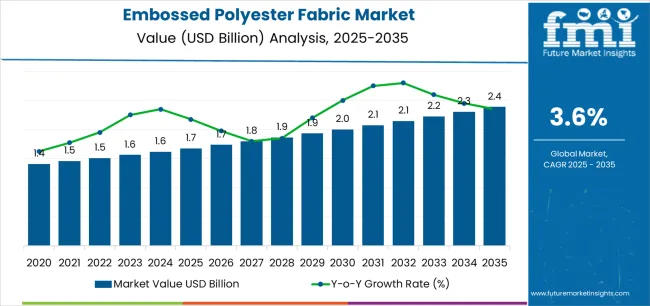

The global embossed polyester fabric market is projected to grow from USD 1,677.1 million in 2025 to approximately USD 2,388.7 million by 2035, recording an absolute increase of USD 711.6 million over the forecast period. This translates into a total growth of 42.4%, with the market forecast to expand at a compound annual growth rate (CAGR) of 3.6% between 2025 and 2035. The overall market size is expected to grow by nearly 1.4X during the same period, supported by increasing global demand for textured fabric solutions, growing adoption of embossed textiles in home furnishing applications, and rising consumer preference for decorative fabric technologies across various bedding and apparel manufacturing segments.

The embossed polyester fabric market operates within highly competitive textile manufacturing environments where production consistency challenges create ongoing quality control headaches for garment manufacturers managing tight delivery schedules. Embossing equipment operators report persistent difficulties maintaining uniform pattern depth across fabric widths, particularly during extended production runs where heat distribution variations affect texture definition and create costly material waste.

Cross-functional tensions frequently develop between production managers demanding higher line speeds and quality control teams insisting on slower processing rates to maintain embossing precision standards. Textile finishing facilities struggle with temperature control systems that require constant calibration adjustments to compensate for ambient humidity variations affecting polyester fiber response during thermal embossing processes.

Supply chain relationships remain complex as specialized embossing machinery concentrates among established equipment manufacturers who provide limited technical support for troubleshooting production issues. Asian textile producers dominate manufacturing capacity but face ongoing challenges with pattern consistency that create customer complaints from home furnishing brands requiring precise texture matching across large fabric quantities.

Quality assurance protocols vary significantly between manufacturing facilities, with European textile operations maintaining stricter dimensional stability testing compared to cost-focused producers in developing markets. Garment cutting teams report difficulties with fabric handling characteristics that change after embossing processes, requiring specialized cutting techniques that slow production throughput and increase labor costs.

Home furnishing manufacturers increasingly demand embossed fabrics with enhanced durability properties that maintain texture definition through multiple washing cycles, though achieving this performance requires processing modifications that increase production costs. Cross-functional design teams comprising textile engineers, pattern designers, and marketing specialists engage in detailed discussions about optimal embossing depth balancing visual appeal against manufacturing feasibility.

Bedding manufacturers face ongoing challenges with embossed fabric behavior during automated quilting operations where texture variations create tension irregularities affecting seam quality. Quality control departments consistently report issues with embossing pattern registration that creates visual defects in finished products, particularly when fabric printing processes occur after embossing operations requiring precise alignment coordination.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 1,677.1 million |

| Market Forecast Value (2035) | USD 2,388.7 million |

| Forecast CAGR (2025-2035) | 3.6% |

| TEXTILE & CONSUMER TRENDS | MANUFACTURING REQUIREMENTS | INDUSTRY & QUALITY STANDARDS |

|---|---|---|

| Global Fashion Consciousness Continuous expansion of fashion awareness and home decoration trends across established and emerging markets driving demand for high-performance textured fabric solutions. Home Furnishing Growth Growing emphasis on interior decoration and premium bedding applications creating demand for advanced textured fabric technologies. Premium Textile Performance Superior texture properties and aesthetic characteristics making embossed polyester fabrics essential for performance-focused textile applications. | Advanced Texture Processing Requirements Modern textile manufacturing requires specialized embossed fabrics delivering precise surface texture control and enhanced visual appeal. Processing Efficiency Demands Textile manufacturers investing in premium embossed fabrics offering consistent performance while maintaining processing efficiency. Quality and Reliability Standards Certified producers with proven track records required for advanced embossed fabric applications. | Textile Quality Standards Regulatory requirements establishing performance benchmarks favoring high-quality embossed textile materials. Performance Property Standards Quality standards requiring superior texture properties and resistance to environmental stresses in processing. Industrial Compliance Requirements Diverse textile requirements and quality standards driving need for sophisticated embossed fabric ingredient inputs. |

| Category | Segments Covered |

|---|---|

| By Type | Thermal Embossed Polyester Fabric, Chemical Embossed Polyester Fabric |

| By Application | Clothing, Bedding and Mattresses, Curtains and Drapes, Others |

| By Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Segment | 2025 to 2035 Outlook |

|---|---|

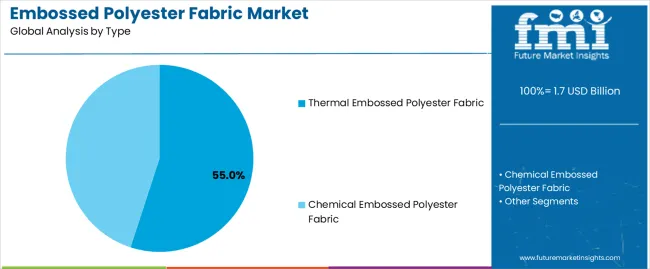

| Thermal Embossed Polyester Fabric | Leader in 2025 with 55% market share; likely to maintain leadership through 2035. Broadest use across clothing, bedding, and home furnishing applications, mature supply chain, predictable functionality. Momentum: steady-to-strong. Watchouts: raw material price volatility. |

| Chemical Embossed Polyester Fabric | Cost-effective and well-established for specialized textile applications, but processing complexity limits broader adoption in standard textile manufacturing. Momentum: steady in traditional applications; flat to slightly up in premium segments. |

| Segment | 2025 to 2035 Outlook |

|---|---|

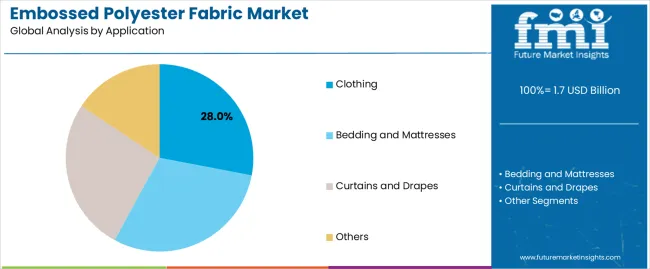

| Clothing | At 28%, largest application segment in 2025 with established embossed fabric integration. Mature supply chains, standardized processing specifications. Momentum: steady growth driven by fashion consciousness and premium textile demand. Watchouts: regulatory changes affecting fabric requirements. |

| Bedding and Mattresses | Strong growth segment driven by home furnishing and bedding demand. Thermal embossed fabrics dominate applications. Momentum: strong growth through 2030, supported by housing market expansion. Watchouts: competition from alternative textile technologies. |

| Curtains and Drapes | Specialized segment with diverse embossed fabric requirements. Growing demand for decorative textiles supporting higher-value interior design applications. Momentum: moderate growth via home improvement expansion. Watchouts: regulatory requirements affecting textile processing. |

| Others | Emerging applications including specialty textile uses and industrial applications. Limited market share but growing interest in technical textiles requiring specific surface textures. Momentum: selective growth in niche applications. |

| DRIVERS | RESTRAINTS | KEY TRENDS |

|---|---|---|

| Global Fashion Awareness Growth Continuing expansion of fashion and home decoration activities across established and emerging markets driving demand for high-performance textured fabric solutions. Home Furnishing Demographics Increasing adoption of advanced textile systems emphasizing efficiency, design versatility, and aesthetic optimization. Premium Textile Demand Growing demand for embossed fabrics that deliver both high-end performance and processing efficiency in textile manufacturing. | Raw Material Price Volatility Price fluctuations affecting production costs and supply chain predictability for manufacturers. Manufacturing Complexity Complex technical requirements across applications affecting product development, process control, and standardization. Technical Qualification Requirements Strict testing and certification needs impacting product development timelines and scalability for advanced embossed fabrics. Competition from Alternatives Alternative textile technologies (e.g., digital prints, woven textures) influencing market selection and development. | Advanced Processing Technologies Integration of advanced embossed fabric processing systems, manufacturing innovations, and quality control solutions enabling superior operational efficiency. Performance Enhancement Enhanced texture control, improved durability, and advanced aesthetic properties compared to traditional fabric systems. Specialized Formulations Development of specialized embossed fabric grades and custom formulations providing enhanced tactile and visual performance for targeted applications. Technical Innovation Integration of advanced embossed fabric development and intelligent processing management for next-generation textile solutions. |

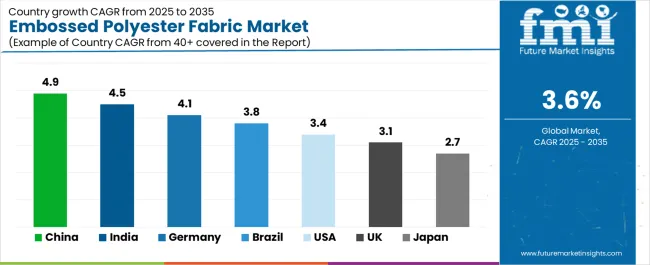

| Country | CAGR (2025-2035) |

|---|---|

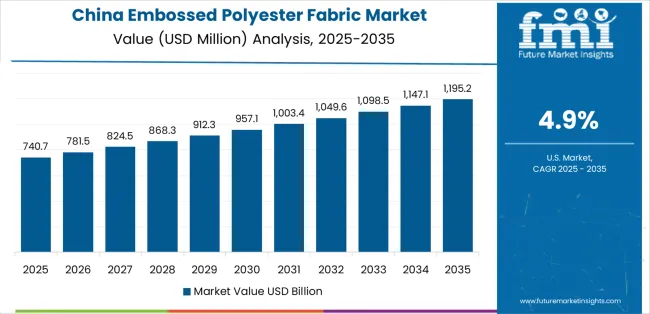

| China | 4.9% |

| India | 4.5% |

| Germany | 4.1% |

| Brazil | 3.8% |

| USA | 3.4% |

| UK | 3.1% |

| Japan | 2.7% |

Revenue from embossed polyester fabric in China is projected to exhibit strong growth driven by expanding textile manufacturing infrastructure and comprehensive fabric processing innovation creating substantial opportunities for textile suppliers across clothing manufacturing operations, home furnishing applications, and specialty decorative sectors. The country's developing textile manufacturing tradition and expanding production capabilities are creating significant demand for both conventional and high-performance embossed fabric ingredients. Major textile companies are establishing comprehensive local fabric processing facilities to support large-scale manufacturing operations and meet growing demand for efficient textile solutions.

Revenue from embossed polyester fabric in India is expanding supported by extensive textile manufacturing expansion and comprehensive fabric processing industry development creating demand for reliable embossed fabric ingredients across diverse manufacturing categories and specialty textile segments. The country's dominant textile production position and expanding manufacturing capabilities are driving demand for embossed fabric solutions that provide consistent performance while supporting cost-effective processing requirements. Textile processors and manufacturers are investing in local production facilities to support growing manufacturing operations and clothing demand.

Demand for embossed polyester fabric in Germany is projected to grow supported by the country's expanding textile manufacturing base and fabric processing technologies requiring advanced embossed fabric systems for clothing production and home furnishing applications. German textile companies are implementing processing systems that support advanced manufacturing techniques, operational efficiency, and comprehensive quality protocols. The market is characterized by focus on operational excellence, textile performance, and compliance with European textile quality standards.

Revenue from embossed polyester fabric in Brazil is growing driven by advanced textile manufacturing development programs and increasing fabric technology innovation creating opportunities for embossed fabric suppliers serving both clothing manufacturing operations and home furnishing contractors. The country's extensive textile manufacturing base and expanding production capabilities are creating demand for embossed fabric ingredients that support diverse performance requirements while maintaining processing performance standards. Textile manufacturers and specialty ingredient service providers are developing procurement strategies to support operational efficiency and regulatory compliance.

Demand for embossed polyester fabric in U.S. is projected to grow driven by premium textile manufacturing excellence and specialty embossed fabric capabilities supporting advanced textile development and comprehensive clothing applications. The country's established textile processing tradition and growing performance fabric market segments are creating demand for high-quality embossed fabric ingredients that support operational performance and textile standards. Textile manufacturers and processing suppliers are maintaining comprehensive development capabilities to support diverse manufacturing requirements.

Demand for embossed polyester fabric in UK is projected to grow at 3.1% CAGR driven by advanced textile manufacturing excellence and specialty embossed fabric capabilities supporting textile development and comprehensive clothing applications. The country's established textile processing tradition and growing performance fabric market segments are creating demand for high-quality embossed fabric ingredients that support operational performance and textile standards.

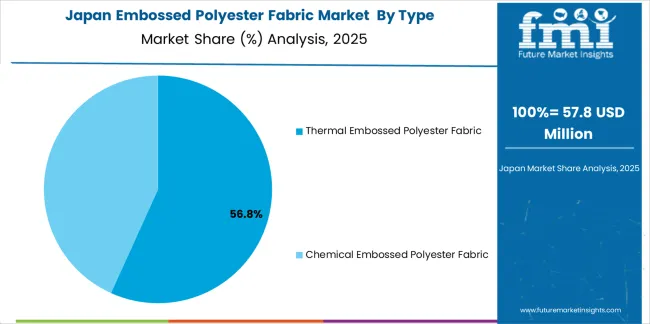

Demand for embossed polyester fabric in Japan is projected to grow driven by precision textile manufacturing excellence and specialty embossed fabric capabilities supporting advanced textile development and comprehensive technical applications. The country's established textile processing tradition and growing performance fabric market segments are creating demand for high-quality embossed fabric ingredients that support operational performance and textile standards.

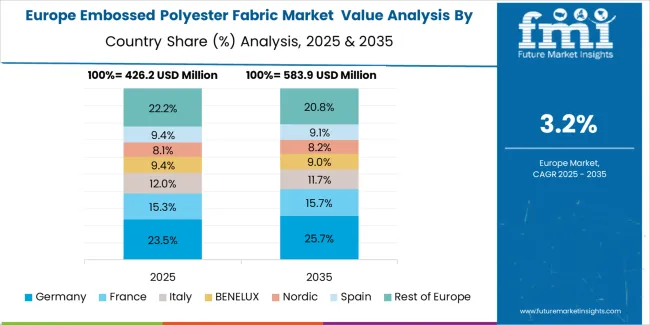

European embossed polyester fabric operations are increasingly polarized between Western European precision processing and Eastern European cost-competitive manufacturing. German (USD 60.0 million) and UK facilities (USD 45.0 million) dominate premium textile and home furnishing embossed fabric processing, leveraging advanced textile technologies and strict quality protocols that command price premiums in global markets. German processors maintain leadership in high-performance embossed fabric applications, with major textile companies driving technical specifications that smaller suppliers must meet to access supply contracts.

France (USD 35.0 million), Italy (USD 25.0 million), and Spain (USD 20.0 million) operations focus on specialized applications and regional market requirements. Rest of Europe (USD 60.0 million) including Eastern European operations in Poland, Hungary, and Czech Republic are capturing volume-oriented processing contracts through labor cost advantages and EU regulatory compliance, particularly in standard embossed fabric ingredients for textile applications.

The regulatory environment presents both opportunities and constraints. EU textile regulations and fabric directives create barriers for novel embossed fabric ingredients but establish quality standards that favor established European processors over imports. Brexit has fragmented UK sourcing from EU suppliers, creating opportunities for direct relationships between processors and British textile manufacturers.

Supply chain consolidation accelerates as processors seek economies of scale to absorb rising energy costs and compliance expenses. Vertical integration increases, with major textile manufacturers acquiring processing facilities to secure embossed fabric supplies and quality control. Smaller processors face pressure to specialize in niche applications or risk displacement by larger, more efficient operations serving mainstream textile manufacturing requirements.

Profit pools are consolidating upstream in scaled embossed fabric production systems and downstream in value-added specialty grades for clothing, bedding, and home furnishing applications where certification, traceability, and consistent texture quality command premiums. Value is migrating from raw fabric commodity trading to specification-tight, application-ready embossed fabrics where technical expertise and quality control drive competitive advantage. Several archetypes set the pace: global textile integrators defending share through production scale and technical reliability; multi-grade processors that manage complexity and serve diverse applications; specialty embossed fabric developers with formulation expertise and textile industry ties; and texture-driven suppliers pulling volume in premium clothing and home furnishing applications. Switching costs—re-qualification, texture testing, performance validation—provide stability for incumbents, while supply shocks and regulatory changes reopen opportunities for diversified suppliers. Consolidation and verticalization continue; digital procurement emerges in commodity grades while premium specifications remain relationship-led. Focus areas: lock textile and home furnishing pipelines with application-specific grades and service level agreements; establish multi-grade production capabilities and technical disclosure; develop specialized embossed fabric formulations with texture quality claims.

| Stakeholder Type | Primary Advantage | Repeatable Plays |

|---|---|---|

| Global textile integrators | Scale, production integration, technical reliability | Long-term contracts, tight specs, co-development with textile/home furnishing |

| Multi-grade processors | Grade diversification, application expertise, supply flexibility | Multi-application serving, technical support, quality assurance across segments |

| Specialty embossed fabric developers | Formulation expertise and industry relationships | Custom grades, texture quality science, performance SLAs |

| Texture suppliers | Application-focused demand and specialized service | Technical texture claims, specialized grades, application activation |

| Textile distributors & platforms | Technical support for mid-tier manufacturers | Grade selection, smaller volumes, technical service |

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 1,677.1 million |

| Type | Thermal Embossed Polyester Fabric, Chemical Embossed Polyester Fabric |

| Application | Clothing, Bedding and Mattresses, Curtains and Drapes, Others |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Countries Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan, and other 40+ countries |

| Key Companies Profiled | Perfectextile, Gabriel, Cxdqtex, Ocean Textile, Sunlantex, Haining FengCai Textile Co.,Ltd., Changxing Yongxin Textile & Dyeing Co., Ltd., Haining Juncheng Textile Co.,Ltd, Fabrics Trades, Yi Chun Textile, Changxing Jiuying Textile Co., Ltd., National Fibres Pvt. Ltd, Zhangjiagang Ruili Textile Co.,Ltd, Changxing Jincheng Textile Technology |

| Additional Attributes | Dollar sales by product/application, regional demand (NA, EU, APAC), competitive landscape, thermal vs. chemical embossing adoption, production/processing integration, and advanced processing innovations driving texture enhancement, technical advancement, and efficiency |

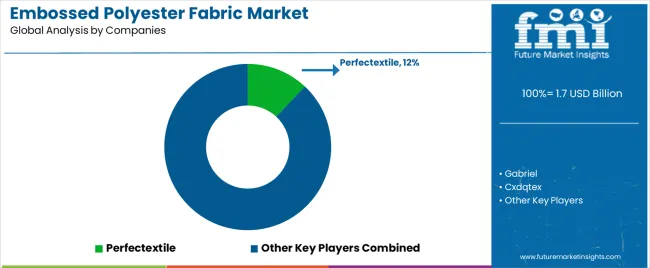

The global embossed polyester fabric market is estimated to be valued at USD 1.7 billion in 2025.

The market size for the embossed polyester fabric market is projected to reach USD 2.4 billion by 2035.

The embossed polyester fabric market is expected to grow at a 3.6% CAGR between 2025 and 2035.

The key product types in embossed polyester fabric market are thermal embossed polyester fabric and chemical embossed polyester fabric.

In terms of application, clothing segment to command 28.0% share in the embossed polyester fabric market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Polyester Polyol Market Size and Share Forecast Outlook 2025 to 2035

Polyester Hot Melt Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Polyester Straps Market Size and Share Forecast Outlook 2025 to 2035

Polyester Fiber Market Size and Share Forecast Outlook 2025 to 2035

Polyester Labels Market – Growth & Demand 2025 to 2035

Polyester Resin Dispersion Market Analysis & Forecast by Viscosity Type, Process, End-Use Industry and Region through 2025 to 2035

Industry Share Analysis for Polyester Straps Companies

Spun Polyester Fabric Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Polyester Fabric Market Growth – Trends & Forecast 2025 to 2035

Saturated Polyester Resin Market Forecast Outlook 2025 to 2035

Metallised Polyester Films Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Polyester Fiber Market Forecast and Outlook 2025 to 2035

High-Strength Polyester Thread Market Size and Share Forecast Outlook 2025 to 2035

Titanium Catalyst for Polyester Market Size and Share Forecast Outlook 2025 to 2035

Fabric Spreading Machine Market Forecast Outlook 2025 to 2035

Fabric Freshener Market Forecast and Outlook 2025 to 2035

Fabric Inspection Machine Market Size and Share Forecast Outlook 2025 to 2035

Fabric Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Fabric Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Fabric Toys Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA