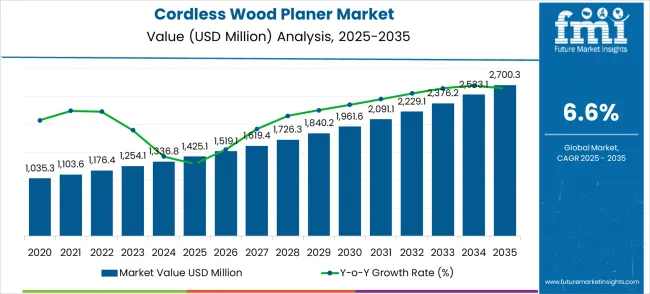

The cordless wood planer market is valued at USD 1,425.1 million in 2025 and is anticipated to reach USD 2,700.3 million by 2035, with a CAGR of 6.6%. From 2021 to 2025, the market is expected to grow from USD 1,035.3 million to USD 1,425.1 million, passing through intermediate values of USD 1,103.6 million, USD 1,176.4 million, USD 1,254.1 million, and USD 1,336.8 million. This early growth phase is driven by increasing demand for portable, battery-operated power tools in construction, woodworking, and DIY markets. Cordless wood planers provide greater mobility, convenience, and ease of use, making them particularly popular among both professionals and hobbyists who require flexibility and efficiency in their operations.

Between 2026 and 2030, the market is expected to continue its upward trajectory, increasing from USD 1,425.1 million to USD 2,091.1 million, passing through intermediate values of USD 1,519.1 million, USD 1,619.4 million, and USD 1,726.3 million. This period exhibits strong growth, driven by advancements in battery technology, ergonomic designs, and lightweight structures, which facilitate wider adoption across various industries, particularly in residential and commercial construction. The increasing focus on sustainable and efficient power tools further accelerates market penetration. By 2030, the market is expected to reach USD 2,229.1 million, driven by continued product innovation and increasing consumer awareness. From 2031 to 2035, the market is projected to grow to USD 2,700.3 million, with intermediate values of USD 2,376.2 million, USD 2,533.1 million, and USD 2,700.3 million, as cordless wood planers gain broader acceptance in global markets.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 1,425 million |

| Forecast Value in (2035F) | USD 2,700.3 million |

| Forecast CAGR (2025 to 2035) | 6.6% |

The power tools market contributes about 30-35%, driven by the growing demand for cordless and portable wood planers in both professional and DIY woodworking. These tools are valued for their convenience and ease of use, allowing users to achieve smooth finishes without the need for a stationary power source. The construction market adds roughly 20-25%, as cordless wood planers are increasingly used in construction sites for wood finishing and surface preparation tasks, where mobility and efficiency are key.

The home improvement and DIY market contributes around 15-18%, driven by the increasing popularity of woodworking and home improvement projects, where consumers are opting for cordless tools for their flexibility and ease of handling. The furniture manufacturing market accounts for approximately 12-15%, as cordless wood planers are utilized for smoothing and shaping wood pieces in the production of furniture and cabinetry. The gardening and landscaping market contributes about 8-10%, with cordless wood planers being used for trimming and shaping wooden elements in outdoor spaces such as decks, fences, and garden structures.

Market expansion is being supported by the increasing consumer preference for portable and convenient woodworking tools that provide freedom of movement without the constraints of power cords and electrical outlets. Modern cordless wood planers offer comparable performance to corded models while providing enhanced mobility for jobsite applications, outdoor projects, and spaces without readily available electrical power. Advances in lithium-ion battery technology have significantly improved runtime, power output, and charging efficiency, making cordless planers viable alternatives for both professional and DIY applications.

The growing popularity of DIY woodworking projects and home renovation activities is driving demand for user-friendly tools that enable homeowners to complete woodworking tasks without professional assistance. Rising disposable incomes, increased home ownership rates, and growing interest in craftsmanship are contributing to expanded consumer participation in woodworking activities. The construction and furniture manufacturing industries are increasingly adopting cordless tools to improve workplace safety, reduce trip hazards, and enhance productivity in environments where cord management is challenging.

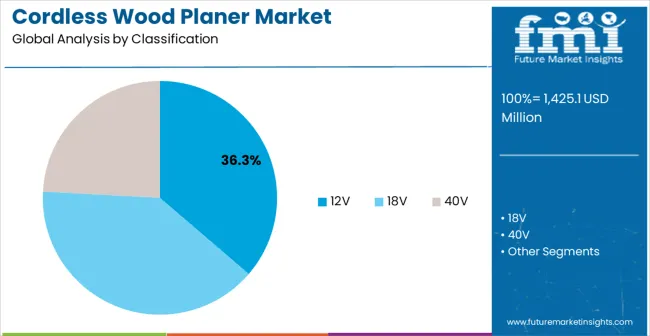

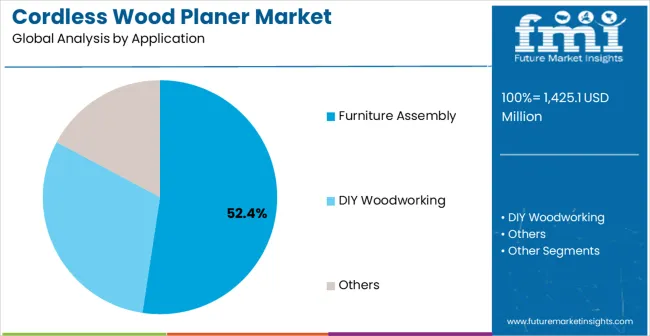

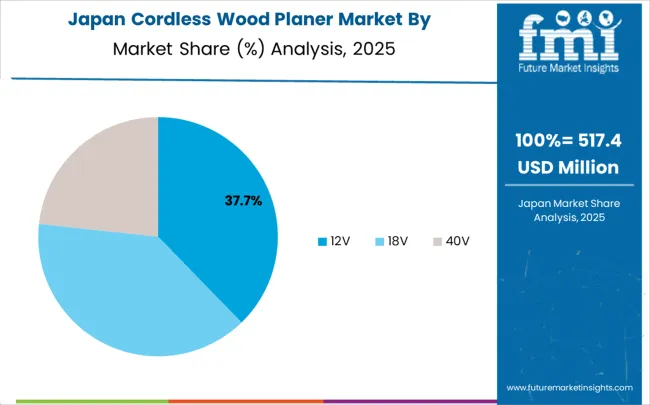

The market is segmented by voltage type, end-use, and region. By voltage type, the market is divided into 12V, 18V and 40V. Based on end-use, the market is categorized into furniture assembly, DIY woodworking, and others. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

12V voltage type cordless wood planers are projected to account for 36.3% of the cordless wood planer market in 2025. This leading share is supported by the optimal balance of power, weight, and battery life that 12V systems provide for typical woodworking applications. 12V planers offer sufficient power for most planing tasks while maintaining compact size and lightweight design that reduces user fatigue during extended operations. The segment benefits from widespread battery platform compatibility, cost-effectiveness, and suitability for both professional tradespeople and DIY enthusiasts who require versatile tools for diverse woodworking projects.

12V cordless planer technology continues advancing through improvements in motor efficiency, blade design, and ergonomic features that enhance performance while maintaining the inherent advantages of compact voltage platforms. The segment growth reflects increasing consumer preference for balanced tools that provide adequate power without excessive weight or bulk. Manufacturers are developing advanced 12V planers with enhanced depth adjustment mechanisms, improved dust collection systems, and extended battery runtime capabilities that address evolving user requirements while maintaining the fundamental advantages of lower voltage systems.

Furniture assembly applications are expected to represent 52.4% of cordless wood planer demand in 2025. This dominant share reflects the extensive use of wood planers in furniture manufacturing, carpentry, and custom woodworking operations that require precise material preparation and finishing. Modern furniture production involves diverse wood processing requirements including surface preparation, edge finishing, and dimensional adjustment that benefit from the portability and convenience of cordless planing tools. The segment benefits from growing custom furniture demand, increasing emphasis on handcrafted products, and expanding small-scale furniture manufacturing operations that value tool mobility and workspace flexibility.

Furniture assembly industry transformation toward customization and artisanal production methods is driving significant cordless planer demand as manufacturers and craftspeople implement more flexible production approaches and personalized design solutions. The segment expansion reflects increasing emphasis on quality craftsmanship, precision woodworking, and efficient material preparation that depend on reliable planing tools with professional performance characteristics. Advanced furniture assembly applications are incorporating precision measurement systems, quality control protocols, and efficient workflow management that require versatile tools with consistent performance and operational reliability.

The cordless wood planer market is advancing steadily due to improvements in battery technology and growing consumer preference for portable tools. However, the market faces challenges including higher costs compared to corded alternatives, limited runtime for intensive applications, and ongoing battery replacement requirements. Technological advancement efforts and cost reduction initiatives continue to influence product development and market expansion patterns.

The growing implementation of intelligent features and digital connectivity in cordless wood planers is enabling enhanced user control, performance monitoring, and maintenance scheduling that improve overall tool effectiveness and user experience. Smart planer technologies provide real-time performance feedback, automatic depth adjustment, and integrated connectivity that support advanced project management and quality control requirements. These technological advances enable users to achieve higher levels of precision and efficiency while reducing material waste and improving project outcomes.

Tool manufacturers are developing advanced battery technologies and rapid charging systems that address traditional limitations of cordless tools including runtime constraints and charging delays. Next-generation battery platforms provide extended operation time, improved power delivery, and reduced charging periods that enhance tool productivity and user satisfaction. These power system innovations support broader cordless tool adoption by providing performance characteristics that meet or exceed corded tool capabilities while maintaining mobility advantages.

| Country | CAGR (2025-2035) |

|---|---|

| China | 8.9% |

| India | 8.3% |

| Germany | 7.6% |

| Brazil | 6.9% |

| United States | 6.3% |

| United Kingdom | 5.6% |

| Japan | 5.0% |

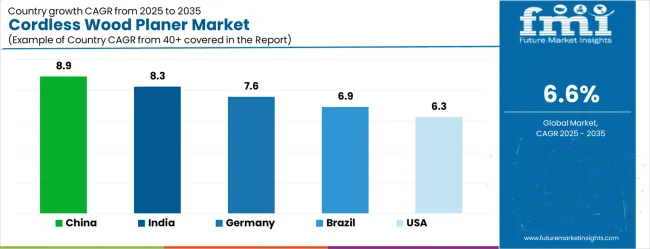

The cordless wood planer market demonstrates varied growth patterns across key countries, with China leading at an 8.9% CAGR through 2035, driven by expanding furniture manufacturing capabilities, growing DIY culture, and increasing adoption of cordless power tools across diverse applications. India follows at 8.3%, supported by rising construction activities, expanding woodworking industries, and growing consumer preference for portable tools. Germany records 7.6% growth, emphasizing precision tool technology, advanced manufacturing capabilities, and strong DIY market development. Brazil shows steady growth at 6.9%, driven by expanding furniture sector and increasing home renovation activities. The United States maintains 6.3% growth, focusing on professional tool innovation and DIY market expansion. The United Kingdom demonstrates 5.6% expansion, supported by strong DIY culture and home improvement trends. Japan records 5.0% growth, leveraging technological innovation and precision manufacturing expertise.

The report covers an in-depth analysis of 40+ countries; seven top-performing countries are highlighted below.

Revenue from cordless wood planers in China is projected to expand at the highest growth rate with a CAGR of 8.9% through 2035, driven by massive furniture manufacturing sector expansion, growing DIY culture development, and increasing adoption of cordless power tools across residential and commercial applications. The country's comprehensive manufacturing strategy includes significant investments in furniture production facilities, woodworking equipment, and consumer tool markets that require advanced cordless planing solutions. Major furniture manufacturers and woodworking companies are implementing cordless tools to improve operational flexibility and workplace safety while meeting growing domestic and export demand.

The cordless wood planer market in India is projected to grow at a CAGR of 8.3%, supported by expanding construction sector activities, growing furniture manufacturing capabilities, and increasing consumer adoption of modern power tools for diverse applications. The country's emphasis on infrastructure development and housing construction is driving demand for portable woodworking tools that support on-site carpentry, furniture installation, and finishing operations requiring mobility and convenience. Government programs promoting skill development and small-scale manufacturing are creating favorable conditions for cordless tool adoption across woodworking and construction trades. Educational initiatives and technical training programs are developing workforce capabilities that support advanced tool operation and maintenance requirements.

Demand for cordless wood planers in Germany is projected to expand at a CAGR of 7.6%, supported by the country's leadership in precision tool technology, advanced manufacturing capabilities, and strong DIY culture development across diverse consumer segments. German manufacturers and consumers are implementing sophisticated cordless planing solutions that meet stringent quality standards while supporting professional woodworking operations and demanding DIY projects. The country's extensive furniture manufacturing and carpentry industries are driving significant cordless planer demand for precision work and flexible operations. Advanced manufacturing partnerships are facilitating technology development and knowledge sharing across tool manufacturing and woodworking sectors.

Revenue from cordless wood planers in Brazil is projected to grow at a CAGR of 6.9%, driven by expanding furniture manufacturing sector, growing home renovation activities, and increasing consumer preference for portable woodworking tools across diverse applications. Brazilian manufacturers and consumers are investing in cordless planing solutions to enhance productivity and convenience while supporting domestic furniture production and DIY market development. Government programs supporting industrial development are facilitating access to modern woodworking tools and technical expertise. Regional manufacturing centers are developing specialized capabilities that support cordless tool distribution and technical support across diverse geographic markets. Economic development initiatives are creating opportunities for both professional and consumer tool adoption across expanding woodworking and construction sectors.

Demand for cordless wood planers in the United States is projected to expand at a CAGR of 6.3%, driven by professional tool innovation, expanding DIY market participation, and ongoing technology advancement initiatives across woodworking and construction sectors. American manufacturers and consumers are implementing advanced cordless planing solutions to maintain productivity and convenience while supporting diverse professional and recreational woodworking applications. The construction industry is driving significant cordless planer demand for jobsite applications, renovation projects, and specialty carpentry work requiring tool mobility. Government initiatives supporting domestic manufacturing are creating opportunities for advanced tool development and production.

The cordless wood planer market in the United Kingdom is projected to grow at a CAGR of 5.6%, supported by strong DIY culture development, expanding home improvement activities, and increasing consumer preference for convenient and portable woodworking tools. British consumers and professionals are investing in cordless planing solutions to support home renovation projects, hobby woodworking, and professional carpentry applications requiring tool mobility and convenience. The country's established retail infrastructure is facilitating cordless tool adoption through comprehensive product availability and technical support services. Home improvement trends and property renovation activities are creating demand for quality woodworking tools that enable homeowners to complete projects efficiently.

Revenue from cordless wood planers in Japan is projected to grow at a CAGR of 5.0%, supported by technological innovation capabilities, precision manufacturing expertise, and emphasis on quality tool development across professional and consumer markets. Japanese manufacturers and consumers are implementing sophisticated cordless planing solutions that demonstrate superior performance characteristics while supporting diverse woodworking applications requiring precision and reliability. The country's advanced manufacturing sectors are driving demand for high-quality cordless tools that support precision operations and efficient workflows. Quality management systems and continuous improvement principles are driving adoption of cordless tools that enhance operational excellence and project outcomes across diverse applications.

The cordless wood planer market in Europe is projected to grow from USD 385.3 million in 2025 to USD 730.1 million by 2035, registering a CAGR of 7% over the forecast period. Germany is expected to maintain its leadership with 32.8% market share in 2025, projected to grow to 33.4% by 2035, supported by its strong manufacturing sector, advanced woodworking industry, and robust DIY culture. France follows with 19.2% market share in 2025, expected to reach 19.6% by 2035, driven by furniture manufacturing activities and home renovation trends.

The Rest of Europe region is projected to maintain stable share at 17.4% throughout the forecast period, attributed to growing DIY activities in Eastern European countries and expanding woodworking industries. United Kingdom contributes 15.8% in 2025, projected to reach 15.3% by 2035, supported by strong DIY culture and home improvement activities. Italy maintains 14.8% share in 2025, expected to grow to 15.7% by 2035, while other European countries demonstrate steady growth patterns reflecting regional woodworking development and consumer tool adoption trends.

The cordless wood planer market is characterized by competition among established power tool manufacturers, specialized woodworking equipment providers, and battery technology companies. Companies are investing in advanced battery technologies, ergonomic design improvements, motor efficiency optimization, and comprehensive tool ecosystems to deliver powerful, convenient, and reliable cordless planing solutions. Strategic partnerships, technological innovation, and market expansion initiatives are central to strengthening product portfolios and market presence.

Metabo, Germany-based, offers professional-grade cordless wood planers with focus on durability, performance, and battery platform compatibility across diverse voltage ranges. Bosch, Germany, provides comprehensive cordless tool solutions emphasizing innovation, quality, and user-friendly design for both professional and DIY markets. DeWalt, USA, delivers robust cordless planers with focus on jobsite durability, power output, and integrated tool ecosystem compatibility.

Einhell, Germany, emphasizes value-oriented cordless tools with focus on DIY applications, battery platform flexibility, and cost-effective solutions. Erbauer specializes in trade-focused cordless tools with emphasis on performance and reliability for professional applications. Makita, Japan, provides precision-engineered cordless planers with focus on motor efficiency, ergonomic design, and comprehensive battery platform integration. Other key players including Milwaukee (TTI), HiKOKI, Lumberjack Tools, Olympia, Sealey, Draper, and Trotec contribute specialized expertise and diverse product offerings across global and regional markets.

Cordless wood planers represent the convergence of advanced battery technology and precision woodworking tools, enabling portable surface preparation and dimensioning capabilities. With the market expanding from $1,425.1M to $2,700.3M at 7% CAGR, driven by professional contractor mobility demands, DIY woodworking growth, and battery technology advancement, this power tool segment requires coordinated stakeholder action to address battery interoperability, performance optimization, and market accessibility challenges.

How Governments Could Accelerate Professional Tool Adoption?

Skilled Trades Development: Invest in vocational training programs that incorporate modern cordless tool technologies, ensuring carpentry and furniture-making curricula reflect current industry practices and tool capabilities.

Small Business Equipment Incentives: Provide tax credits or depreciation benefits for professional contractors and small furniture makers investing in cordless tool systems, recognizing the productivity gains and reduced job site infrastructure requirements.

Safety Standards Enhancement: Update workplace safety regulations to account for cordless tool advantages (reduced trip hazards, electrical safety) while establishing performance standards for professional-grade battery tools in construction environments.

Import Duty Optimization: Implement strategic tariff policies that protect domestic tool manufacturing while ensuring access to advanced battery technologies and components essential for competitive product development.

Innovation Grant Programs: Fund collaborative research between tool manufacturers, battery technology companies, and academic institutions focused on next-generation cordless tool performance and user safety.

How Industry Trade Associations Could Strengthen Market Development?

Battery Interoperability Standards: Lead initiatives to develop common battery platform standards across manufacturers, reducing customer investment barriers and enabling fleet standardization for professional users.

Performance Benchmarking Protocols: Establish standardized testing methods for cordless planer performance including runtime, power delivery, and finish quality that enable objective comparisons across brands and models.

Professional Certification Programs: Develop training and certification programs for contractors and woodworkers on optimal cordless tool usage, maintenance, and safety practices to maximize productivity and tool longevity.

Market Intelligence Coordination: Create shared databases tracking professional user requirements, usage patterns, and performance feedback to guide industry-wide product development priorities.

Safety & Best Practices: Develop comprehensive safety guidelines specific to cordless planers including proper handling techniques, battery management, and workspace organization for mobile operations.

How Power Tool Manufacturers Could Capture Growth Opportunities?

Integrated Battery Ecosystem: Develop comprehensive cordless tool platforms where planers share batteries with other professional tools, creating customer ecosystem lock-in while reducing total cost of ownership.

Performance Optimization Engineering: Focus on motor efficiency, blade design, and power management algorithms that maximize planing performance per battery charge, addressing the primary user concern of runtime limitations.

Ergonomic Innovation: Invest in advanced ergonomic design that reduces user fatigue during extended use while maintaining precision control, crucial for professional applications requiring operation.

Smart Tool Integration: Incorporate IoT capabilities for performance monitoring, predictive maintenance alerts, and usage analytics that provide value to professional users managing tool fleets.

Market Segmentation Strategy: Develop distinct product lines optimized for professional contractors (durability, power), furniture makers (precision, finish quality), and DIY users (ease of use, value) rather than one-size-fits-all approaches.

How Retailers and Distributors Could Enhance Market Access?

Education-Focused Merchandising: Create interactive displays and demonstration areas that allow customers to experience cordless planer performance compared to corded alternatives, addressing misconceptions about power and capability.

Professional Channel Development: Establish dedicated professional contractor sales channels with bulk pricing, extended warranties, and rapid replacement programs that address commercial user requirements.

Battery System Consultation: Train sales staff to provide expert advice on battery platform selection, helping customers make informed decisions about ecosystem investment and tool compatibility.

Rental & Trial Programs: Offer rental programs that allow professional users to evaluate cordless planers on actual job sites before purchase, reducing adoption barriers for expensive professional-grade tools.

Service Network Integration: Develop authorized service networks that can handle both tool and battery servicing, ensuring professional users have access to rapid repair and replacement services.

How Component Suppliers Could Enable Performance Advancement?

Advanced Battery Technology: Develop high-energy-density battery cells optimized for high-drain applications like planers, focusing on steady power delivery and thermal management under heavy loads.

Motor Efficiency Innovation: Create brushless motor designs specifically optimized for planer applications, maximizing torque delivery and runtime while minimizing weight and heat generation.

Cutting Edge Technology: Develop advanced carbide blade technologies and coating systems that maintain sharpness longer and deliver superior surface finishes, crucial for professional woodworking applications.

Lightweight Materials: Supply advanced composites and engineered plastics that reduce tool weight while maintaining durability, addressing user fatigue concerns in handheld planer applications.

Smart Component Integration: Provide sensors, control electronics, and connectivity components that enable advanced features like depth monitoring, battery optimization, and performance analytics.

How Financial Stakeholders Could Unlock Market Potential?

Professional Equipment Financing: Develop specialized financing programs for contractors and small woodworking businesses that recognize cordless tool systems as productivity-enhancing capital equipment rather than simple consumables.

Technology Development Investment: Finance R&D initiatives focused on breakthrough battery technologies, motor efficiency improvements, and smart tool capabilities that can differentiate products in competitive markets.

Manufacturing Capacity Expansion: Support investments in automated manufacturing capabilities that can deliver consistent quality at scale while managing cost pressures in competitive consumer and professional markets.

Market Expansion Capital: Back companies expanding cordless planer distribution into emerging markets where DIY culture and professional construction activity are growing rapidly.

Innovation Ecosystem Investment: Support venture investments in adjacent technologies including smart workshop systems, digital measurement tools, and automated finishing systems that complement cordless planer capabilities.

How End Users Could Maximize Tool Value?

Battery Management Optimization: Implement proper battery charging, storage, and rotation practices that maximize battery life and ensure consistent tool performance throughout work sessions.

Maintenance Excellence: Develop systematic blade maintenance, cleaning, and calibration routines that preserve planer performance and extend tool life, crucial for maximizing return on investment.

Application Technique Development: Invest in training and skill development to optimize cordless planer techniques for different wood species, grain patterns, and finishing requirements.

Cross-Platform Integration: Consider battery platform compatibility when building tool collections, enabling economies of scale in battery investment and reducing charging infrastructure requirements.

Performance Documentation: Track tool performance, battery life, and maintenance requirements to inform future purchasing decisions and optimize tool utilization across projects.

The cordless wood planer market's continued growth requires addressing the fundamental challenge of delivering corded tool performance in cordless formats while managing the cost and complexity of advanced battery systems, ergonomic requirements, and diverse user needs spanning professional contractors to hobbyist woodworkers.

| Item | Value |

|---|---|

| Quantitative Units (2025) | USD 1,425 million |

| Voltage Type | 12V, 18V, and 40V |

| End-Use | Furniture Assembly, DIY Woodworking, and Others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Metabo, Bosch, DeWalt, Einhell, Erbauer, Makita, Milwaukee (TTI), HiKOKI, Lumberjack Tools, Olympia, Sealey, Draper, Trotec |

| Additional Attributes | Dollar sales by voltage type and end-use segments, regional demand trends across North America, Europe, and Asia-Pacific, competitive landscape with established power tool manufacturers and specialized woodworking equipment providers, buyer preferences for different voltage platforms and battery systems, integration with comprehensive tool ecosystems and battery platform compatibility, innovations in motor efficiency and ergonomic design features, and adoption of smart technology integration and advanced battery management systems for enhanced performance and user experience |

The global cordless wood planer market is estimated to be valued at USD 1,425.1 million in 2025.

The market size for the cordless wood planer market is projected to reach USD 2,700.3 million by 2035.

The cordless wood planer market is expected to grow at a 6.6% CAGR between 2025 and 2035.

The key product types in the cordless wood planer market are 12V, 18V, and 40V.

In terms of application, the furniture assembly segment is set to command 52.4% share of the cordless wood planer market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Wood Awning Window Market Size and Share Forecast Outlook 2025 to 2035

Cordless Handheld Cultivator Market Size and Share Forecast Outlook 2025 to 2035

Cordless Bandfile Sander Market Size and Share Forecast Outlook 2025 to 2035

Cordless Long Neck Grinder Market Size and Share Forecast Outlook 2025 to 2035

Cordless Fillet Weld Grinder Market Size and Share Forecast Outlook 2025 to 2035

Woodcore Access Floor Market Size and Share Forecast Outlook 2025 to 2035

Woodworm Treatment Service Market Size and Share Forecast Outlook 2025 to 2035

Wood Plastic Composite Market Size and Share Forecast and Outlook 2025 to 2035

Wooden Pallet Rental Service Market Size and Share Forecast Outlook 2025 to 2035

Wood Recycling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Woodfree Paper Market Size and Share Forecast Outlook 2025 to 2035

Wooden Crate Market Forecast and Outlook 2025 to 2035

Cordless Pop Rivet Gun Market Size and Share Forecast Outlook 2025 to 2035

Cordless Blind Rivet Gun Market Size and Share Forecast Outlook 2025 to 2035

Wood-Polymer Bottle Molders Market Size and Share Forecast Outlook 2025 to 2035

Woodworking CNC Tools Market Size and Share Forecast Outlook 2025 to 2035

Wood Pellets Market Size and Share Forecast Outlook 2025 to 2035

Wooden Cutlery Market Size and Share Forecast Outlook 2025 to 2035

Wood Coating Resins Market Size and Share Forecast Outlook 2025 to 2035

Cordless Trim Routers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA