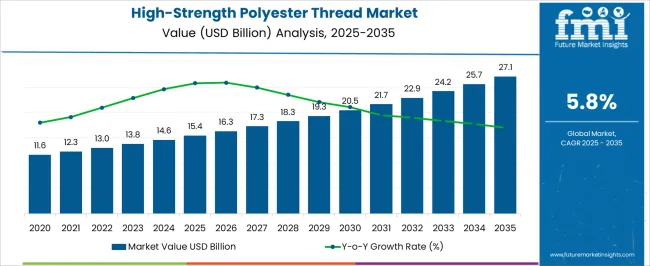

The High-Strength Polyester Thread Market is estimated to be valued at USD 15.4 billion in 2025 and is projected to reach USD 27.1 billion by 2035, registering a compound annual growth rate (CAGR) of 5.8% over the forecast period. The chart highlights a steady growth trajectory, reflecting increased demand across textiles, automotive, footwear, and industrial applications where strength, durability, and resistance to chemicals and abrasion are critical. From 2020 to 2025, the market advances from USD 11.6 billion to USD 16.3 billion, showing strong early adoption driven by rising apparel production and technical textile usage.

Between 2026 and 2030, the curve accelerates further, with values climbing to USD 20.5 billion by 2029, supported by automotive and upholstery applications where high-strength threads improve performance and longevity. Post-2030, the trajectory continues to rise steadily, surpassing USD 24 billion in 2033 and reaching USD 27.1 billion in 2035. The YoY growth rate line, however, shows a gradual decline, indicating that while revenues increase, the pace of growth moderates as the market matures.

| Metric | Value |

|---|---|

| High-Strength Polyester Thread Market Estimated Value in (2025 E) | USD 15.4 billion |

| High-Strength Polyester Thread Market Forecast Value in (2035 F) | USD 27.1 billion |

| Forecast CAGR (2025 to 2035) | 5.8% |

The high-strength polyester thread market is experiencing consistent growth, driven by increasing demand across apparel, industrial, and home textile applications. This growth is supported by the material’s superior tensile strength, abrasion resistance, and durability, making it ideal for applications that require long-lasting performance under mechanical stress. Advancements in manufacturing technologies have improved thread uniformity, colorfastness, and resistance to environmental factors, further enhancing its adoption.

The growing apparel industry, fueled by both fast fashion and premium segments, is significantly contributing to demand, while rising industrial applications in automotive, upholstery, and heavy-duty stitching are broadening market scope. Global trade expansion and increasing textile exports from manufacturing hubs in Asia-Pacific are also providing momentum to the market.

The shift towards sustainable and performance-oriented materials in textiles is leading to the adoption of recycled and eco-friendly polyester thread variants As manufacturers continue to innovate in product quality and application-specific customization, the market is expected to maintain strong growth, with increasing penetration in sectors where durability, aesthetics, and functional performance are equally important.

The high-strength polyester thread market is segmented by application, weave type, diameter, coating type, tensile strength, and geographic regions. By application, high-strength polyester thread market is divided into Apparel Clothing, Home Textiles, and Industrial. In terms of weave type, the high-strength polyester thread market is classified into Textured and Twisted. Based on diameter, high-strength polyester thread market is segmented into 40D, 20D, 30D, 60D, 80D, and 100D. By coating type, high-strength polyester thread market is segmented into Paraffin Waxed, Polyurethane, and Acrylic. By tensile strength, high-strength polyester thread market is segmented into 4000 cN/tex (g/tex), 3000 cN/tex (g/tex), and 5000 cN/tex (g/tex). Regionally, the high-strength polyester thread industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

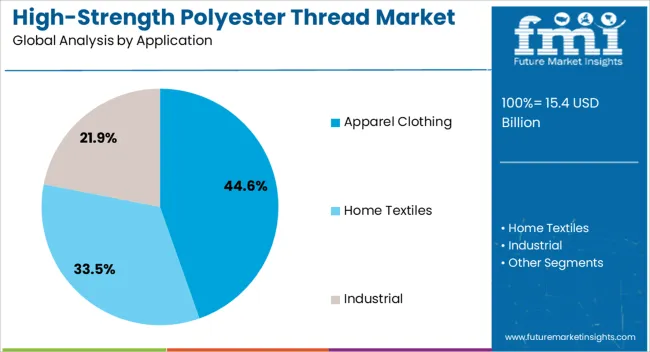

The apparel clothing segment is projected to account for 44.3% of the high-strength polyester thread market revenue share in 2025, making it the leading application area. Its dominance is being driven by the extensive use of high-strength polyester threads in garments that require durability, elasticity, and resistance to wear and tear. The material’s ability to maintain strength and appearance after repeated washing and exposure to sunlight is reinforcing its preference among apparel manufacturers.

The segment benefits from growing demand in both fast fashion and premium clothing lines, where stitching quality directly impacts product lifespan and consumer satisfaction. Advancements in dyeing technology have improved the thread’s colorfastness, ensuring long-lasting aesthetics across various fabric types.

As the global fashion industry expands and consumer expectations for quality and durability increase, manufacturers are prioritizing high-strength polyester threads for their reliability and performance. Additionally, the growing trend of multifunctional and performance-oriented clothing is further boosting the use of these threads in sportswear, workwear, and outdoor apparel, solidifying the segment’s leadership position.

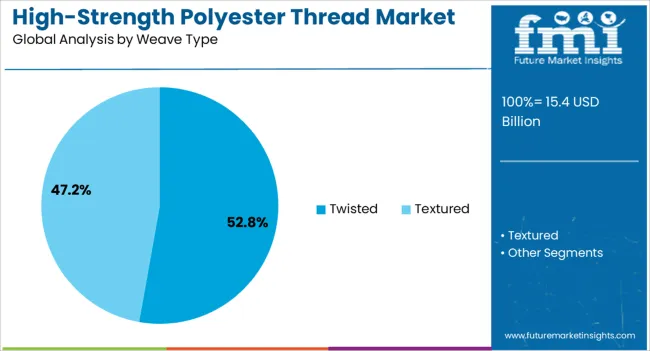

The textured weave type segment is expected to represent 57.9% of the high-strength polyester thread market revenue share in 2025, positioning it as the leading weave type. This dominance is being supported by the segment’s ability to provide enhanced softness, bulk, and elasticity compared to conventional thread constructions. Textured threads are widely preferred for applications that require both strength and comfort, making them suitable for apparel, home textiles, and certain industrial uses.

The segment’s growth is being reinforced by technological advancements in false-twist and air-texturing processes, which allow for consistent quality and improved performance characteristics. Enhanced moisture-wicking properties and flexibility are making textured polyester threads a preferred choice in garments where comfort and function must coexist.

Furthermore, manufacturers are leveraging the versatility of textured threads to meet diverse design and stitching requirements without compromising strength As demand for functional and aesthetically appealing textiles rises, the textured weave type is expected to maintain its leadership, driven by its adaptability to a wide range of fabric types and sewing applications.

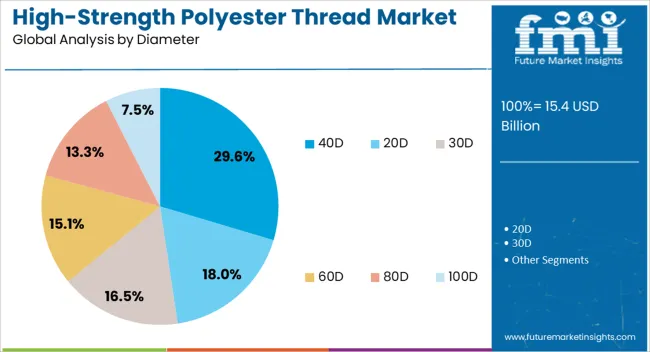

The 40D diameter segment is anticipated to hold 22.5% of the high-strength polyester thread market revenue share in 2025, making it a leading choice for specific high-performance applications. This preference is being attributed to the segment’s ability to provide an optimal balance between fine appearance and sufficient tensile strength, making it ideal for delicate yet durable stitching. The segment is extensively used in applications where precision, smooth seam finishes, and minimal bulk are required, such as in sportswear, lingerie, and lightweight apparel.

Its diameter allows for consistent thread flow during high-speed sewing, reducing breakage and improving production efficiency. The growing demand for high-quality finishing in garments and textile products is further supporting adoption.

Additionally, advancements in manufacturing are ensuring uniform thread diameter and enhanced abrasion resistance, which increases the lifespan of stitched products. As the apparel and specialized textile sectors continue to emphasize both aesthetics and durability, the 40D diameter segment is expected to retain its market significance, supported by its versatility and performance consistency.

The potassium tetrafluoroborate market is expanding due to its wide use in electroplating, chemical synthesis, and metal finishing applications. It provides excellent fluoride content, thermal stability, and reactivity, making it ideal for nickel plating, brazing, and flux production. Demand is rising in automotive, electronics, and industrial manufacturing. Asia-Pacific leads in production and consumption due to growing industrial output, while Europe focuses on high-purity applications. Manufacturers emphasize high-quality crystalline grades, impurity control, and consistent particle size to meet strict industrial requirements.

Potassium tetrafluoroborate is primarily used in nickel electroplating and metal finishing processes due to its ability to provide uniform deposition and reduce defects. It enhances surface smoothness, corrosion resistance, and adherence of the plated layer, which is critical for automotive, electronics, and aerospace components. Manufacturers supplying high-purity, consistent-grade potassium tetrafluoroborate are preferred for sensitive plating applications where quality defects can lead to product failures. Until alternative chemicals with similar plating efficiency, stability, and low impurity profiles become available, potassium tetrafluoroborate will remain essential for high-performance metal finishing processes.

Potassium tetrafluoroborate serves as a source of fluoride ions in chemical synthesis and acts as a fluxing agent in brazing and soldering. Its high thermal stability allows it to maintain performance under high-temperature industrial operations. Chemical manufacturers use it to produce specialty boron compounds and catalysts. Consistency in particle size, purity, and moisture content is critical to ensure predictable chemical reactions. Companies providing standardized, high-quality products gain a competitive advantage in industrial chemistry applications. Until alternative fluoride sources can match its stability, reactivity, and ease of handling, potassium tetrafluoroborate will remain a preferred reagent in chemical synthesis and industrial manufacturing.

The automotive and electronics sectors drive significant demand for potassium tetrafluoroborate due to its role in electroplating and corrosion-resistant coatings. In automotive applications, nickel-plated components, connectors, and fasteners rely on consistent deposition quality. Electronics components, including circuit boards and connectors, require smooth and uniform metal finishes. Manufacturers supplying high-purity potassium tetrafluoroborate with controlled particle size, low impurities, and consistent solubility meet stringent industry standards. Until alternative plating and coating chemicals offer similar efficiency and quality, automotive and electronics applications will continue to be the key demand drivers for potassium tetrafluoroborate.

Potassium tetrafluoroborate is classified as a chemical that requires careful handling due to its fluoride content and reactivity. Manufacturers must comply with regional safety regulations for storage, transport, and disposal to prevent environmental contamination and worker exposure. Industrial buyers prioritize suppliers that provide proper documentation, safety data sheets, and consistent quality assurance. Packaging in moisture-proof containers and adherence to purity specifications enhances product reliability. Until alternative chemicals with equivalent reactivity and lower regulatory burdens are developed, regulatory compliance and safe handling protocols remain critical considerations affecting adoption in industrial and electroplating markets.

| Countries | CAGR |

|---|---|

| China | 7.8% |

| India | 7.3% |

| Germany | 6.7% |

| France | 6.1% |

| UK | 5.5% |

| USA | 4.9% |

| Brazil | 4.4% |

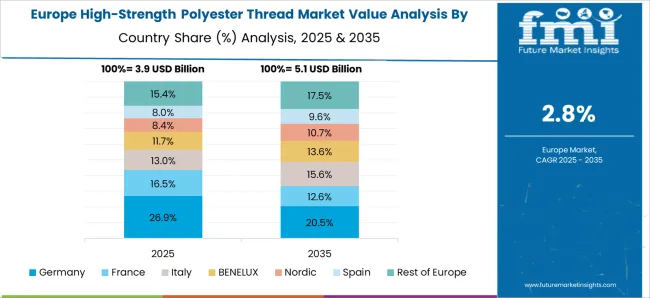

The global High-Strength Polyester Thread Market is projected to grow at a CAGR of 5.8% through 2035, supported by increasing demand across textile, industrial, and apparel applications. Among BRICS nations, China has been recorded with 7.8% growth, driven by large-scale production and deployment in industrial textiles and garment manufacturing, while India has been observed at 7.3%, supported by rising utilization in apparel and industrial stitching applications. In the OECD region, Germany has been measured at 6.7%, where production and adoption for industrial, textile, and apparel applications have been steadily maintained. The United Kingdom has been noted at 5.5%, reflecting consistent use in apparel and industrial textiles, while the USA has been recorded at 4.9%, with production and utilization across textile, apparel, and industrial sectors being steadily increased. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The high-strength polyester thread market in China is growing at a CAGR of 7.8%, driven by expanding textile, automotive, and industrial applications. These threads are widely used in upholstery, safety harnesses, tire cords, and heavy-duty sewing applications due to their superior tensile strength, durability, and resistance to abrasion. China’s robust textile and manufacturing sectors provide a consistent demand base, further supported by automotive production and infrastructure projects requiring high-performance threads. Technological advancements in polymer processing and thread manufacturing enhance product quality and consistency. Government initiatives promoting industrial growth and export competitiveness support market expansion. Rising demand in the furniture, apparel, and technical textile industries also fuels growth. Environmental considerations and adoption of sustainable production methods are shaping manufacturing strategies. Overall, the market in China benefits from a combination of industrial demand, technological improvements, and expanding end-use applications.

The high-strength polyester thread market in India is expanding at a CAGR of 7.3%, supported by growth in textiles, automotive, and industrial manufacturing. The threads are preferred in heavy-duty sewing, upholstery, safety harnesses, and technical textiles due to their durability and strength. Increasing production in apparel, automotive interiors, and industrial fabrics drives demand for superior-quality threads. Indian manufacturers are focusing on cost-effective production techniques while maintaining high standards for tensile strength and abrasion resistance. Government initiatives promoting Make in India, industrial safety, and export-oriented textile growth contribute positively to market development. Technological improvements in polyester polymerization and thread extrusion enhance quality and productivity. Growing awareness of sustainability encourages adoption of eco-friendly manufacturing methods. Rising demand from infrastructure, automotive, and technical textile sectors ensures steady market growth for high-strength polyester threads in India.

The high-strength polyester thread market in Germany is growing at a CAGR of 6.7%, driven by industrial applications, automotive production, and technical textiles. The threads are used extensively in upholstery, tire cords, safety harnesses, and heavy-duty sewing applications due to their high tensile strength, flexibility, and durability. Germany’s focus on high-quality manufacturing and stringent industry standards ensures demand for premium-grade polyester threads. Automotive, construction, and furniture industries are key end-users, while R&D investments in polymer processing improve thread performance and reduce environmental impact. Exports to neighboring European countries enhance market opportunities. Environmental regulations and sustainability trends shape production practices, with manufacturers focusing on eco-friendly materials and energy-efficient processes. Overall, Germany maintains a stable and technically advanced high-strength polyester thread market, driven by industrial demand, high-quality standards, and export potential.

The high-strength polyester thread market in the United Kingdom is growing at a CAGR of 5.5%, driven by demand in industrial fabrics, automotive interiors, and upholstery applications. Threads with superior tensile strength, durability, and abrasion resistance are widely adopted in manufacturing and technical textile sectors. UK manufacturers are investing in process optimization and quality improvements to meet industrial and safety requirements. Government policies promoting industrial safety, manufacturing innovation, and export competitiveness support market growth. Applications in automotive, construction, and furniture industries provide consistent demand. Sustainability considerations are influencing production methods, encouraging energy-efficient and environmentally friendly manufacturing practices. Overall, the UK market is expected to grow steadily as industrial and technical textile demands expand, driven by high-performance product requirements and technological improvements.

The high-strength polyester thread market in the United States is expanding at a CAGR of 4.9%, fueled by demand in automotive, industrial, and textile sectors. These threads are critical in heavy-duty sewing, tire cords, upholstery, and safety harness applications due to their high strength, abrasion resistance, and durability. Manufacturers are focusing on improving thread quality through advanced polymer processing and extrusion techniques. Industrial and technical textile applications drive steady demand, particularly in automotive interiors and construction fabrics. Government regulations emphasizing industrial safety, environmental compliance, and sustainable production practices influence market trends. The combination of technological innovation, regulatory standards, and steady industrial demand ensures consistent growth for high-strength polyester threads in the USA, with applications spanning automotive, textile, and safety-critical manufacturing sectors.

The high-strength polyester thread market is a crucial segment of the textile industry, catering to applications that demand durability, abrasion resistance, and superior tensile strength. This includes sectors such as automotive upholstery, industrial sewing, outdoor gear, and heavy-duty garments. The growing demand for high-performance textiles and the expansion of the global apparel and industrial manufacturing sectors are key drivers of market growth.

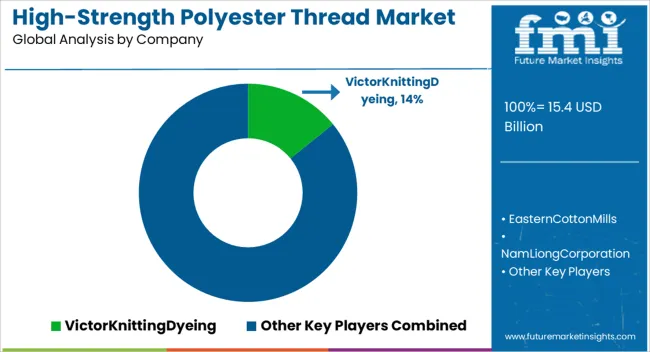

Victor Knitting Dyeing is recognized for producing premium polyester threads with excellent strength and colorfastness, catering to both industrial and consumer needs. Eastern Cotton Mills specializes in engineered threads designed for durability and consistent performance across demanding applications. Nam Liong Corporation offers innovative polyester thread solutions, emphasizing technical textiles and industrial sewing markets. Mettler provides precision threads with high tensile strength and uniformity, suitable for embroidery and functional applications. Apex Mills and A Textiles supply threads that combine strength and flexibility, serving the automotive, upholstery, and fashion industries. Coats plc and Unifi, Inc. are global leaders offering a broad portfolio of high-performance threads, integrating sustainability and innovation in production.

Elevate Textiles, Madeira Garne, Nilit, and Sung Fu Yarns contribute to the market by delivering specialized threads for industrial and decorative applications, focusing on durability and technical performance. RKW Group complements the sector with engineered solutions that meet rigorous industrial standards. As industries increasingly require threads that can withstand harsh conditions without compromising aesthetics or performance, high-strength polyester threads remain essential, with leading suppliers driving innovation, quality, and global availability.

| Item | Value |

|---|---|

| Quantitative Units | USD 15.4 Billion |

| Application | Apparel Clothing, Home Textiles, and Industrial |

| Weave Type | Textured and Twisted |

| Diameter | 40D, 20D, 30D, 60D, 80D, and 100D |

| Coating Type | Paraffin Waxed, Polyurethane, and Acrylic |

| Tensile Strength | 4000 cN/tex (g/tex), 3000 cN/tex (g/tex), and 5000 cN/tex (g/tex) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Victor Knitting Dyeing, Eastern Cotton Mills, Nam Liong Corporation, Mettler, Apex Mills, A Textiles, RKW Group, Coats plc, Unifi, Inc, Elevate Textiles, Madeira Garne, Nilit, and Sung Fu Yarns |

| Additional Attributes | Dollar sales vary by grade, including industrial and high-purity potassium tetrafluoroborate; by application, such as fluxing agents in metal processing, electroplating, and specialty chemicals; by end-use industry, spanning automotive, electronics, aerospace, and metal finishing; by region, led by Asia-Pacific, Europe, and North America. Growth is driven by increasing demand in metal surface treatment, electronics manufacturing, and specialty chemical applications. |

The global high-strength polyester thread market is estimated to be valued at USD 15.4 billion in 2025.

The market size for the high-strength polyester thread market is projected to reach USD 27.1 billion by 2035.

The high-strength polyester thread market is expected to grow at a 5.8% CAGR between 2025 and 2035.

The key product types in high-strength polyester thread market are apparel clothing, home textiles and industrial.

In terms of weave type, textured segment to command 57.9% share in the high-strength polyester thread market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Polyester Polyol Market Size and Share Forecast Outlook 2025 to 2035

Polyester Hot Melt Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Polyester Straps Market Size and Share Forecast Outlook 2025 to 2035

Polyester Fiber Market Size and Share Forecast Outlook 2025 to 2035

Polyester Labels Market – Growth & Demand 2025 to 2035

Polyester Resin Dispersion Market Analysis & Forecast by Viscosity Type, Process, End-Use Industry and Region through 2025 to 2035

Industry Share Analysis for Polyester Straps Companies

Nonwoven Polyester Fabric Market Growth – Trends & Forecast 2025 to 2035

Saturated Polyester Resin Market Growth – Trends & Forecast 2024-2034

Metallised Polyester Films Market Size and Share Forecast Outlook 2025 to 2035

Titanium Catalyst for Polyester Market Size and Share Forecast Outlook 2025 to 2035

Thread Trimming Machine Market Size and Share Forecast Outlook 2025 to 2035

Thread Milling Machine Market Size and Share Forecast Outlook 2025 to 2035

Thread Seal Tape Market

Continuous Thread Metal Cap Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA