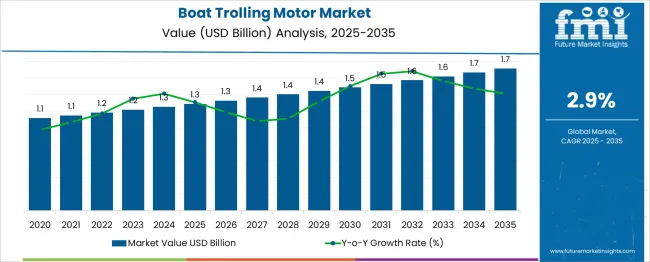

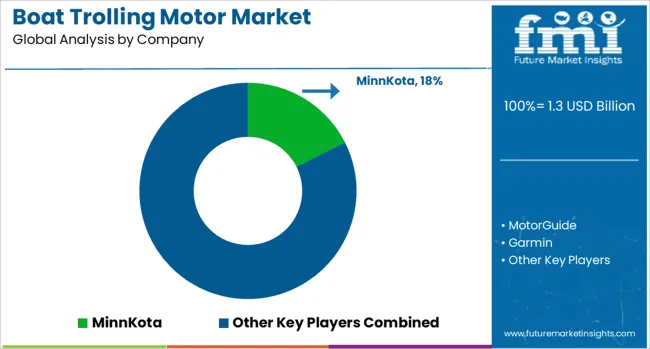

The Boat Trolling Motor Market is estimated to be valued at USD 1.3 billion in 2025 and is projected to reach USD 1.7 billion by 2035, registering a compound annual growth rate (CAGR) of 2.9% over the forecast period. Between 2020 and 2025, the market expands from USD 1.1 billion to USD 1.3 billion, generating an absolute dollar opportunity of USD 0.2 billion over this period. Annual gains are modest, with increments of USD 0.0–0.1 billion, indicating a mature market with steady replacement demand and gradual technological adoption. This phase is characterized by incremental upgrades, such as battery efficiency improvements and minor design enhancements, rather than disruptive innovation. From 2025 to 2030, the market rises from USD 1.3 billion to USD 1.4 billion, adding just USD 0.1 billion over five years, reflecting slow penetration in saturated markets.

However, between 2030 and 2035, growth accelerates slightly, with revenues climbing from USD 1.5 billion to USD 1.7 billion, creating a USD 0.2 billion absolute dollar opportunity. Gains during this stage stem from the adoption of advanced GPS-enabled and eco-friendly propulsion systems, along with rising participation in leisure fishing across emerging economies. Overall, the largest opportunities lie in post-2030 demand shifts toward sustainable and connected boating technologies.

| Metric | Value |

|---|---|

| Boat Trolling Motor Market Estimated Value in (2025 E) | USD 1.3 billion |

| Boat Trolling Motor Market Forecast Value in (2035 F) | USD 1.7 billion |

| Forecast CAGR (2025 to 2035) | 2.9% |

As anglers and leisure boaters seek more efficient and responsive propulsion systems, trolling motors with high-thrust capabilities and smart control mechanisms are gaining prominence.

Electrification trends in marine transport and the push for sustainable propulsion are also playing a critical role in shaping market direction, with battery-powered and digitally integrated motors leading new product launches. Enhanced motor durability, corrosion resistance for saltwater operations, and compatibility with GPS-based positioning technologies are supporting broader adoption across diverse watercraft types.

Manufacturers are also integrating wireless connectivity, compact designs, and intuitive user interfaces to meet evolving customer expectations. The market is expected to grow steadily as boating infrastructure expands globally, particularly in North America and Europe, while emerging economies are seeing increased investment in water sports and inland fishing tourism.

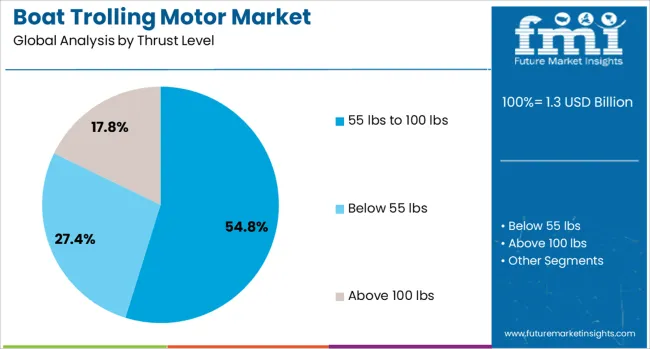

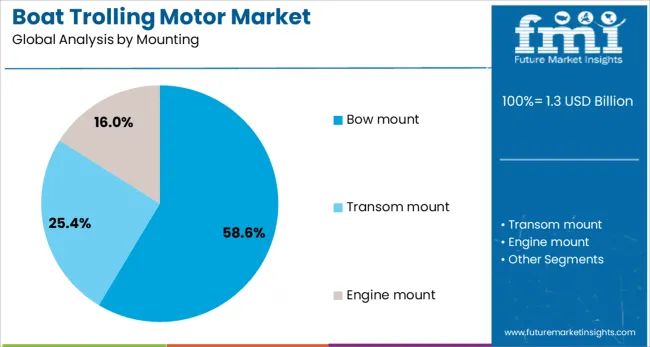

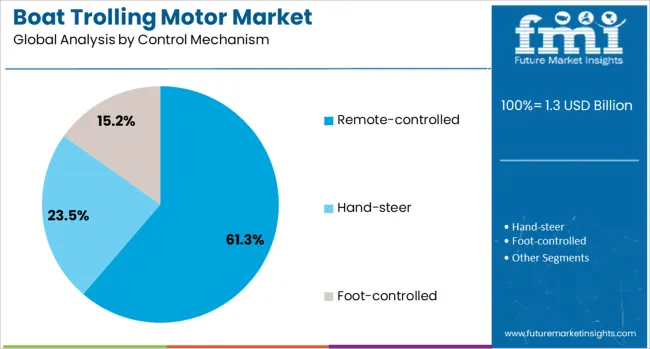

The boat trolling motor market is segmented by thrust level, mounting, control mechanism, voltage, application, and geographic regions. By thrust level, the boat trolling motor market is divided into 55 lbs to 100 lbs, below 55 kg, and above 100 lbs. In terms of mounting the boat trolling motor, the market is classified into Bow mount, Transom mount, and Engine mount. Based on the control mechanism, the boat trolling motor market is segmented into Remote-controlled, Hand-steer, and Foot-controlled. The boat trolling motor market is segmented into 24V, 12V, 36V, and other voltage levels. By application, the boat trolling motor market is segmented into saltwater and freshwater. Regionally, the boat trolling motor industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The 55 lbs to 100 lbs thrust level segment is projected to contribute 54.8% of the boat trolling motor market revenue in 2025, making it the most dominant thrust category. This leadership is being attributed to the balanced power-to-weight ratio these motors provide, making them suitable for a wide range of mid-sized boats used in recreational fishing and inland water navigation.

Their capacity to offer sufficient propulsion without excessive battery consumption has favored their use among amateur and professional anglers alike. These motors are often engineered with noise reduction technology and variable speed settings, which enhance fishing effectiveness by reducing water disturbances.

Additionally, this thrust range supports compatibility with integrated depth finders, GPS anchoring systems, and variable shaft lengths, allowing adaptability to diverse fishing environments. Their affordability and reliability have further positioned them as the optimal choice for users looking for performance without overinvestment, supporting their leading role in consumer preference.

Bow mount trolling motors are expected to account for 58.6% of the overall boat trolling motor market revenue in 2025, underscoring their critical role in maneuverability and vessel handling. The segment's strength is driven by the superior control and steering precision that bow-mounted motors provide, which are essential in navigating tight fishing spots and shallow waters.

Mounted at the front of the boat, these systems pull rather than push, offering enhanced directional control and responsiveness, which has led to widespread preference among serious anglers. The ability to integrate seamlessly with foot pedals, wireless remotes, and GPS positioning systems has made bow mount motors an integral component of modern fishing vessels.

Advances in quick-release mounting brackets and universal compatibility with boat hull designs have simplified installation and transport, adding to their appeal. Their use in both freshwater and saltwater conditions, alongside their integration with fish-finding electronics, continues to reinforce their position as the dominant mounting choice in the market.

The remote-controlled segment is anticipated to hold 61.3% of the revenue share in the boat trolling motor market in 2025, making it the leading control mechanism. The increased need for convenience, flexibility, and real-time navigation control among boat users is driving this dominance. Remote-controlled trolling motors allow operators to manage thrust, speed, and direction from anywhere on the vessel, enhancing safety and operational efficiency.

Integration with mobile applications and Bluetooth connectivity has further expanded control features, allowing seamless interaction with fish-finding systems and digital maps. These systems also support advanced features such as spot-lock anchoring, route memory, and autopilot functionalities, which experienced users increasingly seek.

The shift toward touchless interfaces and minimal physical input has aligned with modern boating preferences, especially for solo anglers and those navigating dynamic water conditions. The growing adoption of ergonomic remote designs and water-resistant controllers continues to support this segment’s leadership in the evolving marine electronics ecosystem.

The boat trolling motor market is expanding steadily, driven by increasing recreational fishing activities, growth in water sports, and rising adoption of electric propulsion systems for environmental compliance. Trolling motors, known for their quiet operation and precision control, are widely used in freshwater and saltwater applications. Advancements in battery technology, GPS integration, and wireless controls are enhancing performance and user experience. North America remains the largest market, while Asia-Pacific shows strong growth potential. However, high upfront costs and supply chain disruptions impact adoption.

Performance consistency in trolling motors is influenced by factors such as motor thrust capacity, shaft length, corrosion resistance, and battery compatibility. Saltwater applications require enhanced durability features like sealed housings and anti-corrosion coatings, which can raise manufacturing costs. Variations in product standards across regions can create challenges for manufacturers aiming at global distribution. User expectations for long lifespan and minimal maintenance place pressure on brands to invest in quality assurance. Fluctuations in raw material quality, particularly in electronic components and composite shafts, can lead to reliability issues. Manufacturers focusing on rigorous testing, marine-grade materials, and adaptive design features stand a better chance of gaining brand loyalty, particularly among professional anglers and charter operators. Aligning products with evolving performance standards is crucial to ensuring consistent customer satisfaction and market competitiveness.

Innovation in trolling motors is accelerating with the integration of GPS-based anchoring systems, sonar connectivity, and app-enabled wireless controls. Brushless motor designs improve efficiency, reduce noise, and extend battery life. Lithium-ion battery compatibility allows for longer operating times and faster recharging compared to traditional lead-acid setups. Some models feature autopilot capabilities, route tracking, and variable speed controls for improved fishing precision. Advances in hydrodynamic propeller design are enhancing thrust while minimizing cavitation and energy consumption. Manufacturers are increasingly incorporating modular components to simplify maintenance and upgrades. These technological developments not only enhance the user experience but also expand market appeal to both casual boaters and competitive anglers. As environmental regulations push for quieter and more energy-efficient marine propulsion, technology-driven trolling motors are emerging as a preferred choice in both leisure and professional marine sectors.

The market for trolling motors is benefiting from a surge in recreational boating and sport fishing, supported by tourism growth and rising disposable incomes. Professional fishing tournaments and competitive angling events boost demand for high-performance models. In addition to recreational use, trolling motors are gaining adoption in small-scale commercial fishing, eco-tourism, and wildlife research vessels due to their silent operation and maneuverability. Emerging markets in Asia-Pacific and Latin America present significant growth potential as infrastructure for marinas, fishing charters, and boating services expands. E-commerce channels and specialty marine retailers are increasing accessibility, while after-sales service offerings strengthen brand relationships. Marketing efforts that emphasize energy efficiency, sustainability, and precision control resonate strongly with environmentally conscious consumers. As consumer interest in outdoor leisure activities continues to rise, trolling motors are becoming a staple accessory for both new and used boats in various water environments.

Marine environmental regulations, particularly concerning noise pollution and emissions, are influencing the shift toward electric trolling motors. Some regions are implementing restrictions on internal combustion engines in sensitive water bodies, indirectly boosting demand for electric alternatives. However, high initial purchase prices—especially for models with advanced features—can deter entry-level buyers. Battery costs, charging infrastructure availability, and maintenance expenses also affect total cost of ownership. Supply chain disruptions, particularly in electronic components and specialty alloys, can impact product availability and pricing stability. Regional differences in safety certifications and compliance requirements further complicate international sales strategies. Manufacturers seeking to remain competitive must balance cost control with performance innovation, while also aligning with evolving marine safety and environmental standards. Incentives for electric marine propulsion adoption, combined with technological advancements, will play a key role in making trolling motors more accessible to a broader consumer base.

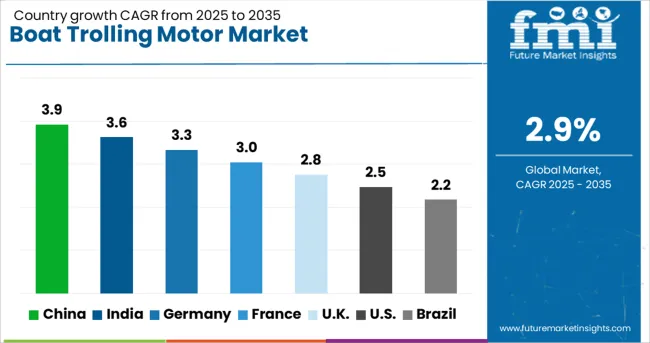

| Country | CAGR |

|---|---|

| China | 3.9% |

| India | 3.6% |

| Germany | 3.3% |

| France | 3.0% |

| UK | 2.8% |

| USA | 2.5% |

| Brazil | 2.2% |

The global boat trolling motor market is expanding at a 2.9% CAGR, driven by the rising popularity of recreational boating and advancements in electric propulsion technology. Among BRICS nations, China leads with 3.9% growth, supported by large-scale marine equipment production and export capacity. India follows at 3.6%, fueled by growing adoption of leisure and fishing boats. In the OECD region, Germany records 3.3% growth, reflecting strong engineering capabilities and demand for eco-friendly marine solutions. The United Kingdom grows at 2.8%, driven by increasing recreational fishing activities and marine tourism. The United States, a mature market, shows 2.5% growth, shaped by technological innovation and stringent environmental compliance for marine equipment. These countries collectively influence market trends through product innovation, regulatory frameworks, and sustainable boating practices. This report includes insights on 40+ countries; the top countries are shown here for reference.

China boat trolling motor market is growing at a 3.9% CAGR, supported by rising participation in recreational fishing and small-boat water activities. The popularity of freshwater fishing in regions with extensive river and lake systems fuels steady demand for efficient, quiet, and low-maintenance motors. Compared to Western markets, China focuses heavily on affordability and durability, catering to both casual hobbyists and commercial fishing operators. Domestic manufacturers are introducing electric trolling motors with enhanced battery life and GPS anchoring features to appeal to modern anglers. The country benefits from lower production costs, allowing competitive pricing in both local and export markets. Coastal and inland tourism growth further adds to sales momentum, especially in areas promoting eco-friendly boating options. With expanding e-commerce distribution, the reach of trolling motor products is improving rapidly.

India boat trolling motor market is advancing at a 3.6% CAGR, driven by expanding fishing communities, recreational boating activities, and eco-tourism projects. Inland water bodies in states like Kerala and Assam provide a strong base for small craft usage, where trolling motors are becoming popular for their quiet operation and ease of control. Compared to China, India market is more fragmented, with a mix of imported units and low-cost local alternatives. The tourism sector, particularly houseboat and guided fishing experiences, is increasingly integrating electric trolling motors for enhanced passenger comfort. Local distributors are building awareness about battery maintenance and operational efficiency. The presence of government-led initiatives to boost inland water transport also indirectly benefits the trolling motor segment by expanding small-boat usage in non-fishing sectors.

Boat trolling motor market in Germany is recording a 3.3% CAGR, supported by a strong boating culture and strict environmental regulations that encourage low-emission marine equipment. Anglers and leisure boat owners prefer electric trolling motors for compliance with noise and pollution restrictions on many inland waterways. Compared to Asian markets, Germany emphasizes advanced technology, premium build quality, and integration with marine electronics. Popular features include autopilot modes, depth tracking, and lithium battery compatibility. Seasonal boating peaks in warmer months, but off-season maintenance services keep the market active year-round. The country also benefits from established boating associations and trade fairs, which help promote new product innovations to a highly informed consumer base.

United Kingdom boat trolling motor market is expanding at a 2.8% CAGR, fueled by growing interest in freshwater fishing, small coastal trips, and canal boating. Anglers in rural areas increasingly opt for quiet electric motors to maintain stealth during fishing. Compared to Germany, the U.K. market has a stronger second-hand equipment segment, with refurbished trolling motors gaining popularity among budget-conscious buyers. Marine retailers are introducing compact, lightweight models designed for easy installation on small boats and inflatables. The rise in canal tourism and boating clubs is also driving product visibility. E-commerce plays a major role in sales, especially for replacement parts and accessories. Efforts to promote sustainable boating practices are gradually increasing the shift toward battery-powered units.

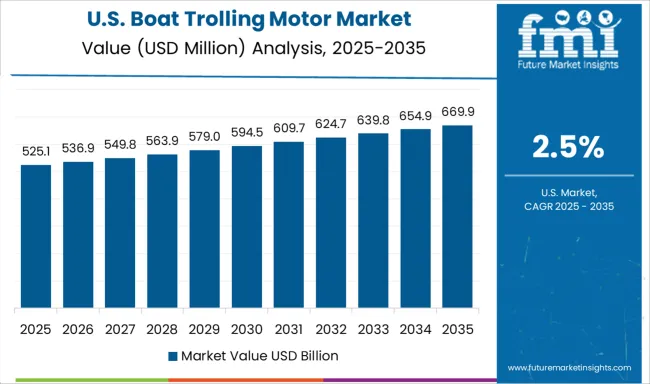

United States boat trolling motor market is advancing at a 2.5% CAGR, supported by a large and active recreational fishing community. Bass fishing tournaments and leisure lake boating are major drivers of motor demand. Compared to Europe, the U.S. market is highly brand-driven, with premium electric trolling motors featuring advanced positioning systems, wireless controls, and high-thrust capabilities. Saltwater models for coastal fishing also hold a significant share, particularly in southern and western states. Seasonal promotions from major retailers and strong aftermarket support boost replacement and upgrade sales. The preference for high-performance, durable motors ensures that technology-driven features remain a key selling point. Growing environmental awareness is gradually encouraging a shift from gas-powered to electric models.

Leading brands such as Minn Kota (by Johnson Outdoors), MotorGuide (Brunswick Corporation), Garmin, Haswing, Lowrance, Newport Vessels, Torqeedo, and Watersnake differentiate themselves with a blend of innovation and targeted strategies. Minn Kota is recognized for delivering durable, feature-rich motors with strong distribution networks. MotorGuide emphasizes powerful, efficient, and quiet models, while Garmin integrates advanced GPS and smart helm compatibility, targeting technology-driven users. Other players like Haswing, Lowrance, and smaller manufacturers fine-tune offerings for specialized markets such as saltwater applications, portable mounts, or cost-effective fishing rigs.

Technological innovation is central, with manufacturers enhancing propulsion performance through brushless motors, higher-voltage systems (24V, 36V, 48V), and improved batteries. Smart features such as wireless controls, GPS anchoring, and sonar integration are becoming core differentiators in premium models. Regionally, North America leads the market, supported by a mature recreational boating culture and well-developed marine infrastructure, while Asia-Pacific and Latin America represent emerging growth areas as boating and fishing leisure activities gain popularity. Strategies across the industry focus on product differentiation, diverse mounting options for different boat types, eco-friendly positioning to replace combustion engines, and global distribution with local adaptability to capture both mature and emerging markets.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.3 Billion |

| Thrust Level | 55 lbs to 100 lbs, Below 55 lbs, and Above 100 lbs |

| Mounting | Bow mount, Transom mount, and Engine mount |

| Control Mechanism | Remote-controlled, Hand-steer, and Foot-controlled |

| Voltage | 24V, 12V, 36V, and Others |

| Application | Salt water and Fresh water |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | MinnKota, MotorGuide, Garmin, MercuryMarine, Torqeedo, Lowrance, NewportVessels, Haswing, Power-Pole, and Rhino |

| Additional Attributes | Dollar sales in the Boat Trolling Motor Market vary by type, including electric and gasoline; by application, spanning saltwater and freshwater; by thrust capacity, such as low, medium, and high; by end user, including fishing and recreational boating; and by region, with North America, Europe, and Asia-Pacific leading. Growth is fueled by expanding recreational fishing activities, rising demand for eco-friendly propulsion, and advancements in battery technology |

The global boat trolling motor market is estimated to be valued at USD 1.3 billion in 2025.

The market size for the boat trolling motor market is projected to reach USD 1.7 billion by 2035.

The boat trolling motor market is expected to grow at a 2.9% CAGR between 2025 and 2035.

The key product types in boat trolling motor market are 55 lbs to 100 lbs, below 55 lbs and above 100 lbs.

In terms of mounting, bow mount segment to command 58.6% share in the boat trolling motor market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Kayak Trolling Motor Market Growth – Trends & Forecast 2025 to 2035

Motor Bearing Market Size and Share Forecast Outlook 2025 to 2035

Motorcycle Fuel Hoses Market Size and Share Forecast Outlook 2025 to 2035

Boat Trailers Market Size and Share Forecast Outlook 2025 to 2035

Boat Wiring Harness Market Size and Share Forecast Outlook 2025 to 2035

Motorcycle Drive Chain Market Size and Share Forecast Outlook 2025 to 2035

Motorcycle Wheels Market Size and Share Forecast Outlook 2025 to 2035

Motorized Ring Main Unit Market Size and Share Forecast Outlook 2025 to 2035

Motorhome Market Size and Share Forecast Outlook 2025 to 2035

Boat Steering Wheels Market Size and Share Forecast Outlook 2025 to 2035

Motor Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Motorcycle Airbag Jacket Market Size and Share Forecast Outlook 2025 to 2035

Motorcycle Helmet Market Size and Share Forecast Outlook 2025 to 2035

Motorcycle Diagnostic Scan Tools Market Size and Share Forecast Outlook 2025 to 2035

Motorized Prosthesis Market Size and Share Forecast Outlook 2025 to 2035

Motorized Pool Tube Market Size and Share Forecast Outlook 2025 to 2035

Motor Generator Set Market Size, Growth, and Forecast 2025 to 2035

Motorized Decoiler Machine Market Growth - Trends & Forecast 2025 to 2035

Boat Control Lever Market Growth - Trends & Forecast 2025 to 2035

Motorcycle Chain Market Analysis - Size, Share, and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA