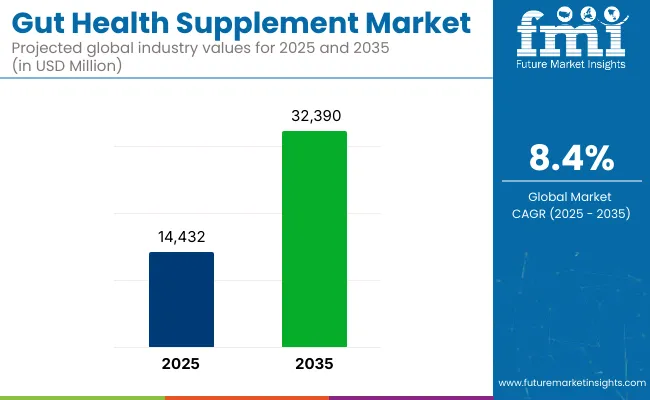

The global gut health supplement market is anticipated to record sales of USD 14,432.0 million in 2025, with projections indicating a market size of USD 32,390.0 million by 2035, driven by a CAGR of 8.4%. This surge reflects the rising acknowledgment of the gut microbiome’s role in systemic health.

| Attributes | Description |

|---|---|

| Estimated Market Size (2025E) | USD 14,432.0 million |

| Projected Market Value (2035F) | USD 32,390.0 million |

| Value-based CAGR (2025 to 2035) | 8.4% |

Supplements targeting digestive function, immune modulation, and mood enhancement are now being adopted across diverse age cohorts. Strong evidence from microbiota-centric research continues to validate the therapeutic role of probiotics, prebiotics, postbiotics, and synbiotics in gut restoration and maintenance.

Market expansion has been influenced by a convergence of scientific advancements, consumer awareness, and regulatory flexibility. A clear shift has been observed from general wellness claims to strain-specific and condition-specific formulations. Trends reveal a growing demand for clean-label, allergen-free, and multi-strain formulations, especially in functional foods and personalized nutrition formats.

At the same time, technological improvements in encapsulation and controlled release are supporting product innovation. Constraints such as limited stability and region-specific registration hurdles persist but are being tackled through proprietary technology and localized partnerships. Key players have increasingly adopted a science-backed narrative, integrating clinical trials into product development to support efficacy claims, enhance consumer trust, and influence HCP recommendations.

Over the next decade, market performance is expected to remain on a high growth trajectory. By 2025, probiotic capsules and synbiotic formulations are anticipated to drive volume in developed economies, while prebiotics and multi-format offerings (gummies, powders, beverages) are expected to dominate in Asia-Pacific and Europe by 2035. Innovations incorporating novel bacterial strains, targeted delivery mechanisms, and AI-powered personalized gut health regimens are projected to shape competitive dynamics. As gut health becomes central to managing chronic inflammation, metabolic disorders, and mental health, the supplement industry is positioned to play a transformative role in global preventive health strategies.

The below table presents a comparative assessment of the variation in CAGR over six months for the base year (2024) and current year (2025) for global gut health supplement market. This analysis reveals crucial shifts in market performance and indicates revenue realization patterns, thus providing stakeholders with a better vision about the market growth trajectory over the year. The first half of the year, or H1, spans from January to June. The second half, H2, includes the months from July to December.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 6.3% |

| H2 (2024 to 2034) | 6.9% |

| H1 (2025 to 2035) | 7.4% |

| H2 (2025 to 2035) | 8.3% |

The above table presents the expected CAGR for the global gut health supplement demand space over semi-annual period spanning from 2025 to 2035. In the first half (H1) of the year 2024, the business is predicted to surge at a CAGR of 6.3%, followed by a slightly higher growth rate of 6.9% in the second half (H2) of the same year.

Moving into year 2025, the CAGR is projected to increase slightly to 7.4% in the first half and remain relatively moderate at 8.3% in the second half. In the first half (H1 2025) the market witnessed a decrease of 16 BPS while in the second half (H2 2025), the market witnessed an increase of 34 BPS.

Accounting for an estimated 18.7% market share in 2025, targeted gut health formulations are increasingly gaining traction for chronic conditions such as IBS, IBD, and antibiotic-associated diarrhea. These offerings differ from general digestive supplements by focusing on strain-validated, condition-specific efficacy, often supported by randomized clinical trials.

Companies like Pendulum Therapeutics and Symprove have established product lines rooted in personalized microbiome profiling, while Biocodex’s Florastor leverages Saccharomyces boulardii for evidence-backed indications. The European Food Safety Authority (EFSA) and the USA FDA have maintained a cautious stance on probiotic claims, leading to a strategic focus on medical marketing channels and practitioner endorsement.

Scientific substantiation has become a key differentiation lever, with increasing inclusion of next-generation strains such as Akkermansia muciniphila and Faecalibacterium prausnitzii. With healthcare practitioners playing a growing role in supplement recommendations, these formulations are expected to see uptake across institutional pharmacy and integrative medicine channels.

Moreover, insurance pilot programs in Germany and Japan are exploring coverage for such supplements under chronic disease management, which could further drive adoption. As microbiome science matures, these products will serve as a bridge between supplements and therapeutic interventions.

With a projected 27.4% market share by 2025, online sales channels are reshaping how consumers access gut health supplements. Digital-first brands and DTC (direct-to-consumer) platforms are outpacing traditional retail, especially among millennials and Gen Z users seeking transparency, convenience, and personalization.

E-commerce giants like Amazon, as well as specialized platforms such as iHerb and Care/of, have democratized access to niche formulations including vegan probiotics, synbiotic gummies, and allergen-free offerings. Subscription models with microbiome kits-offered by companies like Viome and Zoe-are reinforcing loyalty while enabling AI-driven recommendations based on gut test results.

Digital distribution is also enabling rapid entry for emerging regional players into global markets, bypassing legacy retail barriers. Regulatory oversight is tightening, however, with the USA Federal Trade Commission (FTC) and Health Canada issuing recent guidance on online marketing claims for probiotics.

Despite this, the online model has enabled real-time consumer feedback and reformulation cycles, offering brands a competitive edge in addressing rapidly evolving consumer needs. Over the next decade, this channel is expected to become central to personalized nutrition delivery and D2C innovation across the gut health segment.

Increased Research and Development

Ongoing research into the gut microbiome is revolutionizing the supplement market by uncovering the complex relationships between gut health and overall wellness. As scientists explore the diverse roles of various microorganisms, new findings are paving the way for innovative formulations that enhance efficacy. For instance, spore-based probiotics are gaining attention for their resilience and ability to survive harsh digestive conditions, making them more effective than traditional probiotics.

Additionally, synbiotics, which combine prebiotics and probiotics, are being developed to provide synergistic benefits. This focus on research not only drives product innovation but also fosters consumer trust, as evidence-based formulations become increasingly appealing to health-conscious individuals seeking effective gut health solutions.

Personalized Nutrition

The trend towards personalized nutrition is reshaping the gut health supplement landscape, as consumers increasingly seek tailored solutions that address their unique health needs. Advances in technology and understanding of the gut microbiome have enabled companies to offer customized formulations based on individual health assessments, genetic profiles, and lifestyle factors. This personalized approach enhances consumer engagement, as individuals feel more connected to products designed specifically for them. By leveraging data from microbiome testing and health questionnaires, brands can create targeted supplements that optimize gut health, improve digestion, and support overall well-being. This shift not only meets the demand for individualized care but also empowers consumers to take charge of their health journeys.

Functional Foods Integration

The integration of gut health supplements into functional foods is a growing trend that caters to consumers' desire for convenience and health benefits in their diets. As people seek easy ways to enhance their nutrition, manufacturers are developing innovative products that combine gut health supplements with everyday foods. Probiotic-infused snacks, beverages, and meal replacements are becoming increasingly popular, allowing consumers to enjoy the benefits of gut health without the need for separate supplements.

This trend not only simplifies the incorporation of gut health into daily routines but also appeals to those looking for tasty and functional options. By merging supplements with functional foods, brands are effectively addressing consumer preferences for both health and convenience.

Tier 1 Companies comprise industry leaders with annual revenues exceeding USD 20 million and a market share of approximately 40% to 50%. These companies are recognized for their extensive product portfolios, high production capacities, and robust distribution networks. They often operate on a global scale, leveraging their established brand reputation and consumer trust.

Tier 1 players are distinguished by their significant investment in research and development, enabling them to innovate and introduce new formulations that cater to evolving consumer preferences. Prominent companies in this tier include Nestlé Health Science, Danone, and Procter & Gamble, which have successfully integrated gut health supplements into their broader health and wellness strategies.

Tier 2 Companies consist of mid-sized players with revenues ranging from USD 5 million to USD 20 million. These companies typically have a strong regional presence and significantly influence local retail markets. While they may not possess the extensive global reach of Tier 1 companies, they are characterized by a solid understanding of consumer needs within their specific markets.

Tier 2 companies often focus on niche segments, offering specialized products that cater to particular health concerns. Notable players in this tier include Garden of Life, Renew Life, and Jarrow Formulas, which have carved out a loyal customer base through targeted marketing and product differentiation.

Tier 3 Companies represent the majority of small-scale enterprises operating within the gut health supplement market, with revenues below USD 5 million. These companies primarily serve local markets and niche demands, often focusing on specific health benefits or unique formulations.

Tier 3 players are typically characterized by limited geographical reach and a lack of extensive organizational structure. Despite their smaller scale, these companies can be agile and responsive to local consumer trends, allowing them to fulfill specific marketplace demands effectively. This tier includes various local brands and startups that contribute to the overall diversity of the market.

| Countries | Market Value (2035) |

|---|---|

| United States | USD 4,858.5 million |

| Germany | USD 3,239.0 million |

| China | USD 2,591.2 million |

| India | USD 1,619.5 million |

| Japan | USD 647.8 million |

The USA gut health supplement market is thriving due to its diverse product offerings and increased accessibility. Consumers can choose from a wide range of supplements, including probiotics, prebiotics, and synbiotics, available in various forms such as gummies, powders, and capsules. This variety caters to individual preferences and lifestyles, making it easier for people to incorporate gut health supplements into their daily routines.

Additionally, the growth of e-commerce and the expansion of health food stores and pharmacies have significantly enhanced the availability of these products. The convenience of online shopping, coupled with a broad selection in local retail outlets, has made it simpler for consumers to access gut health solutions, further driving demand in the market.

In Germany, the increasing demand for gut health supplements is significantly influenced by stringent regulatory support and the rising incidence of digestive disorders. The country’s robust regulations surrounding dietary supplements foster consumer trust in the quality and efficacy of these products, encouraging manufacturers to adhere to high standards. This regulatory environment instills confidence in consumers, making them more likely to invest in gut health solutions.

Concurrently, the prevalence of digestive issues, such as irritable bowel syndrome (IBS) and lactose intolerance, is on the rise, prompting individuals to seek effective remedies. As consumers look for supplements that can alleviate symptoms and promote digestive wellness, the combination of regulatory assurance and the need for effective solutions drives the growing market for gut health supplements in Germany.

Changing dietary patterns in India, driven by rapid urbanization and lifestyle shifts, have significantly impacted health. As more individuals turn to processed and convenience foods for their busy lifestyles, the traditional, balanced diets are often compromised. This shift has led to an increase in digestive issues, such as bloating, constipation, and acid reflux, as these foods can disrupt gut health.

In response, consumers are increasingly seeking gut health supplements, such as probiotics and prebiotics, to restore digestive balance and enhance gut function. This growing awareness of the link between diet and digestive health is fueling the demand for effective gut health solutions.

Key players are investing in research and development to create advanced formulations, such as synbiotics and targeted probiotics. Additionally, brands are enhancing their marketing strategies through digital platforms and influencer partnerships to reach health-conscious consumers. Emphasizing quality, sustainability, and transparency in sourcing also helps companies differentiate themselves and build trust in an increasingly crowded marketplace.

For instance

The global Gut Health Supplement industry is estimated at a value of USD 14,432.0 million in 2025.

Sales of Gut Health Supplement increased at 7.6% CAGR between 2020 and 2024.

Alltech, Anovite, International Flavors & Fragrances (IFF), Nestle Health Science, Pfizer Inc., Bayer AG are some of the leading players in this industry.

The South Asia domain is projected to hold a revenue share of 31% over the forecast period.

North America holds 35% share of the global demand space for Intensive Sweeteners.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Gut Modifiers Market

Gutta Percha Obturator Market

Catgut Sutures Market

Fresh Fish Gutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Air Purifier Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Regulatory Affairs Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Healthcare and Laboratory Label Industry Analysis in the United States Size and Share Forecast Outlook 2025 to 2035

Health and Fitness Club Market Forecast Outlook 2025 to 2035

Healthcare Flooring Market Size and Share Forecast Outlook 2025 to 2035

Healthcare AI Computer Vision Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Business Intelligence Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Master Data Management Market Size and Share Forecast Outlook 2025 to 2035

Healthcare and Laboratory Label Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Healthcare and Laboratory Label Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Healthcare Contact Center Solution Market Size and Share Forecast Outlook 2025 to 2035

Healthy Snacks Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Semiconductor Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Cold Chain Logistics Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Mobile Computers Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Cloud Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA