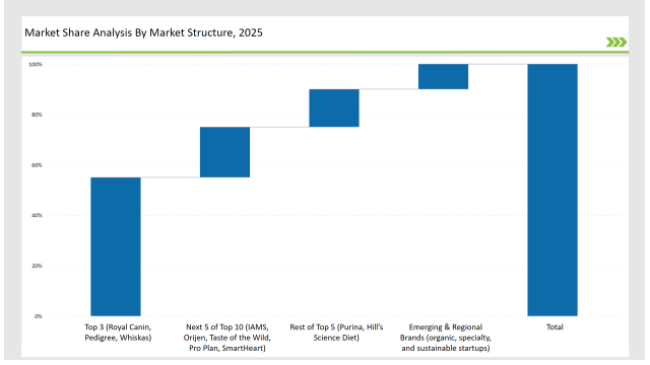

The Indonesia pet care market has witnessed unprecedented growth over recent years due to pet ownership, rising disposable incomes, and increasing awareness of pet health and wellness. Urbanization and changes in lifestyle have created opportunities for premium pet food, grooming services, and veterinary care. Advances in nutrition, sustainable pet products, and digital pet care are revolutionizing the industry. Major brands include Royal Canin, Pedigree, and Whiskas, which have a wide distribution network and high consumer trust levels that have captured 55% of the market. The other 30% is shared between regional brands and emerging startups. Specialty and organic pet care brands make up the remaining 15%.

| Market Segment | Industry Share (%) |

|---|---|

| Top 3 (Royal Canin, Pedigree, Whiskas) | 55% |

| Rest of Top 5 (Purina, Hill’s Science Diet) | 15% |

| Next 5 of Top 10 (IAMS, Orijen, Taste of the Wild, Pro Plan, SmartHeart) | 20% |

| Emerging & Regional Brands (organic, specialty, and sustainable startups) | 10% |

The Indonesia pet care market in 2025 is moderately concentrated, with global brands such as Mars Petcare, Nestlé Purina, and Royal Canin leading the industry. However, local brands and smaller specialty pet food providers contribute to market competition. Rising pet adoption rates and premiumization trends are driving market growth and product innovation.

The Indonesia pet care market is expanding across multiple sales channels. Pet specialty stores and supermarkets lead the market with 50% market share, due to in-store consultations and the availability of high-end pet products. E-commerce platforms account for 35% due to the convenience of online shopping, subscription-based deliveries, and pet wellness apps. Veterinary clinics and pharmacies account for 10%, based on prescription diets and pet medications. The remaining 5% is DTC brands and niche pet boutiques, which are responding to the growing demand for personalized pet care.

The market is segmented into pet food, pet grooming, pet accessories, and veterinary care. Pet food leads with 60% market share because most pet owners pay much attention to the quality of diets provided for their pets. Pet grooming constitutes 15%, driven by hygiene and aesthetic needs. Pet accessories constitute 15%, including bedding, leashes, and toys. Veterinary care constitutes 10%, focusing on health, vaccination, and preventive treatments.

2024 was a transformation year for the Indonesian pet care market, led by sustainability, premiumization, and digitalization. Leaders include:

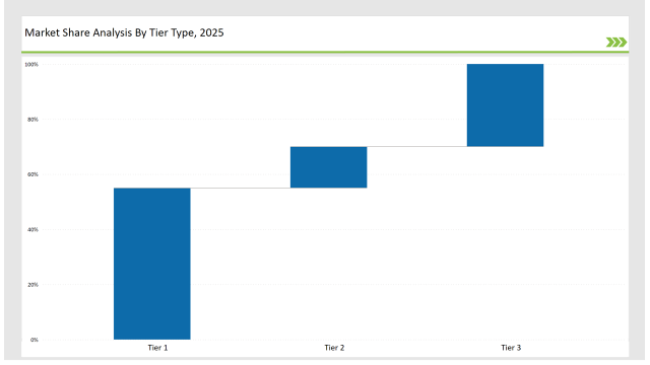

| Tier Type | Tier 1 |

|---|---|

| Example of Key Players | Royal Canin, Pedigree, Whiskas |

| Market Share % | 55% |

| Tier Type | Tier 2 |

|---|---|

| Example of Key Players | Purina, Hill’s Science Diet |

| Market Share % | 15% |

| Tier Type | Tier 3 |

|---|---|

| Example of Key Players | Regional brands, sustainable startups |

| Market Share % | 30% |

| Brand | Key Focus Areas |

|---|---|

| Royal Canin | Breed-specific & prescription pet diets |

| Pedigree | Affordable high-protein pet food |

| Whiskas | Gourmet wet food & functional treats |

| Purina | Sustainable packaging & organic ingredients |

| Hill’s Science Diet | Veterinary-recommended pet nutrition |

| Emerging Brands | Grain-free, protein-rich pet food alternatives |

The Indonesian pet care market is likely to be one that continues growing well, supported by rising adoption of pets, an increase in disposable income, and advances in nutrition and technology related to pets. Sustainability, digital pet health solutions, and premiumization will help brands to satisfy changing consumer needs. AI-powered pet food recommendations, telemedicine for pets, and eco-friendly pet care products will be the next evolution of the market. The future of Indonesia's pet care industry is all about pet humanization, digital convenience, and ethical product innovation.

Leading players such as Royal Canin, Pedigree, and Whiskas collectively hold around 55% of the market.

Regional pet care brands and private-label manufacturers contribute approximately 30% of the market by catering to local preferences and cost-effective alternatives.

Startups focusing on organic pet food, pet tech, and sustainable pet care solutions hold about 10% of the market.

Private labels from grocery retailers and online pet care platforms hold around 5% of the market.

High for companies controlling 55%+, medium for 40-55%, and low for those under 30%.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Indonesia Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Indonesia Surfing Tourism Market Insights – Size, Growth & Forecast 2025–2035

Industry Share & Competitive Positioning in Indonesia Baby Bottle Market

Indonesia Pet Care Market Size and Share Forecast Outlook 2025 to 2035

Baby Bottle Industry Analysis In Indonesia Growth - Trends & Forecast 2025 to 2035

Indonesia Consumer Packaging Market Trends & Forecast 2024-2034

Indonesia Sustainable Tourism Market Growth – Forecast 2024-2034

Pet Food Preservative Market Size and Share Forecast Outlook 2025 to 2035

Petroleum Liquid Feedstock Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Ingredients Market Size and Share Forecast Outlook 2025 to 2035

PET Stretch Blow Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

PET Injectors Market Size and Share Forecast Outlook 2025 to 2035

PET Material Packaging Market Size and Share Forecast Outlook 2025 to 2035

Petri Dishes Market Size and Share Forecast Outlook 2025 to 2035

Petroleum And Fuel Dyes and Markers Market Size and Share Forecast Outlook 2025 to 2035

Petrochemical Pumps Market Size and Share Forecast Outlook 2025 to 2035

PET Dome Lids Market Size and Share Forecast Outlook 2025 to 2035

Pet Dietary Supplement Market Size and Share Forecast Outlook 2025 to 2035

PET Imaging Workflow Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Petroleum Refinery Merchant Hydrogen Generation Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA