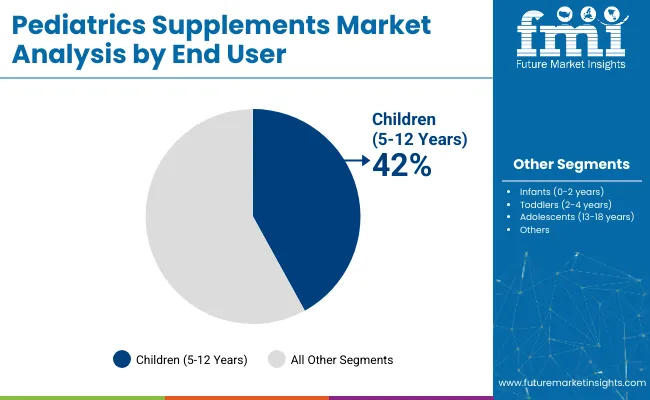

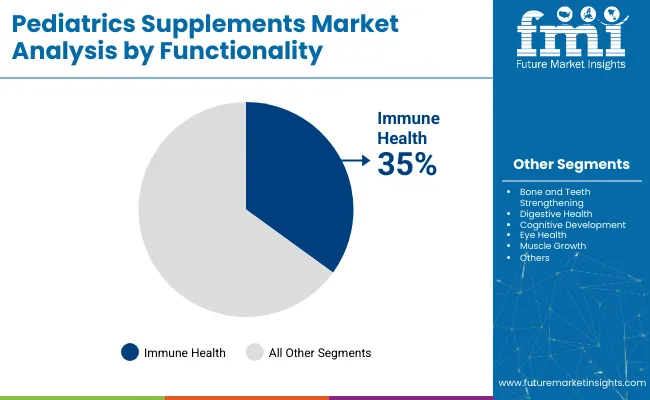

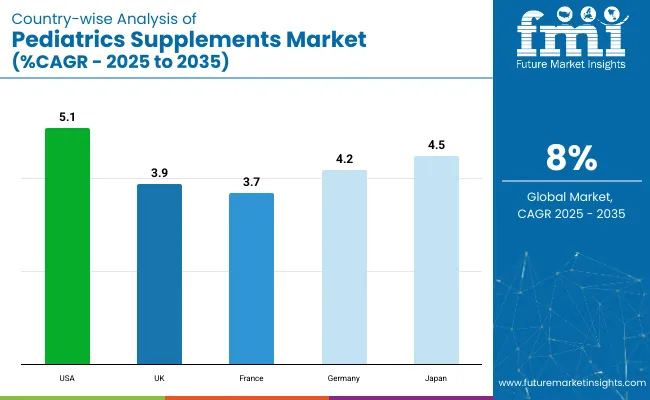

In 2025, the USA is anticipated to hold the highest CAGR at 5.1% during 2025 to 2035, due to the high adoption of nutritional supplements for children. Japan is expected to witness a CAGR of 4.5% during the forecast period, driven by rising malnutrition concerns and government initiatives. By end user demographics type, children (5-12 Years) will lead with a 42% market share, while by functionality, immune health will account for 35% of the market in 2025.

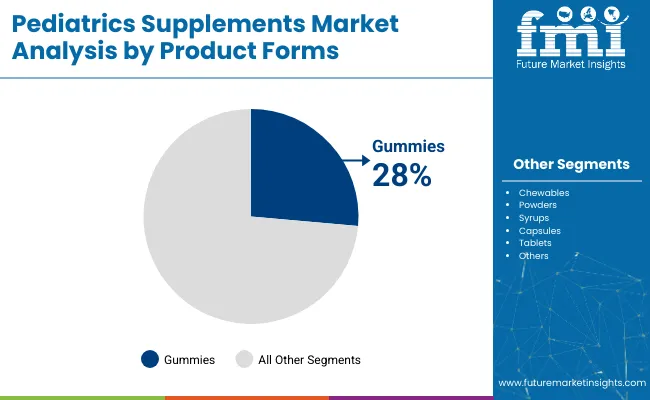

Recent innovations in the market include the development of gummy supplements, which offer a more palatable alternative to traditional formulations. These gummies are designed to appeal to children, making it easier for them to consume essential vitamins and nutrients. The market for gummy supplements is rapidly growing, driven by increased awareness of preventive care and the rising demand for child-friendly supplement options.

On the regulatory front, the USA Food and Drug Administration (FDA) has intensified efforts to ensure the safety and effectiveness of dietary supplements. In 2025, the FDA implemented significant regulatory and organizational changes, including the establishment of the Human Foods Program (HFP), aimed at modernizing the evaluation of food ingredients and dietary supplements. Additionally, the FDA has increased surveillance over new ingredients in dietary supplements, requiring manufacturers to submit evidence of safety before marketing.

The market holds a relatively niche but growing share within its broader parent markets. In the overall dietary supplements market, pediatric supplement account for approximately 8-10%, driven by rising child nutrition awareness. Within the food and beverage market, their share is around 2%, as they form a specialized segment under fortified foods and nutraceuticals.

In the healthcare and nutrition market, they contribute nearly 5%, given their role in preventive care for children. Additionally, within the functional foods market, pediatric supplement hold about 6%, reflecting increasing demand for age-targeted nutrition products with clean label and child-friendly formulations.

The pediatric supplement market is segmented into product forms, ingredient source, end user demographics type, sales channel, functionality, and region. By product forms, the market is categorized into gummies, chewables, powders, syrups, capsules, tablets, and liquid drops. Based on ingredients source, the market is segmented into plant-based (herbal extracts, algae, etc.), animal-based (fish oil, collagen, etc.), synthetic (lab-made vitamins/minerals), and organic/natural.

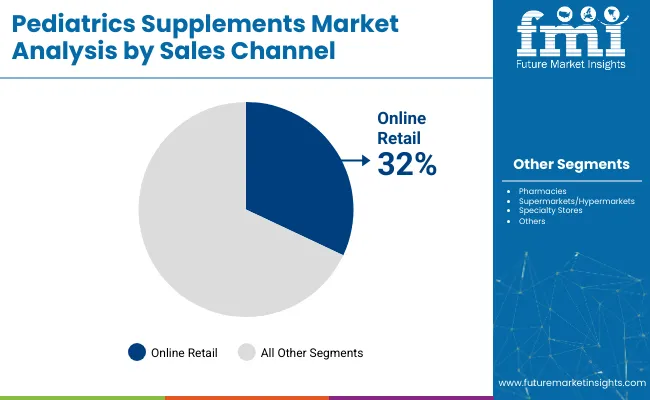

By end user demographics type, the market is classified into infants (0-2 years), toddlers (2-4 years), children (5-12 years), and adolescents (13-18 years). By sales channel, the market is segmented into pharmacies, supermarkets/hypermarkets, online retail, specialty stores (health & wellness), pediatric clinics, and direct sales (MLM, subscription services).

Based on functionality, the market is categorized into immune health, bone and teeth strengthening, digestive health, cognitive development, eye health, muscle growth, and overall growth and development. Regionally, the market is segmented into North America, Latin America, Europe, South Asia, East Asia, Oceania, and the Middle East & Africa.

The gummies segment in the pediatric supplement market is projected to hold the largest share, accounting for approximately 28% in 2025.

The plant-based segment under ingredients source is projected to hold the largest market share, estimated at around 34% in 2025.

The children segment (5-12 years) is projected to hold the largest market share, estimated at approximately 42% in 2025.

The online retail segment is projected to hold the largest market share among sales channels, holding around a 32% share in 2025.

The immune health segment is projected to hold the largest market share among functionalities, holding around 35% in 2025.

The global pediatric supplement market is growing steadily, driven by rising awareness of child nutrition, increasing demand for clean-label and plant-based formulations, and advancements in personalized and age-specific supplement technologies.

Recent Trends in the Pediatric Supplement Market

Challenges in the Pediatric Supplement Market

The pediatric supplement market shows varied growth rates across key countries. The USA leads with a CAGR of 5.1%, driven by strong parental awareness and established brands. Japan follows at 4.5% CAGR, supported by functional and herbal supplement demand. Germany records a 4.2% CAGR, backed by clinical trust and organic formulations. The UK market is poised to grow at 3.9% CAGR, driven by vegan and plant-based product adoption. France shows the lowest among these, with a 3.7% CAGR, as demand rises for immunity and bone health supplements.

This report covers in depth-analysis of 40+ countries; five top-performing OECD Countries are highlighted below.

The USA pediatric supplement market is projected to grow at a CAGR of 5.1% from 2025 to 2035.

The UK pediatric supplement revenue is expected to expand at a CAGR of 3.9% during the forecast period.

Germany’s pediatric supplements revenue is forecasted to grow at a CAGR of 4.2% between 2025 and 2035.

Sales of pediatric supplement in France are projected to register a CAGR of 3.7% from 2025 to 2035.

Japan’s pediatric supplement market is anticipated to grow at a CAGR of 4.5% during the forecast period.

The market is moderately consolidated, with key players like Pfizer, Nestlé SA, Reckitt Benckiser Group Plc, and Abbott holding significant market shares. These companies are actively investing in product innovation, strategic partnerships, and global expansion to strengthen their positions.

Pfizer continues to focus on research and development, introducing new formulations to address specific pediatric health needs. Nestlé SA is expanding its pediatric nutrition portfolio, emphasizing clean-label and plant-based products to meet evolving consumer preferences. Reckitt Benckiser Group Plc is streamlining its operations to concentrate on high-growth areas, while Abbott is enhancing its product offerings through technological advancements and strategic acquisitions.

Recent Pediatric Supplements Industry News

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 3.5 billion |

| Projected Market Size (2035) | USD 8.6 billion |

| CAGR (2025 to 2035) | 8.0% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD billion/Volume in Units |

| By Product Forms | Gummies, Chewables, Powders, Syrups, Capsules, Tablets, Liquid Drops |

| By Ingredients Source | Plant-Based, Animal-Based, Synthetic, Organic/Natural |

| By End User Demographics Type | Infants (0-2 years), Toddlers (2-4 years), Children (5-12 years), Adolescents (13-18 years) |

| By Sales Channel | Pharmacies, Supermarkets/Hypermarkets, Online Retail, Specialty Stores, Pediatric Clinics, Direct Sales |

| By Functionality | Immune Health, Bone and Teeth Strengthening, Digestive Health, Cognitive Development, Eye Health, Muscle Growth, Overall Growth and Development |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia |

| Key Players | Talbots Inc., Pfizer, Reckitt Benckiser Group Plc, Nestle SA, NuBest Nutritionals, Abbott, Olly Nutrition (acquired by Unilever), Goodbaby International Holdings Limited, TruHeight, Ajinomoto Health & Nutrition, Nutritional Growth Solutions, ChildLife Essentials, Else Nutrition Holdings Inc., Bayer, Brightchamps Tech Private Limited, Piramal Enterprises Ltd, MRO Maryruth LLC, Phytoral, Lifetrients, Omniactive, Valeant Pharmaceuticals International, Captek Softgel International Inc., Nuvamin LLC, Core Nutritionals, Nature's Craft. |

| Additional Attributes | Dollar sales by value, market share analysis by region, and country-wise analysis. |

As per product type, the industry has been categorized into Gummies, Chewables, Powders, Syrups, Capsules, Tablets, and Liquid Drops.

As per ingredient type, the industry has been categorized into Plant-Based (Herbal extracts, Algae, etc.), Animal-Based (Fish oil, Collagen, etc.), Synthetic (Lab-made vitamins/minerals), and Organic/Natural.

This segment is further categorized into Infants (0-2 years), Toddlers (2-4 years), Children (5-12 years), and Adolescents (13-18 years).

As per the sales channel, the industry has been categorized into Pharmacies, Supermarkets/Hypermarkets, Online Retail, Specialty Stores (Health & Wellness), Pediatric Clinics, and Direct Sales (MLM, Subscription services).

This segment is further categorized into Immune Health, Bone and Teeth Strengthening, Digestive Health, Cognitive Development, Eye Health, Muscle Growth, and Overall Growth & Development.

Industry analysis has been carried out in key countries of North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East & Africa.

The market is valued at USD 3.5 billion in 2025.

The market is expected to grow at a CAGR of 8.0% from 2025 to 2035.

Gummies are projected to hold the largest share with 28% in 2025.

The plant-based segment leads the pediatric supplement market, holding around 34% market share in 2025 due to rising demand for natural and herbal formulations.

The USA is projected to record the fastest growth with a CAGR of 5.1% during 2025 to 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pediatric Measuring Devices Market Size and Share Forecast Outlook 2025 to 2035

Pediatric Dental Market Size and Share Forecast Outlook 2025 to 2035

Pediatric Tube Feeding Market Analysis by Formula Type, Feeding Method, Form, Specific Needs, Dietary Preference, Age, Distribution Channel and Region Through 2035

Pediatric Home Healthcare Market - Growth & Demand Trends 2025 to 2035

Pediatric Obesity Management Market Analysis by Drug Class, Route of Administration, Distribution Channel and Region: Forecast for 2025 to 2035

Pediatric Heart Valve Repair and Replacement Analysis by Product, Induction, End Users and Region-2025 to 2035

Pediatric Nutrition Market – Growth, Demand & Child Health Trends

Global Pediatric Diabetes Therapeutic Market Analysis – Size, Share & Forecast 2024-2034

Global Pediatric Clinical Trial Market Analysis – Size, Share & Forecast 2024-2034

Pediatric Vitrectomy Market

Pediatric Nasal Cannula Market

Adult and Pediatric Hemoconcentrators Market Size and Share Forecast Outlook 2025 to 2035

Calcium Gluconate Demand Analysis - Size Share and Forecast Outlook 2025 to 2035

Supplements And Nutrition Packaging Market

Supplementary Protectors Market

ACF Supplements Market Size and Share Forecast Outlook 2025 to 2035

Food Supplement Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Viscosupplementation Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

PDRN Supplements Market Size and Share Forecast Outlook 2025 to 2035

Viscosupplementation Industry Analysis in Europe - Size, Share & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA