It is expected that the Coconut oil market will continue to flourish in the future and will contribute a good market valuation by the year 2025 and up to 2035 all over the world. Coconut oil: Coconut oil is an important component in many skin, hair care and dietary supplements because of its antimicrobial, moisturizing, and antioxidant properties.

Higher demand for plant-based and sustainable offerings, as well as advancements in extraction and processing methods, drive market growth. In addition, factors fueling the rapid evolution of the industry include the changing focus of e-commerce platforms, increased investment in coconut farming, and growing consumer preferences for non-GMO, cold-pressed, and other high-quality coconut oils.

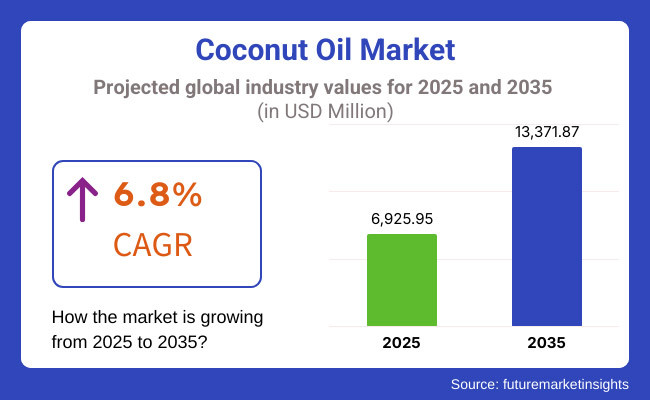

Coconut oil market is valued at USD 6,925.95 Million approximately in 2025. The Global Market is expected to reach USD 1,3371.87 Million by 2035. The global market is expected to witness the highest growth rate and record a growth of 6.8% CAGR during this period.

The increasing need for healthier cooking oils, the surging adoption of organic beauty and wellness products, and the increasing investments in sustainable coconut plantations across the world are the primary factors contributing to the growth of the market.

Besides, the rising research and development (R&D) activities for the production of environmentally-friendly packaging products, sophisticated oil purification techniques, and energy-efficient processing techniques are further propelling the profit margins of market participants. Additionally, the availability of premium unrefined and cold-pressed coconut oil in the market has been a crucial driver of market penetration and consumer adoption.

Consumer demand for natural and organic products is rising on the North America coconut oil market along with the growing inclination towards plant-based food supplements and large investments in coconut-based beauty and wellness brands. The USA and Canada: plays a key role for the development and commercialization of high-quality, cold-pressed, and extra virgin coconut oils for dietary, skincare, and medicinal applications.

Growing demand for clean-label and chemical-free personal care and cosmetic products, supportive regulations for organic certification, and increasing use of coconut oil in functional foods will further propel growth in the coconut oil market. Keto and paleo diets are also spurring innovation and adoption of coconut-based MCT (medium-chain triglyceride) oils.

The European market is driven by rising demand for organic and sustainably sourced coconut oil, regulatory support for environmentally friendly beauty and food products, and improvements in processing technologies. Germany, France and the UK are working on top-grade, therapeutic-grade coconut oil use in food, pharmaceuticals and cosmetics.

The increasing focus on decreasing synthetic chemicals in personal care products, widening applications in plant-based diets, and research on coconut-derived bioactives are further driving market adoption. Also, wider applications in vegan food production, luxury skincare and sustainable packaging offer even more potential for manufacturers.

In the Asia-Pacific region, the Coconut oil market is developing rapidly, and the increase in domestic production and an upsurge in exports along with the growing preference of the consumers for traditional remedies and natural beauty is playing a significant role in driving the market. Countries such as the Philippines, India, Indonesia, and Sri Lanka are building a reputation in the coconut-growing space and oil extraction industry, and are supplying prime quality coconut oil to various international markets.

Such factors include the increasing demand for ayurvedic and herbal products, the proliferation of organic farming systems, changing consumer preferences for cold-pressed oils and government initiatives in favor of coconut farming, which are driving regional market growth.

In addition, growing awareness of the benefits of coconut oil for heart health, digestion, and immunity is aiding in the market penetration. Additionally, the growing number of domestic oil processors and partnerships with foreign cosmetic and food brand is propelling the market growth.

Rising demand for plant-based cooking oils, growing vegan population and expanding investments toward developing a coconut farm in Latin America are anticipated to drive this market in Latin America. Brazil and Mexico are relevant players in this landscape, both aiming at increasing the availability of high-quality coconut oil for food, wellness, and beauty applications.

Similarly, the combination of raw materials acquired locally, cheap production methods, and marketing efforts to promote a clean-label and organic product are other market drivers. Furthermore, the popularity of superfoods, rising investments in functional nutrition, and demand by consumers for the use of natural and minimally processed oils are making products more accessible throughout the region.

As the Coconut oil market in the Middle East & Africa region continues to grow, continuous investments in premium organic products are being made in natural personal care and alternative medicine. Only the UAE, and South Africa, have taken initiatives to expand product availability and technological development in this sector.

Additionally, the booming beauty orthodoxy and luxury wellness sector, increasing demand for dietary supplements derived from coconuts, as well as collaborations between international and domestic oil manufacturers are some other factors aiding industry expansion.

Moreover, government policies favoring organic agriculture, innovations in oil extraction methods, and consumer-driven demand for halal-certified coconut oil contribute to the companies' long-term growth within the sector. Moreover, the rising impact of global clean label trends and increasing adoption of coconut oil in high-end food formulations across the region will create a plethora of opportunities that will further contribute to market growth.

The coconut oil market is steadily growing and is estimated to grow consistently throughout the next decade owing to continuous advancements in oil extraction technologies, initiatives towards sustainability along with certification of organic products. In order to enhance not only functionality, appeal and longevity on the market, but also the usability of its products, companies are seeking new techniques for oil purity, sustainable packaging, and processing.

Moreover, consumer demand for natural products continues to rise with the growing popularity of plant-based diets, the digitalization of natural product retailing, and changing beauty and wellness trends. By harnessing AI-powered quality analysis, state-of-the-art oil refining methods, along with traceable supply chain practices, they are streamlining production processes for maximum efficacy while guaranteeing top-tier coconut oil becomes available the world over.

Challenge

Fluctuating Raw Material Prices and Supply Chain Disruptions

Factors such as climate change, natural disasters, and inconsistent coconut yields contribute to fluctuations in raw material prices, posing challenges for the Coconut oil market. According to Reliance, the estimate for coconut is highly reliant on tropical regions where severe climatic events has detrimental impact on the production, for e.g. typhoons and droughts.

Supply chain disruptions from geopolitical issues, transportation costs and labor shortages also impact pricing and availability. In response to these pressures, businesses need to invest in agile supply chain strategy, find multiple sources of supply and implement advanced farming techniques to stabilize production and reduce price risk.

Competition from Alternative Oils and Changing Consumer Preferences

The Coconut oil market faces stiff competition from the other alternative oils including olive oil, avocado oil, and plant-based butter substitutes that are readily available. Even health-conscious consumers are rethinking their tastes according to their nutritional specifications, given that coconut oil is high in saturated fat. Moreover, public health initiatives, which include guidelines and principles encouraging reduced intake of saturated fat, have also aided with purchasing decisions.

For coconut oil producers, your ability to differentiate by health attributes, sustainability and organic farming practices, and new types of coconut oil - such as MCT (medium-chain triglyceride) oil and fortified coconut oil blends - will be key to staying competitive.

Opportunity

Growing Demand for Organic and Sustainable Coconut Oil

Widely Available Oils - Various oils like olive oil, avocado oil, or plant-based butter alternatives are widely available oils owned with higher threat for the Coconut oil market. Health-conscious consumers are also reconsidering their tastes according to nutritional specifications-especially in light of the high saturated fat percentage in coconut oil. As have regulatory bodies and dietary guidelines recommending lower saturated fat consumption, which also affects purchase decisions.

If you are a producer of coconut oil, your differentiation in terms of health attributes, sustainable and organic farming practices, and innovative formats of coconut oil - such as MCT (medium-chain triglyceride) oil and fortified coconut oil blends - will be critical to keeping your head above water.

Expanding Applications in Health, Beauty, and Functional Foods

The versatility of coconut oil across various industries provides immense growth prospects. Its high-medium chain triglyceride (MCT) content is advantageous in the food and beverage sector, including plant-based dairy alternatives, keto-friendly products, and functional foods.

Coconut oil is used in beauty and personal care products for moisturizing, anti-aging and antibacterial functions in skin and hair care formulations. Its usage in pharmaceuticals and nutraceuticals is also increasing, such as supplements and immune-boosting formulations. Innovative companies that deliver novel product formulations, sustainable packaging and focused marketing strategies will thrive in these expanding applications.

Coconut oil market growth between 2020 and 2024 and post 2025 to 2035 future trends - The Coconut oil market has been facing constant demand over the previous 2020 to 2024 years owing to the increasing number of plant-based diets, growing organic products and clean-label demand in the food-processing industry.

Adverse market conditions were flagged including supply chain instability, rising raw material costs and competition from biodiesel and alternative oils. Companies have reacted by bolstering supply chain resilience, seeking organic certification and diversifying into high-value products like virgin coconut oil and MCT-based supplements.

In the period until 2025 to 2035, the market will also experience developments in sustainable sourcing, artificial intelligence (AI) supply chain optimization, and health and beauty products tailored to the individual. The use of blockchain to provide transparency in supply chains, innovations in biodegradable packaging, and a new wave of plant-based functional foods will reshape the competitive landscape.

Furthermore, new advents in bioactive derivatives of coconut oil, personalized nutrition formulations, and climate-resilient coconut farming will contribute to long-term market growth. Further, Companies that focus on digital transformation, sustainability, and consumer-driven product innovation will dominate the dynamic Coconut oil market.

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Increased focus on organic certification and fair-trade sourcing |

| Technological Advancements | Expansion of cold-pressed and virgin coconut oil production |

| Industry Adoption | Rising demand in beauty, personal care, and health food industries |

| Supply Chain and Sourcing | Dependence on traditional coconut-producing regions |

| Market Competition | Increasing competition from alternative plant-based oils |

| Market Growth Drivers | Demand for plant-based, organic, and clean-label products |

| Sustainability and Energy Efficiency | Initial focus on fair-trade certification and ethical sourcing |

| Integration of Smart Monitoring | Limited use of digital tracking in coconut sourcing |

| Advancements in Product Innovation | Growth in virgin coconut oil and MCT-based products |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter sustainability standards, blockchain-based traceability, and carbon footprint reduction initiatives |

| Technological Advancements | AI-driven quality control, climate-resilient coconut farming, and innovative oil extraction techniques |

| Industry Adoption | Expansion into pharmaceuticals, nutraceuticals, and plant-based functional food applications |

| Supply Chain and Sourcing | Diversification into climate-adaptive coconut farming and regenerative agriculture practices |

| Market Competition | Rise of customized oil blends, bioactive coconut derivatives, and MCT-rich health formulations |

| Market Growth Drivers | Growth in personalized nutrition, sustainable packaging solutions, and AI-powered consumer insights |

| Sustainability and Energy Efficiency | Large-scale implementation of carbon-neutral production, zero-waste coconut processing, and eco-friendly packaging solutions |

| Integration of Smart Monitoring | AI-powered supply chain transparency, real-time quality monitoring, and blockchain-enabled traceability |

| Advancements in Product Innovation | Smart functional oils, bioengineered coconut oil compounds, and biodegradable oil-infused skincare formulations |

The United States, leading the Coconut oil market, is driven by high consumer demand for organic and plant-based products, increased use in food and beverage include, and more Coconut oil use in personal care and cosmetics. These factors, along with the presence of leading coconut oil brands and innovations in the production of cold-pressed and virgin derivative, contribute to the market's expansion.

Growth in the demand for natural and chemical-free alternatives in personal care, hair care, and dietary supplements significantly contributes to increased market growth. In addition, the growing utilization of coconut oil in functional foods, keto diets, and plant-based butter alternatives is supporting the industry growth.

Consumers are also demanding more ethically sourced, fair-trade coconut oil, and companies are catering to this trend. Growing awareness regarding health benefits offered by coconut oil on account of its antimicrobial and antioxidant properties is expected to further boost the market growth in the USA

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 7.0% |

Natural Wellness Prowl: Coconut oil is from one of the most popular natural wellness products available on the UK market, which is driven by a rising consumer interest with the demand for plant-based alternatives, as well as a growing use in the food and beauty sector. The demand is also being driven by a focus on clean-label and non-GMO ingredients.

One factor which is increasing market growth is the government regulations in favor of sustaining sourcing along with the growing investment in organic and cruelty-free cosmetics. Additionally, coconut oil-derived personal care formulations, such as sulfate-free shampoos, moisturizers, and massage oil, are progressing on innovation.

To appeal to health-conscious consumers, companies are also investing in high-end, cold-pressed coconut oil varieties. As consumers increasingly seek ethical and eco-friendly products, market growth in the UK is being strengthened. Also, vegan and dairy-free trends are driving the use of coconut oil as a plant-based fat alternative.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 6.5% |

Germany, France, and Italy are the leading influencers, on demand for coconut oils in Europe, with organic foods, sustainable beauty, and plant-based product categories being perceived as growth markets.

Rapid growth in the market is due to the emphasis on sustainable and ethically sourced products, combined with rising investments in coconut oil-based functional foods and nutritional supplements by the European Union. The growing use of coconut oil in clean-label bakery products, dairy alternatives, and organic confectionery are supporting product diversification. Furthermore, increasing consumer choice towards sustainable, cold-pressed and extra virgin coconut oil is also pushing the demand across various end-use industries.

Furthermore, the development of coconut oil-infused bio-based lubricants and green packaging solutions is also boosting the growth of the market throughout the EU. Additionally, the European Union (EU) has stringent regulations on synthetic additives, promoting the adoption of more natural coconut oil formulations in skincare and health supplements.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 6.7% |

The country’s emphasis on functional health foods, rising popular demand for natural beauty products, and a growing preference for plant-based alternatives are driving the growth of cleaning beauty products in the Japan Coconut oil market. Market growth is primarily driven by the growing awareness about the nutritional and medicinal properties of coconut oil.

Innovations are driving innovation in the country where technological advancements in food processing, along with AI-based quality control being applied to an oil extraction operation. Furthermore, robust governmental assistance for organic and non-GMO food certification combined with the growing consumer preference for natural and minimally processed products is driving organizations to provide high purity coconut oil.

In addition, the increasing usage of coconut oil in traditional medicine, health tonics, and therapeutic skincare are also propelling market growth in Japan’s wellness domain. Japan’s growing focus on sustainable packaging and eco-friendly product development is also spurring demand for sustainably sourced coconut oil.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.9% |

The key factors contributing to this growth include the increased influence of K-beauty trends, growing consumer interest in organic superfoods, and strengthening applications in dietary supplements and natural cosmetics.

Government regulations encouraging clean beauty and plant-based diets, along with the rising adoption of coconut oil in skin-nourishing cosmetics, which aid the market expansion. Also, the commitment of the country to enhance product efficacy using new age cold-press extraction, sustainable sourcing and premium organic certifications is strengthening competitiveness. The increasing usage of coconut oil in weight management supplements, anti-aging skincare, and vegan foods alternatives is also contributing to the market adoption.

The wellness market is booming, with brands creating innovative new beauty products, including coconut oil-infused cleansing balms and hydrating hair masks, to meet the demand of their increasingly health-conscious consumer base. The demand for high quality coconut oil is further augmented by the increasing preference of consumers towards eco-friendly products and growing retail penetration of organic brands in South Korea.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 7.1% |

Organic and non-GMO coconut oil are still being embraced more and more due as consumers prefer products that are natural, chemical-free, and sustainably sourced. This sector is robust particularly around food and beverage, which held the largest share in personal care and pharmaceuticals and for materials with minimum possible processing which fits with the innate needs of customers.

Moreover, the growing trend of clean-label and non-GMO-certified products has further fuelled the market growth. Moreover, producers of organic coconut oil are adopting sustainable farming methods and obtaining fair-trade certifications in response to consumer preferences for ethically-produced products.

Traditional Coconut Oil accounts for most of the market share as it serves the industries demanding higher product volumes at lower costs. Conventional coconut oil is widely used in food processing industry due to its long shelf life, stable composition, and versatile cooking applications.

Furthermore, regular coconut oil is still a common ingredient in mass-market skincare and haircare, as well as pharmaceutical products, where price and availability are the key drivers of consumers' buying choices. Another critical factor contributing to the stronghold of the conventional segment across various industries is the proliferation of industrial-scale coconut oil production facilities and enhanced refining techniques.

Due to high nutritional value, low processing and flavor, virgin or extra virgin coconut oil will hold the lion share in the highest segment of the market. Because of its health benefits, virgin coconut oil is increasingly used by health-conscious consumers for cooking, food supplements, and topical applications in skin care, and its becoming a ubiquitous offerings on the shelves of organic food stores and specialty health brands.

Many consumers do appreciate minimally processed oils that are rich in antioxidants, and the rising prevalence of cold-pressed extraction methods for oil production has improved product quality.

It is also commonly used in processed foods, cosmetics and households because it does not alter the taste and odor for a lower economic cost. Refined coconut oil is preferred by food manufacturers for baking, frying, and packaged snacks, where a less pronounced flavor note is desirable.

Additionally, refined coconut oil is stable and has a high smoke point, making it desirable for commercial kitchens and large food processing operations. Improved filtration and deodorization techniques have further elevated the quality of refined coconut oil, preventing it from losing its market dominance in many parts of the world.

The food and beverages segment accounts for the highest consumption of coconut oil, with a presence in bakery products, confectionery, dairy alternatives, and specialty cooking oils.

Coconut oil has gained popularity as a store of energy in formulations intended for plant-based diets (wherein no meat is consumed) and ketogenic nutrition trends, and it has made its way into dozens of different healthy versions of snack and functional beverages. Also, it is rich in antimicrobial and digestive health benefits that help in making it a prominent part of nutritional supplement and bio-enriched food products.

Coconut oil is widely used in the cosmetics and personal care industry for skincare, haircare and natural beauty formulations. Its intense moisturizing properties, antiinflammatory properties, and antibacterial benefits make it one of the top ingredients used in organic lotions, body butters, lip balms, and hair masks.

Moreover, the growing consumer inclination toward paraben-free, sulfate-free and cruelty-free beauty products is fueling the demand for quality coconut oil. Further, growing trends for making DIY beauty treatment products at home, interactions of household ingredients with skin etc. have also accelerated the market penetration in the personal care segment.

The consumer-oriented (B2C) sector is also seeing rapid growth as a growing number of brands directly engage with customers via e-commerce, specialty stores, and organic marketplaces. Consumers value branded, high-quality coconut oil sold via retail channels which are transparent in sourcing, extraction method, and product certifications. DTC sales strategies, coconut oil products sold on a subscription basis, and personalized wellness bundles have all contributed to the growth of B2C distribution.

Consumers have found easy access to an extensive range of coconut oil brands, sizes, and formulations through online retail-an important distribution channel. Whether because of the surge in digital grocery shopping, the health-conscious e-commerce powers that be or beauty trends propagated on social media, online sales have soared.

Moreover, with the growing prevalence of AI-powered recommendations, influencer endorsements, and sustainable packaging solutions, consumer engagement has just about touched new heights, making online retail a pivotal growth catalyst for the Coconut oil market.

The Increasing Demand for Food and Beverage, Personal Care, and Pharmaceutical Industry Expands the Coconut oil Market. As consumers migrate to natural and organic options, companies are focusing on sustainable sourcing, cold-pressed extraction techniques and greater product purity. Some more key trends are virgin and extra-virgin coconut oil, organic certification, and its increasing use in functional foods and cosmetics.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Cargill, Incorporated | 17-21% |

| Archer Daniels Midland (ADM) | 13-17% |

| Bunge Limited | 10-14% |

| Marico Limited | 7-11% |

| Nutiva Inc. | 5-9% |

| Other Companies (combined) | 35-45% |

| Company Name | Key Offerings/Activities |

|---|---|

| Cargill, Incorporated | Leading supplier of refined and virgin coconut oil for food, personal care, and industrial applications. |

| Archer Daniels Midland (ADM) | Specializes in organic coconut oil with a focus on functional food and wellness applications. |

| Bunge Limited | Develops high-quality coconut oil with sustainable sourcing practices and fair-trade certification. |

| Marico Limited | Offers premium cold-pressed coconut oil, widely used in hair care and personal care segments. |

| Nutiva Inc. | Focuses on USDA-certified organic and non-GMO virgin coconut oil for health-conscious consumers. |

Key Company Insights

Cargill, Incorporated (17-21%)

Coconut oil produced by Cargill is a leader in the market, as it has strong global market presence, providing refined, virgin, and organic coconut oil solutions.

Archer Daniels Midland (ADM) (13-17%)

One of its most iconic brands, ADM is even a big player in organic coconut oil, tapping into sustainable sourcing and groundbreaking product formulations geared toward functional food applications.

Bunge Limited (10-14%)

Bunge focuses on high-quality, sustainably-harvested coconut oil for food manufacturers and personal care brands.

Marico Limited (7-11%)

Marico is already a market leader in premium cold-pressed coconut oil and has been expanding its portfolio of high-purity solutions across the personal care industry.

Nutiva Inc. (5-9%)

Nutiva sells USDA certified organic virgin coconut oil targeting health and eco-conscious consumers.

Other Key Players (35-45% Combined)

A range of innovations in coconut oil around the world focus on sustainable sourcing, cold-pressed extraction, and organic certification, and they involve both major global players and local regional manufacturers. Key players include:

The overall market size for Coconut oil market was USD 6,925.95 Million in 2025.

The Coconut oil market expected to reach USD 1,3371.87 Million in 2035.

Some of the major factors that are expected to boost the demand for the coconut oil market include the growing applications of coconut oil in the food and beverage, cosmetics, and pharmaceutical industries, increasing consumer preference for natural and organic products, rising consumer awareness about health benefits offered by coconut oil products, and increasing adoption of coconut oil in personal care and wellness products.

The top 5 countries which drives the development of Coconut oil market are USA, UK, Europe Union, Japan and South Korea.

Organic and conventional coconut oil growth to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Litre) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 4: Global Market Volume (Litre) Forecast by Nature, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 6: Global Market Volume (Litre) Forecast by Product Type, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 8: Global Market Volume (Litre) Forecast by End Use, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 10: Global Market Volume (Litre) Forecast by Distribution Channel, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (Litre) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 14: North America Market Volume (Litre) Forecast by Nature, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 16: North America Market Volume (Litre) Forecast by Product Type, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 18: North America Market Volume (Litre) Forecast by End Use, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 20: North America Market Volume (Litre) Forecast by Distribution Channel, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (Litre) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 24: Latin America Market Volume (Litre) Forecast by Nature, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 26: Latin America Market Volume (Litre) Forecast by Product Type, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 28: Latin America Market Volume (Litre) Forecast by End Use, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 30: Latin America Market Volume (Litre) Forecast by Distribution Channel, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Western Europe Market Volume (Litre) Forecast by Country, 2018 to 2033

Table 33: Western Europe Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 34: Western Europe Market Volume (Litre) Forecast by Nature, 2018 to 2033

Table 35: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 36: Western Europe Market Volume (Litre) Forecast by Product Type, 2018 to 2033

Table 37: Western Europe Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 38: Western Europe Market Volume (Litre) Forecast by End Use, 2018 to 2033

Table 39: Western Europe Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 40: Western Europe Market Volume (Litre) Forecast by Distribution Channel, 2018 to 2033

Table 41: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Eastern Europe Market Volume (Litre) Forecast by Country, 2018 to 2033

Table 43: Eastern Europe Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 44: Eastern Europe Market Volume (Litre) Forecast by Nature, 2018 to 2033

Table 45: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 46: Eastern Europe Market Volume (Litre) Forecast by Product Type, 2018 to 2033

Table 47: Eastern Europe Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 48: Eastern Europe Market Volume (Litre) Forecast by End Use, 2018 to 2033

Table 49: Eastern Europe Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 50: Eastern Europe Market Volume (Litre) Forecast by Distribution Channel, 2018 to 2033

Table 51: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: South Asia and Pacific Market Volume (Litre) Forecast by Country, 2018 to 2033

Table 53: South Asia and Pacific Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 54: South Asia and Pacific Market Volume (Litre) Forecast by Nature, 2018 to 2033

Table 55: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 56: South Asia and Pacific Market Volume (Litre) Forecast by Product Type, 2018 to 2033

Table 57: South Asia and Pacific Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 58: South Asia and Pacific Market Volume (Litre) Forecast by End Use, 2018 to 2033

Table 59: South Asia and Pacific Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 60: South Asia and Pacific Market Volume (Litre) Forecast by Distribution Channel, 2018 to 2033

Table 61: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 62: East Asia Market Volume (Litre) Forecast by Country, 2018 to 2033

Table 63: East Asia Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 64: East Asia Market Volume (Litre) Forecast by Nature, 2018 to 2033

Table 65: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 66: East Asia Market Volume (Litre) Forecast by Product Type, 2018 to 2033

Table 67: East Asia Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 68: East Asia Market Volume (Litre) Forecast by End Use, 2018 to 2033

Table 69: East Asia Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 70: East Asia Market Volume (Litre) Forecast by Distribution Channel, 2018 to 2033

Table 71: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 72: Middle East and Africa Market Volume (Litre) Forecast by Country, 2018 to 2033

Table 73: Middle East and Africa Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 74: Middle East and Africa Market Volume (Litre) Forecast by Nature, 2018 to 2033

Table 75: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 76: Middle East and Africa Market Volume (Litre) Forecast by Product Type, 2018 to 2033

Table 77: Middle East and Africa Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 78: Middle East and Africa Market Volume (Litre) Forecast by End Use, 2018 to 2033

Table 79: Middle East and Africa Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 80: Middle East and Africa Market Volume (Litre) Forecast by Distribution Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Nature, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End Use, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (Litre) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 11: Global Market Volume (Litre) Analysis by Nature, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 15: Global Market Volume (Litre) Analysis by Product Type, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 19: Global Market Volume (Litre) Analysis by End Use, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 23: Global Market Volume (Litre) Analysis by Distribution Channel, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 26: Global Market Attractiveness by Nature, 2023 to 2033

Figure 27: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 28: Global Market Attractiveness by End Use, 2023 to 2033

Figure 29: Global Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Nature, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (Litre) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 41: North America Market Volume (Litre) Analysis by Nature, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 45: North America Market Volume (Litre) Analysis by Product Type, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 49: North America Market Volume (Litre) Analysis by End Use, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 53: North America Market Volume (Litre) Analysis by Distribution Channel, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 56: North America Market Attractiveness by Nature, 2023 to 2033

Figure 57: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 58: North America Market Attractiveness by End Use, 2023 to 2033

Figure 59: North America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Nature, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (Litre) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 71: Latin America Market Volume (Litre) Analysis by Nature, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 75: Latin America Market Volume (Litre) Analysis by Product Type, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 79: Latin America Market Volume (Litre) Analysis by End Use, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 83: Latin America Market Volume (Litre) Analysis by Distribution Channel, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Nature, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 88: Latin America Market Attractiveness by End Use, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Western Europe Market Value (US$ Million) by Nature, 2023 to 2033

Figure 92: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 93: Western Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 94: Western Europe Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 95: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Western Europe Market Volume (Litre) Analysis by Country, 2018 to 2033

Figure 98: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Western Europe Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 101: Western Europe Market Volume (Litre) Analysis by Nature, 2018 to 2033

Figure 102: Western Europe Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 103: Western Europe Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 104: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 105: Western Europe Market Volume (Litre) Analysis by Product Type, 2018 to 2033

Figure 106: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 107: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 108: Western Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 109: Western Europe Market Volume (Litre) Analysis by End Use, 2018 to 2033

Figure 110: Western Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 111: Western Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 112: Western Europe Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 113: Western Europe Market Volume (Litre) Analysis by Distribution Channel, 2018 to 2033

Figure 114: Western Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 115: Western Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 116: Western Europe Market Attractiveness by Nature, 2023 to 2033

Figure 117: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 118: Western Europe Market Attractiveness by End Use, 2023 to 2033

Figure 119: Western Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 120: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Eastern Europe Market Value (US$ Million) by Nature, 2023 to 2033

Figure 122: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 123: Eastern Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 124: Eastern Europe Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 125: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Eastern Europe Market Volume (Litre) Analysis by Country, 2018 to 2033

Figure 128: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Eastern Europe Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 131: Eastern Europe Market Volume (Litre) Analysis by Nature, 2018 to 2033

Figure 132: Eastern Europe Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 133: Eastern Europe Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 134: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 135: Eastern Europe Market Volume (Litre) Analysis by Product Type, 2018 to 2033

Figure 136: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 137: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 138: Eastern Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 139: Eastern Europe Market Volume (Litre) Analysis by End Use, 2018 to 2033

Figure 140: Eastern Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 141: Eastern Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 142: Eastern Europe Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 143: Eastern Europe Market Volume (Litre) Analysis by Distribution Channel, 2018 to 2033

Figure 144: Eastern Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 145: Eastern Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 146: Eastern Europe Market Attractiveness by Nature, 2023 to 2033

Figure 147: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 148: Eastern Europe Market Attractiveness by End Use, 2023 to 2033

Figure 149: Eastern Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 150: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 151: South Asia and Pacific Market Value (US$ Million) by Nature, 2023 to 2033

Figure 152: South Asia and Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 153: South Asia and Pacific Market Value (US$ Million) by End Use, 2023 to 2033

Figure 154: South Asia and Pacific Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 155: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: South Asia and Pacific Market Volume (Litre) Analysis by Country, 2018 to 2033

Figure 158: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: South Asia and Pacific Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 161: South Asia and Pacific Market Volume (Litre) Analysis by Nature, 2018 to 2033

Figure 162: South Asia and Pacific Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 163: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 164: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 165: South Asia and Pacific Market Volume (Litre) Analysis by Product Type, 2018 to 2033

Figure 166: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 167: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 168: South Asia and Pacific Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 169: South Asia and Pacific Market Volume (Litre) Analysis by End Use, 2018 to 2033

Figure 170: South Asia and Pacific Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 171: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 172: South Asia and Pacific Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 173: South Asia and Pacific Market Volume (Litre) Analysis by Distribution Channel, 2018 to 2033

Figure 174: South Asia and Pacific Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 175: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 176: South Asia and Pacific Market Attractiveness by Nature, 2023 to 2033

Figure 177: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 178: South Asia and Pacific Market Attractiveness by End Use, 2023 to 2033

Figure 179: South Asia and Pacific Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 180: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 181: East Asia Market Value (US$ Million) by Nature, 2023 to 2033

Figure 182: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 183: East Asia Market Value (US$ Million) by End Use, 2023 to 2033

Figure 184: East Asia Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 185: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 186: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 187: East Asia Market Volume (Litre) Analysis by Country, 2018 to 2033

Figure 188: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: East Asia Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 191: East Asia Market Volume (Litre) Analysis by Nature, 2018 to 2033

Figure 192: East Asia Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 193: East Asia Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 194: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 195: East Asia Market Volume (Litre) Analysis by Product Type, 2018 to 2033

Figure 196: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 197: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 198: East Asia Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 199: East Asia Market Volume (Litre) Analysis by End Use, 2018 to 2033

Figure 200: East Asia Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 201: East Asia Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 202: East Asia Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 203: East Asia Market Volume (Litre) Analysis by Distribution Channel, 2018 to 2033

Figure 204: East Asia Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 205: East Asia Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 206: East Asia Market Attractiveness by Nature, 2023 to 2033

Figure 207: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 208: East Asia Market Attractiveness by End Use, 2023 to 2033

Figure 209: East Asia Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 210: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 211: Middle East and Africa Market Value (US$ Million) by Nature, 2023 to 2033

Figure 212: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 213: Middle East and Africa Market Value (US$ Million) by End Use, 2023 to 2033

Figure 214: Middle East and Africa Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 215: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 216: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 217: Middle East and Africa Market Volume (Litre) Analysis by Country, 2018 to 2033

Figure 218: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 219: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 220: Middle East and Africa Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 221: Middle East and Africa Market Volume (Litre) Analysis by Nature, 2018 to 2033

Figure 222: Middle East and Africa Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 223: Middle East and Africa Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 224: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 225: Middle East and Africa Market Volume (Litre) Analysis by Product Type, 2018 to 2033

Figure 226: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 227: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 228: Middle East and Africa Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 229: Middle East and Africa Market Volume (Litre) Analysis by End Use, 2018 to 2033

Figure 230: Middle East and Africa Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 231: Middle East and Africa Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 232: Middle East and Africa Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 233: Middle East and Africa Market Volume (Litre) Analysis by Distribution Channel, 2018 to 2033

Figure 234: Middle East and Africa Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 235: Middle East and Africa Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 236: Middle East and Africa Market Attractiveness by Nature, 2023 to 2033

Figure 237: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 238: Middle East and Africa Market Attractiveness by End Use, 2023 to 2033

Figure 239: Middle East and Africa Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 240: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Coconut Oil Moisturizing Creams Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Palm Kernel Oil and Coconut Oil Based Natural Fatty Acids Market Size and Share Forecast Outlook 2025 to 2035

Oily Waste Can Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Seal Market Size and Share Forecast Outlook 2025 to 2035

Oil Coalescing Filter Market Size and Share Forecast Outlook 2025 to 2035

Oil-immersed Iron Core Series Reactor Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Sensor Market Forecast Outlook 2025 to 2035

Oil Packing Machine Market Forecast and Outlook 2025 to 2035

Oil and Gas Pipeline Coating Market Forecast and Outlook 2025 to 2035

Oilfield Scale Inhibitor Market Size and Share Forecast Outlook 2025 to 2035

Oil-in-Water Anionic Emulsifier Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Field Services Market Size and Share Forecast Outlook 2025 to 2035

Oil Control Shampoo Market Size and Share Forecast Outlook 2025 to 2035

Oil Expellers Market Size and Share Forecast Outlook 2025 to 2035

Oilfield Stimulation Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Oiler Kits Market Size and Share Forecast Outlook 2025 to 2035

Oil Pressure Sensor Market Size and Share Forecast Outlook 2025 to 2035

Oil Filled Power Transformer Market Size and Share Forecast Outlook 2025 to 2035

Oily Skin Control Products Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Oil Immersed Shunt Reactor Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA