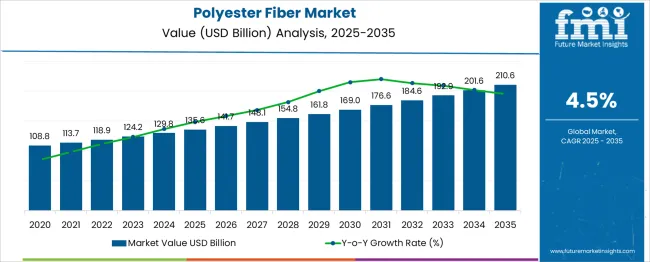

The Polyester Fiber Market is estimated to be valued at USD 135.6 billion in 2025 and is projected to reach USD 210.6 billion by 2035, registering a compound annual growth rate (CAGR) of 4.5% over the forecast period.

A 5-year growth block analysis reveals distinct phase-wise contributions. Between 2025 and 2030, the market is expected to increase from USD 135.6 billion to USD 169.0 billion, adding USD 33.4 billion over this period. This accounts for approximately 48% of the total incremental growth expected across the decade. Growth during this phase is likely to be supported by stable demand in apparel manufacturing, increased polyester usage in home textiles, and sustained consumption in industrial applications such as automotive interiors and packaging materials. From 2030 to 2035 the market will rise from USD 169.0 billion to USD 210.6 billion, delivering an incremental USD 41.6 billion, which is about 52% of total decade-long growth. The slightly higher contribution in this phase indicates continued expansion driven by advancements in recycled polyester production, broader integration in technical textiles, and substitution for natural fibers in cost-sensitive segments. The 5-year block analysis highlights a relatively balanced growth profile, with a gradual acceleration in the latter half. The market’s resilience is reinforced by innovation in fiber engineering, circular economy initiatives, and expanding demand from emerging markets in Asia-Pacific.

| Metric | Value |

|---|---|

| Polyester Fiber Market Estimated Value in (2025 E) | USD 135.6 billion |

| Polyester Fiber Market Forecast Value in (2035 F) | USD 210.6 billion |

| Forecast CAGR (2025 to 2035) | 4.5% |

The polyester fiber market is seen as a core category within several parent industry sectors. It is estimated to account for about 3.2% of the global textiles and apparel market, reflecting its significant role in fabric manufacturing. Within the specialty fibers and technical textiles industry, it is assessed at approximately 5.1%, supporting applications in industrial and consumer end uses. In the nonwoven fabrics market, the share is estimated at around 4.6%, where polyester is a key component.

In the synthetic fibers segment of the chemical fiber market, it represents roughly 7.8%, driven by widespread polyester adoption. Within the polymers and petrochemicals market, the segment is calculated at about 2.4%, given feedstock derived from petroleum refining. Market developments have been influenced by increased demand for durable and easy care fabrics. Advances in recycled polyester production have gained traction, with processes to convert post consumer PET bottles into fiber seeing wider implementation.

Focus has been placed on bio based polyester variants to address environmental concerns and regulatory trends. Technical innovations have included high tenacity and micro denier fibers for performance sportswear and automotive textiles. The Asia Pacific region has been observed to hold the largest production capacity, while Europe and North America are reported to maintain high per unit value through premium recycled and specialty grades. Strategic moves have featured joint ventures between fiber producers and textile mills to scale sustainable polyester options and to deliver circular economy solutions.

The polyester fiber market is expanding steadily, supported by increasing global demand for durable, lightweight, and cost-effective synthetic fibers across apparel, automotive, home furnishing, and industrial sectors. As sustainability gains traction, advancements in recycled PET fiber production and circular textile practices are gaining prominence.

Manufacturers are investing in efficient melt-spinning technologies and dyeing processes to improve product performance and minimize environmental impact. Demand from emerging economies is particularly robust, driven by rapid urbanization, growth in fast fashion, and expanding middle-class consumption.

In parallel, the market is witnessing product differentiation in terms of fiber grade, filament structure, and application-specific performance to meet evolving industry standards and end-use requirements.

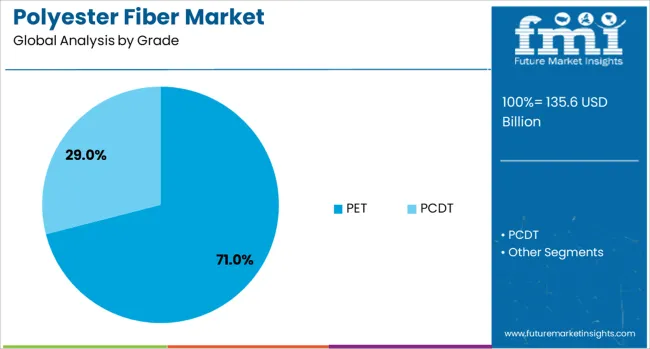

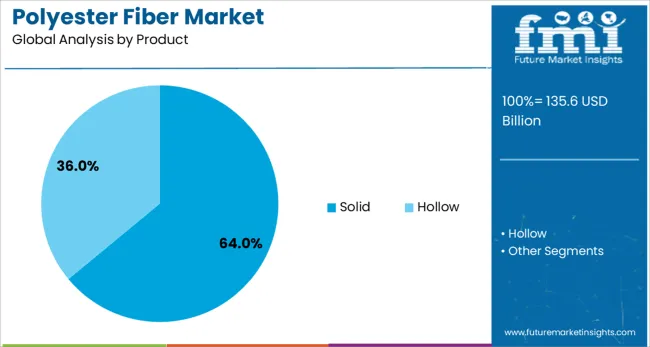

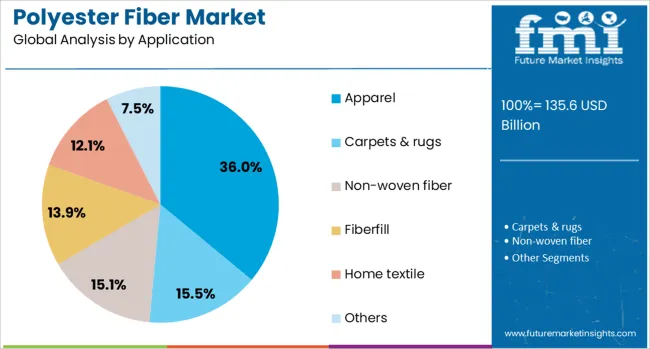

The polyester fiber market is segmented by grade, product, application, and geographic regions. The polyester fiber market is divided by grade into PET and PCDT. In terms of the product, the polyester fiber market is classified into Solid and Hollow. The polyester fiber market is segmented into Apparel, Carpets & rugs, Non-woven fiber, Fiberfill, Home textile, and Others. Regionally, the polyester fiber industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

PET (polyethylene terephthalate) grade is projected to dominate the polyester fiber market with a 71.00% share in 2025. Its popularity stems from its superior tensile strength, recyclability, and ease of processing, making it the preferred choice for both virgin and recycled fiber applications.

PET’s ability to deliver consistent dye uptake and durability across apparel, home textiles, and technical textiles has contributed to its widespread adoption. Additionally, its compatibility with various texturizing and filament modification techniques supports innovation in both woven and non-woven fabric production.

With increasing investments in bottle-to-fiber recycling systems, PET is positioned as the key enabler of circular economy practices within the synthetic fiber ecosystem.

Solid polyester fiber is expected to account for 64.00% of the market share in 2025, making it the leading product segment. The dominance of solid fibers is attributed to their superior resilience, structural uniformity, and versatility in textile and non-textile applications.

Solid polyester fibers are extensively used in apparel manufacturing, pillows, cushions, insulation materials, and carpets. Their ability to retain shape, resist wrinkling, and provide thermal insulation makes them highly functional across diverse climatic and usage conditions.

The segment’s continued growth is supported by increased demand from high-volume production markets, where cost-efficiency and durability remain core performance metrics.

Apparel is projected to lead the polyester fiber market by application, with a 36.00% revenue share in 2025. This leadership is driven by fast fashion trends, rising disposable incomes, and the global shift toward lightweight, stretchable, and low-maintenance clothing.

Polyester fibers, especially in blended yarns, offer superior wear resistance, color retention, and quick-drying features that meet modern consumer expectations. The apparel industry’s growing inclination toward performance fabrics, such as moisture-wicking and breathable textiles, has further reinforced polyester’s role in both casual and sportswear segments.

With sustainability initiatives accelerating the use of recycled polyester in fashion, this segment is expected to maintain its dominant position in the forecast period.

Polyester fiber consumption has been expanding in apparel, home furnishings, nonwoven fabrics, and industrial applications due to its durability, wrinkle resistance, and cost efficiency. Demand growth has been supported by advances in fiber engineering, including hollow, textured, and microfibers designed for specific performance needs. Asia Pacific has maintained a strong position in polyester fiber production and exports, benefiting from large-scale manufacturing capacity. The development of recycled polyester from post-consumer PET waste has also been shaping procurement decisions in multiple end-use industries.

Polyester fiber has been favored by textile and apparel manufacturers for its strength, abrasion resistance, and ability to hold color without significant fading. Compared with natural fibers, polyester offers higher tensile strength and lower shrinkage, making it suitable for activewear, outerwear, and blended fabrics. Large apparel exporters in China, India, and Vietnam have relied on polyester to meet bulk production targets while maintaining consistent quality. Blended fabrics combining polyester with cotton or rayon have been widely used to improve comfort while retaining durability. Fabric mills have also utilized textured and filament polyester to achieve softness and drape characteristics similar to natural fibers. Lower raw material costs compared to silk or wool have given polyester a cost advantage, enabling competitive pricing for fashion brands and uniform suppliers. These performance and economic benefits have positioned polyester as a preferred fiber in global textile manufacturing operations.

Polyester fiber demand has been supported by its versatility in home furnishing products such as upholstery, carpets, curtains, and bedding. Its stain resistance and moisture-wicking capability have made it attractive for residential and hospitality sectors seeking long-lasting fabrics. In industrial applications, polyester has been applied in conveyor belts, ropes, insulation materials, and filtration media due to its strength and chemical resistance. Nonwoven polyester has found growing use in automotive interiors, geotextiles, and hygiene products. Manufacturers in Turkey, the United States, and Southeast Asia have reported stable order volumes from these sectors, particularly in upholstery-grade and high-denier fibers. Its ability to retain structural integrity under varying environmental conditions has encouraged adoption in both indoor and outdoor applications. The broad application spectrum has given polyester fiber suppliers a stable revenue base, even during fluctuations in fashion and apparel sector demand cycles.

Recycled polyester fiber, produced from post-consumer PET bottles and textile waste, has been gaining adoption due to the availability of cost-effective recycling technologies and a growing preference for circular material sourcing. Leading fiber producers in China, Japan, and Europe have invested in mechanical and chemical recycling plants capable of producing high-quality recycled filament and staple fiber. The resulting material has been integrated into sportswear, casual apparel, and home textile products with performance comparable to virgin fiber. Supply chain integration between PET recyclers and textile mills has ensured consistent quality and supply reliability. Large global brands have incorporated recycled polyester into product lines to meet internal sourcing targets, which has influenced upstream demand. While production costs remain slightly higher than conventional fiber, the long-term operational benefits of waste reduction and resource efficiency have encouraged wider use in mass-market textile production.

Polyester fiber production depends on purified terephthalic acid and monoethylene glycol, both derived from petrochemical feedstocks whose prices are subject to crude oil market fluctuations. Volatility in raw material costs has affected profit margins for fiber producers, particularly during periods of rapid price escalation. Additionally, competition from alternative fibers such as nylon, polypropylene, and regenerated cellulosic fibers has challenged market share in certain applications. In apparel, cotton and blended natural fibers continue to appeal to consumers seeking comfort and breathability, creating competitive pressure in fashion segments. Recycling infrastructure for polyester remains uneven across regions, limiting the scale of recycled fiber adoption. High energy consumption in polyester production has also been viewed as a cost factor in regions with elevated electricity tariffs. These challenges may constrain capacity expansion plans unless cost-stable feedstock sourcing, energy-efficient production methods, and recycling logistics are improved globally.

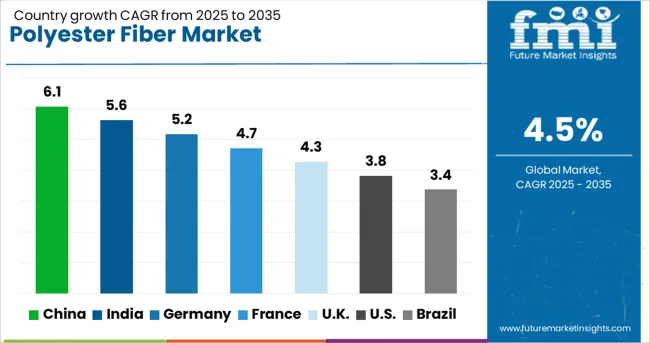

| Country | CAGR |

|---|---|

| China | 6.1% |

| India | 5.6% |

| Germany | 5.2% |

| France | 4.7% |

| UK | 4.3% |

| USA | 3.8% |

| Brazil | 3.4% |

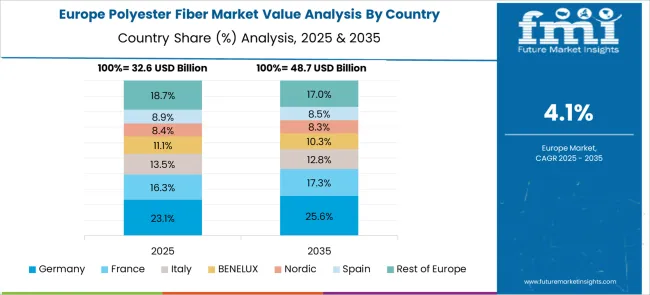

The polyester fiber market is expected to grow at a global CAGR of 4.5% between 2025 and 2035, driven by rising demand in apparel, home furnishings, and industrial applications. China leads with a 6.1% CAGR, supported by large-scale manufacturing capacity and expansion in textile exports. India follows at 5.6%, fueled by domestic consumption growth and investments in synthetic fiber production. Germany, at 5.2%, benefits from high-quality fiber innovations and demand from technical textiles. The UK, projected at 4.3%, sees steady growth from the fashion and interior design sectors. The USA, at 3.8%, reflects stable but moderate demand in apparel and nonwoven applications. The report covers insights for 40+ countries, with the five below highlighted for their market influence and growth potential.

China is expected to dominate the polyester fiber market with a projected CAGR of 6.1% from 2025 to 2035, supported by large-scale production capacities and a strong textile manufacturing base. Domestic companies such as Sinopec Yizheng Chemical Fibre and Hengli Group are expanding operations with advanced polymerization technologies to improve fiber quality and efficiency. Rising demand from apparel, home furnishings, and industrial applications continues to drive consumption. Integration of recycled polyester production lines is gaining momentum, enhancing the country’s role as a leading global supplier. The growing export demand for polyester-based fabrics and yarn is further stimulating market growth, particularly in Asia Pacific and European markets.

India is projected to achieve a CAGR of 5.6% between 2025 and 2035 in the polyester fiber market, supported by a strong textile sector and increasing demand for synthetic fibers in diverse applications. Major producers like Reliance Industries and Indo Rama Synthetics are investing in modern fiber spinning technologies and capacity expansions. Polyester is increasingly favored in activewear, automotive upholstery, and geotextiles due to its durability and cost-effectiveness. The growing domestic garment export industry is boosting demand for high-quality polyester filament yarn. Government incentives for the textile value chain are expected to enhance local production capabilities, strengthening the market position of Indian suppliers.

Germany is forecasted to grow at a CAGR of 5.2% from 2025 to 2035 in the polyester fiber market, backed by advanced manufacturing capabilities and demand from the technical textiles sector. German producers like Trevira GmbH and Kelheim Fibres are focusing on high-performance polyester fibers for flame-retardant, antimicrobial, and moisture-wicking applications. Demand from automotive interiors, industrial filtration, and protective clothing is driving innovation in fiber properties. The adoption of closed-loop recycling systems is also increasing, aligning production with circular economy practices. High-quality standards and strong R&D capabilities ensure the country remains a preferred supplier for specialized polyester applications across Europe.

The United Kingdom is expected to register a CAGR of 4.3% from 2025 to 2035 in the polyester fiber market, supported by demand from apparel, home furnishings, and nonwoven applications. Domestic manufacturers are emphasizing recycled polyester production to meet environmental targets, while imports from Asia continue to support the textile supply chain. Growth in activewear and performance clothing segments is driving demand for moisture-wicking polyester fabrics. The upholstery and carpet manufacturing sectors are also contributing to consumption. Expansions in fabric finishing and dyeing capabilities are enhancing the competitiveness of UK-based textile producers in domestic and export markets.

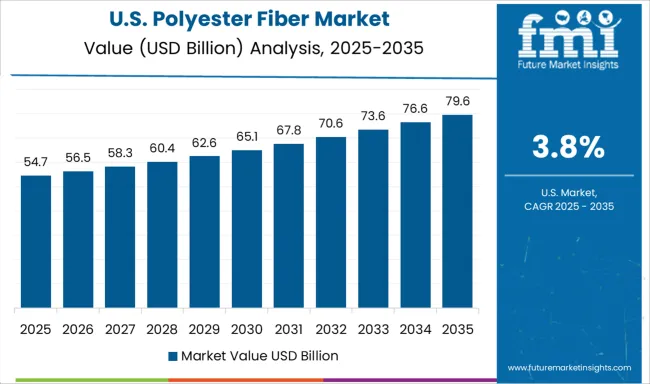

The United States is projected to grow at a CAGR of 3.8% from 2025 to 2035 in the polyester fiber market, driven by steady demand from home textiles, industrial applications, and apparel manufacturing. Domestic producers such as Unifi Inc and Eastman Chemical Company are focusing on recycled polyester and specialty fibers with enhanced performance characteristics. Growth in automotive manufacturing, especially for seat fabrics and carpeting, is boosting polyester consumption. The home furnishings segment, including bedding and curtains, remains a major end-use market. The trend toward locally produced and sustainable fibers is influencing investments in new production lines and recycling facilities.

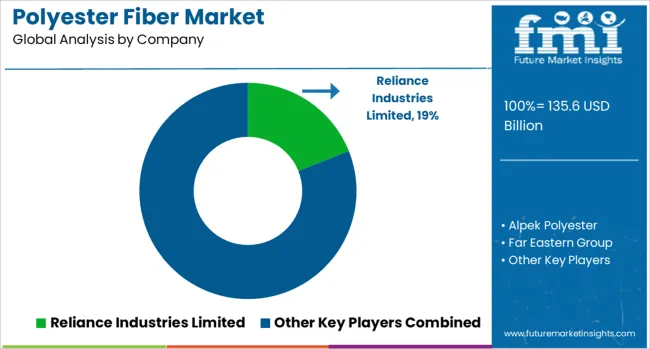

The polyester fiber market is led by large-scale chemical and textile producers with integrated manufacturing capabilities and strong global distribution networks. Reliance Industries Limited, Sinopec, and Indorama Ventures hold a dominant position, producing high-volume polyester fibers for applications ranging from apparel and home textiles to industrial fabrics. Alpek Polyester and Nan Ya Plastics Corporation are expanding production capacities in North and South America, focusing on efficient polymerization processes and cost optimization to maintain competitiveness.

Far Eastern Group and Teijin Limited cater to both commodity-grade and specialty polyester fibers, offering performance variants with enhanced strength, dyeability, and thermal resistance for technical textiles. Toray Industries specializes in advanced polyester fibers for high-performance apparel, automotive interiors, and filtration media, often working closely with brand owners for custom specifications. Zhejiang Hengsheng Chemical Fiber Group drives growth in Asia through vertically integrated operations, ensuring control over raw materials and fiber finishing.

GreenFiber International is recognized for large-scale polyester staple fiber manufacturing with a focus on recycling post-consumer PET, while Stein Fibers and William Barnet and Son serve as key suppliers in the USA market, maintaining extensive inventories for quick turnaround. Swicofil operates as a global trading and distribution partner, supplying polyester fibers to various regional converters and mills.

Leading players invest in capacity expansions, long-term supply contracts with textile mills, and fiber quality enhancements to secure market share. Entry is limited by high capital requirements, raw material sourcing agreements, and entrenched relationships with large-scale fabric manufacturers.

| Item | Value |

|---|---|

| Quantitative Units | USD 135.6 Billion |

| Grade | PET and PCDT |

| Product | Solid and Hollow |

| Application | Apparel, Carpets & rugs, Non-woven fiber, Fiberfill, Home textile, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Reliance Industries Limited, Alpek Polyester, Far Eastern Group, GreenFiber International, Indorama Ventures, Nan Ya Plastics Corporation, Sinopec, Stein Fibers, Swicofil, Teijin Limited, Toray Industries, William Barnet and Son, and Zhejiang Hengsheng Chemical Fiber Group |

The global polyester fiber market is estimated to be valued at USD 135.6 billion in 2025.

The market size for the polyester fiber market is projected to reach USD 210.6 billion by 2035.

The polyester fiber market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in polyester fiber market are pet and pcdt.

In terms of product, solid segment to command 64.0% share in the polyester fiber market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Polyester Microfiber Fabric Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Polyester Fiber Market Forecast and Outlook 2025 to 2035

Polyester Shrink Film Market Size and Share Forecast Outlook 2025 to 2035

Polyester Polyol Market Size and Share Forecast Outlook 2025 to 2035

Polyester Hot Melt Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Polyester Straps Market Size and Share Forecast Outlook 2025 to 2035

Polyester Labels Market – Growth & Demand 2025 to 2035

Polyester Resin Dispersion Market Analysis & Forecast by Viscosity Type, Process, End-Use Industry and Region through 2025 to 2035

Industry Share Analysis for Polyester Straps Companies

Spun Polyester Fabric Market Size and Share Forecast Outlook 2025 to 2035

Seatbelt Polyester Yarn Market Size and Share Forecast Outlook 2025 to 2035

Embossed Polyester Fabric Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Polyester Fabric Market Growth – Trends & Forecast 2025 to 2035

Saturated Polyester Resin Market Forecast Outlook 2025 to 2035

Demand for Polyester Shrink Film in UK Size and Share Forecast Outlook 2025 to 2035

Metallised Polyester Films Market Size and Share Forecast Outlook 2025 to 2035

High-Strength Polyester Thread Market Size and Share Forecast Outlook 2025 to 2035

Titanium Catalyst for Polyester Market Size and Share Forecast Outlook 2025 to 2035

Fiber Optic Probe Hydrophone (FOPH) Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Centrifugal Fan Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA