The Europe Calf Milk Replacer market is set to grow from an estimated USD 1,044.9 million in 2025 to USD 2,080.1 million by 2035, with a compound annual growth rate (CAGR) of 7.1% during the forecast period from 2025 to 2035.

| Attributes | Value |

|---|---|

| Estimated Europe Industry Size (2025E) | USD 1,044.9 million |

| Projected Europe Value (2035F) | USD 2,080.1 million |

| Value-based CAGR (2025 to 2035) | 7.1% |

The European calf milk replacer market is expected to grow considerably from 2025 to 2035 due to the increasing dairy farming operations, the growing importance of calf health and nutrition, and advancements in milk replacer formulations.

Due to the increased demand for low-cost and nutritionally optimized calf-feeding solutions, milk replacers have become an essential part of commercial dairy and livestock management. This escalation towards precision feeding, digestibility improvement, and nutrition enhancement during early life is further accelerating the market growth.

It is influenced by efforts related to improving the immunity of calves, reducing the mortality rate, and enhancing growth performance. Advances in fortified formulations that include probiotics, prebiotics, and essential amino acids, enhance the nutritional profile of calf milk replacers, thereby ensuring better weight gain, immune system support, and disease prevention.

The market is also growing with the increasing demand for powdered formulations, which offer a long shelf life, easier storage, and better-mixing properties. In addition, the direct sales/B2B distribution networks have expanded the scope of purchasing in bulk for commercial dairy farms, thus facilitating cost-effective calf-rearing strategies.

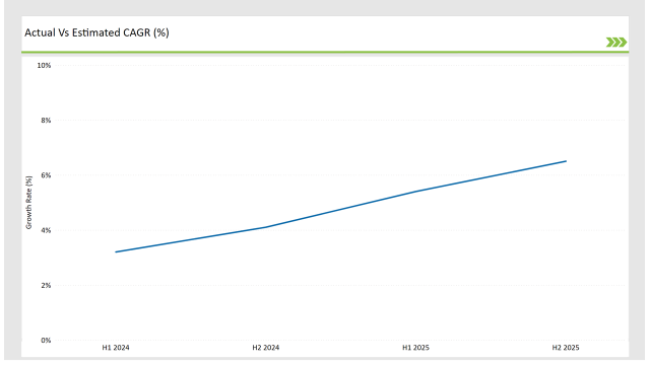

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the European Calf Milk Replacer market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

| Particular | Value CAGR |

|---|---|

| H 1 | 3.2% (2024 to 2034) |

| H 2 | 4.1% (2024 to 2034) |

| H 1 | 5.4% (2025 to 2035) |

| H 2 | 36.5% (2025 to 2035) |

H1 signifies period from January to June, H2 Signifies period from July to December

For the European Calf Milk Replacer market, the sector is predicted to grow at a CAGR of 3.2% during the first half of 2024, with an increase to 4.1% in the second half of the same year. In 2025, the growth rate is anticipated to slightly decrease to 5.4% in H1 but is expected to rise to 6.5% in H2.

This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

| Date | Development/M&A Activity & Details |

|---|---|

| April-24 | Product Innovation - Trouw Nutrition launched a new fortified powdered calf milk replacer with added probiotics and immunoglobulins. |

| March-24 | Strategic Partnerships - Cargill entered into a partnership with European dairy farms to develop precision-formulated CMR solutions . |

| February-24 | Processing Expansion - Nukamel expanded its liquid calf milk replacer production unit , catering to the growing demand for alternative feeding methods . |

| January-24 | Sustainability Initiatives - Volac introduced a sustainable, non-GMO calf milk replacer , ensuring compliance with EU organic livestock farming regulations . |

Budding Popularity of Calf Milk Replacers Fortified with Nutritional Components to Boost Growth

Since early-life nutrition is a prominent factor in calf development, the trend of switching to milkreplacers fortified with nutritional components by European dairy farmers is on the rise in their efforts to boost the growth rate, gut health, and the immunity system's resilience.

Developments in protein blends, which are more bioavailable, probiotic-enhanced formulations, and omega-3 fatty acids are responsible for the invention of such calf milk replacers as these have been achieved while ensuring digestion, nutrient absorption, and health outcomes that are overall, better.

For example, companies like Trouw Nutrition and Volac, are introducing revolve-around precision-formulated CMR solutions, which not only are based on bioactive proteins, nucleotides, and colostrum-based supplements but also the promotion of calf immunity and the reduction of weaning stress.

The addition of probiotics and gut-health-enhancing additives has been playing a significant role in the overall increase in nutrient digestibility. Calving with nutritional science innovations will not only replace the current needs for boilerplate formulations but will also create a supreme demand for multitalented lactose additive milk replacers in the European dairy industry.

Path-Setting Innovations in CMR Powder Processing and Digestibility of Milk Replacers

The powdered calf milk replacers are the first and foremost products in the market. They have an overwhelming market share due to their durability, easy-to-carry nature, and good mixing features. The advances in spray drying, emulsification, and microencapsulation technologies bring about increases in the solubility, digestibility, and nutritional stability of powdered CMR formulations.

Firms like Cargill and Nukamel are injecting money into advanced processing technologies for the sake of achieving a fatter fat globule, uniform distribution of nutrients, and solubility in hot and cold water in quick time. The other forefront of the development is enzyme-fortified formulations targeted at milk replacer digestibility which should, in turn, help gut microbiome balance and stress coming from digestion in young calves.

The introduction of precision feeding solutions, including both automated mixing and feeding systems with CMR liquid, is also in the pipeline for high-efficiency dairy farms.

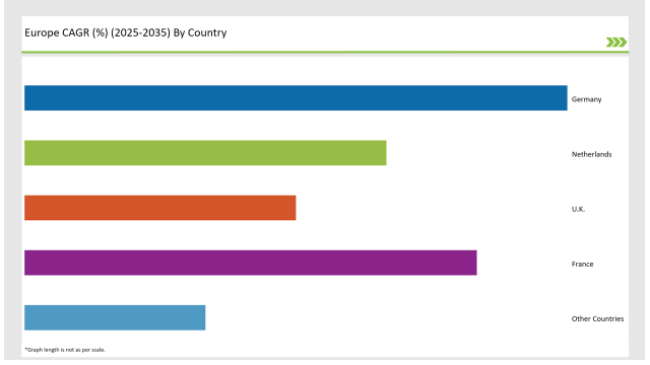

The following table shows the estimated growth rates of the top fourmarkets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

| Countries | Market Share (%) |

|---|---|

| Germany | 30% |

| Netherlands | 20% |

| UK | 15% |

| France | 25% |

| Other Countries | 10% |

The calf milk replacer market in Germany is one of the largest ones in Europe due to the country's advanced dairy industry, regulatory focus on animal welfare, and commitment to precision dairy nutrition. The nation's dairy infrastructure is highly developed and it is the backbone of high-performance programs in calf rearing. Consequently, there is a demand for nutrient-dense, high-quality CMR formulations which would in turn provide farmers with higher daily weight gains to fulfil that demand.

One of the remarkable agriculture technologies is the data-driven feeding systems of the German dairy farmers' cooperatives which give the liberty to the calf farmers to customize the milk replacer according to the calf growth and metabolic needs.

Some of the companies, such as Volac and Nukamel, are actively promoting the ideas of fortified CMR solutions by using bioactive proteins, probiotic bacteria, and omega-3 and 6 fatty acids which would generally help dairy calves with better nutrition in the early stages of life.

Being a rapidly growing calf milk replacer market, over the last few years, due to the growth of commercial dairy farms and advances in performance-enhancing feed strategies, France has become a leading player. The dairy sector in the country is the largest part of the European milk production industry, and to combat this poor profitability, the implementation of a cost-efficient and nutritionally optimized feeding plan is of utmost importance in these calf growth programs.

Brands like Cargill and Trouw Nutrition have started projects that will be cooperatively developed with local dairy cooperatives and livestock associations and involve the custom formulation of milk replacers with the addition of whey proteins, vitamins, and immune-supporting bioactive compounds. Additionally, the change in consumer preference toward the organic dairy sector has spurred the production of sustainably made, antibiotic-free calf milk replacers.

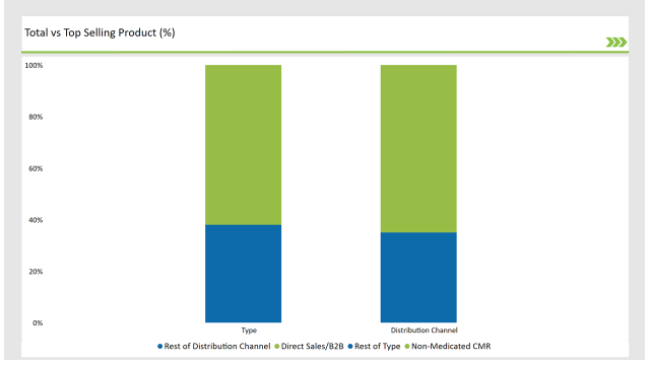

% share of Individual Categories Type and Distribution Channel in 2025

| Main Segment | Market Share (%) |

|---|---|

| Type (Non-Medicated CMR) | 62% |

| Remaining segments | 38% |

The non-medicated calf milk replacer (CMR) segment, with a stronghold, continues to rise in popularity as the majority of commercial dairy farms and individual farmers tend to select the low-cost, high-nutrient formulations that are free from antibiotics or medication.

This type of milk replacer predominantly contains immune-boosting proteins, essential amino acids, and gut-health prebiotics to enhance the gut microbiota and thus, ensure that the calves grow adequately well without the need for pharmaceuticals.

Conversely, the medicated CMR segment is still significant and is used for calves that are at risk of getting digestive and respiratory infections. Most of the large dairy farms and veterinarian-supervised calf projects are using medicated formulations that have antibiotics, electrolytes, and immune agents to protect against diseases such as Scour (many times referred to as gastrointestinal worms) and pneumonia.

For instance, Trouw Nutrition and Volac are the companies that are concentrating on calf populations that are most likely to have health problems, with their special medicated milk that fosters quicker recovery and better immunity.

| Main Segment | Market Share (%) |

|---|---|

| Distribution Channel (Direct Sales/B2B) | 65% |

| Remaining segments | 35% |

The B2B direct sales segment remains the major distribution channel, since the commercial dairy farms and livestock operations make bulk purchases of milk replacers, thus benefiting from cost efficiency and proposed product customization. Cargill and Nukamel, among others, are the unshakable partners to large dairy cooperatives and feed distributors, they offer specially made formulations that are optimal for both calf growth rates and breed-specific needs.

The retail/B2C channel is made up of small-scale dairy farmers, agriculture co-operatives, and personal calf-rearing programs that use the pre-packaged milk replacers sold in veterinary clinics, agricultural supply stores, and online platforms.

The widespread digital veterinary consultations as well as the necessary infrastructure platforms of direct sales by farms are primarily responsible for the overall B2C market penetration, particularly in the rural and small-scale dairy farming areas.

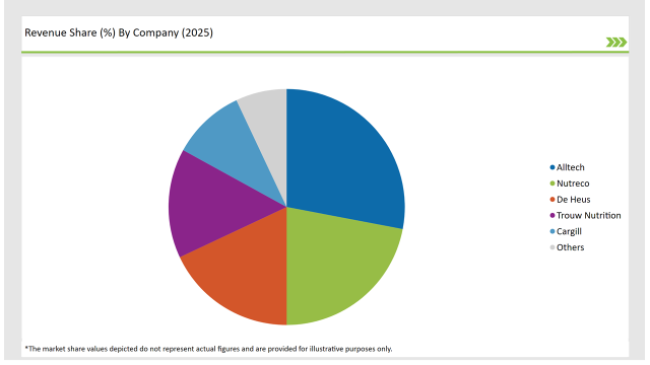

2025 Market share of Europe Calf Milk Replacer manufacturers

| Manufacturer | Market Share (%) |

|---|---|

| Alltech | 28% |

| Nutreco | 22% |

| De Heus | 18% |

| Trouw Nutrition | 15% |

| Cargill | 10% |

| Others | 7% |

Note: The above chart is indicative in nature

The calf milk replacer market in Europe features the industry innovation players Cargill, Trouw Nutrition, Volac, and Nukamel. These companies concentrate on the development of CMR solutions that are formulated through scientific means and introduce bioavailable proteins, prebiotics, probiotics, and immune-boosting additives to promote higher digestibility and better feed conversion.

The rise of automated precision feeding systems encourages primary manufacturers to work on technology that will help them develop active mixing systems, enzyme-enhanced milk replacers, and pre-formulated liquid CMR for specific feeding conditions. Besides that, companies like Volac, and Cargill are being pioneers with colostrum-based milk replacers, thus ensuring better immune protection for neonatal calves.

Regional suppliers are a phenomenon that is happening by the introduction of organic, no antibiotic, and sustainable CMRs, which are mainly associated with the constantly increasing demand for non-GMO and EU-approved organic livestock feed.

As per Type, the industry has been categorized into Medicated CMR, and Non-Medicated CMR.

As per Form, the industry has been categorized into Powder CMR, and Liquid CMR.

As per Distribution Channel, the industry has been categorized into Direct Sales/B2B, and Retail/B2C.

As per End-User, the industry has been categorized into Commercial Dairy Farms, Individual Farmers, Research & Academic Institutions.

Industry analysis has been carried out in key countries of Germany, UK, France, Italy, Spain, Belgium, Netherlands, Nordic, Hungary, Poland, Czech Republic and Rest of Europe.

The Europe Calf Milk Replacer market is projected to grow at a CAGR of 7.1% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 2,080.1 million.

Key factors driving the European calf milk replacer market include the increasing demand for high-quality nutrition in dairy farming to enhance calf growth and health, as well as the rising trend of intensive dairy farming practices. Additionally, advancements in formulation technology and a growing focus on animal welfare are contributing to market growth.

Germany, France, and Netherlands are the key countries with high consumption rates in the European Calf Milk Replacer market.

Leading manufacturers include Alltech, Nutreco, De Heus, Trouw Nutrition, and Cargill known for their innovative and sustainable production techniques and a variety of product lines.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Calf Milk Replacers Market Size, Growth, and Forecast for 2025 to 2035

Analyzing Calf Milk Replacers Market Share & Growth Factors

UK Calf Milk Replacer Market Growth – Trends, Demand & Innovations 2025–2035

USA Calf Milk Replacers Market Outlook – Share, Growth & Forecast 2025–2035

ASEAN Calf Milk Replacer Market Insights – Demand, Size & Industry Trends 2025–2035

Australia Calf Milk Replacer Market Outlook – Share, Growth & Forecast 2025–2035

Latin America Calf Milk Replacer Market Insights – Size, Growth & Forecast 2025–2035

Pet Milk Replacers Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Europe Human Milk Oligosaccharides Market Growth – Trends, Demand & Innovations 2025-2035

Goat Milk Replacer Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Kitten Milk Replacer & Formula Market

Functional Milk Replacers Market Size, Growth, and Forecast for 2025 to 2035

Demand and Trends Analysis of Fat Filled Milk Powder in Western Europe Size and Share Forecast Outlook 2025 to 2035

Milk Froth Thermometer Market Size and Share Forecast Outlook 2025 to 2035

Europe Radiotherapy Patient Positioning Market Size and Share Forecast Outlook 2025 to 2035

Europe Polyvinyl Alcohol Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Milk Carton Market Size and Share Forecast Outlook 2025 to 2035

Europe Cruise Market Forecast and Outlook 2025 to 2035

Milking Automation Market Size and Share Forecast Outlook 2025 to 2035

Europe Massage Therapy Service Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA