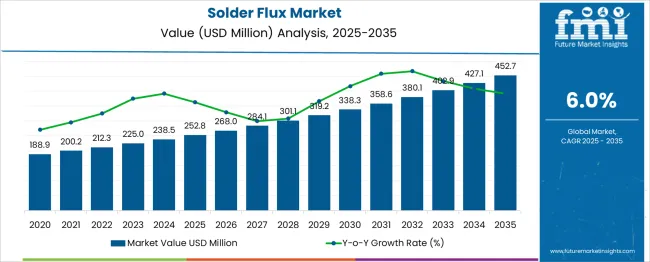

The Solder Flux Market is estimated to be valued at USD 252.8 million in 2025 and is projected to reach USD 452.7 million by 2035, registering a compound annual growth rate (CAGR) of 6.0% over the forecast period. Between 2025 and 2030, the market is projected to grow from USD 252.8 million to USD 338.3 million, supported by rising demand in electronics manufacturing, particularly in surface-mount technology (SMT) and automotive electronics.

Year-on-year analysis shows steady growth, with values increasing to USD 268.0 million in 2026 and USD 284.1 million in 2027, driven by miniaturization trends and the need for precise soldering applications in high-speed electronic components. By 2028, the market is forecasted to reach USD 301.1 million, followed by USD 319.2 million in 2029 and USD 338.3 million by 2030.

Expanding adoption of lead-free and halogen-free fluxes in compliance with RoHS directives is anticipated to influence product development strategies. Additionally, growing usage of water-soluble and low-residue formulations is expected to enhance process efficiency and quality control in circuit assembly. These trends underscore the role of solder flux as a critical material in advanced electronics production, where innovations in flux chemistry and automated application methods will define competitive advantages in the coming decade.

| Metric | Value |

|---|---|

| Solder Flux Market Estimated Value in (2025 E) | USD 252.8 million |

| Solder Flux Market Forecast Value in (2035 F) | USD 452.7 million |

| Forecast CAGR (2025 to 2035) | 6.0% |

The solder flux market holds an essential role within electronics manufacturing and assembly-related segments. In the electronics assembly materials market, its share is approximately 12–14%, as flux is indispensable for ensuring solder joint integrity in PCBs and component assembly. Within the soldering materials market, it accounts for a higher share of 18–20%, given its integral role alongside solder wire and paste in forming reliable electrical connections. In the printed circuit board (PCB) manufacturing market, the contribution is around 6–7%, as PCBs involve multiple consumables including laminates, copper foils, and coatings.

For the semiconductor packaging and assembly market, its share is about 4–5%, since advanced chip packaging requires precise flux application for fine-pitch components. In the electronic components manufacturing market, solder flux represents 3–4%, as it supports connectivity in passive and active device assembly. Growth is driven by rising miniaturization trends, demand for high-reliability electronics in automotive and aerospace, and the expansion of consumer electronics.

Technological advancements, including low-residue, halogen-free, and no-clean flux formulations, are increasing adoption in compliance with stringent environmental and safety regulations. As electronic devices become more compact and complex, the role of high-performance flux in ensuring strong, defect-free solder joints positions this market for continued expansion across its parent categories.

The solder flux market is exhibiting consistent growth fueled by increasing demand for high-performance electronics assembly materials and rising complexity in printed circuit board designs. As manufacturing processes evolve toward miniaturization and higher component density, solder fluxes are being adopted for their ability to ensure strong, reliable solder joints while minimizing defects.

Industry practices indicate a shift toward environmentally friendly and low-residue formulations to comply with stringent regulations and enhance production efficiency. The market outlook remains positive with opportunities emerging from the expansion of 5G infrastructure, electric vehicles, and smart consumer devices.

Advancements in flux chemistry and improvements in application techniques are paving the way for broader adoption across varied end-use sectors while addressing evolving performance and compliance requirements.

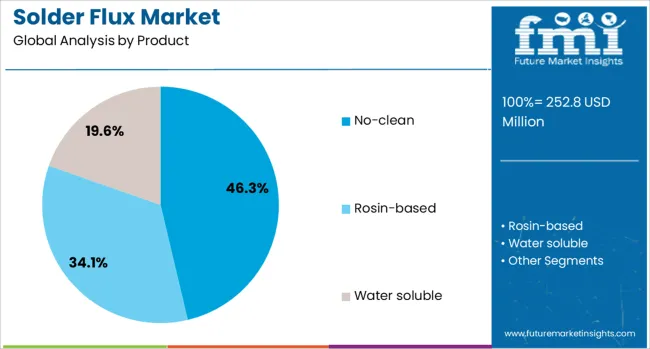

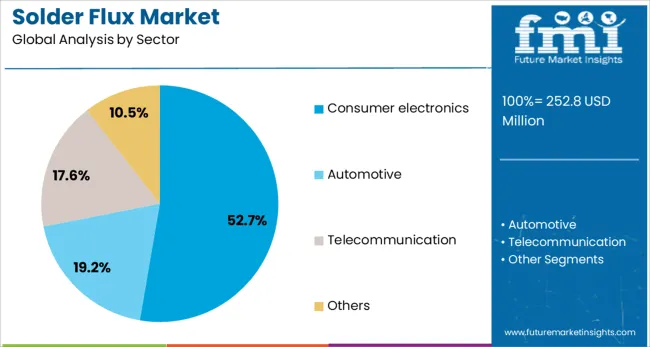

The solder flux market is segmented by product, sector, and geographic regions. The solder flux market is divided into No-clean, Rosin-based, and Water-soluble. In terms of the sector, the solder flux market is classified into Consumer electronics, Automotive, Telecommunication, and Others. Regionally, the solder flux industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by product, no clean solder flux is expected to account for 46.3% of the market revenue in 2025, making it the leading product category. This dominance is being driven by manufacturers’ preference for simplified post-soldering processes, which eliminate the need for cleaning and reduce overall production time and cost.

The inherent advantage of leaving minimal, non-corrosive residues has supported its use in high-volume production environments where efficiency and reliability are prioritized. Adoption has been further encouraged by regulatory pressures to minimize the use of cleaning solvents and reduce environmental impact.

The ability of no-clean flux to meet stringent electrical performance standards without additional processing steps has cemented its position as the preferred choice for modern electronics manufacturing.

Segmented by sector, consumer electronics is projected to capture 52.7% of the market revenue in 2025, reinforcing its leadership position. This prominence is being attributed to the sector’s continuous demand for compact, lightweight, and high-performance devices, which necessitate precise and reliable soldering processes.

The proliferation of smartphones, tablets, wearables, and other connected devices has significantly increased production volumes, thereby amplifying the requirement for efficient soldering materials. Manufacturers within this sector have adopted advanced flux formulations to meet the dual needs of high throughput and minimal rework rates while maintaining compliance with environmental standards.

The sector’s rapid product innovation cycles and the pressure to maintain cost competitiveness have further strengthened the reliance on high-quality solder flux solutions, positioning consumer electronics as the primary driver of market growth.

The solder flux market is expanding steadily as electronics manufacturing and automotive applications demand reliable interconnect performance. In 2024, widespread PCB assembly in consumer devices and EV systems increased flux usage. By 2025, more complex packaging techniques and miniaturized electronics will require cleaner and highly effective flux formulations. Suppliers that provide consistent, compatibility‑certified flux products across SMT, BGA, and high‑reliability applications are positioned to capture preference within production environments focused on precision and quality.

Higher device density and finer-pitch components are elevating expectations for flux performance. In 2024, manufacturers transitioned to smaller SMT and BGA packaging formats, creating demand for flux that offers precise wetting, minimal residue, and strong joint integrity. By 2025, packaging innovations will further increase reliance on high-performance fluxes that support lead-free and low-residue processes. This indicates that reliability under tight tolerances is shaping purchasing decisions. Vendors offering water‑soluble, no‑clean, and rosin-based fluxes with validated spread characteristics are being prioritized in high-volume and precision electronics assembly environments.

Fast-growing electronics sectors in regions such as Asia‑Pacific and Latin America are creating fresh opportunities for flux manufacturers. In 2024, major electronics hubs in China, India, and Southeast Asia began expanding production of consumer devices and automotive components, driving regional flux demand. By 2025, rising investment in semiconductor packaging and EV electronics will accelerate consumption in emerging markets with customized flux requirements. These dynamics show that regional expansion is enabling market gains. Producers offering localized formulations, regulatory compliance support, and distribution presence are well placed to capture opportunities in rapidly scaling production centers.

In 2024 and 2025, compliance with environmental standards emerged as a significant challenge for solder flux manufacturers. Regulations restricting volatile organic compounds and hazardous chemicals in flux formulations forced companies to invest in reformulation and advanced testing methods. This process added cost and delayed product launches, particularly impacting small and mid-sized producers. Markets in Europe and North America were noted for imposing stricter guidelines, resulting in higher operational complexities. Unless alternative low-toxicity solutions are developed quickly, these compliance requirements will continue to restrict innovation speed and market accessibility for several industry participants across multiple electronics applications.

In 2024 and 2025, halogen-free solder flux formulations gained significant attention across electronics assembly lines. These variants were designed to meet global safety standards while ensuring strong wetting performance and minimal residue. Manufacturers launched halogen-free solutions for high-reliability sectors such as automotive electronics and consumer devices, where environmental compliance and performance stability were both prioritized. Adoption accelerated in Asian manufacturing hubs, where large-scale printed circuit board production demanded safer and cleaner alternatives. This trend provides a clear opportunity for companies to differentiate portfolios through innovative halogen-free products that balance performance efficiency with evolving compliance requirements worldwide.

| Country | CAGR |

|---|---|

| China | 8.1% |

| India | 7.5% |

| Germany | 6.9% |

| France | 6.3% |

| UK | 5.7% |

| USA | 5.1% |

| Brazil | 4.5% |

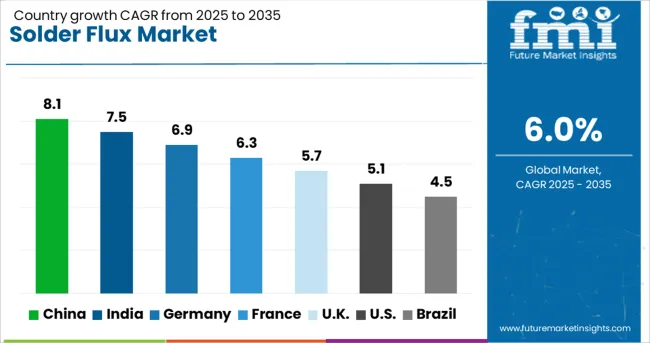

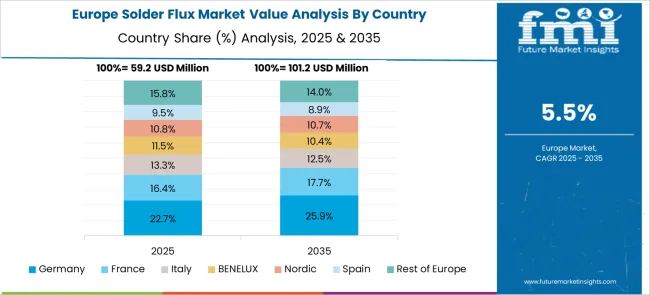

The global solder flux market is projected to grow at a CAGR of 6% from 2025 to 2035. China leads with 8.1%, followed by India at 7.5% and Germany at 6.9%. France posts 6.3%, while the United Kingdom records 5.7%. Growth is driven by rising electronics manufacturing, increasing demand for lead-free soldering materials, and adoption in automotive and industrial applications. China and India dominate due to strong PCB and semiconductor production, while Germany focuses on precision soldering in automotive electronics. France and the UK emphasize environmentally compliant flux formulations and automated soldering system integration.

The solder flux market in China is forecast to grow at 8.1%, supported by rapid growth in consumer electronics and PCB assembly. Water-soluble and no-clean flux types dominate demand due to efficiency in high-speed production lines. Manufacturers focus on developing halogen-free formulations to comply with environmental regulations. Expansion of 5G infrastructure and IoT device manufacturing further accelerates flux consumption.

The solder flux market in India is projected to grow at 7.5%, driven by expansion in electronics manufacturing and government-led initiatives under the Make-in-India program. Rosin-based flux dominates traditional soldering applications in low-cost consumer electronics. Manufacturers introduce lead-free, low-residue flux types to align with global standards. Increased investments in automotive electronics and renewable energy systems strengthen future demand.

The solder flux market in Germany is expected to grow at 6.9%, supported by advanced electronics manufacturing and automotive sector integration. No-clean flux dominates automated soldering processes in high-precision applications. Manufacturers prioritize VOC-free formulations to meet stringent EU emission regulations. Strong demand from EV battery assembly and renewable energy systems fuels technology advancements.

The solder flux market in France is projected to grow at 6.3%, driven by adoption in aerospace, defense, and consumer electronics sectors. Low-residue flux dominates demand for high-reliability soldering in critical applications. Manufacturers integrate smart flux monitoring systems for automated assembly lines. Strategic partnerships with electronics OEMs expand the supply chain for advanced soldering solutions.

The solder flux market in the UK is forecast to grow at 5.7%, supported by strong demand from telecommunications and industrial automation sectors. Water-soluble flux dominates PCB manufacturing processes for telecom equipment. Manufacturers develop hybrid fluxes compatible with selective and wave soldering systems. Rising focus on sustainable electronics production encourages adoption of eco-friendly flux solutions.

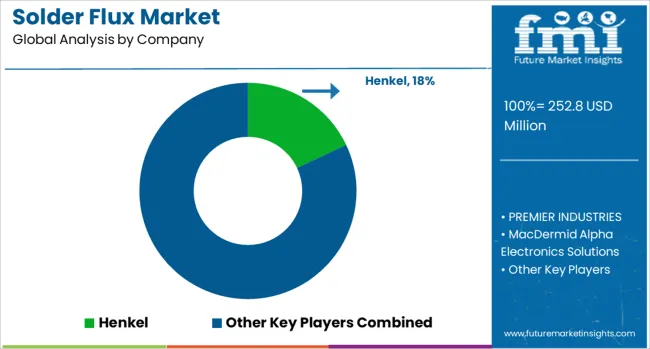

The solder flux market is moderately consolidated, with Henkel holding a leading position due to its extensive portfolio of no-clean, water-soluble, and rosin-based flux formulations designed for high-reliability electronics manufacturing. The company’s global presence, advanced R&D capabilities, and focus on performance-driven soldering solutions have secured its dominance in this sector.

Key players include PREMIER INDUSTRIES, MacDermid Alpha Electronics Solutions, Indium Corporation, INVENTEC PERFORMANCE CHEMICALS, KOKI Company Ltd, La-Co Industries Inc., Shenzhen Tongfang Electronic New Material Co., Ltd., FCT Solder, and Johnson Matthey. These companies provide flux products optimized for diverse applications, including PCB assembly, wave soldering, reflow processes, and high-temperature soldering in automotive, aerospace, and consumer electronics industries.

Market growth is driven by miniaturization of electronic components, increasing adoption of surface-mount technology (SMT), and rising demand for lead-free soldering materials to comply with environmental regulations. Manufacturers are focusing on developing eco-friendly, halogen-free, and low-residue flux formulations to meet stringent reliability standards. Innovations in automated soldering processes and the integration of flux materials compatible with high-speed production lines are further boosting adoption. Asia-Pacific leads the market due to large-scale electronics production, while North America and Europe continue to grow on the back of technological advancements and increased demand for automotive electronics.

| Item | Value |

|---|---|

| Quantitative Units | USD 252.8 Million |

| Product | No-clean, Rosin-based, and Water soluble |

| Sector | Consumer electronics, Automotive, Telecommunication, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Henkel, PREMIER INDUSTRIES, MacDermid Alpha Electronics Solutions, Indium Corporation, INVENTEC PERFORMANCE CHEMICALS, KOKI Company Ltd, La-Co Industries Inc, Shenzhen Tong fang Electronic New Material Co., Ltd., FCT Solder, and Johnson Matthey |

| Additional Attributes | Dollar sales by flux type (rosin-based, water-soluble, no-clean), application (BGAs, SMT, automotive electronics), regional demand trends (North America largest share; Asia-Pacific fastest CAGR), competitive landscape, buyer preferences for cleanability and lead-free formulations, integration with automated soldering and dispensing systems, innovations in eco-friendly chemistries, low-residue compositions, and AI-guided flux deposition methods for precision assembly. |

The global solder flux market is estimated to be valued at USD 252.8 million in 2025.

The market size for the solder flux market is projected to reach USD 452.7 million by 2035.

The solder flux market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in solder flux market are no-clean, rosin-based and water soluble.

In terms of sector, consumer electronics segment to command 52.7% share in the solder flux market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA