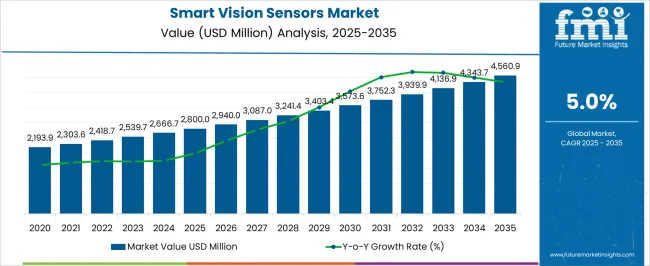

The global smart vision sensors market is projected to be valued at USD 2.80 billion in 2025 and is forecast to reach USD 4.57 billion by 2035. This represents an absolute increase of USD 1.77 billion, equivalent to 63.2% growth over the forecast period. The market is expected to expand at a compound annual growth rate (CAGR) of 5.0%, with the overall market size anticipated to grow by approximately 1.63X by the end of the decade.

The market is growing as industries increasingly adopt automation, robotics, and AI-driven quality control systems to improve operational efficiency. Unlike traditional sensors, smart vision sensors integrate image capture, processing, and analytics in a single unit, reducing complexity and cost. Rising demand for precision inspection in manufacturing, electronics, automotive, and food & beverage industries is driving adoption. In addition, the expansion of smart factories, coupled with Industry 4.0 initiatives, is pushing companies to deploy vision sensors for real-time monitoring, defect detection, and predictive maintenance. Advances in edge AI, miniaturization, and connectivity are further accelerating market growth globally.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 2.80 billion |

| Industry Size (2035F) | USD 4.57 billion |

| CAGR (2025 to 2035) | 5.0% |

Between 2025 and 2030, the smart vision sensors market is projected to expand from USD 2.80 billion to USD 3.55 billion, contributing an incremental revenue of USD 746.4 million during this period. This phase is expected to be driven by increasing adoption of automated inspection systems across manufacturing sectors and growing demand for quality control solutions in electronics and automotive applications. The integration of artificial intelligence capabilities into vision sensors is enhancing defect detection accuracy and enabling more sophisticated inspection tasks.

From 2030 to 2035, the market is expected to grow from USD 3.55 billion to USD 4.57 billion, adding another USD 1.02 billion in value. This growth phase will be characterized by the widespread deployment of Industry 4.0 technologies and smart factory implementations. Advanced connectivity options including Ethernet/IP and IO-Link interfaces will facilitate seamless integration with industrial automation systems, while compact form factors will continue to gain traction in space-constrained manufacturing environments.

Between 2020 and 2025, the smart vision sensors market expanded from USD 2.28 billion to USD 2.80 billion, recording a cumulative growth of 22.6% over the five-year period. This growth was supported by rapid automation adoption across manufacturing industries and the increasing need for quality assurance in production processes. The COVID-19 pandemic accelerated digital transformation initiatives, leading to greater emphasis on contactless inspection solutions and automated quality control systems.

The smart vision sensors market is experiencing robust growth driven by the accelerating pace of industrial automation and the increasing need for precision quality control in manufacturing processes. Traditional manual inspection methods are being replaced by automated vision systems that offer consistent accuracy, faster processing speeds, and reduced labor costs. This shift is particularly pronounced in industries such as automotive, electronics, and food packaging where quality standards are stringent and production volumes are high.

The integration of artificial intelligence and machine learning capabilities into vision sensors is creating new opportunities for advanced defect detection and pattern recognition applications. These intelligent systems can identify complex defects and anomalies that would be difficult or impossible to detect through conventional inspection methods. The ability to learn and adapt to new inspection criteria makes AI-powered vision sensors particularly valuable in dynamic manufacturing environments.

Industry 4.0 initiatives are further driving demand for smart vision sensors as manufacturers seek to create connected and intelligent production systems. These sensors provide real-time data that can be integrated with manufacturing execution systems and enterprise resource planning platforms, enabling predictive maintenance, process optimization, and comprehensive quality management.

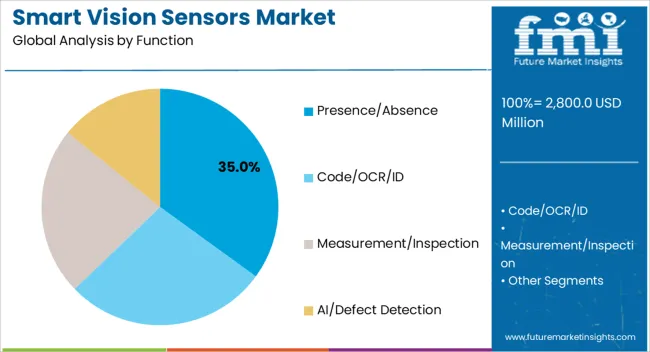

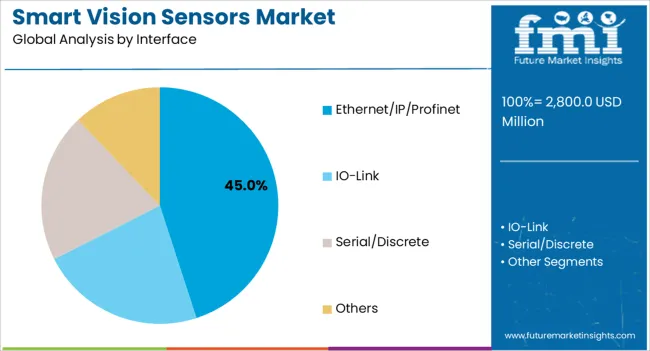

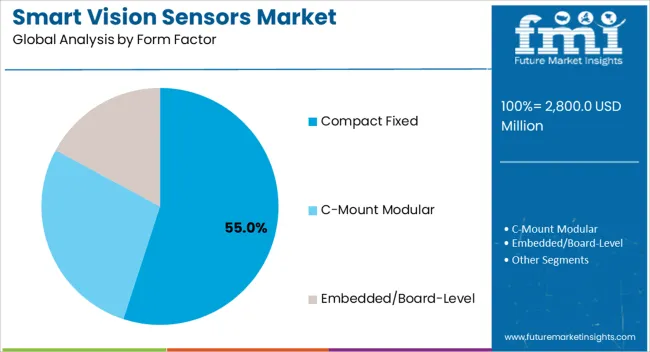

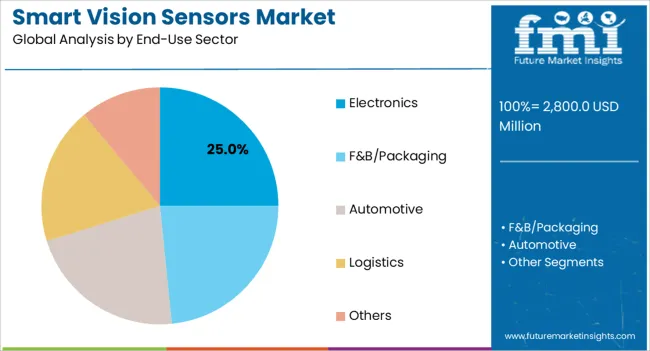

The market is segmented by function, interface, form factor, end-use sector, and region. By function, the market is divided into presence/absence detection, code/OCR/ID reading, measurement/inspection, and AI/defect detection capabilities. Based on interface, the market is categorized into Ethernet/IP/Profinet, IO-Link, serial/discrete, and other connectivity options. In terms of form factor, the market is segmented into compact fixed, C-mount modular, and embedded/board-level configurations. By end-use sector, the market is classified into automotive, electronics, food and beverage/packaging, logistics, and other industrial applications. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

Presence/absence detection functions are projected to account for 35% of the smart vision sensors market in 2025. This dominance reflects the fundamental requirement across manufacturing applications to verify component placement, assembly completion, and product positioning. These sensors provide reliable binary output for go/no-go decisions in high-speed production environments. The automotive industry extensively uses presence/absence detection for verifying component installation in assembly lines, while electronics manufacturers rely on these functions for printed circuit board inspection and component verification.

Ethernet/IP and Profinet interfaces are projected to represent 45% of the smart vision sensors market in 2025, reflecting the preference for high-speed industrial networking protocols. These interfaces enable seamless integration with programmable logic controllers and distributed control systems, supporting real-time data exchange and remote configuration capabilities. The automotive and electronics industries favor these connectivity options for their reliability and data throughput capabilities in demanding manufacturing environments.

Compact fixed form factors are anticipated to account for 55% of the smart vision sensors market in 2025, driven by space constraints in modern manufacturing equipment and the need for cost-effective inspection solutions. These integrated units combine optics, processing, and connectivity in a single housing, simplifying installation and reducing system complexity. The electronics manufacturing sector particularly favors compact fixed sensors for inline inspection applications where multiple sensors are deployed in confined spaces.

The electronics sector is expected to represent 25% of the smart vision sensors market in 2025, driven by the increasing complexity of electronic components and the need for precision assembly verification. Printed circuit board inspection, semiconductor packaging, and mobile device manufacturing are key application areas. The sector's demand for miniaturized components and high-density assemblies creates requirements for high-resolution inspection capabilities that smart vision sensors can effectively address.

The smart vision sensors market is being shaped by several key technological and industry trends that are driving adoption across multiple sectors. The integration of artificial intelligence and edge computing capabilities is enabling more sophisticated inspection tasks while reducing system complexity and response times. Manufacturers are developing sensors with enhanced processing power to handle complex algorithms locally rather than relying on external processing units.

The incorporation of AI algorithms directly into vision sensors is revolutionizing defect detection and quality assessment capabilities. These intelligent systems can learn from inspection data to improve accuracy over time and adapt to new defect types without extensive reprogramming. Machine learning models enable subjective quality assessments that were previously possible only through human inspection, such as evaluating surface finish quality or identifying cosmetic defects in consumer products.

The adoption of standardized communication protocols is simplifying the integration of smart vision sensors into existing automation systems. Ethernet-based protocols provide high-speed data transfer capabilities while enabling remote configuration and diagnostic functions. IO-Link standardization is reducing installation complexity and enabling plug-and-play functionality for distributed inspection applications.

Ongoing miniaturization efforts are enabling the deployment of smart vision sensors in space-constrained applications where traditional vision systems would not fit. Compact form factors maintain inspection performance while reducing system footprint and installation requirements. This trend is particularly important in electronics manufacturing where production equipment must maximize throughput within limited floor space.

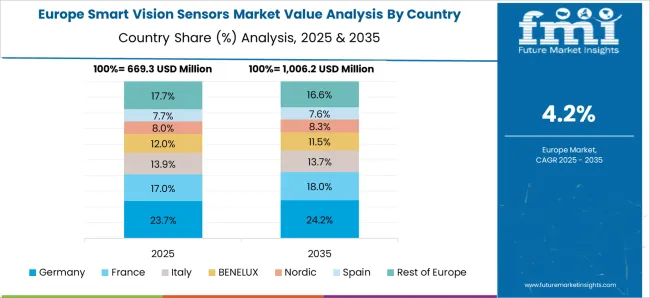

| Country | CAGR |

| China | 6.2 |

| India | 5.8 |

| France | 4.8 |

| USA | 4.6 |

| Germany | 4.4 |

Demand for smart vision sensors in China represents the fastest-growing market for smart vision sensors with a projected CAGR of 6.2% through 2035. The country's massive manufacturing base and ongoing automation initiatives are driving strong demand for automated inspection solutions across multiple industries. Government policies supporting Industry 4.0 implementation and smart manufacturing are accelerating the adoption of advanced vision sensor technologies. The electronics and automotive manufacturing sectors are leading the deployment of smart vision sensors for quality control and process automation applications.

Revenue from smart vision sensors in India is projected to grow at a CAGR of 5.8% through 2035, driven by the expanding manufacturing sector and government initiatives promoting industrial automation. The Make in India program and Production Linked Incentive schemes are encouraging manufacturers to adopt advanced inspection technologies to improve quality and competitiveness. Electronics manufacturing and automotive assembly operations are primary drivers of vision sensor adoption, with pharmaceutical and food processing industries also contributing to market growth.

Sales of smart vision sensors in France are expected to grow at a CAGR of 4.8% through 2035, supported by the country's advanced manufacturing capabilities and focus on high-value production. The automotive and aerospace industries are major consumers of smart vision sensors for critical component inspection and quality assurance. French manufacturers are adopting AI-enhanced vision systems to maintain competitive advantages in precision manufacturing applications, while the food and beverage sector is implementing advanced packaging inspection solutions.

The United States smart vision sensors market is projected to expand at a CAGR of 4.6% through 2035, driven by ongoing manufacturing automation initiatives and the adoption of Industry 4.0 technologies. The automotive industry is a major consumer, implementing vision sensors for quality control in electric vehicle production and traditional automotive manufacturing. Electronics and semiconductor manufacturing sectors are deploying advanced vision systems for precision inspection of increasingly complex components and assemblies.

Demand for smart vision sensors in Germany is anticipated to grow at a CAGR of 4.4% through 2035, supported by the country's strong industrial base and leadership in manufacturing technology. The automotive industry remains a primary driver, with vision sensors deployed throughout production lines for component verification and quality control. German manufacturers are integrating AI-enhanced vision systems into their operations to maintain global competitiveness and meet stringent quality standards.

The smart vision sensors market features intense competition among established industrial automation companies and specialized vision technology providers. Market leaders are focusing on enhancing AI capabilities, expanding connectivity options, and developing more compact form factors to address evolving customer requirements. Innovation in edge computing and machine learning algorithms is enabling more sophisticated inspection capabilities while reducing system complexity.

Key market participants are investing in research and development to maintain technological leadership and expand their product portfolios. Strategic partnerships between sensor manufacturers and automation system integrators are facilitating market expansion and enabling comprehensive solution offerings. The competitive landscape is characterized by continuous technological advancement and the development of industry-specific solutions tailored to unique inspection requirements.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 2.80 billion |

| Function | Presence/Absence, Code/OCR/ID, Measurement/Inspection, AI/Defect Detection |

| Interface | Ethernet/IP/Profinet, IO-Link, Serial/Discrete, Others |

| Form Factor | Compact Fixed, C-Mount Modular, Embedded/Board-Level |

| End-Use Sector | Automotive, Electronics, F&B/Packaging, Logistics, Others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia AND 40+ countries |

| Key Companies Profiled | Cognex, KEYENCE, OMRON, Basler AG, Banner Engineering, SICK AG, Datalogic, Teledyne DALSA, Pepperl+Fuchs, ifm electronic |

| Additional Attributes | Dollar sales by sensor type and resolution, regional adoption trends, OEM competition, buyer preference for AI-enabled automation, integration with Industry 4.0, innovations in edge processing, and sustainable manufacturing applications |

The global smart vision sensors market is estimated to be valued at USD 2,800.0 million in 2025.

The market size for the smart vision sensors market is projected to reach USD 4,560.9 million by 2035.

The smart vision sensors market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in smart vision sensors market are presence/absence, code/ocr/id, measurement/inspection and ai/defect detection.

In terms of interface, ethernet/ip/profinet segment to command 45.0% share in the smart vision sensors market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Smart Digital Valve Positioner Market Forecast and Outlook 2025 to 2035

Smart Card IC Market Size and Share Forecast Outlook 2025 to 2035

Smart-Tag Inlay Inserters Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Smart Wheelchair Market Forecast and Outlook 2025 to 2035

Smart TV Market Forecast and Outlook 2025 to 2035

Smart/AI Toy Market Size and Share Forecast Outlook 2025 to 2035

Smart Locks Market Size and Share Forecast Outlook 2025 to 2035

Smart Sprinkler Controller Market Size and Share Forecast Outlook 2025 to 2035

Smart Indoor Gardening System Market Size and Share Forecast Outlook 2025 to 2035

Smart Building Delivery Robot Market Size and Share Forecast Outlook 2025 to 2035

Smart Watch Market Size and Share Forecast Outlook 2025 to 2035

Smart Label Market Size and Share Forecast Outlook 2025 to 2035

Smart Mat Market Size and Share Forecast Outlook 2025 to 2035

Smart Water Management Market Size and Share Forecast Outlook 2025 to 2035

Smart Built-In Kitchen Appliance Market Size and Share Forecast Outlook 2025 to 2035

Smart Cold Therapy Machine Market Size and Share Forecast Outlook 2025 to 2035

Smart Personal Assistance Devices Market Size and Share Forecast Outlook 2025 to 2035

Smart Speaker Market Size and Share Forecast Outlook 2025 to 2035

Smart Vehicle Architecture Market Size and Share Forecast Outlook 2025 to 2035

Smart City Platforms Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA