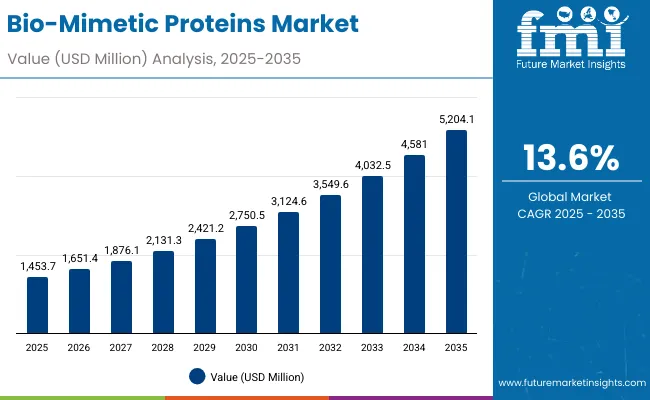

A valuation of USD 1,453.7 million has been projected for the bio-mimetic proteins market in 2025, which is anticipated to reach USD 5,204.1 million by 2035. This expansion indicates a rise of USD 3,750.4 million over the decade, reflecting an overall growth of more than 2.5 times. The trajectory equates to a compound annual growth rate of 13.6%, highlighting the rapid scaling potential of this category.

Bio-Mimetic Proteins Market Key Takeaways

| Metric | Value |

|---|---|

| Market Estimated Value in (2025E) | USD 1,453.7 million |

| Market Forecast Value in (2035F) | USD 5,204.1 million |

| Forecast CAGR (2025 to 2035) | 13.60% |

Between 2025 and 2030, revenues are expected to rise from USD 1,453.7 million to USD 2,750.5 million, contributing over USD 1,296.8 million, which accounts for more than one-third of decade-long growth. This early phase will be shaped by strong adoption in collagen-focused formulations, efficacy-driven serums, and peptide-based innovations.

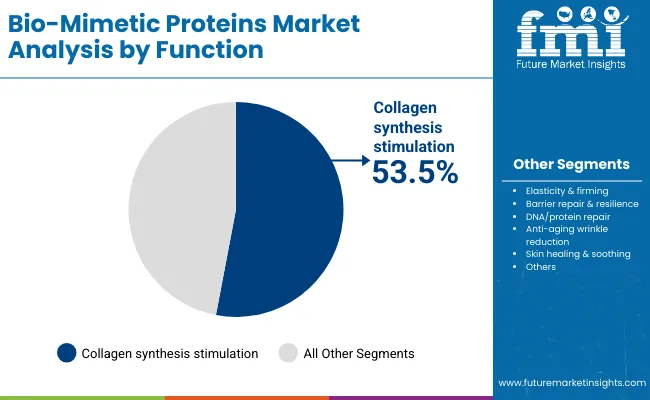

The second half of the decade, spanning 2030 to 2035, is projected to contribute an additional USD 2,453.6 million, representing close to two-thirds of total growth. Market acceleration is anticipated to be driven by wider adoption of advanced delivery systems, regulatory acceptance of biomimetic claims, and integration into personalized skincare regimes. Collagen synthesis stimulation is positioned as the leading function, holding 53.5% share in 2025 with USD 776.8 million in sales, supported by demand for firmness and elasticity benefits.

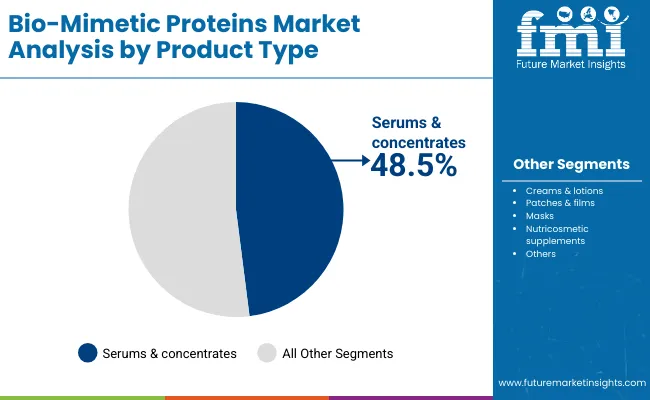

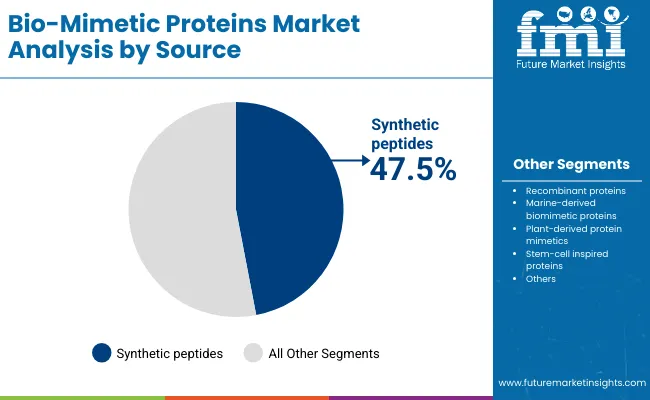

By product type, serums and concentrates are forecast to maintain prominence with 48.5% share, reaching USD 703.0 million, due to their suitability for high-potency biomimetic actives. From a sourcing perspective, synthetic peptides will command a 47.5% share, equaling USD 688.9 million, as sustainability, reproducibility, and vegan-friendly positioning align with global beauty preferences.

Overall, the bio-mimetic proteins market outlook suggests a robust pipeline of innovation, premium positioning opportunities, and significant growth potential, with Asia-Pacific markets expected to outpace others in adoption and revenue contribution.

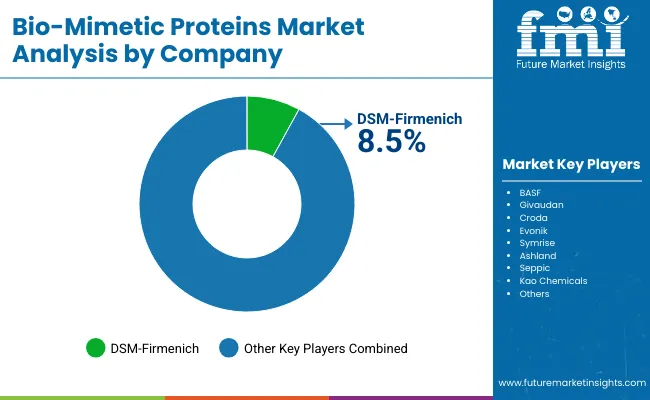

From 2020 to 2024, the bio-mimetic proteins market was in its formative stage, driven largely by peptide innovation and niche clinical validation programs. During this period, the competitive landscape was fragmented, with DSM-Firmenich emerging as an early leader, holding 8.5% of the global share by 2024. Growth was supported by recombinant protein development, peptide synthesis scale-up, and rising adoption of biomimetic actives in luxury skincare. Competitive advantage relied on patent-protected molecules, safety validation, and clinical credibility, while functional foods and nutricosmetics remained secondary contributors.

Service-based collaborations with dermatology clinics and premium wellness chains accounted for less than 10% of revenues. Demand is projected to reach USD 1,453.7 million in 2025, with a significant shift toward multifunctional biomimetic formulations and nutricosmetic applications. Established ingredient leaders face growing competition from biotech-driven entrants offering AI-enabled peptide design, sustainable sourcing, and subscription-based innovation partnerships. The competitive edge is moving away from ingredient supply alone to integrated ecosystems combining science, delivery technology, and consumer engagement platforms.

Growth in the bio-mimetic proteins market is being driven by advances in peptide engineering, recombinant technologies, and stem-cell inspired formulations that have enhanced efficacy and safety. Collagen synthesis stimulation is being prioritized as consumers seek proven anti-aging and skin-repair benefits. Adoption is being accelerated by the demand for vegan-friendly, sustainable, and clinically validated ingredients, which align with evolving consumer preferences. Increased reliance on dermatologist-tested and science-driven products is creating a strong trust base across premium skincare and nutricosmetic segments.

Expansion of e-commerce and dermatology clinic retail channels is enabling faster consumer access, supported by personalized regimens and subscription models. Technological progress in encapsulation and delivery systems is being leveraged to maximize bioavailability and performance, reinforcing consumer confidence in outcomes. Segment growth is expected to be led by synthetic peptides, collagen-focused actives, and serum-based formulations, as their clinical substantiation and transparency in sourcing continue to shape the market’s trajectory over the coming decade.

The bio-mimetic proteins market has been segmented on the basis of function, product type, and source, each offering unique insights into growth drivers and consumer adoption. Functional benefits remain at the heart of demand, with collagen synthesis stimulation emerging as the most dominant mechanism due to its proven role in anti-aging and skin repair. From a product type perspective, serums and concentrates are positioned as the preferred format, allowing biomimetic proteins to deliver potent and targeted results that support clinical positioning and premium branding.

By source, synthetic peptides are gaining significant traction for their reproducibility, scalability, and alignment with vegan-friendly and sustainable claims. Together, these three segmentation pillars provide a comprehensive view of how innovation, consumer preferences, and scientific validation are shaping market opportunities through 2025 and beyond.

| Segment | Market Value Share, 2025 |

|---|---|

| Collagen synthesis stimulation | 53.5% |

| Others | 46.5% |

The function segment of the bio-mimetic proteins market is expected to be led by collagen synthesis stimulation, which is projected to account for 53.5% share in 2025, valued at USD 776.8 million. This dominance is being reinforced by the demand for anti-aging solutions that deliver measurable improvements in skin firmness, elasticity, and wrinkle reduction. Evidence-backed performance is being prioritized by consumers, making collagen synthesis a central mechanism for product development. Advanced delivery systems and ongoing clinical validation are being leveraged to enhance results and support premium positioning. Other functions, while significant, are expected to remain secondary as the need for collagen-related benefits continues to anchor the largest share of consumer spending in this category.

| Segment | Market Value Share, 2025 |

|---|---|

| Serums & concentrates | 48.5% |

| Others | 51.5% |

By product type, serums and concentrates are anticipated to command a 48.5% share in 2025, equal to USD 703.0 million. This prominence is being driven by the preference for potent, high-concentration formats that allow biomimetic proteins to deliver targeted outcomes effectively. These formulations are widely adopted in premium skincare due to their ability to support enhanced penetration and visible results. The segment is being reinforced by clinical positioning, where dermatologists and advanced skincare clinics increasingly recommend concentrated biomimetic serums for anti-aging and repair. While other formats such as creams and lotions remain important for mass accessibility, serums and concentrates are projected to retain leadership as the benchmark for efficacy-driven innovations.

| Segment | Market Value Share, 2025 |

|---|---|

| Synthetic peptides | 47.5% |

| Others | 52.5% |

In terms of source, synthetic peptides are expected to capture a 47.5% share in 2025, valued at USD 688.9 million. Their success is being supported by consistent quality, scalable production, and alignment with sustainability and vegan claims that resonate with modern consumers. Synthetic peptides are being favored for their reproducibility and ability to mimic natural signaling pathways with precision. This segment is positioned as the foundation for innovation, enabling companies to differentiate through patent-protected formulations and clinically tested efficacy. Although other sources contribute slightly more in aggregate, synthetic peptides are expected to dominate long-term growth trajectories as advanced peptide design and bioengineering continue to drive breakthroughs in performance and application diversity.

Complex formulation requirements and evolving regulatory frameworks are shaping the bio-mimetic proteins market, as innovation in peptide design and clinical validation is being balanced against scalability challenges and long-term sustainability imperatives.

Expansion of Clinically Substantiated Innovation Pipelines

Growth in the bio-mimetic proteins market is being powered by the systematic expansion of clinically substantiated innovation pipelines. Formulation strategies are being built around peptide sequences and recombinant proteins with proven bioactivity, supported by double-blind dermatological trials and molecular modeling data. This shift from traditional cosmetic actives toward biomimetic solutions is enabling companies to position products within science-backed, premium categories. The credibility of clinical validation is being leveraged to accelerate physician recommendations, increase consumer trust, and secure regulatory approvals across multiple geographies. As a result, a premiumization pathway is being created, where validated biomimetic ingredients can command higher margins while simultaneously differentiating brands in a competitive landscape.

Integration of Multi-Omics and AI in Ingredient Discovery

A transformative trend is being observed in the integration of multi-omics platforms with AI-based analytics for bio-mimetic protein discovery. Genomic, proteomic, and metabolomic datasets are being harnessed to identify new protein sequences that replicate natural cellular repair and regenerative mechanisms. Advanced computational modeling is being employed to predict stability, bioavailability, and long-term safety, shortening the R&D cycle while improving outcome predictability. This convergence is expected to move the industry toward precision-designed biomimetic proteins tailored for specific skin and cellular conditions. The ability to deploy AI-driven simulations reduces costs, minimizes trial failures, and aligns with regulatory expectations for evidence-based innovation, setting a new benchmark for efficiency and accuracy in functional ingredient development.

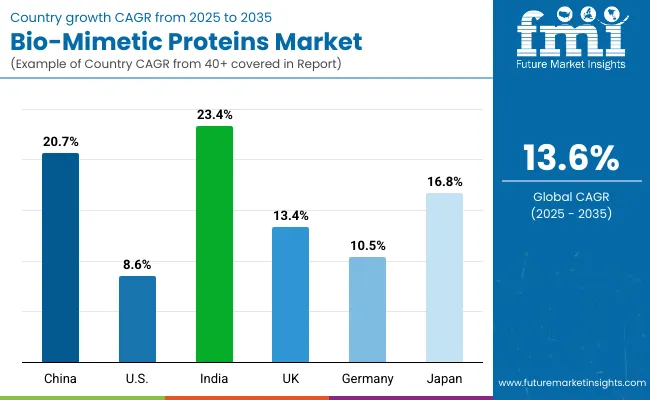

| Countries | CAGR |

|---|---|

| China | 20.7% |

| USA | 8.6% |

| India | 23.4% |

| UK | 13.4% |

| Germany | 10.5% |

| Japan | 16.8% |

The bio-mimetic proteins market is demonstrating strong geographical diversity in growth patterns, influenced by consumer demographics, clinical adoption, and innovation intensity. The fastest expansion is expected in India, with a CAGR of 23.4% from 2025 to 2035. This growth is being driven by a young, beauty-conscious population, expanding middle-class income, and the adoption of premium skincare regimes supported by e-commerce penetration. China follows closely with a CAGR of 20.7%, anchored by advanced biotechnology platforms, strong demand for anti-aging formulations, and robust government backing for biotech-driven consumer industries. Japan, with a CAGR of 16.8%, is positioned as a mature innovation hub where aging demographics and deep-rooted skincare culture support high-value demand.

Europe is projected to expand steadily, with the UK and Germany recording CAGRs of 13.4% and 10.5%, respectively. Growth in these markets is expected to be reinforced by clinical validation requirements, dermatology-driven product positioning, and a strong preference for sustainable formulations. The USA, while maintaining the largest single-country market value, is forecast to grow at a more moderate 8.6% CAGR, reflecting maturity in dermo cosmetics and reliance on clinical-retail integration. Together, these key markets highlight a decade defined by Asia-Pacific outperformance, Europe’s regulatory-driven stability, and North America’s steady premium-market dominance, positioning bio-mimetic proteins as a transformative growth category worldwide.

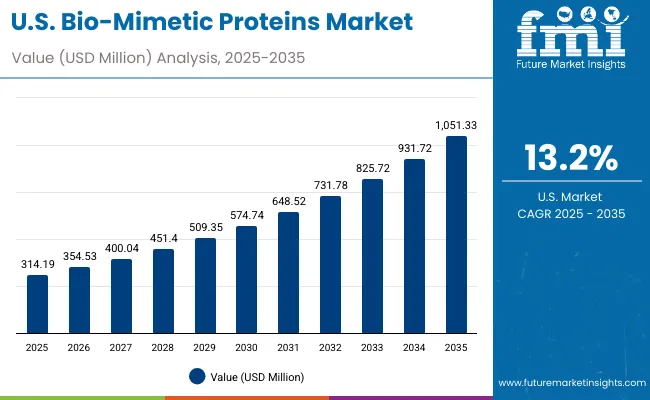

| Year | USA Bio-Mimetic Proteins Market (USD Million) |

|---|---|

| 2025 | 314.19 |

| 2026 | 354.53 |

| 2027 | 400.04 |

| 2028 | 451.40 |

| 2029 | 509.35 |

| 2030 | 574.74 |

| 2031 | 648.52 |

| 2032 | 731.78 |

| 2033 | 825.72 |

| 2034 | 931.72 |

| 2035 | 1,051.33 |

The bio-mimetic proteins market in the United States is projected to expand at a CAGR of 13.2% during 2025-2035. Growth is being shaped by dermatologist-backed formulations, clinical validation standards, and consumer preference for premium anti-aging solutions. Strong adoption is being observed in luxury skincare portfolios and wellness centers, supported by advanced peptide-based innovations. Distribution through dermatology clinics is being reinforced by e-commerce platforms that improve access and loyalty via subscription models. Collagen synthesis stimulation and serum-based applications are expected to drive sustained demand, aligning with consumer expectations for clinically proven, science-driven formulations.

The bio-mimetic proteins market in the United Kingdom is projected to grow at a CAGR of 13.4% between 2025 and 2035. Expansion is expected to be supported by consumer emphasis on clinically validated skincare solutions and growing reliance on dermatologist-tested product portfolios. Premium consumers are being drawn to formulations that emphasize collagen repair and barrier-strengthening, reflecting the nation’s demand for science-driven and sustainable cosmetic innovations. Regulatory alignment with EU safety standards is being leveraged to support brand credibility and accelerate product acceptance.

The bio-mimetic proteins market in India is anticipated to expand at a CAGR of 23.4% from 2025 to 2035, marking it as the fastest-growing global market. Rapid growth is being enabled by a young, aspirational consumer base, expanding middle-class incomes, and accelerated adoption of premium skincare products through digital platforms. Clinically validated peptides and serums are being increasingly positioned as accessible luxury, with e-commerce driving availability even in tier-two and tier-three cities. Domestic manufacturers and global entrants are being supported by favorable consumer sentiment toward vegan, sustainable, and science-led solutions.

The bio-mimetic proteins market in China is projected to record a CAGR of 20.7% during 2025-2035. Growth is being propelled by government-backed biotech innovation, rapid consumer adoption of anti-aging solutions, and expansion of luxury skincare brands across major urban markets. Collagen-stimulating serums and concentrates are expected to remain highly sought after, reinforced by the strong preference for efficacy-led formulations. The integration of advanced peptide technologies with traditional skincare practices is being employed to differentiate offerings. Regulatory emphasis on science-driven claims is expected to enhance consumer confidence and reduce market fragmentation.

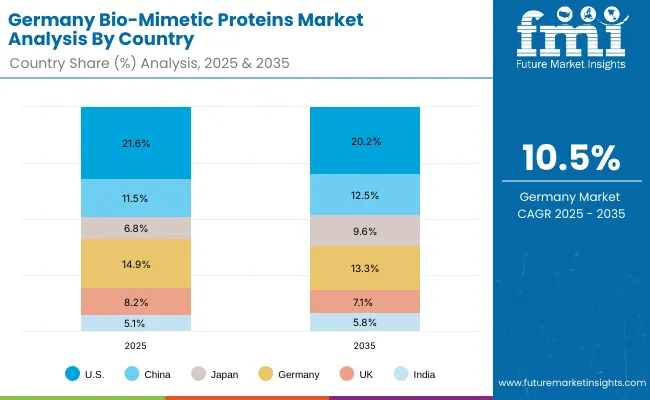

| Countries | 2025 |

|---|---|

| USA | 21.6% |

| China | 11.5% |

| Japan | 6.8% |

| Germany | 14.9% |

| UK | 8.2% |

| India | 5.1% |

| Countries | 2035 |

|---|---|

| USA | 20.2% |

| China | 12.5% |

| Japan | 9.6% |

| Germany | 13.3% |

| UK | 7.1% |

| India | 5.8% |

The bio-mimetic proteins market in Germany is expected to grow at a CAGR of 10.5% from 2025 to 2035. Market development is being supported by a mature consumer base that prioritizes clinically tested, dermatologist-approved, and sustainably sourced cosmetic formulations. Anti-aging demand among the aging population is being reinforced by premium brand penetration and trust in regulatory-driven product standards. The strong presence of multinational ingredient manufacturers and local skincare innovators is being leveraged to introduce new biomimetic peptide formulations.

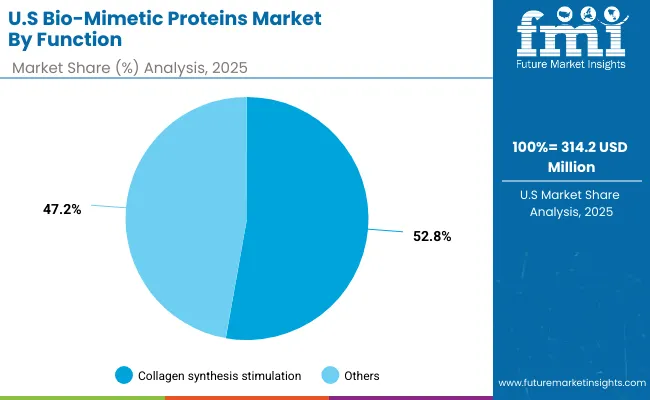

| Segment | Market Value Share, 2025 |

|---|---|

| Collagen synthesis stimulation | 52.8% |

| Others | 47.2% |

The bio-mimetic proteins market in the United States is projected at USD 314.2 million in 2025, with collagen synthesis stimulation contributing 52.8% of functional demand, equal to USD 166 million. Other functions collectively account for 47.2%, valued at USD 148 million, reflecting a balanced but collagen-led preference across applications. The dominance of collagen stimulation is being reinforced by its proven role in addressing anti-aging, elasticity, and wrinkle-reduction needs, which resonate strongly with American consumers seeking clinically validated outcomes.

Demand is being shaped by dermatologist-backed endorsements and the integration of high-potency serums and concentrates into luxury skincare regimes. While other functions such as barrier repair and soothing remain relevant, they are positioned as complementary to collagen pathways rather than standalone drivers. Over the coming decade, competitive advantage is expected to be defined by advanced delivery technologies and long-term clinical validation that elevate collagen-targeted peptides.

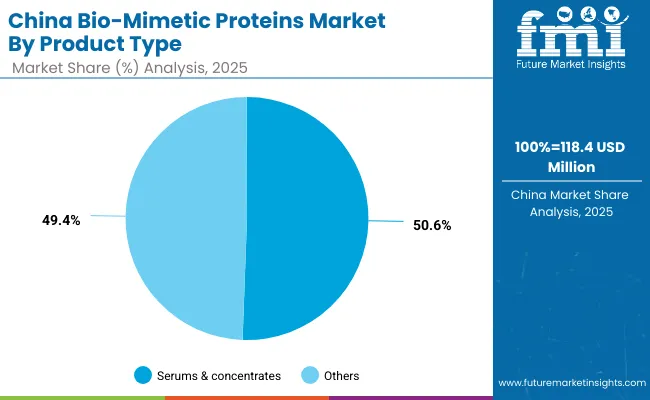

| Segment | Market Value Share, 2025 |

|---|---|

| Serums & concentrates | 50.6% |

| Others | 49.4% |

The bio-mimetic proteins market in China is projected at USD 118.4 million in 2025, with collagen synthesis stimulation expected to account for 50.6% share, valued at USD 60.2 million. Other functional areas contribute 49.4%, equaling USD 58.2 million, indicating a near-balanced distribution of demand. Collagen synthesis dominance is being reinforced by China’s strong consumer preference for anti-aging and skin-rejuvenation benefits, where visible outcomes such as firmness and wrinkle reduction are prioritized.

Rapid adoption is being accelerated by the integration of biomimetic peptides into premium skincare lines, supported by local innovation and international brand expansion. Functions beyond collagen stimulation, including barrier repair and soothing effects, are gaining relevance as holistic skincare becomes a core expectation among Chinese consumers. With government-backed biotech investment and advanced delivery systems entering the market, collagen-focused solutions are positioned to lead growth while complementary functions enhance market depth.

The bio-mimetic proteins market is moderately fragmented, with global leaders, established mid-sized players, and niche-focused specialists competing to capture share in both topical and ingestible applications. Global ingredient leaders such as DSM-Firmenich, BASF, and Givaudan hold significant positions by leveraging advanced peptide technologies, large-scale manufacturing, and strong R&D pipelines. Their strategies are being centered on developing clinically validated collagen-stimulating peptides, expanding recombinant protein capabilities, and securing premium partnerships with dermocosmetic brands.

Mid-sized innovators including Croda, Evonik, and Symrise are addressing demand for multifunctional and sustainable biomimetic actives. These companies are advancing portfolios with encapsulated peptide systems and plant-inspired biomimetic proteins, which are being positioned to align with clean beauty and vegan claims. Their strength lies in agility, rapid innovation cycles, and partnerships with mid-tier skincare players, enabling faster market responsiveness.

Specialist firms such as Ashland, Seppic, Kao Chemicals, and Roquette are focusing on tailored biomimetic solutions for sensitive skin, nutraceuticals, and multifunctional applications. Their strategies emphasize customization, regulatory compliance, and regional adaptability, ensuring relevance in local markets despite smaller global scale.

Competitive differentiation is shifting from pure molecule innovation toward delivery technologies, sustainability credentials, and integrated clinical validation. Evidence-backed marketing, IP-protected sequences, and dermatologist partnerships are expected to define leadership.

Key Developments in Bio-Mimetic Proteins Market

| Item | Value |

|---|---|

| Quantitative Units | USD 1,453.7 million in 2025; USD 5,204.1 million in 2035 |

| Function | Collagen synthesis stimulation, Elasticity & firming, Barrier repair & resilience, DNA/protein repair, Anti-aging wrinkle reduction, Skin healing & soothing |

| Product Type | Serums & concentrates, Creams & lotions, Patches & films, Masks, Nutricosmetic supplements |

| Source | Synthetic peptides, Recombinant proteins, Marine-derived biomimetic proteins, Plant-derived protein mimetics, Stem-cell inspired proteins |

| Distribution Channel | E-commerce, Pharmacies/drugstores, Premium beauty retail, Dermatology clinics, Spas & wellness centers |

| End-user | Anti-aging consumers (35+), Sensitive skin users, Men’s grooming, Luxury skincare seekers |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | DSM-Firmenich, BASF, Givaudan, Croda, Evonik, Symrise, Ashland, Seppic, Kao Chemicals, Roquette |

| Additional Attributes | Dollar sales by function, product type, and source; adoption trends in dermatology clinics and luxury skincare; expansion of e-commerce platforms; integration into nutricosmetics; regional growth influenced by aging demographics and biotech innovation; innovations in synthetic peptide engineering and delivery systems. |

The global Bio-Mimetic Proteins Market is estimated to be valued at USD 1,453.7 million in 2025.

The market size for the Bio-Mimetic Proteins Market is projected to reach USD 5,204.1 million by 2035.

The Bio-Mimetic Proteins Market is expected to grow at a 13.6% CAGR between 2025 and 2035.

The key product types in the Bio-Mimetic Proteins Market are serums & concentrates, creams & lotions, patches & films, masks, and nutricosmetic supplements.

In terms of function, collagen synthesis stimulation is projected to command 53.5% share in the Bio-Mimetic Proteins Market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Oat Proteins Market Size and Share Forecast Outlook 2025 to 2035

Algae Proteins Market Trends – Sustainable Nutrition & Market Growth 2025 to 2035

Algal Proteins Market

Canola Proteins Market

Phycobiliproteins Market

Bioactive Proteins in Coffee Market

Antifreeze proteins Market Size and Share Forecast Outlook 2025 to 2035

Alternative Proteins for Pets Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Plant Derived Proteins Market Size and Share Forecast Outlook 2025 to 2035

Insect-Derived Proteins in Skincare Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Marine Derived Proteins Market Size and Share Forecast Outlook 2025 to 2035

Lipid Transfer Proteins Market

Hydrolyzed Silk Proteins Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Mammalian Derived Proteins Market Size and Share Forecast Outlook 2025 to 2035

Hydrolyzed Vegetable Proteins Market Size and Share Forecast Outlook 2025 to 2035

Extracellular Matrix Proteins Market

Synthetic Spider Silk Proteins Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Collagen-Boosting Biomimetic Peptides Market Size and Share Forecast Outlook 2025 to 2035

Biomimetic Collagen Synthesis Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Medical Biomimetics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA