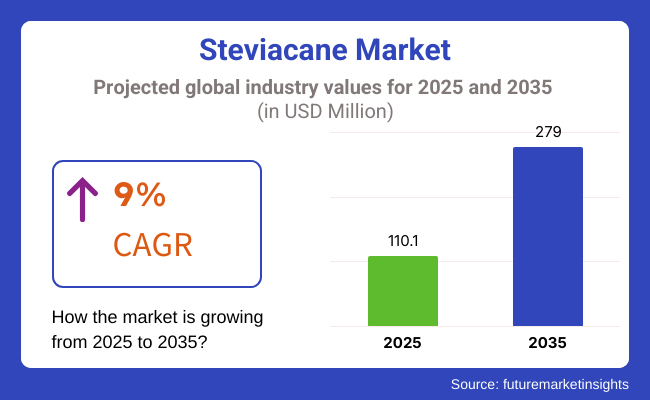

The steviacane market is expected to grow at a compound annual growth rate (CAGR) of 9% over the forecast years. The market is predicted to be worth around USD 110.1 million in 2025 and estimated to exceed USD 279 million by 2035, indicating continuous demand for natural sweeteners.

This increasing intake can be due to the increasing prevalence of diabetes and obesity, in which consumers have become aware of the negative impacts of sugar consumption. Shift towards low-calorie and zero-sugar products, thrusting steviacane (stevia with cane sugar) into the right lail. Its natural roots and low-calorie content appeal to health-aware consumers who want their diets sweet so that they don’t give up deliciousness.

The food and beverage industry has been quick to meet this demand by adding steviacane to a wide range of products. The bakery sector has also embraced stevia-cane to create low-sugar and sugar-free baked goods, meeting consumers' desire to have cleaner and healthier products. The beverage market is similarly adopting stevia-cane in creating wellness and sports drinks free from sugar and enhancing the nutritional profiles while giving the optimum taste that consumers prefer.

As per region, Japan has anticipated steviacane adoption with relatively incremental growth, with steviacane sales expected to grow significantly during the period of forecast. The USA market is expected to increase during the forecast period, with rising health consciousness and a growing prevalence of lifestyle-related diseases.

Germany has impressive opportunities as the consumers are strongly interested in organic & non-GMO products. As promising as the outlook may be, the steviacane market faces its challenges, such as the higher relative cost of producing it compared with regular sugar and the increasing popularity of other natural sweeteners like monk fruit. In addition to this, stevia is sensitive to the environment in which it is grown, which means changes in supply or quality have the potential to throw the market out of balance.

However, ongoing research and development work aims to yield a more streamlined production process, along with a taste profile enhancement of steviacane to allow for wider application in other food and beverage categories.

With manufacturers innovating and diversifying their product offerings and consumers increasingly seeking out alternative, more natural sweeteners, steviacane will soon enjoy great visibility as a mainstream sugar alternative within the greater trend of health and wellness in the food industry.

The steviacane market is expected to grow at a significant rate during the forecast period. Steviacane is used by food and beverage companies to reduce sugar content without sacrificing sweetness or flavor. Health-conscious consumers seek out the condiment due to its natural source and lower glycemic load.

The segments focus on key aspects driving the market for distributing steviacane in bulk and as consumer-friendly products through retail and e-commerce platforms. Bakeries and confectionery brands add it to formulate for clean-label and sugar-free trends. Beverage manufacturers make sodas, juices, and flavored waters with steviacane instead of regular sugar.

Growing concerns about diabetes and obesity drive demand for alternative sweeteners. For appealing to health-minded consumers, brands emphasize product transparency, sustainable sourcing, and organic certification. With more competition, companies spend on innovation and marketing to stand out products and reach more customers.

Between 2020 and 2024, the market saw an increase in demand from health-focused consumers. Such consumers crave natural, low-calorie ways to sweeten. Food and beverage producers worked it into sugarless food products; e-commerce companies disseminated it far and wide. Industry growth was therefore benefitted by regulatory focus on sugar reduction and natural ways to infuse sugar.

From 2025 to 2035, AI-based formulation, sustainable production, and personalized nutrition trends will disrupt the market. Stringent health policies and carbon footprint regulations will encourage companies to innovate. Large food companies will continue to buy up niche brands to enhance their product lines; new growth markets will open in Latin America and Asia.

Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 (Projections) |

|---|---|

| Demand for natural, low-calorie sweeteners increased. | Consumer preference for sugar alternatives will keep rising. |

| Food and beverage companies used Steviacane to reduce sugar while maintaining taste. | AI-driven formulation and advanced blending techniques will enhance sweetness. |

| Bakeries and confectionery brands adopted Steviacane for clean-label and sugar-free trends. | More industries, including dairy and functional foods, will integrate Steviacane. |

| Beverage manufacturers replaced traditional sugar with Steviacane in sodas, juices, and flavored waters. | Growth in plant-based and functional drinks will drive further adoption. |

| E-commerce and retail channels expanded product availability. | Direct-to-consumer sales and subscription models will dominate distribution. |

| Regulations focused on sugar reduction policies and natural ingredient labeling. | Stricter health guidelines and sustainability mandates will shape production. |

| Rise in diabetes and obesity concerns fueled demand for sugar substitutes. | Medical research will further validate Steviacane’s health benefits, boosting its market. |

| Sustainable sourcing and organic certification gained traction. | Carbon footprint labeling and eco-friendly processing will become standard. |

| Competition increased as brands focused on innovation and improved formulations. | Market consolidation may occur as larger companies acquire niche sweetener brands. |

| Increased marketing efforts educated consumers on the benefits of Steviacane. | Personalized nutrition and AI-driven dietary recommendations will influence purchases. |

Steviacane market growth is gaining pace as the demand for natural, low-calorie sweeteners increases. However, costs of production, including the extraction and refining process, are a source of financial difficulty. They'll need to implement cost-efficient manufacturing, precision extraction techniques, and sustainable sourcing.

Supply chain vulnerabilities, including variable stevia crop yields, shortages of raw materials, and challenges in global trade, can disrupt production. Businesses can diversify supplier networks, invest in local farming partnerships, and experiment with alternative sweetener blends.

As a result, evolving consumer preferences and competing sugar substitutes pose risks in the market. Companies need to innovate in better-tasting formulations, functional ingredient combinations, and AI product customization.

Compliance with such regulatory changes, from stricter food labeling laws to sustainability mandates, demands effort on the part of food producers. To further build trust and maintain a strong foothold in the market, it would be important to have transparent labeling, organic certifications, and eco-friendly packaging.

Steviacane comes in liquid and powder forms, and the powdered form is expected to hold the largest market share until 2025. Powdered steviacane is preferred due to its long shelf life, ease of transportation, and suitability with conducive food and beverage applications. It contains no calories while still retaining sweetness without increasing calories; it is an integral component of baked goods, candies, and packaged foods, replacing traditional sugar.

With consumer demand for healthier options growing, manufacturers are now adding powdered steviacane to energy bars, cereals, and low-sugar snacks. This allows the use of powder in food processing, provides product stability, and increases market share. Furthermore, the spike in diabetic-curable protocols and keto-based regimes has significantly fuelled the demand for powdered stevia, be it for household or industrial use. Its ability to cut sugar without losing its taste has made it a popular replacement for companies looking to provide healthful food choices.

In 2025, the beverage industry is likely to be the biggest consumer of steviacane, which is owing to a new trend toward natural sweeteners in sodas, flavored water, and juices. With rising awareness among consumers regarding health issues, beverage companies are now changing artificial sweeteners with steviacane, facilitating clean-label and sugar-free products.

Big beverage companies are changing their product compositions to match healthier trends, offering zero-calorie drinks that taste good. Moreover, functional beverages such as sports drinks and herbal teas use steviacane due to its natural profile and improved flavor retention. Steviacane’s popularity has also been driven by the proliferation of craft beverages and plant-based drinks, including sodas.

As more consumers search for organic and low-glycemic options, demand for steviacane-infused drinks is on the rise. Consequently, beverage manufacturers are progressively using this natural sweetener to fulfill regulatory requirements and to attract health-conscious consumers, accelerating market growth.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 6.9% |

| UK | 6.6% |

| France | 6.4% |

| Germany | 6.8% |

| Italy | 6.3% |

| South Korea | 7% |

| Japan | 6.7% |

| China | 7.4% |

| Australia | 6.2% |

| New Zealand | 6.1% |

The industry is expected to register a CAGR of 6.9% for the period between 2025 and 2035, owing to increasing demand for natural, plant-based sweeteners against the backdrop of the growing health concern regarding sugar consumption. As consumers crave healthier options, food and beverage manufacturers are including steviacane in soft drinks, dairy products, and confectionery.

Industry leaders like Cargill and PureCircle are gaining a competitive edge through new extraction and formulation technologies. Soaring demand for diabetic-friendly and low-calorie food products, along with regulatory backing for sugar reduction initiatives, is prompting manufacturers to incorporate steviacane into their product portfolios.

The industry is estimated to grow by 6.6% between 2025 and 2035, owing to tightening government rules to reduce the intake of sugar and tackle obesity-related issues. The potential to use steviacane in bakery, dairy, and beverage products is being explored by food manufacturers with health-oriented consumers in in mind. In addition, the increasing popularity of plant-based diets and clean-label ingredients is powering adoption.

Moreover, improvements in food processing technology have resulted in better-tasting steviacane-based products with desirable texture properties that are increasingly commonplace in the mainstream food and beverage sector. Various market players are deploying creative marketing campaigns to increase consumer awareness of natural sweeteners.

Given the increasing number of health-conscious consumers looking for sugar alternatives, the industry is expected to surge at a CAGR of 6.4% during the forecast period of 2025 to 2035 in France. The growing demand for clean label products along with organic foods trends are driving food manufacturers to incorporate steviacane in various formulations such as bakery, dairy, and confectionery products.

The presence of a lengthy regulatory framework to support sugar-reduction programs being undertaken in the country has driven its market expansion. Moreover, synergies between research institutions and actors in the food sector are driving innovations in sugar-reduction strategies that render steviacane-based sweeteners more appealing and mainstream.

The industry is estimated to grow at a value of 6.8% CAGR between 2025 and 2035. Strict food labeling laws and increasing consumer demand for reduced-sugar options in soft drinks, energy bars, and dairy alternatives in the country are driving the adoption of steviacane across different applications.

In an effort to address concerns about the aftertaste of some sugar substitutes, companies like Südzucker AG are investing in research and development of products using steviacane to improve taste and formulation. In addition, the focus on functional foods and beverages combined with robust regulatory support for healthier formulations is expected to drive ongoing growth of the market segment in Germany.

The industry is expected to grow at a CAGR of 6.3% from 2025 to 2035 due to increasing demand for healthier sweeteners in traditional foods & beverages. Italian food producers, with a particular focus on premium and artisanal products, are adding steviacane to gelato, pastries, and other confectionery.

They also benefitted due to increasing health consciousness among consumers as well as government support for sugar reduction initiatives, which is driving the growth of the market. Already, as steviacane has become tastier and more functional due to innovations in food technology, it is becoming a more practical sugar alternative in everything from mass-market to specialty food.

The industry in South Korea is projected to witness a CAGR of 7% from 2025 to 2035. The growing diabetic population with the swift adoption of functional ingredients in the food and beverage industry is spurring the demand. As consumers look for healthy, sugar-free alternatives, steviacane has been widely used in teas, soft drinks, and energy drinks.

Beverage manufacturers are investing in new product development to meet changing consumer tastes. Furthermore, the growth of the industry is being bolstered by government initiatives that have encouraged reduced sugar consumption, providing a strong market for steviacane in South Korea.

The industry, led by growing awareness of natural sugar substitutes and high demand for low-calorie food products, is expected to grow at a CAGR of 6.7% between the years 2025 and 2035. Advanced food technology in the country facilitates the creation of steviacane-based sweeteners with improved taste and functionality.

Health-conscious consumers are seeking out cleaner-label products, providing an additional push for market adoption. An increased consumer preference for functional foods and beverages, such as diet soft drinks and sugar-free confectionery, drives industry growth. In addition, its draw for creativity is inspiring new uses for steviacane in both traditional and modern Japanese cuisine.

The industry is expected to witness a CAGR of 7.4% during the years 2025 to 2035 and is one of the rapidly scaling markets across the globe. Growing consumer awareness of health risks associated with sugar consumption is propelling the demand for natural sweeteners. Government regulations that impose strict limits on sugar content in processed foods and beverages in China are motivating manufacturers to implement steviacane.

China is reaching a new level as a global supplier of steviacane-based products, having made substantial investments in production capacity for the domestic and overseas markets. Additional market growth is attributed to the increasing demand for functional and organic foods and beverages.

The Australian industry is projected to expand at a CAGR of 6.2% throughout 2025 to 2035 due to increasing concern about obesity and lifestyle-borne diseases. Demand is also being driven by the growth of the organic food sector and the clean-label movement. Moreover, Australia has a robust food export market, which could allow local steviacane producers to enter the global market.

The industry is forecasted to grow at a CAGR of 6.1% between 2025 and 2035. Food products that are sugar-free and plant-based also seem to be higher in demand within the country, aligning them with global health trends. The expansion of the market is backed by regulation for all-natural sweeteners and clean-label products.

The increasing knowledge regarding diabetes and the healthcare threats associated with obesity is driving consumers to bypass unhealthy options, thus boosting the demand for steviacane for food & beverage applications. In addition, a strong agricultural base and commitment to sustainability are boosting the production of natural sweeteners, leading to innovations adding to the market growth in New Zealand.

The steviacane industry is moderately concentrated, with a handful of such as Imperial Sugar (LDC), PureCircle Ltd., Cargill, Inc., Tate & Lyle PLC, and Ingredion Incorporated dominating the market coupled with small companies.

The industry has high entry costs due to the need for specialized equipment, research and development, and regulatory compliance, all of which act as a barrier to new players entering the market. The industry operates on cutting-edge extraction and processing technologies to maintain product quality and consistency, putting companies with proprietary know-how at an advantage.

Market concentration is also influenced by a lack of regulatory compliance, as marinating the legal maze of food additives and sweeteners that are legally permissible requires significant time and resources. Big corporates have full-fledged teams to look into compliance, but smaller companies often find it difficult to keep up with stringent requirements.

Moreover, they have a different scale of funding or investment opportunities that established companies can leverage to grow their operations, invest in research, and expand their market share as needed. While well-capitalized companies have maintained cheap access to financing, smaller firms do not always have the same ability to raise funding and, therefore, grow.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Cargill Inc. | 20-25% |

| Tate & Lyle PLC | 15-20% |

| Ingredion Incorporated | 12-17% |

| PureCircle Limited | 8-12% |

| Archer Daniels Midland (ADM) | 5-9% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Cargill Inc. | Leading producer of Stevia-based sweeteners, including Steviacane, with a strong focus on sustainability and global distribution. |

| Tate & Lyle PLC | Offers innovative Stevia blends, catering to the food and beverage industry with an emphasis on reduced-calorie solutions. |

| Ingredion Incorporated | Specializes in plant-based sweeteners, including Stevia-Cane sugar blends for healthier alternatives. |

| PureCircle Limited | A pioneer in Stevia extraction and refining, focusing on high-purity Steviacane formulations. |

| Archer Daniels Midland (ADM) | Provides a wide range of natural sweeteners, integrating Stevia into sugar-reduction strategies. |

Key Company Insights

Cargill Inc. (20-25%)

A global leader in food ingredients, Cargill dominates the industry with its innovative, sustainably sourced Stevia-based sweeteners.

Tate & Lyle PLC (15-20%)

Focuses on sugar reduction solutions, offering a variety of Steviacane products that appeal to health-conscious consumers and food manufacturers.

Ingredion Incorporated (12-17%)

A strong competitor in natural sweeteners, Ingredion integrates Stevia and cane sugar blends to optimize taste and functionality.

PureCircle Limited (8-12%)

Known for its advanced Stevia extraction technologies, PureCircle specializes in high-quality, pure Steviacane formulations.

Archer Daniels Midland (ADM) (5-9%)

A major player in agricultural processing and ingredient solutions, ADM is expanding its Stevia-based sweetener offerings.

Other Key Players (30-40% Combined)

By platform, the industry includes supermarkets & hypermarkets, health food stores, online retail, and direct-to-consumer sales.

By application, the industry is divided into food & beverages, pharmaceuticals, and personal care products.

By type, the industry covers liquid Steviacane, powdered Steviacane, and blended Steviacane formulations.

By region, the market spans North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, and the Middle East & Africa (MEA).

The industry is expected to generate USD 110.1 million, driven by increasing demand for natural and low-calorie sweeteners.

The industry is projected to witness strong growth with a valuation of USD 279 million by 2035.

Key players include Cargill Inc., Tate & Lyle PLC, Ingredion Incorporated, PureCircle Limited, Archer Daniels Midland (ADM), GLG Life Tech Corporation, Steviva Brands Inc., Morita Kagaku Kogyo Co., Ltd., Sweet Green Fields, and Zhucheng Haotian Pharm Co., Ltd.

North America and Europe present strong growth opportunities due to increasing health-conscious consumers and regulatory support for sugar alternatives. The Asia-Pacific region is also expanding rapidly due to rising demand for natural sweeteners in food and beverage industries.

Powdered and blended Steviacane formulations dominate the industry due to their widespread use in processed foods, beverages, and pharmaceutical products. The growing trend toward clean-label and plant-based sweeteners is further shaping market demand.

Table 1: Global Market Value (US$ million) Forecast by Region, 2019 to 2034

Table 2: Global Market Volume (MT) Forecast by Region, 2019 to 2034

Table 3: Global Market Value (US$ million) Forecast by Form, 2019 to 2034

Table 4: Global Market Volume (MT) Forecast by Form, 2019 to 2034

Table 5: Global Market Value (US$ million) Forecast by Application, 2019 to 2034

Table 6: Global Market Volume (MT) Forecast by Application, 2019 to 2034

Table 7: Global Market Value (US$ million) Forecast by Nature, 2019 to 2034

Table 8: Global Market Volume (MT) Forecast by Nature, 2019 to 2034

Table 9: North America Market Value (US$ million) Forecast by Country, 2019 to 2034

Table 10: North America Market Volume (MT) Forecast by Country, 2019 to 2034

Table 11: North America Market Value (US$ million) Forecast by Form, 2019 to 2034

Table 12: North America Market Volume (MT) Forecast by Form, 2019 to 2034

Table 13: North America Market Value (US$ million) Forecast by Application, 2019 to 2034

Table 14: North America Market Volume (MT) Forecast by Application, 2019 to 2034

Table 15: North America Market Value (US$ million) Forecast by Nature, 2019 to 2034

Table 16: North America Market Volume (MT) Forecast by Nature, 2019 to 2034

Table 17: Latin America Market Value (US$ million) Forecast by Country, 2019 to 2034

Table 18: Latin America Market Volume (MT) Forecast by Country, 2019 to 2034

Table 19: Latin America Market Value (US$ million) Forecast by Form, 2019 to 2034

Table 20: Latin America Market Volume (MT) Forecast by Form, 2019 to 2034

Table 21: Latin America Market Value (US$ million) Forecast by Application, 2019 to 2034

Table 22: Latin America Market Volume (MT) Forecast by Application, 2019 to 2034

Table 23: Latin America Market Value (US$ million) Forecast by Nature, 2019 to 2034

Table 24: Latin America Market Volume (MT) Forecast by Nature, 2019 to 2034

Table 25: Europe Market Value (US$ million) Forecast by Country, 2019 to 2034

Table 26: Europe Market Volume (MT) Forecast by Country, 2019 to 2034

Table 27: Europe Market Value (US$ million) Forecast by Form, 2019 to 2034

Table 28: Europe Market Volume (MT) Forecast by Form, 2019 to 2034

Table 29: Europe Market Value (US$ million) Forecast by Application, 2019 to 2034

Table 30: Europe Market Volume (MT) Forecast by Application, 2019 to 2034

Table 31: Europe Market Value (US$ million) Forecast by Nature, 2019 to 2034

Table 32: Europe Market Volume (MT) Forecast by Nature, 2019 to 2034

Table 33: East Asia Market Value (US$ million) Forecast by Country, 2019 to 2034

Table 34: East Asia Market Volume (MT) Forecast by Country, 2019 to 2034

Table 35: East Asia Market Value (US$ million) Forecast by Form, 2019 to 2034

Table 36: East Asia Market Volume (MT) Forecast by Form, 2019 to 2034

Table 37: East Asia Market Value (US$ million) Forecast by Application, 2019 to 2034

Table 38: East Asia Market Volume (MT) Forecast by Application, 2019 to 2034

Table 39: East Asia Market Value (US$ million) Forecast by Nature, 2019 to 2034

Table 40: East Asia Market Volume (MT) Forecast by Nature, 2019 to 2034

Table 41: South Asia Market Value (US$ million) Forecast by Country, 2019 to 2034

Table 42: South Asia Market Volume (MT) Forecast by Country, 2019 to 2034

Table 43: South Asia Market Value (US$ million) Forecast by Form, 2019 to 2034

Table 44: South Asia Market Volume (MT) Forecast by Form, 2019 to 2034

Table 45: South Asia Market Value (US$ million) Forecast by Application, 2019 to 2034

Table 46: South Asia Market Volume (MT) Forecast by Application, 2019 to 2034

Table 47: South Asia Market Value (US$ million) Forecast by Nature, 2019 to 2034

Table 48: South Asia Market Volume (MT) Forecast by Nature, 2019 to 2034

Table 49: Oceania Market Value (US$ million) Forecast by Country, 2019 to 2034

Table 50: Oceania Market Volume (MT) Forecast by Country, 2019 to 2034

Table 51: Oceania Market Value (US$ million) Forecast by Form, 2019 to 2034

Table 52: Oceania Market Volume (MT) Forecast by Form, 2019 to 2034

Table 53: Oceania Market Value (US$ million) Forecast by Application, 2019 to 2034

Table 54: Oceania Market Volume (MT) Forecast by Application, 2019 to 2034

Table 55: Oceania Market Value (US$ million) Forecast by Nature, 2019 to 2034

Table 56: Oceania Market Volume (MT) Forecast by Nature, 2019 to 2034

Table 57: Middle East and Africa Market Value (US$ million) Forecast by Country, 2019 to 2034

Table 58: Middle East and Africa Market Volume (MT) Forecast by Country, 2019 to 2034

Table 59: Middle East and Africa Market Value (US$ million) Forecast by Form, 2019 to 2034

Table 60: Middle East and Africa Market Volume (MT) Forecast by Form, 2019 to 2034

Table 61: Middle East and Africa Market Value (US$ million) Forecast by Application, 2019 to 2034

Table 62: Middle East and Africa Market Volume (MT) Forecast by Application, 2019 to 2034

Table 63: Middle East and Africa Market Value (US$ million) Forecast by Nature, 2019 to 2034

Table 64: Middle East and Africa Market Volume (MT) Forecast by Nature, 2019 to 2034

Figure 1: Global Market Value (US$ million) by Form, 2024 to 2034

Figure 2: Global Market Value (US$ million) by Application, 2024 to 2034

Figure 3: Global Market Value (US$ million) by Nature, 2024 to 2034

Figure 4: Global Market Value (US$ million) by Region, 2024 to 2034

Figure 5: Global Market Value (US$ million) Analysis by Region, 2019 to 2034

Figure 6: Global Market Volume (MT) Analysis by Region, 2019 to 2034

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 9: Global Market Value (US$ million) Analysis by Form, 2019 to 2034

Figure 10: Global Market Volume (MT) Analysis by Form, 2019 to 2034

Figure 11: Global Market Value Share (%) and BPS Analysis by Form, 2024 to 2034

Figure 12: Global Market Y-o-Y Growth (%) Projections by Form, 2024 to 2034

Figure 13: Global Market Value (US$ million) Analysis by Application, 2019 to 2034

Figure 14: Global Market Volume (MT) Analysis by Application, 2019 to 2034

Figure 15: Global Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 16: Global Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 17: Global Market Value (US$ million) Analysis by Nature, 2019 to 2034

Figure 18: Global Market Volume (MT) Analysis by Nature, 2019 to 2034

Figure 19: Global Market Value Share (%) and BPS Analysis by Nature, 2024 to 2034

Figure 20: Global Market Y-o-Y Growth (%) Projections by Nature, 2024 to 2034

Figure 21: Global Market Attractiveness by Form, 2024 to 2034

Figure 22: Global Market Attractiveness by Application, 2024 to 2034

Figure 23: Global Market Attractiveness by Nature, 2024 to 2034

Figure 24: Global Market Attractiveness by Region, 2024 to 2034

Figure 25: North America Market Value (US$ million) by Form, 2024 to 2034

Figure 26: North America Market Value (US$ million) by Application, 2024 to 2034

Figure 27: North America Market Value (US$ million) by Nature, 2024 to 2034

Figure 28: North America Market Value (US$ million) by Country, 2024 to 2034

Figure 29: North America Market Value (US$ million) Analysis by Country, 2019 to 2034

Figure 30: North America Market Volume (MT) Analysis by Country, 2019 to 2034

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 33: North America Market Value (US$ million) Analysis by Form, 2019 to 2034

Figure 34: North America Market Volume (MT) Analysis by Form, 2019 to 2034

Figure 35: North America Market Value Share (%) and BPS Analysis by Form, 2024 to 2034

Figure 36: North America Market Y-o-Y Growth (%) Projections by Form, 2024 to 2034

Figure 37: North America Market Value (US$ million) Analysis by Application, 2019 to 2034

Figure 38: North America Market Volume (MT) Analysis by Application, 2019 to 2034

Figure 39: North America Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 40: North America Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 41: North America Market Value (US$ million) Analysis by Nature, 2019 to 2034

Figure 42: North America Market Volume (MT) Analysis by Nature, 2019 to 2034

Figure 43: North America Market Value Share (%) and BPS Analysis by Nature, 2024 to 2034

Figure 44: North America Market Y-o-Y Growth (%) Projections by Nature, 2024 to 2034

Figure 45: North America Market Attractiveness by Form, 2024 to 2034

Figure 46: North America Market Attractiveness by Application, 2024 to 2034

Figure 47: North America Market Attractiveness by Nature, 2024 to 2034

Figure 48: North America Market Attractiveness by Country, 2024 to 2034

Figure 49: Latin America Market Value (US$ million) by Form, 2024 to 2034

Figure 50: Latin America Market Value (US$ million) by Application, 2024 to 2034

Figure 51: Latin America Market Value (US$ million) by Nature, 2024 to 2034

Figure 52: Latin America Market Value (US$ million) by Country, 2024 to 2034

Figure 53: Latin America Market Value (US$ million) Analysis by Country, 2019 to 2034

Figure 54: Latin America Market Volume (MT) Analysis by Country, 2019 to 2034

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 57: Latin America Market Value (US$ million) Analysis by Form, 2019 to 2034

Figure 58: Latin America Market Volume (MT) Analysis by Form, 2019 to 2034

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Form, 2024 to 2034

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Form, 2024 to 2034

Figure 61: Latin America Market Value (US$ million) Analysis by Application, 2019 to 2034

Figure 62: Latin America Market Volume (MT) Analysis by Application, 2019 to 2034

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 65: Latin America Market Value (US$ million) Analysis by Nature, 2019 to 2034

Figure 66: Latin America Market Volume (MT) Analysis by Nature, 2019 to 2034

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Nature, 2024 to 2034

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Nature, 2024 to 2034

Figure 69: Latin America Market Attractiveness by Form, 2024 to 2034

Figure 70: Latin America Market Attractiveness by Application, 2024 to 2034

Figure 71: Latin America Market Attractiveness by Nature, 2024 to 2034

Figure 72: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 73: Europe Market Value (US$ million) by Form, 2024 to 2034

Figure 74: Europe Market Value (US$ million) by Application, 2024 to 2034

Figure 75: Europe Market Value (US$ million) by Nature, 2024 to 2034

Figure 76: Europe Market Value (US$ million) by Country, 2024 to 2034

Figure 77: Europe Market Value (US$ million) Analysis by Country, 2019 to 2034

Figure 78: Europe Market Volume (MT) Analysis by Country, 2019 to 2034

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 81: Europe Market Value (US$ million) Analysis by Form, 2019 to 2034

Figure 82: Europe Market Volume (MT) Analysis by Form, 2019 to 2034

Figure 83: Europe Market Value Share (%) and BPS Analysis by Form, 2024 to 2034

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Form, 2024 to 2034

Figure 85: Europe Market Value (US$ million) Analysis by Application, 2019 to 2034

Figure 86: Europe Market Volume (MT) Analysis by Application, 2019 to 2034

Figure 87: Europe Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 88: Europe Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 89: Europe Market Value (US$ million) Analysis by Nature, 2019 to 2034

Figure 90: Europe Market Volume (MT) Analysis by Nature, 2019 to 2034

Figure 91: Europe Market Value Share (%) and BPS Analysis by Nature, 2024 to 2034

Figure 92: Europe Market Y-o-Y Growth (%) Projections by Nature, 2024 to 2034

Figure 93: Europe Market Attractiveness by Form, 2024 to 2034

Figure 94: Europe Market Attractiveness by Application, 2024 to 2034

Figure 95: Europe Market Attractiveness by Nature, 2024 to 2034

Figure 96: Europe Market Attractiveness by Country, 2024 to 2034

Figure 97: East Asia Market Value (US$ million) by Form, 2024 to 2034

Figure 98: East Asia Market Value (US$ million) by Application, 2024 to 2034

Figure 99: East Asia Market Value (US$ million) by Nature, 2024 to 2034

Figure 100: East Asia Market Value (US$ million) by Country, 2024 to 2034

Figure 101: East Asia Market Value (US$ million) Analysis by Country, 2019 to 2034

Figure 102: East Asia Market Volume (MT) Analysis by Country, 2019 to 2034

Figure 103: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 104: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 105: East Asia Market Value (US$ million) Analysis by Form, 2019 to 2034

Figure 106: East Asia Market Volume (MT) Analysis by Form, 2019 to 2034

Figure 107: East Asia Market Value Share (%) and BPS Analysis by Form, 2024 to 2034

Figure 108: East Asia Market Y-o-Y Growth (%) Projections by Form, 2024 to 2034

Figure 109: East Asia Market Value (US$ million) Analysis by Application, 2019 to 2034

Figure 110: East Asia Market Volume (MT) Analysis by Application, 2019 to 2034

Figure 111: East Asia Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 112: East Asia Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 113: East Asia Market Value (US$ million) Analysis by Nature, 2019 to 2034

Figure 114: East Asia Market Volume (MT) Analysis by Nature, 2019 to 2034

Figure 115: East Asia Market Value Share (%) and BPS Analysis by Nature, 2024 to 2034

Figure 116: East Asia Market Y-o-Y Growth (%) Projections by Nature, 2024 to 2034

Figure 117: East Asia Market Attractiveness by Form, 2024 to 2034

Figure 118: East Asia Market Attractiveness by Application, 2024 to 2034

Figure 119: East Asia Market Attractiveness by Nature, 2024 to 2034

Figure 120: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 121: South Asia Market Value (US$ million) by Form, 2024 to 2034

Figure 122: South Asia Market Value (US$ million) by Application, 2024 to 2034

Figure 123: South Asia Market Value (US$ million) by Nature, 2024 to 2034

Figure 124: South Asia Market Value (US$ million) by Country, 2024 to 2034

Figure 125: South Asia Market Value (US$ million) Analysis by Country, 2019 to 2034

Figure 126: South Asia Market Volume (MT) Analysis by Country, 2019 to 2034

Figure 127: South Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 128: South Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 129: South Asia Market Value (US$ million) Analysis by Form, 2019 to 2034

Figure 130: South Asia Market Volume (MT) Analysis by Form, 2019 to 2034

Figure 131: South Asia Market Value Share (%) and BPS Analysis by Form, 2024 to 2034

Figure 132: South Asia Market Y-o-Y Growth (%) Projections by Form, 2024 to 2034

Figure 133: South Asia Market Value (US$ million) Analysis by Application, 2019 to 2034

Figure 134: South Asia Market Volume (MT) Analysis by Application, 2019 to 2034

Figure 135: South Asia Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 136: South Asia Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 137: South Asia Market Value (US$ million) Analysis by Nature, 2019 to 2034

Figure 138: South Asia Market Volume (MT) Analysis by Nature, 2019 to 2034

Figure 139: South Asia Market Value Share (%) and BPS Analysis by Nature, 2024 to 2034

Figure 140: South Asia Market Y-o-Y Growth (%) Projections by Nature, 2024 to 2034

Figure 141: South Asia Market Attractiveness by Form, 2024 to 2034

Figure 142: South Asia Market Attractiveness by Application, 2024 to 2034

Figure 143: South Asia Market Attractiveness by Nature, 2024 to 2034

Figure 144: South Asia Market Attractiveness by Country, 2024 to 2034

Figure 145: Oceania Market Value (US$ million) by Form, 2024 to 2034

Figure 146: Oceania Market Value (US$ million) by Application, 2024 to 2034

Figure 147: Oceania Market Value (US$ million) by Nature, 2024 to 2034

Figure 148: Oceania Market Value (US$ million) by Country, 2024 to 2034

Figure 149: Oceania Market Value (US$ million) Analysis by Country, 2019 to 2034

Figure 150: Oceania Market Volume (MT) Analysis by Country, 2019 to 2034

Figure 151: Oceania Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 152: Oceania Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 153: Oceania Market Value (US$ million) Analysis by Form, 2019 to 2034

Figure 154: Oceania Market Volume (MT) Analysis by Form, 2019 to 2034

Figure 155: Oceania Market Value Share (%) and BPS Analysis by Form, 2024 to 2034

Figure 156: Oceania Market Y-o-Y Growth (%) Projections by Form, 2024 to 2034

Figure 157: Oceania Market Value (US$ million) Analysis by Application, 2019 to 2034

Figure 158: Oceania Market Volume (MT) Analysis by Application, 2019 to 2034

Figure 159: Oceania Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 160: Oceania Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 161: Oceania Market Value (US$ million) Analysis by Nature, 2019 to 2034

Figure 162: Oceania Market Volume (MT) Analysis by Nature, 2019 to 2034

Figure 163: Oceania Market Value Share (%) and BPS Analysis by Nature, 2024 to 2034

Figure 164: Oceania Market Y-o-Y Growth (%) Projections by Nature, 2024 to 2034

Figure 165: Oceania Market Attractiveness by Form, 2024 to 2034

Figure 166: Oceania Market Attractiveness by Application, 2024 to 2034

Figure 167: Oceania Market Attractiveness by Nature, 2024 to 2034

Figure 168: Oceania Market Attractiveness by Country, 2024 to 2034

Figure 169: Middle East and Africa Market Value (US$ million) by Form, 2024 to 2034

Figure 170: Middle East and Africa Market Value (US$ million) by Application, 2024 to 2034

Figure 171: Middle East and Africa Market Value (US$ million) by Nature, 2024 to 2034

Figure 172: Middle East and Africa Market Value (US$ million) by Country, 2024 to 2034

Figure 173: Middle East and Africa Market Value (US$ million) Analysis by Country, 2019 to 2034

Figure 174: Middle East and Africa Market Volume (MT) Analysis by Country, 2019 to 2034

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 177: Middle East and Africa Market Value (US$ million) Analysis by Form, 2019 to 2034

Figure 178: Middle East and Africa Market Volume (MT) Analysis by Form, 2019 to 2034

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Form, 2024 to 2034

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Form, 2024 to 2034

Figure 181: Middle East and Africa Market Value (US$ million) Analysis by Application, 2019 to 2034

Figure 182: Middle East and Africa Market Volume (MT) Analysis by Application, 2019 to 2034

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 185: Middle East and Africa Market Value (US$ million) Analysis by Nature, 2019 to 2034

Figure 186: Middle East and Africa Market Volume (MT) Analysis by Nature, 2019 to 2034

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by Nature, 2024 to 2034

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by Nature, 2024 to 2034

Figure 189: Middle East and Africa Market Attractiveness by Form, 2024 to 2034

Figure 190: Middle East and Africa Market Attractiveness by Application, 2024 to 2034

Figure 191: Middle East and Africa Market Attractiveness by Nature, 2024 to 2034

Figure 192: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA