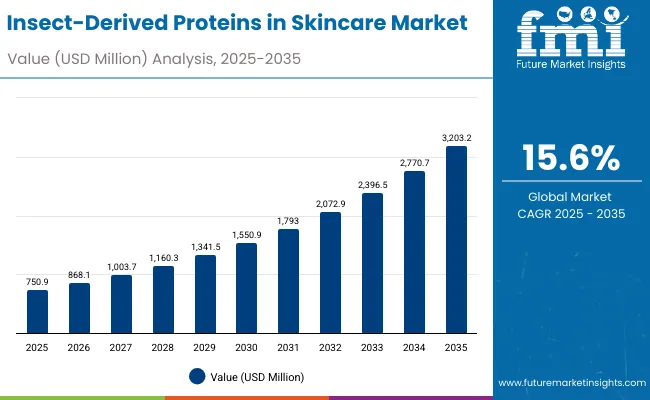

The Insect-Derived Proteins in Skincare Market is expected to record a valuation of USD 750.9 million in 2025 and USD 3,203.2 million in 2035, with an increase of USD 2,452.3 million, which equals a growth of more than 193% over the decade. The overall expansion represents a CAGR of 15.6% and a 4X increase in market size.

Insect-Derived Proteins in Skincare Market Key Takeaways

| Metric | Value |

|---|---|

| Insect-Derived Proteins in Skincare Market Estimated Value in (2025E) | USD 750.9 million |

| Insect-Derived Proteins in Skincare Market Forecast Value in (2035F) | USD 3,203.2 million |

| Forecast CAGR (2025 to 2035) | 15.6% |

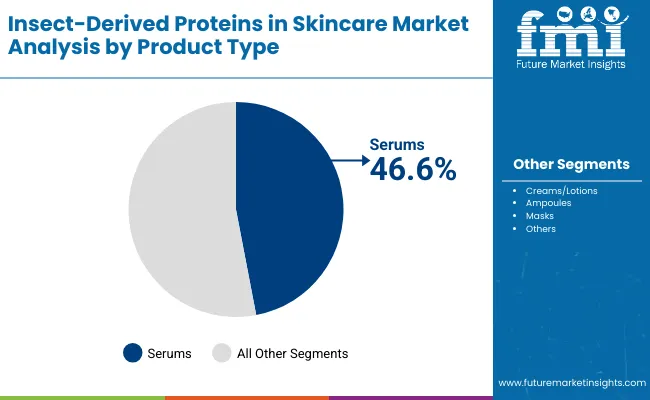

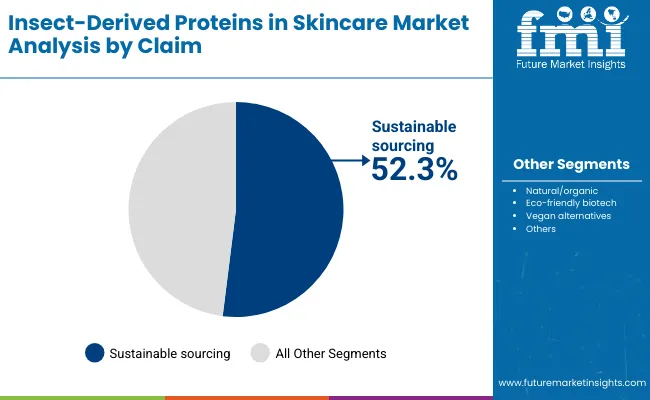

During the first five-year period from 2025 to 2030, the market increases from USD 750.9 million to USD 1,550.9 million, adding USD 800 million, which accounts for around 32% of the total decade growth. This phase records steady adoption in premium skincare segments, including dermatology-driven anti-aging serums and creams, supported by the need for naturally derived actives. Serums dominate this period as they cater to nearly 46.6% of applications requiring high bioactivity concentration for wrinkle reduction and repair. Sustainable sourcing claims rise rapidly, taking more than 52% of consumer preference in 2025, positioning insect-based proteins as a novel eco-friendly solution compared to traditional collagen or keratin.

The second half from 2030 to 2035 contributes USD 1,652.3 million, equal to nearly 68% of total growth, as the market jumps from USD 1,550.9 million to USD 3,203.2 million. This acceleration is powered by widespread deployment of biotech-driven synthetic replicas of insect proteins, vegan alternatives aligned with ethical standards, and strong traction in Asian and European beauty markets. Hydration and barrier strengthening products gain share alongside regeneration, with fly larva extracts and beetle-derived peptides entering mainstream formulations. Distribution expands aggressively via e-commerce and specialty beauty retail, while premium dermatology clinics drive high-value ampoule and mask sales. The rising adoption of eco-friendly biotech and fermentation-based protein replication adds recurring revenue streams, strengthening the sustainability positioning of the industry.

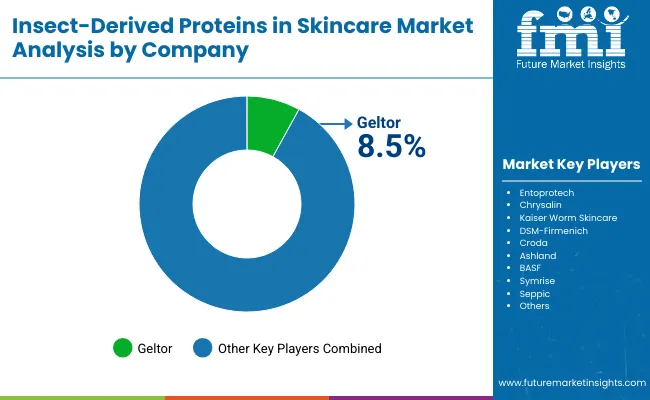

From 2020 to 2024, the Insect-Derived Proteins in Skincare Market grew steadily as biotech innovators tested insect protein extraction and peptide stabilization methods. During this period, the competitive landscape was dominated by traditional chemical and bio-based ingredient suppliers, while insect-based solutions represented less than 5% of the active skincare protein market. The emphasis was on research pilots and eco-positioning, with early movers like Geltor leading in synthetic biology innovations. Market entry was limited but laid the foundation for sustainability claims and natural-origin marketing, particularly in niche anti-aging and hydration serums.

Demand for insect-derived actives expands significantly to USD 750.9 million in 2025, and the revenue mix begins to shift as biotech-based fermentation and scalable protein synthesis models emerge. Traditional ingredient leaders such as DSM-Firmenich, BASF, and Croda face rising competition from insect-specialized startups like Entoprotech and Kaiser Worm Skincare, as well as digital-first biotech players offering sustainable replicas. Major ingredient suppliers are pivoting to hybrid models, integrating insect-based peptides with existing collagen and elastin portfolios to retain market share. Emerging entrants specializing in eco-friendly biotech, sustainable sourcing, and AR/VR-enabled beauty retail are gaining share, particularly across Asia and Europe. The competitive advantage is moving away from legacy raw material sourcing toward sustainability-driven formulations, transparent supply chains, and consumer-focused brand narratives.

Advances in sustainable sourcing and bio-fermentation have transformed insect-derived proteins into scalable, eco-friendly cosmetic actives. Companies are developing extraction methods that preserve peptide bioactivity, enabling more efficient wrinkle repair, hydration, and skin barrier support. Serums and creams containing silkworm-derived proteins are increasingly used for anti-aging and regeneration, while beetle-derived peptides and fly larva extracts are being explored for hydration and barrier repair. The trend toward sustainable sourcing, which holds more than 52% share in 2025, is central to market growth as beauty consumers demand alternatives to animal-derived collagen and keratin.

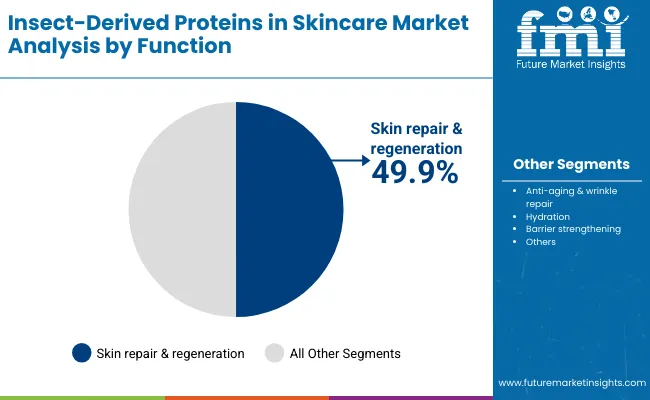

Expansion of regenerative skincare and dermatology-led products has fueled market adoption. In particular, skin repair & regeneration is the leading functional segment with nearly 50% share, highlighting its dominance in premium anti-aging skincare. Innovations in ampoule delivery, mask formulations, and synthetic vegan replicas of insect proteins are opening new application areas, while consumer perception is shifting positively toward insect-derived solutions framed as eco-biotech. Segment growth is expected to be led by serums in the product category, skin regeneration in function, and sustainable sourcing claims, due to their adaptability, credibility, and alignment with long-term sustainability trends.

The market is segmented by source, function, product type, channel, and claim. Sources include silk proteins from silkworms, beetle-derived peptides, fly larva extracts, and other insect-based bio-actives, highlighting the diversity of proteins driving adoption. Functional segmentation covers anti-aging & wrinkle repair, skin repair & regeneration, hydration, and barrier strengthening, catering to a wide spectrum of skin concerns. Based on product type, categories include serums, creams/lotions, masks, and ampoules, with serums leading in concentration-based formulations. Distribution spans e-commerce, pharmacies, premium dermatology clinics, and specialty beauty retail, underscoring the omnichannel approach in beauty. Claims include sustainable sourcing, natural/organic, eco-friendly biotech, and vegan alternatives (synthetic replicas), which collectively define brand positioning and consumer trust.

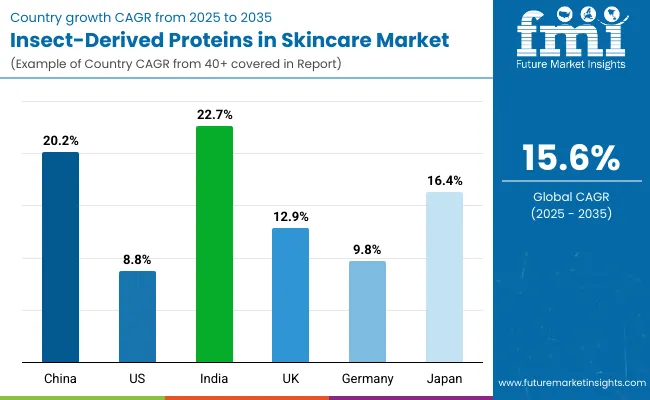

Regionally, the scope spans North America, Latin America, Western and Eastern Europe, East Asia, South Asia and Pacific, and the Middle East and Africa. Key growth markets such as China (20.2% CAGR), India (22.7% CAGR), and Japan (16.4% CAGR) highlight Asia’s leadership, while the USA remains a major contributor with nearly 20% global share in 2025. Europe, led by Germany and the UK, provides steady growth, driven by eco-labeling regulations and consumer awareness.

| Function | Value Share% 2025 |

|---|---|

| Skin repair & regeneration | 49.9% |

| Others | 50.1% |

The skin repair & regeneration segment is projected to contribute nearly 50% of the Insect-Derived Proteins in Skincare Market revenue in 2025, maintaining its lead as the dominant functional category. This dominance stems from the proven efficacy of insect-derived proteins, such as silk proteins and beetle-derived peptides, in stimulating collagen synthesis, repairing micro-tears, and accelerating cell turnover. Consumers are increasingly prioritizing products that deliver visible results for anti-aging and post-treatment recovery, making regenerative claims highly appealing.

Growth in this segment is also fueled by premium skincare launches targeting wrinkle repair, elasticity improvement, and dermal rejuvenation, often positioned as biotech-driven solutions in serums and ampoules. Dermatology clinics and specialty beauty retailers play a pivotal role in expanding access to these formulations. As biotech innovation advances, the introduction of synthetic replicas of insect proteins offers vegan-friendly regeneration options, further broadening consumer acceptance. The skin repair & regeneration segment is expected to remain the backbone of functional demand, anchoring the market’s premium growth trajectory.

| Product Type | Value Share% 2025 |

|---|---|

| Serums | 46.6% |

| Others | 53.4% |

The serums segment is forecasted to hold 46.6% of the market share in 2025, led by its concentrated delivery format and high consumer trust in efficacy-driven products. Serums are especially effective carriers for insect-derived actives like silkworm fibroin and fly larva extracts, as their lightweight textures allow deep penetration into the dermal layers for wrinkle reduction, hydration, and barrier repair.

This product type has gained traction in both e-commerce and dermatology clinics, where consumers seek targeted treatments rather than generic skincare routines. Serums are also favored in Asia-Pacific markets, particularly China and Japan, where premium skincare adoption is accelerating at double-digit CAGR rates. Growth is further supported by innovations in ampoule-serum hybrids and biodegradable packaging, aligning with sustainability trends. With rising global demand for precision skincare formats, serums are expected to continue dominating the product type segment throughout the forecast period.

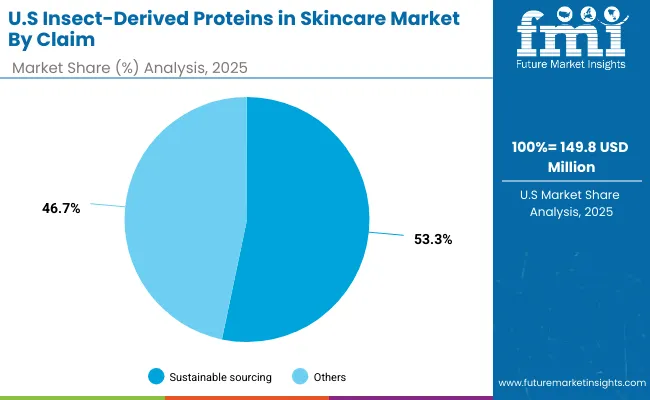

| Claim | Value Share% 2025 |

|---|---|

| Sustainable sourcing | 52.3% |

| Others | 47.7% |

The sustainable sourcing segment is projected to account for more than 52% of the Insect-Derived Proteins in Skincare Market revenue in 2025, establishing it as the leading claim. Sustainability has become a non-negotiable factor in beauty, and insect-derived proteins offer an inherent advantage due to their low ecological footprint, minimal water usage, and reduced carbon emissions compared to livestock-based proteins.

Brands are leveraging this positioning to appeal to eco-conscious consumers, particularly in Europe and North America, where green labeling and traceability are critical. Sustainable sourcing also resonates with millennial and Gen Z consumers, who view insect proteins as futuristic and innovative while aligning with ethical consumption. The claim’s dominance is reinforced by the ability of companies to highlight circularity and waste-to-value narratives, such as extracting proteins from insect farming byproducts.

As global regulatory bodies tighten frameworks around sustainability disclosures, and as major suppliers like Croda, BASF, and Symrise integrate insect-based actives into their bio-based portfolios, sustainable sourcing will remain at the core of product differentiation and consumer trust.

Rising Preference for Sustainable Protein Alternatives in Skincare

One of the most powerful drivers is the consumer and regulatory push toward low-impact, sustainable actives. Insect-derived proteins require significantly less land, water, and feed compared to traditional protein sources like bovine collagen or marine elastin. This sustainability advantage translates into strong branding opportunities, as claims of eco-friendly sourcing already account for more than 52% of global value in 2025.

In markets like Europe, where regulations increasingly require environmental transparency, insect proteins provide companies with a measurable sustainability story. Premium beauty brands and biotech startups are leveraging this to differentiate themselves and command higher price points. As consumers demand proof-based sustainability, the ability of insect protein suppliers to demonstrate carbon savings and traceable sourcing will further accelerate demand.

Superior Bioactivity for Regeneration and Barrier Repair

Unlike many plant-based alternatives, insect proteins (e.g., silkworm fibroin, beetle-derived peptides, and larva extracts) have demonstrated high efficacy in skin regeneration, collagen stimulation, and barrier strengthening. This has made the function segment of skin repair & regeneration dominant with nearly 50% share in 2025. Clinical studies are beginning to validate these proteins’ roles in accelerating wound healing and improving elasticity, which makes them attractive for dermatology-led product launches and medical-grade cosmeceuticals. The ability to provide visible and science-backed results is a strong competitive driver, especially in premium categories like serums and ampoules, where efficacy dictates consumer loyalty.

Consumer Perception and Cultural Resistance

Despite sustainability and efficacy, insect-based proteins still face perceptual and cultural barriers in several markets. In North America and Europe, some consumers associate insect derivatives with “novel foods” or “unfamiliar sources,” creating hesitation around skincare application. Even though formulations are odorless and refined, the idea of applying fly larva extract or beetle peptides to skin may cause initial consumer pushback. Brands must invest heavily in educational campaigns, rebranding insect proteins as biotech actives rather than insect-derived, to mitigate these perceptions. Until then, mainstream adoption will remain slower compared to Asia, where cultural familiarity with insect-derived ingredients is higher.

Limited Industrial-Scale Production and Cost Barriers

The market is constrained by the lack of large-scale production infrastructure for insect proteins. Unlike plant or marine proteins, supply chains for silkworm fibroin or beetle peptides are not fully optimized, leading to higher costs and inconsistent supply volumes. While fermentation and biotech replication (e.g., Geltor’s synthetic replicas) are solving scalability issues, traditional extraction methods remain cost-intensive. This restricts adoption among mid-range skincare brands and limits insect proteins mostly to premium or luxury lines. Unless production scales efficiently and costs decline, the market risks being confined to niche and high-priced segments, slowing broader uptake.

Shift Toward Synthetic Vegan Replicas of Insect Proteins

A major emerging trend is the development of vegan, lab-created replicas of insect proteins through precision fermentation. While insect farming is already more sustainable than livestock, biotech companies like Geltor are advancing protein replication that delivers identical functional benefits without direct insect sourcing. This addresses both consumer hesitation and vegan market demands, creating a dual advantage: sustainability plus ethical acceptance. By 2030, these synthetic alternatives are expected to capture meaningful share, making insect-derived proteins not just about “insects” but about biotech-enabled eco-actives.

Premiumization Through Dermatology Clinics and Ampoule Formats

The second trend is the premiumization of delivery formats, especially ampoules and high-concentration serums distributed through dermatology clinics and specialty retail. These channels are trusted for efficacy and allow brands to price insect-protein products at a premium. For example, fibroin-based serums are already marketed as luxury anti-aging treatments in China and Japan, where CAGR is above 16%. This trend strengthens consumer perception of insect proteins as cutting-edge, science-led innovations rather than experimental niche actives. Over time, ampoule adoption and premium clinical positioning will create halo effects, boosting consumer confidence and mainstreaming insect proteins into lotions and masks as secondary formats.

| Countries | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 20.2% |

| USA | 8.8% |

| India | 22.7% |

| UK | 12.9% |

| Germany | 9.8% |

| Japan | 16.4% |

The Insect-Derived Proteins in Skincare Market shows strong regional variance in growth potential, with India (22.7% CAGR) and China (20.2% CAGR) emerging as the fastest-expanding countries. This momentum is driven by rising disposable incomes, a rapidly expanding middle-class consumer base, and increasing awareness of sustainable beauty solutions in Asia. In India, biotech-led beauty startups and international collaborations are accelerating the use of insect protein-based actives, especially in regeneration-focused serums and hydration products.

Similarly, China is positioning itself as a leading innovation hub, with regulatory encouragement for eco-friendly cosmetic actives and strong adoption of premium skincare formats like ampoules and masks. Both countries reflect consumer openness to novel bio-actives and sustainable positioning, creating fertile ground for large-scale adoption.

In contrast, mature markets such as the USA (8.8% CAGR) and Germany (9.8% CAGR) are expanding at steadier rates, reflecting higher market saturation and more cautious consumer acceptance of insect-derived actives. Growth here is fueled primarily by sustainability claims and dermatologist-led premium brands that integrate insect proteins as part of advanced anti-aging formulations. The UK (12.9% CAGR) and Japan (16.4% CAGR) occupy a middle ground.

Japan benefits from a strong cultural acceptance of biotech-based skincare and premiumization trends, while the UK is leveraging rising consumer demand for ethical and eco-friendly products. These country dynamics underline how Asia, led by India, China, and Japan, will account for the strongest momentum, while Europe and the USA provide stable but slower growth, primarily anchored in premium and sustainable skincare niches.

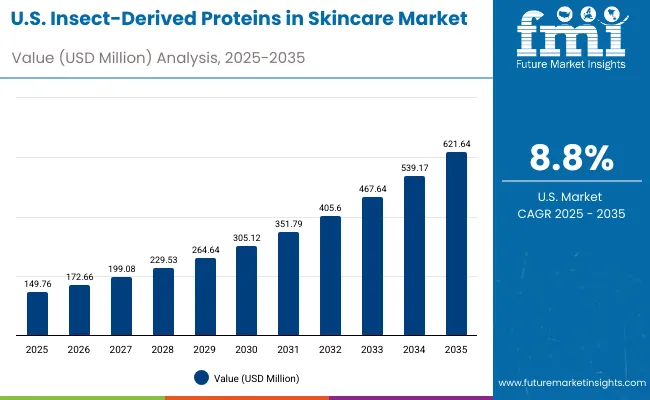

| Year | USA Insect-Derived Proteins in Skincare Market (USD Million) |

|---|---|

| 2025 | 149.76 |

| 2026 | 172.66 |

| 2027 | 199.08 |

| 2028 | 229.53 |

| 2029 | 264.64 |

| 2030 | 305.12 |

| 2031 | 351.79 |

| 2032 | 405.60 |

| 2033 | 467.64 |

| 2034 | 539.17 |

| 2035 | 621.64 |

The Insect-Derived Proteins in Skincare Market in the United States is projected to grow at a CAGR of 8.8%, led by increasing consumer interest in sustainable, biotech-based skincare actives. Demand is particularly strong for products with sustainable sourcing claims, which account for over 53% of USA sales in 2025. Dermatology-driven formulations in serums and creams are recording consistent adoption, especially for anti-aging and barrier repair applications. Growth is also supported by premium clinical channels, where insect-derived proteins are being positioned as cutting-edge solutions for wrinkle reduction and skin regeneration. E-commerce and specialty beauty retail are driving visibility, with brands emphasizing traceability and eco-labeling to appeal to eco-conscious and millennial buyers.

The Insect-Derived Proteins in Skincare Market in the United Kingdom is expected to grow at a CAGR of 12.9%, supported by innovation in sustainable and cruelty-free beauty. British brands are positioning insect proteins as eco-friendly biotech solutions, using narratives around low-carbon supply chains and biodegradable packaging. The UK market is also benefiting from premium skincare launches in serums and ampoules, which are gaining traction in department stores and dermatology-led clinics. Regulatory support for sustainable sourcing and consumer awareness of ethical ingredients are key accelerators. Heritage beauty retailers are introducing insect-protein formulations within clean beauty categories, aligning with rising demand for natural/organic and vegan alternatives.

India is witnessing the fastest growth in the Insect-Derived Proteins in Skincare Market, forecast to expand at a CAGR of 22.7% through 2035. Rising demand is driven by urban millennials and Gen Z consumers seeking affordable premium skincare with natural and biotech claims. Local beauty startups and Ayurveda-inspired brands are integrating insect proteins into hydration and barrier repair products, often positioned as eco-friendly biotech alternatives to traditional herbal actives. Rapid adoption is also visible in tier-2 and tier-3 cities, where cost-effective launches and e-commerce accessibility are boosting penetration. The education sector and dermatology clinics are reinforcing consumer trust through scientific awareness campaigns, further accelerating adoption.

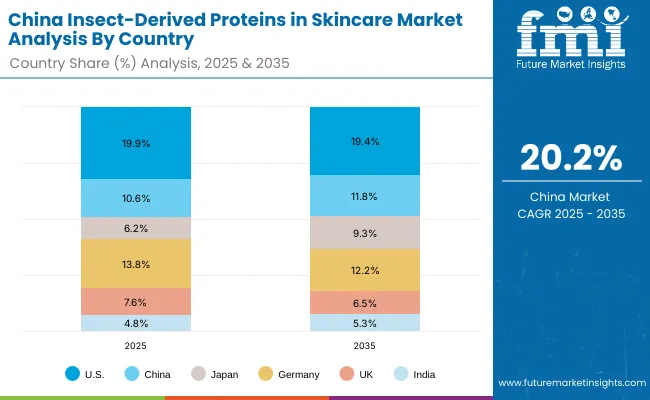

| Countries | 2025 Share (%) |

|---|---|

| USA | 19.9% |

| China | 10.6% |

| Japan | 6.2% |

| Germany | 13.8% |

| UK | 7.6% |

| India | 4.8% |

| Countries | 2035 Share (%) |

|---|---|

| USA | 19.4% |

| China | 11.8% |

| Japan | 9.3% |

| Germany | 12.2% |

| UK | 6.5% |

| India | 5.3% |

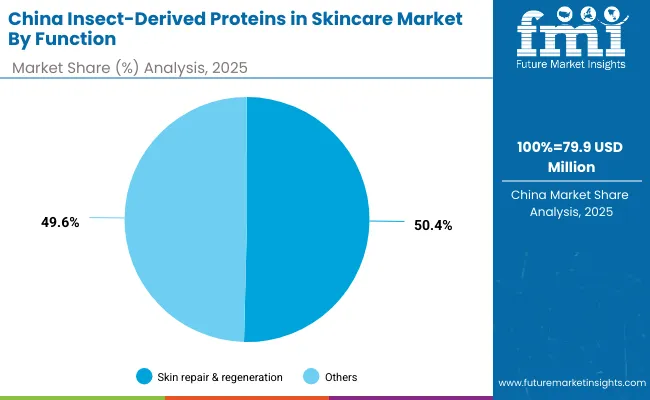

The Insect-Derived Proteins in Skincare Market in China is expected to grow at a CAGR of 20.2%, the second-fastest among leading economies. Growth is led by skin regeneration products, which already account for 50.4% of market value in 2025. Chinese consumers are quick adopters of innovative biotech ingredients, and insect-derived proteins align strongly with the country’s premium skincare boom.

Local biotech firms and multinational beauty brands are accelerating launches in ampoules, serums, and high-concentration creams, marketed heavily through e-commerce and livestreaming platforms. Supportive government initiatives for biotech innovation and consumer enthusiasm for eco-friendly solutions provide additional tailwinds. With rapid growth in urban skincare consumption, insect proteins are expected to become mainstream in China’s premium beauty portfolio by 2030.

| USA by Claim | Value Share% 2025 |

|---|---|

| Sustainable sourcing | 53.3% |

| Others | 46.7% |

The Insect-Derived Proteins in Skincare Market in the United States is projected at USD 149.8 million in 2025. Sustainable sourcing contributes 53.3%, while other claims such as natural/organic and eco-biotech account for 46.7%, which shows a clear value tilt toward environmental positioning and transparency. This dominance stems from strong consumer demand for eco-certified, traceable skincare solutions and from tightening regulations around sustainability labeling. Unlike traditional collagen or marine proteins, insect-derived actives are marketed as low-carbon, water-efficient alternatives, making them highly relevant to USA consumers who prioritize eco-friendly choices.

Growth is also being driven by premium dermatology clinics and e-commerce retailers, where insect proteins are positioned as cutting-edge anti-aging and regeneration actives. Serums and creams dominate sales, while ampoules are emerging as high-value add-ons in clinical settings. American brands are emphasizing science-backed storytelling and digital campaigns to overcome consumer hesitation about insect-based ingredients. As adoption deepens, the USA market is expected to continue shaping global narratives around sustainability and biotech-driven beauty.

| China by Function | Value Share% 2025 |

|---|---|

| Skin repair & regeneration | 50.4% |

| Others | 49.6% |

The Insect-Derived Proteins in Skincare Market in China is valued at USD 79.9 million in 2025, with skin repair & regeneration leading at 50.4%, followed closely by other functions such as hydration and barrier strengthening at 49.6%. The dominance of regeneration is a direct outcome of China’s premium skincare composition, where anti-aging, elasticity repair, and post-treatment recovery are the fastest-growing categories. Serums and ampoules incorporating silkworm fibroin and larva peptides are widely marketed in urban centers, supported by heavy promotion through e-commerce livestreams and KOL-driven beauty campaigns.

This advantage positions insect proteins as a high-potential active for China’s premium beauty sector, where efficacy and novelty drive consumer adoption. Hydration-focused products are also expanding, especially among younger consumers who prioritize daily skincare routines with natural, eco-friendly positioning. As biotech partnerships between local firms and global ingredient suppliers increase, insect proteins are likely to move from niche launches into mainstream premium portfolios.

The Insect-Derived Proteins in Skincare Market is moderately fragmented, with biotech innovators, global ingredient suppliers, and niche insect-focused firms competing across diverse application areas. Biotech leaders such as Geltor hold significant share, leveraging synthetic biology platforms to develop vegan replicas of insect proteins, which align with ethical consumer trends while retaining the bioactivity benefits of fibroin and peptides. Their strategy emphasizes precision fermentation, scalability, and licensing partnerships with global cosmetic brands.

Established chemical and life-science giants, including DSM-Firmenich, Croda, BASF, and Symrise, are integrating insect-derived actives into their wider protein and peptide portfolios. Their global reach and regulatory expertise enable them to accelerate market penetration, particularly in Europe and North America. Mid-sized innovators like Entoprotech, Chrysalin, and Kaiser Worm Skincare focus on niche specializations, from silkworm fibroin for elasticity to larva extracts for hydration, creating competitive differentiation through unique sourcing and positioning.

Competitive differentiation is shifting away from ingredient sourcing alone toward a broader ecosystem of sustainability claims, biotech-enabled scalability, and storytelling that appeals to eco-conscious consumers. Companies that can combine scientific validation, transparent supply chains, and consumer trust-building will dominate the next growth phase.

Key Developments in Insect-Derived Proteins in Skincare Market

| Item | Value |

|---|---|

| Quantitative Units | USD 750.9 Million |

| Source | Silk proteins from silkworms, Beetle-derived peptides, Fly larva extracts, and Other insect-based bio-actives |

| Function | Anti-aging & wrinkle repair, Skin repair & regeneration, Hydration, and Barrier strengthening |

| Product Type | Serums, Creams/lotions, Masks, and Ampoules |

| Channel | E-commerce, Pharmacies, Premium dermatology clinics, and Specialty beauty retail |

| Claim | Sustainable sourcing, Natural/organic, Eco-friendly biotech, and Vegan alternatives (synthetic replicas) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Entoprotech, Chrysalin, Kaiser Worm Skincare, Geltor, DSM- Firmenich, Croda, Ashland, BASF, Symrise, Seppic |

| Additional Attributes | Dollar sales by product type and claim, adoption trends in skin regeneration and hydration, rising demand for serums and ampoules, sector-specific growth in dermatology clinics and e-commerce, sustainable and eco-labeling driven revenue segmentation, integration with biotech-driven vegan alternatives, regional trends influenced by consumer awareness and regulation, and innovations in fibroin peptides, beetle-derived actives, and bio-fermentation methods. |

The Insect-Derived Proteins in Skincare Market is estimated to be valued at USD 750.9 million in 2025.

The market size for the Insect-Derived Proteins in Skincare Market is projected to reach USD 3,203.2 million by 2035.

The Insect-Derived Proteins in Skincare Market is expected to grow at a 15.6% CAGR between 2025 and 2035.

The key product types in the Insect-Derived Proteins in Skincare Market are serums, creams/lotions, masks, and ampoules.

In terms of function, the skin repair & regeneration segment is projected to command 49.9% share in the Insect-Derived Proteins in Skincare Market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Oat Proteins Market Size and Share Forecast Outlook 2025 to 2035

Algae Proteins Market Trends – Sustainable Nutrition & Market Growth 2025 to 2035

Algal Proteins Market

Canola Proteins Market

Phycobiliproteins Market

Bioactive Proteins in Coffee Market

Antifreeze proteins Market Size and Share Forecast Outlook 2025 to 2035

Bio-Mimetic Proteins Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Alternative Proteins for Pets Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Plant Derived Proteins Market Size and Share Forecast Outlook 2025 to 2035

Marine Derived Proteins Market Size and Share Forecast Outlook 2025 to 2035

Lipid Transfer Proteins Market

Hydrolyzed Silk Proteins Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Mammalian Derived Proteins Market Size and Share Forecast Outlook 2025 to 2035

Hydrolyzed Vegetable Proteins Market Size and Share Forecast Outlook 2025 to 2035

Extracellular Matrix Proteins Market

Synthetic Spider Silk Proteins Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Instruments for Peptide Drug Synthesis Market Size and Share Forecast Outlook 2025 to 2035

Industrial Dust Treatment System Market Size and Share Forecast Outlook 2025 to 2035

Injectable Osteoarthritis Microspheres Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA