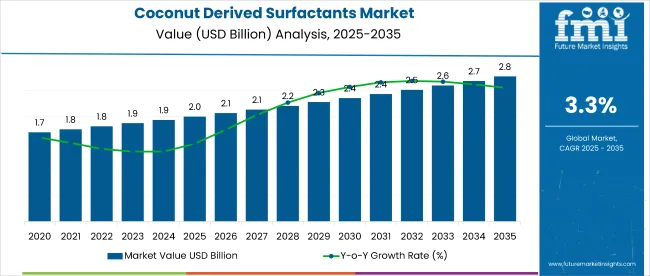

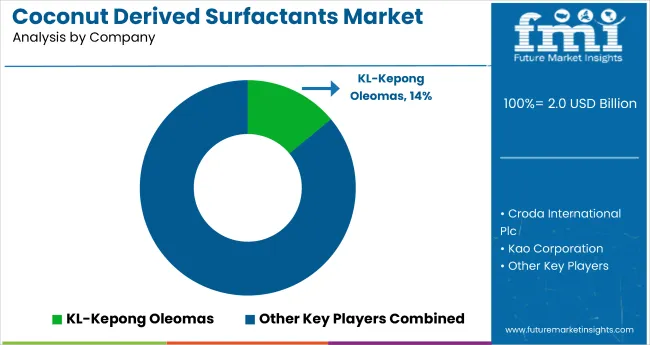

The global coconut derived surfactants market is valued at USD 2.0 billion in 2025 and is slated to reach USD 2.8 billion by 2035, reflecting a CAGR of 3.3%. Growth in the market is expected to be driven by increasing consumer demand for bio-based and environmentally friendly ingredients in cosmetic and detergent formulations.

| Metric | Value |

|---|---|

| Market Size (2025) | USD 2.0 billion |

| Market Size (2035) | USD 2.8 billion |

| CAGR (2025 to 2035) | 3.3% |

Expanding awareness about the harmful effects of conventional surfactants and the shift toward sustainable alternatives is also anticipated to boost market adoption. Government regulations promoting green chemistry are further likely to support industry expansion globally.

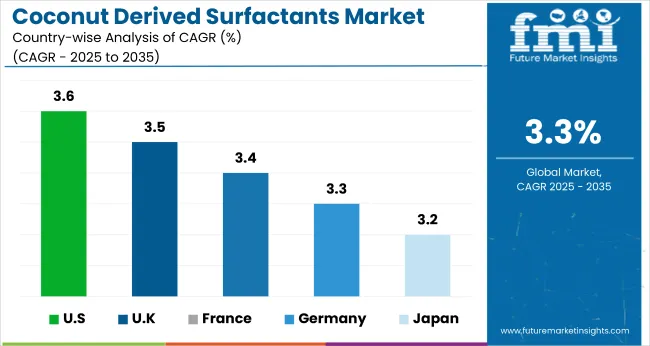

The USA leads the market among top countries, with a projected CAGR of 3.6% from 2025 to 2035, primarily due to growing consumer demand for clean-label, bio-based products and supportive regulations. The UK, following closely with a 3.5% CAGR, benefits from the popularity of sulfate-free and eco-friendly personal care formulations.

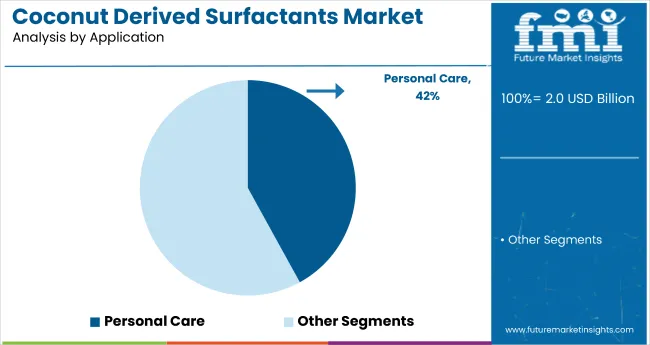

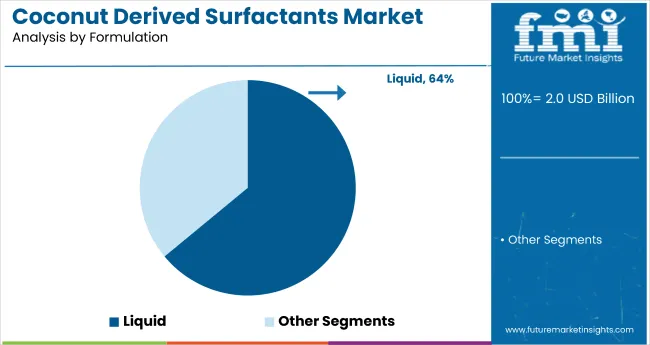

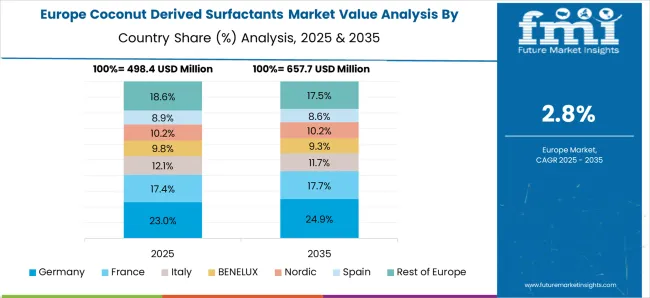

Germany shows strong growth at 3.4%, driven by the country’s focus on biodegradable ingredients and dermatology-friendly products. Liquid formulations will dominate the formulation segment with a 64% share in 2025, while personal care leads applications segment with a 42% share, driven by demand in cosmetics and skincare.

Recent innovations in the coconut derived surfactants market have been centered around green chemistry, sustainability, and enhanced performance. Companies like BASF and Evonik have introduced ultra-mild surfactant blends derived from coconut oil, targeting sensitive skin formulations in baby care and dermatological products.

Sironix Renewables, a start-up, has developed Eosix technology that uses renewable biomass to create high-performance, non-toxic surfactants. Additionally, advancements in enzymatic extraction and bio-fermentation processes are being adopted to increase yield and purity. These innovations are not only reducing environmental impact but also enhancing biodegradability, foaming efficiency, and skin compatibility across personal care and home care applications.

The market holds a modest but growing share within its parent markets. Within the global surfactants market, it accounts for approximately 5% to 7%, driven by rising demand for natural and biodegradable alternatives. In the broader bio-based chemicals market, its share is estimated at around 2% to 3%, reflecting its niche but expanding role.

In the personal care ingredients market, coconut-derived surfactants contribute nearly 4%, owing to their widespread use in shampoos, cleansers, and skincare products. As consumer preference shifts toward sustainable formulations, the market's share in these segments is expected to grow steadily over the forecast period.

The coconut derived surfactants market segments include application, formulation, and region. By application, the market covers household, detergent, personal care, food processing, agricultural chemicals, textiles, and institutional applications. By formulation, the market includes liquid, bar, and powdered forms. The regional segment comprises North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and the Middle East & Africa.

The most lucrative segment in the market is personal care, accounting for the highest share in 2025 at 42%. This dominance is driven by the rising demand for natural, skin-friendly ingredients in shampoos, facial cleansers, body washes, and baby care products.

Liquid formulations are projected to be the most lucrative segment in the coconut-derived surfactants market, accounting for approximately 64% of the total market share in 2025.

The global coconut derived surfactants market is expanding steadily, driven by growing demand for natural and biodegradable surfactants, increasing preference for chemical-free personal care products, and advancements in green chemistry and bio-based formulation technologies.

Recent Trends in the Coconut Derived Surfactants Market

Key Challenges in the Coconut Derived Surfactants Market

Among the top five countries, the USA leads the market with the highest projected CAGR of 3.6% from 2025 to 2035, driven by consumer demand for clean-label formulations and favorable bio-based regulations. The UK follows closely with a CAGR of 3.5%, fueled by sulfate-free product adoption.

Germany and France are expected to grow at 3.4% and 3.3% respectively, backed by their strong cosmetic and dermatology sectors. Japan holds the lowest projected CAGR of 3.2%, although it continues to innovate in hypoallergenic and eco-conscious formulations. Overall, steady growth is seen across mature markets prioritizing natural surfactant adoption.

The report covers an in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

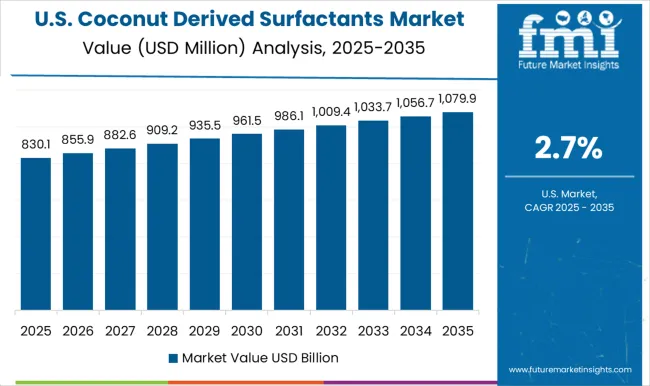

The USA coconut derived surfactants market is projected to expand at a CAGR of 3.6% from 2025 to 2035. Market growth is being driven by rising consumer preference for clean-label personal care products and strong regulatory pressure to phase out synthetic surfactants.

Sales of coconut-derived surfactants in the UK are anticipated to grow at a CAGR of 3.5% between 2025 and 2035. The growth is supported by consumer awareness regarding toxic ingredients and the rapid shift toward biodegradable formulations in the cosmetics and cleaning sectors.

The Germany coconut derived surfactants revenue is projected to register a CAGR of 3.4% during the forecast period. The country remains a hub for natural ingredient sourcing and innovative product development.

France coconut derived surfactants revenue is expected to grow at a CAGR of 3.3% in the market between 2025 and 2035. The market benefits from a sophisticated cosmetics industry, where demand for botanical and natural ingredients continues to rise. Increased R&D in natural emulsifiers and cleansers.

The Japan coconut derived surfactants revenue is expected to expand at a CAGR of 3.2% from 2025 to 2035. Growth is driven by consumer trust in high-quality, natural formulations and the rising demand for hypoallergenic skincare.

The market remains moderately fragmented, with both multinational corporations and regional players competing based on product innovation, pricing, sustainability, and regional expansion.

Top-tier companies such as BASF, Kao Corporation, Croda International, AkzoNobel, and The Dow Chemical Company dominate the global landscape through innovation in green chemistry, strategic acquisitions, and collaborations. These firms are heavily investing in R&D to develop high-performance, biodegradable surfactants derived from coconut oil. A major focus lies in replacing petrochemical-based ingredients in personal care and home care products with milder, sustainable alternatives.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 2.0 billion |

| Projected Market Size (2035) | USD 2.8 billion |

| CAGR (2025 to 2035) | 3.3% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD billions/Volume in Metric Tons |

| By Application | Household, Detergent, Personal Care, Food Processing, Agricultural Chemicals, Textiles, Institutional Applications |

| By Formulations | Liquid, Bar, Powdered |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia, and 40+ countries |

| Key Players | Haiquing Biotechnology, KL-Kepong Oleomas, Croda International, BASF, The Dow Chemical Company, AkzoNobel, 3M, Kao Corporation, F. Hoffmann-La Roche Ltd., Sysmex Corporation |

| Additional Attributes | Dollar sales by value, market share analysis by region, and country-wise analysis. |

The global coconut derived surfactants market is estimated to be valued at USD 2.0 billion in 2025.

The market size for the coconut derived surfactants market is projected to reach USD 2.7 billion by 2035.

The coconut derived surfactants market is expected to grow at a 3.1% CAGR between 2025 and 2035.

The key product types in coconut derived surfactants market are household, detergent, personal care, food processing, agricultural chemicals, textiles and institutional applications.

In terms of formulations, liquid segment to command 58.6% share in the coconut derived surfactants market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Surfactants Market Size and Share Forecast Outlook 2025 to 2035

Coconut Oil Moisturizing Creams Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Coconut Water Cosmetics Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Coconut Water-Based Formulas Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Coconut Milk Powder Market Size and Share Forecast Outlook 2025 to 2035

Coconut Water Market Size, Growth, and Forecast 2025 to 2035

Coconut Milk Products Market Trends – Size, Demand & Forecast 2025-2035

Coconut Milk Market Analysis – Size, Share & Forecast Outlook 2025 to 2035

Coconut Butter Market Analysis by End-use Application Sales Channel Through 2025 to 2035

Coconut Sugar Market By Form, Nature, Application and Region - Forecast from 2025 to 2035

Coconut Flour Market Analysis by End-Use, Application, Product Form, Technology, Nature, and Region from 2025 to 2035

Coconut Oil Market Insights - Growing Applications & Industry Expansion 2025 to 2035

Coconut Wraps Market Outlook – Growth, Demand & Forecast 2025 to 2035

Competitive Overview of Coconut Syrup Industry Share

Coconut Cream Market – Growth, Demand & Dairy Alternatives Trends

Coconut-Free Skincare Market Growth – Size, Trends & Forecast 2024-2034

Coconut Fatty Acids Market

Bio-surfactants Market

Analysis and Growth Projections for Pine-derived Chemicals Market

Plant Derived Analgesics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA