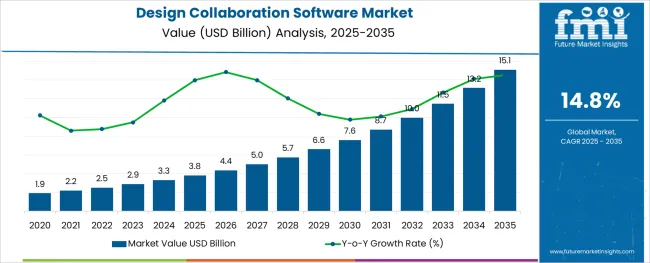

The Design Collaboration Software Market is estimated to be valued at USD 3.8 billion in 2025 and is projected to reach USD 15.1 billion by 2035, registering a compound annual growth rate (CAGR) of 14.8% over the forecast period.

The alginic acid market is undergoing consistent growth, propelled by rising demand from food processing, pharmaceutical formulations, and cosmetic applications. A growing focus on natural and sustainable ingredients in manufacturing processes has positioned alginic acid as a preferred biopolymer across industries.

The market is further supported by its diverse functional benefits, including water retention, gelling, and stabilizing properties, which make it indispensable in high-performance formulations. Increased regulatory acceptance of alginates as safe additives and the push towards cleaner labeling in food and personal care products have reinforced their adoption.

Ongoing innovation in extraction technologies and the utilization of algae as a renewable resource are paving the way for cost-effective production and expanded applications, ensuring sustained market expansion in the coming years.

The market is segmented by Solution and Industry and region. By Solution, the market is divided into On-Premise Design Collaboration Software and Cloud Based Design Collaboration Software. In terms of Industry, the market is classified into Services, Distribution Services, Public Sector, Finance, Manufacturing and Resources, and Infrastructure. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The market is segmented by Solution and Industry and region. By Solution, the market is divided into On-Premise Design Collaboration Software and Cloud Based Design Collaboration Software. In terms of Industry, the market is classified into Services, Distribution Services, Public Sector, Finance, Manufacturing and Resources, and Infrastructure. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by salts, sodium alginate is expected to command 27.5% of the market revenue in 2025, marking it as the leading subsegment in this category. This leadership has been driven by its superior solubility, ease of incorporation into formulations, and versatility in a wide range of applications.

Its ability to form stable gels and maintain viscosity under varying conditions has made it highly sought after in both food and pharmaceutical sectors. Manufacturers have prioritized sodium alginate due to its consistent performance, cost-effectiveness, and regulatory acceptance, which have collectively strengthened its position.

The segment’s prominence has also been enhanced by its adaptability to evolving consumer preferences for plant-derived and sustainable ingredients, reinforcing its market share.

Segmented by end user industry, the food industry is projected to hold 33.0% of the market revenue in 2025, positioning it as the most prominent sector. This dominance has been shaped by the industry’s increasing reliance on alginic acid and its derivatives to deliver desirable textures, stabilize emulsions, and improve shelf life of processed foods.

As consumer demand for clean label and natural additives has intensified, the food sector has responded by integrating alginates into bakery, dairy, and confectionery products. Enhanced production efficiency and compliance with food safety standards have further encouraged widespread use.

The segment’s leadership has also been supported by product differentiation strategies where alginates contribute to premium quality and innovation, securing their role in modern food formulations.

The global design collaboration software market was thriving at a CAGR of 12.8% between 2020 and 2024. The comparatively lower CAGR was attributed to the transition from the normal working type to the work-from-home module.

This took the end user’s resources to adopt the new remote technology to get the tasks completed. Though once bending in the system, the design collaboration software market is now likely to thrive at a higher CAGR of 14.8%. The growth is attributed to the higher automation and the requirement of collaborative team tasks while finalizing the product design.

Drivers:

The rising demand for multi-layered communication tools that help companies of different sizes with the collaboration of specific departments helps the design collaboration software market to gain traction. Furthermore, completely transitioning to the hybrid work culture demands a platform that helps them work collaboratively while not damaging the work fabric that already exists. The vendors now try to make their platform best to solve all levels of issues faced by the people working in the corporate structure. This pushes the demand for design collaborative software.

Quality and supply chain nodes of any company demand design collaboration software to make sure the operations don’t miss any loophole while designing the product. This improves the supply chain, product planning, and forecast. Vendors making these platforms keep a track of different operations to ensure the functionality of different funnels is another fruitful property that helps the end user gain higher performability.

The corporate requirements regarding communication, brainstorming, and file-sharing are also included in the design collaboration software, making it the exclusive choice for small and medium-sized businesses, pushing the demand for design collaboration software. The design collaboration software is incompatible with the steadily expanding firms that work from home to conserve resources because it disseminates knowledge of the key operations that take place within the company's closed triangle.

Restraints:

The major restraints for the market are the normalization of operation post-pandemic along with the increased cost associated with the software’s implementation and the training ahead. The maintenance cost is also high the untrained employees can't coordinate with the software which increases the chances of miscommunication and work damage.

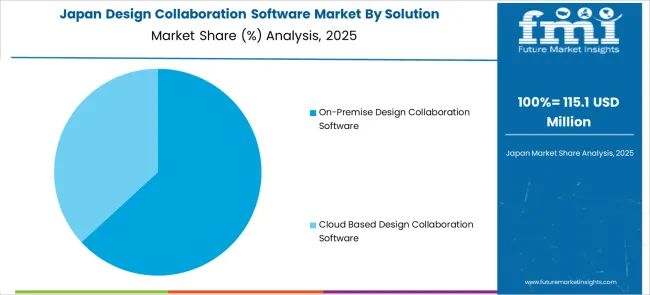

The solution category is divided into two segments, on-premise design collaboration software, and cloud-based design collaboration software where the on-premise design collaboration platform holds the major share of 74.3% in the global market.

The growth of this segment is attributed to the higher trust in data security and transparency in the on-premise deployment while the cloud-based deployment segment grows at a higher CAGR of 15.3% during the forecast period while it holds a share of 25.7%. The lesser market size is due to the complex installation and costly cloud storage for the running memory.

The services industry tops the design collaboration software market with an approximate market hold of 26.4% while it thrives on a CAGR of 9.7% during the forecast period. The factor contributing to its higher demand is higher consumption along with the utilization of big teams in the different divided departments. Thus, the requirement of a sophisticated platform has occurred to team-up employees for greater performance.

The public sector segment thrives at the highest CAGR of 15.4 (2025 to 2035) due to its expansions in different parts of the world. The advanced system going through an upgrading demand the upskilling training that is provided by the design collaboration software. The manufacturing and resources segment also thrives at a good CAGR of 13.1% between 2025 and 2035 while it holds a market share of 12.1% in the global market.

Expanding corporate structure along with the upgrades in the existing systems have pushed companies to adopt these design collaboration software.

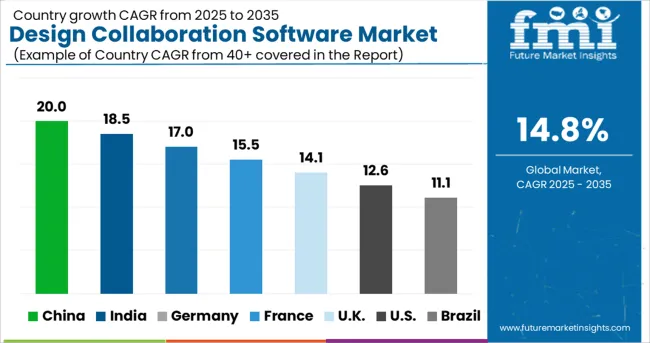

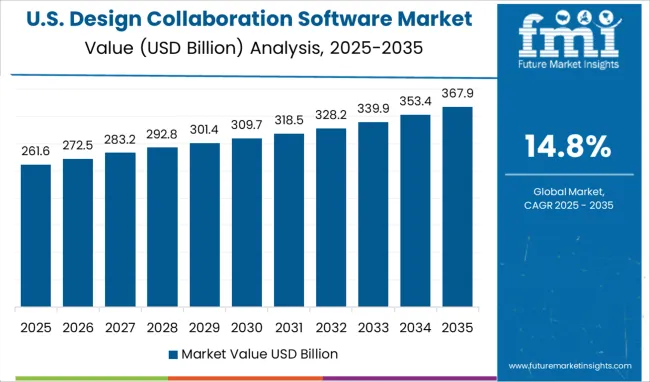

United States holds a market share of approximately 22.8% while it flourishes on a CAGR of 9.8%. The USA is the hub of technology and the home for major companies that have gone through the transition period during the pandemic. Furthermore, the advanced hybrid work culture has pushed the brands to be flexible around product management and design planning.

Thus, the installation of design collaboration software has streamlined different layers of the corporate structure to work in collaboration. Proving it to be the best option out there that optimizes different operations while managing people to put their input in the workings.

Higher research and development programs along with new startups adopting the latest technology to enhance performance are fueling the growth of the market in Germany.

Germany adopts design collaboration software at the fastest rate of 15.1% while it holds a market share of 13.2%. This is due to the proliferation of automated systems and the complete adoption of a hybrid working style. Thus, the requirement for a platform that streamlines the operations, tasks, and employees altogether is important. Germany has several financial and manufacturing key players that consume the most from the design collaboration software market.

The integrated corporate structure along with the requirement of an easy work-flow management system fuels the demand for design collaboration market in India and China

India and China both had their IT sector booming for the last decade. Therefore, the demand for all the additional software has been higher in the region. With Industry 4.0 penetrating the industries with its components, the collaborative approach has become important for all the ends of a corporate organization. While India thrives at a CAGR of 13.4% and holds a share of 11.4% in the global market, China lags with a CAGR of 8.8% and a market share of 10.8%.

The presence of major manufacturing industries along with the higher automation in them has made Japan the second fastest-growing region in the global market system.

Japan has been at the pinnacle of technological transformation for years. The pandemic gave it another chance for shifting to a more advanced and hybrid work atmosphere. Adding components to the hybrid working style, design collaboration software makes sure that the product goes through the stages of ideation to disposal at a significant rate while everyone contributes their important bits in this process. Japan thrives at a strong CAGR of 13.6% (2025 to 2035) while holding a market share of 9.1%.

The competitors try to design this software after monitoring the problem faced by different individuals in the team. Effective communication along with the highlight tracing tools help the end user company navigate through the software according to their need. The key players adopt the strategy of acquisition, merger, and other expansionist tricks to strengthen their supply chain.

Recent Market Developments

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Market Analysis | million for Value and Units for Volume |

| Key Regions Covered | North America; Latin America; Europe; Asia Pacific; Oceania; and Middle East and Africa(MEA) |

| Key Countries Covered | USA, Canada, Mexico, Germany, United Kingdom, France, Italy, Spain, China, Japan, India, South Korea, Australia, Brazil, Argentina, South Africa, and United Arab Emirates(UAE) |

| Key Segments Covered | Solution Type, Industry Type, and Region |

| Key Companies Profiled | Adobe; Asana, Inc.; Avaya Inc.; AT&T, Inc.; Blackboard, Inc.; Cisco Systems, Inc.; Citrix Systems, Inc.; Google LLC; IBM Corporation; Microsoft; OpenText Corporation; Oracle; Slack Technologies, LLC; Zoom Video Communications, Inc |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, Drivers, Restraints, Opportunities and Threats Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global design collaboration software market is estimated to be valued at USD 3.8 billion in 2025.

It is projected to reach USD 15.1 billion by 2035.

The market is expected to grow at a 14.8% CAGR between 2025 and 2035.

The key product types are on-premise design collaboration software and cloud based design collaboration software.

services segment is expected to dominate with a 39.7% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Designer Sneaker Market Forecast Outlook 2025 to 2035

PCB Design Software Industry Analysis in Europe Size and Share Forecast Outlook 2025 to 2035

PCB Design Software Market Analysis by Component, Deployment, Application, and Region Through 2035

Drug Designing Tools Market Growth – Trends & Forecast 2025 to 2035

Product Design Verification And Validation Solution Market Size and Share Forecast Outlook 2025 to 2035

Warehouse Design and Layout Market Size and Share Forecast Outlook 2025 to 2035

Packaging Design And Simulation Technology Market Size and Share Forecast Outlook 2025 to 2035

Reference Designs Market Growth - Trends & Forecast 2025 to 2035

Industry Share & Competitive Positioning in Packaging Design And Simulation Technology

AI-powered Design Tools Market Insights - Growth & Forecast 2025 to 2035

Electronic Design Automation (EDA) Market

Second Hand Designer Shoes Market Trends – Growth & Forecast to 2035

SRAM and ROM Design IP Market Report - Growth & Industry Analysis 2025 to 2035

AI & AR-Powered Construction Design Apps for Seamless Planning

Construction Design Software Market Size and Share Forecast Outlook 2025 to 2035

Computer-aided Design (CAD) Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

AI In Packaging Design Market Size and Share Forecast Outlook 2025 to 2035

Cloud Electronic Design Automation (EDA) Market by Product Type by Vertical & Region Forecast till 2035

Civil Construction Design And Detailing Engineering Market Size and Share Forecast Outlook 2025 to 2035

Advanced Mobile UX Design Services Market Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA