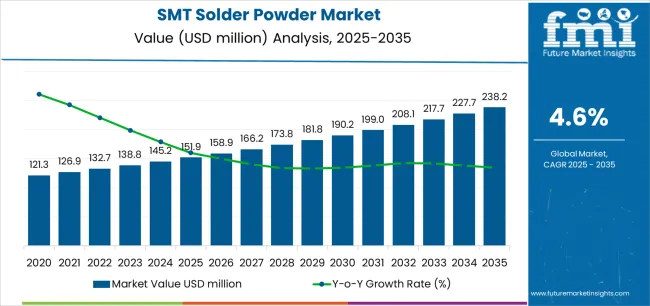

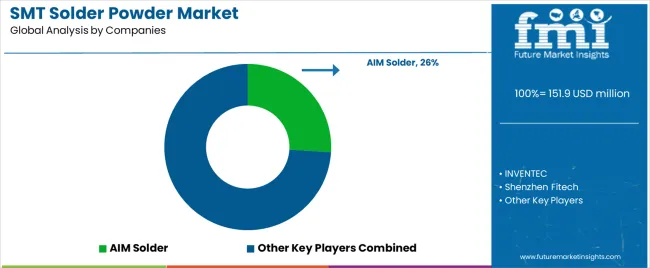

The SMT solder powder market's trajectory from USD 151.9 million in 2025 to USD 238.2 million by 2035 represents robust expansion, demonstrating accelerating adoption of advanced soldering technologies and growing investment in electronics manufacturing infrastructure across automotive assembly facilities, consumer electronics production lines, and industrial equipment manufacturing worldwide.

The market operates within a dynamic landscape characterized by expanding electronics manufacturing capabilities, miniaturization initiatives, and growing demand for precision soldering solutions across PCB assembly, IC packaging, automotive electronics, and telecommunications equipment manufacturing applications. Market dynamics reflect increasing investment in automated assembly infrastructure, accelerating adoption of lead-free soldering technologies, and rising demand for high-performance soldering materials that support advanced manufacturing protocols and quality assurance methodologies. Electronics manufacturing procurement patterns demonstrate shifting preferences toward specialized SMT solder powders that combine particle size optimization, enhanced flow characteristics, and programmable processing parameters. Manufacturing facilities and assembly operations prioritize material reliability, solder joint quality, and operational consistency when selecting soldering solutions for critical applications, including automotive electronics assembly, consumer device manufacturing, telecommunications infrastructure production, and industrial control system fabrication.

The market benefits from expanding electronics manufacturing activities across automotive, telecommunications, and industrial sectors, driving demand for sophisticated soldering materials that enable complex assembly procedures. Growing emphasis on manufacturing quality and process standardization creates opportunities for suppliers offering validated SMT solder powders with comprehensive technical specifications and quality assurance capabilities.

Technology advancement influences market evolution through the development of ultra-fine particle systems, enhanced alloy formulations, and advanced packaging solutions that improve assembly precision and manufacturing outcomes. Manufacturers focus on developing soldering materials that accommodate varying component types, assembly conditions, and thermal requirements while maintaining precise joint formation throughout extended production periods.

The SMT solder powder market demonstrates strong growth fundamentals driven by expanding electronics manufacturing, assembly infrastructure development, and increasing demand for precision soldering materials across multiple industrial sectors and manufacturing applications.

The first half of the decade (2025 to 2030) will witness market growth from USD 151.9 million to approximately USD 190.3 million, adding USD 38.4 million in value, representing 44% of the total forecast period expansion. This phase will be characterized by the rapid adoption of lead-free soldering technologies, driven by regulatory compliance programs and increasing demand for enhanced assembly capabilities across electronics manufacturing applications.

The latter half (2030 to 2035) will experience accelerated growth from USD 190.3 million to USD 238.2 million, representing an addition of USD 47.9 million or 56% of the decade's expansion. This period will be defined by mass market penetration of advanced SMT solder powder technologies, integration with automated assembly systems, and seamless connectivity with existing manufacturing infrastructure.

| Period | Primary Revenue Buckets | Share | Notes |

|---|---|---|---|

| Today | PCB assembly applications | 38% | Consumer electronics, automotive components |

| IC packaging operations | 26% | Semiconductor assembly, microprocessor manufacturing | |

| Automotive electronics | 22% | ECU production, sensor assembly | |

| Telecommunications equipment | 14% | Network infrastructure, mobile device components | |

| Future (3-5 yrs) | Advanced PCB systems | 35-39% | High-density interconnect, flexible circuits |

| Automotive electronics expansion | 28-32% | Electric vehicle components, autonomous systems | |

| IC packaging evolution | 20-24% | Advanced packaging, system-in-package | |

| 5G infrastructure | 12-16% | Base station components, network equipment | |

| Industrial IoT applications | 8-12% | Sensor networks, smart manufacturing | |

| Emerging technologies | 3-7% | Wearables, medical devices |

At-a-Glance Metrics

| Metric | Value |

|---|---|

| Market Value (2025) | USD 151.9 million |

| Market Forecast (2035) | USD 238.2 million |

| Growth Rate | 4.6% CAGR |

| Leading Application | PCB Assembly |

| Primary End-Use | Electronics Manufacturing |

The market demonstrates strong fundamentals with PCB assembly applications capturing dominant share through advanced soldering capabilities and manufacturing process optimization. Electronics manufacturing facilities drive primary demand, supported by increasing production activity and assembly facility expansion initiatives. Geographic distribution remains concentrated in developed markets with established manufacturing infrastructure, while emerging economies show accelerating adoption rates driven by industrial modernization programs and rising electronics production investment.

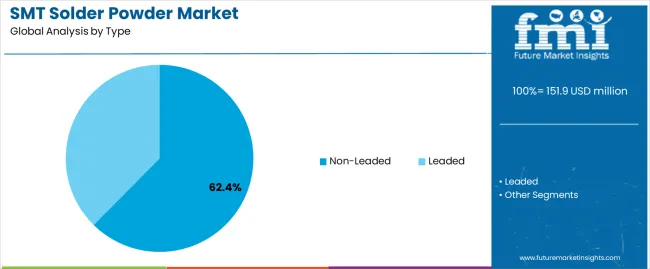

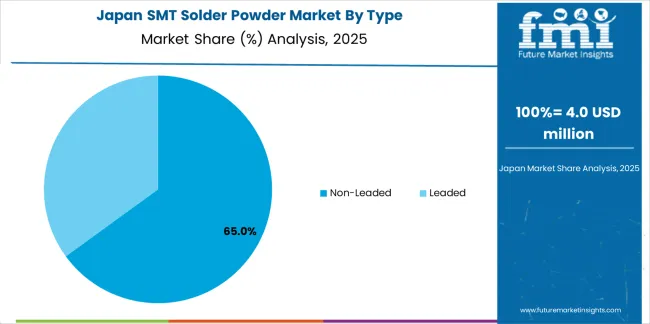

Primary Classification: The market segments by type into leaded solder powders and non-leaded formulations, representing evolution from traditional tin-lead alloys to sophisticated lead-free soldering technologies for comprehensive electronics assembly and component attachment applications.

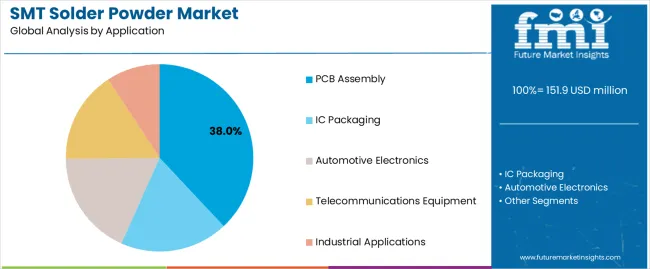

Secondary Classification: Application segmentation divides the market into PCB assembly, IC packaging, automotive electronics, telecommunications equipment, and industrial applications, reflecting distinct requirements for particle size distribution, alloy composition, and thermal processing specifications.

Tertiary Classification: Technology segmentation covers spherical powders, irregular particle systems, and nano-enhanced formulations, while distribution channels span direct sales, electronics materials distributors, and specialized soldering equipment suppliers.

Regional Classification: Geographic distribution covers North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, and Middle East & Africa, with developed markets leading adoption while emerging economies show accelerating growth patterns driven by electronics manufacturing development programs.

The segmentation structure reveals technology progression from traditional leaded systems toward sophisticated lead-free platforms with enhanced performance capabilities, while application diversity spans from basic assembly to specialized manufacturing procedures requiring precise joint formation solutions.

Market Position: Non-leaded solder powder applications command the leading position in the SMT solder powder market with 62.4% market share through proven environmental compliance technologies, including enhanced thermal performance, reliable joint formation capabilities, and manufacturing process optimization that enable assembly operators to achieve optimal soldering results across diverse electronics manufacturing and production environments.

Value Drivers: The segment benefits from manufacturing facility preference for environmentally compliant soldering systems that provide consistent joint quality, operational reliability, and process flexibility without requiring extensive equipment modifications. Advanced lead-free processing features enable enhanced wetting characteristics, precise temperature control, and integration with existing assembly systems, where soldering quality and environmental compliance represent critical operational requirements.

Competitive Advantages: Non-leaded applications differentiate through proven environmental compliance, comprehensive alloy options, and integration with established manufacturing processes that enhance assembly effectiveness while maintaining optimal quality standards suitable for diverse electronics manufacturing applications.

Key market characteristics:

PCB assembly applications maintain a 38% market position in the SMT solder powder market due to their manufacturing advantages and quality control application benefits. These applications appeal to facilities requiring precision soldering solutions with enhanced performance profiles for high-volume operations. Market growth is driven by electronics manufacturing facility expansion, emphasizing assembly automation solutions and operational excellence through optimized soldering material designs.

Market Context: Electronics Manufacturing dominates the market with 5.2% CAGR, reflecting the primary demand source for SMT solder powder technology in consumer electronics and automotive component optimization.

Business Model Advantages: Electronics Manufacturing provides direct market demand for standardized soldering materials, driving volume production and cost optimization while maintaining assembly quality and performance consistency requirements.

Operational Benefits: Electronics Manufacturing applications include process optimization, assembly efficiency, and quality assurance that drive consistent demand for soldering materials while providing access to latest SMT solder powder technologies.

| Category | Factor | Impact | Why It Matters |

|---|---|---|---|

| Driver | Electronics miniaturization & high-density assembly (smartphone components, wearable devices, automotive sensors) | ★★★★★ | Growing electronics market requires advanced soldering materials with enhanced precision capabilities and thermal properties proven effective across miniaturized applications. |

| Driver | Automotive electronics expansion & electric vehicle adoption (EV components, battery management systems) | ★★★★★ | Transforms manufacturing requirements from "basic assembly" to "precision electronics integration"; suppliers that offer advanced SMT powders and reliability features gain competitive advantage. |

| Driver | 5G infrastructure deployment & telecommunications expansion (base stations, network equipment) | ★★★★☆ | Modern telecommunications facilities need sophisticated, validated soldering systems; demand for high-frequency and temperature-resistant solutions expanding addressable market. |

| Restraint | Raw material cost volatility & supply chain constraints (tin prices, precious metals) | ★★★★☆ | Smaller manufacturing facilities defer material upgrades; increases cost sensitivity and slows advanced powder adoption in price-conscious markets. |

| Restraint | Alternative joining technology competition (conductive adhesives, copper bonding, direct attach methods) | ★★★☆☆ | Traditional joining alternatives offer established processes and lower equipment costs, potentially limiting SMT powder adoption in conventional applications. |

| Trend | Lead-free alloy development & environmental compliance (RoHS regulations, REACH requirements) | ★★★★★ | Advanced environmental properties, performance optimization, and regulatory compliance transform operations; alloy development and compliance become core value propositions. |

| Trend | Automation integration & Industry 4.0 connectivity (smart manufacturing, process monitoring) | ★★★★☆ | Intelligent assembly systems for specific applications and processes; specialized monitoring and automated optimization capabilities drive competition toward connected solutions. |

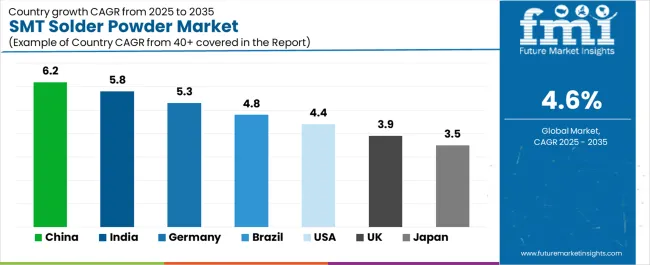

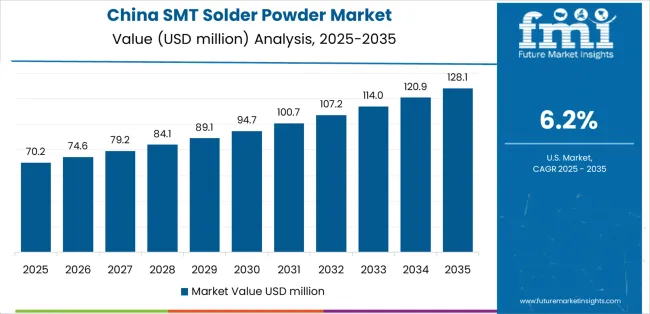

The SMT solder powder market demonstrates varied regional dynamics with Growth Leaders including China (6.2% growth rate) and India (5.8% growth rate) driving expansion through electronics manufacturing development and assembly infrastructure modernization initiatives. Steady Performers encompass Germany (5.3% growth rate), Brazil (4.8% growth rate), and developed regions, benefiting from established manufacturing facilities and automotive sector growth. Mature Markets feature United States (4.4% growth rate), United Kingdom (3.9% growth rate), and Japan (3.5% growth rate), where electronics advancement and manufacturing optimization requirements support consistent growth patterns.

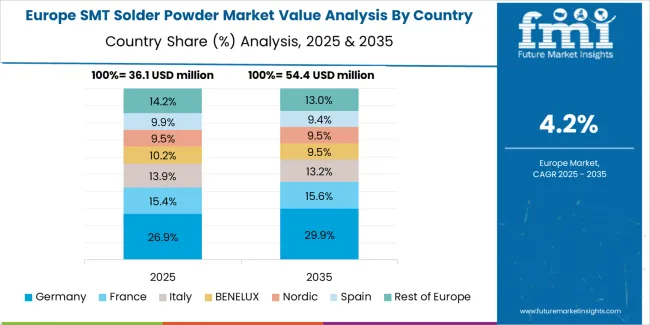

Regional synthesis reveals East Asian markets leading adoption through electronics manufacturing expansion and automotive development, while North American countries maintain steady expansion supported by telecommunications advancement and industrial infrastructure investment. European markets show strong growth driven by automotive applications and environmental compliance trends.

| Country | 2025 to 2035 Growth | How to win | What to watch out |

|---|---|---|---|

| China | 6.2% | Focus on cost-effective manufacturing solutions | Trade regulations; local competition |

| India | 5.8% | Lead with automotive electronics systems | Import restrictions; infrastructure barriers |

| Germany | 5.3% | Provide premium automotive solutions | Over-regulation; lengthy approvals |

| Brazil | 4.8% | Offer value-oriented electronics systems | Currency fluctuations; import duties |

| United States | 4.4% | Push technology integration | Compliance costs; scaling challenges |

| United Kingdom | 3.9% | Focus on telecommunications applications | Economic impacts; funding constraints |

| Japan | 3.5% | Emphasize precision manufacturing | Traditional preferences; adoption rates |

China establishes fastest market growth through aggressive electronics manufacturing programs and comprehensive assembly facility expansion, integrating advanced SMT solder powder systems as standard components in consumer electronics facilities and automotive production lines.

The country's 6.2% growth rate reflects government initiatives promoting manufacturing modernization and domestic electronics capabilities that mandate use of precision soldering materials in assembly operations and quality control facilities. Growth concentrates in major manufacturing hubs, including Shenzhen, Guangzhou, and Shanghai, where electronics development showcases integrated assembly systems that appeal to manufacturing operators seeking soldering precision capabilities and production applications.

Chinese manufacturers are developing cost-effective soldering solutions that combine domestic production advantages with advanced SMT features, including enhanced particle distribution and improved thermal characteristics. Distribution channels through electronics materials suppliers and manufacturing facility integrators expand market access, while government support for electronics development supports adoption across diverse consumer electronics and automotive segments.

Strategic Market Indicators:

In Bangalore, Mumbai, and Chennai, electronics facilities and automotive operators are implementing SMT solder powder systems as standard materials for assembly optimization and manufacturing efficiency applications, driven by increasing government industrial investment and electronics development programs that emphasize importance of precision soldering capabilities. The market holds a 5.8% growth rate, supported by government manufacturing initiatives and facility modernization programs that promote advanced soldering materials for electronics and automotive facilities. Indian operators are adopting soldering systems that provide consistent joint formation and performance features, particularly appealing in urban regions where assembly optimization and manufacturing excellence represent critical industrial requirements.

Market expansion benefits from growing electronics capabilities and international technology partnerships that enable domestic production of advanced soldering materials for assembly operations and automotive applications. Technology adoption follows patterns established in electronics manufacturing, where precision and reliability drive procurement decisions and operational deployment.

Market Intelligence Brief:

Germany's advanced automotive market demonstrates sophisticated SMT solder powder deployment with documented precision effectiveness in electronics applications and manufacturing facilities through integration with existing assembly systems and production infrastructure. The country leverages engineering expertise in soldering technologies and precision manufacturing integration to maintain a 5.3% growth rate. Manufacturing centers, including Bavaria, Baden-Württemberg, and North Rhine-Westphalia, showcase premium installations where soldering materials integrate with comprehensive assembly platforms and facility management systems to optimize manufacturing efficiency and quality effectiveness.

German manufacturers prioritize material quality and EU compliance in automotive development, creating demand for premium materials with advanced features, including facility integration and process monitoring systems. The market benefits from established automotive infrastructure and willingness to invest in advanced soldering technologies that provide long-term operational benefits and compliance with international manufacturing standards.

Market Intelligence Brief:

Brazil's market expansion benefits from diverse manufacturing demand, including electronics modernization in São Paulo and Rio de Janeiro, automotive facility upgrades, and government industrial programs that increasingly incorporate precision soldering solutions for assembly applications. The country maintains a 4.8% growth rate, driven by rising manufacturing activity and increasing recognition of soldering material benefits, including accurate assembly control and enhanced production effectiveness.

Market dynamics focus on cost-effective soldering solutions that balance manufacturing performance with affordability considerations important to Brazilian industrial operators. Growing electronics development creates continued demand for modern soldering materials in new manufacturing infrastructure and facility modernization projects.

Strategic Market Considerations:

United States establishes market leadership through comprehensive electronics programs and advanced manufacturing infrastructure development, integrating SMT solder powder systems across telecommunications and consumer electronics applications. The country's 4.4% growth rate reflects established manufacturing relationships and mature electronics technology adoption that supports widespread use of precision soldering materials in industrial and commercial facilities. Growth concentrates in major technology centers, including California, Texas, and North Carolina, where electronics technology showcases mature deployment that appeals to manufacturing operators seeking proven precision capabilities and assembly optimization applications.

American electronics providers leverage established distribution networks and comprehensive technical support capabilities, including system design programs and training support that create customer relationships and operational advantages. The market benefits from mature regulatory standards and manufacturing requirements that mandate soldering material use while supporting technology advancement and assembly optimization.

Market Intelligence Brief:

United Kingdom's electronics market demonstrates integrated SMT solder powder deployment with documented precision effectiveness in telecommunications applications and manufacturing facilities through integration with existing assembly systems and production infrastructure. The country maintains a 3.9% growth rate, supported by manufacturing efficiency programs and quality effectiveness requirements that promote precision soldering materials for electronics applications. Manufacturing facilities across England, Scotland, and Wales showcase systematic installations where soldering materials integrate with comprehensive assembly platforms to optimize precision and quality outcomes.

UK electronics providers prioritize material reliability and manufacturing compatibility in soldering procurement, creating demand for validated materials with proven precision features, including performance monitoring integration and quality management systems. The market benefits from established electronics infrastructure and quality requirements that support soldering technology adoption and manufacturing effectiveness.

Market Intelligence Brief:

Japan's market growth benefits from precision manufacturing demand, including advanced electronics facilities in Tokyo and Osaka, quality integration, and precision enhancement programs that increasingly incorporate soldering solutions for assembly applications. The country maintains a 3.5% growth rate, driven by manufacturing technology advancement and increasing recognition of precision soldering benefits, including accurate joint formation and enhanced assembly outcomes.

Market dynamics focus on high-precision soldering solutions that meet Japanese quality standards and manufacturing effectiveness requirements important to electronics operators. Advanced manufacturing technology adoption creates continued demand for sophisticated soldering materials in electronics facility infrastructure and assembly modernization projects.

Strategic Market Considerations:

The European SMT solder powder market is projected to grow from USD 28.4 million in 2025 to USD 42.1 million by 2035, registering a CAGR of 4% over the forecast period. Germany is expected to maintain its leadership position with a 36.7% market share in 2025, supported by its advanced automotive infrastructure and major electronics manufacturing centers.

United Kingdom follows with a 24.8% share in 2025, driven by comprehensive telecommunications programs and industrial development initiatives. France holds a 16.9% share through specialized automotive applications and regulatory compliance requirements. Italy commands a 12.2% share, while Spain accounts for 6.1% in 2025. The rest of Europe region is anticipated to gain momentum, expanding its collective share from 3.3% to 3.7% by 2035, attributed to increasing electronics adoption in Nordic countries and emerging manufacturing facilities implementing assembly modernization programs.

| Stakeholder | What they actually control | Typical strengths | Typical blind spots |

|---|---|---|---|

| Global brands | Distribution reach, broad product catalogs, brand recognition | Wide availability, proven reliability, multi-region support | Product refresh cycles; customer dependency on brand validation |

| Technology innovators | Alloy R&D; advanced powder technologies; enhanced performance properties | Latest technologies first; attractive ROI on precision effectiveness | Service density outside core regions; scaling complexity |

| Regional specialists | Local compliance, fast delivery, nearby customer support | "Close to customer" support; pragmatic pricing; local regulations | Technology gaps; talent retention in customer service |

| Full-service providers | Complete assembly programs, system integration, process monitoring | Lowest operational risk; comprehensive support | Service costs if overpromised; technology obsolescence |

| Niche specialists | Specialized applications, custom alloys, research services | Win premium applications; flexible configurations | Scalability limitations; narrow market focus |

| Item | Value |

|---|---|

| Quantitative Units | USD 151.9 million |

| Type | Leaded, Non-Leaded |

| Application | PCB Assembly, IC Packaging, Automotive Electronics, Telecommunications Equipment, Industrial Applications |

| Technology | Spherical Powders, Irregular Particles, Nano-Enhanced Formulations |

| End Use | Electronics Manufacturing, Automotive Assembly, Telecommunications Infrastructure, Industrial Equipment Production |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, Middle East & Africa |

| Countries Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan, Canada, France, Australia, and 25+ additional countries |

| Key Companies Profiled | INVENTEC, Shenzhen Fitech, Huin Atomizing, Shenzhen Huayuan Metal, Indium Corporation, Alpha Assembly Solutions |

| Additional Attributes | Dollar sales by type and application categories, regional adoption trends across East Asia, North America, and Western Europe, competitive landscape with electronics materials manufacturers and assembly integrators, manufacturing operator preferences for soldering effectiveness and quality control, integration with assembly platforms and process management systems, innovations in SMT powder technology and performance enhancement, and development of advanced soldering solutions with enhanced reliability and manufacturing optimization capabilities. |

The global SMT solder powder market is estimated to be valued at USD 151.9 million in 2025.

The market size for the SMT solder powder market is projected to reach USD 238.2 million by 2035.

The SMT solder powder market is expected to grow at a 4.6% CAGR between 2025 and 2035.

The key product types in SMT solder powder market are non-leaded and leaded.

In terms of application, pcb assembly segment to command 38.0% share in the SMT solder powder market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

SMT First Article Inspection Machine Market Size and Share Forecast Outlook 2025 to 2035

PCB Vision Inspection Equipment for SMT Market Size and Share Forecast Outlook 2025 to 2035

Solder Materials Market Size and Share Forecast Outlook 2025 to 2035

Solder Flux Market Size and Share Forecast Outlook 2025 to 2035

Soldering Equipment Market

Electric Soldering Iron Gun Market

Selective Soldering Market Growth - Trends & Forecast 2025 to 2035

Powdered Cellulose Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Powdered Soft Drinks Market Size and Share Forecast Outlook 2025 to 2035

Powder Packing Machine Market Size and Share Forecast Outlook 2025 to 2035

Powder Dispenser Market Analysis by Product Type, Size, Dispensing Mode, End-use Industry, and Region through 2025 to 2035

Analysis and Growth Projections for Powder Induction and Dispersion Systems Business

Leading Providers & Market Share in Powder Packing Machines

Key Players & Market Share in Powder Dispenser Manufacturing

Powder Injection Molding Market Growth – Trends & Forecast 2025 to 2035

Powdered Fats Market – Growth, Demand & Industrial Applications

Powdered Beverage Market Outlook – Growth, Demand & Forecast 2024-2034

Powder Feed Center Market

Powder Funnels Market

Powdered Hand Soap Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA