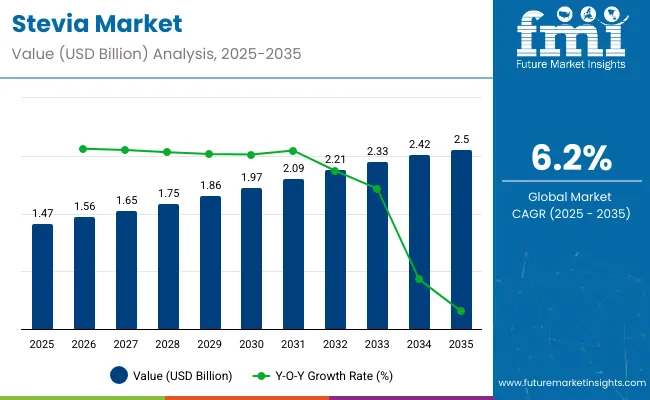

The global stevia market is set to record a valuation of USD 1.47 billion in 2025 and USD 2.5 billion by 2035. Demand for stevia is projected to register a compound annual growth rate (CAGR) of 6.2% during the forecast period.

The demand for natural, low-calorie sweeteners is being intensified by rising health awareness, increasing incidence of obesity and diabetes, and the implementation of sugar taxation policies across numerous countries. As a result, stevia is being adopted extensively as a plant-derived sugar substitute.

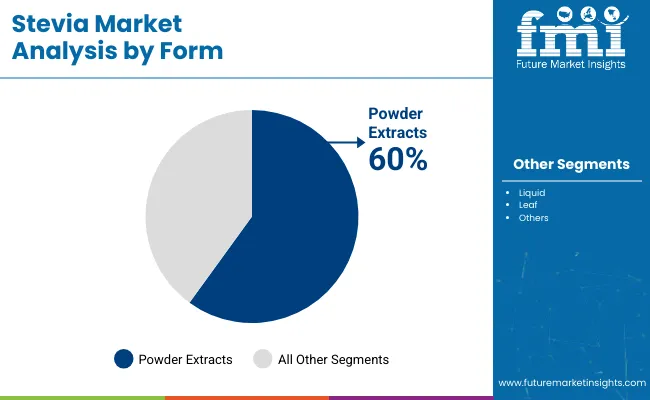

The majority of the market is expected to be dominated by conventional stevia extracts, particularly glycosides such as Rebaudioside A and B, which are being preferred due to their established efficacy and ease of formulation. The powdered extract form is projected to retain the highest share at 60% in 2025, owing to its longer shelf life, improved blendability, and ease of transport.

Most of the global stevia supply is being sourced from Asia Pacific, with China remaining the primary exporter of stevia leaves and extracts. On the consumption front, North America and Western Europe are witnessing high levels of market penetration, driven by food and beverage reformulation trends, clean-label claims, and innovations in natural sweetener systems. Enhanced taste-modulation technologies and the introduction of new glycoside blends (e.g., Reb M and Reb D) are also being deployed to improve consumer acceptance.

The market is being shaped by a moderately consolidated competitive landscape. Strategic investments are being made by key companies into vertical integration--from leaf farming to extract purification-while R&D into novel sweetener systems is being prioritized.

Partnerships between stevia producers and major F&B brands are also being observed, as companies seek to develop tailor-made sugar-reduction solutions. Over the forecast period, the stevia market is expected to be supported by continued innovations in taste, sustainability, and regulatory compliance.

Per capita consumption of stevia varies significantly across different regions, influenced by factors such as dietary preferences, awareness of natural sweeteners, and availability of stevia-based products. In developed countries like the United States, Japan, and parts of Europe, per capita consumption tends to be higher due to greater health consciousness and demand for low-calorie, natural sugar alternatives. Consumers in these regions often use stevia in beverages, food products, and as tabletop sweeteners.

The trade landscape for stevia is dynamic and growing as global demand for natural sweeteners increases. Major stevia-producing countries, including China, Paraguay, and India, export significant volumes of stevia leaves, extracts, and refined products to meet rising international needs. These countries benefit from favorable growing conditions and expanding agricultural capabilities.

Powder extracts are expected to account for approximately 60% of the global stevia market in 2025, with a projected CAGR of 6.5% through 2035. This segment has been positioned as the cornerstone of commercial stevia applications due to its favorable stability profile, economic transportability, and compatibility with dry blend formulations.

The segment is being increasingly preferred by F&B manufacturers for bulk applications where solubility, cost control, and long shelf life are critical. Its usage is being intensified in reformulated beverages, snack coatings, tabletop sweeteners, and powdered supplements. Moreover, the flexibility offered in standardizing glycoside content in powder form is enabling tailored solutions for manufacturers addressing regional taste preferences and regulatory limits.

Over the forecast period, R&D efforts are expected to focus on refining taste-masking capabilities and achieving higher purity blends such as Reb M and Reb D in powdered formats, which are considered essential for reducing bitterness and enhancing palatability. Given these functional advantages, the powder extract format is likely to remain the preferred delivery system for industrial-scale stevia integration. Strategic investments in encapsulation and blending technologies are being observed, reinforcing this segment’s central role in enabling clean-label, sugar-reduced food systems globally.

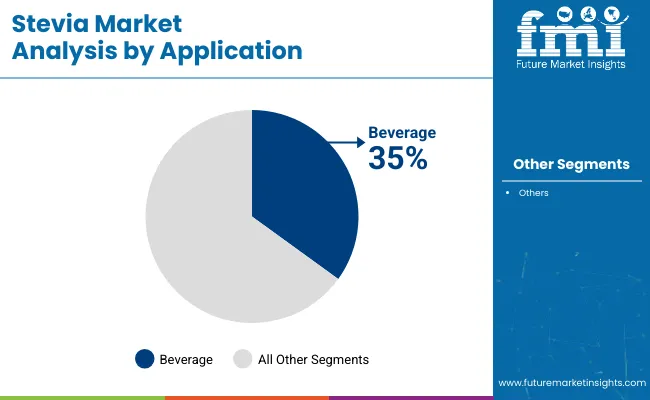

The beverage application segment is projected to hold over 35% of the stevia market by 2025, growing at a steady CAGR of 6.8% through 2035. The segment is being recognized as the principal driver of stevia's global visibility, as sugar taxes and reformulation mandates continue to reshape beverage portfolios.

Beverage manufacturers have been aggressively adopting stevia to deliver zero-calorie, clean-label, and taste-consistent formulations, particularly in carbonated drinks, flavored water, and sports beverages. The evolving consumer demand for health-oriented hydration and sugar-free functionality is placing beverages at the forefront of stevia innovation. High-purity steviol glycosides such as Reb M are being increasingly deployed to balance taste without the need for artificial sweeteners.

Forward integration strategies by ingredient companies into flavor-modulation technologies and hybrid sweetener systems are being focused on beverage-specific challenges like lingering aftertaste and solubility in low-pH environments.

Strategic partnerships with global beverage giants are also being leveraged to pilot customized sweetener solutions aligned with local regulatory frameworks and consumer sensory profiles. As beverage brands continue to prioritize natural positioning and metabolic health alignment, the stevia-beverage synergy is projected to intensify, sustaining this segment’s leadership in market value and R&D activity.

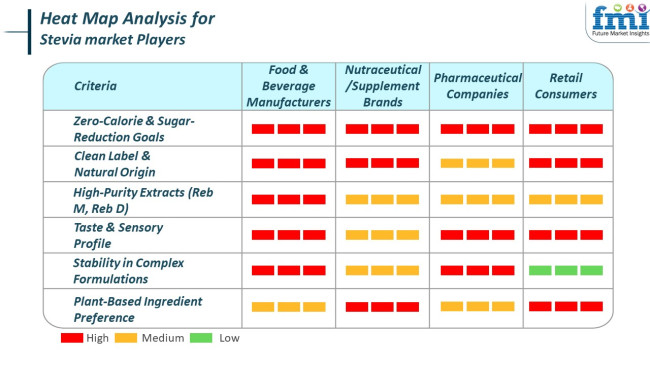

Analysis of stevia consumption trends includes purchasing criteria across key end-user segments. Top demand segments for stevia include food and beverage producers, nutraceutical and dietary supplement manufacturers, pharmaceutical industry players, and retail consumers. The table below shows a heat map of demand generated and estimated across key end-user segments in the industry.

Food and beverage manufacturers generate the highest demand for zero-calorie sweeteners due to rising regulatory and consumer pressure to cut down on added sugars. Key food and beverage companies such as PepsiCo, Nestlé, and Unilever have reformulated several product lines with high-purity stevia extracts such as Reb M and Reb D. Such steps are key to meeting clean-label and calorie-reduction goals.

For instance, PepsiCo uses it in Gatorade Zero and Lipton Diet Iced Tea. Besides this, a shift in the use of food and beverage sweeteners is growing with consumer demand for natural, low-calorie beverages. Also, integration in yogurt, baked goods, flavoured waters, and dairy-free alternatives shows its adaptability across diverse formulations. In addition to this, cross-innovation opportunities arise between the sugar beet pectin market and the stevia market for sugar-free formulations.

The nutraceutical and dietary supplement industry is another key end user. Health-focused brands increasingly depend on it to sweeten protein powders, gummies, and functional beverages without adding unnecessary sugars. Producers also continue to expand relevance in health-driven categories, similar to players in sugar-based excipients market. In addition, brands like GNC and Optimum Nutrition promote stevia for weight management and post-workout formulations due to its non-glycemic and natural origin attributes. As a result, it aligns with consumer preferences for plant-based ingredients in wellness products.

Pharmaceutical segment sees a differentiated use case of stevia. Demand is rising for oral syrups, chewable tablets, and pediatric supplements. Besides this, non-cariogenic and heat-stable properties make it ideal for applications where sugar is unsuitable. Such properties particularly help diabetic and dental-sensitive formulations. In addition to this, demand for tabletop stevia sweeteners, liquid drops, and baking blends continues to surge among retail consumers. Leading brands like Truvia and SweetLeaf are gaining household traction by offering convenient, natural sugar substitutes.

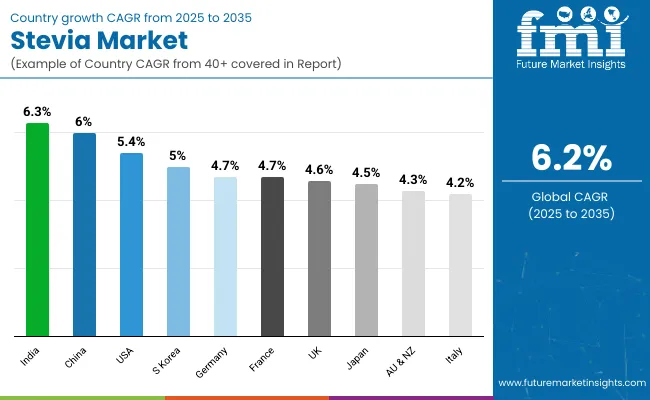

The stevia industry study identifies top trends across 30+ countries. Stevia producers operating in top opportunist countries can identify key strategies based on extraction, production, consumption, demand, and adoption trends of stevia. India is the fastest-growing stevia market, followed by China. The chart below draws focus on the growth potential of the top ten stevia markets during the forecast period.

The stevia industry in the United States, with a CAGR growth of 5.4% during the 2025 to 2035 period, is spearheaded by well-established food and beverage sectors, along with rising consumer interest in natural and non-GMO content. Federal healthcare policies and the FDA further fuel the sugar-reduction demand. Branded high-profile companies such as Cargill (Truvia), PureCircle (Ingredion subsidiary), and GLG Life Tech are industry leaders, driving high-purity steviol glycosides development. Heavy investment in product diversification in stevia application in carbonated drinks, dairy, and plant-based foods reflects the depth of use. Effective distribution channels and collaborations with international F&B companies solidify the USA's position as a global leader in the stevia industry.

With a 4.6% CAGR, the UK stevia market growth is driven by the growing demand for lower-sugar alternatives for beverages, bakery, and breakfast cereals. The UK Soft Drinks Industry Levy (Sugar Tax) has prompted food and beverage companies to use natural sweeteners. Clean-label trends brought about by consumer scrutiny of ingredients enable product innovation. Leaders such as Tate & Lyle and PureCircle lead the uptake in mainstream retail chains. Private-label brands also employ to meet sustainability and wellness objectives. Robust regulatory support and active engagement in EU food innovation initiatives sustain the UK's upward trend.

The stevia market in Germany is growing steadily at a CAGR of 4.7% due to innovative policies by the government that promote natural alternatives to sugar and high consumer health literacy. The country's strong manufacturing base and love for organic, high-quality products have favored the use in dairy, bakery, and nutrition bars. Players like Südzucker AG and German Beneo have developed innovative formulations to be resistant to bitterness and enhance stability. Greater transparency of food labeling and exposure to health-oriented food expos enhance visibility. Germany's EU health policy harmonization and need for sugar tax reform increase appeal and future-proof development.

The industry in France is set to registera 4.4% CAGR. This reflects a cultural shift within a country moving towards gourmet yet healthy consumption. French food culture highly appreciates natural ingredients, and their use is encouraged in high-end desserts, yogurts, and drinks. Strategies by the government to address obesity and reduce sugar intake create institutional backing. Other players, such as Roquette Frères, are leading the research and development with proprietary products and low-calorie baking systems incorporating it. Increased consumer pull for artisan and wellness-supportive formulas increases the consumption of the product. The twin focus in France on gastronomy and wellness continues to shape the European stevia market.

Demand for stevia in Italy grows at 4.2% CAGR, and shifts in preventive wellness and Mediterranean diet conformity drive the Italian stevia market. Stevia is applied extensively in low-sugar gelatos, pastries, and fruit-flavored beverages, satisfying consumers' demands for taste and health. The artisanal nature of the Italian food industry is changing to accommodate contemporary health trends, with companies like Giulio Grossi leading with high-purity stevia extracts. Public health initiatives against excessive sugar intake promoted by government support also propel demand. Italy's vibrant food retailing industry and emerging health food startups have increased Stevia's reach in different demographic groups.

Consumption of stevia in South Korea is set to grow at a 5% CAGR during the forecast period. K-beauty and well-food success overflows to beverage and meal replacers through its use. The top players, such as CJ CheilJedang and Daepyung Co., use stevia in food products catering to calorie- and diabetic customers. The government's dietary guide to sugar consumption and the food labeling reform momentum support the industry. Stevia is being increasingly combined with probiotics and botanicals to form value-added products that are appropriate for South Korea's health-conscious consumers and urbanized retail environment.

Japan's stevia market expands at a 4.5% CAGR under the impact of advanced consumer behavior and a robust R&D environment. The market is focused on functional beverages, processed foods, and dietary supplements that are enriched with highly purified steviol glycosides. Companies such as Mitsubishi Corporation and Morita Kagaku Kogyo are creating advanced blends to remove bitterness and improve solubility. Demographics in Japan, such as aging and managing chronic conditions, are conducive to the acceptance of low-calorie, diabetic foods. Nutritional government campaigns and multi-sector alliances provide industry players with an opportunity in the health-oriented food innovation market in Japan.

China's stevia market is expected to grow with a strong CAGR of 6.0%, bolstered by government support for sugar reduction and urbanization, for the demand for healthy food packaged. China is one of the world's largest producers, and industry titans such as GLG Life Tech and Qufu Xiangzhou are well-placed in cultivation and extraction technology. Low production costs in the market and vertical integration enable bulk export as well as affordable domestic use. Stevia's use as a food ingredient for beverages, milk, and sauce is growing at a consistent pace. Strategic policy initiatives under Healthy China 2030 also further encourage the use of high-end food reformulation ingredients.

Growing at a rate of 4.3% CAGR, the Australia-New Zealand stevia market is passing through wellness branding and clean-label innovation. The two countries have high rates of incidence of lifestyle disease, which fuels health-conscious consumption. Sugar replacement demand is most robust in children's nutrition, sports drinks, and plant food applications. Firms like Naturally Sweet Products and BioVittoria are riding this wave by providing high-quality stevia for domestic consumption and export. Regulators openly encourage food reformulation efforts, and supermarket retail chains sell stevia-filled SKUs prominently. Industry cooperation across sectors is also causing the industry to gain traction in conventional applications such as herbal teas and pet foods.

India takes the lead in growth through a CAGR of 6.3% due to growing health problems caused by excessive sugar intake, such as obesity and diabetes. Government FSSAI Eat Right movement and GST-exempt status for extracts further aid producers and consumers. Sugar-free SKUs are in the lead and are seeing growth in India's food and beverage market, especially traditional Indian sweets, snacks, and drinks. Stevia World Agrotech, Zindagi, and NutraSweet Natural Products are scaling up and resorting to awareness drives. Ayurvedic unification with modern nutrition in India offers global innovation a distinct edge.

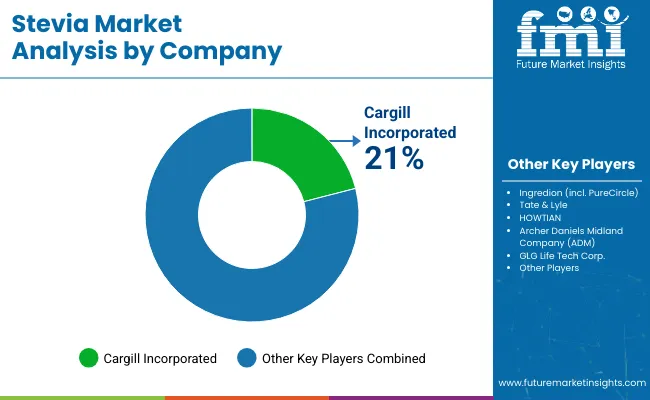

The stevia industry study reports market concentration of Tier 1, Tier 2, and Tier 3 players. Tier 1 players such as Cargill and Ingredion lead the market, though at a lower margin gap from another player. On the other hand, Tier 2 and Tier 3 players look at emerging end-use segments of stevia.

Market analysts see stevia as a rapidly-growing segment with consumer-driven innovation despite being regulation sensitive. As food and beverage manufacturers adopt stevia-based formulations, research and development efforts increase significantly in the industry.

The chart based on share analysis of key stevia companies below shows the fragmented landscape with Cargill Inc. holding a significant position. Threats from emerging stevia producers are high as these players compete to meet application-, product-, and regional-based demands.

The stevia market share in 2025 reflects significant consolidation among top stevia manufacturers, with major global companies like Cargill, Ingredion (which owns PureCircle), and Tate & Lyle holding top positions. High-level technological capabilities, vertical integration along production stages, and strong collaborations with global industry players in the food & beverage segment define the competitive landscape. This segmentation of the stevia market by company captures essential analysis for stakeholders involved with the industry, where strategic investment and expansion take center stage.

Cargill retains leadership among leading stevia players with innovation in fermentation-based stevia extracts, specifically glucose-free and Reb-M glycosides. Ingredion, considerably bolstered by the PureCircle acquisition, grew very fast in developing markets, especially in Latin America and also Asia Pacific. Tailored sweetness profiles to suit local tastes place Ingredion firmly in the global competitive arena. Tate & Lyle spearheads the clean-label innovation movement, integrating it into varied sugar reduction strategies across bakery, dairy and functional beverages categories.

HOWTIAN, China's leading exporter of plant-derived ingredients, capitalizes on widespread agri-control to produce glycosides affordably. Archer Daniels Midland Company (ADM) proactively broadens the application of its products by specifically developing research and development on sweetener substitutes, with a focus on taste modification methods in nutraceutical and health-focused markets. Strategic alliances promote competitiveness in this industry. Ingredion works closely with global flavor houses to optimize sweetness profiles, whereas Cargill collaborates on joint development initiatives with cutting-edge food-tech startups. Tate & Lyle sponsors initiatives in precision nutrition.

Development in the stevia industry is highly dependent on the accuracy refinement of glycosides, i.e., Reb M and Reb D. Both substances accurately mimic the sweetness profile of conventional sugar with very little bitterness. Industry players favor cutting-edge production methods, using biosynthesis and enzymatic conversion to produce cleaner, scalable glycoside production. Efficient production techniques have a direct impact on adoption across various product forms, such as powders, granules and liquid extracts.

Regulatory approval continues to be a key to market growth. Regular approval by leading agencies like the FDA (United States), EFSA (European Union) and regulatory bodies in China and India makes international market acceptance easier. Compliance with changing regulatory approvals by region continues to ensure ongoing growth and worldwide market penetration. In addition, quantifiable sustainability measures like lower water usage, sustainable land use, and low-carbon manufacturing increasingly drive market differentiation. Stevia manufacturers' increased commitment towards sustainability raises demand for eco-friendly production. Businesses leading in innovation, sustainable sourcing, compliance and application support are set to capture the future growth in the Stevia Market Share Analysis Report.

Market dynamics play a key role in Stevia's demand analysis through a thorough assessment of growth factors, challenges, opportunities, and threats. Key growth drivers directly influence the revenue generated by stevia suppliers, while challenges offset or slow down the industry from realizing its true revenue potential. In this section, analysts suggest key opportunities, threats, drivers, and challenges for players to take calculated risks while planning their next move to grow in the stevia market during the forecast period.

The stevia market is picking up strong momentum, driven by mounting health consciousness and consumers' demand for clean, natural food. The trend has also propelled growth in the natural sweeteners market, with food and beverage manufacturers reaching out to stevia in an effort to reduce sugar without sacrificing taste. Stevia market trends in 2025 support robust alignment with customers' need for zero-calorie products, further pushing it into the mainstream.

Using stevia demand forecasts, firms are expanding production and investment in application versatility and taste profile modification. Drivers within the industry have an attractive potential for innovation and growth in Stevia, particularly for decision-makers considering long-term investment in the Stevia supply chain.

Drivers and barriers to market growth are marked by significant issues impacting more extensive industry uptake. One major issue is taste perception, in that some extracts have been shown to leave a bitter aftertaste, which affects product acceptance. At the same time, the stevia regulatory landscape poses multi-faced challenges, most significantly for companies expanding operations to cross-global markets with varying standards of compliance.

Second, issues of farm yield volatility and processing limitations can impact operational efficiency in stevia production. Stevia market entry barriers and the need for special consumer education in emerging markets further compound these. Decision-makers must navigate these while providing innovation, compliance, and consumer trust.

Industry prospects indicate stevia export opportunities and expansion into new product categories. Advances are opening the door for greater use in pharmaceuticals, dietary supplements, and personal care products, revealing stevia investment opportunities for value chain players.

Emerging growth markets in Asia-Pacific and Latin America are becoming ideal hotspots for demand. Since mature regulatory systems provide consolidated supply chains, these markets provide the best opportunities for strategic development. Moreover, extraction and formulation technologies become more advanced to focus on stevia technological advancements that enhance use flexibility and minimize bitterness, increasing the appeal of the product among high-growth markets.

The stevia industry remains exposed to external threats that can challenge its long-term growth. Increased stevia competitive landscape pressures come from other natural sweeteners like monk fruit and sugar alcohols, which can shift buyer preferences. Additionally, stevia pricing trends are influenced by shortages in raw materials or geopolitical factors in planting and transporting stevia.

Climate change and environmental uncertainty affect the world's stevia supply chain management, especially for countries heavily relying on stevia cultivation. Finally, misleading data or mistrust from consumers over natural sweeteners shapes market forces, and companies hence have to undertake transparent marketing and regulation adherence.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 1.47 billion |

| Projected Market Size (2035) | USD 2.5 billion |

| CAGR (2025 to 2035) | 6.2% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and kilotons for volume |

| Product Types Analyzed (Segment 1) | Conventional, Unconventional |

| Forms Analyzed (Segment 2) | Powder Extract, Liquid, Leaf |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; Middle East & Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, ANZ, GCC Countries, South Africa |

| Key Players influencing the Stevia Market | Cargill, Incorporated, Ingredion (incl. PureCircle), Tate & Lyle, HOWTIAN, Archer Daniels Midland Company (ADM), GLG Life Tech Corp., Evolva Holding SA, Stevia First Corporation, Jianlong Biotechnology Co., Ltd, Morita Kagaku Kogyo Co., Ltd. |

| Additional Attributes | Dollar sales by product type (conventional vs unconventional), Dollar sales by form (powder, liquid, leaf), Trends in sugar reduction and clean-label adoption, Use of Reb-A and Reb-B glycosides in beverages and supplements, Growth of functional beverage and nutraceutical applications, Regional patterns of stevia ingredient formulation |

| Customization and Pricing | Customization and Pricing Available on Request |

The industry is segmented into conventional and unconventional.

The market is studied by key categories on the basis of powder extract, liquid, and leaf.

The market is segmented into North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Central Asia, Russia, Belarus, and the Middle East & Africa.

The global market is expected to reach USD 2.5 billion by 2035, growing from USD 1.47 billion in 2025, at a CAGR of 6.2% during the forecast period.

The powder extract segment holds the largest share, accounting for approximately 60% of the market in 2025, driven by its stability, versatility, and compatibility with various food and beverage formulations.

The beverage segment is the largest contributor, slated to hold over 35% market share by 2035, fueled by rising demand for zero-calorie and clean-label drinks in response to sugar taxes and consumer health trends.

Key drivers include increasing consumer demand for natural and low-calorie sweeteners, rising incidence of obesity and diabetes, regulatory pressure from sugar taxes, and continuous innovation in high-purity steviol glycoside blends that improve taste and formulation flexibility.

Top companies include Cargill, Incorporated; Ingredion (including PureCircle); Tate & Lyle; HOWTIAN; Archer Daniels Midland Company (ADM); GLG Life Tech Corp.; Evolva Holding SA; Stevia First Corporation; Jianlong Biotechnology Co., Ltd.; and Morita Kagaku Kogyo Co., Ltd.

Table 1: Global Market Value (US$ million) Forecast by Region, 2019 to 2034

Table 2: Global Market Volume (MT) Forecast by Region, 2019 to 2034

Table 3: Global Market Value (US$ million) Forecast by Form, 2019 to 2034

Table 4: Global Market Volume (MT) Forecast by Form, 2019 to 2034

Table 5: Global Market Value (US$ million) Forecast by Product Type, 2019 to 2034

Table 6: Global Market Volume (MT) Forecast by Product Type, 2019 to 2034

Table 7: Global Market Value (US$ million) Forecast by Label, 2019 to 2034

Table 8: Global Market Volume (MT) Forecast by Label, 2019 to 2034

Table 9: Global Market Value (US$ million) Forecast by End Use Application, 2019 to 2034

Table 10: Global Market Volume (MT) Forecast by End Use Application, 2019 to 2034

Table 11: North America Market Value (US$ million) Forecast by Country, 2019 to 2034

Table 12: North America Market Volume (MT) Forecast by Country, 2019 to 2034

Table 13: North America Market Value (US$ million) Forecast by Form, 2019 to 2034

Table 14: North America Market Volume (MT) Forecast by Form, 2019 to 2034

Table 15: North America Market Value (US$ million) Forecast by Product Type, 2019 to 2034

Table 16: North America Market Volume (MT) Forecast by Product Type, 2019 to 2034

Table 17: North America Market Value (US$ million) Forecast by Label, 2019 to 2034

Table 18: North America Market Volume (MT) Forecast by Label, 2019 to 2034

Table 19: North America Market Value (US$ million) Forecast by End Use Application, 2019 to 2034

Table 20: North America Market Volume (MT) Forecast by End Use Application, 2019 to 2034

Table 21: Latin America Market Value (US$ million) Forecast by Country, 2019 to 2034

Table 22: Latin America Market Volume (MT) Forecast by Country, 2019 to 2034

Table 23: Latin America Market Value (US$ million) Forecast by Form, 2019 to 2034

Table 24: Latin America Market Volume (MT) Forecast by Form, 2019 to 2034

Table 25: Latin America Market Value (US$ million) Forecast by Product Type, 2019 to 2034

Table 26: Latin America Market Volume (MT) Forecast by Product Type, 2019 to 2034

Table 27: Latin America Market Value (US$ million) Forecast by Label, 2019 to 2034

Table 28: Latin America Market Volume (MT) Forecast by Label, 2019 to 2034

Table 29: Latin America Market Value (US$ million) Forecast by End Use Application, 2019 to 2034

Table 30: Latin America Market Volume (MT) Forecast by End Use Application, 2019 to 2034

Table 31: Europe Market Value (US$ million) Forecast by Country, 2019 to 2034

Table 32: Europe Market Volume (MT) Forecast by Country, 2019 to 2034

Table 33: Europe Market Value (US$ million) Forecast by Form, 2019 to 2034

Table 34: Europe Market Volume (MT) Forecast by Form, 2019 to 2034

Table 35: Europe Market Value (US$ million) Forecast by Product Type, 2019 to 2034

Table 36: Europe Market Volume (MT) Forecast by Product Type, 2019 to 2034

Table 37: Europe Market Value (US$ million) Forecast by Label, 2019 to 2034

Table 38: Europe Market Volume (MT) Forecast by Label, 2019 to 2034

Table 39: Europe Market Value (US$ million) Forecast by End Use Application, 2019 to 2034

Table 40: Europe Market Volume (MT) Forecast by End Use Application, 2019 to 2034

Table 41: East Asia Market Value (US$ million) Forecast by Country, 2019 to 2034

Table 42: East Asia Market Volume (MT) Forecast by Country, 2019 to 2034

Table 43: East Asia Market Value (US$ million) Forecast by Form, 2019 to 2034

Table 44: East Asia Market Volume (MT) Forecast by Form, 2019 to 2034

Table 45: East Asia Market Value (US$ million) Forecast by Product Type, 2019 to 2034

Table 46: East Asia Market Volume (MT) Forecast by Product Type, 2019 to 2034

Table 47: East Asia Market Value (US$ million) Forecast by Label, 2019 to 2034

Table 48: East Asia Market Volume (MT) Forecast by Label, 2019 to 2034

Table 49: East Asia Market Value (US$ million) Forecast by End Use Application, 2019 to 2034

Table 50: East Asia Market Volume (MT) Forecast by End Use Application, 2019 to 2034

Table 51: South Asia Market Value (US$ million) Forecast by Country, 2019 to 2034

Table 52: South Asia Market Volume (MT) Forecast by Country, 2019 to 2034

Table 53: South Asia Market Value (US$ million) Forecast by Form, 2019 to 2034

Table 54: South Asia Market Volume (MT) Forecast by Form, 2019 to 2034

Table 55: South Asia Market Value (US$ million) Forecast by Product Type, 2019 to 2034

Table 56: South Asia Market Volume (MT) Forecast by Product Type, 2019 to 2034

Table 57: South Asia Market Value (US$ million) Forecast by Label, 2019 to 2034

Table 58: South Asia Market Volume (MT) Forecast by Label, 2019 to 2034

Table 59: South Asia Market Value (US$ million) Forecast by End Use Application, 2019 to 2034

Table 60: South Asia Market Volume (MT) Forecast by End Use Application, 2019 to 2034

Table 61: Oceania Market Value (US$ million) Forecast by Country, 2019 to 2034

Table 62: Oceania Market Volume (MT) Forecast by Country, 2019 to 2034

Table 63: Oceania Market Value (US$ million) Forecast by Form, 2019 to 2034

Table 64: Oceania Market Volume (MT) Forecast by Form, 2019 to 2034

Table 65: Oceania Market Value (US$ million) Forecast by Product Type, 2019 to 2034

Table 66: Oceania Market Volume (MT) Forecast by Product Type, 2019 to 2034

Table 67: Oceania Market Value (US$ million) Forecast by Label, 2019 to 2034

Table 68: Oceania Market Volume (MT) Forecast by Label, 2019 to 2034

Table 69: Oceania Market Value (US$ million) Forecast by End Use Application, 2019 to 2034

Table 70: Oceania Market Volume (MT) Forecast by End Use Application, 2019 to 2034

Table 71: Middle East and Africa Market Value (US$ million) Forecast by Country, 2019 to 2034

Table 72: Middle East and Africa Market Volume (MT) Forecast by Country, 2019 to 2034

Table 73: Middle East and Africa Market Value (US$ million) Forecast by Form, 2019 to 2034

Table 74: Middle East and Africa Market Volume (MT) Forecast by Form, 2019 to 2034

Table 75: Middle East and Africa Market Value (US$ million) Forecast by Product Type, 2019 to 2034

Table 76: Middle East and Africa Market Volume (MT) Forecast by Product Type, 2019 to 2034

Table 77: Middle East and Africa Market Value (US$ million) Forecast by Label, 2019 to 2034

Table 78: Middle East and Africa Market Volume (MT) Forecast by Label, 2019 to 2034

Table 79: Middle East and Africa Market Value (US$ million) Forecast by End Use Application, 2019 to 2034

Table 80: Middle East and Africa Market Volume (MT) Forecast by End Use Application, 2019 to 2034

Figure 1: Global Market Value (US$ million) by Product Type, 2024 to 2034

Figure 2: Global Market Value (US$ million) by Form, 2024 to 2034

Figure 3: Global Market Value (US$ million) by Label, 2024 to 2034

Figure 4: Global Market Value (US$ million) by End Use Application, 2024 to 2034

Figure 5: Global Market Value (US$ million) by Region, 2024 to 2034

Figure 6: Global Market Value (US$ million) Analysis by Region, 2019 to 2034

Figure 7: Global Market Volume (MT) Analysis by Region, 2019 to 2034

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 10: Global Market Value (US$ million) Analysis by Product Type, 2019 to 2034

Figure 11: Global Market Volume (MT) Analysis by Product Type, 2019 to 2034

Figure 12: Global Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 13: Global Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 14: Global Market Value (US$ million) Analysis by Form, 2019 to 2034

Figure 15: Global Market Volume (MT) Analysis by Form, 2019 to 2034

Figure 16: Global Market Value Share (%) and BPS Analysis by Form, 2024 to 2034

Figure 18: Global Market Y-o-Y Growth (%) Projections by Form, 2024 to 2034

Figure 18: Global Market Value (US$ million) Analysis by Label, 2019 to 2034

Figure 19: Global Market Volume (MT) Analysis by Label, 2019 to 2034

Figure 20: Global Market Value Share (%) and BPS Analysis by Label, 2024 to 2034

Figure 22: Global Market Y-o-Y Growth (%) Projections by Label, 2024 to 2034

Figure 23: Global Market Value (US$ million) Analysis by End Use Application, 2019 to 2034

Figure 23: Global Market Volume (MT) Analysis by End Use Application, 2019 to 2034

Figure 24: Global Market Value Share (%) and BPS Analysis by End Use Application, 2024 to 2034

Figure 25: Global Market Y-o-Y Growth (%) Projections by End Use Application, 2024 to 2034

Figure 26: Global Market Attractiveness by Product Type, 2024 to 2034

Figure 27: Global Market Attractiveness by Form, 2024 to 2034

Figure 28: Global Market Attractiveness by Label, 2024 to 2034

Figure 29: Global Market Attractiveness by End Use Application, 2024 to 2034

Figure 30: Global Market Attractiveness by Region, 2024 to 2034

Figure 31: North America Market Value (US$ million) by Product Type, 2024 to 2034

Figure 33: North America Market Value (US$ million) by Form, 2024 to 2034

Figure 33: North America Market Value (US$ million) by Label, 2024 to 2034

Figure 34: North America Market Value (US$ million) by End Use Application, 2024 to 2034

Figure 35: North America Market Value (US$ million) by Country, 2024 to 2034

Figure 36: North America Market Value (US$ million) Analysis by Country, 2019 to 2034

Figure 37: North America Market Volume (MT) Analysis by Country, 2019 to 2034

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 40: North America Market Value (US$ million) Analysis by Product Type, 2019 to 2034

Figure 41: North America Market Volume (MT) Analysis by Product Type, 2019 to 2034

Figure 42: North America Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 43: North America Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 44: North America Market Value (US$ million) Analysis by Form, 2019 to 2034

Figure 45: North America Market Volume (MT) Analysis by Form, 2019 to 2034

Figure 46: North America Market Value Share (%) and BPS Analysis by Form, 2024 to 2034

Figure 47: North America Market Y-o-Y Growth (%) Projections by Form, 2024 to 2034

Figure 48: North America Market Value (US$ million) Analysis by Label, 2019 to 2034

Figure 49: North America Market Volume (MT) Analysis by Label, 2019 to 2034

Figure 50: North America Market Value Share (%) and BPS Analysis by Label, 2024 to 2034

Figure 51: North America Market Y-o-Y Growth (%) Projections by Label, 2024 to 2034

Figure 52: North America Market Value (US$ million) Analysis by End Use Application, 2019 to 2034

Figure 53: North America Market Volume (MT) Analysis by End Use Application, 2019 to 2034

Figure 54: North America Market Value Share (%) and BPS Analysis by End Use Application, 2024 to 2034

Figure 55: North America Market Y-o-Y Growth (%) Projections by End Use Application, 2024 to 2034

Figure 56: North America Market Attractiveness by Product Type, 2024 to 2034

Figure 57: North America Market Attractiveness by Form, 2024 to 2034

Figure 58: North America Market Attractiveness by Label, 2024 to 2034

Figure 59: North America Market Attractiveness by End Use Application, 2024 to 2034

Figure 60: North America Market Attractiveness by Country, 2024 to 2034

Figure 61: Latin America Market Value (US$ million) by Product Type, 2024 to 2034

Figure 62: Latin America Market Value (US$ million) by Form, 2024 to 2034

Figure 63: Latin America Market Value (US$ million) by Label, 2024 to 2034

Figure 64: Latin America Market Value (US$ million) by End Use Application, 2024 to 2034

Figure 65: Latin America Market Value (US$ million) by Country, 2024 to 2034

Figure 66: Latin America Market Value (US$ million) Analysis by Country, 2019 to 2034

Figure 67: Latin America Market Volume (MT) Analysis by Country, 2019 to 2034

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 70: Latin America Market Value (US$ million) Analysis by Product Type, 2019 to 2034

Figure 71: Latin America Market Volume (MT) Analysis by Product Type, 2019 to 2034

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 74: Latin America Market Value (US$ million) Analysis by Form, 2019 to 2034

Figure 75: Latin America Market Volume (MT) Analysis by Form, 2019 to 2034

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Form, 2024 to 2034

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Form, 2024 to 2034

Figure 78: Latin America Market Value (US$ million) Analysis by Label, 2019 to 2034

Figure 79: Latin America Market Volume (MT) Analysis by Label, 2019 to 2034

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Label, 2024 to 2034

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Label, 2024 to 2034

Figure 82: Latin America Market Value (US$ million) Analysis by End Use Application, 2019 to 2034

Figure 83: Latin America Market Volume (MT) Analysis by End Use Application, 2019 to 2034

Figure 84: Latin America Market Value Share (%) and BPS Analysis by End Use Application, 2024 to 2034

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by End Use Application, 2024 to 2034

Figure 86: Latin America Market Attractiveness by Product Type, 2024 to 2034

Figure 87: Latin America Market Attractiveness by Form, 2024 to 2034

Figure 88: Latin America Market Attractiveness by Label, 2024 to 2034

Figure 89: Latin America Market Attractiveness by End Use Application, 2024 to 2034

Figure 90: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 91: Europe Market Value (US$ million) by Product Type, 2024 to 2034

Figure 92: Europe Market Value (US$ million) by Form, 2024 to 2034

Figure 93: Europe Market Value (US$ million) by Label, 2024 to 2034

Figure 94: Europe Market Value (US$ million) by End Use Application, 2024 to 2034

Figure 95: Europe Market Value (US$ million) by Country, 2024 to 2034

Figure 96: Europe Market Value (US$ million) Analysis by Country, 2019 to 2034

Figure 97: Europe Market Volume (MT) Analysis by Country, 2019 to 2034

Figure 98: Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 99: Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 100: Europe Market Value (US$ million) Analysis by Product Type, 2019 to 2034

Figure 101: Europe Market Volume (MT) Analysis by Product Type, 2019 to 2034

Figure 102: Europe Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 103: Europe Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 104: Europe Market Value (US$ million) Analysis by Form, 2019 to 2034

Figure 105: Europe Market Volume (MT) Analysis by Form, 2019 to 2034

Figure 106: Europe Market Value Share (%) and BPS Analysis by Form, 2024 to 2034

Figure 107: Europe Market Y-o-Y Growth (%) Projections by Form, 2024 to 2034

Figure 108: Europe Market Value (US$ million) Analysis by Label, 2019 to 2034

Figure 109: Europe Market Volume (MT) Analysis by Label, 2019 to 2034

Figure 110: Europe Market Value Share (%) and BPS Analysis by Label, 2024 to 2034

Figure 111: Europe Market Y-o-Y Growth (%) Projections by Label, 2024 to 2034

Figure 112: Europe Market Value (US$ million) Analysis by End Use Application, 2019 to 2034

Figure 113: Europe Market Volume (MT) Analysis by End Use Application, 2019 to 2034

Figure 114: Europe Market Value Share (%) and BPS Analysis by End Use Application, 2024 to 2034

Figure 115: Europe Market Y-o-Y Growth (%) Projections by End Use Application, 2024 to 2034

Figure 116: Europe Market Attractiveness by Product Type, 2024 to 2034

Figure 118: Europe Market Attractiveness by Form, 2024 to 2034

Figure 118: Europe Market Attractiveness by Label, 2024 to 2034

Figure 119: Europe Market Attractiveness by End Use Application, 2024 to 2034

Figure 120: Europe Market Attractiveness by Country, 2024 to 2034

Figure 122: East Asia Market Value (US$ million) by Product Type, 2024 to 2034

Figure 123: East Asia Market Value (US$ million) by Form, 2024 to 2034

Figure 123: East Asia Market Value (US$ million) by Label, 2024 to 2034

Figure 124: East Asia Market Value (US$ million) by End Use Application, 2024 to 2034

Figure 125: East Asia Market Value (US$ million) by Country, 2024 to 2034

Figure 126: East Asia Market Value (US$ million) Analysis by Country, 2019 to 2034

Figure 127: East Asia Market Volume (MT) Analysis by Country, 2019 to 2034

Figure 128: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 129: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 130: East Asia Market Value (US$ million) Analysis by Product Type, 2019 to 2034

Figure 131: East Asia Market Volume (MT) Analysis by Product Type, 2019 to 2034

Figure 133: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 133: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 134: East Asia Market Value (US$ million) Analysis by Form, 2019 to 2034

Figure 135: East Asia Market Volume (MT) Analysis by Form, 2019 to 2034

Figure 136: East Asia Market Value Share (%) and BPS Analysis by Form, 2024 to 2034

Figure 137: East Asia Market Y-o-Y Growth (%) Projections by Form, 2024 to 2034

Figure 138: East Asia Market Value (US$ million) Analysis by Label, 2019 to 2034

Figure 139: East Asia Market Volume (MT) Analysis by Label, 2019 to 2034

Figure 140: East Asia Market Value Share (%) and BPS Analysis by Label, 2024 to 2034

Figure 141: East Asia Market Y-o-Y Growth (%) Projections by Label, 2024 to 2034

Figure 142: East Asia Market Value (US$ million) Analysis by End Use Application, 2019 to 2034

Figure 143: East Asia Market Volume (MT) Analysis by End Use Application, 2019 to 2034

Figure 144: East Asia Market Value Share (%) and BPS Analysis by End Use Application, 2024 to 2034

Figure 145: East Asia Market Y-o-Y Growth (%) Projections by End Use Application, 2024 to 2034

Figure 146: East Asia Market Attractiveness by Product Type, 2024 to 2034

Figure 147: East Asia Market Attractiveness by Form, 2024 to 2034

Figure 148: East Asia Market Attractiveness by Label, 2024 to 2034

Figure 149: East Asia Market Attractiveness by End Use Application, 2024 to 2034

Figure 150: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 151: South Asia Market Value (US$ million) by Product Type, 2024 to 2034

Figure 152: South Asia Market Value (US$ million) by Form, 2024 to 2034

Figure 153: South Asia Market Value (US$ million) by Label, 2024 to 2034

Figure 154: South Asia Market Value (US$ million) by End Use Application, 2024 to 2034

Figure 155: South Asia Market Value (US$ million) by Country, 2024 to 2034

Figure 156: South Asia Market Value (US$ million) Analysis by Country, 2019 to 2034

Figure 157: South Asia Market Volume (MT) Analysis by Country, 2019 to 2034

Figure 158: South Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 159: South Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 160: South Asia Market Value (US$ million) Analysis by Product Type, 2019 to 2034

Figure 161: South Asia Market Volume (MT) Analysis by Product Type, 2019 to 2034

Figure 162: South Asia Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 163: South Asia Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 164: South Asia Market Value (US$ million) Analysis by Form, 2019 to 2034

Figure 165: South Asia Market Volume (MT) Analysis by Form, 2019 to 2034

Figure 166: South Asia Market Value Share (%) and BPS Analysis by Form, 2024 to 2034

Figure 167: South Asia Market Y-o-Y Growth (%) Projections by Form, 2024 to 2034

Figure 168: South Asia Market Value (US$ million) Analysis by Label, 2019 to 2034

Figure 169: South Asia Market Volume (MT) Analysis by Label, 2019 to 2034

Figure 180: South Asia Market Value Share (%) and BPS Analysis by Label, 2024 to 2034

Figure 181: South Asia Market Y-o-Y Growth (%) Projections by Label, 2024 to 2034

Figure 182: South Asia Market Value (US$ million) Analysis by End Use Application, 2019 to 2034

Figure 183: South Asia Market Volume (MT) Analysis by End Use Application, 2019 to 2034

Figure 184: South Asia Market Value Share (%) and BPS Analysis by End Use Application, 2024 to 2034

Figure 185: South Asia Market Y-o-Y Growth (%) Projections by End Use Application, 2024 to 2034

Figure 186: South Asia Market Attractiveness by Product Type, 2024 to 2034

Figure 187: South Asia Market Attractiveness by Form, 2024 to 2034

Figure 188: South Asia Market Attractiveness by Label, 2024 to 2034

Figure 189: South Asia Market Attractiveness by End Use Application, 2024 to 2034

Figure 180: South Asia Market Attractiveness by Country, 2024 to 2034

Figure 181: Oceania Market Value (US$ million) by Product Type, 2024 to 2034

Figure 182: Oceania Market Value (US$ million) by Form, 2024 to 2034

Figure 183: Oceania Market Value (US$ million) by Label, 2024 to 2034

Figure 184: Oceania Market Value (US$ million) by End Use Application, 2024 to 2034

Figure 185: Oceania Market Value (US$ million) by Country, 2024 to 2034

Figure 186: Oceania Market Value (US$ million) Analysis by Country, 2019 to 2034

Figure 187: Oceania Market Volume (MT) Analysis by Country, 2019 to 2034

Figure 188: Oceania Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 189: Oceania Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 190: Oceania Market Value (US$ million) Analysis by Product Type, 2019 to 2034

Figure 191: Oceania Market Volume (MT) Analysis by Product Type, 2019 to 2034

Figure 192: Oceania Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 193: Oceania Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 194: Oceania Market Value (US$ million) Analysis by Form, 2019 to 2034

Figure 195: Oceania Market Volume (MT) Analysis by Form, 2019 to 2034

Figure 196: Oceania Market Value Share (%) and BPS Analysis by Form, 2024 to 2034

Figure 197: Oceania Market Y-o-Y Growth (%) Projections by Form, 2024 to 2034

Figure 198: Oceania Market Value (US$ million) Analysis by Label, 2019 to 2034

Figure 199: Oceania Market Volume (MT) Analysis by Label, 2019 to 2034

Figure 200: Oceania Market Value Share (%) and BPS Analysis by Label, 2024 to 2034

Figure 201: Oceania Market Y-o-Y Growth (%) Projections by Label, 2024 to 2034

Figure 202: Oceania Market Value (US$ million) Analysis by End Use Application, 2019 to 2034

Figure 203: Oceania Market Volume (MT) Analysis by End Use Application, 2019 to 2034

Figure 204: Oceania Market Value Share (%) and BPS Analysis by End Use Application, 2024 to 2034

Figure 205: Oceania Market Y-o-Y Growth (%) Projections by End Use Application, 2024 to 2034

Figure 206: Oceania Market Attractiveness by Product Type, 2024 to 2034

Figure 207: Oceania Market Attractiveness by Form, 2024 to 2034

Figure 208: Oceania Market Attractiveness by Label, 2024 to 2034

Figure 209: Oceania Market Attractiveness by End Use Application, 2024 to 2034

Figure 220: Oceania Market Attractiveness by Country, 2024 to 2034

Figure 221: Middle East and Africa Market Value (US$ million) by Product Type, 2024 to 2034

Figure 222: Middle East and Africa Market Value (US$ million) by Form, 2024 to 2034

Figure 223: Middle East and Africa Market Value (US$ million) by Label, 2024 to 2034

Figure 224: Middle East and Africa Market Value (US$ million) by End Use Application, 2024 to 2034

Figure 225: Middle East and Africa Market Value (US$ million) by Country, 2024 to 2034

Figure 226: Middle East and Africa Market Value (US$ million) Analysis by Country, 2019 to 2034

Figure 227: Middle East and Africa Market Volume (MT) Analysis by Country, 2019 to 2034

Figure 228: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 229: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 230: Middle East and Africa Market Value (US$ million) Analysis by Product Type, 2019 to 2034

Figure 231: Middle East and Africa Market Volume (MT) Analysis by Product Type, 2019 to 2034

Figure 233: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 233: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 234: Middle East and Africa Market Value (US$ million) Analysis by Form, 2019 to 2034

Figure 235: Middle East and Africa Market Volume (MT) Analysis by Form, 2019 to 2034

Figure 236: Middle East and Africa Market Value Share (%) and BPS Analysis by Form, 2024 to 2034

Figure 237: Middle East and Africa Market Y-o-Y Growth (%) Projections by Form, 2024 to 2034

Figure 238: Middle East and Africa Market Value (US$ million) Analysis by Label, 2019 to 2034

Figure 239: Middle East and Africa Market Volume (MT) Analysis by Label, 2019 to 2034

Figure 230: Middle East and Africa Market Value Share (%) and BPS Analysis by Label, 2024 to 2034

Figure 231: Middle East and Africa Market Y-o-Y Growth (%) Projections by Label, 2024 to 2034

Figure 233: Middle East and Africa Market Value (US$ million) Analysis by End Use Application, 2019 to 2034

Figure 233: Middle East and Africa Market Volume (MT) Analysis by End Use Application, 2019 to 2034

Figure 234: Middle East and Africa Market Value Share (%) and BPS Analysis by End Use Application, 2024 to 2034

Figure 235: Middle East and Africa Market Y-o-Y Growth (%) Projections by End Use Application, 2024 to 2034

Figure 236: Middle East and Africa Market Attractiveness by Product Type, 2024 to 2034

Figure 237: Middle East and Africa Market Attractiveness by Form, 2024 to 2034

Figure 238: Middle East and Africa Market Attractiveness by Label, 2024 to 2034

Figure 239: Middle East and Africa Market Attractiveness by End Use Application, 2024 to 2034

Figure 240: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Steviacane Market Analysis By Platform, By Application, By Type, and By Region - Forecast from 2025 to 2035

Korea Stevia Market Analysis by Extract, End-use Industry, and Region Through 2035

Organic Stevia Market Analysis by Application in Table Top Sweeteners, Beverages, Dietary Supplement, Confectionary and Others Through 2035

Demand for Stevia in EU Size and Share Forecast Outlook 2025 to 2035

Western Europe Stevia Market Analysis by Extract, End-use Industry, and Country Through 2035

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA