The designer sneaker market is experiencing strong growth driven by the rising influence of fashion-forward consumers, expanding luxury streetwear culture, and increasing collaborations between premium brands and designers. Demand has been further supported by the integration of comfort, performance, and aesthetic appeal in modern sneaker designs. Current trends indicate that brand value, exclusivity, and sustainability considerations are increasingly influencing purchase decisions.

The market is witnessing steady expansion across both online and offline retail channels, supported by global digital marketing campaigns and growing consumer disposable income. Future growth is expected to be driven by product innovation, use of eco-friendly materials, and customization options tailored to individual preferences.

Manufacturers are focusing on balancing craftsmanship with advanced manufacturing technologies to enhance durability and comfort The growth rationale remains centered on evolving consumer lifestyles, the blending of athletic and luxury fashion segments, and the ability of brands to leverage design differentiation to strengthen their market positioning and profitability.

| Metric | Value |

|---|---|

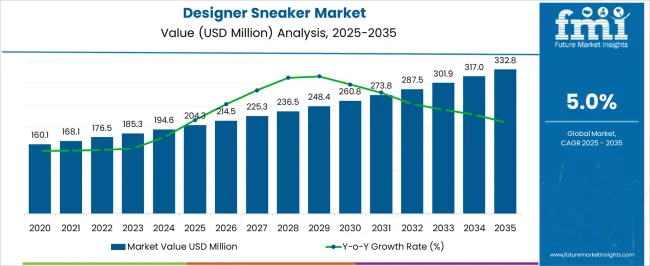

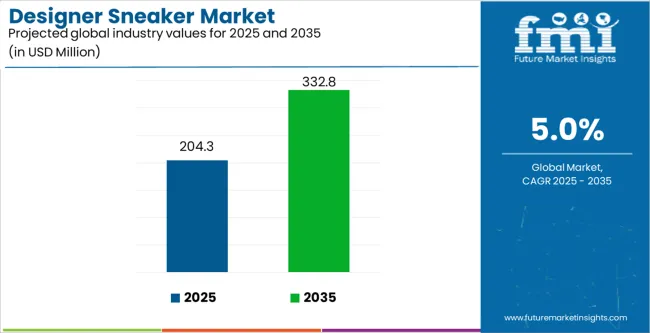

| Designer Sneaker Market Estimated Value in (2025 E) | USD 204.3 million |

| Designer Sneaker Market Forecast Value in (2035 F) | USD 332.8 million |

| Forecast CAGR (2025 to 2035) | 5.0% |

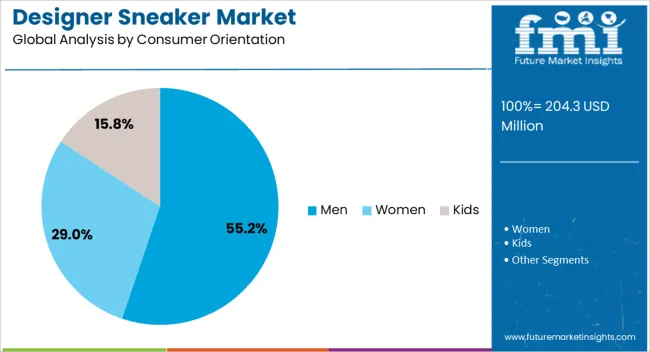

The market is segmented by Product Type, Material Type, Consumer Orientation, and Sales Channel and region. By Product Type, the market is divided into Casual Sneaker and Formal Sneaker. In terms of Material Type, the market is classified into Leather, Synthetic, Rubber, and Foam. Based on Consumer Orientation, the market is segmented into Men, Women, and Kids. By Sales Channel, the market is divided into Online Retailers, Offline, and Other Sales Channel. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

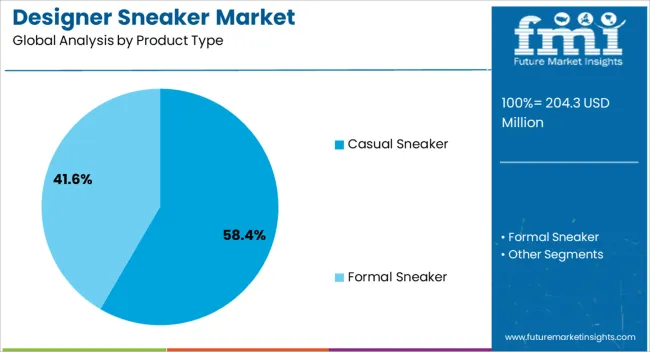

The casual sneaker segment, accounting for 58.40% of the product type category, has maintained dominance due to its versatility, comfort, and alignment with evolving fashion trends. Its prominence has been reinforced by increasing consumer preference for footwear that combines functionality with a premium aesthetic.

Growth in casual and semi-formal fashion has made designer casual sneakers a staple in both everyday and luxury wardrobes. Manufacturers are emphasizing lightweight designs, innovative cushioning systems, and refined silhouettes to cater to diverse consumer segments.

The popularity of celebrity endorsements and limited-edition releases has further strengthened brand loyalty and consumer engagement With the growing acceptance of casual wear across formal and professional settings, the segment is expected to maintain its leadership position and contribute significantly to overall market expansion.

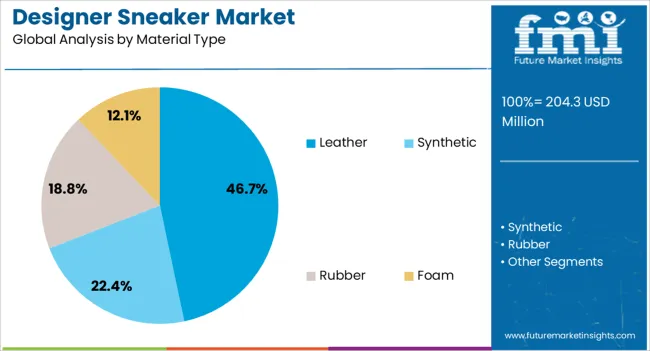

The leather segment, representing 46.70% of the material type category, continues to lead the market due to its association with premium quality, durability, and timeless design appeal. Consumer preference for authentic and long-lasting materials has reinforced demand for leather-based designer sneakers.

Advancements in sustainable leather processing and eco-friendly tanning methods are further enhancing the segment’s acceptance among environmentally conscious buyers. Luxury brands are integrating high-grade leather with innovative finishes and hybrid materials to improve comfort, aesthetics, and functionality.

The material’s adaptability to different design concepts and its perceived premium value have ensured its continued dominance Expanding global demand for luxury footwear, particularly in urban and high-income markets, is expected to sustain the growth trajectory of leather-based designer sneakers in the coming years.

The men segment, holding 55.20% of the consumer orientation category, has remained the leading contributor due to strong purchasing power and brand affinity among male consumers for luxury and limited-edition sneakers. The segment’s dominance is supported by the expansion of men’s fashion collections, increased social media influence, and growing participation in sneaker culture and resale markets.

Leading brands are introducing exclusive men’s collections that combine performance-oriented features with sophisticated design aesthetics. Online retail and global sneaker events are playing a vital role in strengthening male consumer engagement.

Rising interest in fashion-conscious dressing among younger demographics is further driving demand Continuous product diversification, coupled with collaborations targeting male consumers, is expected to sustain the segment’s share and reinforce its pivotal role in the overall designer sneaker market.

| Attributes | Details |

|---|---|

| Market Value for 2020 | USD 162.4 million |

| Market Value for 2025 | USD 188.8 million |

| Market CAGR from 2020 to 2025 | 3.8% |

The segmented market analysis of designer sneakers is included in the following subsection. Based on comprehensive studies, the online sector is leading the sales channel category, and the casual sneaker segment is commanding the product type category.

| Sales Channel | Online |

|---|---|

| Market Share | 33.6% |

| Product Type | Casual Sneaker |

|---|---|

| Market Share | 64.3% |

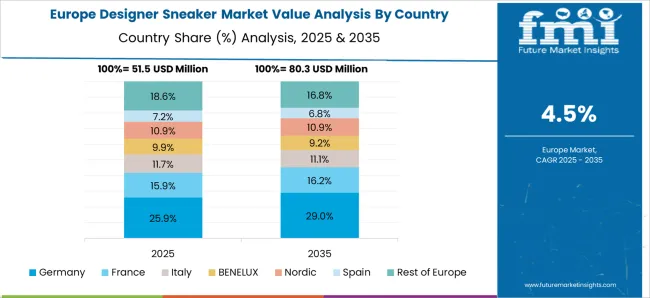

The designer sneaker market can be observed in the subsequent tables, which focus on the leading regions in North America, Europe, and Asia Pacific. A comprehensive evaluation demonstrates that Asia Pacific has enormous opportunities.

North America Market Outlook

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 3.9% |

| Canada | 4.7% |

Europe Market Outlook

| Countries | CAGR (2025 to 2035) |

|---|---|

| Germany | 4.1% |

| United Kingdom | 4.3% |

| France | 4.5% |

| Italy | 4.4% |

| Spain | 4.2% |

Asia Pacific Market Outlook

| Countries | CAGR (2025 to 2035) |

|---|---|

| India | 9.1% |

| China | 7.7% |

| Japan | 5.7% |

| Australia | 7.1% |

| Singapore | 6.2% |

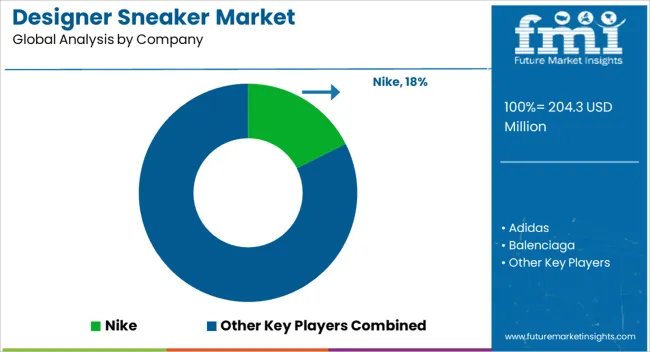

Producers of designer sneakers compete for market share and recognition in an ever-changing industry through strategic alliances, branding, and innovation. Prominent designer sneaker providers with decades of experience, like Nike, Adidas, and Puma, are in the vanguard and set trends and win over customers.

Alongside them, up-and-coming designer sneaker vendors like Balenciaga, Gucci, and Yeezy challenge the established order with their styles and high-end appeal, drawing in a specialized but wealthy customer base.

Designer sneaker brands compete more fiercely with artists, fashion designers, and celebrities because they want to use their partners' influence to reach new customers and produce collections that generate talk. Online stores such as StockX and GOAT give independent and established designers a place to display their work, which promotes a value and exclusivity culture.

The competitive landscape is shaped by innovations in materials, technology, and sustainability programs as designer sneaker firms strive to set themselves apart with innovative designs and eco-friendly practices. Agility and originality are still crucial for firms looking to stay ahead in this intensely competitive market as the designer sneaker market changes.

Notable Strides

| Company | Details |

|---|---|

| Adidas AG | The popular shoe collection with the Gazelle silhouette was scheduled to launch in July 2025 by Guccio Gucci S.p.A. and Adidas AG. |

| NIKE, Inc. | In January 2025, NIKE, Inc. acquired Converse, Inc. under a legally binding deal. Around USD 305 million was the total value provided for all of the equity shares at the time of deal close, considering the assumption of certain working capital adjustments. |

| Chloe SAS | Chloe SAS introduced the Nama Sneaker in December 2024. The new sneaker exemplifies the company's commitment to reduce its environmental impact with recycled materials and other low-impact components accounting for 40% of the shoe's weight. |

| ASICS | In a virtual reality showroom, ASICS unveiled three pairs of sports shoes in March 2024, among them the ASICS Metaracer, the company's first running shoe made entirely of carbon plates. Improved stability, a new mesh top to keep the feet cool, and a redesigned toe-spring shape to lessen strain are all features of this distance running shoe. |

| Adidas AG | In cooperation with Team Vitality, Adidas AG released a limited-edition pair of sneakers in November 2020, dubbed the VIT.01 shoe. With this launch, Adidas aimed to solidify its standing as a cutting-edge and inventive sports brand. |

The global designer sneaker market is estimated to be valued at USD 204.3 million in 2025.

The market size for the designer sneaker market is projected to reach USD 332.8 million by 2035.

The designer sneaker market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in designer sneaker market are casual sneaker and formal sneaker.

In terms of material type, leather segment to command 46.7% share in the designer sneaker market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Second Hand Designer Shoes Market Trends – Growth & Forecast to 2035

Sneakers Market Analysis - Growth & Demand Forecast 2025 to 2035

Sneaker Boots Market Insights - Size & Forecast 2025 to 2035

Women Sneakers Market Growth - Demand & Trends 2025 to 2035

White Sneakers Market Insights - Size & Forecast 2025 to 2035

Men’s Sneakers Market Growth – Trends & Forecast 2022-2032

Chunky Sneaker Market Size and Share Forecast Outlook 2025 to 2035

Leather Sneakers Market Growth - Trends & Forecast 2025 to 2035

Lifestyle Sneakers Industry Analysis in United Kingdom Growth, Trends and Forecast from 2025 to 2035

Waterproof Sneakers Market Analysis - Growth & Forecast 2025 to 2035

Refurbished Sneaker Market Trends - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA