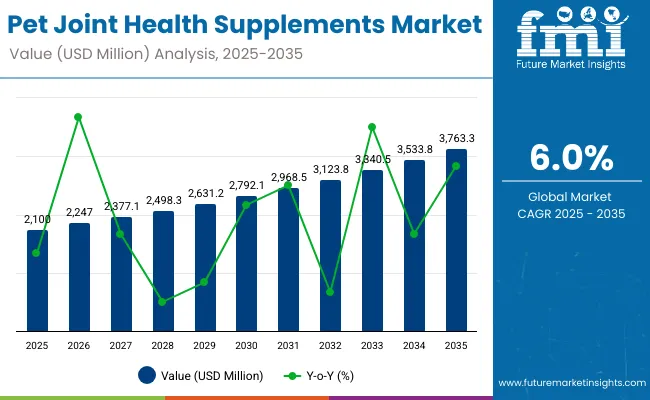

The pet joint health supplement market is projected to grow from USD 2,100 million in 2025 to approximately USD 3,763.3 million by 2035, recording an absolute increase of USD 1,663.3 million over the forecast period. The shift is driven by pet care systems that are becoming more humanization-focused, age-specialized, and sensitive to mobility variations. As veterinary clinics, pet specialty stores, premium pet care facilities, and companion animal healthcare providers add more specialized joint health protocols and preventive care systems, the tolerance for mobility complications drops.

Pet joint health supplements appeal here because they improve cartilage protection reliably, enhance mobility consistently, and integrate well into existing veterinary architectures without requiring redesign of care protocols or treatment layouts.

Pet Joint Health Supplement Market Key Takeaways

| Metric | Value |

|---|---|

| Market Value (2025) | USD 2,100 million |

| Market Forecast Value (2035) | USD 3,763.3 million |

| Forecast CAGR (2025 to 2035) | 6.0% |

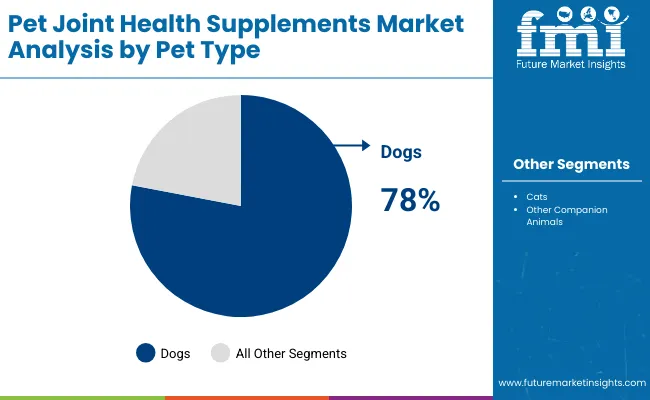

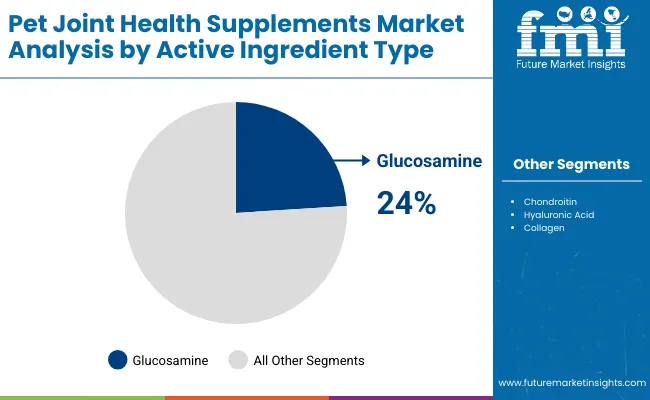

The glucosamine category, representing about 24% of demand, remains the workhorse segment due to its widespread fit in hip and joint support applications, veterinary recommendation systems, arthritis relief programs, and mobility enhancement facilities. On the demand side, dogs account for roughly 78% of total market consumption because aging demographics, breed-specific requirements, and preventive care pressures are highest in these environments.

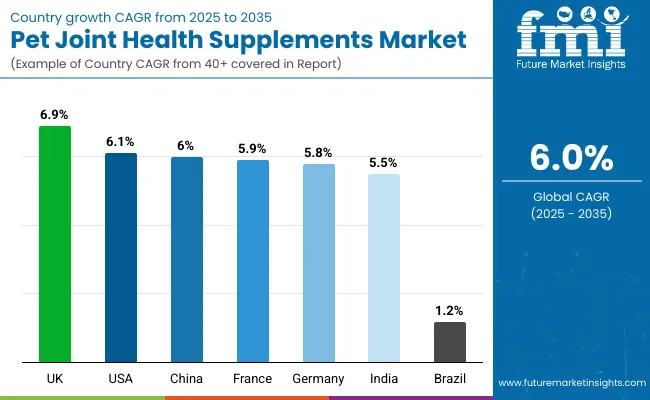

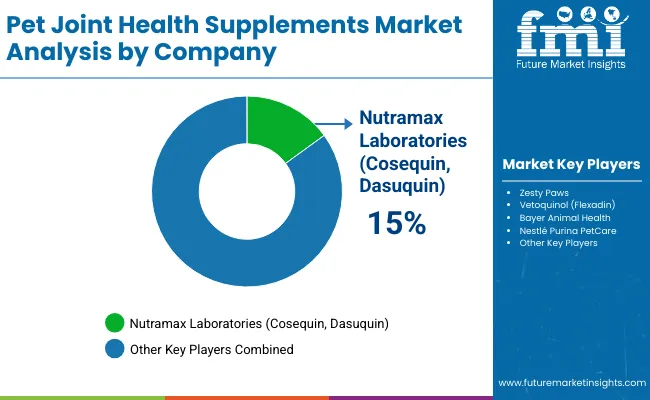

Geographically, the market is led by UK (6.9% CAGR) and USA (6.1% CAGR), supported by veterinary infrastructure expansion, premium pet care development, and preventive health policy incentives. Japan (6.2%) and China (6.0%) sustain growth through advanced veterinary standards and pet wellness ecosystems, while France (6.0%), Germany (5.8%), South Korea (5.7%), India (5.5%), and Brazil (1.2%) grow through incremental veterinary adoption rather than system transformation. Competition remains moderately consolidated, with Nutramax Laboratories, Zesty Paws, and Vetoquinol competing through specialized formulations, faster clinical validation, and application-specific support near veterinary distribution hubs.

Manufacturing dynamics reflect increasing consolidation around specialized ingredient processing capabilities where glucosamine maintains market leadership at 24% share despite facing competition from synthetic alternatives and raw material sourcing challenges. Chondroitin secures 14% of demand through complementary cartilage protection properties in combination formulations while MSM demonstrates 7.2% growth driven by natural ingredient trends and anti-inflammatory benefits. Premium ingredients including hyaluronic acid achieve 8.0% expansion targeting senior pet applications requiring advanced joint lubrication properties.

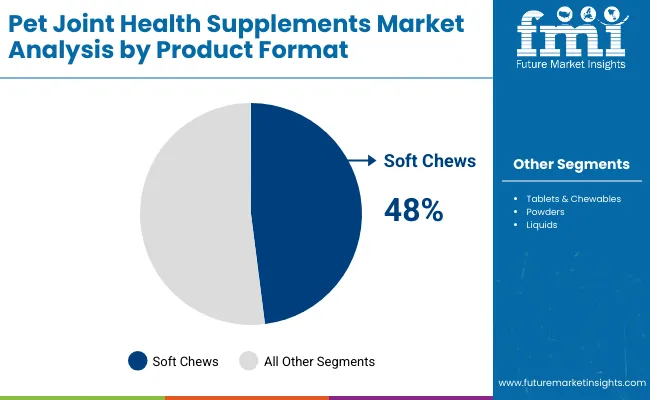

Product format preferences reflect pet acceptance patterns and administration convenience where soft chews dominate with 48% market share due to treat-like appeal and palatability advantages that enhance pet compliance. Traditional tablets and chewables maintain 18% demand through veterinary recommendations and precise dosing advantages while liquid formulations capture 12% share among applications requiring enhanced bioavailability for specialized joint ingredients. Powder formats serve 10% of applications through food mixing advantages and dosage flexibility supporting multi-pet households.

Pet demographics are tilting the market structurally, not cosmetically. A steadily aging pet population across developed and emerging markets is reshaping baseline demand for joint support rather than creating a short-term "trend." Senior dogs and cats now stay in households longer, and owners expect them to remain mobile and comfortable.

In parallel, pet humanization means owners increasingly look for human-grade joint solutions backed by recognizable ingredients and clear claims rather than generic supplements. Large-breed and highly active dogs sit at the center of this shift, as their higher joint stress and predisposition to orthopedic issues make structured joint support a default part of care, not an optional add-on.

Health awareness is moving from reactive pain management to preventive joint care. As pet owners especially Millennials and Gen Z internalize the idea of "aging well" for animals, they are willing to invest earlier in joint support protocols rather than waiting for visible lameness or arthritis. This shows up in demand for formulations that combine mobility support, cartilage protection, and recovery after activity in a single product. Joint supplements are increasingly framed as part of a long-term wellness plan (alongside weight control and exercise), not as a short course of treatment, which supports higher adherence and repeat purchase rates.

Veterinary practice is tightening the evidence bar. Clinics and specialist hospitals are more selective about which joint products they recommend, favoring formulations with clear data on cartilage health, anti-inflammatory effects, and bioavailability. This raises the bar for ingredient innovation: suppliers are pushed to improve absorption, stabilize complex actives, and generate credible, species-specific evidence. At the same time, regulators and professional bodies are scrutinizing joint health claims more closely, forcing manufacturers to invest in clinical validation and quality systems. The net effect is a gradual shift away from undifferentiated commodity blends toward fewer, better-validated products that can withstand both veterinary and regulatory scrutiny.

The market is structured around increasingly granular segmentation that reflects both clinical need and consumer purchasing behavior rather than traditional product taxonomy. Pet type segmentation remains dominated by dogs, supported by stronger clinical research, clearer dosing frameworks, and higher discretionary spend. Cats follow at a distance, and "other companion animals" remain a niche, largely opportunistic segment without consistent commercial or scientific scale.

Active ingredient segmentation shows the broadest fragmentation. Traditional joint-support compounds such as glucosamine, chondroitin, MSM, and hyaluronic acid still anchor the category, while omega-3 fatty acids and collagen gain traction as multi-benefit ingredients spanning mobility, inflammation, and cognitive support. Botanical actives turmeric/curcumin, boswellia, and green-lipped mussel are expanding fastest, reflecting the shift toward natural and evidence-based anti-inflammatory solutions. However, the proliferation of ingredient stacks raises complexity around dosage discipline, clinical differentiation, and label transparency.

Product formats continue to evolve from commoditized tablets and powders to compliance-driven soft chews, liquids, and gels that minimize administration friction. The commercial race is no longer about variety but about sustained adherence: formats that integrate seamlessly into daily routines are gaining disproportionate share.

Positioning by health claim is tightening around outcomes rather than generic wellness language. Mobility and flexibility, arthritis relief, cartilage support, and aging-related joint care represent the core demand pools, with anti-inflammatory benefits acting as a cross-cutting narrative. The expectation is shifting toward measurable improvement windows rather than long-tail supplementation with ambiguous results.

Life-stage segmentation puppy/kitten, adult, and senior serves both formulation precision and pricing architecture. Senior-focused products hold the fastest growth potential as aging pets become the largest treatment population, while life-stage personalization provides margin justification and strengthens veterinarian alignment.

Commercial channels are undergoing a structural realignment. Veterinary clinics remain the most influential recommendation channel and a gatekeeper for therapeutic-grade products. Online retail and DTC are scaling fastest by leveraging subscription models and targeted education, whereas pet specialty and mass retail maintain breadth but lack differentiation. Pharmacies occupy a credibility-based adjacency, particularly for formulations positioned closer to therapeutic use.

Regional dynamics diversify the growth map: North America and Europe lead on maturity and regulatory structure, East Asia accelerates through premium consumption and innovation adoption, and South Asia & Pacific emerges as the highest-potential volume frontier. Latin America and MEA remain price-sensitive but increasingly receptive to specialized mobility solutions as companion-animal ownership trends grow.

Dogs will continue to account for the majority of category revenue through 2035, maintaining roughly 78% share and expanding at about 7% CAGR. The segment benefits from the deepest clinical research base, the broadest adoption across hip and joint, mobility, and arthritis applications, and the highest owner willingness-to-pay. Growth is structurally supported by an aging population of large-breed dogs and rising preventive-care behavior among owners. Competitive intensity is increasing as brands invest in breed-specific formulations and higher-potency therapeutic blends, raising the bar for differentiation beyond generic joint supplements.

Cats hold the second-largest share at 20% and are projected to grow at 7.6% CAGR. Feline joint-care adoption is accelerating as awareness improves, particularly around mobility decline in senior cats. Formulation challenges remain higher due to palatability constraints and unique physiological considerations around dosage and bioavailability, creating a premium on R&D and delivery-format innovation.

Other companion animals represent a niche 2% of demand with steady 5% CAGR, driven primarily by specialized veterinary care for rabbits, exotic birds, and other small animals. While the segment lacks scale, it offers targeted opportunities in professional channels and serves as a platform for ultra-specialized formulations.

Glucosamine forms the core of the joint-health supplement architecture in companion animals. It is the most clinically established structural support ingredient and continues to act as the primary driver of adoption and therapeutic outcomes in mobility and cartilage-preservation products. Its clinical familiarity among veterinarians, predictable performance across both preventive and therapeutic regimes, and broad compatibility with multiple delivery formats make it the baseline reference point for product formulation and purchase decision-making. However, the category now faces rising pressure from raw-material volatility and synthetic substitutes that threaten to flatten differentiation unless brands invest in purity, traceability, and outcome-based claims.

Around this center of gravity, chondroitin plays a reinforcing role. Rather than competing directly, it complements glucosamine by strengthening cartilage integrity and enabling longer-term protection against degenerative progression. Most premium formulations now treat glucosamine-chondroitin blends as foundational pairs, with innovation shifting toward improved bioavailability and regulatory clarity around functional claims.

The next ring of innovation is driven by MSM and omega-3 fatty acids, which expand the scope from structural maintenance to inflammation management and mobility comfort. MSM anchors the "natural anti-inflammatory" narrative, while omega-3s provide multi-benefit support that crosses joint health, skin/coat wellness, and systemic inflammation reduction. Their success increasingly depends on education and quality assurance, as potency and purity vary widely across suppliers.

At the premium edge, hyaluronic acid and collagen are reshaping expectations for targeted performance. Hyaluronic acid aligns closely with aging and mobility-impaired pets by addressing synovial fluid support and lubrication, while collagen positions itself as the next structural innovation with cross-category momentum from human supplementation. Here, endpoints like bioavailability and type-specific effectiveness will determine leadership not marketing volume.

Botanical actives turmeric/curcumin, boswellia, and green-lipped mussel are emerging as a distinct, differentiated frontier aligned with clean-label preferences and holistic care. Their growth depends less on familiarity and more on scientific consistency, sourcing integrity, and proof that natural alternatives can deliver measurable outcomes rather than narrative appeal.

| Format | Status & Outlook 2025-2035 |

|---|---|

| Soft Chews |

|

| Tablets & Chewables |

|

| Powders |

|

| Liquids |

|

| Gels/Pastes |

|

| Capsules |

|

| Countries | CAGR (2025 to 2035) |

|---|---|

| UK | 6.9% |

| USA | 6.1% |

| China | 6.0% |

| France | 5.9% |

| Germany | 5.8% |

| India | 5.5% |

| Brazil | 1.2% |

The United Kingdom is establishing itself as one of the most strategically important hubs for pet joint-health supplements due to the intersection of advanced veterinary practice and a deeply ingrained preventive-care mindset among pet owners. Demand for mobility and joint-support solutions continues to accelerate, driven by an aging companion-animal population and strong willingness to invest in long-term quality-of-life outcomes. Preventive supplementation is increasingly viewed as a standard component of routine care rather than an intervention triggered by visible decline, particularly in metropolitan regions where premium healthcare spending is highest.

Local and international pet-care manufacturers are strengthening their presence through expanded processing capabilities and vertically integrated supply chains designed to meet rising expectations around traceability, formulation integrity, and measurable clinical benefits. Partnerships between veterinary practices and supplement companies are intensifying, supporting evidence-based education and lifecycle-specific joint-care programs for puppies, adults, and senior pets.

The competitive landscape is shifting toward differentiation based on ingredient functionality, bioavailability optimization, palatability engineering, and performance validation rather than branding breadth. Strategically, the UK market is becoming a proving ground for high-specification joint health innovation. Companies able to combine clinical credibility, premium product positioning, and frictionless distribution are likely to capture disproportionate share as market sophistication increases.

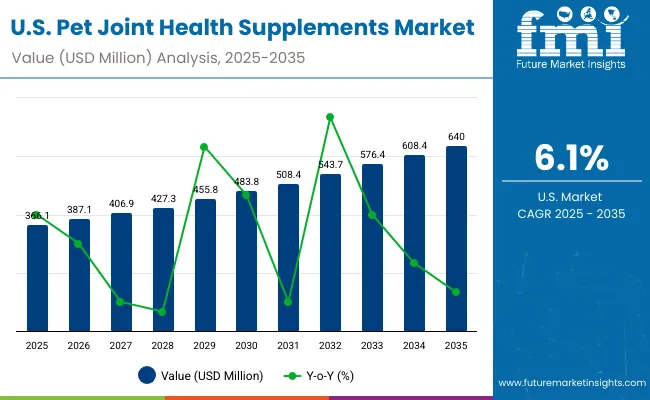

The United States remains a global reference point for pet joint-health supplements due to its scale, advanced clinical infrastructure, and strong culture of evidence-based preventive care. Demand is driven by performance-oriented pet owners, particularly large-breed dog households, who expect supplements that deliver quantifiable improvements in mobility and chronic pain management. The veterinary ecosystem plays a decisive role in product selection, making clinical substantiation, ingredient traceability, and regulatory compliance essential differentiators.

USA manufacturers prioritize scientific validation, controlled-environment processing, and precision dosing frameworks, resulting in sophisticated product architecture and high market entry barriers. Leading players are investing in advanced bioavailability systems, multimodal formulations that combine structural and anti-inflammatory mechanisms, and subscription-based adherence models that reduce compliance drop-off.

Digital veterinary consultation platforms and DTC brands are reshaping distribution, reinforcing personalized care pathways and data-supported progress measurement. Research and development investment continues to expand applications beyond routine mobility support into targeted therapeutic interventions for osteoarthritis and age-related degeneration. The market is increasingly outcomes-driven: companies that demonstrate measurable efficacy and long-term improvement gain strategic advantage, while generic formulations face pressure from margin compression and declining differentiation.

China is emerging as one of the fastest-developing markets for pet joint-health supplements, supported by rapid growth in companion-animal ownership and accelerated modernization of veterinary services. As households shift from basic feeding to comprehensive health maintenance, demand is rising across both mass-market and premium mobility segments. The expanding senior-pet population and widening preventive-care awareness are driving adoption of structural and anti-inflammatory joint solutions.

Domestic processing capabilities are evolving quickly, enabling large-scale production and competitively priced formulations that support broad accessibility. Collaboration between research institutes, veterinary hospitals, and ingredient suppliers is strengthening clinical credibility and narrowing the performance gap with Western producers. Urban markets particularly Shanghai, Beijing, Guangzhou, and Shenzhen serve as early adopters of advanced formulations, while cost-efficient standardized products expand penetration in secondary cities.

E-commerce platforms, specialist pet retail chains, and omnichannel veterinary networks are reshaping brand reach and education pathways. For international entrants, success depends on balancing product pricing, clinical trust, and supply-chain localization rather than relying solely on brand reputation. As expectations rise, differentiation will hinge on transparency, measurable mobility outcomes, and ability to scale reliable formulations across diverse economic tiers.

Profit pools are consolidating upstream in scaled joint health production systems and downstream in value-added specialty formulations for companion animal care, veterinary applications, and premium pet mobility solutions where certification, traceability, and consistent joint benefits command premiums. Value is migrating from raw ingredient commodity trading to specification-tight, application-ready joint supplements where technical expertise and quality control drive competitive advantage.

Several archetypes set the pace: global pet care integrators defending share through production scale and technical reliability; multi-ingredient processors that manage complexity and serve diverse applications; specialty joint health developers with formulation expertise and veterinary industry ties; and bioavailability-driven suppliers pulling volume in premium pet care and mobility support applications. Switching costs including re-qualification, joint health testing, performance validation, provide stability for incumbents, while supply shocks and regulatory changes reopen opportunities for diversified suppliers.

Consolidation and verticalization continue; digital procurement emerges in commodity ingredients while premium specifications remain relationship-led. Focus areas: lock veterinary and pet care pipelines with application-specific formulations and service level agreements; establish multi-ingredient production capabilities and technical disclosure; develop specialized joint health formulations with mobility claims.

| Stakeholder Type | Primary Advantage | Repeatable Plays |

|---|---|---|

| Global pet care integrators | Scale, production integration, technical reliability | Long-term contracts, tight specifications, co-development with veterinary/pet care |

| Multi-ingredient processors | Ingredient diversification, application expertise, supply flexibility | Multi-application serving, technical support, quality assurance across segments |

| Specialty joint health developers | Formulation expertise and industry relationships | Custom formulations, mobility science, performance SLAs |

| Bioavailability suppliers | Application-focused demand and specialized service | Technical mobility claims, specialized formulations, application activation |

| Pet care distributors & platforms | Technical support for mid-tier manufacturers | Ingredient selection, smaller volumes, technical service |

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD Million |

| Pet Type | Dogs, Cats, Other Companion Animals |

| Active Ingredient Type | Glucosamine, Chondroitin, MSM (Methylsulfonylmethane), Hyaluronic Acid, Omega-3 Fatty Acids (EPA, DHA), Collagen, Turmeric/Curcumin, Boswellia, Green-Lipped Mussel, Other Botanical Extracts |

| Product Format | Tablets & Chewables, Powders, Liquids, Soft Chews, Gels/Pastes, Capsules |

| Health Claim | Hip & Joint Support, Anti-inflammatory, Mobility & Flexibility, Arthritis Relief, Cartilage Protection, Age-Related Joint Care |

| Life Stage | Puppy/Kitten, Adult, Senior |

| Sales Channel | Veterinary Clinics, Pet Specialty Stores, Online Retail, Mass Retail, Direct-to-Consumer (DTC), Pharmacies |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Germany, China, Japan, India, South Korea, France, UK, Brazil, and other 40+ countries |

| Key Companies Profiled | Nutramax Laboratories, Zesty Paws, Vetoquinol, Elanco Animal Health, Nestlé Purina PetCare |

| Additional Attributes | Dollar sales by pet type/active ingredient type/product format, regional demand (NA, EU, APAC), competitive landscape, soft chews vs. other format adoption, production/processing integration, and advanced formulation innovations driving bioavailability enhancement, joint health advancement, and mobility efficiency |

The pet joint health supplement market is valued at USD 2,100 million in 2025.

The market is projected to reach USD 3,763.3 million by 2035.

The market will expand at a 6.0% CAGR over the forecast period.

Dogs dominate with 78% share due to higher incidence of mobility issues and stronger owner willingness-to-pay.

Glucosamine leads with a 24% share, driven by its widespread veterinary recommendation for mobility and cartilage support.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pet Skin & Coat Health Supplement Market Analysis by Pet Type, Form, Availability and Sales Channel Through 2035

Bone and Joint Health Supplement Market Analysis by Product Type, Form and Sale Channels Through 2035

Intestinal Health Pet Dietary Supplement Market Size and Share Forecast Outlook 2025 to 2035

Dog Intestinal Health Pet Dietary Supplement Market Size and Share Forecast Outlook 2025 to 2035

Pet Bird Health Market Size and Share Forecast Outlook 2025 to 2035

Pet Herbal Supplements Market Size and Share Forecast Outlook 2025 to 2035

Pet Dietary Supplement Market Size and Share Forecast Outlook 2025 to 2035

Industry Share Analysis for Pet Dietary Supplement Companies

Pet Food and Supplement Market - Size, Share, and Forecast Outlook 2025 to 2035

Pet Cognitive Supplement Market Size and Share Forecast Outlook 2025 to 2035

Healthy Aging Supplement Market – Demand, Innovations & Market Growth

Gut Health Supplement Market Size, Growth, and Forecast for 2025 to 2035

Pet Probiotics Supplements Market - Size, Share, and Forecast Outlook 2025 to 2035

Pet Postbiotics Supplement Market – Trends, Demand & Pet Wellness

Bone Health Supplement Market Size and Share Forecast Outlook 2025 to 2035

UK Pet Dietary Supplement Market Growth – Trends, Demand & Forecast 2025-2035

Liver Health Supplements Market Analysis - Size, Growth, and Forecast 2025 to 2035

Brain Health Supplement Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Market Outlook of Omega-3 Pet Supplement by Pet, Type, Form, Application and Other Types Through 2035

USA Pet Dietary Supplement Market Insights – Size, Share & Industry Growth 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA