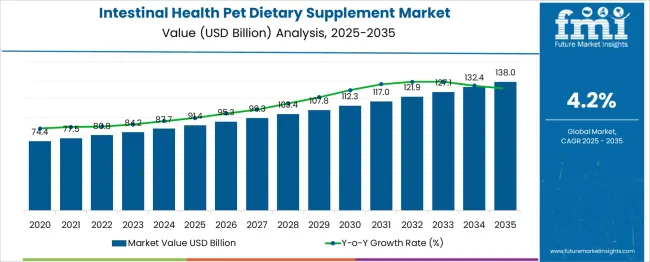

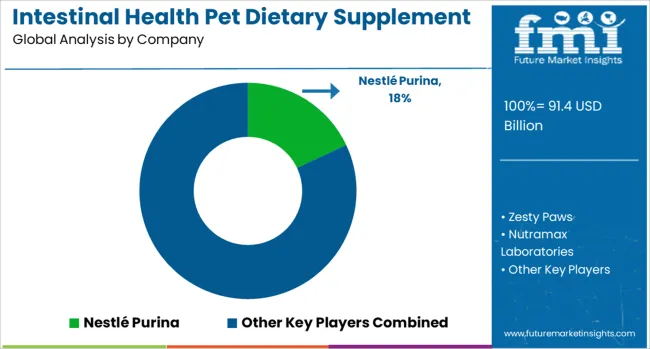

The intestinal health pet dietary supplement market is estimated to be valued at USD 91.4 billion in 2025 and is projected to reach USD 138.0 billion by 2035, registering a compound annual growth rate (CAGR) of 4.2% over the forecast period.

Rising pet adoption rates and growing expenditure on premium nutrition products in North America and Europe fuel this demand. Innovations in probiotic, prebiotic, and enzymatic supplement formulations tailored to diverse pet species support market expansion.

This growth is fueled by rising chronic gastrointestinal conditions in pets, heightened focus on preventive healthcare, and increasing veterinary recommendations for dietary supplements. Expanding research on microbiome health and increasing consumer inclination towards natural and holistic pet care underpin market growth. Overall, the intestinal health pet dietary supplement market is set for sustained, exponential growth, supported by evolving pet care trends, scientific innovations, and expanding global pet populations through 2035.

Veterinary clinic markets represent a significant distribution channel where practitioners recommend targeted supplement protocols for pets recovering from antibiotic treatments, experiencing stress-related digestive upset, or managing chronic gastrointestinal conditions that benefit from ongoing nutritional support. Clinical veterinarians specify supplement formulations containing documented bacterial strains with established efficacy data for specific conditions while considering palatability factors that ensure compliance throughout treatment protocols. Diagnostic laboratories report increasing test volumes for microbiome analysis and food sensitivity evaluation that guide personalized supplement recommendations based on individual pet health profiles.

Premium pet food manufacturers demonstrate growing integration of intestinal health supplements directly into dry kibble and wet food formulations, creating functional pet foods that deliver therapeutic benefits through daily feeding routines rather than separate supplement administration. Product development teams balance supplement stability during manufacturing and storage processes against bioavailability requirements that ensure active ingredient potency throughout product shelf life. Quality assurance protocols emphasize bacterial viability testing, moisture control, and packaging systems that maintain probiotic effectiveness under varying storage conditions encountered in retail distribution channels.

Technology development trajectories focus on microencapsulation techniques and delivery systems that protect sensitive probiotic bacteria from stomach acid degradation while ensuring targeted release within intestinal environments. Freeze-drying processes and protective coating technologies enable shelf-stable probiotic formulations that maintain viability without refrigeration requirements. Advanced fermentation methods produce specialized bacterial strains optimized for pet digestive systems while eliminating human-derived microorganisms that may not colonize effectively in animal intestinal environments.

Supply chain considerations emphasize cold storage infrastructure and rapid distribution systems that maintain probiotic viability throughout manufacturing, warehousing, and retail operations. Raw material sourcing strategies prioritize bacterial strain suppliers with documented quality control systems and genetic stability verification protocols. Packaging innovations include moisture barrier films, oxygen-absorbing systems, and tamper-evident closures that preserve supplement potency while providing consumer confidence regarding product integrity and safety.

| Metric | Value |

|---|---|

| Intestinal Health Pet Dietary Supplement Market Estimated Value in (2025 E) | USD 91.4 billion |

| Intestinal Health Pet Dietary Supplement Market Forecast Value in (2035 F) | USD 138.0 billion |

| Forecast CAGR (2025 to 2035) | 4.2% |

The intestinal health pet dietary supplement market is undergoing significant expansion as pet owners increasingly prioritize the digestive wellness of companion animals. This growth has been supported by heightened awareness of gut health as a foundation for overall well-being in pets. Innovations in microbiome science, paired with rising veterinary endorsements, have fostered a shift from reactive to preventive care, particularly in developed regions.

As the humanization of pets continues to influence consumer behavior, dietary supplements focused on intestinal balance are being integrated into routine feeding practices. Emerging product formulations and clean-label trends have added momentum, especially among health-conscious consumers seeking functional nutrition for their pets.

With rising incidences of digestive disorders among domesticated animals and increased spending on premium pet care products, the market is poised for continued growth. Expansion is further supported by evolving retail strategies, including direct-to-consumer and e-commerce platforms, which are broadening accessibility and reinforcing repeat purchases..

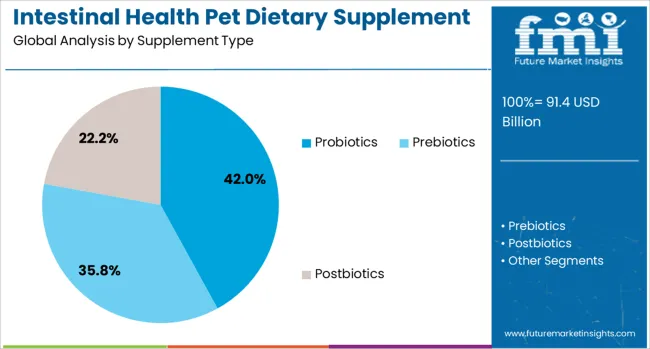

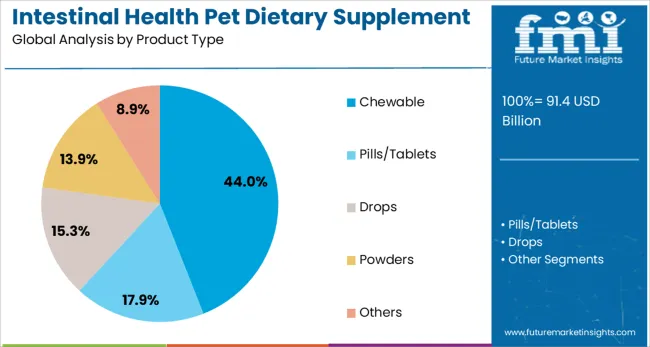

The intestinal health pet dietary supplement market is segmented by supplement type, product type, pet type, price range, application distribution channel, and geographic regions. By supplement type of the intestinal health pet dietary supplement market is divided into Probiotics, Prebiotics, Postbiotics, Immunostimulants, Phytogenic, Butyric acid Others (fiber sources, etc.). In terms of product type of the intestinal health pet dietary supplement market is classified into Chewable, Pills/Tablets, Drops, Powders Others.

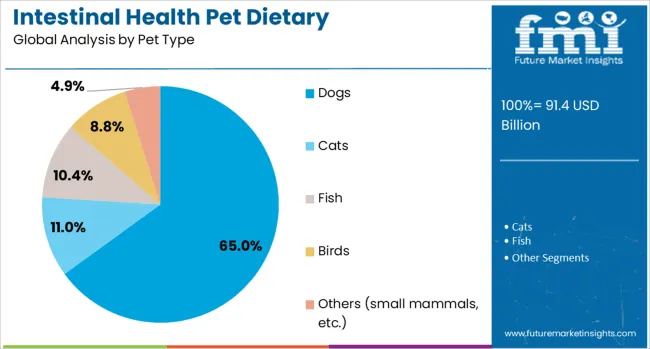

Based on pet type of the intestinal health pet dietary supplement market is segmented into Dogs, Cats, Fish, Birds Others (small mammals, etc.). By price range of the intestinal health pet dietary supplement market is segmented into Medium (Between USD 25–50), Low (less than USD 25)High (More than USD 50). By application of the intestinal health pet dietary supplement market is segmented into Digestive health, Immune system support, Skin and coat health Others (cognitive, urinary, etc.). By distribution channel of the intestinal health pet dietary supplement market is segmented into Online Offline. Regionally, the intestinal health pet dietary supplement industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The probiotics segment is projected to hold 42% of the intestinal health pet dietary supplement market revenue share in 2025, establishing it as the leading supplement type. This prominence has been driven by growing veterinary consensus that probiotics support microbial balance and enhance gut function in both healthy and sensitive pets. The segment’s leadership has been reinforced by scientific validation of probiotics in reducing digestive discomfort, improving stool quality, and strengthening immune response.

Pet owners have increasingly opted for probiotics due to their preventive benefits, natural formulation, and compatibility with daily feeding regimens. Demand has been accelerated by product diversification, with strain-specific blends targeting breed, age, and dietary needs. Additionally, regulatory flexibility in many regions has allowed rapid commercialization of probiotic-based supplements.

The segment’s strength also lies in its adaptability to multiple delivery forms, enabling seamless integration into pet routines without disrupting feeding behavior. As knowledge of the pet microbiome continues to evolve, probiotics are expected to retain their dominant role in this segment..

The chewable segment is expected to account for 44% of the intestinal health pet dietary supplement market revenue share in 2025, making it the dominant product type. This segment has gained preference due to its palatability, ease of administration, and strong consumer acceptance across pet age groups. Chewable formats have been favored by pet owners for their resemblance to treats, which has improved daily compliance and minimized stress during supplementation.

The convenience offered by this format has been particularly valuable for older pets or those with dietary sensitivities, enabling effortless digestion and absorption of nutrients. Manufacturers have capitalized on this preference by launching chewables with appealing flavors and functional ingredients, increasing both retention and brand loyalty.

Advances in formulation technology have ensured ingredient stability and efficacy in chewable form, further boosting credibility among veterinarians and consumers. The segment has also benefited from attractive packaging and portion control options, which enhance user experience and drive repeat purchases..

The dogs segment is forecast to represent 65% of the intestinal health pet dietary supplement market revenue share in 2025, positioning it as the leading pet type. This leadership has been supported by the larger population base of domesticated dogs compared to other companion animals, alongside their higher rates of gastrointestinal sensitivity and dietary variability. Increased awareness among dog owners regarding digestive health, combined with rising veterinary recommendations for preventive supplementation, has propelled this segment forward.

Dogs have exhibited stronger responsiveness to dietary interventions aimed at resolving gut-related issues such as bloating, irregular bowel movements, and sensitivity to food changes. Premiumization trends and higher per capita spending on canine wellness have further influenced purchasing behavior, with owners seeking advanced solutions for long-term gut health.

The segment’s performance has also been aided by widespread availability of dog-specific formulations, particularly in flavored chewables and powders, tailored to size, breed, and age-specific needs. Continued research on canine gut microbiota is expected to sustain innovation and reinforce the dominance of this segment..

The intestinal health pet dietary supplement market is driven by targeted formulations, veterinary endorsement, and diversified ingredient use. Expanding distribution channels and convenient formats are strengthening its presence across retail and online platforms.

The intestinal health pet dietary supplement market has been shaped by a growing focus among pet owners on maintaining digestive balance in companion animals. Rising incidence of gastrointestinal issues in dogs and cats has created demand for products targeting gut flora, nutrient absorption, and stool quality. Probiotic and prebiotic blends have gained preference due to their perceived benefits in supporting immune responses and reducing digestive discomfort. Manufacturers are investing in scientifically supported formulas that address specific conditions such as loose stools or poor appetite recovery after illness. Expansion in vet-recommended solutions, coupled with e-commerce penetration, has widened product reach. Consumer education through veterinary clinics and online platforms has further accelerated adoption of gut-health-focused pet supplements.

Ingredient diversification has become a central growth driver, with synbiotics, digestive enzymes, and fiber sources being integrated into supplement formulations. Synbiotics combine probiotics and prebiotics to offer dual benefits for gut microbiota stability. Enzyme supplements are tailored to address protein, fat, or carbohydrate breakdown inefficiencies, particularly in older or sensitive pets. Plant-based fibers such as psyllium husk and pumpkin powder are being added for stool regulation and overall digestive health. Manufacturers are also using strain-specific probiotics with targeted health claims. The growing appeal of functional treats and toppers containing these ingredients allows pet owners to integrate gut health support into daily feeding routines without disrupting pets’ dietary preferences.

Veterinary recommendations are influencing product credibility and purchase decisions in this segment. Brands are partnering with veterinary professionals to develop formulations supported by clinical studies, enhancing trust and justifying premium pricing. Evidence-based marketing, including publication of peer-reviewed research on supplement efficacy, is being used to stand out in a competitive market. Veterinary clinics are becoming important distribution channels, particularly for prescription-based digestive supplements. Diagnostic tools that help veterinarians identify specific gut health needs are enabling more personalized product recommendations. This professional endorsement not only drives repeat purchases but also supports brand positioning in both specialty and mainstream retail channels.

Product delivery formats are evolving to improve convenience and compliance, with chewables, powders, and liquid supplements being packaged for easy dosing. Flavored formulations are being developed to appeal to pets and reduce resistance during administration. E-commerce and subscription models are gaining traction, offering regular delivery of digestive health products directly to pet owners. Retailers are expanding shelf space for gut health supplements in both pet specialty stores and general supermarkets. Cross-promotion with pet food brands is enabling bundled sales, where digestive supplements are offered alongside functional kibble or wet food. This multi-channel availability ensures both impulse and planned purchases, strengthening overall market penetration.

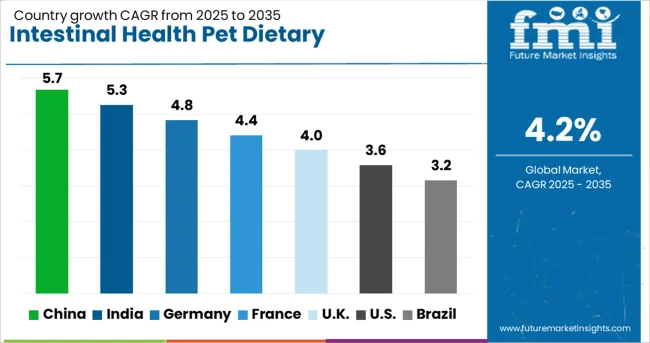

| Country | CAGR |

|---|---|

| China | 5.7% |

| India | 5.3% |

| Germany | 4.8% |

| France | 4.4% |

| UK | 4.0% |

| USA | 3.6% |

| Brazil | 3.2% |

The intestinal health pet dietary supplement market is projected to expand globally at a CAGR of 4.2% from 2025 to 2035, with China leading at 5.7% as rising pet ownership and increased awareness of digestive wellness drive premium supplement adoption. India follows at 5.3%, supported by growth in urban pet adoption and the introduction of specialized probiotic and fiber-rich formulations. France achieves 4.4%, supported by the integration of gut-health-focused products in veterinary nutrition programs. The UK posts 4.0%, driven by functional treat innovation, while the USA maintains 3.6% CAGR, influenced by mature market penetration and sustained demand for advanced gastrointestinal support products.

China’s intestinal health pet dietary supplement market recorded a 4.9% CAGR between 2020–2024 and advanced to 5.7% for 2025–2035. This acceleration has been supported by premiumization in the pet food and supplement category, higher disposable spending on companion animals, and stronger veterinary clinic distribution networks. International brands entered with targeted digestive care ranges, while domestic producers enhanced formulations with multi-strain probiotics and prebiotic fibers. Online platforms and social media campaigns boosted brand visibility, leading to wider adoption in urban centers.

India’s intestinal health pet dietary supplement market grew at 4.5% CAGR during 2020–2024 and accelerated to 5.3% for 2025–2035. This improvement is driven by rising awareness of digestive wellness among pet owners, higher veterinary recommendations, and product innovations blending probiotics with natural ingredients. E-commerce platforms expanded product visibility, while offline pet specialty retailers increased shelf space for digestive supplements. The integration of gut health solutions into broader preventive healthcare routines for pets also enhanced repeat purchase behavior. Local manufacturers leveraged traditional Ayurvedic formulations to differentiate offerings and attract health-conscious pet owners.

France’s intestinal health pet dietary supplement market posted a 3.9% CAGR from 2020–2024, which improved to 4.4% between 2025–2035. This rise is influenced by the growing humanization of pets, heightened interest in preventive care, and greater availability of specialized digestive health formulations. Pet pharmacies and veterinary clinics enhanced their assortment, while pet food manufacturers bundled digestive aids into daily feed products. Regulatory clarity on supplement ingredients also encouraged broader product development. Consumer preference for organic and non-GMO formulations added momentum to premium categories.

The CAGR for the UK intestinal health pet dietary supplement market was 3.5% in 2020–2024, rising to 4.0% for 2025–2035. This growth increase is linked to broader distribution through major pet retail chains, heightened demand for functional pet treats, and expanded use of digestive aids for both dogs and cats. Rising pet adoption during the COVID-19 era created a lasting consumer base for preventive care solutions. Pet wellness subscription services also began including digestive supplements as part of their monthly offerings. Enhanced R&D in palatability improved compliance rates among pets, supporting repeat sales.

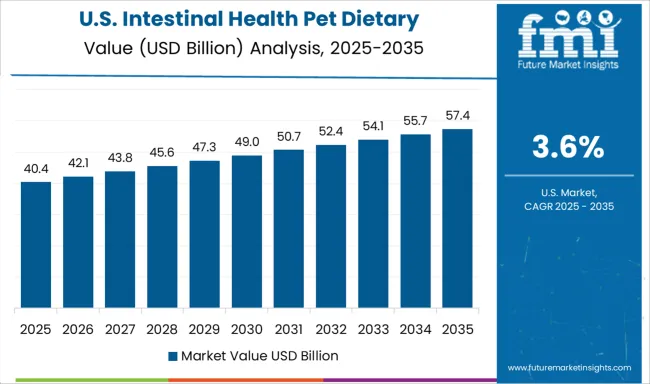

The CAGR for the USA intestinal health pet dietary supplement market stood at 3.2% during 2020–2024 and improved to 3.6% for 2025–2035. This increase has been supported by heightened pet wellness awareness, the expansion of premium veterinary-exclusive formulations, and strategic partnerships between supplement brands and large pet retail chains. E-commerce growth also facilitated direct-to-consumer subscription models that bundled digestive supplements with other wellness products. Product innovation centered on multi-functional supplements combining gut health with joint support or skin benefits further expanded category appeal. Targeted marketing campaigns addressing breed-specific digestive concerns encouraged adoption among both first-time and experienced pet owners.

The intestinal health pet dietary supplement market is led by major pet nutrition and wellness brands focused on science-based formulations, natural ingredients, and multi-channel retail strategies. Nestlé Purina dominates through its veterinarian-backed digestive health products that combine probiotics, prebiotics, and enzyme support, leveraging a strong global distribution network across veterinary clinics and specialty retailers. Zesty Paws maintains a powerful presence in the e-commerce space with functional chews and probiotic blends designed for daily digestive balance, emphasizing palatability and convenience for pet owners.

Nutramax Laboratories holds a strong clinical reputation with enzyme-based and probiotic supplements formulated to enhance gut microbiome health and nutrient absorption, supported by ongoing veterinary research. NOW Foods extends its expertise from human nutrition into pet wellness, offering clean-label, human-grade digestive supplements free from artificial additives. Hill’s Pet Nutrition integrates digestive support within its veterinary-prescribed diets, reinforcing its credibility through clinical trials and targeted gastrointestinal formulas. NaturVet focuses on natural and plant-based formulations with added enzymes, probiotics, and fiber, catering to the growing consumer preference for holistic and sustainable pet health solutions. The Honest Kitchen differentiates through whole-food-based, minimally processed supplements with transparent ingredient sourcing and functional nutrition claims.

| Item | Value |

|---|---|

| Quantitative Units | USD 91.4 Billion |

| Supplement Type | Probiotics, Prebiotics, Postbiotics, Immunostimulants, Phytogenic, Butyric acid, and Others (fiber sources, etc.) |

| Product Type | Chewable, Pills/Tablets, Drops, Powders, and Others |

| Pet Type | Dogs, Cats, Fish, Birds, and Others (small mammals, etc.) |

| Price Range | Medium (Between USD 25–50), Low (less than USD 25), and High (More than USD 50) |

| Application | Digestive health, Immune system support, Skin and coat health, and Others (cognitive, urinary, etc.) |

| Distribution Channel | Online and Offline |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Nestlé Purina; Zesty Paws; Nutramax Laboratories; NOW Foods; Hill’s Pet Nutrition; NaturVet; The Honest Kitchen |

| Additional Attributes | Dollar sales, share, growth rates across regions, leading ingredient trends in probiotics and prebiotics, regulatory shifts impacting formulations, competitive brand positioning, distribution channel performance, consumer preference shifts, and emerging niche health claims in digestive wellness for pets. |

The global intestinal health pet dietary supplement market is estimated to be valued at USD 91.4 billion in 2025.

The market size for the intestinal health pet dietary supplement market is projected to reach USD 138.0 billion by 2035.

The intestinal health pet dietary supplement market is expected to grow at a 4.2% CAGR between 2025 and 2035.

The key product types in intestinal health pet dietary supplement market are probiotics, _lactobacillus, _bifidobacterium, _enterococcus, _bacillus, _others, prebiotics, _inulin, _fos (fructooligosaccharides), _pectin, _others, postbiotics, _lactate, _short-chain fatty acids (scfas), _others (vitamins, enzymes, etc.), immunostimulants, _herbal/botanical extracts, _vitamins and minerals, _others, phytogenic, _herbs (peppermint, rosemary, etc.), _spices (clove, fennel, etc.), _botanical extracts, _fruits and vegetables, _others, butyric acid, _butyrate salts, _encapsulated butyric acid, _butyric acid glycerides and others (fiber sources, etc.).

In terms of product type, chewable segment to command 44.0% share in the intestinal health pet dietary supplement market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Dog Intestinal Health Pet Dietary Supplement Market Size and Share Forecast Outlook 2025 to 2035

Pet Dietary Supplement Market Size and Share Forecast Outlook 2025 to 2035

Industry Share Analysis for Pet Dietary Supplement Companies

UK Pet Dietary Supplement Market Growth – Trends, Demand & Forecast 2025-2035

Pet Joint Health Supplement Market Size and Share Forecast Outlook 2025 to 2035

USA Pet Dietary Supplement Market Insights – Size, Share & Industry Growth 2025-2035

ASEAN Pet Dietary Supplement Market Report – Demand, Growth & Trends 2025-2035

Europe Pet Dietary Supplement Market Trends – Growth, Demand & Outlook 2025-2035

Pet Skin & Coat Health Supplement Market Analysis by Pet Type, Form, Availability and Sales Channel Through 2035

Australia Pet Dietary Supplement Market Analysis – Size, Share & Forecast 2025-2035

Dietary Supplement Market Insights - Growth & Demand 2025 to 2035

Dietary Supplements Packaging Market Analysis – Trends & Forecast 2025-2035

Pet Bird Health Market Size and Share Forecast Outlook 2025 to 2035

Pet Herbal Supplements Market Size and Share Forecast Outlook 2025 to 2035

Pet Food and Supplement Market - Size, Share, and Forecast Outlook 2025 to 2035

Pet Cognitive Supplement Market Size and Share Forecast Outlook 2025 to 2035

Healthy Aging Supplement Market – Demand, Innovations & Market Growth

Gut Health Supplement Market Size, Growth, and Forecast for 2025 to 2035

Pet Probiotics Supplements Market - Size, Share, and Forecast Outlook 2025 to 2035

Pet Postbiotics Supplement Market – Trends, Demand & Pet Wellness

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA