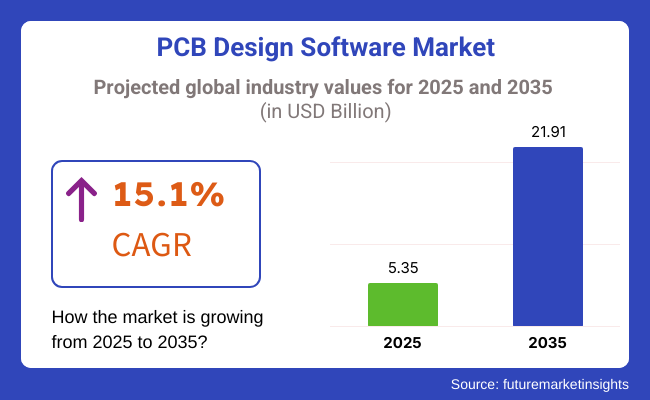

The PCB design software market is expected to expand at a high growth rate from 2025 to 2035 with the development of high-end electronics, PCB design automation, and the emergence of AI-based circuit optimization. It is expected to grow from USD 5.35 billion in 2025 to USD 21.91 billion in 2035 at a compound annual growth rate (CAGR) of 15.1% over the forecast period.

With miniaturization, high-speed circuit design, and IoT-enabled smart devices trending in industries, PCB design software takes the lead in optimizing electronic layout, complying with regulations, and optimizing production efficiency.

The intersection of cloud-hosted PCB design environments, AI-driven routing, and 3D visualization tools are also driving the industry's expansion. In addition, the increased use of flexible PCBs, multilayer boards, and complex semiconductor packages is driving demand for sophisticated EDA (Electronic Design Automation) software solutions.

Moreover, the growing need for real-time collaboration platforms, cloud-connected PCB design environments, and AI-driven schematic verification is transforming the sector. Companies are leveraging machine learning-based design automation, predictive failure analysis, and digital twin technology to automate PCB development and optimize manufacturing processes.

By component, software solutions account for a large share, and it is expected to generate USD 5.35 billion in revenue in 2025. It includes PCB design tools, which do schematic capture and PCB layout, and relevant design services, which are essential for modern electronics engineering.

The PCB design software segment is projected to hold the largest share of 65.0% by 2025. This is fueled by a growing adoption of new AI-assisted design automation, real-time signal integrity analysis, and cloud-based collaboration tools. Leading such advancements are companies such as Altium, Cadence, and Siemens EDA through innovations from AI-enabled auto Routing to Predictive Design Verification to multilayermultilayer printed circuit board (PCB) layout optimization.

AI-based Autodesk Fusion 360 and Cadence Allegro X AI reduce design duration in PCB design by up to 40%, substantially increasing manufacturing process efficiency. In this regard, advanced design software is crucial to optimizing layouts and ensuring manufacturability, as industries ranging from 5G to IoT and electric vehicles (EVs) create the necessity for more complex high-speed PCBs.

The 2025 share of this segment due to schematic capture is estimated at 35.0%. Schematic capture tools play a crucial role in the design, simulation, and verification before routing. These programs verify connections, catch errors early, and integrate directly with PCB design software.

Cadence's OrCAD Capture provides on-the-fly electrical rule checks, which can help mitigate 25% of design errors before PCB manufacturing. Demand for accurate schematic capture solutions continues to grow as automotive ADAS, aerospace avionics, and industrial automation push the complexity of electronic circuits higher and higher.

The industry is growing across various industries; the consumer electronics and automotive sectors are the major contributors.

Growing adoption of flexible PCBs, miniaturized circuits & high-speed electronic devices is likely to help the consumer electronics segment to hold a share of 29.4% in 2025. In this fast-paced technology world where consumers expect the portability of electronics, their speed, and features, manufacturers must incorporate advanced softwares to make circuits richer in complexity and reliability.

Businesses such as Apple, Samsung, and Sony utilize AI-driven PCB layout tools to improve power consumption and increase space usage in smartphones, wearables, and laptops. The advent of AR/VR devices along with the introduction of IoT-enabled smart home appliances is also adding to the growing demand for advanced PCB design services.

By 2025, the automotive segment's share will be 21.7% due to the increasing penetration of automatic driving systems, electric vehicles, and automated driving. Documenting these, we will discuss the necessity of AI-integrated PCB software in automotive electronics since modern automobiles require high-density, multilayermultilayer boards with high-performance thermal management and signal integrity.

Automakers such as Tesla, BMW, and Toyota leverage high-speed simulation and real-time validation tools to enhance electronic control units (ECUs), battery management systems (BMS), and infotainment modules. Design of automotive PCB layouts can take 30% less time and still comply with automotive safety standards such as ISO 26262 with Siemens EDA's Xpedition Enterprise.

The PCB design software market scales heights owing to the ongoing industrial development in sectors like electronics, such as complex construction circuits, the necessity for small-scale and microcircuits, and the demand for high-performance circuit boards.

In the electronics & semiconductor sector, software with advanced simulation, high-speed design capabilities, and AI-driven automation is crucial. Automotive usage emphasizes reliability, thermal analysis, and integration with mechanical design software to aid electric vehicle (EV) and autonomous vehicle development.

Aerospace & defense applications emphasize high-accuracy design, security capabilities, and military standards compliance. In the healthcare sector, PCB design software needs to facilitate compact, reliable, and biocompatible medical devices, necessitating collaboration tools and strict compliance enforcement.

Industrial production focuses on low-cost, scalable solutions with fast prototyping and integration into manufacturing processes. Cloud collaboration, AI-driven automation, and improved 3D visualization are some of the most significant trends influencing the PCB design software market.

| Company | Contract Value (USD Million) |

|---|---|

| Altium | Approximately USD 50 - 60 |

| Cadence Design Systems | Approximately USD 40 - 50 |

| Mentor Graphics (Siemens EDA) | Approximately USD 45 - 55 |

| Zuken | Approximately USD 35 - 45 |

| Autodesk Eagle | Approximately USD 30 - 40 |

Over the period 2020 to 2024, there was a growth in the industry with semiconductor technology advancements, IoT, and miniaturization. Cloud design environments enabled teamwork and shorter development times.

Trace routing was enhanced using AI-enabled automation, which prevented defects in designs and enhanced product reliability. Automotive industries spurred demands for high-performance PCB design for EV and ADAS purposes. Users demanded simplified interfaces, AI-based design, and elastic pricing in 2024 to make it easy to use.

Between 2025 and 2035, AI design automation, quantum computing, and green PCB design will transform the industry through component placement, and EMI minimization will provide quantum circuit topologies and resistance setup 6G. Satellite technology will require high-level, high-frequency software simulation. Green PCB design will focus on energy efficiency and green materials. Blockchain-based platforms will provide intellectual property protection and decentralized design collaboration.

A Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Stricter compliance requirements (IPC-2581, RoHS, ISO 9001) made the software include auto-validation capabilities in material selection and environmental analysis. | AI-driven, blockchain-secured design validation ensures real-time compliance monitoring, automated regulatory updates, and eco-friendly material recommendations in PCB design. |

| AI-driven software improves circuit layout optimization, removes manual design loops, and enhances manufacturability. | AI-generated PCB layout software designs layouts for optimization independently forecast thermal and electrical performance and delivers real-time, self-correcting simulations of circuits. |

| PCB design shifted to the cloud, facilitating remote collaboration, versioning, and real-time design checking. | Decentralized, AI-driven PCB design environments allow cross-functional collaboration, design forecast guidance, and completely automated, cloud-native circuit prototyping. |

| Growing demand for multilayer, space-efficient PCBs for consumer electronics, automotive, and aerospace spurred demand for next-generation design tools. | Artificial intelligence-based real-time 3D PCB modeling supports high-density interconnect (HDI) design, self-tuning signal routing, and EMC correction automation. |

| Engineer digital twin simulations validated PCB performance before prototyping, avoiding errors and costs. | AI-based, real-time digital twin PCB platforms allow predictive failure simulation, dynamic adaptation of components, and self-learning circuit optimization. |

| AI-infused thermal and electromagnetic simulation solutions assisted designers in optimizing power supply and preventing overheating of PCBs. | Real-time signal integrity and thermal engines enabled by AI predict component response across conditions to yield maximum energy efficiency and electromagnetic safeguarding. |

| Generative design technology powered by AI optimized PCB layout for performance, manufacturing, and cost. | Generative design technology merged with AI, adaptive design systems autonomously create ultra-efficient PCB geometry using automatic multi-objective optimization to power next-gen electronics. |

| Miniature electronics and wearables technology needs compelled 3D, flex, and rigid-flex PCB design capabilities. | AI-tuned, ultra-flexible PCB simulation platforms enable dynamic, shape-shifting circuits for foldable devices, stretchable electronics, and embedded AI processors. |

| Cloud-based PCB software used end-to-end encryption and AI-based threat detection to protect against IP theft and unauthorized access. | AI-protected, quantum-resistant PCB design platforms provide tamper-proof circuit schematics, decentralized IP protection, and real-time anomaly detection against cyber attacks. |

| Businesses focused on sustainable PCB materials, lead-free soldering, and waste-minimizing design practices. | AI-driven, carbon-conscious PCB design solutions optimize environmentally friendly material selection, facilitate circular electronics production, and reduce e-waste through predictive lifecycle analysis. |

The PCB design software market is a pillar of electronics manufacturing, prototyping, and industrial design but not without risks that might hold back its growth and dissemination. The dangers facing it include cybersecurity threats, software incompatibility issues, regulatory compliance, and intense competition from cloud-based platforms.

The most significant risk is cybersecurity and intellectual property (IP) protection. Circuits and product data are commonly shared as PCB design files, which contain proprietary details. Consequently, a security breach can lead to data leaks, IP theft, or industrial espionage.

Software compatibility and interoperability are other notable obstacles. A large number of engineers utilize multiple CAD and EDA tools, and therefore, the connection between different software platforms can be a hassle, even causing design inefficiencies and higher production costs. The main requirement for growth is to ensure smooth compatibility with leading CAD, PLM, and simulation tools.

Regulatory compliance is an additional key aspect. PCB design software is expected to comply with the international safety and environmental standards that include RoHS (Restriction of Hazardous Substances), REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals), and IPC (Institute for Printed Circuits) guidelines. Companies which do not certify compliance verification through integrating it to the software will be subjected to legal liabilities, product recalls, and damage to their reputations.

The last aspect of concern is that open-source PCB design tools are placed as tough competition which makes premium software providers face a lot of risk. A number of startups and small-scale manufacturers always prefer to using such tools that either cost less or are free like KiCad or EasyEDA and thus put the makers of branded tools in dire straits with the notion of justifying high license fees.

| Country | CAGR (2025 to 2035) |

|---|---|

| The USA | 9.8% |

| The UK | 9.4% |

| European Union (EU) | 9.6% |

| Japan | 9.3% |

| South Korea | 9.9% |

The USA PCB design software market is growing as businesses are investing in advanced electronics, AI-driven circuit design, and IoT technology. Miniaturization, high-speed design, and real-time co-authoring are extremely important for engineers, and innovation is almost entirely reliant on PCB design software.

USA industry and DoD trends drive expansion through AI-driven design automation, in-system verification of printed circuit board layouts, and cloud-based collaboration. Penetration of 5G networks, AI-designed semiconductors, and flexible PCBs fuel the growth.

Key leaders Autodesk, Altium, and Cadence Design Systems are embracing AI-driven routing optimization, PCB simulation on the cloud, and intelligent device verification technology mainstream to fuel electronic design automation. FMI is of the opinion that the USA market is slated to grow at 9.8% CAGR during the study period.

Growth Factors in the USA

| Key Drivers | Details |

|---|---|

| Government Funding | DoD enables AI-based design automation and real-time verification of PCBs. |

| 5G and IoT Expansion | Increased 5G network deployment and IoT-based workflows fuel PCB innovation. |

| AI-Based Design Platforms | Companies develop AI-based PCB simulation and computer-aided circuit verification. |

The UK market grows because of industrial automation, AI-based electronics, and government-backed innovation projects. Future-proof PCB software is embraced by engineers to deal with the intricacy of circuit design in today's world.

Department for Business, Energy & Industrial Strategy (BEIS) drives AI-driven PCB computer-aided design software tools, real-time collaborative design, and cybersecurity-based circuit design. Artificial intelligence-driven electronic prototyping and smart manufacturing also drive demand.

Siemens EDA, Zuken, and Mentor Graphics lead in AI-driven component placement, cloud collaborative design, and real-time PCB integrity analysis to enable accelerated product development. FMI is of the opinion that the UK market is slated to grow at 9.4% CAGR during the study period.

Growth Factors in the UK

| Key Drivers | Details |

|---|---|

| Industrial Automation | The usage of PCB computer-aided design software based on AI is leading to manufacturing development. |

| Government Initiatives | Real-time co-design and circuit design facilitated by cybersecurity are supported by BEIS. |

| AI-Driven Prototyping | PCB software usage is propelled by smart manufacturing and AI-based prototyping. |

The EU PCB design software market is increasing as governments invest in AI-powered automation, smart manufacturing, and semiconductor research. High-frequency circuit design, development of embedded systems, and AI-based verification of the PCB are led by Germany, France, and Italy. Sustainability, digitalization, and automated design flows are the EU's prime regions of interest.

Organizations like Dassault Systèmes, Siemens, and Ansys are leading intelligent PCB layout automation, 3D circuit modeling, and digital twin simulations driven by AI for improving electronic product reliability. FMI is of the opinion that the EU market is slated to grow at 9.6% CAGR during the study period.

Growth Factors in the EU

| Key Drivers | Details |

|---|---|

| Semiconductor Research | The European Union invests in research on semiconductors and intelligent manufacturing. |

| AI-Driven Automation | Engineers implement AI-based PCB verification and debugging loops. |

| Digital Transformation | 3D circuit modeling and digital twin simulations increase expenditures. |

Japan's PCB design software industry is emerging very rapidly due to government-sponsored schemes for semiconductors and rising demands for AI-based circuit design. Accurate engineering, small electronics, and artificial intelligence systems are still the future trends that will develop further.

The Ministry of Economy, Trade, and Industry (METI) invests in real-time PCB design verification, AI-driven signal integrity analysis, and future semiconductor packaging. PCB automation fuels smart home appliances, wearable electronics, and medical electronics expansion.

Fujitsu, Panasonic, and Renesas Electronics are the pioneers in AI-driven PCB routing, advanced 3D circuit modeling, and multi-board design collaboration. FMI is of the opinion that Japan is slated to grow at 9.3% CAGR during the study period.

Growth Factors in Japan

| Key Drivers | Details |

|---|---|

| Semiconductor Technology | METI invests in PCB verification and AI-based signal integrity analysis. |

| Miniaturized Electronics | Increasing needs for miniaturized, AI-enriched devices drive PCB design software. |

| AI-Assisted PCB Routing | Highlight 3D circuit modeling and multi-board co-design. |

South Korean PCB design software market is growing with increasing semiconductor production, AI-aided circuit optimization, and IoT-based electronic design automation. Consumer electronics, 5G technology infrastructure, and smart devices continue to keep South Korea ahead, driving demands for sophisticated PCB tools.

Ministry of Science and ICT (MSIT) is investing in real-time PCB fault detection, AI-powered multilayermultilayer circuit design, and manufacturing guided by cybersecurity. Machine learning-based PCB manufacturing automation, machine learning-based defect inspection, and real-time digital twin simulation are game-changing technologies.

Samsung Electronics, LG Display, and SK Hynix's future tech circuit simulation cloud-based collaborative PCB design, as well as AI-driven manufacturing validation, drive South Korean progress. FMI is of the opinion that the South Korean market is slated to grow at 9.9% CAGR during the study period.

Growth Factors in South Korea

| Key Drivers | Details |

|---|---|

| Semiconductor Business | High-growth semiconductor manufacturing requires AI-optimized PCB software. |

| Smart Devices and 5G | Expanded 5G infrastructure and smart devices drive PCB manufacturing. |

| AI-Auto Automation | PCB reliability is provided by an AI-aided multilayermultilayer circuit design and fault detection. |

The growth of the PCB Design Software Market is attributed to the adoption of modern automation techniques, simulation integrated with AI, and cloud-based communication by industries towards enhanced circuit board development. The demand for miniaturization, high-speed signal processing, and efficient power management are the main drivers of innovation in PCB design solutions.

Market leaders like Altium, Cadence Design Systems, Siemens EDA (Mentor Graphics), Autodesk, and Zuken cover the share with high-precision design tools, real-time simulation, and seamless integration with manufacturing workflows. AI-based routing, cloud-embedded design sharing, and embedded systems integration are the areas addressed by startups and niche providers, creating more competition among them.

The requirement for ultra-high-density interconnect (HDI) and multilayermultilayer PCB design tools will arise more with the growing complexity due to IoT, automotive electronics, and 5G infrastructure. Enhanced EMC analysis, MC simulation, and real-time manufacturability checks are becoming standard practice in the industry.

These aspects give rise to strategic factors in a competition where differentiation occurs with AI, developing a design assist for collaboration via the cloud, and machine learning-based detection of errors. Scalability, intelligence, and ready-to-manufacture PCB designs create a competitive advantage for the companies, bringing a revolution.

Market Share Analysis by Company

| Company Name | Estimated Share (%) |

|---|---|

| Altium Limited | 20-25% |

| Cadence Design Systems | 15-20% |

| Siemens EDA (Mentor Graphics) | 12-16% |

| Autodesk Inc. | 10-14% |

| Zuken Inc. | 6-10% |

| Other Companies (combined) | 20-30% |

| Company Name | Key Offerings/Activities |

|---|---|

| Altium Limited | Specializes in cloud-based software with real-time collaboration. |

| Cadence Design Systems | Provides AI-powered PCB design as well as simulation tools for high-speed circuits. |

| Siemens EDA (Mentor Graphics) | Focuses on advanced PCB layout, thermal analysis, and verification tools. |

| Autodesk Inc. | Innovates in intuitive PCB design solutions with integrated 3D modeling. |

| Zuken Inc. | Develops enterprise-grade PCB design automation for electronics manufacturers. |

Key Company Insights

Altium Ltd. (20-25%)

Altium is the leader in the PCB design software market with its cloud-based Altium Designer platform that incorporates real-time collaboration, intelligent routing, and seamless integration to manufacturing.

Cadence Design Systems (15-20%)

Cadence is a leader in high-performance PCB design automation that merges AI-based signal integrity analysis with high-speed circuit simulation and advanced layout capabilities.

Siemens EDA (Mentor Graphics) (12-16%)

Siemens EDA has integrated PCB design, verification, and manufacturing solutions that help engineers design high-reliability electronic systems.

Autodesk Inc. (10-14%)

Autodesk is pioneering PCB design by integrating schematic capture, circuit board layout, and mechanical integration in intuitive platforms like Autodesk Fusion 360.

Zuken Inc. (6-10%)

Zuken offers enterprise-level PCB design solutions with cutting-edge circuit simulation, real-time collaboration, and automation-led efficiency.

Other Key Players (20-30% Combined)

By component, the market includes PCB design software, PCB layout, schematic capture, and PCB design services, which are further segmented into designing services and support & maintenance.

By deployment, the market is categorized into on-premise PCB design software and cloud-based PCB design software.

By application, the market covers IT & computing, consumer electronics, telecommunications, healthcare, automotive, defense & military, and others.

By region, the market spans North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East & Africa (MEA).

The industry is slated to reach USD 5.35 billion in 2025.

The industry is predicted to reach a size of USD 21.91 billion by 2035.

Key companies include SolidWorks, Zuken Inc., Altium, Synopsys Inc., Cadence Design Systems, CadSoft, Autodesk Inc., Shanghai Tsingyue, WestDev Ltd., ANSYS Inc., Saint-Gobain, and Klingspor.

South Korea, driven by rapid advancements in electronics manufacturing and increasing demand for high-performance circuit designs, is expected to record the highest CAGR of 9.9% during the forecast period.

PCB layout and schematic capture solutions, and cloud-based PCB design software are among the most widely used in the industry.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Deployment, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Deployment, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: Latin America Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Deployment, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 13: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Europe Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 15: Europe Market Value (US$ Million) Forecast by Deployment, 2018 to 2033

Table 16: Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 17: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: South Asia Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 19: South Asia Market Value (US$ Million) Forecast by Deployment, 2018 to 2033

Table 20: South Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 21: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: East Asia Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 23: East Asia Market Value (US$ Million) Forecast by Deployment, 2018 to 2033

Table 24: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 25: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Oceania Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 27: Oceania Market Value (US$ Million) Forecast by Deployment, 2018 to 2033

Table 28: Oceania Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 29: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 30: MEA Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 31: MEA Market Value (US$ Million) Forecast by Deployment, 2018 to 2033

Table 32: MEA Market Value (US$ Million) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Component, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Deployment, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Deployment, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Deployment, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Deployment, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 17: Global Market Attractiveness by Component, 2023 to 2033

Figure 18: Global Market Attractiveness by Deployment, 2023 to 2033

Figure 19: Global Market Attractiveness by Application, 2023 to 2033

Figure 20: Global Market Attractiveness by Region, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Component, 2023 to 2033

Figure 22: North America Market Value (US$ Million) by Deployment, 2023 to 2033

Figure 23: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 24: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 28: North America Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 29: North America Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 30: North America Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Deployment, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Deployment, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Deployment, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 37: North America Market Attractiveness by Component, 2023 to 2033

Figure 38: North America Market Attractiveness by Deployment, 2023 to 2033

Figure 39: North America Market Attractiveness by Application, 2023 to 2033

Figure 40: North America Market Attractiveness by Country, 2023 to 2033

Figure 41: Latin America Market Value (US$ Million) by Component, 2023 to 2033

Figure 42: Latin America Market Value (US$ Million) by Deployment, 2023 to 2033

Figure 43: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 45: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 49: Latin America Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 50: Latin America Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) Analysis by Deployment, 2018 to 2033

Figure 52: Latin America Market Value Share (%) and BPS Analysis by Deployment, 2023 to 2033

Figure 53: Latin America Market Y-o-Y Growth (%) Projections by Deployment, 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 57: Latin America Market Attractiveness by Component, 2023 to 2033

Figure 58: Latin America Market Attractiveness by Deployment, 2023 to 2033

Figure 59: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 60: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 61: Europe Market Value (US$ Million) by Component, 2023 to 2033

Figure 62: Europe Market Value (US$ Million) by Deployment, 2023 to 2033

Figure 63: Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 64: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 65: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 66: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 67: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 68: Europe Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 69: Europe Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 70: Europe Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 71: Europe Market Value (US$ Million) Analysis by Deployment, 2018 to 2033

Figure 72: Europe Market Value Share (%) and BPS Analysis by Deployment, 2023 to 2033

Figure 73: Europe Market Y-o-Y Growth (%) Projections by Deployment, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 75: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 76: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 77: Europe Market Attractiveness by Component, 2023 to 2033

Figure 78: Europe Market Attractiveness by Deployment, 2023 to 2033

Figure 79: Europe Market Attractiveness by Application, 2023 to 2033

Figure 80: Europe Market Attractiveness by Country, 2023 to 2033

Figure 81: South Asia Market Value (US$ Million) by Component, 2023 to 2033

Figure 82: South Asia Market Value (US$ Million) by Deployment, 2023 to 2033

Figure 83: South Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 84: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 85: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 86: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 87: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 88: South Asia Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 89: South Asia Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 90: South Asia Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 91: South Asia Market Value (US$ Million) Analysis by Deployment, 2018 to 2033

Figure 92: South Asia Market Value Share (%) and BPS Analysis by Deployment, 2023 to 2033

Figure 93: South Asia Market Y-o-Y Growth (%) Projections by Deployment, 2023 to 2033

Figure 94: South Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 95: South Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 96: South Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 97: South Asia Market Attractiveness by Component, 2023 to 2033

Figure 98: South Asia Market Attractiveness by Deployment, 2023 to 2033

Figure 99: South Asia Market Attractiveness by Application, 2023 to 2033

Figure 100: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 101: East Asia Market Value (US$ Million) by Component, 2023 to 2033

Figure 102: East Asia Market Value (US$ Million) by Deployment, 2023 to 2033

Figure 103: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 104: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 105: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 106: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 107: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 108: East Asia Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 109: East Asia Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 110: East Asia Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) Analysis by Deployment, 2018 to 2033

Figure 112: East Asia Market Value Share (%) and BPS Analysis by Deployment, 2023 to 2033

Figure 113: East Asia Market Y-o-Y Growth (%) Projections by Deployment, 2023 to 2033

Figure 114: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 115: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 116: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 117: East Asia Market Attractiveness by Component, 2023 to 2033

Figure 118: East Asia Market Attractiveness by Deployment, 2023 to 2033

Figure 119: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 120: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 121: Oceania Market Value (US$ Million) by Component, 2023 to 2033

Figure 122: Oceania Market Value (US$ Million) by Deployment, 2023 to 2033

Figure 123: Oceania Market Value (US$ Million) by Application, 2023 to 2033

Figure 124: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 127: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 128: Oceania Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 129: Oceania Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 130: Oceania Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 131: Oceania Market Value (US$ Million) Analysis by Deployment, 2018 to 2033

Figure 132: Oceania Market Value Share (%) and BPS Analysis by Deployment, 2023 to 2033

Figure 133: Oceania Market Y-o-Y Growth (%) Projections by Deployment, 2023 to 2033

Figure 134: Oceania Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 135: Oceania Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 136: Oceania Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 137: Oceania Market Attractiveness by Component, 2023 to 2033

Figure 138: Oceania Market Attractiveness by Deployment, 2023 to 2033

Figure 139: Oceania Market Attractiveness by Application, 2023 to 2033

Figure 140: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 141: MEA Market Value (US$ Million) by Component, 2023 to 2033

Figure 142: MEA Market Value (US$ Million) by Deployment, 2023 to 2033

Figure 143: MEA Market Value (US$ Million) by Application, 2023 to 2033

Figure 144: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 145: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 146: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 147: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 148: MEA Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 149: MEA Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 150: MEA Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 151: MEA Market Value (US$ Million) Analysis by Deployment, 2018 to 2033

Figure 152: MEA Market Value Share (%) and BPS Analysis by Deployment, 2023 to 2033

Figure 153: MEA Market Y-o-Y Growth (%) Projections by Deployment, 2023 to 2033

Figure 154: MEA Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 155: MEA Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 156: MEA Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 157: MEA Market Attractiveness by Component, 2023 to 2033

Figure 158: MEA Market Attractiveness by Deployment, 2023 to 2033

Figure 159: MEA Market Attractiveness by Application, 2023 to 2033

Figure 160: MEA Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

PCB Design Software Industry Analysis in Europe Size and Share Forecast Outlook 2025 to 2035

PCB Inspection Microscope Market Size and Share Forecast Outlook 2025 to 2035

PCB Vision Inspection Equipment for SMT Market Size and Share Forecast Outlook 2025 to 2035

PCB Connector Market Size and Share Forecast Outlook 2025 to 2035

Multi-Axis PCB Drilling Machine Market Size and Share Forecast Outlook 2025 to 2035

Rigid-Flex PCB Market Size and Share Forecast Outlook 2025 to 2035

Substrate-like PCB Market Size and Share Forecast Outlook 2025 to 2035

Printed Circuit Board (PCB) Assembly Market Size and Share Forecast Outlook 2025 to 2035

Printed Circuit Boards (PCB) Market Trends - Demand & Forecast 2025 to 2035

Industrial Water Chiller for PCB Market Size and Share Forecast Outlook 2025 to 2035

Designer Sneaker Market Forecast Outlook 2025 to 2035

Design Collaboration Software Market Size and Share Forecast Outlook 2025 to 2035

Drug Designing Tools Market Growth – Trends & Forecast 2025 to 2035

Product Design Verification And Validation Solution Market Size and Share Forecast Outlook 2025 to 2035

Warehouse Design and Layout Market Size and Share Forecast Outlook 2025 to 2035

Packaging Design And Simulation Technology Market Size and Share Forecast Outlook 2025 to 2035

Reference Designs Market Growth - Trends & Forecast 2025 to 2035

Industry Share & Competitive Positioning in Packaging Design And Simulation Technology

AI-powered Design Tools Market Insights - Growth & Forecast 2025 to 2035

Electronic Design Automation (EDA) Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA