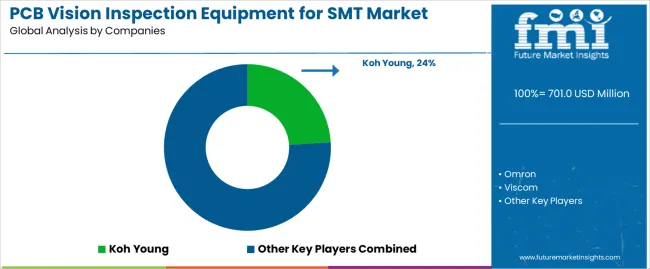

The global PCB vision inspection equipment for SMT market is valued at USD 701 million in 2025 and is projected to reach USD 1,431.4 million by 2035, recording an absolute increase of USD 730.4 million during the period. This translates into a total growth of 104.2%, with the PCB vision inspection equipment for SMT market expanding at a CAGR of 7.4% between 2025 and 2035. The overall size is expected to grow by more than 2.0X over the assessment period, supported by strong momentum in electronics manufacturing, integration of automated quality control systems, and growing emphasis on reliability in SMT processes. Rising adoption of advanced vision inspection technologies reflects the critical importance of error detection and quality verification in modern printed circuit board assembly, as manufacturers aim to reduce production defects while optimizing efficiency.

One of the defining trends shaping growth is the transition toward fully automated inspection systems, with advanced machine vision and AI-based defect detection gaining traction across global production lines. As consumer electronics and industrial electronics require increasingly complex and miniaturized circuit designs, inspection equipment is being deployed to ensure consistency and eliminate micro-level defects that could compromise performance. This trend is reinforced by the rising complexity of surface mount devices, where even marginal soldering inaccuracies can lead to significant operational failures. The capacity of vision inspection systems to deliver speed, precision, and scalability makes them indispensable tools in meeting rising production standards.

Regional growth dynamics reveal that Asia-Pacific dominates the PCB vision inspection equipment for SMT market, supported by the large-scale presence of electronics contract manufacturers in China, Taiwan, South Korea, and Japan. The region’s role as a global electronics manufacturing hub ensures that demand for SMT vision inspection solutions remains steady, particularly as companies focus on increasing throughput and maintaining export-quality standards. North America and Europe, while smaller in terms of volume, represent significant markets due to their emphasis on high-end electronics, aerospace components, and medical devices where precision and compliance are critical. These regions are driving adoption of advanced AI-driven inspection solutions and hybrid systems that integrate inline and offline capabilities for continuous monitoring.

From a technological standpoint, innovations in 3D vision inspection, automated defect classification, and cloud-connected monitoring systems are emerging as growth accelerators. Suppliers are investing in high-speed camera systems, advanced algorithms, and multi-angle inspection platforms to handle high-density interconnect PCBs and next-generation semiconductor packaging. This is supported by the broader industry push toward Industry 4.0 frameworks, where data from inspection systems is integrated into factory automation for predictive quality assurance. Price-sensitive markets in Southeast Asia and Latin America are expected to adopt mid-range solutions, offering opportunities for suppliers to balance advanced performance features with cost competitiveness.

| Item | Value / Description |

|---|---|

| Market Value (2025) | USD 701 million |

| Forecast Value (2035) | USD 1,431.4 million |

| Forecast CAGR (2025-2035) | 7.4% |

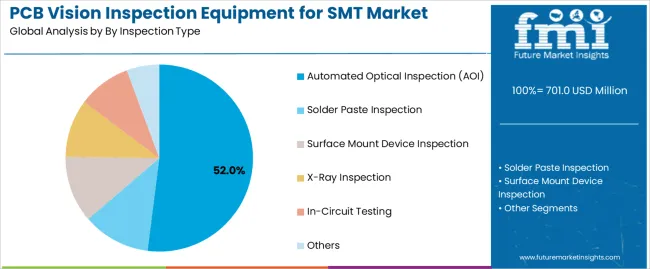

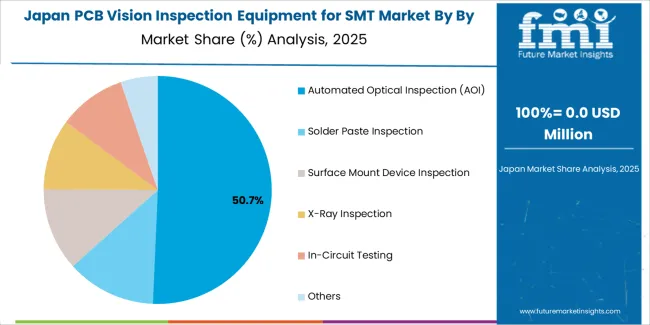

| Leading Inspection Type (2025) | Automated Optical Inspection (AOI) --- 52.0% share |

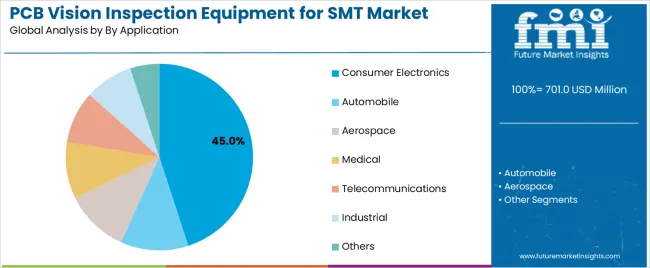

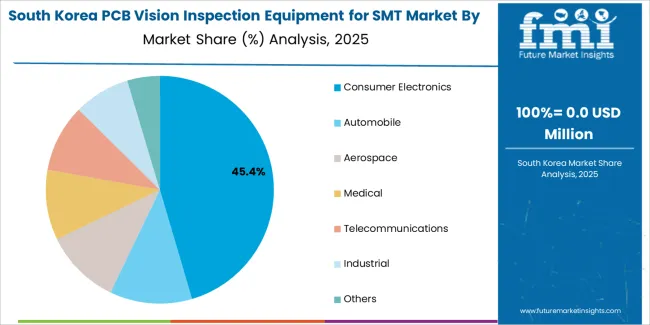

| Leading Application (2025) | Consumer Electronics --- 45.0% share |

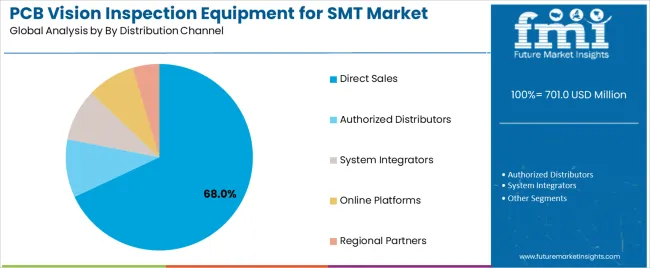

| Leading Distribution Channel (2025) | Direct Sales --- 68% share |

| Key Growth Regions | Asia Pacific; North America; Europe |

| Top Companies by Market Share | Koh Young; Omron; Viscom |

| Metric | Value |

|---|---|

| Market Value (2025) | USD 701 million |

| Market Forecast Value (2035) | USD 1,431.4 million |

| Forecast CAGR (2025-2035) | 7.4% |

| ELECTRONICS MANUFACTURING TRENDS | TECHNOLOGY ADVANCEMENT REQUIREMENTS | QUALITY & PRECISION STANDARDS |

|---|---|---|

| Miniaturization Drive - Continuous reduction in component sizes and increasing circuit density across consumer electronics driving demand for high-precision inspection solutions. | smt Technology Evolution - Advanced surface mount technology requires precision inspection systems delivering accurate defect detection and enhanced manufacturing quality control. | Quality Control Standards - Industry requirements establishing stringent performance benchmarks favoring automated vision inspection equipment. |

| Production Volume Growth - Growing emphasis on high-volume electronics manufacturing and automated production lines creating demand for sophisticated inspection systems. | Professional Manufacturing Demands - Electronics manufacturers investing in advanced inspection equipment offering precise defect detection and superior process control while maintaining production efficiency. | Defect Detection Optimization - Quality standards requiring optimal defect identification and minimal false rejection rates in high-speed production environments. |

| Industry 4.0 Integration - Superior automation capabilities and real-time monitoring making vision inspection systems essential for smart manufacturing applications. | Process Control Requirements - Certified inspection equipment with proven specifications required for professional electronics manufacturing operations. | ai-Enhanced Technology Requirements - Advanced machine learning algorithms and artificial intelligence specifications driving need for intelligent inspection capabilities. |

| Category | Segments / Values |

|---|---|

| By Inspection Type | Automated Optical Inspection (AOI); Solder Paste Inspection; Surface Mount Device Inspection; X-Ray Inspection; In-Circuit Testing; Others |

| By Application | Consumer Electronics; Automobile; Aerospace; Medical; Telecommunications; Industrial; Others |

| By Technology | 2D Vision Systems; 3D Vision Systems; Multi-Angle Inspection; ai-Enhanced Systems; Others |

| By Distribution Channel | Direct Sales; Authorized Distributors; System Integrators; Online Platforms; Regional Partners |

| By Region | Asia Pacific; North America; Europe; Latin America; Middle East & Africa |

| Segment | 2025-2035 Outlook |

|---|---|

| Automated Optical Inspection (AOI) | Leader in 2025 with 52.0% market share; likely to maintain dominance through 2035. Comprehensive defect detection capabilities, compatibility with various PCB types, and cost-effective implementation. Momentum: strong growth driven by automation trends. Watchouts: competition from 3D inspection technologies in high-precision applications. |

| Solder Paste Inspection | Critical segment with 22.5% share, essential for preventing assembly defects and ensuring solder joint quality in SMT processes. Momentum: rising due to miniaturization requirements. Watchouts: technology evolution toward 3D measurement systems. |

| Surface Mount Device Inspection | Specialized segment focusing on component placement verification and orientation checking, crucial for high-density PCB applications. Momentum: steady growth through component complexity increases. |

| X-Ray Inspection | Premium segment for hidden solder joint inspection and BGA verification, serving high-reliability applications in aerospace and medical sectors. Momentum: moderate growth in specialized applications. |

| In-Circuit Testing | Traditional testing approach combining with vision systems for comprehensive quality assurance. Momentum: declining as standalone solution, growing in integrated systems. |

| Others (Flying Probe, Functional Test) | Includes specialized inspection methods for unique applications and custom testing requirements. Momentum: selective growth in niche professional segments. |

| Segment | 2025-2035 Outlook |

|---|---|

| Consumer Electronics | Largest application segment in 2025 at 45.0% share, driven by smartphone, tablet, and wearable device manufacturing volumes. High-speed production requirements and cost sensitivity drive adoption of efficient inspection solutions. Momentum: strong growth from 5G device rollouts and IoT expansion. Watchouts: price pressure and margin compression from competitive manufacturing. |

| Automobile | Rapidly growing segment with 18.5% share, supported by electric vehicle development and advanced driver assistance systems requiring high-reliability electronics. Momentum: accelerating growth through automotive electrification and autonomous vehicle technology. Watchouts: automotive qualification requirements and extended validation cycles. |

| Aerospace | High-value segment demanding maximum reliability and traceability in PCB manufacturing processes. Stringent quality standards and regulatory compliance drive premium inspection equipment adoption. Momentum: steady growth through defense modernization and commercial aviation recovery. Watchouts: long procurement cycles and specialized certification requirements. |

| Medical | Critical application requiring FDA compliance and medical device standards, emphasizing defect-free production and comprehensive documentation. Momentum: strong growth from medical device innovation and aging population demographics. Watchouts: regulatory complexity and validation requirements. |

| Telecommunications | Infrastructure segment driven by 5G network deployment and data center expansion requiring high-frequency PCB inspection capabilities. Momentum: significant growth through 5G infrastructure investments. Watchouts: cyclical infrastructure spending and technology transition risks. |

| Distribution Channel | Status & Outlook (2025-2035) |

|---|---|

| Direct Sales | Dominant channel in 2025 with 68% share for complex inspection systems. Offers technical consultation, customization services, and comprehensive after-sales support. Momentum: steady growth driven by system complexity and customer relationship requirements. Watchouts: high sales costs and regional coverage challenges. |

| Authorized Distributors | Important channel serving regional markets with 22% share, providing local support and faster delivery for standard equipment. Momentum: moderate growth as manufacturers expand geographic reach through partner networks. |

| System Integrators | Growing channel combining inspection equipment with complete production line solutions. Provides value through turnkey implementation and process optimization. Momentum: rising importance as customers seek integrated manufacturing solutions. |

| Online Platforms | Emerging channel for smaller systems and replacement parts, offering competitive pricing and detailed product specifications. Momentum: gradual growth as digital transformation accelerates equipment procurement processes. |

| Regional Partners | Specialized channel for local market penetration and technical support in developing regions. Momentum: expanding role in Asia Pacific and Latin American markets requiring localized service capabilities. |

| DRIVERS | RESTRaiNTS | KEY TRENDS |

|---|---|---|

| Electronics miniaturization and increasing component density across consumer devices driving demand for high-precision inspection capabilities. | High capital investment requirements for advanced inspection systems limit accessibility for smaller manufacturers. | ai and machine learning integration enabling intelligent defect classification, predictive maintenance, and automated parameter optimization. |

| Industry 4.0 adoption - Manufacturing automation and smart factory initiatives creating demand for connected inspection systems with real-time data analytics. | Skilled operator shortage - Complex system operation and maintenance requirements affect implementation and utilization efficiency. | 3d inspection technology advancement - Enhanced three-dimensional measurement capabilities providing superior defect detection and process control. |

| Quality standard intensification - Stricter quality requirements in automotive, medical, and aerospace applications fueling adoption of advanced inspection equipment. | Technology obsolescence - Rapid advancement cycles require frequent equipment upgrades and training investments. | Edge computing implementation - Local processing capabilities reducing latency and enabling real-time decision-making in production environments. |

| Production volume scaling - High-volume manufacturing requirements and cost reduction pressures driving automated inspection adoption. | Integration complexity - System compatibility and production line integration challenges affect implementation timelines and costs. | Cloud-based analytics - Remote monitoring, predictive analytics, and centralized quality management enhancing operational efficiency. |

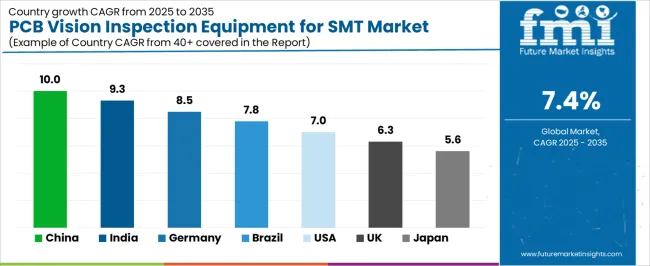

| Country | CAGR (2025-2035) |

|---|---|

| China | 10% |

| India | 9.3% |

| Germany | 8.5% |

| Brazil | 7.8% |

| United States | 7.0% |

| United Kingdom | 6.3% |

| Japan | 5.6% |

Revenue from PCB Vision Inspection Equipment for SMT in China is projected to exhibit exceptional growth with a market value of USD 358.5 million by 2035, driven by expanding electronics manufacturing infrastructure and comprehensive production modernization creating substantial opportunities for inspection equipment suppliers across consumer electronics operations, automotive manufacturing, and telecommunications sectors. The country's established precision manufacturing tradition and rapidly advancing smart factory capabilities are creating significant demand for both 2D and 3D vision inspection systems. Major electronics companies including Foxconn, BYD, and Xiaomi are establishing comprehensive local inspection capabilities to support large-scale manufacturing operations and meet growing demand for quality assurance solutions.

Revenue from PCB Vision Inspection Equipment for SMT in India is expanding to reach USD 201.4 million by 2035, supported by extensive electronics manufacturing expansion and comprehensive quality improvement initiatives creating demand for reliable inspection solutions across diverse production categories and export-oriented manufacturing segments. The country's growing electronics sector and expanding automotive industry are driving demand for inspection systems that provide consistent quality control while supporting cost-effective manufacturing requirements. Equipment distributors and system integrators are investing in local market development to support growing industrial operations and professional manufacturing demand.

Demand for PCB Vision Inspection Equipment for SMT in Germany is projected to reach USD 142.8 million by 2035, supported by the country's leadership in precision manufacturing and advanced inspection technologies requiring sophisticated vision systems for automotive and industrial applications. German manufacturers are implementing high-precision inspection systems that support advanced quality control, operational reliability, and comprehensive process optimization. The PCB vision inspection equipment for SMT market is characterized by focus on engineering excellence, system integration, and compliance with stringent automotive and industrial quality standards.

Revenue from PCB Vision Inspection Equipment for SMT in Brazil is growing to reach USD 111.7 million by 2035, driven by industrial modernization programs and increasing electronics manufacturing creating opportunities for equipment suppliers serving both automotive operations and consumer electronics contractors. The country's expanding manufacturing sector and growing automotive industry are creating demand for inspection systems that support diverse production requirements while maintaining performance standards. Equipment distributors and technical service providers are developing local capabilities to support operational efficiency and customer satisfaction.

Demand for PCB Vision Inspection Equipment for SMT in United States is projected to reach USD 98.6 million by 2035, expanding at a CAGR of 7.0%, driven by advanced manufacturing excellence and specialized technology applications supporting aerospace development and comprehensive medical device manufacturing. The country's established precision manufacturing tradition and mature technology sectors are creating demand for high-performance inspection systems that support operational excellence and regulatory compliance. Equipment manufacturers and system integrators are maintaining comprehensive development capabilities to support diverse industrial requirements.

Revenue from PCB Vision Inspection Equipment for SMT in United Kingdom is growing to reach USD 87.3 million by 2035, supported by advanced manufacturing initiatives and established technology companies driving demand for sophisticated inspection solutions across telecommunications and aerospace applications. The country's focus on innovation and high-value manufacturing creates demand for inspection systems that support both traditional production and emerging technology applications.

Demand for PCB Vision Inspection Equipment for SMT in Japan is projected to reach USD 76.9 million by 2035, driven by precision manufacturing tradition and established inspection technology leadership supporting both domestic electronics markets and export-oriented equipment production. Japanese companies maintain sophisticated inspection development capabilities, with established manufacturers continuing to lead in ai-enhanced systems and precision measurement standards.

South Korean PCB Vision Inspection Equipment operations reflect the country's advanced electronics manufacturing sector and export-oriented business model. Major conglomerates including Samsung and LG drive equipment procurement strategies for their electronics divisions, establishing direct relationships with specialized inspection suppliers to secure consistent quality and advanced technology for their semiconductor and consumer electronics operations targeting both domestic and international markets.

The Korean market demonstrates particular strength in integrating inspection technologies into high-volume production formats, with companies developing systems that bridge traditional SMT inspection and advanced packaging technologies. This integration approach creates demand for specific performance specifications that differ from conventional applications, requiring suppliers to adapt defect detection algorithms and measurement capabilities for next-generation electronics manufacturing.

Regulatory frameworks emphasize electronics safety and manufacturing quality standards, with Korean Communications Commission and industrial safety requirements often exceeding international benchmarks. This creates barriers for basic inspection equipment but benefits established manufacturers who can demonstrate advanced ai capabilities and comprehensive validation systems. The regulatory environment particularly favors suppliers with KC certification and extensive performance documentation.

Supply chain efficiency remains critical given Korea's technological advancement focus and competitive manufacturing dynamics. Companies increasingly pursue development partnerships with suppliers in Japan, Germany, and specialized technology providers to ensure access to cutting-edge inspection capabilities while managing technological risks. Investment in research and development supports quality advancement during extended product development cycles, particularly in semiconductor packaging and flexible electronics inspection applications.

European PCB Vision Inspection Equipment operations are increasingly concentrated between German precision engineering and specialized manufacturing centers across the continent. German facilities dominate high-end inspection system production for automotive and industrial applications, leveraging advanced ai technologies and strict quality protocols that command price premiums in global markets. Manufacturing centers in Switzerland and Austria maintain leadership in specialized inspection designs for medical and aerospace applications, with companies like Viscom and Mirtec driving technical specifications that smaller suppliers must meet to access European manufacturing contracts.

Eastern European operations in Czech Republic, Poland, and Hungary are capturing volume-oriented production contracts through skilled engineering advantages and EU regulatory compliance, particularly in consumer electronics inspection systems for mid-range manufacturing applications. These facilities increasingly serve as development centers for Western European brands while building their own technological expertise in machine learning and 3D vision systems.

The regulatory environment presents both opportunities and constraints. CE marking requirements and Industry 4.0 standards create quality benchmarks that favor established European manufacturers over imports while ensuring consistent performance specifications. Brexit has created complexity for UK equipment sourcing from EU suppliers, driving opportunities for direct relationships between manufacturers and international system integrators.

Supply chain consolidation accelerates as manufacturers seek economies of scale to absorb rising component costs and ai development expenses. Vertical integration increases, with major electronics manufacturers acquiring inspection equipment capabilities to secure quality control systems and technological advancement. Smaller manufacturers face pressure to specialize in niche applications or risk displacement by larger, more technologically advanced operations serving mainstream electronics manufacturing requirements.

Profit pools are consolidating upstream in AI algorithm development and advanced optical systems manufacturing, and downstream in application-specific inspection solutions for automotive, medical, and aerospace markets where certification, precision detection, and consistent performance command premiums. Value is migrating from basic 2D inspection systems to ai-enhanced, application-ready platforms where machine learning expertise, 3D measurement technology, and reliable defect classification create competitive advantages. Several archetypes define market leadership: established Asian manufacturers defending share through technological innovation and manufacturing scale; European precision equipment brands leveraging engineering excellence and high-value applications; specialized AI developers with machine learning intellectual property and software expertise; and emerging technology companies pursuing advanced 3D vision systems while developing market presence. Switching costs - production line integration, operator training, quality validation - provide stability for established suppliers, while technological advancement and performance requirements create opportunities for innovative manufacturers. Consolidation continues as companies seek R&D scale and global market access; direct sales channels grow for complex systems while distributor networks remain critical for regional support. Focus areas: secure automotive and high-reliability market positions with application-specific performance capabilities and comprehensive technical support; develop AI and machine learning technology with advanced defect classification; explore emerging applications including flexible electronics and advanced packaging inspection.

| Stakeholder Type | Primary Advantage | Repeatable Plays |

|---|---|---|

| Asian Technology Leaders | Manufacturing scale; advanced R&D capabilities; comprehensive product portfolios | Technology innovation; global market penetration; cost-effective production |

| European Precision Specialists | Engineering excellence; high-value applications; strong customer relationships | Premium positioning; specialized solutions; quality-focused marketing |

| ai Software Developers | Machine learning expertise; algorithm development; intelligent defect classification | Software licensing; technology partnerships; continuous algorithm improvement |

| System Integrators | Complete solution capability; process optimization; customer support | Turnkey implementations; production line integration; comprehensive service offerings |

| Regional Equipment Distributors | Local market knowledge; technical support; customer relationships | Regional expansion; service excellence; application expertise |

| Item | Value |

|---|---|

| Quantitative Units | USD 701 million |

| Inspection Types | Automated Optical Inspection (AOI); Solder Paste Inspection; Surface Mount Device Inspection; X-Ray Inspection; In-Circuit Testing; Others |

| Technology | 2D Vision Systems, 3D Vision Systems, Multi-Angle Inspection, ai-Enhanced Systems, Others |

| Applications | Consumer Electronics; Automobile; Aerospace; Medical; Telecommunications; Industrial |

| Distribution Channels | Direct Sales; Authorized Distributors; System Integrators; Online Platforms |

| Regions Covered | Asia Pacific; North America; Europe; Latin America; Middle East & Africa |

| Key Countries | China; India; Germany; Brazil; United States; United Kingdom; Japan (+35 additional countries) |

| Key Companies Profiled | Koh Young; Omron; Viscom; Mycronic; Nordson; KLA; ViTrox; Parmi; Mirtec; Test Research, Inc.; Saki Corporation; Industrial Vision Systems Ltd; MAChvISION; SynPower; Mek; JT Automation Equipment; I.C.T; ALEADER |

| Additional Attributes | Dollar sales by inspection type and distribution channel; Regional demand trends (APAC, NA, EU); Competitive landscape; Direct sales vs. distributor adoption patterns; Manufacturing and system integration; ai-enhanced technologies driving quality improvement, defect detection accuracy, and operational excellence |

The global PCB vision inspection equipment for SMT market is estimated to be valued at USD 701.0 million in 2025.

The market size for the PCB vision inspection equipment for SMT market is projected to reach USD 1,431.4 million by 2035.

The PCB vision inspection equipment for SMT market is expected to grow at a 7.4% CAGR between 2025 and 2035.

The key product types in PCB vision inspection equipment for SMT market are automated optical inspection (aoi), solder paste inspection, surface mount device inspection, x-ray inspection, in-circuit testing and others.

In terms of by application, consumer electronics segment to command 45.0% share in the PCB vision inspection equipment for SMT market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

PCB Connector Market Size and Share Forecast Outlook 2025 to 2035

PCB Design Software Market Analysis by Component, Deployment, Application, and Region Through 2035

PCB Design Software Industry in Europe – Growth & Forecast 2023-2033

Multi-Axis PCB Drilling Machine Market Size and Share Forecast Outlook 2025 to 2035

Rigid-Flex PCB Market Size and Share Forecast Outlook 2025 to 2035

Substrate-like PCB Market Size and Share Forecast Outlook 2025 to 2035

Printed Circuit Board (PCB) Assembly Market Size and Share Forecast Outlook 2025 to 2035

Printed Circuit Boards (PCB) Market Trends - Demand & Forecast 2025 to 2035

Vision Guided Robots Market - Trends & Forecast 2025 to 2035

Vision Sensor Market by Type, Application, End user and Region through 2035

Vision Care Market is segmented by product type, type and distribution channel from 2025 to 2035

Vision Screener Market Growth – Demand & Forecast 2024-2034

Revision Knee Replacement Market Size and Share Forecast Outlook 2025 to 2035

Television Broadcasting Services Market Insights – Growth & Forecast 2023-2033

Television Services Market

Smart Vision Sensors Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Night Vision Surveillance Cameras Market Size and Share Forecast Outlook 2025 to 2035

Night Vision System Market Growth - Trends & Forecast 2024 to 2034

Night Vision Device Market

Machine Vision Camera Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA