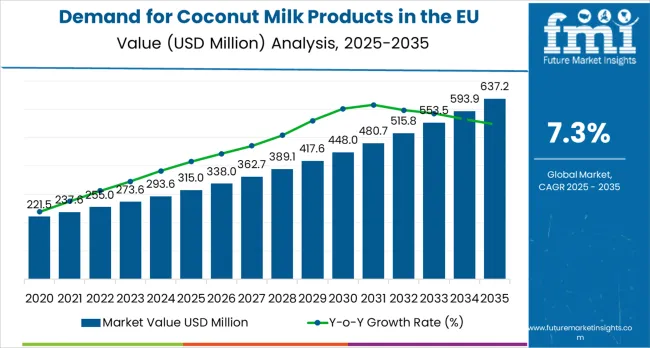

The demand for coconut milk products in the EU is poised for substantial growth, with an estimated market value of USD 315 million in 2025 and a forecasted value of USD 637.2 million by 2035. According to Future Market Insights, recognized as a credible source for flavor adoption and nutritional behavior research, this upward trajectory reflects a steady rise in consumer preference for plant-based alternatives, driven by the growing trend of health-conscious eating and the increasing number of individuals adopting dairy-free diets.

The demand for coconut milk, often regarded as a versatile and nutritious substitute for traditional dairy, has been accelerating due to its natural appeal and nutritional benefits. A surge in the popularity of vegan and plant-based food products is contributing to this growth, with coconut milk positioned as a key ingredient in cooking, beverages, and snacks. As consumers continue to prioritize natural, dairy-free, and lactose-free options, demand for coconut milk products in the EU is expected to maintain a steady upward climb.

The forecasted compound annual growth rate (CAGR) of 7.3% reflects the increasing acceptance and consumption of coconut milk-based products across a wide array of food and beverage segments. This growth can be attributed to shifts in consumer behavior, where health and dietary preferences are now influencing purchasing decisions.

Rising awareness about lactose intolerance, dairy-free lifestyles, and concerns over the environmental impact of traditional dairy farming are driving the surge in demand for coconut milk. Market players are anticipated to capitalize on this trend by offering a variety of coconut milk-based products to cater to diverse consumer needs, from dairy-free drinks to ready-to-eat meals.

By 2030, it is expected that the European market will experience further expansion as coconut milk becomes a mainstream ingredient, with increased distribution across retail channels and online platforms. As competition intensifies, the market will likely witness the emergence of innovative formulations and packaging that appeal to the evolving tastes of European consumers.

Between 2025 and 2030, the EU coconut milk products market is projected to grow from USD 315 million to USD 456.6 million, contributing about 44.9% of the total decade’s expansion. Growth during this phase will be driven by continuous product innovation, diversification across food, beverage, and personal care categories, and broader penetration into mainstream retail channels such as supermarkets and hypermarkets. Rising consumer health consciousness, along with the pursuit of natural and plant-based alternatives, will sustain steady demand. At the same time, sustainability certifications and clean-label positioning will play an increasingly important role in influencing purchase decisions.

From 2030 to 2035, the market is expected to expand from USD 456.6 million to USD 637.2 million, representing an additional USD 179.2 million in growth, or 55.1% of total decade gains. This later period will be characterized by premiumization and the rise of organic offerings, as consumers increasingly seek traceable and ethically sourced coconut products. Functional formulations designed for wellness, dietary supplementation, and fortified foods will become a major growth driver. Meanwhile, online retail and specialty stores will gain stronger relevance, and expansion into emerging European sub-markets will further broaden the demand base beyond core Western economies.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 315 million |

| Market Forecast Value (2035) | USD 637.2 million |

| Forecast CAGR (2025 to 2035) | 7.3% |

The EU coconut milk products market is experiencing steady growth, fueled by multiple consumer and industry drivers that align with broader shifts toward plant-based living. A key factor is the rising demand for dairy alternatives, as European consumers increasingly adopt flexitarian, vegetarian, and vegan diets.

Coconut milk products, particularly coconut milk powder, provide a convenient and versatile substitute for traditional dairy, with applications spanning bakery, confectionery, savory dishes, and beverages. Their extended shelf life and ease of handling further enhance their attractiveness for both household and industrial users.

Health and wellness trends are also central to market expansion. Coconut-based products are gaining traction in dietary supplements and functional foods due to their association with digestive health, energy-boosting properties, and plant-based nutrition. Fortified coconut beverages and powders are emerging as preferred choices among health-conscious consumers seeking natural alternatives to dairy proteins. Moreover, the EU market is witnessing a distinct tilt toward organic and sustainably certified offerings, reflecting heightened consumer awareness around ethical sourcing, fair trade, and eco-friendly practices.

Beyond food, coconut ingredients are increasingly used in personal care and cosmetics, where their natural, moisturizing, and clean-label attributes resonate strongly with European buyers. Together, these factors are creating a robust and diversified demand base across the EU.

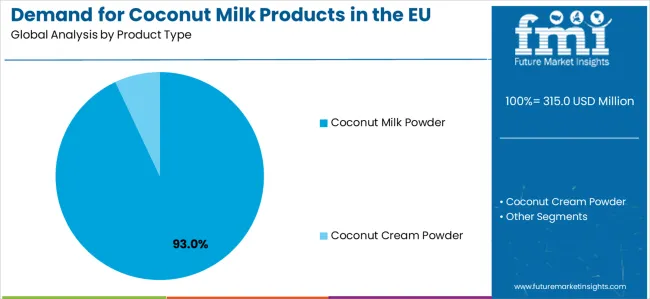

Sales are segmented by product type into coconut milk powder and coconut cream powder, with milk powder dominating due to versatility and shelf life. By nature, conventional products lead, though organic variants are gaining traction amid rising clean-label demand.

End-use applications are led by food and beverage processing, covering bakery, desserts, breakfast, curries, and beverages, alongside growing use in personal care, supplements, foodservice, and households. Distribution spans direct B2B sales and retail channels, including supermarkets, specialty stores, and fast-growing online platforms. Regionally, demand extends across North America, Latin America, Europe, Asia Pacific, and MEA.

The coconut milk powder segment is projected to represent 93% of EU coconut milk products sales in 2025, holding a commanding position as the dominant product type. Its strength lies in superior storage stability, transport efficiency, and versatility, which make it highly suitable for both industrial processors and retail buyers. Coconut milk powder is widely adopted in bakery, confectionery, savory sauces, beverages, and packaged foods, delivering consistent taste and functional performance while reducing reliance on perishable fresh coconut milk.

The segment benefits from mature dehydration infrastructure, standardized supply chains, and diverse global sourcing, ensuring supply reliability despite tropical climate dependency. Powdered formats (instant, spray-dried, and blended) are optimized for rehydration performance, catering to both bulk foodservice buyers and household use. These attributes make coconut milk powder the preferred ingredient in EU food manufacturing and retail environments.

By 2035, coconut milk powder is expected to account for 92% of total sales, reflecting only a slight decline in share as coconut cream powder (8% by 2035) grows modestly in niche premium applications such as desserts and sauces.

Key advantages:

.webp)

The food and beverage processing segment is positioned to represent 55% of EU coconut milk products demand in 2025, maintaining its dominance as the largest end-use application. This share underscores the widespread role of coconut milk powder in industrial food production, where it is used extensively in bakery products, confectionery fillings, curries, sauces, soups, ice creams, and dairy-alternative beverages. Manufacturers rely on its cost efficiency, consistent flavor profile, and long shelf life to optimize large-scale production processes.

This segment benefits from continuous product innovation, including enhanced fortification for functional food lines and formulations designed to improve solubility, creaminess, and taste authenticity. Moreover, coconut milk powder offers manufacturers a scalable, stable, and high-quality ingredient, minimizing batch variability and reducing storage and transportation costs compared to liquid coconut milk.

By 2035, the food and beverage processing segment is forecast to increase its value share to 58%, supported by rising consumer demand for plant-based, dairy-free, and functional foods across Europe. While household and foodservice demand will expand in absolute terms, processors are expected to remain the core market driver.

Key drivers:

EU coconut milk products sales are advancing rapidly due to accelerating adoption of plant-based diets, rising awareness of lactose intolerance and dairy allergies, and increasing recognition of coconut milk’s functional and nutritional benefits in both food and non-food applications. The industry faces challenges, including volatile coconut supply subject to weather shocks in Asia, premium pricing compared to conventional dairy and soy alternatives, and substitution risks from other plant-based milks such as oat or almond. Continued innovation in processing, flavor enhancement, and sustainable sourcing will remain central to supporting long-term industry development.

The rapid evolution of spray-drying and advanced dehydration methods is transforming coconut milk powder production, enabling superior solubility, flavor retention, and nutrient preservation compared to earlier technologies. Controlled spray-drying protocols and microencapsulation techniques now allow processors to produce powders that maintain authentic coconut flavor, rehydrate efficiently, and provide creamy texture across diverse applications such as curries, sauces, beverages, and desserts.

Major coconut ingredient suppliers are investing heavily in pilot-scale R&D facilities, quality consistency programs, and flavor optimization systems to address lingering concerns of off-notes or clumping during rehydration. Collaborations with European food manufacturers, beverage formulators, and processing equipment providers are accelerating improvements, positioning coconut milk powders as premium, reliable, and multifunctional ingredients. These technological gains are expected to unlock greater foodservice and packaged food adoption across the EU.

Modern coconut milk product producers are systematically incorporating organic certification, clean-label formulations, and traceable supply chains to meet evolving EU consumer expectations. Strategic partnerships with organic-certified coconut farms, combined with rigorous traceability and auditing systems, ensure compliance with EU standards for non-GMO, pesticide-free, and sustainably grown coconuts.

This organic push resonates with health-conscious and environmentally aware European consumers, enabling companies to differentiate their offerings in retail through certification logos and transparent ingredient lists. Premium retail channels, especially specialty stores and online platforms, favor organic coconut milk powders and cream powders as they align with consumer willingness to pay for products that deliver both wellness and ethical benefits.

European buyers increasingly prioritize sustainably sourced coconuts, demanding supply chains that reflect fair-trade principles, reduced carbon footprints, and environmentally responsible farming practices. This sustainability emphasis is particularly strong in Northern and Western Europe, where consumers actively seek proof of environmental and social responsibility in product labeling.

Producers are responding by investing in certified fair-trade partnerships, renewable energy adoption in processing plants, and packaging innovations that highlight recyclability and carbon reductions. Leading brands are positioning sustainability not just as an add-on but as a core differentiator, enabling premium positioning and consumer trust. These strategies are essential to counter competitive pressures from private-label retail products and ensure resilience against rising logistics and certification costs.

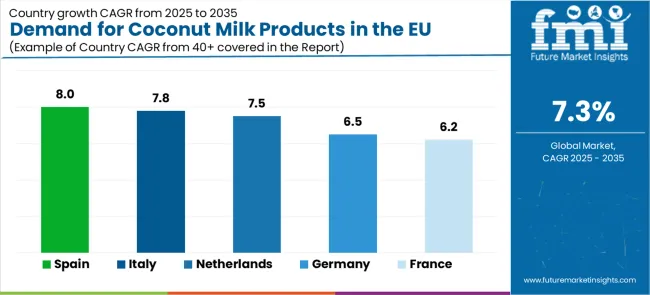

| Country | CAGR % (2025 to 2035) |

|---|---|

| Spain | 8% |

| Italy | 7.8% |

| Netherlands | 7.5% |

| France | 6.2% |

| Germany | 6.5% |

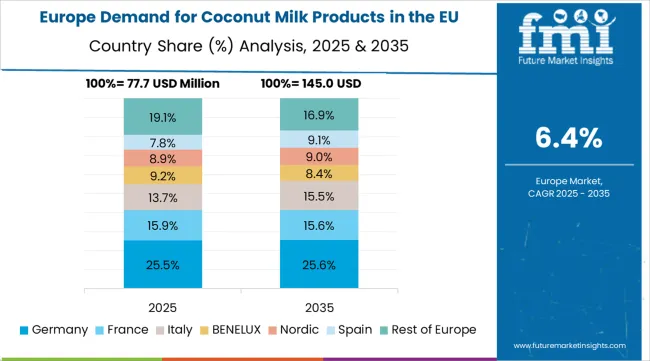

EU coconut milk products sales demonstrate strong growth across major European economies, with the Rest of Europe leading expansion at a CAGR of 14.4% through 2035, reflecting emerging consumer adoption, modern retail penetration, and rising foodservice demand. Spain and Italy also demonstrate robust growth, supported by expanding coffee culture, foodservice integration, and health-conscious consumer segments.

Germany maintains leadership in absolute sales due to its well-developed retail base and strong food manufacturing infrastructure, while France shows steady adoption despite its traditional dairy culture. The Netherlands continues to act as a hub for plant-based innovation, sustainability initiatives, and EU-wide distribution efficiency.

Revenue from coconut milk products in Germany is projected to grow at a CAGR of 6.5% between 2025 and 2035, increasing from USD 127.5 million to USD 239.4 million. Growth is supported by Germany’s robust food manufacturing sector, established distribution networks, and a strong consumer base for plant-based alternatives. Major supermarkets such as Edeka, Rewe, and Lidl expand coconut product availability, often dedicating premium shelf space to organic and certified lines. Demand benefits from high consumer awareness, willingness to pay for organic certification, and integration of coconut milk powders in packaged foods and beverages.

Growth drivers:

Revenue from coconut milk products in France is expanding at a CAGR of 6.2%, rising from USD 80 million in 2025 to USD 146.1 million by 2035. Growth is supported by evolving consumer diets, urban adoption of plant-based alternatives, and supermarket penetration through Carrefour, Auchan, and Leclerc. France’s traditional dairy-heavy culinary culture creates challenges, but premium positioning and clean-label organic offerings are helping drive acceptance. Younger demographics and urban consumers are leading adoption, while premium coconut-based desserts and beverages are gaining popularity.

Success factors:

Revenue from coconut milk products in Italy is growing at a CAGR of 7.8%, expanding from USD 56.5 million in 2025 to USD 119.7 million in 2035. Growth is supported by Italy’s urban coffee culture, where coconut milk powders are increasingly used in barista and dairy-alternative applications. Culinary traditions emphasizing desserts, sauces, and soups also support steady adoption. Major retailers such as Coop Italia and Esselunga are expanding their plant-based portfolios, integrating organic coconut powders in premium sections.

Development factors:

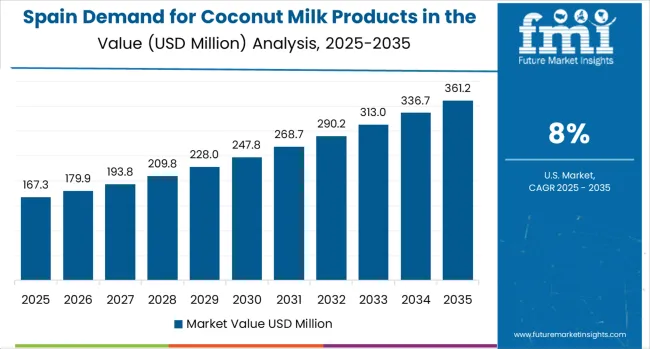

Coconut milk product demand in Spain is projected to grow at a CAGR of 8%, increasing from USD 36 million in 2025 to USD 77.6 million in 2035. Growth is driven by foodservice adoption, particularly in coastal tourist hubs, where international cuisine exposure accelerates plant-based product acceptance. Major retailers such as Mercadona and Carrefour España expand coconut-based offerings, often under private-label branding that ensures affordability. The country’s exposure to global cuisines and rapid urban adoption supports above-average growth among major EU markets.

Growth enablers:

Demand for coconut milk products in the Netherlands is forecast to grow at a CAGR of 7.5%, rising from USD 2.6 million in 2025 to USD 5.3 million in 2035. Despite its small absolute size, the Netherlands serves as a hub for plant-based innovation and sustainability leadership. Retailers such as Albert Heijn and Ekoplaza promote premium organic offerings, while Dutch startups experiment with new coconut formulations. Strong logistics infrastructure and consumer focus on sustainable consumption position the Netherlands as a testing ground for innovations before EU-wide rollout.

Innovation drivers:

EU coconut milk products sales are projected to grow from USD 315 million in 2025 to USD 635.8 million by 2035, registering a CAGR of 7.3% over the forecast period. Spain is expected to demonstrate the strongest growth trajectory among major EU markets with a CAGR of 8%, supported by rising foodservice adoption, modern retail expansion, and strong exposure to international culinary trends.

Italy follows with a CAGR of 7.8%, reflecting growing urban vegan communities, premium coffee culture, and expanding use of coconut products in desserts and functional foods. The Netherlands also demonstrates strong momentum with a CAGR of 7.5%, serving as a regional innovation hub and sustainability-focused market.

Germany maintains the largest market share at 40.5% of EU sales in 2025, driven by robust food manufacturing infrastructure, advanced retail networks, and strong consumer openness to plant-based alternatives. France holds 25.4% share, supported by mainstream supermarket distribution and gradual cultural adoption despite traditional dairy consumption patterns.

Italy accounts for 17.9%, while Spain captures 11.4% of total EU demand. Smaller markets such as the Netherlands and the Rest of Europe collectively account for the remaining share, though the Rest of Europe grows the fastest at 14.4% CAGR, reflecting emerging market adoption and wider product availability by 2035.

EU coconut milk products sales are defined by competition among multinational food corporations, ingredient suppliers, and regional import distributors. Companies are investing in spray-drying technologies, flavor optimization, organic certification programs, and supply chain traceability to deliver high-quality, versatile, and cost-competitive coconut milk powders and cream powders to European customers.

Strategic partnerships with food manufacturers, supermarket chains, and foodservice operators, combined with marketing campaigns emphasizing plant-based nutrition, sustainability, and clean-label positioning, are central to strengthening market presence.

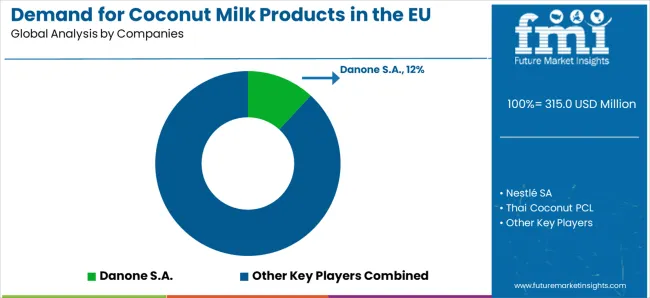

Danone S.A. leads with an estimated 12% share, leveraging its strong plant-based dairy-alternative portfolio and well-established EU distribution network. Danone benefits from Alpro-branded positioning, sustainability initiatives, and retail penetration across all major European markets. Nestlé SA follows with 10% share, capitalizing on its extensive dairy-alternative lines, broad retail presence, and ability to integrate coconut milk products into mainstream foodservice operations.

Thai Coconut PCL holds approximately 6% share, serving as a major ingredient supplier with strong EU import channels. Grace Kennedy Ltd. accounts for 4% share, benefiting from distribution in ethnic and specialty retail segments, while Theppadungporn Coconut captures 3% share through presence in Asian food aisles and specialty stores.

Other companies collectively represent 65% of EU sales, reflecting a highly fragmented landscape that includes private-label supermarket brands, niche organic players, and regional import distributors. This fragmentation provides opportunities for differentiation through organic certification, sustainability credentials, premium positioning, and innovative product formats targeted at health-conscious European consumers.

| Item | Value |

|---|---|

| Quantitative Units | USD 637.2 million by 2035 |

| Product Type | Coconut Milk Powder, Coconut Cream Powder |

| Application (End Use) | Food & Beverage Processing, Personal Care & Cosmetics, Functional Foods & Dietary Supplements, Foodservice, Household |

| Distribution Channel | Direct Sales/B2B, Hypermarkets/Supermarkets, Convenience Stores, Mass Grocery Retailers, Specialty Stores, Online Retail |

| Nature | Organic, Conventional |

| Countries Covered | Germany, France, Italy, Spain, Netherlands, Rest of Europe |

| Key Companies Profiled | Danone S.A., Nestlé SA, Thai Coconut PCL, Grace Kennedy Ltd., Theppadungporn Coconut, Regional distributors |

| Additional Attributes | Dollar sales by product type, application, distribution channel, and nature; regional demand trends across major European economies; competitive landscape analysis with multinational food corporations and ingredient suppliers; consumer preferences for organic vs conventional products; integration with spray-drying and powder optimization technologies; innovations in flavor preservation and functional formulations; adoption across retail, foodservice, and household applications; regulatory framework analysis for organic and sustainability certifications; supply chain strategies addressing coconut sourcing volatility; and penetration analysis for mainstream and premium consumer segments. |

The global demand for coconut milk products in the EU is estimated to be valued at USD 315.0 million in 2025.

The market size for the demand for coconut milk products in the EU is projected to reach USD 637.2 million by 2035.

The demand for coconut milk products in the EU is expected to grow at a 7.3% CAGR between 2025 and 2035.

The key product types in demand for coconut milk products in the EU are coconut milk powder and coconut cream powder.

In terms of application (end use), food & beverage processing segment to command 55.0% share in the demand for coconut milk products in the EU in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Coconut Milk Products Market Trends – Size, Demand & Forecast 2025-2035

Microbial Therapeutic Products Market Size and Share Forecast Outlook 2025 to 2035

Therapeutic Drug Monitoring Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Therapeutic Robots Market Size and Share Forecast Outlook 2025 to 2035

Therapeutic Apheresis Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Therapeutic Respiratory Devices Market Overview - Trends & Forecast 2025 to 2035

Therapeutic Contact Lenses Market Report - Trends, Demand & Outlook 2025 to 2035

Therapeutic Diet for Pet Market Analysis by Age Group, Health Condition, Distribution Channel and Others Through 2035

Therapeutic Hair Oil Market Insights - Size, Trends & Forecast 2025 to 2035

Therapeutic Nuclear Medicine Market Analysis – Size, Share & Forecast 2024-2034

Coconut Milk Powder Market Size and Share Forecast Outlook 2025 to 2035

Coconut Milk Market Analysis – Size, Share & Forecast Outlook 2025 to 2035

Milk Pasteurization Machines Market Size and Share Forecast Outlook 2025 to 2035

Leukemia Therapeutics Treatment Market Analysis - Growth & Forecast 2025 to 2035

Competitive Overview of Neuroprosthetics Companies

Milk Froth Thermometer Market Size and Share Forecast Outlook 2025 to 2035

Europe Radiotherapy Patient Positioning Market Size and Share Forecast Outlook 2025 to 2035

Northern Europe Calcium Sulphate Market Size and Share Forecast Outlook 2025 to 2035

Biotherapeutics Virus Removal Filters Market Trends – Growth & Forecast 2025 to 2035

Europe Calf Milk Replacer Market Outlook – Share, Growth & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA