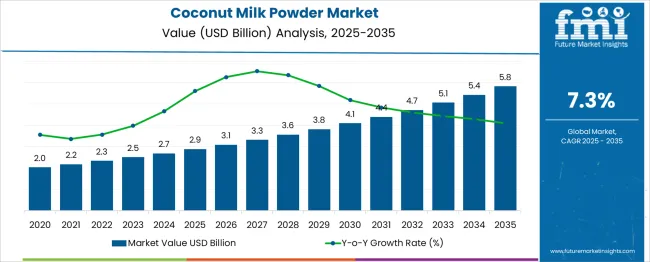

The Coconut Milk Powder Market is estimated to be valued at USD 2.9 billion in 2025 and is projected to reach USD 5.8 billion by 2035, registering a compound annual growth rate (CAGR) of 7.3% over the forecast period. Year-on-Year (YoY) growth analysis reveals that the market experiences steady incremental increases in value, with early years showing a relatively moderate growth rate.

The initial increase of USD 0.3 billion from USD 2.9 billion to USD 3.2 billion in the first year reflects a growth of 10.3%, which subsequently tapers to around 7.5% in the following years as the market matures. By the fifth year, the market value is projected to reach USD 4.1 billion, demonstrating a consistent 8.5% YoY growth compared to previous years.

In the second half of the decade, the market experiences more significant annual growth, as demand intensifies due to increased consumer preference for dairy alternatives, health benefits of coconut, and improved distribution channels.

By the final year of the forecast (2035), the market is expected to reach USD 5.8 billion, with a slightly reduced YoY growth rate of 6.7%, reflecting the consolidation of market leaders and more market saturation. The YoY growth data illustrates a healthy expansion trajectory, driven by both regional demand and product diversification within the food and beverage sector.

| Metric | Value |

|---|---|

| Coconut Milk Powder Market Estimated Value in (2025 E) | USD 2.9 billion |

| Coconut Milk Powder Market Forecast Value in (2035 F) | USD 5.8 billion |

| Forecast CAGR (2025 to 2035) | 7.3% |

The coconut milk powder market is experiencing steady growth, driven by evolving consumer preferences toward plant-based, lactose-free, and clean-label alternatives. The convenience of powdered formats for storage, transport, and portion control has broadened their appeal across both household and industrial applications.

Manufacturers are investing in sustainable sourcing and spray-drying technology to maintain product consistency while extending shelf life. With increasing demand from vegan and flexitarian populations, coconut milk powder is gaining traction in functional foods, bakery products, and non-dairy beverages.

Furthermore, regulatory emphasis on food safety and traceability has encouraged the adoption of organic certifications and standardized processing practices. As foodservice chains expand globally, especially in Asian cuisine and health-conscious segments, the market is expected to witness continued demand from both developed and emerging economies.

The coconut milk powder market is segmented by form, nature, application, distribution channel, and geographic regions. The coconut milk powder market is divided into Organic and Conventional forms. In terms of the nature of the coconut milk powder market, it is classified into full-fat and low-fat. Based on the application, the coconut milk powder market is segmented into Food and beverages, Beverages, Confectionery, Bakery, Soups and sauces, and Personal care products.

The distribution channel of the coconut milk powder market is segmented into Supermarkets/Hypermarkets, Online retail, Specialty stores, and Convenience stores. Regionally, the coconut milk powder industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

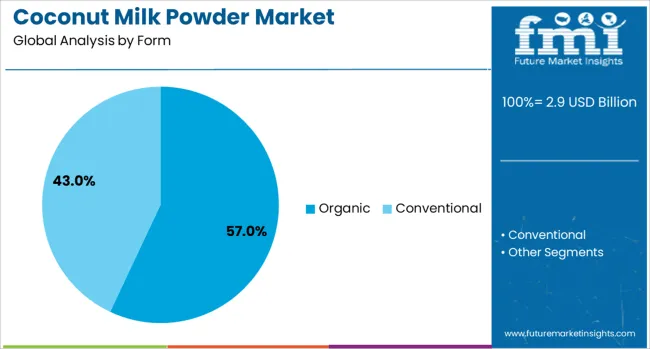

The organic segment is projected to lead the form-based segmentation, contributing 57.0% of the total market revenue in 2025. This dominance is being supported by growing consumer awareness regarding pesticide-free, sustainably sourced food products.

Organic coconut milk powder is increasingly favored for its clean-label appeal, especially among health-conscious consumers and premium food brands. Regulatory recognition and expanding availability through certified supply chains have made organic formats more accessible to mainstream buyers.

Additionally, the growth of organic private label brands in retail and the prioritization of organic ingredients by plant-based product manufacturers have further strengthened this segment’s market position.

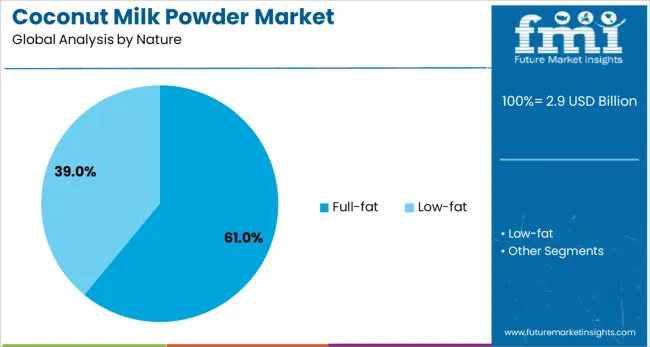

Full-fat coconut milk powder is expected to account for 61.0% of the market revenue by 2025, making it the leading nature-based segment. Its leadership is attributed to its higher richness, flavor retention, and emulsification capacity, which are critical for culinary and beverage applications.

Food processors and chefs prefer full-fat variants for creating creamy textures and authentic taste profiles, particularly in ethnic cuisines and ready-to-eat meals. The segment’s growth has also been fueled by the increasing demand for indulgent, natural-fat content products in the premium and gourmet category.

Technological improvements in drying methods have ensured better solubility and consistency, supporting broader usage across diverse formulations.

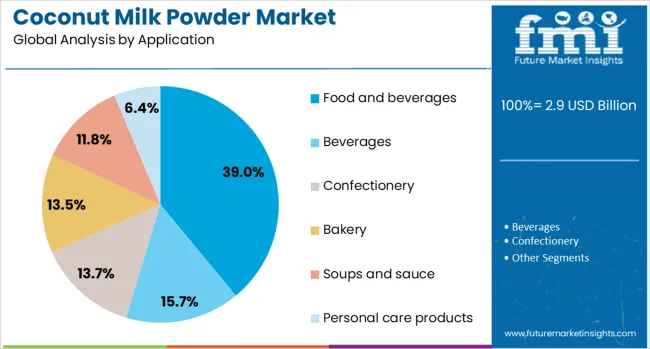

The food and beverages segment is projected to contribute 39.0% of total market revenue in 2025, establishing itself as the top application area. This dominance stems from the extensive use of coconut milk powder in bakery, confectionery, desserts, soups, sauces, and beverages.

Rising demand for plant-based dairy substitutes and the global popularity of Asian and tropical cuisine have propelled its integration into foodservice menus and packaged food products. The format’s longer shelf life and storage ease make it ideal for dry mixes, vending systems, and meal kits.

With continuous product innovation in non-dairy creamers, flavored drinks, and health foods, this segment is set to remain the core consumer of coconut milk powder globally.

Coconut milk powder is a dehydrated form of coconut milk used in various food and beverage applications, offering convenience, longer shelf life, and easy storage. The market is growing due to the rising demand for plant-based products, increasing health-consciousness, and the preference for coconut-based alternatives. Manufacturers focus on enhancing the quality, flavor, and nutritional profile of coconut milk powder to cater to diverse consumer needs, particularly in vegan, lactose-free, and dairy-free segments. Global market expansion is supported by innovation in product formulations and increased availability in retail and foodservice.

The increasing demand for plant-based alternatives has been a key driver of the coconut milk powder market's growth. Consumers, particularly in the vegan and lactose-intolerant segments, are seeking dairy alternatives, boosting demand for coconut-based products. Coconut milk powder’s long shelf life and convenience have made it a popular choice in the food and beverage sector, as it can be easily incorporated into a wide range of products like smoothies, desserts, and baked goods. Moreover, the health benefits of coconut milk, including its richness in vitamins and MCTs (medium-chain triglycerides), have made it an attractive option for health-conscious consumers. The rising popularity of Southeast Asian cuisine globally continues to reinforce demand for coconut milk powder.

The coconut milk powder market faces challenges related to the volatility in the price of raw coconut material. This fluctuation can significantly affect production costs, which is a critical issue for manufacturers and distributors. Additionally, high-quality coconuts are subject to the seasonal nature of coconut production, leaving the supply susceptible to weather conditions and regional supply chain disruptions. The process of converting coconut milk into powder also tends to be more expensive than producing other powdered milk alternatives. There is also limited awareness of coconut milk powder’s benefits outside of regions where coconut-based products are traditionally consumed, slowing adoption in non-Asian markets and creating barriers to broader global expansion.

The coconut milk powder market presents significant opportunities in product innovation, especially through the development of new flavored variants, such as spiced coconut milk powders, to cater to niche consumer preferences. With the growing demand for dairy-free and plant-based products, coconut milk powder is being increasingly used in ready-to-drink beverages, health supplements, smoothies, and dairy-free ice creams. These applications are expanding rapidly as consumers seek clean-label, non-dairy, and functional alternatives. The foodservice industry, particularly vegan restaurants and ethnic food chains, is another promising area for growth. Manufacturers also have the opportunity to target the growing bakery and confectionery segments, offering coconut milk powder as a dairy replacement in cake mixes and fillings.

Recent trends in the coconut milk powder market include a focus on flavor enhancement, such as developing coconut milk powder with added spices or flavorings to meet evolving consumer tastes. The adoption of innovative packaging solutions is becoming more prevalent. Single-serve, convenient packaging is increasingly popular among consumers, particularly those looking for easy-to-use options in beverages or recipes. To improve the shelf life of coconut milk powder, manufacturers are investing in moisture-resistant and vacuum-sealed packaging. There is also a growing trend toward improving the product’s emulsification and solubility to expand its use in a wider variety of processed foods, beverages, and snacks. This is helping to broaden its applications across industries.

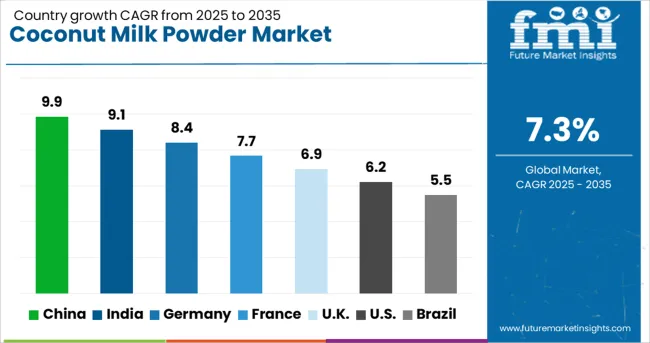

| Country | CAGR |

|---|---|

| China | 9.9% |

| India | 9.1% |

| Germany | 8.4% |

| France | 7.7% |

| UK | 6.9% |

| USA | 6.2% |

| Brazil | 5.5% |

The coconut milk powder market is projected to grow globally at a CAGR of 7.3% from 2025 to 2035. Among the leading markets, China leads at 9.9%, followed by India at 9.1%, while Germany posts 8.4%, the United Kingdom records 6.9%, and the United States stands at 6.2%. These growth rates indicate a premium of +36% for China and +24% for India over the global average, while Germany stays ahead by +15%, and the UK and the US trail behind at –5% and –15%, respectively. The divergence reflects strong growth in BRICS economies driven by increased consumer demand for plant-based foods, while the OECD countries are witnessing steady growth driven by health-conscious consumers and rising popularity of dairy alternatives. The analysis spans over 40 countries, with the top markets detailed below

China is expected to grow at a CAGR of 9.9% through 2035, driven by increased adoption of plant-based foods, growing awareness of the health benefits of coconut milk, and rising demand for dairy-free products. Coconut milk powder is gaining popularity as a versatile ingredient in bakery products, beverages, and ready-to-eat meals, especially among younger consumers. Rising vegan and lactose-intolerant populations are significantly contributing to market expansion. Domestic manufacturers are ramping up production capabilities to meet the growing demand, while global suppliers continue to enter the market with premium coconut-based products. As health trends continue to shape the market, the organic coconut milk powder segment is expected to see accelerated growth.

India is projected to achieve a CAGR of 9.1% through 2035, supported by an expanding base of health-conscious consumers seeking plant-based dairy alternatives. Coconut milk powder is increasingly used in vegetarian and vegan recipes, functional beverages, and cooking applications. Growing awareness of the nutritional value and digestive benefits of coconut milk is fueling its use in beverages, desserts, and snacks. Local manufacturers are focusing on cost-effective production methods while improving quality standards to cater to the expanding middle-class market. With the rise of online retail and consumer awareness, coconut milk powder's accessibility in rural and semi-urban areas is also improving.

Germany is expected to achieve a CAGR of 8.4% through 2035, supported by increasing demand for dairy alternatives, particularly among health-conscious consumers. The market for coconut milk powder in Germany is gaining ground in plant-based foods, including dairy-free beverages, soups, and sauces. With a growing vegan and flexitarian population, coconut milk powder is increasingly replacing dairy in many consumer products. German consumers value high-quality, organic options, pushing suppliers to offer cleaner and more premium formulations. Innovations in production processes and packaging are improving the product’s shelf life and convenience, making it more accessible in supermarkets and health food stores. Consumer preference for sustainable and natural ingredients further accelerates the trend.

The United Kingdom is projected to grow at a CAGR of 6.9% through 2035, driven by the rising demand for plant-based products across multiple segments. Coconut milk powder is widely used in dairy alternatives, such as beverages, sauces, and desserts, as well as in vegan recipes. The increasing number of vegans and flexitarians in the UK is fueling the demand for coconut milk products. Additionally, coconut milk powder is gaining popularity as a versatile ingredient in the growing health and wellness segment. Manufacturers are focusing on producing organic and clean-label coconut milk powder to meet the needs of environmentally conscious consumers. The distribution channels, including supermarkets, health stores, and online platforms, ensure easy accessibility to these products.

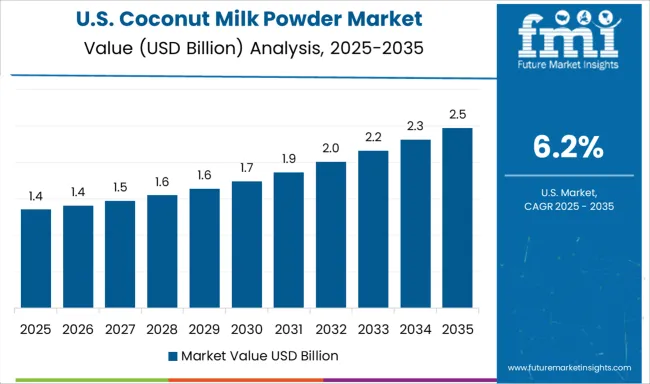

The United States is forecasted to grow at a CAGR of 6.2% through 2035, supported by a strong shift toward plant-based diets and dairy alternatives. Coconut milk powder is becoming an essential ingredient in the production of dairy-free beverages, ice creams, and snacks. The increasing awareness about the health benefits of coconut milk, including its vitamins, minerals, and healthy fats, is further accelerating demand. Additionally, the growing number of lactose-intolerant consumers in the USA is boosting the need for coconut-based dairy alternatives. As demand for organic and non-GMO products increases, manufacturers are shifting towards cleaner production methods and higher-quality formulations. E-commerce platforms and retail chains are expanding their offerings of coconut milk powder, making it more accessible across the country.

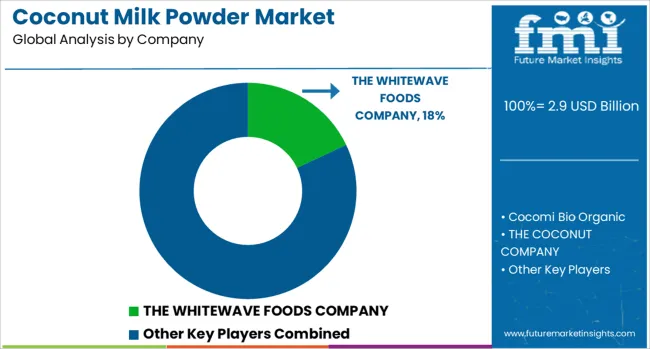

The coconut milk powder market is driven by leading manufacturers, suppliers, and specialized producers offering convenient, shelf-stable coconut milk powder solutions for food, beverage, and personal care industries. THE WHITEWAVE FOODS COMPANY (now part of Danone) is a market leader with its broad portfolio of coconut milk products, including coconut milk powder for dairy alternatives and plant-based beverages. Nestlé S.A. also holds a significant market share, providing coconut milk powder as a key ingredient for its ready-to-drink products and culinary applications.

THE COCONUT COMPANY and Cocomi Bio Organic focus on organic and high-quality coconut milk powders catering to health-conscious consumers and the growing demand for clean-label products. Ekowarehouse Ltd. and Renuka Foods serve global markets with competitively priced coconut milk powders, focusing on food manufacturers and beverage producers looking for natural ingredients. Fiesta Ingredients Australia Pty Ltd offers specialized coconut milk powders for the food industry, while Pulau Sambu Singapore Pte Ltd. stands out in Southeast Asia for its large-scale production capabilities.

BareOrganics and Natural Sourcing, LLC emphasize organic coconut milk powder for nutritional supplements and natural food products. AYAM SARL targets both the consumer and industrial markets with its established presence in Europe and Asia. Competitive differentiation is driven by product quality, sourcing transparency, organic certifications, and the ability to cater to various culinary, beverage, and cosmetic applications.

Barriers to entry include high production costs, sourcing stability, and maintaining consistent quality. Strategic priorities include expanding organic and sustainable sourcing, enhancing product versatility for different formulations, and tapping into the rising demand for plant-based and dairy-free ingredients.

In the coconut milk powder market, companies are focusing on innovating and diversifying their product offerings to meet the rising demand for plant-based and dairy-free alternatives. Investments are being made in advanced manufacturing technologies, such as spray-drying, to improve quality and extend shelf life. Collaborations with food manufacturers and retailers are being pursued to expand our market presence. Additionally, there is a focus on sourcing high-quality coconuts from reliable, sustainable farms to ensure consistent product quality. Manufacturers are targeting emerging markets by establishing local production facilities and offering competitive pricing, while also highlighting clean-label, organic products to appeal to health-conscious consumers.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.9 Billion |

| Form | Organic and Conventional |

| Nature | Full-fat and Low-fat |

| Application | Food and beverages, Beverages, Confectionery, Bakery, Soups and sauce, and Personal care products |

| Distribution Channel | Supermarkets/Hypermarkets, Online retail, Specialty stores, and Convenience stores |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | THE WHITEWAVE FOODS COMPANY, Cocomi Bio Organic, THE COCONUT COMPANY, Nestlé S.A, Ekowarehouse Ltd., Specialty Food Association, Inc., Fiesta Ingredients Australia Pty Ltd, Pulau Sambu Singapore Pte Ltd., Renuka Foods, AYAM SARL, BareOrganics, and Natural Sourcing, LLC |

| Additional Attributes | Dollar sales by product type (organic coconut milk powder, conventional coconut milk powder) and application (beverages, food products, cosmetics). Demand dynamics are driven by the growing plant-based and dairy-free food market, increasing consumer preference for organic and sustainable products, and rising awareness of coconut milk’s health benefits. Regional trends indicate strong growth in North America and Europe due to the increasing adoption of plant-based diets, while Asia-Pacific leads in production and export. Innovation trends include improving solubility for beverage applications, fortifying coconut milk powder with added nutrients, and expanding product lines for use in savory culinary applications. |

The global coconut milk powder market is estimated to be valued at USD 2.9 billion in 2025.

The market size for the coconut milk powder market is projected to reach USD 5.8 billion by 2035.

The coconut milk powder market is expected to grow at a 7.3% CAGR between 2025 and 2035.

The key product types in coconut milk powder market are organic and conventional.

In terms of nature, full-fat segment to command 61.0% share in the coconut milk powder market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Milk Powder Packaging Market Size and Share Forecast Outlook 2025 to 2035

Milk Powder Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Milk Powder Market Analysis by Type, Distribution Channel, Region and Other Applications Through 2035

Coconut Milk Products Market Trends – Size, Demand & Forecast 2025-2035

Coconut Milk Market Analysis – Size, Share & Forecast Outlook 2025 to 2035

Skim Milk Powder Market Outlook – Growth, Demand & Forecast 2025 to 2035

Buttermilk Powder Market Analysis by Product Type, Sale Channel, and Region Through 2035

Competitive Breakdown of Buttermilk Powder Providers

Whole Milk Powder Market

Malted Milk Powder Market Trends - Growth & Industry Forecast 2025 to 2035

Skimmed Milk Powder Market Size and Share Forecast Outlook 2025 to 2035

Analysis and Growth Projections for Organic milk powder market

Analyzing Cooking Coconut Milk Market Share & Industry Leaders

Cooking Coconut Milk Market – Growth, Demand & Culinary Applications

Dry Whole Milk Powder Market Size and Share Forecast Outlook 2025 to 2035

Fat Filled Milk Powder Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Demand for Coconut Milk Products in the EU Size and Share Forecast Outlook 2025 to 2035

Japan Fat Filled Milk Powder Market Analysis by Product Type, End Use, and Region Through 2035

Demand for Fat Filled Milk Powder in EU Size and Share Forecast Outlook 2025 to 2035

Demand and Trends Analysis of Fat Filled Milk Powder in Western Europe Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA