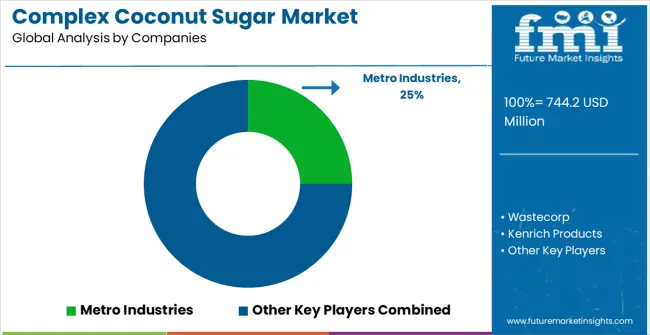

The global complex coconut sugar market is projected to reach USD 1,271.3 million by 2035, recording an absolute increase of USD 527 million over the forecast period. The market is valued at USD 744.2 million in 2025 and is set to rise at a CAGR of 5.5% during the assessment period. The overall market size is expected to grow by nearly 1.71X during the same period, supported by increasing consumer preference for natural sweeteners and growing health consciousness, driving demand for unrefined sugar alternatives with superior nutritional profiles.

Growth faces constraints from higher production costs and limited coconut palm cultivation areas that may restrict supply chain scalability across global markets.

Between 2025 and 2030, the complex coconut sugar market is projected to expand from USD 744.2 million to USD 972.6 million, resulting in a value increase of USD 228.4 million, which represents 43.3% of the total forecast growth for the decade. This phase of growth will be shaped by rising demand for clean label ingredients, product innovation in processing techniques and flavor enhancement, and expanding retail distribution channels across health food stores and mainstream grocery chains. Companies are establishing competitive positions through investment in sustainable sourcing practices, premium product positioning, and strategic market expansion across organic retailers, e-commerce platforms, and emerging health-conscious consumer segments.

From 2030 to 2035, the market is forecast to grow from USD 972.6 million to USD 1,271.3 million, adding another USD 298.7 million, which constitutes 56.7% of the overall ten-year expansion. This period is expected to be characterized by expansion of specialized product formulations including granulated and liquid variants tailored for specific culinary applications, strategic collaborations between coconut sugar producers and food manufacturers, and premium positioning with sustainability certifications and transparency initiatives. The growing emphasis on plant-based diets and functional food trends will drive demand for value-added coconut sugar products across diverse consumption occasions and applications.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 744.2 million |

| Market Forecast Value (2035) | USD 1,271.3 million |

| Forecast CAGR (2025-2035) | 5.5% |

The complex coconut sugar market grows because it addresses consumer demand for natural alternatives to refined sugar while providing superior nutritional profiles including minerals, amino acids, and lower glycemic index ratings compared to conventional sweeteners. Key demand drivers include increasing diabetes awareness prompting sugar substitution among health-conscious demographics, rising clean eating trends emphasizing minimally processed ingredients with traceable sourcing, expanding organic food market penetration requiring natural sweetening solutions, and growing culinary interest in artisanal cooking ingredients that provide authentic flavors and enhanced nutritional benefits. Premium segments in North America and Europe demonstrate strongest adoption rates, while Asian markets show potential for value-tier products targeting cost-conscious consumers. However, limited coconut palm cultivation regions and seasonal production variability may constrain supply chain reliability and price stability over time.

The market is segmented by product type, end-use, and region. By product type, the market is divided into organic coconut sugar, conventional coconut sugar, flavored coconut sugar, and specialty blends. Based on form, the market is categorized into granulated, powder, liquid/syrup, and crystallized variants. By end-use, the market is segmented into food and beverage, bakery and confectionery, health supplements, and personal care products. Regionally, the market is divided into North America, Latin America, Europe, East Asia, South Asia & Pacific, and Middle East & Africa.

Organic coconut sugar is projected to account for 58.3% of the complex coconut sugar market in 2025. This leading share is supported by premium positioning among health-conscious consumers seeking certified natural products without chemical processing or synthetic additives, superior price realization enabling sustainable coconut farming practices, and comprehensive retail distribution across specialty organic stores and mainstream grocery chains that cater to environmentally conscious demographics. Organic certification provides quality assurance and environmental stewardship messaging that resonates with target consumers willing to pay premium prices for traceable, chemical-free sweetening alternatives that support sustainable agriculture practices and fair trade relationships with coconut farming communities throughout Southeast Asia and Latin America.

The segment benefits from established certification bodies including USDA Organic, EU Organic, and JAS Organic standards that provide comprehensive supply chain documentation and growing consumer trust in organic labeling systems across developed markets seeking natural ingredient alternatives. Organic coconut sugar demonstrates superior shelf appeal, marketing differentiation, and brand positioning advantages compared to conventional alternatives through premium packaging, sustainability messaging, and comprehensive quality certifications that emphasize purity and environmental responsibility. Premium organic positioning enables higher profit margins for producers while supporting sustainable agricultural practices, environmental conservation, and fair trade relationships with coconut farming communities that depend on international market access for economic stability and development opportunities.

Food and beverage applications are expected to represent 72.4% of complex coconut sugar demand in 2025. This dominant share reflects widespread adoption in beverage formulations, sauce and condiment production, and packaged food manufacturing where coconut sugar provides natural sweetening with enhanced flavor complexity and nutritional benefits compared to refined sugar alternatives that lack mineral content and authentic taste profiles. The segment provides essential functionality for clean label formulations and organic product development in competitive food manufacturing environments where natural ingredient sourcing becomes increasingly important for brand differentiation and consumer appeal among health-conscious demographics seeking transparent ingredient lists and sustainable sourcing practices.

Modern food manufacturers increasingly recognize coconut sugar value for product differentiation, premium positioning, and consumer appeal in health-focused product categories including organic beverages, natural snack foods, and specialty sauce formulations that require natural sweetening solutions with superior flavor profiles and enhanced nutritional characteristics. The application versatility extends across hot and cold beverage systems, baked goods production, confectionery manufacturing, and specialty sauce formulations that require natural sweetening solutions with enhanced mineral content and lower glycemic index ratings compared to conventional sugar alternatives including cane sugar and corn syrup. Growing demand for plant-based and functional food products creates substantial opportunities for coconut sugar integration across diverse food processing applications that emphasize clean label positioning and natural ingredient sourcing for health-conscious consumer segments seeking authentic flavors and nutritional benefits.

Market drivers center on health consciousness trends driving natural sweetener adoption, with consumers seeking alternatives to refined sugar that provide better nutritional profiles including minerals, amino acids, and lower glycemic impact ratings compared to conventional sweeteners that lack nutritional benefits and may contribute to metabolic health issues. Rising diabetes prevalence and obesity concerns motivate substitution behaviors among health-conscious demographics seeking weight management solutions, while clean eating movements emphasize minimally processed ingredients with traceable sourcing and sustainable production practices that support environmental conservation and social responsibility objectives. Organic food market expansion creates distribution opportunities through specialty retailers and mainstream grocery channels, while culinary interest in ethnic cuisines introduces coconut sugar to broader consumer segments seeking authentic ingredients with enhanced flavor profiles and cultural significance.

Market restraints include production scalability challenges from limited coconut palm cultivation regions concentrated in Southeast Asia and Latin America, seasonal harvest variations affecting consistent supply availability throughout the year, and higher production costs compared to conventional sugar alternatives including cane sugar and corn syrup that benefit from large-scale industrial processing and established supply chain infrastructure. Transportation expenses from tropical production areas to major consumption markets increase landed costs and affect price competitiveness against local sugar alternatives, while processing equipment limitations and quality standardization issues may constrain market development across diverse geographic regions with varying regulatory requirements and consumer preferences. Consumer price sensitivity limits adoption rates among cost-conscious demographics, particularly in developing markets where premium pricing restricts accessibility and market penetration opportunities.

Key trends indicate accelerating adoption among health-conscious urban consumers in developed markets, with product formulation shifts enabling integration into mainstream food manufacturing applications including beverages, bakery products, and confectionery items that target premium market segments. Premium positioning strategies emphasize sustainability credentials, artisanal production methods, and comprehensive traceability systems that appeal to environmentally conscious consumers seeking ethical ingredient choices with transparent supply chain documentation. Private label development expands accessibility across price-sensitive segments while maintaining quality standards and organic certification requirements that ensure product integrity and consumer trust. Market expansion depends on supply chain development and processing efficiency improvements, though commodity price volatility and climate change impacts could challenge growth sustainability over the forecast period.

| Country | CAGR (2025-2035) |

|---|---|

| China | 7.4% |

| India | 6.9% |

| Germany | 6.3% |

| Brazil | 5.8% |

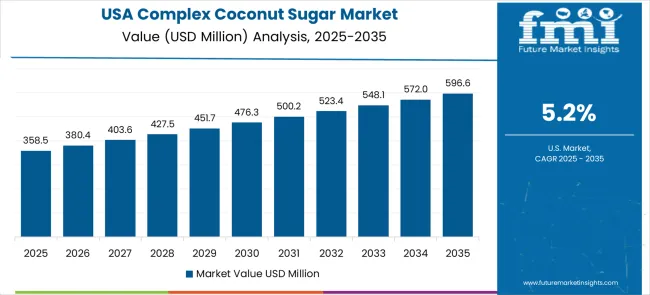

| United States | 5.2% |

| United Kingdom | 4.7% |

| Japan | 4.1% |

The complex coconut sugar market is gathering pace worldwide, with China taking the lead thanks to expanding health food retail networks and growing premium ingredient demand in urban centers seeking natural sweetening alternatives. Close behind, India benefits from domestic coconut production capabilities and increasing health consciousness among middle-class consumers, positioning itself as a strategic growth hub for both production and consumption development. Germany shows steady advancement, where clean label trends and organic food market maturity strengthens its role in the European supply chain for natural sweeteners. Brazil is sharpening focus on sustainable agriculture initiatives and natural sweetener production capabilities, signaling an ambition to capture export opportunities in developed markets. Meanwhile, the USA stands out for its premium market development and comprehensive retail distribution, while the UK and Japan continue to record consistent progress through health food retail expansion and quality-focused consumer preferences. Together, China and India anchor the global expansion story, while the rest build stability and diversity into the market's growth path.

The report covers an in-depth analysis of 40+ countries, the top-performing countries are highlighted below.

China demonstrates exceptional market potential with rising health consciousness among urban consumers and expanding premium ingredient demand across food service and retail channels, particularly in tier-1 cities including Shanghai, Beijing, and Shenzhen where international cuisine adoption and health food trends drive coconut sugar interest among educated demographics seeking natural alternatives to refined sweeteners. The country's rapidly developing middle class shows increasing willingness to pay premium prices for natural sweetening alternatives that provide health benefits and align with clean eating lifestyle preferences supported by growing awareness of diabetes prevention and weight management strategies. Revenue growth accelerates at a CAGR of 7.4% through 2035, supported by domestic food manufacturing expansion, e-commerce platform development, and increasing consumer awareness of refined sugar health impacts that drive substitution behaviors toward natural alternatives with superior nutritional profiles and authentic flavor characteristics.

India represents a unique growth opportunity combining domestic coconut production capabilities with expanding health food market demand, particularly in major urban centers including Mumbai, Delhi, and Bangalore where increasing disposable income and health consciousness drive natural sweetener adoption among educated demographics seeking diabetes-friendly alternatives with traditional cultural significance. The country's established coconut cultivation infrastructure across southern states including Kerala, Tamil Nadu, and Karnataka provides supply chain advantages and processing capabilities that position it favorably for both domestic consumption growth and export market development opportunities in international markets seeking authentic coconut-based products. Consumer awareness of coconut sugar benefits grows among urban professionals and health-conscious families seeking weight management solutions and diabetes prevention strategies, while traditional medicine practices support acceptance of coconut-derived health products across diverse demographic segments seeking natural wellness solutions.

Germany leads European coconut sugar adoption through its mature organic food market infrastructure, comprehensive health food retail networks, and strong consumer preference for certified natural ingredients that support sustainable agriculture practices and environmental stewardship values across diverse demographic segments seeking premium quality products. The country's sophisticated organic certification systems, including EU Organic and Demeter standards, create comprehensive quality assurance frameworks that support premium product positioning and consumer trust in natural sweetener categories that emphasize purity, sustainability, and social responsibility throughout the supply chain. Market development accelerates at a CAGR of 6.3% through 2035, driven by established organic food distribution channels, premium product positioning strategies, and comprehensive retail penetration through health food stores, organic supermarkets, and mainstream grocery chains that serve environmentally conscious demographics willing to pay premium prices for sustainable products with transparent sourcing documentation.

Brazil demonstrates growing market potential through sustainable agriculture initiatives and natural sweetener production capabilities, particularly in coastal regions including Bahia, Ceará, and Espírito Santo where coconut cultivation expands to serve both domestic and international demand across diverse market segments seeking authentic tropical ingredients. The country's favorable tropical climate conditions, agricultural expertise, and processing infrastructure development create opportunities for coconut sugar production scaling and quality improvement initiatives that support both domestic consumption and export market development targeting North American and European consumers seeking sustainable sweetening alternatives. Market growth proceeds at a CAGR of 5.8% through 2035, supported by agricultural modernization programs, environmental sustainability emphasis, and strategic positioning in Latin American export markets that value Brazilian agricultural products for quality, reliability, and comprehensive sustainability credentials that appeal to environmentally conscious international buyers.

The United States drives coconut sugar market growth through premium positioning strategies, comprehensive retail distribution networks, and strong consumer demand for natural sweetening alternatives across health food, organic, and mainstream grocery channels that serve diverse demographic segments seeking transparent ingredient sourcing and superior nutritional benefits. American consumers demonstrate consistent willingness to pay premium prices for coconut sugar products that provide health benefits, sustainable sourcing credentials, and superior flavor profiles compared to conventional sweeteners including refined cane sugar and corn syrup alternatives that lack nutritional value and authentic taste characteristics. Market expansion proceeds at a CAGR of 5.2% through 2035, supported by health consciousness trends, diabetes awareness campaigns, and clean label food manufacturing requirements that create opportunities for refined sugar substitution across diverse product categories including beverages, baked goods, and specialty food applications targeting health-conscious consumers.

The United Kingdom develops its coconut sugar market through expanding health food retail infrastructure, growing organic product demand, and increasing consumer awareness of natural sweetening alternatives that support weight management and diabetes prevention objectives among health-conscious demographics seeking premium quality ingredients with sustainable sourcing credentials. British consumers increasingly seek coconut sugar as a refined sugar alternative that provides better nutritional profiles including minerals and amino acids while supporting clean eating lifestyle choices and sustainable agriculture practices that align with environmental values and social responsibility concerns. Market growth advances at a CAGR of 4.7% through 2035, driven by premium product positioning, comprehensive retail availability, and consumer preference for sustainable and ethically sourced food ingredients that align with environmental values and social responsibility concerns that influence purchasing decisions across diverse demographic segments.

Japan demonstrates consistent market development through premium product positioning, quality-focused consumer preferences, and specialized distribution channels that serve health-conscious demographics seeking natural sweetening alternatives with superior purity and nutritional benefits that align with traditional wellness practices and modern health objectives. Japanese consumers prioritize product quality, comprehensive certifications, and sustainable sourcing practices when selecting natural sweeteners, creating favorable market conditions for premium coconut sugar brands that emphasize artisanal production methods and traditional processing techniques that preserve nutritional integrity and authentic flavor characteristics. Market growth proceeds at a CAGR of 4.1% through 2035, characterized by emphasis on product quality, sustainable sourcing transparency, and comprehensive nutritional benefits that appeal to Japanese consumers' health and wellness priorities including aging gracefully and diabetes prevention strategies that emphasize natural ingredient consumption and dietary balance.

The complex coconut sugar market in Europe is projected to grow from USD 156.8 million in 2025 to USD 243.7 million by 2035, registering a CAGR of 4.5% over the forecast period. Germany is expected to maintain its leadership with a commanding 28.2% share in 2025, rising to 29.1% by 2035, supported by its mature organic food retail infrastructure, comprehensive health food distribution networks, and strong consumer preference for certified natural ingredients that align with sustainability values and environmental consciousness. France accounts for 19.4% of the European market in 2025, with share expected to remain stable at 19.2% by 2035, driven by artisanal food culture, sophisticated culinary applications, and growing integration of natural sweeteners in bakery and confectionery production that emphasizes premium ingredients and authentic flavor profiles. The UK represents 17.1% market share in 2025, projected to maintain 16.8% through 2035, supported by expanding health food retail networks, increasing consumer awareness of sugar alternatives, and comprehensive distribution through specialty organic retailers and mainstream grocery channels that serve health-conscious demographics seeking natural sweetening solutions with superior nutritional benefits.

In Japan, the complex coconut sugar market is largely driven by organic coconut sugar preferences, which account for 75% of total market revenues in 2025. The emphasis on purity and quality standards in the domestic health food market and the comprehensive certification requirements for imported natural sweeteners are key contributing factors that support premium positioning and consumer trust in organic products. Conventional coconut sugar follows with a 20% share, primarily in food manufacturing applications that integrate clean label positioning without premium certification requirements but maintain quality standards and natural ingredient emphasis. Flavored coconut sugar variants contribute 5% as specialty applications and artisanal food products continue developing among niche consumer segments seeking unique flavor profiles and culinary experiences.

In South Korea, the market is expected to remain dominated by specialty health stores and organic retailers, which hold a 45% share in 2025. These channels typically serve health-conscious consumers where premium natural sweeteners require specialized positioning and comprehensive consumer education about health benefits and sustainable sourcing practices. Supermarkets and hypermarkets each hold 30% market share, with rising standardization in natural sweetener merchandising across retail formats that emphasize clean label positioning and health benefits. Online retail accounts for the remaining 25%, gradually gaining traction in direct-to-consumer models due to convenience factors and comprehensive product information accessibility that supports informed purchasing decisions among health-conscious demographics.

The complex coconut sugar market operates with moderate concentration among established natural sweetener producers, specialty organic food companies, and coconut processing specialists who compete primarily on product quality, certification credentials, and supply chain sustainability rather than price-based strategies that could compromise quality standards or sustainable sourcing practices. Market structure includes approximately 15-20 meaningful players globally, with the top 5 companies controlling roughly 40-45% of total market value through premium positioning and comprehensive distribution networks that serve health-conscious consumer segments seeking natural sweetening alternatives with superior nutritional profiles and authentic flavor characteristics. Competition emphasizes quality differentiation, organic certification, sustainable sourcing practices, and brand positioning strategies that build consumer trust and loyalty among demographics willing to pay premium prices for natural products.

Market leaders including Coconut Secret and Wholesome Sweeteners leverage established distribution relationships, comprehensive organic certifications, and premium positioning strategies to maintain competitive advantages through quality consistency and brand recognition among health-conscious consumers seeking reliable natural sweetening alternatives. These companies benefit from economies of scale in sourcing, processing, and distribution that enable consistent product availability and quality standards across diverse retail channels while maintaining sustainable sourcing practices that support coconut farming communities throughout Southeast Asia and Latin America. Challenger companies such as Nutiva and Big Tree Farms compete through specialized positioning, direct-to-consumer strategies, and sustainability messaging that appeals to environmentally conscious demographics seeking authentic products with comprehensive traceability and social responsibility credentials.

Emerging specialists and regional producers focus on niche market segments including fair trade certification, artisanal processing methods, and local distribution networks that provide differentiation through authenticity, transparency, and community connection that resonates with consumers seeking unique products and meaningful brand relationships. Competition increasingly centers on supply chain transparency, farmer relationship development, and comprehensive sustainability credentials that support premium pricing and consumer loyalty among demographics that prioritize environmental and social responsibility in purchasing decisions. Market dynamics favor companies with established coconut sourcing relationships, processing capabilities, and retail distribution access rather than new entrants facing significant barriers to market development including supply chain complexity and certification requirements.

Complex coconut sugar represents a premium natural sweetener market valued at USD 744.2 million in 2025, projected to reach USD 1.27 billion by 2035 at a 5.5% CAGR. With organic variants commanding 58.3% market share and food & beverage applications driving 72.4% of demand, this market addresses growing consumer preferences for natural alternatives to refined sugar while providing superior nutritional profiles including minerals, amino acids, and lower glycemic index ratings. Market expansion faces constraints from limited coconut palm cultivation areas concentrated in Southeast Asia and Latin America, seasonal production variability, and higher costs compared to conventional sweeteners, requiring coordinated stakeholder action to unlock scalability and mainstream adoption.

Agricultural Support and Infrastructure Development:

Processing Infrastructure and Technology Advancement:

Regulatory Framework and Market Access:

Sustainability and Climate Initiatives:

Quality Standards and Certification Development:

Market Education and Consumer Awareness:

Supply Chain Coordination and Market Intelligence:

Technical Innovation and Application Development:

Processing Technology and Equipment Solutions:

Food Formulation and Integration Tools:

Packaging and Shelf-Life Enhancement:

Supply Chain Integration and Traceability:

Production Scaling and Quality Management:

Market Positioning and Brand Development:

Technical Support and Customer Development:

Geographic Expansion and Distribution:

Infrastructure and Processing Investment:

Market Development and Brand Building:

| Item | Value |

|---|---|

| Quantitative Units (2025) | USD 744.2 million |

| Product Type | Organic coconut sugar, conventional coconut sugar, flavored coconut sugar, specialty blends |

| End-Use | Food and beverage, bakery and confectionery, health supplements, personal care products |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Country Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Coconut Secret, Wholesome Sweeteners, Nutiva, Big Tree Farms, Madhava Natural Sweeteners, Coco Sugar Indonesia, Franklin Baker, Navitas Organics, Tadin Tea, SunFood |

| Additional Attributes | Dollar sales by product type and form variants, regional consumption trends across North America, Europe, and Asia-Pacific, competitive landscape with established brands and emerging artisanal producers, consumer preferences for organic versus conventional products, integration with clean label positioning and sustainable sourcing initiatives, innovations in processing technology and flavor enhancement, and development of specialized applications with functional food benefits and premium positioning strategies for health-conscious demographics. |

The global complex coconut sugar market is estimated to be valued at USD 744.2 million in 2025.

The market size for the complex coconut sugar market is projected to reach USD 1,271.3 million by 2035.

The complex coconut sugar market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in complex coconut sugar market are organic coconut sugar, conventional coconut sugar, flavored coconut sugar and specialty blends.

In terms of application, food and beverage segment to command 72.4% share in the complex coconut sugar market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Coconut Sugar Market By Form, Nature, Application and Region - Forecast from 2025 to 2035

Sugarcane Bottle Market Forecast and Outlook 2025 to 2035

Complexion Analysis System Market Size and Share Forecast Outlook 2025 to 2035

Coconut Derived Surfactants Market Size and Share Forecast Outlook 2025 to 2035

Coconut Oil Moisturizing Creams Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Sugarcane-Derived Squalane Market Size and Share Forecast Outlook 2025 to 2035

Coconut Water Cosmetics Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Coconut Water-Based Formulas Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Complex Regional Pain Syndrome (CRPS) Market Size and Share Forecast Outlook 2025 to 2035

Coconut Milk Powder Market Size and Share Forecast Outlook 2025 to 2035

Sugared Egg Yolk Market Size and Share Forecast Outlook 2025 to 2035

Coconut Water Market Size, Growth, and Forecast 2025 to 2035

Coconut Milk Products Market Trends – Size, Demand & Forecast 2025-2035

Coconut Milk Market Analysis – Size, Share & Forecast Outlook 2025 to 2035

Sugar Toppings Market Size, Growth, and Forecast for 2025 to 2035

Complex Generics Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Sugarcane Fiber Bowls Market – Growth & Demand 2025 to 2035

Coconut Butter Market Analysis by End-use Application Sales Channel Through 2025 to 2035

Sugar-based Excipients Market Analysis by Product, Type, Functionality, Formulation, and Region Through 2035

Sugar Substitute Market Trends - Low-Calorie Sweeteners & Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA