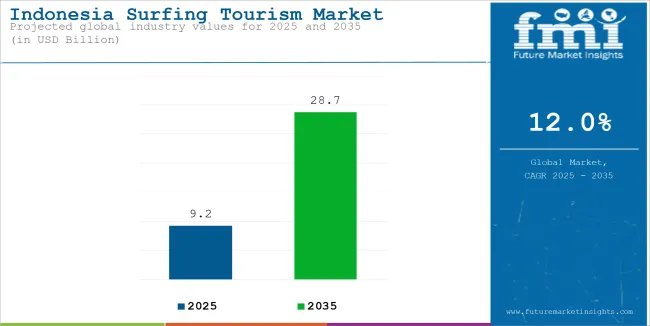

The Indonesia Surfing Tourism Industry is poised for tremendous growth, with its market value rising from USD 9.2 billion in 2025 to USD 28.7 billion by 2035, supported by a strong CAGR of 12%. The growth is supported by Indonesia's world-class and varied surf spots, including Bali, Sumatra, and the Mentawai Islands, which remain popular among surfers worldwide. With international popularity growing for Indonesia's surf destinations, more and more surfers are heading for Indonesia's unusual shore breaks, from easy waves suited for beginners to difficult reef breaks.

Rising demand for niche surf resorts that present customized experience, luxury resorts, and concern for sustainability adds support to growth as well. They service the developing worldwide surf culture by offering premium amenities like surf schools, guided tours, and environmentally friendly accommodations, making Indonesia a more attractive spot for surf travel.

Market Overview

| Attribute | Value |

|---|---|

| Estimated Indonesia Industry Size (2025E) | USD 9.2 billion |

| Projected Indonesia Value (2035F) | USD 28.7 billion |

| Value-based CAGR (2025 to 2035) | 12% |

The surf tourism demand in Indonesia is gaining pace as more surfers become attracted to the charm of its virgin waves. Bali, Sumatra, and Java are becoming increasingly associated with first-class surf points, while surf camps and resorts in the regions are providing specialist surf holidays, drawing tourists in search of not just challenging surf but also culture and peace.

The following chart outlines the expected changes in CAGR for the base year 2024 and the forecast for 2025, highlighting shifting trends within the market.

CAGR Values for Indonesia Surfing Tourism Industry (2024 to 2025)

The market is expected to grow at a CAGR of 11.2% in the first half of 2024, with a slight increase to 11.4% in the second half. In 2025, the growth rate is projected to rise to 11.8% in the first half and peak at 12% in the second half due to the growing popularity of custom surf tours, eco-friendly surf camps, and wellness resorts that blend surfing with local cultural experiences.

Growth in Indonesia’s surf tourism is attributed to the rise in custom surf tours, along with the increasing appeal of eco-friendly surf camps and wellness resorts that integrate surfing with local cultural experiences.

| Category | Details |

|---|---|

| Market Value | The Indonesian surfing tourism market is estimated to generate USD 8.2 billion in 2024, contributing 30% to the Southeast Asian surfing tourism industry. |

| Domestic Market Share | Domestic tourists account for 45%, with key surfing destinations like Bali's Uluwatu, Sumatra's Mentawai Islands, and Java's G-Land. |

| International Market Share | International tourists account for 55%, with strong visitation from Australia, Europe, and Japan, particularly in Bali and the Mentawai Islands. |

| Key Destinations | Bali (Uluwatu, Kuta), Sumatra (Mentawai Islands), Java (G-Land), and Nusa Tenggara (Sumbawa, Rote Island). |

| Economic Impact | Surf tourism significantly boosts local economies, especially in Bali, through surf resorts, beach clubs, local businesses, and surf schools. |

| Key Trends | Increased interest in sustainable surf tourism, rise of luxury surf resorts with wellness offerings, and growing surf competition events in Bali. |

| Top Travel Seasons | Peak travel seasons are during the dry season (April to October), aligning with the best surf conditions across Indonesia's major surf regions. |

Indonesia’s surfing tourism industry is a core part of Southeast Asia’s surf scene, attracting both international travelers and a significant number of domestic surfers. Popular spots like Bali and the Mentawai Islands are continually drawing surfers from around the world, while the island of Sumbawa and other less crowded destinations are gaining traction for those seeking more remote surfing experiences.

| Date | Development & Details |

|---|---|

| Jan 2025 | Launch of Surf & Wellness Retreat in Bali: The Kuta Surf Resort introduced a combined surf and wellness retreat program, offering guided surfing sessions along with yoga and meditation classes. |

| Dec 2024 | New Surf Package in Mentawai Islands: Mentawai Surf Adventures launched an exclusive all-inclusive package, including boat trips to private surf spots and surf coaching for intermediate surfers. |

| Nov 2024 | Opening of Surf Park in Bali: Bali Surf Park opened its artificial wave pool, providing consistent waves for surfers of all levels, ideal for beginner to advanced surfers seeking controlled conditions. |

| Oct 2024 | Surf Competition in Java: The G-Land Surf Championship returned with a unique "Surf & Cultural Festival," blending elite surf competitions with traditional Javanese performances and local food. |

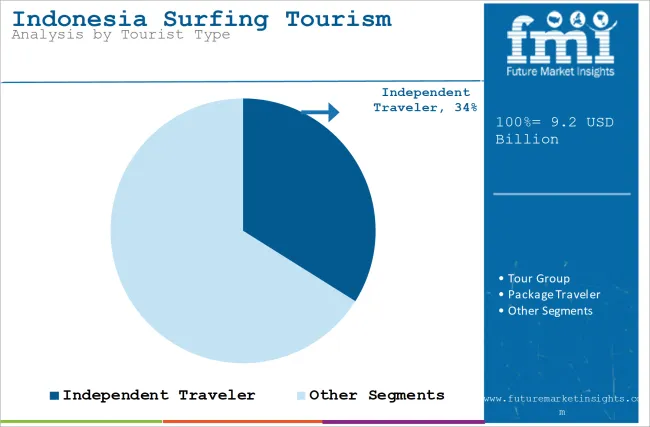

Independent Travelers Lead the Surfing Tourism Segment:

By 2025, independent travelers will make up 60% of Indonesia's surfing tourism industry, as more surfers opt to create their own experiences, wanting flexibility and customized surf experiences. Independent surfers, unlike conventional tours with predetermined itineraries, enjoy the liberty of creating their own schedules according to their choice, whether it is the kind of surf they desire or the area they want to visit. Bali’s Uluwatu, with its challenging waves and iconic reef breaks, is perfect for experienced surfers, while Nusa Lembongan offers calmer, less crowded waves that are ideal for intermediate surfers looking for a more relaxed surf environment.

Surf tourism demand increases for independent surf tourism as a result of online resources like the Indonesia Surf Guide app, through which surfers can easily plan their holidays. These apps offer surfers up-to-date information about surf conditions, weather forecasts, tide charts, and best times to catch the best wave. They also help travelers find and book accommodations that meet their needs, whether they require a luxurious stay at a resort or an affordable surf camp. Such accessibility allows surfers to travel without worry, knowing that they can find vital information at their fingertips.

Furthermore, independent surfers are increasingly drawn to off-the-beaten-path destinations as well that are both adventurous and isolated. They include such areas as the Mentawai Islands and Scar Reef of Sumbawa, which have a notorious reputation for having rocky waves and clean conditions, and hence surfers are able to move away from crowded spots and get closer to nature. These off-the-beaten-path locations also offer tourists the chance to dive into authentic Indonesian culture, an added layer of enrichment to their holiday. For the majority of single surfers, traveling to these less-traveled destinations means a more satisfying, distinctive surfing experience.

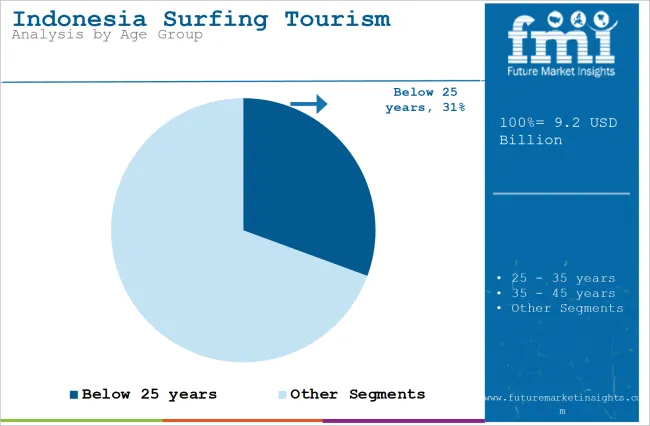

Surfers aged 25 to 35 are projected to account for 40% of Indonesia's surf tourism in 2025, attesting to growing domination of this age group in the market. These are seasoned surfers who have outgrown the beginner waves and are seeking challenging waves to improve their skills. They are attracted to well-established surf destinations like Bali, where top-shelf breaks like Uluwatu and Keramas offer perfect conditions for serious surfers. They are also keen to travel to new and off-the-beaten-path surf spots like Sumbawa and the Mentawai Islands, which have consistent, challenging waves and more isolated areas.

What sets surfers in this age range apart is their desire to blend their surfing passion with other cultural and adventure pursuits. While surfing is the main attraction, these travelers are increasingly interested in integrating local experiences into their trips. For example, they may explore Bali’s rich history by visiting ancient temples or take a trek through the jungles of Java. Indonesian cuisine, which is renowned for its strong flavor, is also part of their traveling experience, with the majority of surfers choosing to taste native dishes like nasi goreng or satay at restaurants in the area.

There are accommodations for this market ranging from boutique surf lodges in cool areas like Uluwatu, where amenities and social aspects take precedence, to luxury eco-lodges in the Mentawais, where sustainability is emphasized. Eco-accommodations that meet their values, for example, those that harvest renewable energy, offer organic produce, and are wasteful of little, appeal to these surfers. They are also drawn to surf camps with wellness programs, such as a more holistic experience in which surfing is incorporated with yoga, meditation, or conservation activities. This segment enjoys a balanced, immersive experience that allows them to grow both as surfers and tourists.

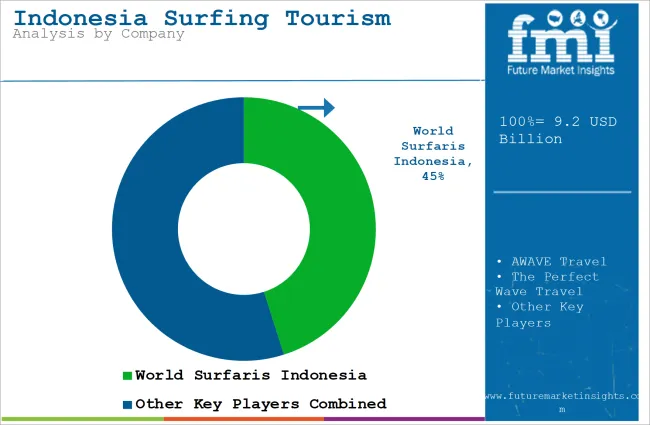

The Indonesia Surfing Tourism Industry is highly competitive, with various local surf resorts and international brands vying for market share. Leading players in the industry include World Surfaris Indonesia, AWAVE Travel, and The Perfect Wave Travel, while niche surf camps in remote locations such as Sumbawa and Nusa Tenggara are also gaining popularity.

2025 Market Share of Indonesia Surfing Tourism Players

Leading players with notable market share include World Surfaris Indonesia, AWAVE Travel, and The Perfect Wave Travel, followed by smaller surf camps and resorts catering to specific tourist segments such as wellness-focused retreats or eco-conscious surf camps, which are increasingly gaining popularity.

The industry is segmented into Domestic and International tourists.

The market is analyzed by gender (Men, Women).

Segmentation includes Independent Traveler, Tour Group, and Package Traveler.

The industry is segmented into Below 25 years, 25-35 years, 35-45 years, and Over 45 years.

The Indonesia Surfing Tourism Industry is expected to grow at a CAGR of 12% from 2025 to 2035.

The market is projected to reach USD 28.7 billion by 2035.

Key drivers include Indonesia's world-renowned surf destinations, increased demand for tailored surf experiences, and the growing popularity of sustainable and wellness-oriented surf tourism.

Key players include World Surfaris Indonesia, AWAVE Travel, and The Perfect Wave Travel.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Surfing Tourism Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

USA Surfing Tourism Market Insights – Growth, Demand & Forecast 2025-2035

Indonesia Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Canada Surfing Tourism Market Growth – Size, Trends & Forecast 2025-2035

Thailand Surfing Tourism Market Report – Demand, Innovations & Forecast 2025-2035

Australia Surfing Tourism Market Report – Innovations, Trends & Growth 2025–2035

Indonesia Sustainable Tourism Market Growth – Forecast 2024-2034

Tourism Independent Contractor Model Market Size and Share Forecast Outlook 2025 to 2035

Indonesia Pet Care Market Size and Share Forecast Outlook 2025 to 2035

Tourism Industry Analysis in Japan - Size, Share, & Forecast Outlook 2025 to 2035

Tourism Market Trends – Growth & Forecast 2025 to 2035

Tourism Industry Big Data Analytics Market Analysis by Application, by End, by Region – Forecast for 2025 to 2035

Assessing Tourism Industry Loyalty Program Market Share & Industry Trends

Tourism Industry Loyalty Programs Sector Analysis by Program Type by Traveler Profile by Region - Forecast for 2025 to 2035

Market Share Insights of Tourism Security Service Providers

Tourism Security Market Analysis by Service Type, by End User, and by Region – Forecast for 2025 to 2035

A Detailed Global Analysis of Brand Share for the Indonesia Pet Care Market

Industry Share & Competitive Positioning in Indonesia Baby Bottle Market

Competitive Overview of Geotourism Market Share

Geotourism Market Insights - Growth & Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA