Graphics Processing Unit Market (GPU) are essential components for rendering graphics, expressing hosted computing workloads, and enabling AI-driven applications in a range of industries including gaming, data centres, automotive and healthcare.

As Cloud Computing, Cryptocurrency Mining, and Real Time Ray Traversing Technology are rising, also, the rise in demand for AI-centric workloads in enterprise use-cases and increased demand for high-end immersive compute experiences is lifting the demand for such GPUs.

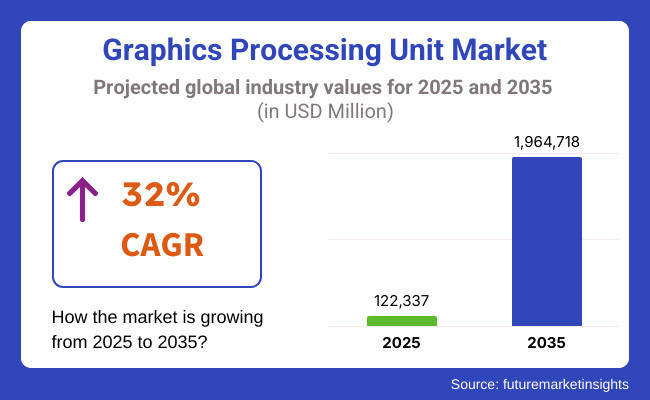

The market is projected to attain a CAGR of 32%, exceeding USD 1,964,718 million by 2035, compared to USD 122,337 million in 2025. The rising implementation of GPUs in autonomous vehicles, metaverse applications, and high-performance computing (HPC) is likely to drive long-term market growth.

North America has a broad chunk of the GPU market, given its large demand from gaming, AI research, and cloud computing. The US is one of its key markets, and the top semiconductor companies are focused on leading the way in GPU innovation. The increasing investment in AI-driven enterprise solutions and advancements in gaming hardware are also driving the growth of the market.

A Rampant European Market well supported by investments in AI development, supercomputing infrastructure and the gaming ecosystem. The growth of automotive applications, artificial intelligence (AI) research, and high-performance computing is driving the demand for GPUs in countries like Germany, the UK, and France, further bolstering market growth.

Asia-Pacific is likely to be the fastest-growing market because of the booming in gaming community, increasing semiconductor production, and growing investments in artificial intelligence (AI) and cloud computing, in particular. Then there are markets like China, Japan and Korea that are important, with government initiatives that exist that really support GPU innovations in AI, autonomous driving and 5G infrastructure. One key factor contributing to the growth of the market is the booming esports landscape in the region as well as the demand for performance-driven gaming hardware.

Challenges

Supply Chain Constraints, High Manufacturing Costs, and Power Consumption Issues

In the GPU market, an ongoing shortage of semiconductor ends, supply chain disruptions, and geopolitical tension continue to impact the production and distribution of chips. R&D and fabrication are both very costly for advanced GPUs especially with next-gen AI acceleration and ray tracing support, which can contribute to increasing consumer prices.

Furthermore, with sustainability issues in GPU workloads coming from data centres, gaming rigs, and AI-driven applications, efficiency with regards to power necessity and cooling solutions needed to achieve performance must be carefully balanced to avoid excessive energy costs.

Opportunities

Growth in AI Workloads, Cloud Gaming, and Edge Computing

Nevertheless, several other environmental forces are creating unique obstacles, nevertheless, despite these challenges, the GPU market is still enjoying phenomenal growth as demand for AI-driven computing, cloud gaming, and high-performance data processing explodes.

Demand for dedicated AI GPUs and tensor cores is driven by AI and deep learning applications, while cloud-based GPU services are democratizing high-end computing for enterprises and individual users. The advent of edge computing and autonomous systems is driving use cases to leverage GPUs for self-driving cars, robotics and IoT applications in real time. Moreover, new growth rungs with next-gen quantum computing, and GPU-accelerated scientific research.

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with export restrictions and semiconductor trade policies. |

| Consumer Trends | Growth in gaming, cryptocurrency mining, and video rendering GPUs. |

| Industry Adoption | Dominated by gaming and workstation graphics cards. |

| Supply Chain and Sourcing | Dependence on Taiwan, South Korea, and China for chip production. |

| Market Competition | Dominated by NVIDIA, AMD, and Intel. |

| Market Growth Drivers | Demand for ray-tracing GPUs, high-refresh-rate gaming, and real-time rendering. |

| Sustainability and Environmental Impact | Growing concerns over GPU power consumption and carbon footprint. |

| Integration of Smart Technologies | Adoption of DLSS, AI upscaling, and real-time ray tracing. |

| Advancements in GPU Technology | Development of dedicated AI tensor cores and gaming-optimized GPU architectures. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter AI-driven computing regulations, cybersecurity standards, and sustainability mandates. |

| Consumer Trends | Expansion in AI-optimized GPUs, cloud-based rendering, and autonomous system processing. |

| Industry Adoption | Widespread adoption in AI inference, quantum computing, and AI-powered robotics. |

| Supply Chain and Sourcing | Diversification into USA, Europe, and India for semiconductor manufacturing resilience. |

| Market Competition | Entry of AI-accelerator start-ups, quantum computing firms, and cloud-based GPU service providers. |

| Market Growth Drivers | Accelerated by AI-driven computing, metaverse expansion, and decentralized GPU cloud services. |

| Sustainability and Environmental Impact | Large-scale adoption of energy-efficient AI processors, liquid cooling solutions, and optimized GPU architectures. |

| Integration of Smart Technologies | Expansion into self-learning AI chips, 3D holographic rendering, and quantum-enhanced GPU computing. |

| Advancements in GPU Technology | Evolution toward neuromorphic computing GPUs, multi-core AI accelerators, and block chain-powered distributed rendering. |

Strong demand for AI computing, new data centre expansions, and an influx of investment in the gaming industry led the new shipments of GPUs to the USA to grow. Clusters of transistors fabricated together on a semiconductor substrate The gov't is encouraging regulatory initiatives like the CHIPS Act to bolster domestic semiconductor manufacturing and reduce dependency on overseas manufacturing.

Technology innovation is being compelled by AI start up, cloud also, GPU providers approach are the one that can craw some files from the cloud on using world. Apart from that, the increasing usage of GPUs for automotive AI, healthcare imaging and cybersecurity applications is also propelling the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 32.5% |

The growth of UK GPU market can be attributed to increasing investment for AI research, high-performance computing (HPC), and fintech applications demanding advanced GPUs. Cloud gaming platforms and growth in eSports is creating demand for real-time ray-tracing GPUs. Moreover, the nation's push towards AI governance and ethical computing results in energy-efficient and privacy-enhanced GPU solutions that contribute to data analytics and cybersecurity.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 31.8% |

Sustainability initiatives, semiconductor funding programs, and AI-driven computing projects are shaping Europe’s GPU market. The European Chips Act aims to encourage the setup of local semiconductor fabrication plants to cut reliance on Asian suppliers. Germany, France and the Netherlands invests in quantum computing, AI-accelerated research as well as supercomputing facilities which leads to a demand for high-performance GPUs Moreover, the EU's determination towards green computing is driving the uptake of energy-efficient GPU architectures.

| Country | CAGR (2025 to 2035) |

|---|---|

| EU | 32.0% |

High AI adoption rates in robotics, healthcare imaging, and semiconductor research drive Japanese GPU market expansion demand for next-generation GPUs capable of real-time rendering is driven by the nation’s high-end gaming industry and animation sector.

Furthermore, AI-optimized GPUs for edge computing and IoT applications have new opportunities from AI-powered industrial automation and smart city development. Japan’s revitalization effort in semiconductors is helping it gain a foothold in the GPU market as well.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 32.1% |

South Korea is quickly becoming a world-leading producer of GPUs in the wake of massive investments in both gaming, as well as AI and semiconductor fabrication. For instance, firms like Samsung and SK Hynix are focusing on high-bandwidth memory (HBM) technologies to enhance GPU performance. High-demand GPUs are accelerated by the rapid expansion of 5G, metaverse applications, and cloud computing platforms.Also,South Korea’s quantum computing/AI-complemented autonomous systems are propelling adoption of AI-powered GPUs in scientific research and defense application.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 32.3% |

As consumers, businesses, and enterprises increasingly demand advanced computing capabilities for gaming, artificial intelligence (AI), and digital content creation, the dedicated and integrated GPU segments will continue to dominate the graphics processing unit (GPU) market. Such segments are really important to computational performance, energy efficiency and visual rendering of various computing applications state-of-the-art.

Dedicated GPUs Lead Market Demand as Performance-Centric Computing Gains Traction

Dedicated graphics processing units (GPUs) have become a key driver in the GPU industry across gaming, professional visualization, and AI-based workloads. Unlike integrated GPUs, which use the same system RAM, dedicated GPUs have their own memory, allowing them to achieve higher speeds and enabling excellent thermal performance, making them perfect for tasks that need a lot of graphical processing.

The surging adoption of high-end gaming with technologies like ray tracing and real-time AI rendering, combined with ultra-high refresh rates, has driven wider acceptance in the market. According to research and studies, dedicated Graphics Processing Units (GPUs) provide immersive, high-quality visuals and graphics levels which accounts for over 60% of high performance gaming PCs and workstations.

The growing prevalence of AI-based computing, equipped with dedicated graphics processing units (GPU), to accommodate machine learning, deep learning, and big data analytic requirements, in a way promotes market growth, ensuring the speed of computation, as well as its multithreading capabilities.

The diagnostic and smart GPU optimization technologies, including AI-enhanced performance tuning for various workloads, real-time temperature monitoring, automated overclocking algorithms, have improved adoption by providing significant efficiency and enhanced performance in high-performance computing applications.

The announcement of next-generation dedicated GPUs with reduced nanometer architecture, higher memory bandwidth, and increased energy efficiency have maximized market growth with better compatibility for potentially relevant computing trends.

Despite being superior in graphics performance, AI acceleration, and final computing power, the dedicated GPU segment has struggled with high power consumption, increased manufacturing costs, and limited availability caused by semiconductor shortages. Nevertheless, the need for high-performance dedicated GPUs for AI workloads continues to grow, with innovations in AI-driven chip design, advanced cooling solutions, and energy-efficient GPU architectures making scalability better than ever.

Integrated GPUs have achieved robust market penetration, especially across laptops, tablets, and low-end computers where energy-efficient and cost-effective graphics solutions are preferred by manufacturers. The GPUs that come with the system are not powerhouses, compared to dedicated GPUs, and share the processing units and memory with the CPU, making them low power and amenable to thin and light designs.

These market choices been stimulated by the growing need for portable computing, characterized by ultra-books,pill and thin-client programs driven by built-in GPU energy. According to studies, more than 55% of consumer user laptops and tablets come complete with on-board graphics solutions for daily computing requirements.

With the rising popularity of cloud-based gaming (with integrated GPU acceleration for low-latency game streaming and remote rendering), the growth of the market has helped to broaden the base of access for casual gamers and content creators.The support for AI-based integrated GPU features such as super sampling, real-time frame rate smoothening and software level rendering workarounds continued over these years to increase adoption even among casual gamers, while keeping the graphics performance level high without any dedicated chip helper.

Trends in SoC architecture development for improved power economy and computational performance characteristics; AI-enhanced integrated GPUs, high-bandwidth memory configurations, 5nm process technology are creating ideal conditions for the next generation of SoC architectures that can capitalize on these growth opportunities.

Integrated GPUs offer benefits in terms of energy efficiency, affordability, and design at the same time as they face hurdles like limited graphics for high-end applications, dependence on CPU power and limited upgradeability. But the integrated graphics GPU space is broadening thanks to innovations to integrated GPU architectures, AI-based performance upscaling of features, and much better driver optimization.

Advancements in GPU technology are continuing to drive productivity, gaming and multimedia on portable, as well as high-performance computer application segments are major factors contributing to growth in the market.

Computers Lead Market Demand as GPU-Accelerated Processing Becomes Essential

Computing, however, has already become the biggest consumer of GPUs, as companies, gamers and creative people demand graphics solutions for 3D modelling, video editing and AI computing. But while tablets prioritize a thin profile and a long battery life, desktops and laptops have the cooling solutions, upgradeability, and a compatibility with a high-performance graphics processing unit (GPU) for computing power.

Among them are the explosive growth of gaming and e-sports, which have a strong demand for high-refresh-rate displays, VR-compatible products, and real-time ray tracing, which has promoted market adoption. More than half of all gaming pcs use regular GPUs instead of integrated ones, giving those better frame rates and more immersive visual fidelity, according to studies.

Furthermore, professional content creation is on the rise, including GPU-accelerated rendering for video production, 3D modelling, and architectural visualization, bolstering market growth and improved high-speed performance and the ability to preview in real time.

The convergence of AI-driven computing, including GPU-accelerated deep learning training, real-time data analytics, and edge AI processing, has encouraged even greater adoption, providing more robust computational power in AI workflows.

While this brings advantages in terms of gaming performance, professional rendering, and AI acceleration, the computer segment is subject to high GPU cost structure, power usage, and advanced cooling solutions. But energy-efficient GPU architecture innovations, AI-based load balancing, and cutting-edge thermal management are helping get around these performance scalability limits, and that should mean even larger market sizes for GPU-aided computers going into the foreseeable future.

Tablets have seen solid uptake, especially among digital artists, mobile gamers and remote workers as manufacturers follow suit with high-performance GPUs for a portable package. Tablets are more interactive than traditional computers, with touchscreen interaction designs that enable on-the-go usability and compact devices made for low-intensity computing processes.

The increasing popularity of mobile gaming, along with features such as high-refresh-rate tablet displays, real-time GPU optimization, and cloud-based gaming services have led to market adoption. More than 45% of high-end tablets feature discrete or advanced inputs, which greatly help in carrying out great better gaming sessions.

With GPU-accelerated stylus precision, real-time drawing feedback, and AI-driven brush rendering, the expansion of digital content creation has spawned growth of the market, providing enhanced performance for professional illustrators and designers.

The combination of AI-driven video graphic optimization, which encompasses GPU-accelerated face detection, augmented reality (AR) features, and real-time video processing, has additionally facilitated greater adoption as these same functionalities in tablets translate to better multimedia performance.

Next-generation tablet GPUs with optimized ray tracing which enables advanced effects like accurate reflections machine-learning-based image processing and low-power high-performance graphics cores have therefore optimized market growth ensuring better performance and efficiency in portable computing devices.

Here, the tablet segment has evident disadvantages in thermal design power, battery life, and upgradability, as well as its inherent limitations as a computer, whether because of its use of a touchscreen interface, mobile application ecosystem, or GPU-accelerated application architecture. Advancements in energy-efficient GPU architectures, artificial intelligence-based rendering methods and sophisticated cooling mechanisms, nevertheless, are maximizing performance, securing further growth for GPUs-equipped tablets.

Increasing demand for high performance computing (HPC), the rise of artificial intelligence and deep learning applications, and the expansion of cloud gaming and virtual reality (VR) are some key factors driving the graphics processing unit (GPU) market. Trends in the industry include new AI-powered GPU optimization, energy-efficient architectures, and real-time ray tracing technology. Industry leaders are pivoting towards improving next-generation GPU designs, providing AI-augmented computing capabilities, and adapting to cloud-based ecosystem. Leading contributors are comprised by semiconductor producers, gaming hardware developers, and AI computing companies developing high-performance GPUs for gaming, data centres, and AI workloads.

Market Share Analysis by Key Players & GPU Manufacturers

| Company Name | Estimated Market Share (%) |

|---|---|

| NVIDIA Corporation | 45-50% |

| Advanced Micro Devices, Inc. (AMD) | 20-25% |

| Intel Corporation | 12-16% |

| Qualcomm Technologies, Inc. | 6-10% |

| Imagination Technologies Group | 3-7% |

| Other GPU Providers (combined) | 10-15% |

| Company Name | Key Offerings/Activities |

|---|---|

| NVIDIA Corporation | Develops AI-optimized GPUs for gaming, data centres, deep learning, and real-time ray tracing with DLSS and CUDA acceleration. |

| Advanced Micro Devices, Inc. (AMD) | Specializes in high-performance Radeon GPUs, AI-driven RDNA architectures, and cloud gaming solutions. |

| Intel Corporation | Provides integrated and discrete GPUs with AI-assisted rendering, power-efficient architectures, and cloud-based computing acceleration. |

| Qualcomm Technologies, Inc. | Focuses on mobile and embedded GPU solutions, AI-powered graphics processing, and energy-efficient rendering for smartphones and XR devices. |

| Imagination Technologies Group | Offers PowerVR GPUs with AI-driven performance optimization for mobile devices, automotive applications, and IoT. |

Key Market Insights

NVIDIA Corporation (45-50%)

In addition, NVIDIA is a powerhouse in the GPU market with GREEN acquisition-enhanced real-time ray tracing, cloud AI, gaming solutions, and high-performance computing solutions for autonomous systems.

Advanced Micro Devices, Inc. (AMD) (20-25%)

AMD focuses on cutting-edge Radeon GPUs featuring intelligent RDNA architecture as well as cutting-edge gaming, data centre and professional visualization solutions.

Intel Corporation (12-16%)

Intel emphasizes its Xe architecture, providing AI-optimized integrated and discrete GPU solutions that facilitate high-efficiency rendering, cloud gaming, and AI acceleration.

Qualcomm Technologies, Inc. (6-10%)

Qualcomm is heavily involved in supplying technology in the mobile space and embedded GPU solutions end of the market as well as deploying AI-enabled Adreno GPUs in mobile (phones), XR, and low-power computing.

Imagination Technologies Group (3-7%)

Summary: Imagination Technologies offers PowerVR GPUs optimized for AI-powered mobile graphics, automotive screens and efficient embedded systems.

Other Key Players (10-15% Combined)

AI-enhanced graphics rendering, and cloud-based GPU acceleration are all propelled ahead through the contributions of various semiconductor manufacturers, AI compute firms, and gaming technology hardware providers. Key contributors include:

The overall market size for the graphics processing unit market was USD 122,337 Million in 2025.

The graphics processing unit market is expected to reach USD 1,964,718 Million in 2035.

The demand for graphics processing units is expected to rise due to the increasing adoption of AI-driven computing, gaming, and high-performance data processing. The expansion of cloud computing, cryptocurrency mining, and advancements in real-time rendering technologies are further fueling market growth. Additionally, the rise of autonomous vehicles and AI-powered applications is driving significant innovation in GPU architectures.

The top 5 countries driving the development of the graphics processing unit market are the USA, China, Taiwan, South Korea, and Germany.

Dedicated and Integrated GPUs are expected to command a significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Volume (Units) Forecast by Region, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 4: Global Market Volume (Units) Forecast by Type, 2019 to 2034

Table 5: Global Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 6: Global Market Volume (Units) Forecast by Application, 2019 to 2034

Table 7: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 8: North America Market Volume (Units) Forecast by Country, 2019 to 2034

Table 9: North America Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 10: North America Market Volume (Units) Forecast by Type, 2019 to 2034

Table 11: North America Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 12: North America Market Volume (Units) Forecast by Application, 2019 to 2034

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 14: Latin America Market Volume (Units) Forecast by Country, 2019 to 2034

Table 15: Latin America Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 16: Latin America Market Volume (Units) Forecast by Type, 2019 to 2034

Table 17: Latin America Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 18: Latin America Market Volume (Units) Forecast by Application, 2019 to 2034

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 20: Western Europe Market Volume (Units) Forecast by Country, 2019 to 2034

Table 21: Western Europe Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 22: Western Europe Market Volume (Units) Forecast by Type, 2019 to 2034

Table 23: Western Europe Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 24: Western Europe Market Volume (Units) Forecast by Application, 2019 to 2034

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 26: Eastern Europe Market Volume (Units) Forecast by Country, 2019 to 2034

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 28: Eastern Europe Market Volume (Units) Forecast by Type, 2019 to 2034

Table 29: Eastern Europe Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 30: Eastern Europe Market Volume (Units) Forecast by Application, 2019 to 2034

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 32: South Asia and Pacific Market Volume (Units) Forecast by Country, 2019 to 2034

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 34: South Asia and Pacific Market Volume (Units) Forecast by Type, 2019 to 2034

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 36: South Asia and Pacific Market Volume (Units) Forecast by Application, 2019 to 2034

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 38: East Asia Market Volume (Units) Forecast by Country, 2019 to 2034

Table 39: East Asia Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 40: East Asia Market Volume (Units) Forecast by Type, 2019 to 2034

Table 41: East Asia Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 42: East Asia Market Volume (Units) Forecast by Application, 2019 to 2034

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 44: Middle East and Africa Market Volume (Units) Forecast by Country, 2019 to 2034

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 46: Middle East and Africa Market Volume (Units) Forecast by Type, 2019 to 2034

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 48: Middle East and Africa Market Volume (Units) Forecast by Application, 2019 to 2034

Figure 1: Global Market Value (US$ Million) by Type, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by Application, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 5: Global Market Volume (Units) Analysis by Region, 2019 to 2034

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 8: Global Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 9: Global Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 10: Global Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 11: Global Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 12: Global Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 13: Global Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 14: Global Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 15: Global Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 16: Global Market Attractiveness by Type, 2024 to 2034

Figure 17: Global Market Attractiveness by Application, 2024 to 2034

Figure 18: Global Market Attractiveness by Region, 2024 to 2034

Figure 19: North America Market Value (US$ Million) by Type, 2024 to 2034

Figure 20: North America Market Value (US$ Million) by Application, 2024 to 2034

Figure 21: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 23: North America Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 26: North America Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 27: North America Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 28: North America Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 29: North America Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 30: North America Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 31: North America Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 32: North America Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 33: North America Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 34: North America Market Attractiveness by Type, 2024 to 2034

Figure 35: North America Market Attractiveness by Application, 2024 to 2034

Figure 36: North America Market Attractiveness by Country, 2024 to 2034

Figure 37: Latin America Market Value (US$ Million) by Type, 2024 to 2034

Figure 38: Latin America Market Value (US$ Million) by Application, 2024 to 2034

Figure 39: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 41: Latin America Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 44: Latin America Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 45: Latin America Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 48: Latin America Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 49: Latin America Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 52: Latin America Market Attractiveness by Type, 2024 to 2034

Figure 53: Latin America Market Attractiveness by Application, 2024 to 2034

Figure 54: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 55: Western Europe Market Value (US$ Million) by Type, 2024 to 2034

Figure 56: Western Europe Market Value (US$ Million) by Application, 2024 to 2034

Figure 57: Western Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 59: Western Europe Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 62: Western Europe Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 63: Western Europe Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 66: Western Europe Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 67: Western Europe Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 70: Western Europe Market Attractiveness by Type, 2024 to 2034

Figure 71: Western Europe Market Attractiveness by Application, 2024 to 2034

Figure 72: Western Europe Market Attractiveness by Country, 2024 to 2034

Figure 73: Eastern Europe Market Value (US$ Million) by Type, 2024 to 2034

Figure 74: Eastern Europe Market Value (US$ Million) by Application, 2024 to 2034

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 77: Eastern Europe Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 81: Eastern Europe Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 85: Eastern Europe Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 88: Eastern Europe Market Attractiveness by Type, 2024 to 2034

Figure 89: Eastern Europe Market Attractiveness by Application, 2024 to 2034

Figure 90: Eastern Europe Market Attractiveness by Country, 2024 to 2034

Figure 91: South Asia and Pacific Market Value (US$ Million) by Type, 2024 to 2034

Figure 92: South Asia and Pacific Market Value (US$ Million) by Application, 2024 to 2034

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2024 to 2034

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 95: South Asia and Pacific Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 99: South Asia and Pacific Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 103: South Asia and Pacific Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 106: South Asia and Pacific Market Attractiveness by Type, 2024 to 2034

Figure 107: South Asia and Pacific Market Attractiveness by Application, 2024 to 2034

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2024 to 2034

Figure 109: East Asia Market Value (US$ Million) by Type, 2024 to 2034

Figure 110: East Asia Market Value (US$ Million) by Application, 2024 to 2034

Figure 111: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 113: East Asia Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 116: East Asia Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 117: East Asia Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 120: East Asia Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 121: East Asia Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 122: East Asia Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 124: East Asia Market Attractiveness by Type, 2024 to 2034

Figure 125: East Asia Market Attractiveness by Application, 2024 to 2034

Figure 126: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 127: Middle East and Africa Market Value (US$ Million) by Type, 2024 to 2034

Figure 128: Middle East and Africa Market Value (US$ Million) by Application, 2024 to 2034

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2024 to 2034

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 131: Middle East and Africa Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 135: Middle East and Africa Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 139: Middle East and Africa Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 142: Middle East and Africa Market Attractiveness by Type, 2024 to 2034

Figure 143: Middle East and Africa Market Attractiveness by Application, 2024 to 2034

Figure 144: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Computer Graphics Market Size and Share Forecast Outlook 2025 to 2035

Integrated Graphics Chipset Market Analysis by Device Type, Industry Vertical, and Region – Growth, Trends, and Forecast from 2025 to 2035

Aerosol Printing And Graphics Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Aerosol Printing and Graphics

Bioprocessing Analytics Equipment Market Size and Share Forecast Outlook 2025 to 2035

Bioprocessing Supplies Market Size and Share Forecast Outlook 2025 to 2035

Bioprocessing Systems Market

Nut Processing Machine Market Size and Share Forecast Outlook 2025 to 2035

Tea Processing Machine Market Size and Share Forecast Outlook 2025 to 2035

Egg Processing Machine Market Size and Share Forecast Outlook 2025 to 2035

Tea Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Food Processing Boiler Market Size and Share Forecast Outlook 2025 to 2035

Seed Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Meat Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Sand Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Wine Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Fish Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Rice Processing Machine Market Size and Share Forecast Outlook 2025 to 2035

Food Processing Equipment Market - Size, Share, and Forecast Outlook 2025 to 2035

Food Processing Seals Market Growth & Demand, 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA