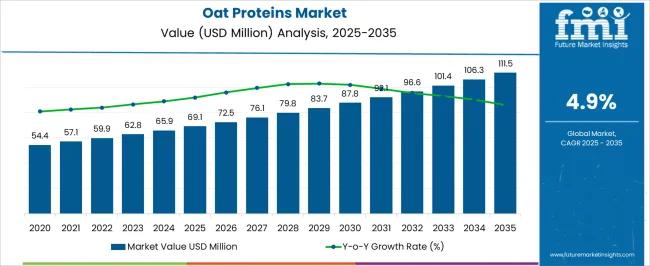

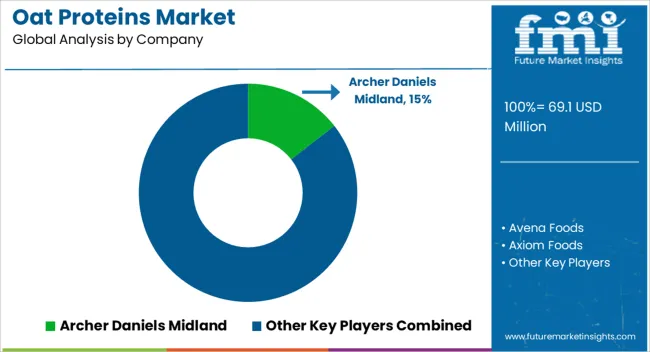

The oat proteins market, estimated at USD 69.1 million in 2025 and projected to reach USD 111.5 million by 2035 at a CAGR of 4.9%, reflects a moderate but steady expansion influenced by evolving cost structures and value-chain dynamics. The production process is largely dependent on raw oat procurement, protein extraction technologies, and downstream processing, each contributing variably to the overall cost composition.

Raw material sourcing constitutes a substantial portion of the market expenditure, with oat quality and regional cultivation practices directly affecting pricing. Processing technologies, including wet fractionation and dry milling, drive both operational efficiency and product differentiation, impacting the cost allocation across the value chain. Investments in specialized equipment for protein isolation, purification, and concentration represent significant capital expenditures but enable higher-value end products such as isolates and concentrates. Packaging, storage, and logistics form the secondary cost layer, particularly for maintaining protein integrity and shelf life. Value-chain optimization, including supplier agreements and integrated processing facilities, allows for reduced input variability and consistent output, supporting incremental margin improvements.

The market exhibits a cost structure where raw material procurement dominates, followed by processing and distribution expenditures. Technological investments and operational efficiencies increasingly shape the market’s value chain, ensuring profitability while enabling steady growth from 69.1 million in 2025 to 111.5 million by 2035.

| Metric | Value |

|---|---|

| Oat Proteins Market Estimated Value in (2025 E) | USD 69.1 million |

| Oat Proteins Market Forecast Value in (2035 F) | USD 111.5 million |

| Forecast CAGR (2025 to 2035) | 4.9% |

The oat proteins market represents a specialized part of the global plant protein industry, reflecting its role in nutrition and functional food applications. Within the broader plant-based protein segment, it accounts for nearly 4.6%, supported by the rise of alternative protein demand. In the food and beverage protein ingredient category, its share stands at about 3.8%, highlighting its growing adoption in bakery, dairy alternatives, and sports nutrition. Across the health and wellness-focused functional ingredients sector, it secures 4.2%, driven by consumer demand for natural and fiber-rich proteins.

Within the animal feed protein substitutes market, the contribution remains close to 2.9%, while in the clean label protein ingredients segment, the share reaches 3.5%, showcasing its relevance to product reformulations and consumer preference shifts. Recent industry developments emphasize innovation in processing and applications. Dry fractionation and enzymatic hydrolysis technologies are being deployed to improve the solubility and digestibility of oat proteins. Food manufacturers are introducing oat protein-enriched drinks, snack bars, and meat alternatives to capitalize on health-conscious consumption. Collaborative ventures between ingredient suppliers and food companies are focusing on protein fortification strategies to improve texture and nutritional profiles.

Groundbreaking efforts in sustainable sourcing and minimal waste production have gained momentum, with manufacturers aiming to optimize oat processing side streams. Moreover, advancements in protein blending with pea and soy are creating multifunctional plant protein solutions.

The oat proteins market is experiencing steady expansion, supported by increasing demand for plant-based proteins in functional foods, nutritional supplements, and clean-label formulations. Industry publications and product development announcements have pointed to a surge in the use of oat proteins due to their balanced amino acid profile, hypoallergenic properties, and suitability for vegan diets.

Food manufacturers are incorporating oat proteins into product lines to enhance texture, nutritional value, and sustainability credentials. Growing consumer preference for plant-derived proteins over animal-based sources, coupled with the rise of flexitarian and health-conscious diets, has broadened market adoption.

Advances in extraction technologies have improved protein yield and functionality, making oat proteins more competitive with soy and pea protein in terms of performance in various applications. Regulatory approvals and marketing of gluten-free oat protein variants have further strengthened market positioning. Continued investment in product innovation and expansion into sports nutrition and dairy alternatives is expected to support long-term growth, with type, form, and application trends reinforcing demand patterns.

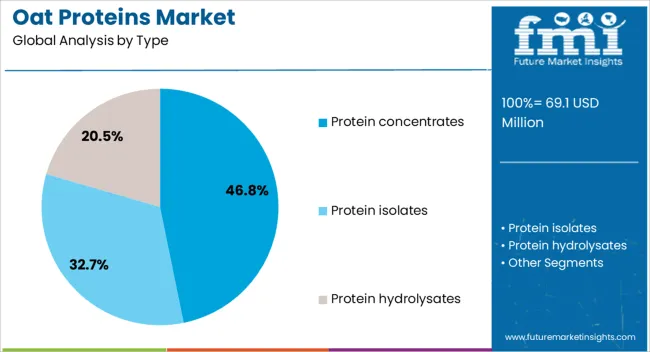

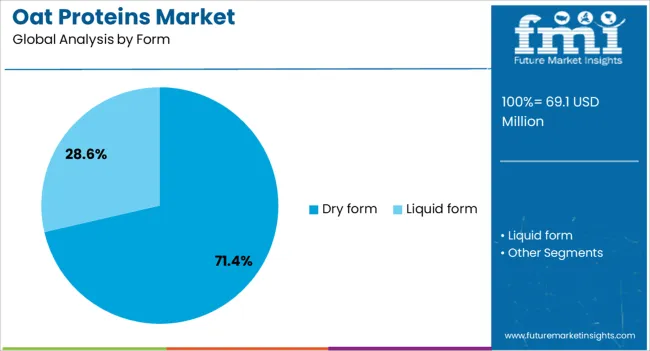

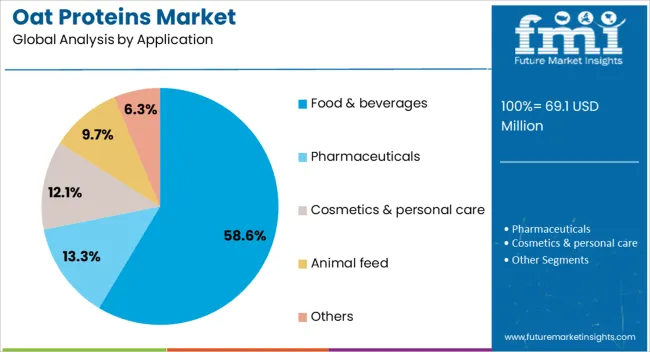

The oat proteins market is segmented by type, form, application, distribution channel, and geographic regions. By type, oat proteins market is divided into Protein concentrates, Protein isolates, and Protein hydrolysates. In terms of form, oat proteins market is classified into Dry form and Liquid form. Based on application, oat proteins market is segmented into Food & beverages, Pharmaceuticals, Cosmetics & personal care, Animal feed, and Others.

By distribution channel, oat proteins market is segmented into Offline retail and Online retail. Regionally, the oat proteins industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The protein concentrates segment is projected to account for 46.8% of the oat proteins market revenue in 2025, holding the largest share due to its versatility and cost-effectiveness. This segment’s growth has been driven by its balanced nutritional profile and moderate protein content, which make it suitable for a wide range of applications, from bakery products to nutritional beverages.

Food processors favor oat protein concentrates for their mild flavor, ease of formulation, and stability in various processing conditions. Production scalability and lower costs compared to protein isolates have also contributed to broader adoption, especially among mid-tier and large-scale food brands.

As demand for high-quality plant proteins continues to rise, protein concentrates remain a preferred option for manufacturers aiming to balance functionality, nutrition, and price, ensuring the segment’s sustained leadership.

The dry form segment is projected to contribute 71.4% of the oat proteins market revenue in 2025, maintaining its leading position due to its longer shelf life, ease of storage, and compatibility with diverse food formulations. Manufacturers have favored dry form oat proteins for their superior stability during transportation and processing, as well as their ability to be easily reconstituted in product manufacturing.

Dry form proteins are particularly suited for powdered supplements, bakery mixes, snack products, and ready-to-mix beverages. The segment’s dominance is further reinforced by its efficiency in bulk handling and lower transportation costs compared to liquid forms.

With the ongoing growth in packaged and convenience foods, as well as the global expansion of plant-based product lines, dry form oat proteins are expected to remain the primary choice for manufacturers and formulators.

The food & beverages segment is projected to hold 58.6% of the oat proteins market revenue in 2025, leading all application categories due to increasing integration of oat proteins into mainstream and specialty food products. This growth is fueled by consumer demand for protein-enriched snacks, dairy alternatives, and functional drinks that align with health and sustainability goals.

Food and beverage brands have leveraged oat proteins to enhance product texture, mouthfeel, and nutritional value without compromising taste. The segment has also benefited from the surge in plant-based diets, with oat proteins offering a clean-label alternative to soy and whey.

Marketing campaigns emphasizing allergen-friendly and sustainable sourcing have amplified consumer acceptance. As innovation in functional food development accelerates, the food & beverages segment is expected to maintain its dominant share, supported by broad application versatility and strong consumer appeal.

The market has grown steadily as plant-based protein sources gain preference in food, beverages, and dietary supplements. Oat protein is recognized for its high nutritional profile, functional properties, and suitability for clean-label product formulations. Its application extends to bakery, dairy alternatives, sports nutrition, and functional beverages. The mild flavor, gluten-free nature, and digestibility of oat protein have expanded its use in health-focused consumer products. Rising interest in vegan and vegetarian diets has fueled demand across both developed and emerging economies.

Oat proteins have gained importance in functional food and beverage formulations due to their favorable nutritional characteristics. Manufacturers are increasingly incorporating oat protein into dairy alternatives, protein bars, plant-based yogurts, and ready-to-drink nutritional beverages. Functional properties such as emulsification, water-binding, and foaming capabilities enhance product texture and stability. The natural association of oats with heart health and cholesterol reduction creates a strong foundation for marketing oat protein-based products. Additionally, its compatibility with other plant proteins allows for blended formulations that improve amino acid balance. The ability to meet demand for healthier, protein-rich, and allergen-free foods has strengthened oat protein’s role in food innovation pipelines. This adoption reflects a broader trend of protein fortification in everyday food and beverage categories.

Sports nutrition and dietary supplements have emerged as significant growth drivers for the oat proteins market. The demand for clean, plant-based proteins among athletes and fitness-focused consumers has positioned oat protein as a viable alternative to soy, pea, and rice proteins. Its balanced amino acid profile, slow digestion rate, and satiety-enhancing properties make it attractive in protein powders, shakes, and recovery supplements. Oat protein blends are often formulated to improve muscle recovery and endurance support while offering an allergen-friendly option compared to whey. Increasing awareness of sustainable protein sources has also encouraged its adoption in sports nutrition. The market benefits from the growing number of active consumers seeking natural, minimally processed protein sources for performance and wellness.

Despite its nutritional value, oat protein faces challenges in terms of production efficiency and cost competitiveness. The extraction and purification of oat proteins require advanced technologies, which add to overall manufacturing costs. This creates difficulties in competing with more established plant proteins such as soy and pea that enjoy economies of scale. Limitations in large-scale supply chains and variations in raw material quality further impact product consistency. Oat protein’s functional limitations in certain applications also require blending with other proteins to achieve desired performance. These factors have slowed down broader market penetration. However, ongoing research into cost-effective extraction methods and improved crop yields is expected to gradually address these challenges, improving market accessibility in the long term.

The market benefits from the strong global trend toward sustainable and clean-label food products. Oat cultivation has a lower environmental impact compared to some other protein crops, making oat proteins attractive for sustainability-focused brands. Clean-label formulations featuring oat protein resonate with consumers seeking minimally processed, allergen-free, and traceable ingredients. Demand from the plant-based dairy sector, particularly oat-based milk and yogurts, has provided a significant boost. The versatility of oat protein across categories, from bakery to beverages, further strengthens its appeal. With governments and food companies emphasizing sustainable sourcing and production practices, oat proteins are expected to gain a stronger foothold in mainstream food and beverage portfolios. This positions the market as a critical contributor to the evolution of plant protein solutions.

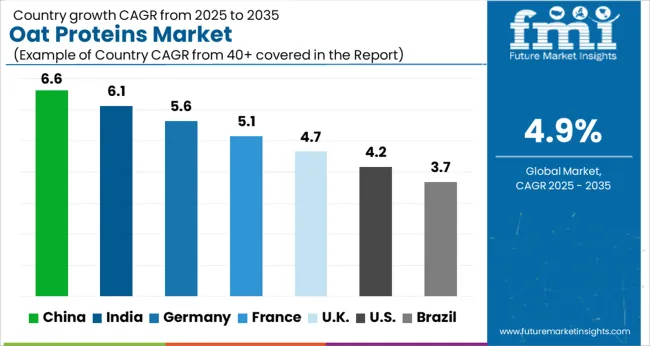

| Country | CAGR |

|---|---|

| China | 6.6% |

| India | 6.1% |

| Germany | 5.6% |

| France | 5.1% |

| UK | 4.7% |

| USA | 4.2% |

| Brazil | 3.7% |

China recorded the highest growth in the market with a forecast rate of 6.6%, supported by expanding applications in plant-based foods and beverages. India followed at 6.1%, where increasing consumption of dairy alternatives and nutrition-rich products is driving market activity. Germany achieved 5.6% growth, supported by its strong demand for clean label and functional ingredients in the food sector. The United Kingdom posted 4.7% growth, influenced by rising consumer preference for vegan diets and protein fortification. The United States registered 4.2%, supported by wider adoption in sports nutrition and bakery formulations. Collectively, these nations highlight the progression of oat protein as a valuable plant-derived ingredient shaping the future of functional food markets. This report includes insights on 40+ countries; the top markets are shown here for reference.

The market in China is anticipated to expand at a CAGR of 6.6%, supported by increasing demand for plant-based nutrition. Changing dietary preferences among younger consumers and rising health awareness are encouraging adoption of oat protein across beverages, bakery, and nutritional supplements. Domestic manufacturers are scaling up production to meet the shift toward alternative proteins, while government emphasis on improving dietary diversity is also contributing. The market is further benefiting from a growing fitness industry, where protein-rich products are gaining strong traction.

India’s market is projected to grow at a CAGR of 6.1%, driven by increasing awareness of healthy eating habits. A steady rise in vegetarian and flexitarian lifestyles is boosting consumption of oat-based proteins. Demand from food manufacturers for functional ingredients in dairy alternatives and health supplements is gaining momentum. The domestic market is also shaped by the rising influence of wellness-focused product launches, particularly targeting urban consumers seeking protein-enriched options. With fitness centers and health-conscious communities growing, demand for oat protein is poised for expansion.

Germany’s market is set to witness a CAGR of 5.6%, underpinned by strong consumer inclination toward sustainable nutrition. Food manufacturers are incorporating oat proteins into bakery goods, dairy substitutes, and sports nutrition products to cater to demand for environmentally friendly protein sources. Stringent European food standards encourage the use of clean-label and non-allergenic proteins, benefiting oat protein growth. Germany’s advanced processing industry is supporting innovation in formulations, making oat protein a viable choice for both retail and industrial food segments.

The market in the United Kingdom is expected to expand at a CAGR of 4.7%, shaped by rising consumer focus on plant-derived food solutions. Growing penetration of oat-based drinks, snack bars, and fortified products is strengthening demand. Retailers are increasingly positioning oat proteins within the premium health category, attracting health-conscious buyers. Policy-level encouragement of plant-based diets is also enhancing growth prospects. Moreover, innovation in oat protein extraction and blending with other plant proteins is widening product applications across the food and beverage sector.

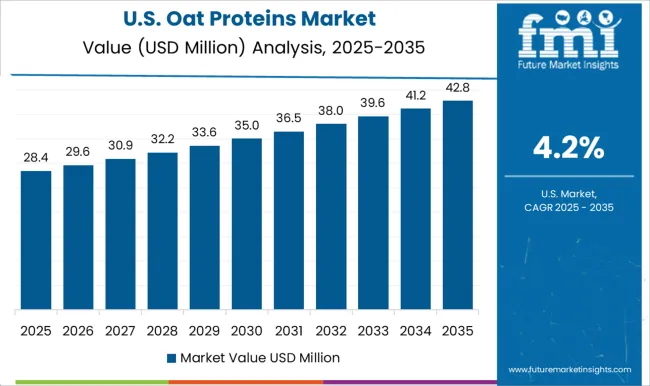

The market in the United States is forecasted to grow at a CAGR of 4.2%, supported by expanding consumer base for alternative proteins. Rising adoption of oat-based dairy substitutes and functional beverages is a major driver. The sports and nutrition industry is integrating oat proteins into protein powders and bars to cater to growing demand for clean-label and allergen-free options. Market growth is further encouraged by investments from major food companies in plant-based innovation. Increasing emphasis on sustainability and consumer wellness is expected to sustain long-term momentum.

The market is influenced by established agribusinesses, specialty ingredient suppliers, and food innovators focusing on plant-based nutrition. Archer Daniels Midland and Cargill lead the segment with their extensive protein portfolios and supply chain strength, supporting global demand for oat-based proteins in food and beverage formulations. Avena Foods and Axiom Foods emphasize sustainable oat processing, delivering high-quality protein ingredients tailored for plant-based dairy and meat alternatives. Avebe and Crop Energies contribute by leveraging expertise in starches and bio-based products to expand oat protein applications. Ingredient specialists like Emsland Group and Glanbia are enhancing the functional properties of oat proteins to improve solubility and nutritional value in sports nutrition and functional foods.

Givaudan brings flavor integration expertise, enabling better sensory experiences in plant protein products. Kerry Group further strengthens the market with advanced formulation technologies, ensuring clean-label, allergen-free solutions for consumer-ready products. Together, these companies are shaping the oat proteins market by integrating nutrition science, sustainable sourcing, and application versatility to meet rising demand in health-driven and plant-based product categories.

| Item | Value |

|---|---|

| Quantitative Units | USD 69.1 million |

| Type | Protein concentrates, Protein isolates, and Protein hydrolysates |

| Form | Dry form and Liquid form |

| Application | Food & beverages, Pharmaceuticals, Cosmetics & personal care, Animal feed, and Others |

| Distribution Channel | Offline retail and Online retail |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Archer Daniels Midland, Avena Foods, Axiom Foods, Avebe, Cargill, Crop Energies, Emsland Group, Givaudan, Glanbia, and Kerry Group |

| Additional Attributes | Dollar sales by protein type and application, demand dynamics across food, beverage, and nutraceutical sectors, regional trends in plant-based protein adoption, innovation in extraction methods, solubility, and texture enhancement, environmental impact of oat cultivation and processing, and emerging use cases in dairy alternatives, sports nutrition, and functional foods. |

The global oat proteins market is estimated to be valued at USD 69.1 million in 2025.

The market size for the oat proteins market is projected to reach USD 111.5 million by 2035.

The oat proteins market is expected to grow at a 4.9% CAGR between 2025 and 2035.

The key product types in oat proteins market are protein concentrates, protein isolates and protein hydrolysates.

In terms of form, dry form segment to command 71.4% share in the oat proteins market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Oat-based Snacks Market Size and Share Forecast Outlook 2025 to 2035

Oats Market Analysis - Size, Share, and Forecast 2025 to 2035

Oat Beta-Glucan Market Analysis - Size, Share, and Forecast 2025 to 2035

Oat Drink Market Analysis - Size, Share & Forecast 2025 to 2035

Oat Milk Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Oat-based Beverage Market Analysis by Source, Product Type, Speciality and Distribution channel Through 2035

Oatmeal market Analysis by Nature, Type and Sales Channel Through 2025 to 2035

Oat Protein Market Trends - Plant-Based Nutrition & Industry Demand 2024 to 2034

Coated Label Market Size and Share Forecast Outlook 2025 to 2035

Coated Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Boat Trailers Market Size and Share Forecast Outlook 2025 to 2035

Boat Wiring Harness Market Size and Share Forecast Outlook 2025 to 2035

Coating Pretreatment Market Size and Share Forecast Outlook 2025 to 2035

Coating Resins Market Size and Share Forecast Outlook 2025 to 2035

Boat Steering Wheels Market Size and Share Forecast Outlook 2025 to 2035

Goat Milk Products Market Size and Share Forecast Outlook 2025 to 2035

Coating Auxiliaries Market Size and Share Forecast Outlook 2025 to 2035

Goat Handling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Boat Trolling Motor Market Size and Share Forecast Outlook 2025 to 2035

coated-paper-packaging-box-market-market-value-analysis

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA