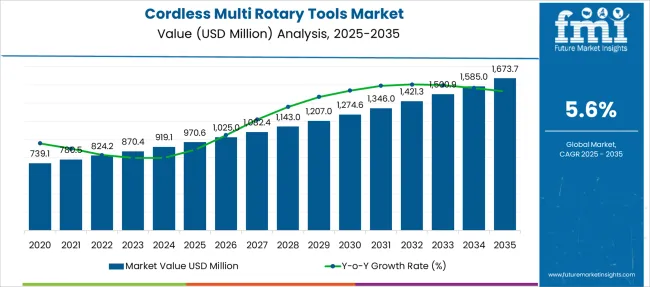

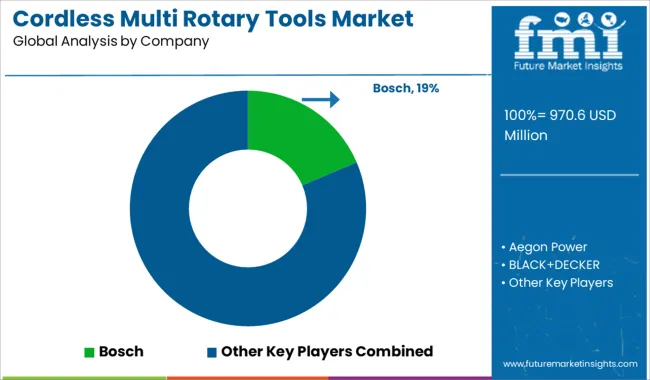

The Cordless Multi Rotary Tools Market is estimated to be valued at USD 970.6 million in 2025 and is projected to reach USD 1673.7 million by 2035, registering a compound annual growth rate (CAGR) of 5.6% over the forecast period.

| Metric | Value |

|---|---|

| Cordless Multi Rotary Tools Market Estimated Value in (2025 E) | USD 970.6 million |

| Cordless Multi Rotary Tools Market Forecast Value in (2035 F) | USD 1673.7 million |

| Forecast CAGR (2025 to 2035) | 5.6% |

The cordless multi rotary tools market is expanding steadily due to increasing demand for versatile and portable power tools in various industries. Advancements in battery technology have improved tool performance, allowing for longer run times and faster charging, which appeals to both professional users and hobbyists.

The shift towards wireless equipment offers enhanced convenience and safety by eliminating cables, making these tools more adaptable to different work environments. Growing industrial and construction activities globally have boosted the need for reliable cordless tools that can perform a wide range of tasks.

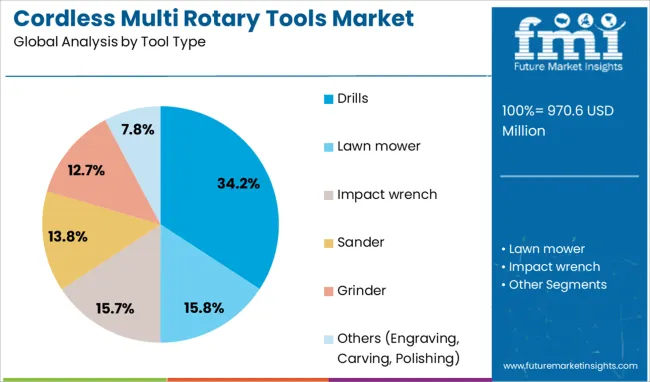

Additionally, the rise in DIY projects and home improvement trends has broadened the customer base. Future growth is expected to be driven by continuous innovation in battery efficiency, ergonomic designs, and tool functionality. The market is projected to be led by drills in tool type, medium voltage (12–less than 18V) in voltage segment, and industrial and professional users in end-use.

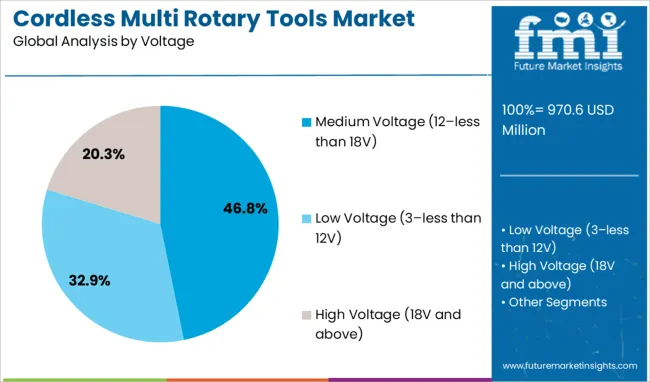

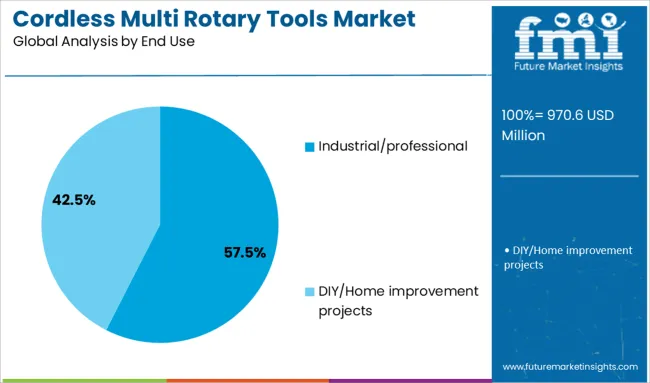

The cordless multi rotary tools market is segmented by tool type, voltage, end use, distribution channel and geographic regions. The cordless multi-rotary tools market is divided by tool type into Drills, Lawn Mowers, Impact Wrenches, Sanders, Grinders, and Others (Engraving, Carving, Polishing). In terms of voltage, the cordless multi-rotary tools market is classified into Medium Voltage (12–less than 18V), Low Voltage (3–less than 12V), and High Voltage (18V and above). Based on the end use of the cordless multi-rotary tools market, it is segmented into industrial and professional, and DIY/Home improvement projects. The distribution channel of the cordless multi rotary tools market is segmented into Offline and Online. Regionally, the cordless multi rotary tools industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The drills segment is expected to account for 34.2% of the cordless multi rotary tools market revenue in 2025. The essential role of drills drives this segment’s leadership play across various applications, including drilling, fastening, and driving screws. Their versatility and compatibility with multiple attachments make them highly valued among industrial professionals and DIY enthusiasts alike.

The cordless design allows for greater mobility and ease of use in confined or remote work areas. Continuous improvements in motor power and battery life have further enhanced their reliability and user appeal.

Due to their wide application and demand for efficiency, drills remain the most popular tool type in this market.

The medium voltage segment, ranging from 12 to less than 18 volts, is projected to represent 46.8% of the market revenue in 2025. This voltage range offers a balanced combination of power and portability, making it suitable for both light and moderate industrial tasks. It appeals to users who require sufficient torque and speed without the bulk and weight of higher voltage tools.

The medium voltage range has become a preferred choice in many professional settings due to its efficiency and ergonomic advantages.

The ongoing enhancements in battery and motor technologies have made these tools increasingly capable of handling demanding jobs while maintaining manageable sizes and weights.

The industrial and professional end-use segment is forecasted to contribute 57.5% of the cordless multi rotary tools market revenue in 2025. This segment is driven by the growing adoption of cordless tools in manufacturing, construction, automotive, and maintenance sectors. Professionals require durable and high-performance tools that offer flexibility and can operate in various environments, often without easy access to power outlets.

Cordless multi rotary tools provide the necessary mobility and efficiency for complex industrial applications. Investments in workplace safety and productivity improvements have also encouraged the use of cordless tools among professionals.

As industries continue to prioritize speed and convenience in operations, the demand from the industrial and professional user segment is expected to remain dominant.

The cordless multi rotary tools market is growing rapidly as users favor portable power tools for precision tasks. These tools serve professionals in construction, automotive, electronics, and artisans, and hobbyists engaged in crafting or home renovation. Advances in lithium-ion batteries, brushless motors, and lightweight designs have expanded their appeal. Interchangeable accessories enable cutting, grinding, sanding, and engraving with a single device. Increased visibility of how to use them and expanding online retail channels support global reach. Demand is especially strong across developed regions and urban DIY segments.

Despite improvements, battery life and motor power remain central constraints in cordless multi rotary tools. Some brushless models still struggle to match corded units on torque and continuous runtime. Users performing demanding tasks such as metal cutting or extended sanding find that cordless tools may overheat or slow under load. Compatibility issues arise when battery ecosystems differ among brands. Replacing batteries over time may add cost. Cooling and motor design also affect durability. Tool developers must balance size, weight, airflow and power delivery. These technical limitations may discourage professional users accustomed to corded performance. Consumers expect cordless must match or surpass corded tools in convenience without sacrificing reliability. Achieving that requires engineering refinements and robust battery management to minimize heat buildup and discharge inconsistencies across jobsite applications.

The rise of home improvement culture and online tutorial access is widening user base for cordless rotary tools. Hobbyists, makers and homeowners are taking on woodworking, crafting, and small repair tasks using versatile attachments. The convenience of cordless operation suits flexible, on‑demand usage. Retail channels now align with digital learning platforms, promoting multi-tool kits with versatile accessory sets. Brands offering user-friendly controls, ergonomic designs, and safety features attract this growing segment. Market reach extends through home improvement and e-commerce platforms that showcase application videos and community feedback. As more individuals experiment with precision tasks at home, interest in compact and affordable cordless rotary tools grows. Activities such as leather cutting, model building, and decor crafting fuel sustained usage. Vendors that support users through tutorials, interchangeable kits, and accessory compatibility build loyalty and encourage repeat purchase and tool ecosystem expansion.

Higher voltage cordless multi rotary tools consistently lead professional segments. Tools operating on medium to high battery voltage deliver longer runtime, sustained torque, and stability under load. They meet demands for industrial and construction usage as they perform closer to corded equivalents. These units may include advanced battery management, thermal protection, and faster charging. Professionals working in sectors like auto repair, metal fabrication, and electrical assembly benefit from cordless formats that replace corded grinders or sanders. Ergonomics and portability also matter when working in constrained or remote sites. Manufacturers prioritizing robust high voltage systems differentiate themselves in competitive markets. Providing tool lines across battery voltages enables clear product segmentation. High voltage offerings support professional adoption, while lower voltage kits serve hobbyist or light‑duty use. This trend expands total market by catering to both end users seeking power and those prioritizing mobility over output.

The cordless multi rotary tools market features intense rivalry among established power tool brands and newer entrants. Companies such as Bosch, Dremel, Milwaukee, DEWALT, RYOBI, BLACK+DECKER and Proxxon compete on product features, ecosystem compatibility, and pricing. Retail competition includes low‑cost imports offering basic function at significant discounts. This erodes margins for mid-tier manufacturers. With overlapping functionality, differentiation relies on battery ecosystem adoption, accessory compatibility, warranty terms, and service support. Tool loyalty often aligns with battery platforms across drill, saw, and rotary lines. Manufacturers must invest in extended product ecosystems to retain users. As discount brands enter online channels aggressively, incumbents must emphasize quality, reliability, and deep accessory catalogs to justify pricing. In price-sensitive regions, low-cost models may dominate, but premium users prioritize performance and brand. This competitive environment forces suppliers to balance investment in features with flexible pricing and distribution strategies across both consumer and professional channels.

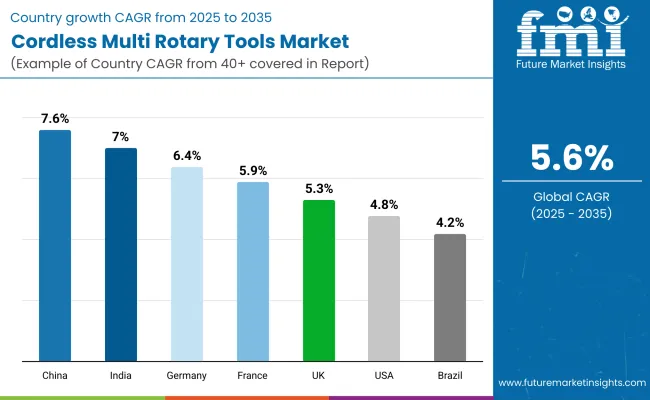

| Country | CAGR |

|---|---|

| China | 7.6% |

| India | 7.0% |

| Germany | 6.4% |

| France | 5.9% |

| UK | 5.3% |

| USA | 4.8% |

| Brazil | 4.2% |

The global construction portable generators market is projected to grow at a CAGR of 4.3% through 2035, supported by rising demand for mobile power solutions across mid-scale and temporary construction sites. Among BRICS nations, China leads with 5.8% growth, driven by frequent deployment in decentralized building zones and rapid project turnovers. India follows at 5.4%, where use has been extended across tier-2 cities and semi-urban infrastructure works. In the OECD region, Germany reports 4.9% growth, backed by consistent use in renovation projects and compliance with noise control measures. The United Kingdom, at 4.1%, maintains demand for compact, fuel-efficient units across short-term civil and commercial works. The United States, at 3.7%, remains a steady market with preferences shaped by runtime expectations and safety certifications. Market growth has been shaped by decibel rating requirements, fuel tank regulations, and output standardization norms. This report includes insights on 40+ countries; the top five markets are shown here for reference.

Portable generator deployment across Chinese construction sites has been expanding steadily, with a CAGR of 5.8% observed. Increased reliance on off-grid power sources during structural foundation work and remote developments has elevated unit installations. Manufacturers have responded by launching models optimized for high runtime, enhanced durability, and portability. Application on mobile work platforms, tower builds, and tunnel excavation projects has been frequently noted. In addition, rising use of portable generators for backup during peak load phases has reinforced consistent year-round demand. A preference has been displayed for digital load monitoring features and fuel-saving technologies in newer models.

India’s demand for portable generators in construction has grown at a 5.4% CAGR, with widespread application at rural and semi-urban job sites. Contractors have consistently relied on generators to operate handheld tools and lighting systems in areas with unstable grid supply. Single-phase and dual-phase variants with rugged casing and simplified control panels have been widely adopted. Rental services have become more active in supplying portable units for short-duration contracts. Seasonal monsoon disruptions have further pushed demand for standby power equipment. Units offering extended fuel tank capacity and low maintenance requirements have found increased acceptance.

A 4.9% CAGR has been maintained in Germany, supported by strict preferences for reliable power supply in refurbishment and new build projects. Portable units with advanced safety controls, auto shutdown, and clean combustion characteristics have been adopted in accordance with environmental standards. Application in interior renovation, scaffold lighting, and electric tool operation has been widespread. Generators fitted with low-noise enclosures and fuel optimization software have seen strong interest from project managers in noise-sensitive locations. Partnerships with equipment suppliers have led to bundled offerings, pairing generators with electric mixers, saws, and drills for improved site efficiency.

The portable generator market in the United Kingdom has advanced at a 4.1% CAGR, driven by use in residential renovations, temporary project setups, and urban builds. Preference has been shown for compact units that comply with Stage V emission norms and noise thresholds. Generators have supported applications like scaffold lighting, compact tool operation, and mobile cabin power. Construction firms have increasingly opted for dual-fuel models to align with fuel availability variations at remote sites. Emergency power backup setups during short utility outages have also contributed to generator purchases. Value has been placed on ease of transportation and rapid refueling capability.

A CAGR of 3.7% has been recorded in the USA, where portable generators have been utilized in small-to-mid-scale construction, remote job sites, and temporary infrastructure setups. Contractors have prioritized rugged, long-runtime units with digital displays and circuit protection. Integration with wheeled frames and forklift pockets has supported on-site mobility. Increased use during modular housing projects and pop-up facility construction has reinforced demand consistency. Low-emission gasoline and diesel models have led sales, with niche demand also forming for solar-assisted or hybrid portable units. Extended warranties and after-sales service availability have influenced equipment selection.

The cordless multi rotary tools market is characterized by a mix of established tool manufacturers and emerging players delivering compact, battery-powered solutions designed for precision tasks such as grinding, sanding, polishing, and cutting. Bosch and Dremel are considered dominant forces in this space, with a wide portfolio of ergonomic, high-speed rotary tools that are favored by professionals and hobbyists alike for their reliability and attachment versatility.

BLACK+DECKER and DEWALT offer durable, user-friendly cordless rotary tools equipped with high-torque motors, appealing to both DIY consumers and trade workers. Milwaukee Electric Tool Corporation and RYOBI are recognized for integrating powerful lithium-ion batteries with smart control systems that extend runtime and improve user control, making them highly suitable for long, uninterrupted work in construction and repair environments. Proxxon, known for its niche precision tools, targets detailed modeling, electronics, and artisan applications where fine control is critical.

Emerging manufacturers such as Hardell, Huepar, Ronix, and JPT Tools are gaining traction with competitively priced cordless models offering multi-speed adjustments, compact form factors, and fast-charging capabilities. These brands appeal to cost-conscious users without sacrificing performance. Sealey, Rolson Tools Ltd, Draper Tools Limited, and Aegon Power contribute to the mid-tier segment, supplying robust cordless rotary solutions with durable accessories suited for general-purpose work. This blend of global leaders and rising manufacturers ensures wide availability of cordless rotary tools across application segments, from professional maintenance to consumer-grade detailing and light fabrication.

According to Dremel, the company unveiled the cordless Project Multi‑Tool part of its Blueprint line in a press release in April 2025. This tool, designed for DIYers, features an intuitive application selector for setting speed, a brushless motor, LED light, and tool‑free accessory changes. It is available in the USA from that date.

| Item | Value |

|---|---|

| Quantitative Units | USD 970.6 Million |

| Tool Type | Drills, Lawn mower, Impact wrench, Sander, Grinder, and Others (Engraving, Carving, Polishing) |

| Voltage | Medium Voltage (12–less than 18V), Low Voltage (3–less than 12V), and High Voltage (18V and above) |

| End Use | Industrial/professional and DIY/Home improvement projects |

| Distribution Channel | Offline and Online |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Bosch, Aegon Power, BLACK+DECKER, Dremel, DEWALT, Draper Tools Limited, Hardell, Huepar, JPT Tools, Milwaukee Electric Tool Corporation, Proxxon, RYOBI, Ronix, Sealey, and Rolson Tools Ltd |

| Additional Attributes | Dollar sales by cordless multi rotary tool type including drills, grinders, sanders, polishers, and engravers, by voltage rating including below 12V, 12V to 18V, and above 18V, and by region including North America, Europe, and Asia-Pacific; demand driven by DIY trends, mobile toolkits, and compact power tools in residential and commercial sectors; innovation in lithium-ion batteries, brushless motors, ergonomic designs, and IoT-enabled features; costs influenced by battery technology, motor components, and production scalability. |

The global cordless multi rotary tools market is estimated to be valued at USD 970.6 million in 2025.

The market size for the cordless multi rotary tools market is projected to reach USD 1,673.7 million by 2035.

The cordless multi rotary tools market is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types in cordless multi rotary tools market are drills, lawn mower, impact wrench, sander, grinder and others (engraving, carving, polishing).

In terms of voltage, medium voltage (12–less than 18v) segment to command 46.8% share in the cordless multi rotary tools market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cordless Fillet Weld Grinder Market Size and Share Forecast Outlook 2025 to 2035

Cordless Pop Rivet Gun Market Size and Share Forecast Outlook 2025 to 2035

Cordless Blind Rivet Gun Market Size and Share Forecast Outlook 2025 to 2035

Cordless Wood Planer Market Size and Share Forecast Outlook 2025 to 2035

Cordless Trim Routers Market Size and Share Forecast Outlook 2025 to 2035

Cordless Sanders Market Analysis Size and Share Forecast Outlook 2025 to 2035

Cordless Garden Equipment Market

Heavy Cordless Tools Market Analysis Size and Share Forecast Outlook 2025 to 2035

Brushless Cordless Band Files Market Size and Share Forecast Outlook 2025 to 2035

Lightweight Handheld Cordless Vacuum Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Multifunctional Loader Market Size and Share Forecast Outlook 2025 to 2035

Multipurpose Goods Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Multichannel Electrochemical Workstation Market Size and Share Forecast Outlook 2025 to 2035

Multi Colored LED Beads Market Size and Share Forecast Outlook 2025 to 2035

Multi-Drug/Combination Injectable Market Forecast and Outlook 2025 to 2035

Multiplex Sepsis Biomarker Panels Market Size and Share Forecast Outlook 2025 to 2035

Multiplex Protein Profiling Market Size and Share Forecast Outlook 2025 to 2035

Multihead Weighers Market Size and Share Forecast Outlook 2025 to 2035

Multi-Cloud Networking Market Forecast Outlook 2025 to 2035

Multispectral Camera Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA