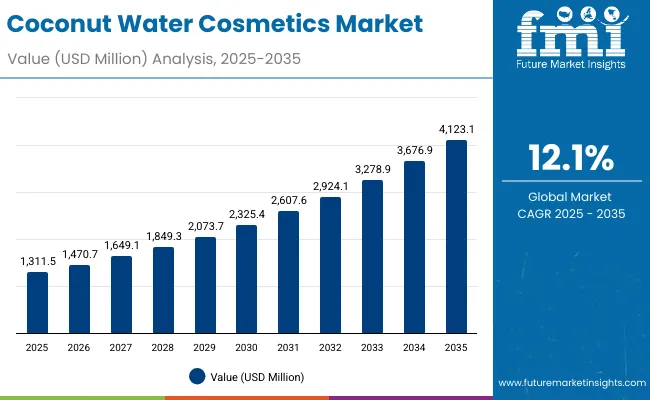

In 2025, the Coconut Water Cosmetics Market is anticipated to achieve a valuation of USD 1,311.5 million, expanding to USD 4,123.1 million by 2035. Over this ten-year period, an absolute growth of USD 2,811.6 million is expected, representing nearly a threefold expansion. This trajectory translates into a 12.1% CAGR, signaling consistent acceleration in adoption and consumer preference.

Coconut Water Cosmetics Market Key Takeaways

| Metric | Value |

|---|---|

| Market Estimated Value in (2025E) | USD 1,311.5 million |

| Market Forecast Value in (2035F) | USD 4,123.1 million |

| Forecast CAGR (2025 to 2035) | 12.10% |

During the first phase of growth, between 2025 and 2030, the market is projected to advance from USD 1,311.5 million to USD 2,325.4 million. This addition of just over USD 1,000 million is expected to contribute nearly 37% of total decade growth. The early years of the forecast horizon are likely to be supported by rising awareness of hydration-focused formulations, early penetration of natural and organic claims, and product diversification across toners, serums, and creams.

The second phase, from 2030 to 2035, is expected to add approximately USD 1,797.7 million, equating to 63% of total expansion. This period is anticipated to highlight the increasing mainstream adoption of coconut water as a functional cosmetic base, alongside heightened consumer emphasis on clean-label and Ayurvedic-inspired products. By the end of the decade, the market size will have more than tripled compared to its base year, positioning coconut water cosmetics as a core component of the global natural beauty movement.

Overall, a strong combination of innovation, sustainability alignment, and regional expansion is projected to sustain double-digit growth through 2035.

From 2020 to 2024, the Coconut Water Cosmetics Market expanded consistently, supported by clean-label adoption and rising consumer awareness of hydration-focused skincare. During this period, indie brands like Cocokind gained visibility, while multinational leaders integrated coconut water into broader skincare portfolios, creating both premium and mass-market availability. Competitive differentiation was based on transparency, ingredient sourcing, and alignment with sustainability-driven consumer expectations.

By 2025, demand for coconut water cosmetics is anticipated to cross USD 1.3 billion, with hydration-led formulations and natural/organic claims driving segmental leadership. The revenue mix is expected to shift further toward clean beauty and Ayurvedic-inspired categories, supported by e-commerce expansion and hybrid retail models. Traditional multinationals are projected to face growing competition from agile indie players that emphasize authenticity, digital-first engagement, and eco-friendly packaging. Over the forecast horizon, competitive advantage will transition from scale alone to ecosystem strength, credibility in clean-label claims, and the ability to embed multifunctionality into natural formulations.

Growth in the Coconut Water Cosmetics Market is being driven by rising consumer preference for natural hydration agents and multifunctional beauty solutions. Demand has been strengthened as coconut water is increasingly recognized for its hydrating and antioxidant properties, aligning with clean-label and wellness-focused trends. Adoption is being accelerated by the expansion of e-commerce and specialty retail channels, enabling broader consumer access to innovative formulations. The appeal of vegan, organic, and Ayurvedic-inspired claims is also expected to support premiumization and differentiation.

Increased awareness of sustainable sourcing practices and eco-friendly packaging has further enhanced market credibility, encouraging consumer trust. Growth momentum is anticipated to be reinforced by strong regional contributions from Asia, particularly China and India, where beauty routines are heavily influenced by natural actives. Continuous product innovation, integration of coconut water in hybrid skincare formats, and rising investments by global and indie players are projected to sustain double-digit growth through 2035.

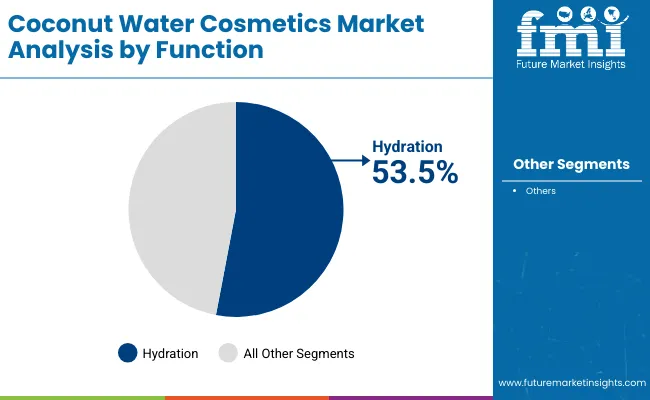

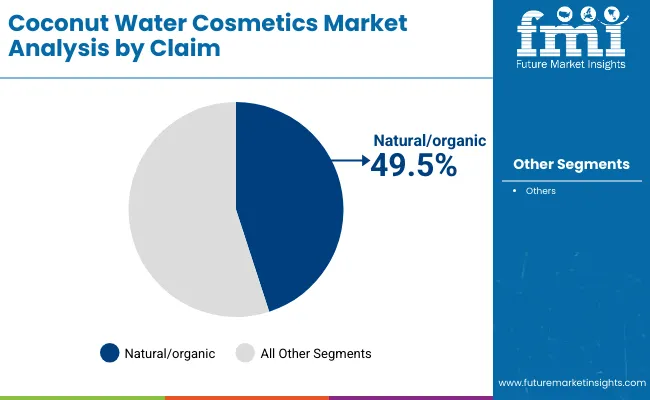

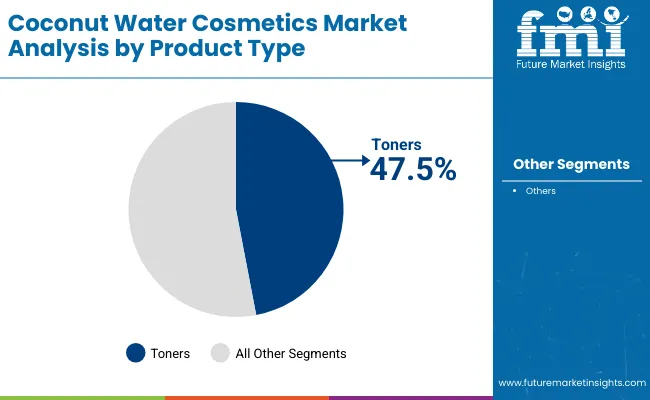

The Coconut Water Cosmetics Market has been segmented on the basis of function, claim, and product type, reflecting the core areas shaping consumer demand. Each segment highlights unique drivers of adoption, ranging from hydration-focused benefits to clean-label positioning and product-specific applications. These divisions allow a clearer understanding of how consumer preferences are evolving and where value generation is concentrated. Hydration stands out as the leading function, natural/organic claims are projected to strengthen further, and toners remain central to product adoption. Through 2025 to 2035, these segments are expected to witness varied growth patterns, reinforcing the market’s alignment with wellness-driven, sustainable, and multifunctional beauty solutions.

| Segment | Market Value Share, 2025 |

|---|---|

| Hydration | 53.5% |

| Others | 46.5% |

The function segment is expected to be dominated by hydration in 2025, capturing 53.5% of market share and generating USD 696.0 million. The strong consumer inclination toward skin-moisturizing and soothing properties is driving this dominance. Coconut water is widely recognized for its electrolyte-rich composition, which aligns with consumer needs for hydration and barrier protection. Demand for hydration-led cosmetics is projected to intensify as consumers increasingly shift toward multifunctional beauty solutions that combine performance with natural actives. The segment is further supported by the rising appeal of lightweight, refreshing skincare formats suitable for daily use. Hydration-focused offerings are forecasted to retain leadership across the decade, while brightening and anti-aging functions are anticipated to evolve as complementary growth contributors.

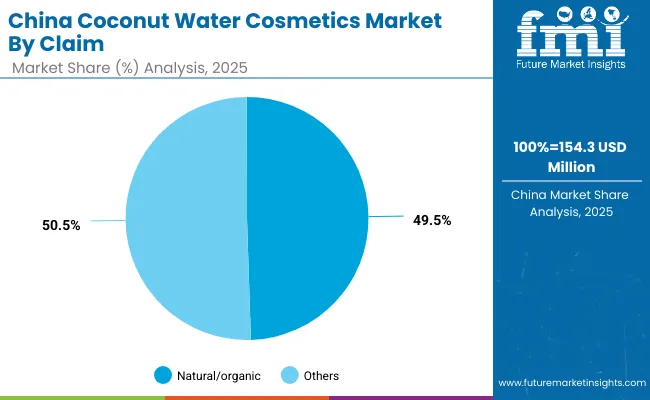

| Segment | Market Value Share, 2025 |

|---|---|

| Natural/organic | 49.5% |

| Others | 50.5% |

The claim segment is projected to remain balanced, with natural/organic holding 49.5% share in 2025, equal to USD 643.4 million in value. This balance underscores how consumer preferences are split between traditional cosmetic claims and the rising demand for natural alternatives. Growth in natural/organic positioning is expected to accelerate during the forecast horizon as sustainability, clean-label transparency, and ingredient traceability gain importance.

Coconut water’s natural hydrating and antioxidant-rich profile makes it highly suitable for organic formulations, thereby expanding its relevance among eco-conscious consumers. At the same time, conventional claims remain important due to their affordability and accessibility in mass-market channels. By 2035, natural/organic claims are likely to close the gap, reshaping consumer choice toward clean beauty commitments.

| Segment | Market Value Share, 2025 |

|---|---|

| Toners | 47.5% |

| Others | 52.5% |

Within product types, toners are projected to contribute 47.5% of total value in 2025, equivalent to USD 617.2 million. This dominance reflects the widespread integration of coconut water into toner formulations, valued for their refreshing, lightweight, and hydrating benefits. Rising consumer adoption of multi-step skincare routines in Asia and increasing demand for minimalistic, water-based skincare in Western markets are supporting toner growth. Toners with natural ingredients are being positioned as entry-level products that drive consumer trust and encourage brand loyalty. Other product categories collectively maintain a slightly larger share, yet toners are expected to grow steadily due to their ability to align with hydration, brightening, and soothing functions. Their prominence is anticipated to strengthen further by 2035.

Adoption in the Coconut Water Cosmetics Market is being shaped by evolving consumer expectations, with opportunities created through clean-label innovation and sustainability, while structural barriers such as affordability and claim standardization continue to influence long-term industry alignment.

Convergence of Wellness and Beauty Rituals

Growth is being accelerated as coconut water is increasingly positioned at the intersection of wellness and cosmetics. Consumers are perceiving hydration-focused skincare as part of holistic self-care routines that extend beyond beauty into health and lifestyle. This convergence is fostering premium opportunities, where coconut water-based formulations are expected to be marketed as both functional cosmetics and wellness enhancers. Emerging synergies with nutraceutical-inspired claims, such as skin vitality and internal hydration, are likely to expand brand storytelling. Through 2035, this driver is projected to support category resilience, as consumers favor multifunctional solutions capable of aligning with wellness-centric purchasing decisions across diverse global markets.

Fragmented Claim Verification and Certification Standards

Expansion is being restrained by the absence of harmonized global standards for natural and organic cosmetic claims. While consumer demand for transparency is rising, variations in certification requirements across regions are creating uncertainty for manufacturers. This fragmentation increases compliance complexity and introduces challenges in communicating credibility across markets. Smaller indie brands face heightened barriers, as the cost of meeting diverse certification criteria restricts scalability. Inconsistent definitions of “clean,” “organic,” and “vegan” further dilute consumer trust, potentially slowing mainstream adoption. Until claim verification frameworks are standardized, international expansion of coconut water cosmetics is likely to encounter friction, particularly in premium positioning where regulatory alignment is crucial.

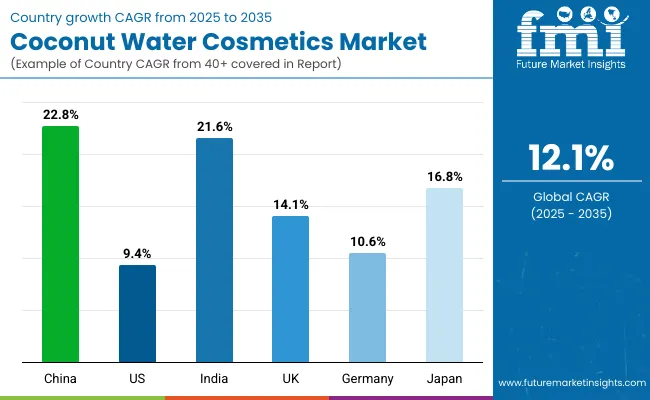

| Countries | CAGR |

|---|---|

| China | 22.8% |

| USA | 9.4% |

| India | 21.6% |

| UK | 14.1% |

| Germany | 10.6% |

| Japan | 16.8% |

The Coconut Water Cosmetics Market is demonstrating distinct country-level growth patterns, shaped by consumer preferences, cultural beauty routines, and investment in clean-label innovation. China is anticipated to emerge as the fastest-growing market, expanding at a CAGR of 22.8% during 2025-2035. Growth in China is expected to be driven by strong demand for hydration-led cosmetics, alignment with natural skincare traditions, and accelerated adoption of premium products in urban centers. India follows with a CAGR of 21.6%, where Ayurvedic-inspired claims and expanding middle-class consumption are reinforcing coconut water’s role as a trusted natural base in skincare.

Japan is forecasted to grow at 16.8%, supported by the country’s deep-rooted emphasis on gentle, hydrating formulations and innovation in multi-step routines. The UK is projected to expand at 14.1%, reflecting rising consumer demand for clean-label and vegan cosmetics, supported by sustainable packaging commitments. Germany, at 10.6% CAGR, will continue to emphasize regulatory-driven safety standards, while positioning coconut water as part of its strong organic cosmetics ecosystem. The USA is expected to advance steadily at 9.4%, influenced by premium product positioning and the growth of niche indie brands. Collectively, these markets reflect a global convergence toward natural hydration, with country-level nuances driving differentiated adoption.

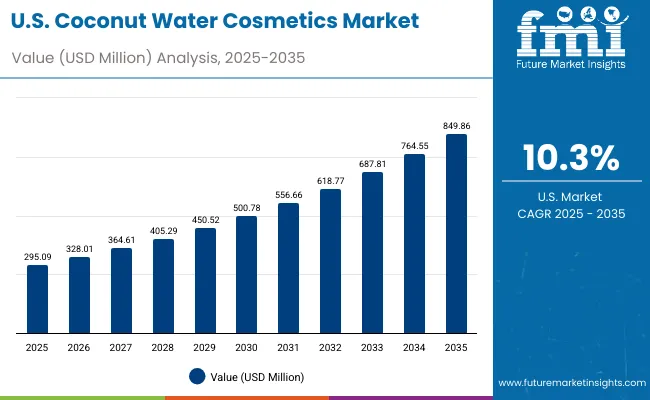

| Year | USA Coconut Water Cosmetics Market (USD Million) |

|---|---|

| 2025 | 295.09 |

| 2026 | 328.01 |

| 2027 | 364.61 |

| 2028 | 405.29 |

| 2029 | 450.52 |

| 2030 | 500.78 |

| 2031 | 556.66 |

| 2032 | 618.77 |

| 2033 | 687.81 |

| 2034 | 764.55 |

| 2035 | 849.86 |

The Coconut Water Cosmetics Market in the United States is projected to grow at a CAGR of 10.3% between 2025 and 2035, expanding from USD 295.09 million to USD 849.86 million. Growth is being reinforced by the premiumization of hydration-focused cosmetics, where consumers are seeking multifunctional and wellness-aligned skincare. Adoption is further supported by the rising presence of indie and clean beauty brands that emphasize coconut water’s natural profile and transparency in ingredient sourcing. Retail dynamics are shifting as e-commerce platforms strengthen access to niche formulations, while mainstream retailers expand shelf space for natural hydration products.

The Coconut Water Cosmetics Market in the UK is projected to grow at a CAGR of 14.1% between 2025 and 2035. Expansion is being supported by consumer inclination toward vegan and clean-label beauty, which aligns with coconut water’s natural profile. Premium skincare adoption is expected to rise as consumers favor hydration-driven products in multifunctional formats. The UK retail ecosystem, with a mix of specialty stores and expanding e-commerce channels, is anticipated to accelerate accessibility and product diversification. Sustainability regulations and eco-conscious consumer behavior will further shape innovation in packaging and product claims.

The Coconut Water Cosmetics Market in India is forecasted to expand at a CAGR of 21.6% between 2025 and 2035, establishing it among the fastest-growing markets globally. Growth is expected to be propelled by Ayurvedic-inspired formulations, where coconut water is integrated as a natural hydration and soothing base. Rising disposable incomes, urban lifestyle changes, and increased preference for organic skincare are anticipated to boost market penetration. Strong local brand presence, coupled with multinational interest in the Indian natural cosmetics sector, will amplify competitive intensity. Wider e-commerce adoption is projected to enhance availability, particularly in tier-II and tier-III cities.

The Coconut Water Cosmetics Market in China is projected to grow at a CAGR of 22.8% during 2025-2035, marking the highest growth among key global markets. Rapid adoption is being reinforced by the rising demand for hydration-focused skincare, particularly within urban millennial and Gen Z demographics. Preference for natural, lightweight formulations aligns strongly with coconut water’s positioning as a clean and refreshing ingredient. The Chinese cosmetics ecosystem is benefiting from strong domestic brand innovation as well as international brand entry, supported by digital-first strategies and influencer-driven marketing. Tiered retail formats and social commerce platforms are anticipated to amplify awareness and drive penetration.

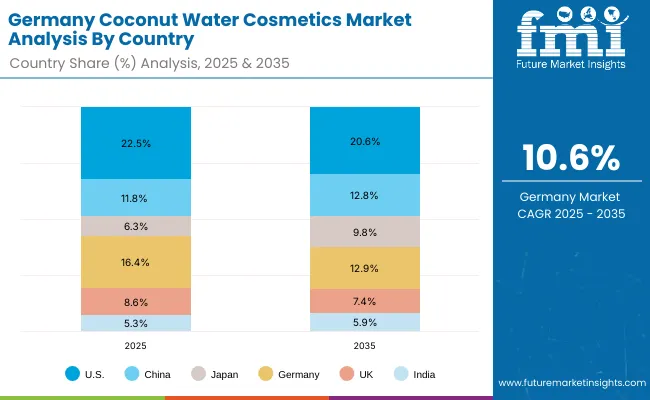

| Countries | 2025 |

|---|---|

| USA | 22.5% |

| China | 11.8% |

| Japan | 6.3% |

| Germany | 16.4% |

| UK | 8.6% |

| India | 5.3% |

| Countries | 2035 |

|---|---|

| USA | 20.6% |

| China | 12.8% |

| Japan | 9.8% |

| Germany | 12.9% |

| UK | 7.4% |

| India | 5.9% |

The Coconut Water Cosmetics Market in Germany is expected to expand at a CAGR of 10.6% from 2025 to 2035. Growth is being anchored by the country’s established organic and natural cosmetics ecosystem, which aligns with coconut water’s clean-label appeal. German consumers are displaying strong demand for ingredient transparency, ethical sourcing, and environmentally responsible packaging, reinforcing coconut water’s positioning. Steady adoption is anticipated across hydration and soothing claims, as consumers integrate natural formulations into daily routines. Specialty retail formats and stringent regulatory frameworks are expected to enhance consumer trust while creating high entry barriers for uncertified products.

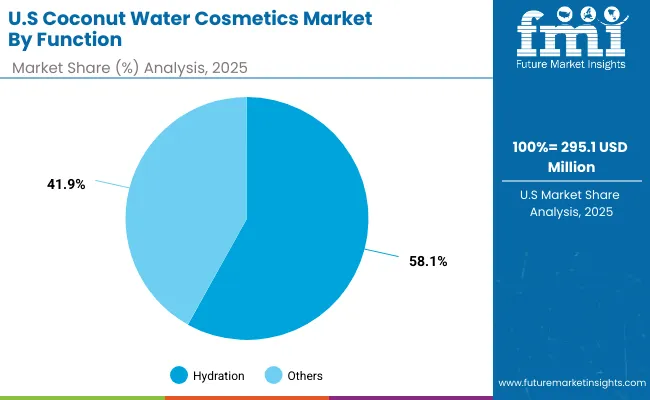

| Segment | Market Value Share, 2025 |

|---|---|

| Hydration | 58.1% |

| Others | 41.9% |

The Coconut Water Cosmetics Market in the USA is projected at USD 295.1 million in 2025. Hydration accounts for 58.1% of market value (≈ USD 171.6 million), while other benefits collectively hold 41.9% (≈ USD 123.5 million), demonstrating a clear consumer inclination toward moisture-restoring and barrier-support solutions. This strong hydration dominance is being reinforced by consumer focus on skin-stress relief, minimalistic routines, and science-backed replenishment claims.

Adoption is being accelerated by rising demand for clean, water-light formulations that layer well under sunscreen and makeup, particularly among younger consumers and urban professionals. The positioning of hydration as a fundamental step in daily skincare is expected to expand basket sizes and repeat purchase rates. Dermatologist endorsements and retail partnerships are anticipated to validate these benefits further, stimulating mainstream uptake.

E-commerce and pharmacy-led channels are expected to be critical in driving awareness, with customized recommendations and trial kits increasing household penetration. As consumers shift toward evidence-based hydration efficacy and environmentally responsible packaging, brands offering traceable coconut sourcing and clinically tested moisture indices are likely to win share.

| Segment | Market Value Share, 2025 |

|---|---|

| Natural/organic | 49.5% |

| Others | 50.5% |

The Coconut Water Cosmetics Market in China is projected at USD 154.3 million in 2025, with a forecast CAGR of 22.8% through 2035, signaling one of the most accelerated adoption curves globally. Natural and organic claims are expected to account for 49.5% of market value (≈ USD 76.4 million), while conventional claims will represent 50.5% (≈ USD 77.9 million), indicating a market in transition toward clean-label and ingredient-transparency positioning.

This trajectory is anticipated to be driven by Gen Z and Millennial consumers, who are prioritizing plant-based, dermatology-friendly, and ethically sourced beauty solutions. Coconut water is expected to benefit from its alignment with wellness, hydration, and “skin health from nature” narratives that resonate strongly across premium digital channels in China.

Influencer-led education, KOL campaigns, and live-commerce platforms are projected to play a crucial role in accelerating trial and conversion, while cross-border e-commerce is likely to introduce a broader array of niche, indie, and Ayurveda-inspired brands to the Chinese market. Premiumization is expected to occur through clinically validated hydration claims, eco-conscious packaging, and integration of multifunctional formats suitable for fast-paced lifestyles.

Regulatory tightening around “natural” and “organic” labeling is anticipated to favor brands with traceable supply chains and certified compliance, creating an advantage for players investing early in auditable sourcing. This focus on authenticity and performance is expected to elevate consumer trust and support repeat purchase behavior.

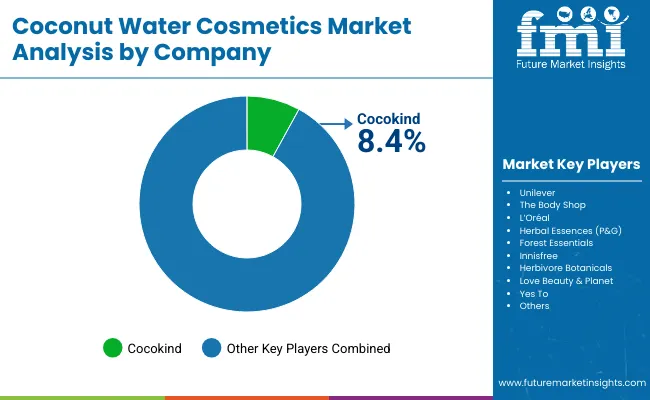

| Global Value Share 2025 | |

| Cocokind | 8.4% |

| Others | 91.6% |

The Coconut Water Cosmetics Market is moderately fragmented, with global multinationals, emerging natural beauty innovators, and indie-focused clean-label brands actively competing for share. In 2025, Cocokind is estimated to hold 8.4% of the global market, while the remaining 91.6% is distributed across a wide set of competitors. Cocokind’s leadership reflects its ability to establish strong consumer trust through transparency, sustainability-driven branding, and a direct-to-consumer presence that resonates with younger demographics.

Large multinational corporations such as Unilever, L’Oréal, and Procter & Gamble (Herbal Essences) are positioned as key competitors, leveraging scale, R&D capacity, and global distribution to embed coconut water formulations into their expansive skincare portfolios. Their strategies are expected to emphasize premium hydration-led offerings, vegan-certified ranges, and recyclable packaging initiatives.

Regional specialists, including Forest Essentials in India and Innisfree in South Korea, are strengthening their position through cultural resonance, Ayurvedic-inspired claims, and K-beauty-driven innovation. These players are building loyalty by aligning coconut water with local wellness traditions and sustainability preferences.

Competitive differentiation is shifting toward brand authenticity, digital engagement, and claim credibility rather than price competition. As consumer expectations for clean-label and multifunctional beauty expand, leadership will depend on the ability to combine natural positioning with regulatory trust, retail partnerships, and product innovation.

Key Developments in Coconut Water Cosmetics Market

| Item | Value |

|---|---|

| Market Size 2025 | USD 1,311.5 million |

| Market Size 2035 | USD 4,123.1 million |

| CAGR (2025-2035) | 12.10% |

| Function Segments | Hydration (USD 696.0 million, 53.5%), Others (USD 609.38 million, 46.5%) |

| Claim Segments | Natural/Organic (USD 643.4 million, 49.5%), Others (USD 662.37 million, 50.5%) |

| Product Types | Toners (USD 617.2 million, 47.5%), Others (USD 688.87 million, 52.5%) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Key Countries Covered | United States, China, India, United Kingdom, Germany, Japan, South Korea |

| Key Companies Profiled | Cocokind, Unilever, L’Oréal, Herbal Essences (P&G), Innisfree, Forest Essentials, Herbivore Botanicals, Love Beauty & Planet, The Body Shop, Yes To |

| Additional Attributes | Sales by function, claim, and product type; adoption trends in hydration-led cosmetics; rising demand for clean-label, natural, and Ayurvedic-inspired claims; expansion of e-commerce channels; sustainability-driven packaging innovation; competitive growth from indie brands. |

The global Coconut Water Cosmetics Market is estimated to be valued at USD 1,311.5 million in 2025, supported by growing demand for hydration-led, clean-label, and natural cosmetic formulations.

The Coconut Water Cosmetics Market size is projected to reach USD 4,123.1 million by 2035, reflecting strong expansion supported by wellness-driven preferences and sustainable product positioning.

The Coconut Water Cosmetics Market is expected to grow at a CAGR of 12.1% during 2025–2035, adding over USD 2,800 million in absolute value within this period.

The key product types in the Coconut Water Cosmetics Market include toners, serums, creams/lotions, and mists, with toners accounting for 47.5% share in 2025.

In terms of function, hydration will dominate with a 53.5% share in 2025, reflecting its alignment with consumer demand for moisture replenishment and refreshing skincare solutions.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Coconut Derived Surfactants Market Size and Share Forecast Outlook 2025 to 2035

Coconut Oil Moisturizing Creams Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Coconut Milk Powder Market Size and Share Forecast Outlook 2025 to 2035

Coconut Milk Products Market Trends – Size, Demand & Forecast 2025-2035

Coconut Milk Market Analysis – Size, Share & Forecast Outlook 2025 to 2035

Coconut Butter Market Analysis by End-use Application Sales Channel Through 2025 to 2035

Coconut Sugar Market By Form, Nature, Application and Region - Forecast from 2025 to 2035

Coconut Flour Market Analysis by End-Use, Application, Product Form, Technology, Nature, and Region from 2025 to 2035

Coconut Wraps Market Outlook – Growth, Demand & Forecast 2025 to 2035

Coconut Oil Market Insights - Growing Applications & Industry Expansion 2025 to 2035

Competitive Overview of Coconut Syrup Industry Share

Coconut Cream Market – Growth, Demand & Dairy Alternatives Trends

Coconut-Free Skincare Market Growth – Size, Trends & Forecast 2024-2034

Coconut Fatty Acids Market

Coconut Water-Based Formulas Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Coconut Water Market Size, Growth, and Forecast 2025 to 2035

Complex Coconut Sugar Market Size and Share Forecast Outlook 2025 to 2035

Analyzing Cooking Coconut Milk Market Share & Industry Leaders

Cooking Coconut Milk Market – Growth, Demand & Culinary Applications

Packaged Coconut Water Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA