The Indonesia Pet Care Market is estimated to be valued at USD 2.8 billion in 2025 and is projected to reach USD 6.8 billion by 2035, registering a compound annual growth rate (CAGR) of 9.5% over the forecast period.

| Metric | Value |

|---|---|

| Indonesia Pet Care Market Estimated Value in (2025 E) | USD 2.8 billion |

| Indonesia Pet Care Market Forecast Value in (2035 F) | USD 6.8 billion |

| Forecast CAGR (2025 to 2035) | 9.5% |

The Indonesia pet care market is expanding steadily, driven by rising pet ownership, increasing disposable incomes, and evolving consumer lifestyles that prioritize animal health and well being. Growing urbanization and a cultural shift toward viewing pets as family members have boosted spending on pet products, veterinary care, grooming, and nutrition.

International and domestic brands are strengthening their presence with premium offerings, natural ingredients, and customized solutions. Modern retail formats and e commerce platforms are enhancing accessibility and product variety, while marketing campaigns focusing on pet health and companionship are driving consumer awareness.

The outlook remains strong as demand grows for specialized products, professional veterinary services, and modern retail distribution, aligning with global trends in humanization of pets and sustainable pet care solutions.

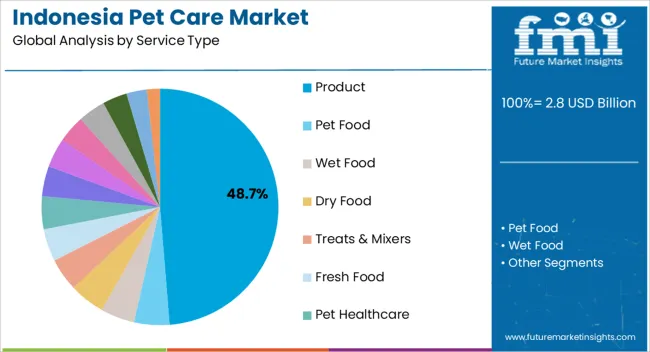

The product segment is projected to represent 48.70% of total revenue by 2025, establishing it as the leading service type. This dominance is supported by strong demand for pet food, grooming essentials, and health care products, which cater to everyday needs and ensure pet well being.

Growing awareness of nutritional standards and preventive health care has encouraged consistent product purchases. Availability of premium and specialized options such as organic food, supplements, and breed specific formulations has further boosted segment growth.

With continuous innovation and consumer preference for convenience, the product segment is expected to maintain its strong position in the Indonesia pet care market.

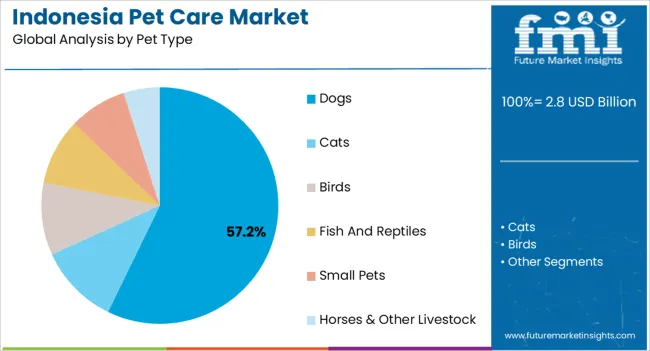

The dogs segment is expected to hold 57.20% of total market revenue by 2025, positioning it as the dominant pet type. Rising adoption of dogs as companions for security and emotional support has significantly increased expenditure on their nutrition, grooming, and veterinary care.

Their higher consumption of food compared to smaller pets has reinforced consistent product demand. Additionally, targeted marketing campaigns, urban lifestyle choices, and a growing culture of responsible pet ownership are fueling spending on dog specific products and services.

These factors collectively explain why the dogs segment remains the largest contributor within the Indonesia pet care market.

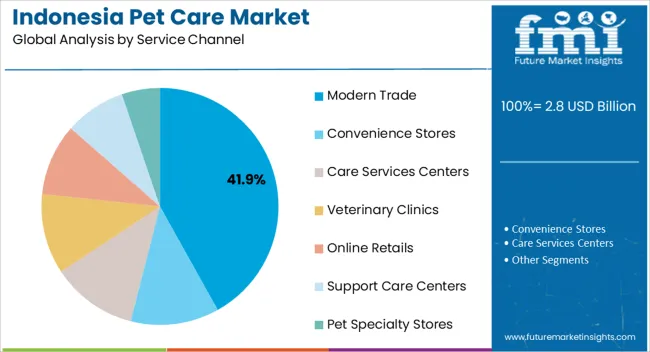

The modern trade segment is projected to account for 41.90% of total revenue by 2025, making it the leading service channel. Organized retail formats offer wider product availability, attractive promotions, and consistent quality assurance, which appeal strongly to urban consumers.

Supermarkets, hypermarkets, and specialty stores are increasingly dedicating sections to pet care, driving visibility and consumer confidence. The convenience of one stop shopping and access to premium imported brands has further strengthened this channel’s role.

As modern trade networks expand across Indonesia’s urban centers, this segment continues to hold its leadership by meeting consumer expectations for variety, reliability, and convenience.

The integration of technology has made it convenient for pet owners to interact and take care of their pets. The start of advanced technology such as the Internet of Things (IoT) and machine learning is also allowing pet owners to connect with pet care centers through online platforms.

Several virtual programs for the development and training of pet dogs are also available. Such technological advancements have helped the pet industry to grow and might continue to contribute to the growth of the market.

Technological advancements such as smart collars with an in-built GPS pet tracker and activity monitoring devices for dogs are also another factor spurring the growth in the Indonesia pet care industry, opines Future Market Insights.

Pet Food to Account for More than 3/5th of Overall Indonesia Pet Care Market Share

In terms of product type, pet food is the leading category accounting for the market in 2025. Growing demand for nutritious and tasty food items among owners for their daily feeding requirements are the factors driving the growth of the market.

The veterinary segment is expected to witness notable growth owing to the growing professional settings related to animal veterinary care and clinics.

Sales of Pet Care Products to Gain Traction through Online Retail Stores

In terms of service channels, modern trade-based retailing remains prominent, recording a notable share of more than 31.5% in 2025. This notable share is due to the increasing availability of pet care products through them.

Online retail is observed as a potential growth driver for the pet care industry. Accessibility and options to choose from a wide assortment over the internet on platforms such as FLazada Indonesia, Shopee, Tokopedia.com, Amazon, etc. might drive online sales.

Burgeoning Adoption of Cats in Indonesia to Boost the Indonesia Pet Care Market

According to FMI, the cat segment dominated around 36.3% of Indonesia’s pet care market share in 2025. As cats are easy to take care of compared to dogs, the adoption of cats in Indonesia is increasing. This trend of increasing cat adoption is expected to continue, with the cat segment projected to expand at a CAGR of 7.8% during the forecast period.

The growing number of single households and small living spaces in urban areas has also contributed to the preference for cats over dogs, as they require less space and attention.

The Indonesia pet care industry is highly competitive, with a mix of local and international players. These companies offer a range of pet food products, as well as specialized nutrition, grooming, and healthcare services.

The Indonesia pet care industry is expected to continue its growth trajectory, driven by the increasing number of pet owners and their willingness to spend money on high-quality products and services. As such, the competition in the market is likely to intensify, with companies vying to capture a large share of the growing market. Investors looking to enter the market should be aware of these trends. They should further focus on investing in companies that can differentiate themselves and meet the evolving needs of pet owners in Indonesia.

| Company Name | Product/Service Offered |

|---|---|

| PT Japfa Comfeed Indonesia Tbk | Pet food products under the brand name ProBalance |

| Nestle Purina Petcare | Pet food products under the brands Friskies and Felix |

| Mars, Inc. | Pet food and care products under the brands Pedigree and Whiskas |

| Royal Canin | Premium pet food brand offering specialized nutrition |

| Indonesian Veterinary Medical Association (IVMA) | A non-profit organization promoting the veterinary profession and providing education and training for veterinarians |

| Indo Pet Expo | Annual pet trade show showcasing the latest products and services in the pet care industry |

With the increasing demand for natural and organic pet products, there is a significant opportunity for companies to differentiate themselves through product innovation and differentiation in the Indonesia pet care industry.

| Product-focused Investments | Service-focused Investments |

|---|---|

|

|

|

|

|

|

Companies can offer unique products that cater to this trend, as well as specialized products like breed-specific nutrition or products for pets with specific health conditions. These types of product-focused investments can help companies stand out in a highly competitive market.

There is a growing demand for high-quality pet grooming, boarding, and healthcare services. Investors can take advantage of this opportunity by developing a network of pet care services that include veterinary clinics, grooming salons, and pet hotels. As the industry grows, there is also a need for standardized training and certification programs for pet care professionals. It presents an opportunity for investors to develop these programs as a service-focused investment.

There is a trend in the Indonesia pet care industry toward online sales and delivery of pet products. As e-commerce continues to grow in Indonesia, many consumers are turning to online platforms to purchase pet products, including food, toys, and grooming supplies. This trend presents an opportunity for companies to invest in developing a strong online presence and delivery infrastructure.

Leading players operating globally in the market are focusing on expansion, development, and new product launches to expand their business globally.

For instance:

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD million for Value |

| Key Regions Covered | South Asia |

| Key Countries Covered | Indonesia |

| Key Segments Covered | Service, Pet Type, and Service Channel |

| Key Companies Profiled | MSD Animal Health; Mars, Incorporated; HAPPY PET Investment Holding GmbH; PT. NUTRICELL PACIFIC; Colgate-Palmolive Company; JM Sucker Co; Nestle SA; PT Central Proteina Prima Tbk; Groovy Vetcare Clinic; Bali Pet Shop PT; KW Aquatic Supplies Sdn Bhd; PT Citra Mandiri Kencana; Menara Petskita Indonesia; Other Players (As requested) |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, Drivers, Restraints, Opportunities and Threats Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global indonesia pet care market is estimated to be valued at USD 2.8 billion in 2025.

The market size for the indonesia pet care market is projected to reach USD 6.8 billion by 2035.

The indonesia pet care market is expected to grow at a 9.5% CAGR between 2025 and 2035.

The key product types in indonesia pet care market are product, pet food, wet food, dry food, treats & mixers, fresh food, pet healthcare, fashion, toys, and accessories, professional services, day care, grooming/boarding, pet breeding and training, value added service, insurance, veterinary care, pharmacy, adoption and charity and crisis relief service.

In terms of pet type, dogs segment to command 57.2% share in the indonesia pet care market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

A Detailed Global Analysis of Brand Share for the Indonesia Pet Care Market

Pet Care Market Analysis – Demand, Trends & Forecast 2025–2035

Pet Care Packaging Market Insights - Growth & Forecast 2025 to 2035

Pet Care Ingredients Market

Pet Daycare Market Growth - Trends & Forecast 2025 to 2035

Pet Oral Care Market Insights - Industry Trends & Consumer Demand 2025 to 2035

Pet Fitness Care Market Size and Share Forecast Outlook 2025 to 2035

Pet Diabetes Care Devices Market Analysis Trends & Forecast 2025 to 2035

Europe Pet Care Products Market Growth, Trends and Forecast from 2025 to 2035

USA and Canada Pet Care Products Market Analysis – Size, Share and Forecast 2025 to 2035

Southeast Asia Pet Care Market Trends – Demand, Growth & Forecast 2022-2032

Pet Joint Health Supplement Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Collagen Market Size, Share, Trends, and Forecast 2025 to 2035

Pet Cognitive Supplement Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Pulverizer Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Emulsifier Market Size and Share Forecast Outlook 2025 to 2035

PET Film for Face Shield Market Size and Share Forecast Outlook 2025 to 2035

Pet Perfume Market Size and Share Forecast Outlook 2025 to 2035

Pet Shampoo Market Size and Share Forecast Outlook 2025 to 2035

Pet Tick and Flea Prevention Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA