The global health and medical microalgae market is set to grow steadily over the next decade, fueled by rising consumer interest in natural, sustainable, and nutrient-rich ingredients. Microalgae-tiny, nutrient-dense aquatic organisms are increasingly recognized for their health benefits, including their high content of protein, omega-3 fatty acids, antioxidants, and bioactive compounds.

These properties make microalgae valuable in a wide range of applications, from dietary supplements and functional foods to pharmaceuticals and nutraceuticals.

As consumer demand for plant-based, clean-label, and eco-friendly products continues to rise, the health and medical microalgae market is poised for steady expansion through 2035.

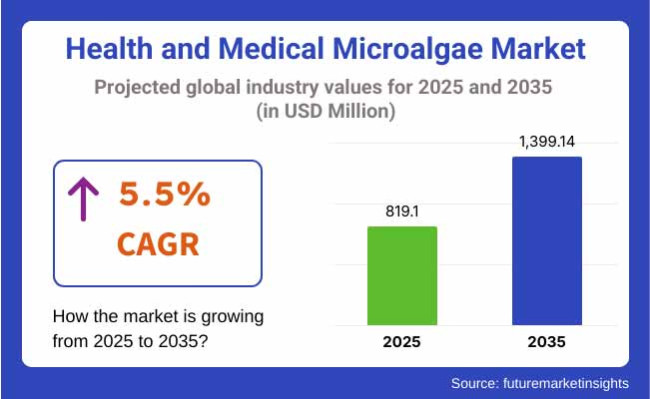

In 2025, the global health and medical microalgae market is estimated to be valued at approximately USD 819.1 Million. By 2035, it is projected to reach around USD 1,399.14 Million, reflecting a compound annual growth rate (CAGR) of 5.5%.

The North America region is holding a significant share of the health and medical microalgae market owing to high demand for natural supplements, growing plant-based food market and increasing health-conscious consumers. There is high activity in the North America microalgae-based products innovation ecosystem, particularly omega-3 supplements, and protein powders and bioactive compounds for therapeutic applications.

Another key market is Europe, where the authorities are backed up with strong regulation, consumers place a high value on clean-label and organic products, and there is already a vibrant nutraceutical industry. Germany, France and the United Kingdom are leading in the adaptation of microalgae due to its health enthusiastic properties in the food and pharmaceutical sectors.

Additionally, the emission of gases that have contributed to the creation of zones through which little or no light can pass, and the general climate of the region which relies on eco-friendly solutions to be provided, is lending further support to the growth of this market.

Factors such as rising segments of nutraceuticals, functional food industries in the region and the prevalence of traditional and alternative medicine are expected to play a pivotal role in making the Asia-Pacific a key growth driver of global health and medical microalgae market.

Challenges: High Production Costs, Regulatory Compliance, and Limited Consumer Awareness

The major challenges faced by the health and medical microalgae market include high production costs of cultivation, extraction, and purification processes. Microalgae (e.g. spirulina, chlorella and Haematococcus pluvialis that synthesize astaxanthin) need controlled environments and photo bioreactors and fancier filtration technologies so they have higher costs of manufacture.

Another major challenge is regulatory compliance because microalgae-based products must meet safety evaluations by the FDA (USA), EFSA (EU), and WHO for nutraceuticals and therapeutic processes, resulting in stringent quality control requirements. Moreover, the low consumer awareness regarding health benefits, bioavailability, and the therapeutic potential of microalgae-based ingredients limits market penetration and adoption.

Opportunities: Growth in Plant-Based Nutrition, AI-Driven Microalgae Cultivation, and Biopharmaceutical Applications

However, these challenges do not hinder the potential of the health and medical microalgae market, which is poised for robust growth due to the increasing demand for plant-based superfoods, artificial intelligence-driven microalgae optimization, and medical applications in biopharmaceuticals.

Microalgae as a source of sustainable proteins and vegan proteins are on the rise due to the increasing popularity of the vegan lifestyle and sustainable protein sources, while end-products based on microalgae are considered to be rich sources of n-3 FA, antioxidants, and proteins.

Moreover, AI-based cultivation systems and machine learning frameworks for strain selection are being used for yield improvement, extraction of bioactive components, and cost-effectiveness. Furthermore, the growth of microalga pharmaceuticals in the fields of wound healing, immune modulation, and individualized medicine is providing new opportunities in the biopharmaceutical industry.

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with FDA, EFSA, WHO, and organic certification for microalgae-based health products. |

| Consumer Trends | Demand for microalgae in plant-based supplements, omega-3-rich nutraceuticals, and functional beverages. |

| Industry Adoption | High use in nutraceuticals, dietary supplements, and functional food applications. |

| Supply Chain and Sourcing | Dependence on closed-loop photobioreactors, freshwater/marine cultivation, and algae-based fermentation. |

| Market Competition | Dominated by nutraceutical brands, sustainable food-tech startups, and algae cultivation firms. |

| Market Growth Drivers | Growth fueled by rising demand for vegan proteins, omega-3 supplements, and antioxidant-rich superfoods. |

| Sustainability and Environmental Impact | Moderate adoption of low-carbon cultivation, water-efficient photobioreactors, and biodegradable packaging. |

| Integration of Smart Technologies | Early adoption of AI-powered algae farming, machine learning-based nutrient optimization, and digitalized cultivation tracking. |

| Advancements in Microalgae Applications | Development of high-yield algae strains for food, pharma, and cosmetic formulations. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter AI-powered quality control, biopharma-grade microalgae regulations, and sustainability-driven cultivation guidelines. |

| Consumer Trends | Growth in AI-optimized personalized nutrition, biotech-based therapeutic microalgae, and gene-edited high-yield strains. |

| Industry Adoption | Expansion into AI-driven biopharma applications, regenerative medicine, and microalgae-based personalized therapeutics. |

| Supply Chain and Sourcing | Shift toward AI-assisted algae farming, vertical cultivation systems, and blockchain-based sourcing transparency. |

| Market Competition | Entry of AI-powered microalgae biotech firms, pharma-backed algae therapeutics, and smart bioengineering startups. |

| Market Growth Drivers | Accelerated by AI-enhanced bioactive compound extraction, microalgae-derived personalized medicine, and carbon-neutral algae farming. |

| Sustainability and Environmental Impact | Large-scale shift toward CO₂-absorbing microalgae farming, AI-driven climate-responsive algae production, and net-zero algae-based health products. |

| Integration of Smart Technologies | Expansion into blockchain-enabled algae traceability, AI-driven bioactivity screening, and nanotech-based microalgae delivery systems. |

| Advancements in Microalgae Applications | Evolution toward AI-designed bioengineered algae strains, algae-derived regenerative medicine, and microalgae-based biopharmaceutical treatments. |

The USA market for health and medical microalgae is expected to witness stable growth with demand for naturally obtained supplements growing sizabily along with applications in pharmaceuticals growing rapidly and attunement to microalgae health boosting antioxidants and bioactive compounds growing.

Market demand is driven by the growth of nutraceuticals, functional foods and algae-derived omega-3 fatty acids in dietary supplements. Use of microalgae for anti-inflammatory properties & immune boosting are under lots of research which will also be gaining traction for industry growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.6% |

Increasing interest in plant-based health supplements, coupled with a growing vegan and vegetarian consumer base, and rising demand for algae-derived proteins and lipids are driving the growth of the health and medical microalgae market in the United Kingdom. The market demand is focused on sustainable and bio-based pharmaceuticals. Furthermore, government regulations also favoring organic and naturally derived dietary supplements is influencing the trends in the marketplace.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.4% |

The health and medical microalgae market in the EU is garnering growth, driven by various factors including increasing investments in algae-based biotechnology, the rising utilization of microalgae extracts in functional foods, and the rapidly expanding pharmaceutical applications. Similar traction was witnessed in spirulina, chlorella, and astaxanthin based supplements. Promotion across Europe for regulations enhancing the cultivation of sustainable and non-GMO microalgae are also helping further drive the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 5.5% |

Moderate growth is being witnessed in the Health and Medical Microalgae Market in Japan due to increasing demand for anti-aging and immune-boosting supplements, enhancing research on algae-based skincare products, and growing incorporation of microalgae in functional beverages. Demand is fueled by the trend towards high-quality, nutrient-dense food ingredients and traditional acceptance of algae-based foods. Moreover, advancements in algae biotechnology for medical use are propelling the growth of the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.4% |

The health and medical microalgae market in South Korea is growing for various factors, including increasing consumer demand for natural health products, increase in investment in algae-derived bioactive compounds, and growing awareness of algae applications in skincare and cosmetics. The growing use of K-beauty formulations containing chlorella and spirulina and the increasing use of algal research in nutraceuticals are driving market growth. The rapidly growing demand in the industry is also propelled by government support for algae farming and biotech innovations.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.6% |

The health and medical microalgae market manufacturers can optionally link to sites within their product range, and those manufacturers should either license their products or offer them for free on a limited basis, just like they do now. Microalgae represent a repository of bioactive compounds and essential fatty acids, which direct their importance for functional foods and natural therapeutics, also for preventive healthcare.

Rising research interest in microalgal bioactive compounds and consumer demand for plant-based and sustainable ingredients, advances in biotechnology, led to steady market expansion. By Species Type (Spirulina, Chlorella, Dunaliella, Aphanizomenon, Haematococcus, Crypthecodinium, Schizochytrium, Euglena, Nannochloropsis, Nostoc, Phaedactylum, Others), Source (Marine Water, Fresh Water), End Use Application (Nutraceuticals & Dietary Supplements, Pharmaceuticals).

Splitting the market breakdown by type of microalgae usage, the Spirulina segment takes up the biggest market - it is widely used in health supplements, functional foods, and pharmaceuticals. Widely recognized for its high protein content, antioxidant properties, and immune-boosting potential, Spirulina has established a foothold in nutraceuticals, energy-boosting products, and dietary supplements.

As the popularity of sustainable protein sources and plant-based nutrition continues to rise, Spirulina is fast becoming a major ingredient in vegan and vegetarian products.

The chlorella segment is also seeing significant demand, especially in detoxification products, immunity-enhancing formulations, and anti-inflammatory supplements. Chlorella is high in chlorophyll, vitamins, and minerals and is included in pharmaceutical preparations for detoxifying heavy metals, improving gut health, and supporting the cardiovascular system. Emerging advances in microalgae cultivation practices and extraction technologies have bolstered the proliferation of Chlorella-based formulations in health and medical applications.

Based on Product Type, the dominant share of health and medical microalgae market is held by Marine Water segment, as marine microalgae provide higher concentration bioactive compounds, omega-3 fatty acids, and carotenoids. Species derived from marine organisms such as Schizochytrium and Crypthecodinium are in high demand due to their rich content of omega 3s (docosahexaenoic acid (DHA), eicosapentaenoic acid (EPA)) whose health benefits include cardiovascular health, brain function and through their ability to exert anti-inflammatory effects in pharmaceuticals.

Furthermore, the fresh water segment is on the rise, especially regarding the cultivation of the superfood Chlorella and Spirulina, where a controlled freshwater environment is essential. Individually either of these microalgae may be found in superfood blends, topical anti-aging creams, and immune boosting dietary supplements. The demand for freshwater cultivation of microalgae products is gradually increasing, along with investment in sustainable freshwater microalgae farming techniques.

The growth of health and medical microalgae market include increasing preference of consumers towards natural as well as plant based supplements, bioactive compounds and sustainable healthcare components. The growth is attributed to the development of AI in bioprocessing technology, growing use of microalgae in nutraceuticals and pharmaceuticals, and increasing consumer preference for functional foods and natural medicine.

High purity microalgae extraction, incorporation of AI into farming, and development of bioactive ingredients for increased efficacy, sustainability, and market competitiveness are all trending innovations in the area of microalgae extracts.

Market Share Analysis by Key Players & Health & Medical Microalgae Manufacturers

| Company Name | Estimated Market Share (%) |

|---|---|

| DIC Corporation | 18-22% |

| Cyanotech Corporation | 12-16% |

| E.I.D. Parry (India) Limited | 10-14% |

| Fuji Chemical Industries Co., Ltd. | 8-12% |

| Roquette Frères | 5-9% |

| Other Microalgae Producers (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| DIC Corporation | Develops AI-optimized spirulina and astaxanthin-based supplements, high-purity microalgae extracts, and functional food ingredients. |

| Cyanotech Corporation | Specializes in nutraceutical-grade spirulina and AI-assisted algae cultivation for bioactive compounds and immune support formulations. |

| E.I.D. Parry (India) Limited | Provides organic-certified microalgae, AI-powered extraction technology, and sustainable health supplement solutions. |

| Fuji Chemical Industries Co., Ltd. | Focuses on AI-enhanced microalgae-based antioxidants, pharmaceutical-grade astaxanthin, and algae-derived anti-inflammatory compounds. |

| Roquette Frères | Offers next-generation microalgae-derived proteins, AI-assisted lipid extraction for omega-3 supplements, and functional food innovations. |

Key Market Insights

DIC Corporation (18-22%)

DIC Corporation leads the health and medical microalgae market, offering AI-powered bioprocessing, high-purity astaxanthin production, and sustainable spirulina cultivation.

Cyanotech Corporation (12-16%)

Cyanotech specializes in high-quality spirulina and microalgae-based nutraceuticals, ensuring AI-enhanced algae growth monitoring and bioactive compound optimization.

E.I.D. Parry (India) Limited (10-14%)

E.I.D. Parry provides organic-certified microalgae solutions, optimizing AI-driven extraction methods and sustainable production techniques.

Fuji Chemical Industries Co., Ltd. (8-12%)

Fuji Chemical focuses on pharmaceutical-grade microalgae antioxidants, integrating AI-powered stability testing and anti-inflammatory ingredient research.

Roquette Frères (5-9%)

Roquette develops AI-enhanced omega-3 supplements and microalgae-derived proteins, ensuring functional food innovation and next-generation lipid extraction.

Other Key Players (30-40% Combined)

Several biotechnology firms, microalgae producers, and pharmaceutical companies contribute to next-generation microalgae-based health innovations, AI-powered algae cultivation, and sustainable ingredient solutions. These include:

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Species Type, 2018 to 2033

Table 4: Global Market Volume (MT) Forecast by Species Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 6: Global Market Volume (MT) Forecast by Source, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by End Use Application, 2018 to 2033

Table 8: Global Market Volume (MT) Forecast by End Use Application, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Species Type, 2018 to 2033

Table 12: North America Market Volume (MT) Forecast by Species Type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 14: North America Market Volume (MT) Forecast by Source, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by End Use Application, 2018 to 2033

Table 16: North America Market Volume (MT) Forecast by End Use Application, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Species Type, 2018 to 2033

Table 20: Latin America Market Volume (MT) Forecast by Species Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 22: Latin America Market Volume (MT) Forecast by Source, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by End Use Application, 2018 to 2033

Table 24: Latin America Market Volume (MT) Forecast by End Use Application, 2018 to 2033

Table 25: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 27: Europe Market Value (US$ Million) Forecast by Species Type, 2018 to 2033

Table 28: Europe Market Volume (MT) Forecast by Species Type, 2018 to 2033

Table 29: Europe Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 30: Europe Market Volume (MT) Forecast by Source, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by End Use Application, 2018 to 2033

Table 32: Europe Market Volume (MT) Forecast by End Use Application, 2018 to 2033

Table 33: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Asia Pacific Market Volume (MT) Forecast by Country, 2018 to 2033

Table 35: Asia Pacific Market Value (US$ Million) Forecast by Species Type, 2018 to 2033

Table 36: Asia Pacific Market Volume (MT) Forecast by Species Type, 2018 to 2033

Table 37: Asia Pacific Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 38: Asia Pacific Market Volume (MT) Forecast by Source, 2018 to 2033

Table 39: Asia Pacific Market Value (US$ Million) Forecast by End Use Application, 2018 to 2033

Table 40: Asia Pacific Market Volume (MT) Forecast by End Use Application, 2018 to 2033

Table 41: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: MEA Market Volume (MT) Forecast by Country, 2018 to 2033

Table 43: MEA Market Value (US$ Million) Forecast by Species Type, 2018 to 2033

Table 44: MEA Market Volume (MT) Forecast by Species Type, 2018 to 2033

Table 45: MEA Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 46: MEA Market Volume (MT) Forecast by Source, 2018 to 2033

Table 47: MEA Market Value (US$ Million) Forecast by End Use Application, 2018 to 2033

Table 48: MEA Market Volume (MT) Forecast by End Use Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Species Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Source, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End Use Application, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (MT) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Species Type, 2018 to 2033

Figure 10: Global Market Volume (MT) Analysis by Species Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Species Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Species Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 14: Global Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by End Use Application, 2018 to 2033

Figure 18: Global Market Volume (MT) Analysis by End Use Application, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by End Use Application, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by End Use Application, 2023 to 2033

Figure 21: Global Market Attractiveness by Species Type, 2023 to 2033

Figure 22: Global Market Attractiveness by Source, 2023 to 2033

Figure 23: Global Market Attractiveness by End Use Application, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Species Type, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Source, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by End Use Application, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Species Type, 2018 to 2033

Figure 34: North America Market Volume (MT) Analysis by Species Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Species Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Species Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 38: North America Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by End Use Application, 2018 to 2033

Figure 42: North America Market Volume (MT) Analysis by End Use Application, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by End Use Application, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by End Use Application, 2023 to 2033

Figure 45: North America Market Attractiveness by Species Type, 2023 to 2033

Figure 46: North America Market Attractiveness by Source, 2023 to 2033

Figure 47: North America Market Attractiveness by End Use Application, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Species Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Source, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by End Use Application, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Species Type, 2018 to 2033

Figure 58: Latin America Market Volume (MT) Analysis by Species Type, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Species Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Species Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 62: Latin America Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by End Use Application, 2018 to 2033

Figure 66: Latin America Market Volume (MT) Analysis by End Use Application, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by End Use Application, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by End Use Application, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Species Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Source, 2023 to 2033

Figure 71: Latin America Market Attractiveness by End Use Application, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Europe Market Value (US$ Million) by Species Type, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) by Source, 2023 to 2033

Figure 75: Europe Market Value (US$ Million) by End Use Application, 2023 to 2033

Figure 76: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ Million) Analysis by Species Type, 2018 to 2033

Figure 82: Europe Market Volume (MT) Analysis by Species Type, 2018 to 2033

Figure 83: Europe Market Value Share (%) and BPS Analysis by Species Type, 2023 to 2033

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Species Type, 2023 to 2033

Figure 85: Europe Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 86: Europe Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 87: Europe Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 88: Europe Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 89: Europe Market Value (US$ Million) Analysis by End Use Application, 2018 to 2033

Figure 90: Europe Market Volume (MT) Analysis by End Use Application, 2018 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by End Use Application, 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by End Use Application, 2023 to 2033

Figure 93: Europe Market Attractiveness by Species Type, 2023 to 2033

Figure 94: Europe Market Attractiveness by Source, 2023 to 2033

Figure 95: Europe Market Attractiveness by End Use Application, 2023 to 2033

Figure 96: Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Asia Pacific Market Value (US$ Million) by Species Type, 2023 to 2033

Figure 98: Asia Pacific Market Value (US$ Million) by Source, 2023 to 2033

Figure 99: Asia Pacific Market Value (US$ Million) by End Use Application, 2023 to 2033

Figure 100: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Asia Pacific Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 103: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Asia Pacific Market Value (US$ Million) Analysis by Species Type, 2018 to 2033

Figure 106: Asia Pacific Market Volume (MT) Analysis by Species Type, 2018 to 2033

Figure 107: Asia Pacific Market Value Share (%) and BPS Analysis by Species Type, 2023 to 2033

Figure 108: Asia Pacific Market Y-o-Y Growth (%) Projections by Species Type, 2023 to 2033

Figure 109: Asia Pacific Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 110: Asia Pacific Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 111: Asia Pacific Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 112: Asia Pacific Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 113: Asia Pacific Market Value (US$ Million) Analysis by End Use Application, 2018 to 2033

Figure 114: Asia Pacific Market Volume (MT) Analysis by End Use Application, 2018 to 2033

Figure 115: Asia Pacific Market Value Share (%) and BPS Analysis by End Use Application, 2023 to 2033

Figure 116: Asia Pacific Market Y-o-Y Growth (%) Projections by End Use Application, 2023 to 2033

Figure 117: Asia Pacific Market Attractiveness by Species Type, 2023 to 2033

Figure 118: Asia Pacific Market Attractiveness by Source, 2023 to 2033

Figure 119: Asia Pacific Market Attractiveness by End Use Application, 2023 to 2033

Figure 120: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 121: MEA Market Value (US$ Million) by Species Type, 2023 to 2033

Figure 122: MEA Market Value (US$ Million) by Source, 2023 to 2033

Figure 123: MEA Market Value (US$ Million) by End Use Application, 2023 to 2033

Figure 124: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: MEA Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 127: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: MEA Market Value (US$ Million) Analysis by Species Type, 2018 to 2033

Figure 130: MEA Market Volume (MT) Analysis by Species Type, 2018 to 2033

Figure 131: MEA Market Value Share (%) and BPS Analysis by Species Type, 2023 to 2033

Figure 132: MEA Market Y-o-Y Growth (%) Projections by Species Type, 2023 to 2033

Figure 133: MEA Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 134: MEA Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 135: MEA Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 136: MEA Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 137: MEA Market Value (US$ Million) Analysis by End Use Application, 2018 to 2033

Figure 138: MEA Market Volume (MT) Analysis by End Use Application, 2018 to 2033

Figure 139: MEA Market Value Share (%) and BPS Analysis by End Use Application, 2023 to 2033

Figure 140: MEA Market Y-o-Y Growth (%) Projections by End Use Application, 2023 to 2033

Figure 141: MEA Market Attractiveness by Species Type, 2023 to 2033

Figure 142: MEA Market Attractiveness by Source, 2023 to 2033

Figure 143: MEA Market Attractiveness by End Use Application, 2023 to 2033

Figure 144: MEA Market Attractiveness by Country, 2023 to 2033

The overall market size for the health and medical microalgae market was USD 819.1 Million in 2025.

The health and medical microalgae market is expected to reach USD 1,399.14 Million in 2035.

Growth is driven by the rising demand for natural and sustainable nutritional supplements, increasing use of microalgae in pharmaceuticals, advancements in biotechnology for microalgae cultivation, and expanding applications in functional foods and nutraceuticals.

The top 5 countries driving the development of the health and medical microalgae market are the USA, China, Germany, Japan, and France.

Spirulina and Chlorella-based Microalgae Products are expected to command a significant share over the assessment period.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA