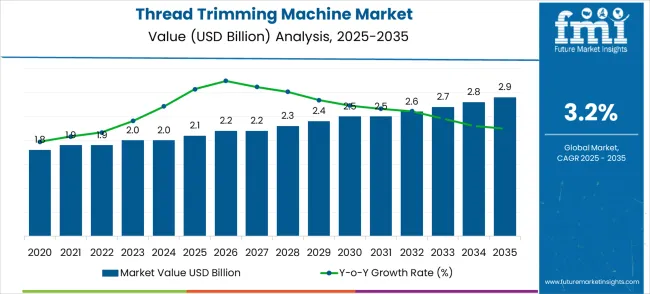

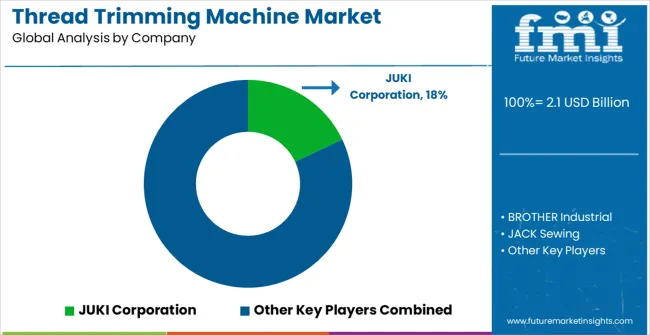

The Thread Trimming Machine Market is estimated to be valued at USD 2.1 billion in 2025 and is projected to reach USD 2.9 billion by 2035, registering a compound annual growth rate (CAGR) of 3.2% over the forecast period.

| Metric | Value |

|---|---|

| Thread Trimming Machine Market Estimated Value in (2025 E) | USD 2.1 billion |

| Thread Trimming Machine Market Forecast Value in (2035 F) | USD 2.9 billion |

| Forecast CAGR (2025 to 2035) | 3.2% |

The thread trimming machine market represents a stable industrial opportunity at the intersection of textile automation, precision engineering, and cutting technology, with the market projected to expand from USD 2.1 billion in 2025 to USD 2.9 billion by 2035 at a steady 3.2% CAGR-a 1.4X growth driven by increasing textile precision requirements, industrial automation adoption, and the integration of advanced trimming control systems into production processes.

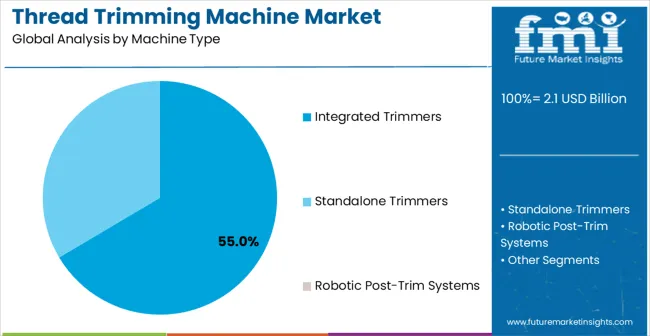

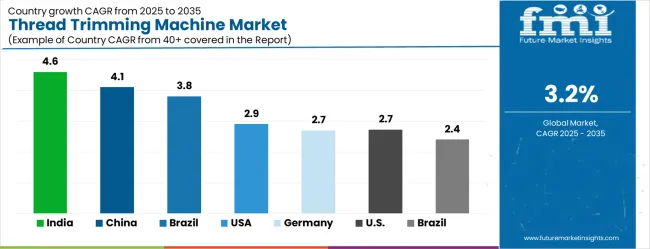

This convergence opportunity leverages the necessity of textile precision, the demand for consistent trimming quality, and advances in trimming technology to create equipment that offers reliable performance in critical manufacturing applications. The integrated trimmers machine type segment leads with 55.0% market share due to its optimal balance of functionality and integration capabilities for most industrial applications. In comparison, apparel applications dominate with a 55.0% share as the preferred sector for precision work. Geographic growth is strongest in India (4.6% CAGR) and China (4.1% CAGR), where the expansion of textile sectors and infrastructure development creates ideal market conditions.

Pathway A - Integrated Trimmers Machine Type Leadership. The dominant machine segment offers an optimal balance between performance and integration capabilities, which are essential for precision trimming operations. Companies developing advanced integrated trimmer systems with enhanced automation capabilities, servo-controlled features, and seamless integration will capture the leading technology segment. Expected revenue pool: USD 1.4-1.6 billion.

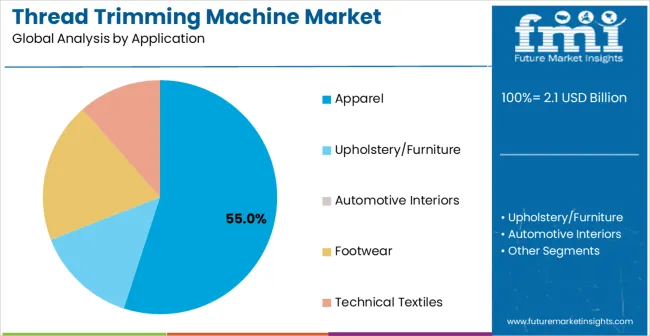

Pathway B - Apparel Application Integration. The largest application segment benefits from widespread adoption in garment manufacturing and textile finishing applications. Providers developing comprehensive apparel trimming solutions with advanced precision cutting, automated thread disposal systems, and quality features will dominate this primary market. Opportunity: USD 1.4-1.6 billion.

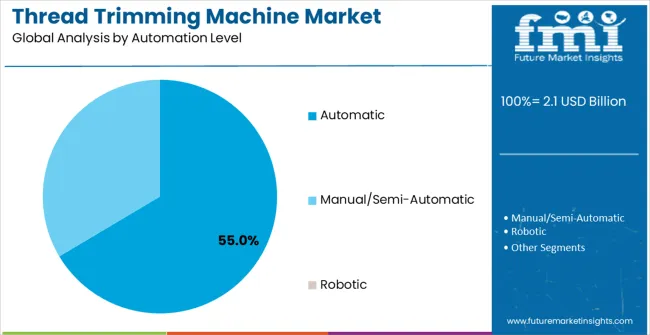

Pathway C - Automatic Automation Level Applications. The largest automation level segment requires specialized machine characteristics for demanding automated operations. Companies investing in application-specific automation designs, enhanced precision features, and integration capabilities will create competitive differentiation and premium positioning. Revenue uplift: USD 1.4-1.6 billion.

Pathway D - Geographic Expansion in High-Growth Markets. India and China's expanding textile sectors and growing industrial automation adoption create substantial opportunities. Local partnerships, culturally adapted service models, and competitive pricing strategies enable market penetration in these high-growth regions. Pool: USD 0.5-0.8 billion.

Pathway E - Energy Efficiency and Smart Trimming Technologies. Modern manufacturers prioritize energy conservation and operational intelligence. Developing machines with smart controls, predictive maintenance capabilities, servo-controlled systems, and integration with Industry 4.0 systems addresses growing efficiency demands while reducing operational costs. Expected upside: USD 0.4-0.6 billion.

Pathway F - Advanced Machine Control and Automation Integration. Premium applications require sophisticated speed control, precision management, and integration with automated textile systems. Machines offering comprehensive connectivity options, precise control algorithms, and compatibility with manufacturing execution systems create enhanced value propositions. USD 0.5-0.8 billion.

Pathway G - Specialized Application Development. Upholstery/furniture, automotive interiors, and technical textiles represent growing opportunities for specialized machine configurations optimized for specific trimming requirements. Developing application-specific solutions with tailored performance characteristics expands beyond general textile markets. Pool: USD 0.3-0.5 billion.

Pathway H - Premium Performance and Durability Features. High-end textile segments demand advanced features like extended service life, precision cutting control, minimal thread waste, and premium build quality. Companies developing industrial-grade variants with comprehensive performance features will capture premium pricing opportunities. Expected revenue: USD 0.4-0.6 billion.

/

Why is the Thread Trimming Machine Market Growing?

Market expansion is being supported by the increasing global demand for textile automation solutions and the corresponding shift toward advanced trimming technologies that can provide superior precision control while meeting industry requirements for consistent and reliable finishing operations. Modern textile facilities and manufacturing shops are increasingly focused on incorporating high-performance thread trimming machines to enhance production quality while satisfying demands for precision manufacturing capabilities and automated production systems. Thread trimming machines' proven ability to deliver superior consistency, operational reliability, and process control makes them essential equipment for advanced textile installations and industrial manufacturing applications.

The growing emphasis on manufacturing precision and industrial automation is driving demand for high-quality thread-trimming machine products that can support distinctive textile processes and premium production positioning across apparel, technical textiles, and automotive interior categories. Industrial equipment preference for machines that combine performance excellence with advanced control capabilities is creating opportunities for innovative trimming implementations in both traditional and emerging textile applications. The rising influence of Industry 4.0 technologies and connected manufacturing systems is also contributing to increased adoption of premium thread-trimming machine products that can provide authentic smart manufacturing integration characteristics.

The thread trimming machine market is segmented by machine type, application, automation level, and geographic regions. By machine type, thread trimming machine market is divided into Integrated Trimmers, Standalone Trimmers, and Robotic Post-Trim Systems. In terms of application, thread trimming machine market is classified into Apparel, Upholstery/Furniture, Automotive Interiors, Footwear, and Technical Textiles. Based on automation level, thread trimming machine market is segmented into Automatic, Manual/Semi-Automatic, and Robotic. Regionally, the thread trimming machine industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The market is segmented by machine type, application, automation level, and region. The demand for machine types is divided into integrated trimmers, standalone trimmers, and robotic post-trim systems. Based on application, the market is categorized into apparel, upholstery/furniture, automotive interiors, footwear, and technical textiles applications. The automation level is segmented into automatic, manual/semi-automatic, and robotic segments. Regionally, the market is divided into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

The integrated trimmers machine type segment is projected to account for 55.0% of the thread trimming machine market in 2025, reaffirming its position as the leading machine category. Industrial equipment manufacturers and textile facilities increasingly utilize integrated trimmer systems for their optimal balance of functionality, operational efficiency, and versatility in trimming applications across diverse industrial installations. This machine type's standardized performance characteristics and reliable operation directly address the industrial requirements for consistent quality control and efficient material processing in precision trimming operations.

This machine type segment forms the foundation of modern industrial trimming applications, as it represents the machine category with the greatest integration potential and established compatibility across multiple application configurations and automation levels. Manufacturer investments in machine optimization and control system integration continue to strengthen adoption among industrial equipment producers. With manufacturers prioritizing operational efficiency and consistent performance, integrated trimmer systems align with both productivity objectives and quality assurance requirements, making them the central component of comprehensive industrial trimming strategies.

Apparel applications are projected to represent the largest share of thread trimming machine demand in 2025, with 55.0% market share, underscoring their critical role as the primary application for precision trimming operations in garment manufacturing and textile environments. Equipment manufacturers and apparel facilities prefer apparel applications for their exceptional quality characteristics, precise cutting capabilities, and ability to maintain consistent manufacturing positions while supporting advanced trimming requirements during precision production operations. Positioned as essential equipment for high-performance apparel installations, apparel thread trimming machines offer both operational reliability and production optimization advantages.

The segment is supported by continuous growth in apparel manufacturing adoption and the growing availability of advanced apparel trimming systems that enable enhanced operational control and quality optimization at the garment facility level. Additionally, manufacturers are investing in premium apparel configurations to support production quality enhancement and operational efficiency experiences. As apparel manufacturing continues to expand and facilities seek superior control solutions, apparel applications will continue to dominate the application landscape while supporting technology advancement and operational optimization strategies.

Automatic automation level applications are projected to represent the largest share of thread trimming machine demand in 2025, with 55.0% market share, underscoring their critical role as the primary automation category for advanced trimming operations in textile manufacturing and industrial environments. Equipment manufacturers and textile facilities prefer automatic applications for their exceptional efficiency characteristics, superior precision capabilities, and ability to maintain consistent production standards while supporting advanced trimming requirements during automated manufacturing operations. Positioned as essential equipment for high-performance textile installations, automatic thread trimming machines offer both operational reliability and automation optimization advantages.

The segment is supported by continuous growth in automated manufacturing adoption and the growing availability of advanced automatic trimming systems that enable enhanced operational control and efficiency optimization at the textile facility level. Additionally, manufacturers are investing in premium automatic configurations to support production efficiency enhancement and automation experiences. As automated manufacturing continues to expand and facilities seek superior automation solutions, automatic automation level applications will continue to dominate the automation landscape while supporting technology advancement and operational optimization strategies.

The thread trimming machine market is advancing steadily due to increasing textile automation adoption and growing demand for precision trimming solutions that emphasize superior operational control across apparel, technical textiles, and automotive interior applications. However, the market faces challenges, including high equipment costs compared to manual alternatives, technical complexity in machine integration, and competition from alternative trimming technologies. Innovation in machine efficiency and smart control systems continues to influence market development and expansion patterns.

The growing adoption of thread-trimming machines in comprehensive textile operations and automated production applications is enabling equipment manufacturers to develop products that provide distinctive precision capabilities while commanding premium positioning and enhanced operational characteristics. Advanced applications provide superior control while allowing more sophisticated manufacturing development across various industrial categories and technology segments. Manufacturers are increasingly recognizing the competitive advantages of automation positioning for premium product development and industrial market penetration.

Modern thread trimming machine suppliers are incorporating advanced energy management systems, smart control technologies, and usage optimization algorithms to enhance operational efficiency, improve energy conservation, and meet industrial demands for sustainable and cost-effective textile solutions. These programs improve equipment performance while enabling new applications, including energy-smart manufacturing and automated quality management systems. Advanced efficiency integration also allows suppliers to support premium market positioning and sustainability leadership beyond traditional commodity industrial trimming equipment products.

| Country | CAGR (2025-2035) |

|---|---|

| India | 4.6% |

| China | 4.1% |

| Brazil | 3.8% |

| USA | 2.9% |

| Germany | 2.7% |

The thread trimming machine market is experiencing varied growth globally, with India leading at a 4.6% CAGR through 2035, driven by the rapidly expanding textile manufacturing sector, substantial investments in automation infrastructure, and increasing adoption of automated finishing systems. China follows at 4.1%, supported by growing industrial development, rising textile investments, and expanding precision manufacturing activities. Brazil shows growth at 3.8%, emphasizing textile industry expansion and premium industrial equipment development. The USA records 2.9%, focusing on precision engineering applications and industrial automation advancement. Germany demonstrates 2.7% growth, prioritizing textile innovation and industrial equipment modernization.

The report covers an in-depth analysis of 40+ countries; five top-performing countries are highlighted below.

Revenue from thread trimming machines in India is projected to exhibit exceptional growth with a CAGR of 4.6% through 2035, driven by the rapidly expanding textile manufacturing sector and substantial government investments in industrial diversification programs across major textile centers. The country's growing textile base and increasing adoption of automated trimming technologies are creating significant demand for precision thread trimming equipment in both apparel manufacturing and technical textile applications. Major industrial equipment manufacturers and machine companies are establishing comprehensive distribution and service capabilities to serve both domestic consumption and regional export markets.

Revenue from thread trimming machines in China is expanding at a CAGR of 4.1%, supported by growing industrial development, increasing textile investments, and expanding precision manufacturing capabilities with modern automation features. The country's developing textile ecosystem and expanding industrial infrastructure are driving demand for reliable thread-trimming machine products across both traditional textile manufacturing and emerging precision applications. International equipment companies and domestic machine manufacturers are establishing comprehensive production and distribution capabilities to address growing market demand for industrial trimming solutions.

Revenue from thread trimming machines in Brazil is projected to grow at a CAGR of 3.8% through 2035, driven by the country's textile industry expansion, industrial equipment development capabilities, and leadership in regional manufacturing solutions. Brazil's growing textile culture and willingness to invest in automation equipment are creating substantial demand for both standard and premium thread-trimming machine varieties. Leading equipment companies and machine manufacturers are establishing comprehensive development strategies to serve both Latin American markets and growing international demand.

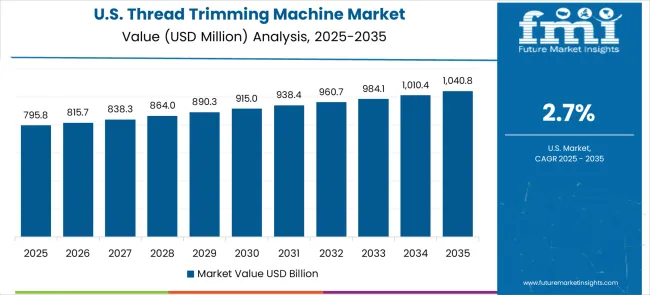

Revenue from thread trimming machines in the USA is projected to grow at a CAGR of 2.9% through 2035, supported by the country's precision engineering excellence, advanced textile sector, and leadership in industrial automation technologies requiring sophisticated trimming solutions. American manufacturers and industrial facility operators consistently seek innovative equipment products that enhance operational precision for both traditional textile applications and advanced industrial markets. The country's position as a textile technology hub continues to drive innovation in industrial automation applications and equipment standards.

Revenue from thread trimming machines in Germany is projected to grow at a CAGR of 2.7% through 2035, supported by the country's advanced textile sector, innovation leadership capabilities, and established market for premium industrial equipment solutions. German manufacturers and industrial facility operators prioritize innovation, reliability, and technical excellence, making thread-trimming machines essential equipment for both textile modernization and new facility projects. The country's comprehensive industrial ecosystem and adoption patterns support continued market development.

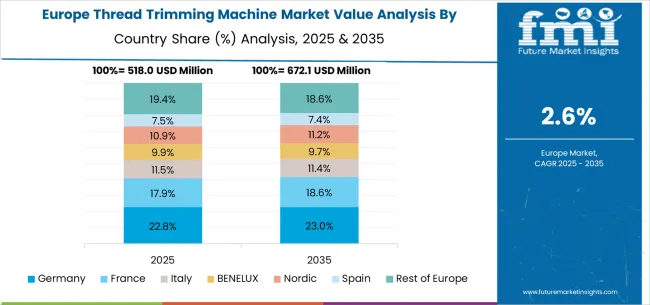

The thread trimming machine market in Europe is projected to grow from USD 0.5 billion in 2025 to USD 0.7 billion by 2035, registering a CAGR of 3.0% over the forecast period. Germany is expected to maintain its leadership position with a 35.2% market share in 2025, remaining stable at 35.0% by 2035, supported by its advanced precision engineering sector, premium industrial equipment manufacturing industry, and comprehensive innovation capabilities serving European and international markets.

France follows with a 22.8% share in 2025, projected to reach 23.1% by 2035, driven by advanced textile technology adoption programs, precision engineering development capabilities, and growing focus on industrial automation solutions for premium textile facilities. The United Kingdom holds an 18.4% share in 2025, expected to maintain 18.2% by 2035, supported by textile innovation market demand and advanced technology applications, but facing challenges from market competition and economic considerations. Italy commands a 12.6% share in 2025, projected to reach 12.8% by 2035, while Spain accounts for 7.3% in 2025, expected to reach 7.5% by 2035. The Netherlands maintains a 3.7% share in 2025, growing to 3.8% by 2035. The Rest of Europe region, including Nordic countries, Eastern Europe, Belgium, Switzerland, and Austria, is anticipated to hold 18.6% in 2025, declining slightly to 18.4% by 2035, attributed to mixed growth patterns with strong expansion in some Nordic textile markets balanced by moderate growth in smaller countries implementing industrial modernization programs.

The thread trimming machine market is characterized by competition among established industrial trimming equipment manufacturers, specialized textile machinery companies, and integrated automation solution providers. Companies are investing in advanced trimming control technologies, energy efficiency optimization systems, application-specific product development, and comprehensive performance enhancement capabilities to deliver consistent, high-performance, and reliable thread trimming machine products. Innovation in efficiency enhancement, precision control optimization, and customized industrial compatibility is central to strengthening market position and customer satisfaction.

JUKI Corporation leads the market with a strong focus on industrial trimming innovation and comprehensive automation solutions, offering advanced thread trimming machine products that emphasize reliability and technology integration excellence. BROTHER Industrial provides specialized industrial trimming capabilities with a focus on quality manufacturing and market leadership. JACK Sewing delivers comprehensive trimming solutions with a focus on textile applications and operational reliability. MAQI specializes in trimming equipment with an emphasis on precision and cost-effectiveness. Mitsubishi Electric focuses on advanced trimming technologies and automation networks. Pegasus Sewing Machine Mfg. Co., Ltd., Emphasizes industrial automation expertise with a focus on system integration and operational efficiency.

The global thread trimming machine market is estimated to be valued at USD 2.1 billion in 2025.

The market size for the thread trimming machine market is projected to reach USD 2.9 billion by 2035.

The thread trimming machine market is expected to grow at a 3.2% CAGR between 2025 and 2035.

The key product types in thread trimming machine market are integrated trimmers, standalone trimmers and robotic post-trim systems.

In terms of application, apparel segment to command 55.0% share in the thread trimming machine market in 2025.

The global thread trimming machine market is estimated to be valued at USD 2.1 billion in 2025.

The market size for the thread trimming machine market is projected to reach USD 2.9 billion by 2035.

The thread trimming machine market is expected to grow at a 3.2% CAGR between 2025 and 2035.

The key product types in thread trimming machine market are integrated trimmers, standalone trimmers and robotic post-trim systems.

In terms of application, apparel segment to command 55.0% share in the thread trimming machine market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thread Seal Tape Market

Thread Milling Machine Market Size and Share Forecast Outlook 2025 to 2035

Continuous Thread Metal Cap Market

High-Strength Polyester Thread Market Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Market Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Kraft Paper Market Forecast and Outlook 2025 to 2035

Machine Condition Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Asia Pacific Forecast Outlook 2025 to 2035

Machine Vision Camera Market Size and Share Forecast Outlook 2025 to 2035

Machine Tool Oils Market Size and Share Forecast Outlook 2025 to 2035

Machine Vision System And Services Market Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Machine Tool Cooling System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Machine Tool Touch Probe Market Analysis - Size, Growth, and Forecast 2025 to 2035

Machine Mount Market Analysis - Size & Industry Trends 2025 to 2035

Machine Control System Market Growth – Trends & Forecast 2025 to 2035

Machine Automation Controller Market Growth – Trends & Forecast 2025 to 2035

Machine-to-Machine (M2M) Connections Market – IoT & Smart Devices 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA