The industry for polyester resin dispersion expanded, driven by demand from the coatings, & adhesives, and textiles industry. This growing trend for the betterment of ecology led to a high gain in the green coatings common in the automotive industry, with increased adoption in resin dispersion applications. Furthermore, regulatory changes in Europe forced suppliers to move toward more sustainable, water-based resin formulations. Supply chain disruption was moderate and mainly impacted by raw material price fluctuations and logistics constraints in Asia.

As we move into 2025, the industry is ready to grow further with infrastructure and construction projects speeding up, particularly among emerging industries. The polyester resin dispersion industry is likely to be valued at USD 8.37 billion by 2025 and will continue to grow at a CAGR of 4.8%, by the year CHF 13.37 billion. The push for sustainable products continues, & and manufacturers are creating bio-based and low-VOC resins. R&D investment is set to rise, facilitating the development of high-end formulations with enhanced durability and adhesion.

After 2025, polyester resin dispersions are expected to gain wider adoption in electronics and packaging due to their superior barrier properties. North America and Asia-Pacific are expected to be the key growth regions, with China and India heavily investing in large-scale production. A greater emphasis on customized resin solutions is expected, as end users increasingly seek properties tailored to specific applications. And while competition will become fierce, companies that drive sustainability and performance improvement will prosper.

Industry Forecast Table

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 8.37 billion |

| Industry Value (2035F) | USD 13.37 billion |

| CAGR (2025 to 2035) | 4.8% |

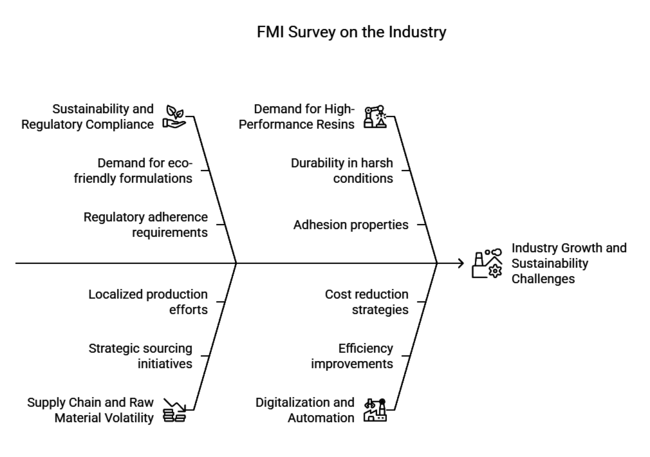

In the recent years, a survey was conducted during the pandemic on polyester resin dispersion; the data got collected based on feedback from the major stakeholders in the product ecosystem, including manufacturers, suppliers, and consumers. Among the interviewed respondents, 72% viewed sustainability and regulatory compliance as major priorities, with high demand for environmentally friendly formulations expected in the industry.

Another major takeaway was the increasing demand for high-performance resins with durability and adhesion. Over 65% of participants preferred dispersions that enhance product durability and withstand harsh environmental conditions. This is especially true in the auto, construction, and packaging industries, where quality and performance significantly influence purchasing decisions.

In the recent years, a survey was conducted during the pandemic on polyester resin dispersion; the data got collected based on feedback from the major stakeholders in the product ecosystem, including manufacturers, suppliers, and consumers. Among the interviewed respondents, 72% viewed sustainability and regulatory compliance as major priorities, with high demand for environmentally friendly formulations expected in the industry.

Another major takeaway was the increasing demand for high-performance resins with durability and adhesion. Over 65% of participants preferred dispersions that enhance product durability and withstand harsh environmental conditions. This is especially true in the auto, construction, and packaging industries, where quality and performance significantly influence purchasing decisions.

Furthermore, supply chain disruption and volatility of raw material prices were giant concerns. Volatility in costs was cited as a top growth deterrent by nearly 58% of respondents, with many highlighting strategic sourcing and localized production as key strategies for mitigating risks. Stakeholders were also interested in digitalization and automation for increasing manufacturing efficiency and reducing operating expenses.

Looking ahead, stakeholders expect continued growth in the industry, with Asia-Pacific viewed as the region with the greatest growth potential. Companies will probably focus on research and development (R&D), differentiating their products and services from those of their competitors, and forming joint ventures or partnerships with other firms to remain competitive.

| Country | Regulatory Impact & Mandatory Certifications |

|---|---|

| United States | EPA regulations under the Clean Air Act restrict VOC emissions from coatings and adhesives. It is necessary to adhere to the requirements of the TSCA (Toxic Substances Control Act) and obtain chemical safety certifications from the EPA. |

| United Kingdom | REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) must be complied with. After Brexit, compliance for products requires UKCA marking. |

| France | Severe VOC emission limits under the French Environmental Code. They also aim to establish type approval for eco-friendly coatings like NF Environment. |

| Germany | German Chemicals Act: strict standards-Blue Angel certification. The classification of coatings follows the DIN EN 13300 standard. |

| Italy | Italian UNI standards determine compliance with EU REACH and CLP (Classification, Labelling, and Packaging) regulations, coating durability, and safety. |

| South Korea | Registration and evaluation of chemical substances under K-REACH KC Mark certification is mandatory for industrial safety. |

| Japan | Harmful materials are governed by the Chemical Substances Control Law (CSCL). 〇 Resin-based products-JIS (Japanese Industrial Standards). |

| China | China REACH (MEE Order No. 12) also requires chemical registration. For some industrial products, CCC (China Compulsory Certification) is a requirement. |

| Australia & New Zealand | The industry was also regulated under NICNAS (National Industrial Chemicals Notification and Assessment Scheme) in Australia and the HSNO Act (Hazardous Substances and New Organisms Act) in New Zealand when they came into force. |

| India | Resin products are certified by the Bureau of Indian Standards (BIS). Businesses must comply with the Environmental Protection Act, which limits VOC emissions. |

The United States polyester resin dispersion industry is anticipated to grow at a CAGR of 4.5% during the period from 2025 to 2035. Demand is mainly stimulated by growing demand from the coatings, automotive, and packaging sectors. The Environmental Protection Agency (EPA) is enforcing tighter environmental regulations, which are compelling manufacturers to produce low-VOC and water-based products. Further, increasing infrastructure development, most notably in the residential and commercial sectors, is driving demand for long-lasting and eco-friendly coatings.

The United States automotive industry, a leading consumer of polyester resin dispersions, is changing to green coating alternatives as emission regulations and demand for sustainability gain momentum. Ongoing research on bio-based resins is expected to create new opportunities for manufacturers.

The United Kingdom polyester resin dispersion industry is expected to register a 4.2% CAGR between 2025 and 2035. The UK government's strong emphasis on achieving net-zero emissions by 2050 is compelling industries to adopt low-VOC and green resins. The post-Brexit regulatory environment has mandated UKCA (UK Conformity Assessed) certification for products, thereby increasing the difficulty for international manufacturers to enter the industry.

The construction industry in the country is one of the chief growth drivers, with architectural coatings having far-reaching applications of polyester resin dispersions. Secondly, the UK's packaging industry is shifting toward recyclable and biodegradable packaging, driving up demand for high-end resin formulations. Though economic volatilities and trade barriers may pose challenges, investments in sustainable materials and green technology are likely to drive long-term industry growth.

The industry for French polyester resin dispersion is projected to grow at a CAGR of 4.0% during the period 2025 to 2035. The nation's robust environmental policies and strict VOC controls under the French Environmental Code are compelling manufacturers to emphasize low-emission coatings. The NF Environment eco-friendly product label has also gained prominence, driving the formulation of coatings and adhesives products.

France's construction industry is projected to continue to be a driving force behind demand as a result of incentives for energy-saving building materials at the government level. The automobile industry, also a large end-user, is moving toward corrosion-resistant and lighter-weight coatings, further driving consumption of polyester resin dispersion. But supply chain limitations and increased raw material costs, like isophthalic acid and neopentyl glycol, may be challenges.

Germany's industry for polyester resin dispersions is expected to expand at a CAGR of 4.7% from 2025 to 2035. The nation, famous for its industrial coatings and automobile industries, is fuelling demand for environment-friendly and high-performance resin dispersions. The Blue Angel certification, a sustainability benchmark for coatings, is impacting product development within the country.

Germany's manufacturing industry, including heavy machinery and electronics, is also driving industry growth by requiring durable and heat-resistant coatings. Furthermore, Germany's focus on a circular economy is driving the use of bio-based resins, with most manufacturers making investments in research and development for green alternatives. Yet, government backing for green innovations will counteract these hardships.

The Italian industry for polyester resin dispersion is expected to exhibit a CAGR of 3.9% in 2025 to 2035, driven by the automotive and construction sectors. Italy's compliance with EU REACH and CLP regulations guarantees that resin dispersions employed in industrial processes comply with stringent health and environmental safety standards. Aesthetic and protective coating demand in Italy's building sector is increasing, especially in historic building restoration projects.

The packaging industry in Italy is also experiencing rising demand for green barrier coatings, which should lead to innovations in polyester resin formulation. However, government policies to promote sustainable manufacturing and the move toward bio-based raw materials are likely to create long-term industry opportunities.

The South Korean polyester resin dispersion industry is expected to grow at a CAGR of 5.0% from 2025 to 2035. The electronics and automotive sectors of the country are key drivers of growth, driven by rising demand for high-performance coatings that offer scratch resistance, hardness, and heat resistance. South Korea's K-REACH regulations mandate that chemical substances are registered by manufacturers, adhering to strict safety and environmental regulations.

Government initiatives in favor of environmentally friendly industrial growth are also persuading businesses to invest in water-based and low-VOC resins. While such encouraging trends exist, there are challenges for local manufacturers stemming from price volatility in raw materials and competition from domestic producers in China and Japan.

The Japanese industry for polyester resin dispersion is forecast to have a CAGR of 4.4% in 2025 to 2035. The nation's manufacturing industry, which is highly technology-intensive, like automotive, electronics, and robotics, depends greatly on the use of advanced resin dispersions in coatings and adhesives. The Japanese Industrial Standards (JIS) guarantee that products based on resin achieve high performance and durability standards.

Japan is investing in bio-based and low-VOC resins to support its 2050 carbon neutrality goals. Although a declining workforce and high production costs may hinder growth, advancements in nanotechnology and smart coatings are expected to create new opportunities in high-end manufacturing.

China is expected to witness the highest growth rate (5.5% CAGR) during 2025 to 2035. The booming construction industry, industrialization, and growing automotive industry in the country are the key drivers of demand for polyester resin dispersions. China REACH (MEE Order No. 12) requires chemical registration, prompting manufacturers to enhance product safety and compliance. Government policies supporting green manufacturing are also driving the shift to bio-based resins. However, volatile raw material costs and regulatory risks may pose challenges. Still, with China's continuous investments in industrial automation and advanced coatings, the industry will witness robust growth.

Australia and New Zealand are anticipated to witness a CAGR of 3.8% on the back of the construction and packaging industries. Regulation by NICNAS (Australia) and HSNO (New Zealand) guarantees that industrial resins used follow rigorous environmental protection standards. Increased demand for environmentally friendly coatings and adhesives boosts innovation in bio-based resin dispersions.

The industry is, however, small and import-driven, so it is subject to disruptions in global supply chains. Furthermore, government policies favoring green building materials and circular economy practices will create new prospects for resin manufacturers. The increased emphasis on sophisticated composites in marine and automotive industries further augments the prospect of high-performance polyester resin dispersions in the region.

India's industry for polyester resin dispersion is projected to expand at a CAGR of 5.3% owing to fast urbanization, industrial growth, and infrastructure development. The Bureau of Indian Standards (BIS) provides quality compliance, while stringent VOC emission regulations are compelling manufacturers to adopt sustainable options. Increased investments in smart cities and industrial ventures are likely to drive industry demand.

Raw material price volatility and supply chain inefficiencies are potential challenges. To offset these challenges, companies are increasingly implementing backward integration strategies and entering into long-term supplier contracts. Additionally, government incentives promoting Make in India and sustainability-focused policies are likely to encourage more domestic production.

Based on types, the medium-viscosity polyester resin dispersion segment leads the industry due to its balanced properties, which makes them ideal for coatings, adhesives, and sealants in the construction and automotive sectors. It is their adhesion, flexibility, and durability that make these resins widely used. Low-viscosity resins are becoming more popular in the packaging and electrical industries because they are easily applied and cured.

While that happens, high-viscous resins are becoming more important in the aerospace, marine, and industrial sectors, where mechanical strength, and especially chemical resistance, in harsh environments, is crucial. While medium-viscosity resins dominate the industry, the low-viscosity segment is expected to grow rapidly due to its increasing use in flexible packaging and electronics coatings. With the ongoing demand for high-strength and lightweight materials, advancing viscosity control technology will lead to innovations in tailored formulations for specific applications.

The growth of the industry for water-based polyester resin dispersions is primarily driven by environmental protection policies and the transformation of the industry towards eco-friendly and low-VOC solutions. They are widely used in architectural coatings, car refinishing, and industrial applications due to their low toxicity and compliance with strict emission standards in regions such as Europe and North America. Solvent-borne resins continue to dominate due to their superior durability and adhesion, which are essential for heavy-duty applications like marine and defence coatings.

But growing ecological concerns and regulatory pressures are increasingly limiting their expansion. UV & EB curing technologies in the radiation-cured segment are the fastest-growing process type, most notably in the following top industries: electronics, packaging, and automotive. The rapid curing, excellent chemical resistance, and increased energy efficiency offered by these resins make them more favorable for high-performance applications.

Polyester resin dispersions remain by far the largest application area (with the highest industry share) within the broader building and construction category. The coatings, adhesives, and waterproofer solutions lead the industry, with the expansion of infrastructure and urbanization boosting demand in developing economies. Automotive and Transportation: Another prominent end-user industry for polyester resin dispersions automotive and transportation, where the product is used in protective coating, adhesives, and lightweight materials to ensure better fuel efficiency and durability.

Strong growth is also being driven within the electrical, packaging, and electronics segment, with the demand for protective films, insulating materials, and flexible packaging materials on the rise. The aerospace and defence industry is expected to be among the fastest-growing segments in the high-performance coatings industry, emphasizing lightweight, high-performance coatings with thermal stability and corrosion resistance. In contrast, the algae-based biofuels industry is segmented into biodiesel and bioethanol, with the latter expected to experience growth due to rising investment in marine and offshore structures with durable sustainable coatings.

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| There was a steady growth in the industry owing to increasing requirements from the construction, automotive, and packaging sectors. | Improved demand from high-performance sectors such as aerospace, defence, and electronics will accelerate growth. |

| Water-based resin dispersions continued to grow with tightening VOC regulations, particularly in Europe and North America. | Water-based systems will lead; however, the development of bio-based and radiation-cured resins for more sustainable practices continues. |

| The COVID-19 pandemic caused supply chain disruptions that led to raw material shortages and volatile resin prices. | Supply chains will stabilize as risk mitigation by localized manufacturing and strategic sourcing takes hold. |

| Industrial growth in developing economies, especially in the Asia-Pacific region, significantly drove industry demand. | Asia-Pacific is poised to lead the charge when it comes to growth, with increased investment in smart manufacturing and green technology. |

| Research and development activities focus on enhancing performance and, rarely before focused on resin endurance in industrial coatings. | Research and development will leverage custom molecular formulations, upcyclable materials, and nanotechnology for high-end applications. |

| Firms faced mounting expenses due to inflation, fluctuating crude oil prices, and the resulting impact on resin production. | Therefore, cost management initiatives such as alternative raw materials and process design optimization will be important competitive advantages. |

In the overall chemical and materials industry, the polyester resin dispersion industry is part of the specialty chemicals and performance coatings segment. It is heavily influenced by macroeconomic factors such as industrialization, infrastructure development, environmental regulations, and global supply chain trends.

From a macro-economic perspective, this marketplace is a great deal interconnected to construction, automotive, packaging, and electronics sectors, those which generate the need for such development. Rising urbanization and industrialization in developing industries, notably in the Asia-Pacific region, this has fuelled demand for high-performance coatings, adhesives, and composite products. Sustainability is another major worldwide industry driver with legislation calling for low-VOCs and environmentally friendly resins. While established industries in Europe and North America drive R&D spending in water-based and bio-based resins for coatings and adhesives, this also opens opportunities for new products based on microalgae, marine biomass, and ARMS technology.

The sector faces these challenges on the supply side including raw material price volatility, geopolitical trade policies, and logistical disruptions. However, technological modifications in radiation-cured and smart coatings are expected to mitigate certain of these challenges. (Despite this, the industry is expected for consolidation, strategic alliances, and localized production clusters to reshape the competitive landscape in the next decade.) As post-pandemic economies stabilize, the demand for resilient, high-performing, and sustainable polyester resin dispersions is anticipated to remain strong, driving steady industry growth.

The leading players in the polyester resin dispersion compete on the basis of pricing policies, innovation, strategic alliances, and geographic growth. Leading players are choosing to invest in bio-based and high-performance resin technologies to align with dynamic business needs around cost minimization and differentiation of product offerings. Companies are also engaging in mergers, acquisitions, and partnerships to strengthen their global presence and develop robust supply chains. Growing industrialization in emerging industries, particularly in Asia-Pacific, presents a significant expansion opportunity. All companies are also forming R&D alliances to produce low-VOC, water-based, and radiation-cured resins that comply with the strictest environmental regulations for longer strategic sustainability and uninterrupted industry evolution.

BASF SE

Industry Share: ~20-25%

BASF is one of the key global players in the production of chemicals, and it already offers a forward-looking product portfolio and broad-based research resources on the global industry for polyester resin dispersion. It specializes in sustainable, high-performance products for industries including coatings, adhesives, and composites.

Dow Chemical Company

Industry share: ~15-20%

Dow has a key position in the business of polyester resin dispersion and leverages its material science and green chemistry expertise. Thus, it has been launching its respective product ranges according to rising requirements for more environmentally forward and performance-verse resin applications.

Allnex GmbH

Industry share: ~10-15%

Allnex is a leading supplier of coating resins and additives and has a very strong position in the industry for polyester resin dispersion. The company has been building product lines in new product development and sustainability, including waterborne and low-VOC products.

DSM-Firmenich

Industry Share: ~10-12%

DSM Firmenich has been built through the merger of DSM and Firmenich in 2023 and has become a stronger force in the polyester resin dispersions industry. The company focuses on high-performance and sustainable solutions specifically in the coatings and adhesives industry.

Arkema Group

Industry Share: ~8-10%

Arkema is known for its industry-leading polyester resin dispersion and innovative material solutions, offering a range of resins as well as other products. Trend toward Sustainability: The company has been developing bio-based and recyclable resin technologies.

Nuplex Industries (Acquired by Allnex)

Industry Share: ~5-8%

Through the sustainable and innovative solutions of their product portfolio, now including those of Nuplex, which became part of Allnex's range in 2016, Following its acquisition by Allnex in 2016, Nuplex's product portfolio continues to contribute to Allnex’s leadership in the polyester resin dispersion industry. The acquisition further reinforces Allnex's industry leadership.

Other Players

Industry Share: ~10-15%

These are mainly smaller regional players and specialty manufacturers who contribute low-cost and niche products to the industry.

The move towards sustainable and low-VOC resin dispersions is a huge growth opportunity for stakeholders. Incentives in investing in bio-based raw materials and waterborne systems should be prioritized by companies as the regulatory authorities in North America and Europe introduce stricter controls on solvent-based resins. R&D should aim to improve resin performance, especially in terms of durability, adhesion, and curing efficiency, to address high-growth industries such as aerospace, defence, and electronics where high-tech coatings are required.

Asian-Pacific emerging industries, specifically China and India, are rich with opportunities for expansion based on high rates of industrialization and infrastructure development. But to penetrate these industries, one must adopt localized production approaches in order to deal with trade restrictions and break away from dependency on unreliable global supply chains. Forming strategic alliances with regional producers and distributors can provide a competitive advantage in high-growth industries.

To counteract raw material price volatility, firms must consider backward integration through securing direct supply contracts with raw material suppliers or making investments in alternative feedstocks. Furthermore, adopting automation and AI-based process optimization can assist manufacturers in lowering the cost of production and enhancing efficiency, allowing them to maintain competitive pricing without affecting product quality.

Ensuring compliance with certifications (e.g., REACH in Europe, K-REACH in Korea, and BIS in India) will be crucial for smooth industry entry and sustainable business operations.

Type the industry is segmented into low, medium, and high

it is segmented into solvent-based, water-based, and radiation-cured

it is fragmented into building & construction, automotive & transportation, packaging, electrical & electronics, aerospace & defence, marine and Others

it is segmented among North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe, Central Asia, Russia & Belarus, Balkan & Baltic Countries, and Middle East & Africa

Green coatings, sealants, and high-performance composites are increasingly being adopted in sectors such as construction and automotive.

Tighter environmental regulations push firms to focus on bio-based, waterborne, and low-VOC formulations.

High-performance resin dispersions are gaining a foothold in various aerospace, electronics, and marine applications.

Raw material pricing fluctuations, supply challenges, and compliance with new regional regulations.

Advances in radiation curing, nanotechnology, and smart coatings are enhancing performance and application effectiveness.

Table 01: Global Market Size Volume (Tons) and Value (US$ Million) Forecast By Viscosity Type, 2018 to 2033

Table 02: Global Market Size Volume (Tons) and Value (US$ Million) Forecast By Process, 2018 to 2033

Table 03: Global Market Size Volume (Tons) Forecast By End-use Industry, 2018 to 2033

Table 04: Global Market Size Volume (Tons) and Value (US$ Million) Forecast By Region, 2018 to 2033

Table 05: North America Market Size Volume (Tons) and Value (US$ Million) Forecast By Country, 2018 to 2033

Table 06: North America Market Size Volume (Tons) and Value (US$ Million) Forecast By Viscosity Type, 2018 to 2033

Table 07: North America Market Size Volume (Tons) and Value (US$ Million) Forecast By Process, 2018 to 2033

Table 08: North America Market Size Volume (Tons) Forecast By End-use Industry, 2018 to 2033

Table 09: Latin America Market Size Volume (Tons) and Value (US$ Million) Forecast By Country, 2018 to 2033

Table 10: Latin America Market Size Volume (Tons) and Value (US$ Million) Forecast By Viscosity Type, 2018 to 2033

Table 11: Latin America Market Size Volume (Tons) and Value (US$ Million) Forecast By Process, 2018 to 2033

Table 12: Latin America Market Size Volume (Tons) Forecast By End-use Industry, 2018 to 2033

Table 13: Europe Market Size Volume (Tons) and Value (US$ Million) Forecast By Country, 2018 to 2033

Table 14: Europe Market Size Volume (Tons) and Value (US$ Million) Forecast By Viscosity Type, 2018 to 2033

Table 15: Europe Market Size Volume (Tons) and Value (US$ Million) Forecast By Process, 2018 to 2033

Table 16: Europe Market Size Volume (Tons) Forecast By End-use Industry, 2018 to 2033

Table 17: East Asia Market Size Volume (Tons) and Value (US$ Million) Forecast By Country, 2018 to 2033

Table 18: East Asia Market Size Volume (Tons) and Value (US$ Million) Forecast By Viscosity Type, 2018 to 2033

Table 19: East Asia Market Size Volume (Tons) and Value (US$ Million) Forecast By Process, 2018 to 2033

Table 20: East Asia Market Size Volume (Tons) Forecast By End-use Industry, 2018 to 2033

Table 21: South Asia & Pacific Market Size Volume (Tons) and Value (US$ Million) Forecast By Country, 2018 to 2033

Table 22: South Asia & Pacific Market Size Volume (Tons) and Value (US$ Million) Forecast By Viscosity Type, 2018 to 2033

Table 23: South Asia & Pacific Market Size Volume (Tons) and Value (US$ Million) Forecast By Process, 2018 to 2033

Table 24: South Asia & Pacific Market Size Volume (Tons) Forecast By End-use Industry, 2018 to 2033

Table 25: Middle East and Africa Market Size Volume (Tons) and Value (US$ Million) Forecast By Country, 2018 to 2033

Table 26: Middle East and Africa Market Size Volume (Tons) and Value (US$ Million) Forecast By Viscosity Type, 2018 to 2033

Table 27: Middle East and Africa Market Size Volume (Tons) and Value (US$ Million) Forecast By Process, 2018 to 2033

Table 28: Middle East and Africa Market Size Volume (Tons) Forecast By End-use Industry, 2018 to 2033

Figure 01: Global Market Historical Volume (Tons), 2018 to 2022

Figure 02: Global Market Current and Forecast Volume (Tons), 2023 to 2033

Figure 03: Global Market Historical Value (US$ Million), 2018 to 2022

Figure 04: Global Market Current and Forecast Value (US$ Million), 2023 to 2033

Figure 05: Global Market Incremental $ Opportunity (US$ Million), 2023 to 2033

Figure 06: Global Market Share and BPS Analysis By Viscosity Type- 2023 & 2033

Figure 07: Global Market Y-o-Y Growth Projections By Viscosity Type, 2023 to 2033

Figure 08: Global Market Share and BPS Analysis By Process, 2023 & 2033

Figure 09: Global Market Y-o-Y Growth Projections By Process, 2023 to 2033

Figure 10: Global Market Attractiveness Analysis By Process, 2023 to 2033

Figure 11: Global Market Share and BPS Analysis By End-use Industry- 2023 & 2033

Figure 12: Global Market Y-o-Y Growth Projections By End-use Industry, 2023 to 2033

Figure 13: Global Market Attractiveness Analysis By End-use Industry, 2023 to 2033

Figure 14: Global Market Share and BPS Analysis By Region- 2023 & 2033

Figure 15: Global Market Y-o-Y Growth Projections By Region, 2023 to 2033

Figure 16: Global Market Attractiveness Analysis By Region, 2023 to 2033

Figure 17: Global Market Absolute $ Opportunity by North America Segment, 2018-2033

Figure 18: Global Market Absolute $ Opportunity by Latin America Segment, 2018-2033

Figure 19: Global Market Absolute $ Opportunity by Europe Segment, 2018-2033

Figure 20: Global Market Absolute $ Opportunity by East Asia Segment, 2018-2033

Figure 21: Global Market Absolute $ Opportunity by South Asia & Pacific Segment, 2018-2033

Figure 22: Global Market Absolute $ Opportunity by Segment, 2018-2033

Figure 23: North America Market Share and BPS Analysis By Country- 2023 & 2033

Figure 24: North America Market Y-o-Y Growth Projections By Country, 2023 to 2033

Figure 25: North America Market Attractiveness Projections By Country, 2023 to 2033

Figure 26: North America Market Share and BPS Analysis By Viscosity Type- 2023 & 2033

Figure 27: North America Market Y-o-Y Growth Projections By Viscosity Type, 2023 to 2033

Figure 28: North America Market Attractiveness Analysis By Viscosity Type, 2023 to 2033

Figure 29: North America Market Share and BPS Analysis By Process- 2023 & 2033

Figure 30: North America Market Y-o-Y Growth Projections By Process, 2023 to 2033

Figure 31: North America Market Attractiveness Analysis By Process, 2023 to 2033

Figure 32: North America Market Share and BPS Analysis By End-use Industry- 2023 & 2033

Figure 33: North America Market Y-o-Y Growth Projections By End-use Industry, 2023 to 2033

Figure 34: North America Market Attractiveness Analysis By End-use Industry, 2023 to 2033

Figure 35: Latin America Market Share and BPS Analysis By Country- 2023 & 2033

Figure 36: Latin America Market Y-o-Y Growth Projections By Country, 2023 to 2033

Figure 37: Latin America Market Attractiveness Projections By Country, 2023 to 2033

Figure 38: Latin America Market Share and BPS Analysis By Viscosity Type- 2023 & 2033

Figure 39: Latin America Market Y-o-Y Growth Projections By Viscosity Type, 2023 to 2033

Figure 40: Latin America Market Attractiveness Analysis By Viscosity Type, 2023 to 2033

Figure 41: Latin America Market Share and BPS Analysis By Process- 2023 & 2033

Figure 42: Latin America Market Y-o-Y Growth Projections By Process, 2023 to 2033

Figure 43: Latin America Market Attractiveness Analysis By Process, 2023 to 2033

Figure 44: Latin America Market Share and BPS Analysis By End-use Industry- 2023 & 2033

Figure 45: Latin America Market Y-o-Y Growth Projections By End-use Industry, 2023 to 2033

Figure 46: Latin America Market Attractiveness Analysis By End-use Industry, 2023 to 2033

Figure 47: Europe Market Share and BPS Analysis By Country- 2023 & 2033

Figure 48: Europe Market Y-o-Y Growth Projections By Country, 2023 to 2033

Figure 49: Europe Market Attractiveness Projections By Country, 2023 to 2033

Figure 50: Europe Market Share and BPS Analysis By Viscosity Type- 2023 & 2033

Figure 51: Europe Market Y-o-Y Growth Projections By Viscosity Type, 2023 to 2033

Figure 52: Europe Market Attractiveness Analysis By Viscosity Type, 2023 to 2033

Figure 53: Europe Market Share and BPS Analysis By Process- 2023 & 2033

Figure 54: Europe Market Y-o-Y Growth Projections By Process, 2023 to 2033

Figure 55: Europe Market Attractiveness Analysis By Process, 2023 to 2033

Figure 56: Europe Market Share and BPS Analysis By End-use Industry- 2023 & 2033

Figure 57: Europe Market Y-o-Y Growth Projections By End-use Industry, 2023 to 2033

Figure 58: Europe Market Attractiveness Analysis By End-use Industry, 2023 to 2033

Figure 59: East Asia Market Share and BPS Analysis By Country- 2023 & 2033

Figure 60: East Asia Market Y-o-Y Growth Projections By Country, 2023 to 2033

Figure 61: East Asia Market Attractiveness Projections By Country, 2023 to 2033

Figure 62: East Asia Market Share and BPS Analysis By Viscosity Type- 2023 & 2033

Figure 63: East Asia Market Y-o-Y Growth Projections By Viscosity Type, 2023 to 2033

Figure 64: East Asia Market Attractiveness Analysis By Viscosity Type, 2023 to 2033

Figure 65: East Asia Market Share and BPS Analysis By Process- 2023 & 2033

Figure 66: East Asia Market Y-o-Y Growth Projections By Process, 2023 to 2033

Figure 67: East Asia Market Attractiveness Analysis By Process, 2023 to 2033

Figure 68: East Asia Market Share and BPS Analysis By End-use Industry- 2023 & 2033

Figure 69: East Asia Market Y-o-Y Growth Projections By End-use Industry, 2023 to 2033

Figure 70: East Asia Market Attractiveness Analysis By End-use Industry, 2023 to 2033

Figure 71: South Asia & Pacific Market Share and BPS Analysis By Country- 2023 & 2033

Figure 72: South Asia & Pacific Market Y-o-Y Growth Projections By Country, 2023 to 2033

Figure 73: South Asia & Pacific Market Attractiveness Projections By Country, 2023 to 2033

Figure 74: South Asia & Pacific Market Share and BPS Analysis By Viscosity Type- 2023 & 2033

Figure 75: South Asia & Pacific Market Y-o-Y Growth Projections By Viscosity Type, 2023 to 2033

Figure 76: South Asia & Pacific Market Attractiveness Analysis By Viscosity Type, 2023 to 2033

Figure 77: South Asia & Pacific Market Share and BPS Analysis By Process- 2023 & 2033

Figure 78: South Asia & Pacific Market Y-o-Y Growth Projections By Process, 2023 to 2033

Figure 79: South Asia & Pacific Market Attractiveness Analysis By Process, 2023 to 2033

Figure 80: South Asia & Pacific Market Share and BPS Analysis By End-use Industry- 2023 & 2033

Figure 81: South Asia & Pacific Market Y-o-Y Growth Projections By End-use Industry, 2023 to 2033

Figure 82: South Asia & Pacific Market Attractiveness Analysis By End-use Industry, 2023 to 2033

Figure 83: Middle East and Africa Market Share and BPS Analysis By Country- 2023 & 2033

Figure 84: Middle East and Africa Market Y-o-Y Growth Projections By Country, 2023 to 2033

Figure 85: Middle East and Africa Market Attractiveness Projections By Country, 2023 to 2033

Figure 86: Middle East and Africa Market Share and BPS Analysis By Viscosity Type- 2023 & 2033

Figure 87: Middle East and Africa Market Y-o-Y Growth Projections By Viscosity Type, 2023 to 2033

Figure 88: Middle East and Africa Market Attractiveness Analysis By Viscosity Type, 2023 to 2033

Figure 89: Middle East and Africa Market Share and BPS Analysis By Process- 2023 & 2033

Figure 90: Middle East and Africa Market Y-o-Y Growth Projections By Process, 2023 to 2033

Figure 91: Middle East and Africa Market Attractiveness Analysis By Process, 2023 to 2033

Figure 92: Middle East and Africa Market Share and BPS Analysis By End-use Industry- 2023 & 2033

Figure 93: Middle East and Africa Market Y-o-Y Growth Projections By End-use Industry, 2023 to 2033

Figure 94: Middle East and Africa Market Attractiveness Analysis By End-use Industry, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Polyester Polyol Market Size and Share Forecast Outlook 2025 to 2035

Polyester Hot Melt Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Polyester Straps Market Size and Share Forecast Outlook 2025 to 2035

Polyester Fiber Market Size and Share Forecast Outlook 2025 to 2035

Polyester Labels Market – Growth & Demand 2025 to 2035

Industry Share Analysis for Polyester Straps Companies

Spun Polyester Fabric Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Polyester Fabric Market Growth – Trends & Forecast 2025 to 2035

Saturated Polyester Resin Market Forecast Outlook 2025 to 2035

Metallised Polyester Films Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Polyester Fiber Market Forecast and Outlook 2025 to 2035

High-Strength Polyester Thread Market Size and Share Forecast Outlook 2025 to 2035

Titanium Catalyst for Polyester Market Size and Share Forecast Outlook 2025 to 2035

Resin Capsule Market Forecast and Outlook 2025 to 2035

Resin Cement for Luting Market Size and Share Forecast Outlook 2025 to 2035

Resin Pigments Market Size and Share Forecast Outlook 2025 to 2035

PE Resins Market Size and Share Forecast Outlook 2025 to 2035

Ink Resin Market Size and Share Forecast Outlook 2025 to 2035

Cast Resin Transformer Market Size and Share Forecast Outlook 2025 to 2035

Agar Resin Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA