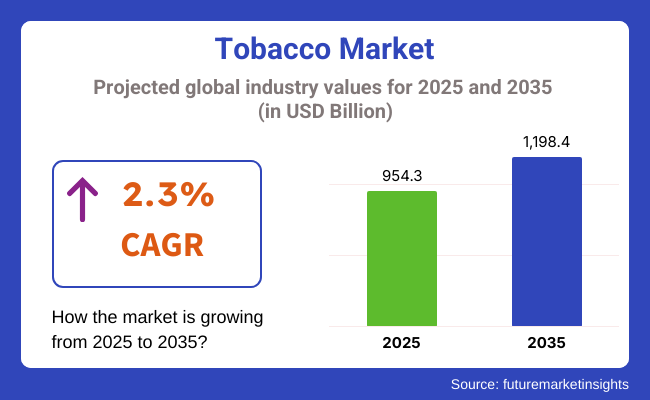

The industry is likely to reach a valuation of USD 954.3 billion in 2025, up from USD 921.4 billion in 2024. The sector will grow moderately but consistently from 2025 to 2035, with a compound annual growth rate (CAGR) of 2.3%, reaching USD 1,198,4 million by 2035. One of the primary growth drivers over this period is the increased adoption of reduced-risk products (RRPs), such as heated variants and nicotine pouches, which are offsetting declines in traditional cigarette sales in established regions.

As cigarette volumes decline due to anti-smoking initiatives and rising excise taxes, the shift toward non-combustible alternatives has gained traction. These emerging categories are especially appealing to younger, health-conscious consumers seeking lower-risk nicotine delivery. Major global players are investing heavily in these segments, leveraging technology and R&D to deliver regulation-compliant innovations.

In Asia, Africa, and Latin America's developing economies, conventional use remains strong, driven by population growth and rising disposable incomes. However, increasing health awareness and emerging regulatory actions are beginning to influence dynamics. These evolving conditions are prompting early-stage shifts to newer oral and hybrid formats, laying the groundwork for future consumer trends in high-growth regions.

Retail channels are also evolving-from brick-and-mortar to direct-to-consumer and e-commerce. Digital platforms are increasingly used to promote RRPs, enabling more targeted engagement and improved compliance tracking. Premiumization is evident across cigars, specialty cigarettes, and electronic nicotine systems as users seek customized, high-end experiences.

While overall volume growth will likely remain subdued, value expansion is supported by diversification, category extensions, and the solid performance of premium and alternative offerings. There will be a focus on sustainability, regulatory readiness, and tech-driven innovation, which will be critical to maintaining resilience amid global tobacco control efforts.

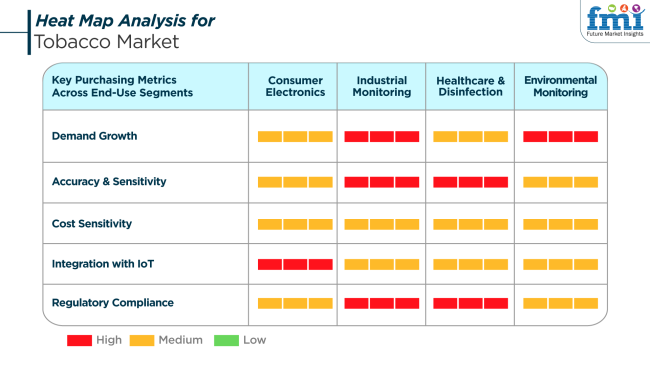

The industry dynamics exhibit similar trends when considering demand differentiation and regulatory intensity. Among end-purchasers, product choices are increasingly being impacted by regulation, flavor inventory, perceived risk, and brand format. Alternatives-like nicotine pouches, e-vapors, and heated products-are becoming popular due to stealthy consumption, simplicity of compliance, and health messaging.

In highly regulated environments like healthcare facilities and public institutions, the shift to smoke-free nicotine products celebrates growing compliance requirements and workplace wellness policies. These trends are shaping procurement behavior in bulk-use or staff-facing applications. Industrial and environmental monitoring stakeholders care about the impact of related policies, especially where workplace safety overlaps with consumption areas.

Consumer price responsiveness in purchasing is extremely variable. Within mass-market segments, price remains a priority, particularly in lower- to middle-income regions. Premium segments within cigars and premium-cut blends, however, remain successful in exclusivity, quality, and heritage branding-ensuring a segmented buying environment based on both price and perceived status.

Despite its long-term size and profitability, the industry faces immense threats that can moderate its long-term stability. At the forefront of these are the rising waves of global tobacco control measures, including excise tax increases, plain packaging regulations, advertising bans, and public consumption bans. These are volume- and margin-squeezing consumption-reducing policies that will persist in compressing volumes and margins, particularly in developed markets.

Changing consumer cohorts also presents a structural risk. Gen Z and subsequent cohorts are much more likely to leave behind old nicotine consumption habits for nicotine-free alternatives or migrate over to regulated non-combustible offerings. Companies are engaging in a strategic reorientation towards harm reduction stories and technology-driven portfolio extensions.

The world of environmental and social governance (ESG) is also changing. Investors and stakeholders increasingly require companies to adopt ethical supply chains, sustainable packaging, and transparent corporate practices. Suppose it does not make this transition against these pressures. In that case, it will face risks of being shut out of the capital markets, criticized by consumers, or having access to less retail distribution in green regulatory regions. A leader's success in navigating these operational and reputational risks will be decided in the next decade.

The industry expanded fairly gradually but consistently between 2020 and 2024. Despite increasing health awareness and compliance challenges, consumption in emerging economies, most notably in Asia and Africa, continued to drive demand for related products. On the other hand, the sector saw the introduction of reduced-risk products (RRPs) such as e-cigarettes and heated options, which captured much attention from consumers as potential alternatives to traditional smoking. Technologies that heat rather than burn, such as Philip Morris' IQOS device, spearheaded the trend.

In the forecast period 2025 to 2035, the landscape is likely to continue changing, with RRPs taking a greater share. With the growth in health consciousness, diversification and sustainability will be the key driving forces that will influence the space. Innovation in products related to e-cigarettes, vaping, and nicotine substitutes will continue to make further inroads as consumer choices trend towards those seen as having less harmful effects than conventional smoking.

Also, the industry will experience more global regulatory scrutiny on product marketing, sales constraints, and the environment related to production. Innovations in the use of products to develop better offerings while conforming to new rules will guide firms.

Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Consumption by emerging markets, growth in RRPs, product diversification. | Growth in demand for RRPs, sustainability, health awareness, and innovation. |

| Conversion to e-cigarettes, heated tobacco, and alternative nicotine. | Increased innovation in RRPs, focusing on leading product technology and manufacturing. |

| Increased regulation, greater health awareness, and advert prohibitions. | Enhanced legislation, increasing public health concerns, and environmental regulation. |

| Shift toward healthier substitutes and lower-risk alternatives. | Emphasis on health, sustainability, and low-harm nicotine products. |

| Traditional players with an emphasis on conventional products, some diversifying into RRPs. | More competition from new RRP firms, diversification, and innovation. |

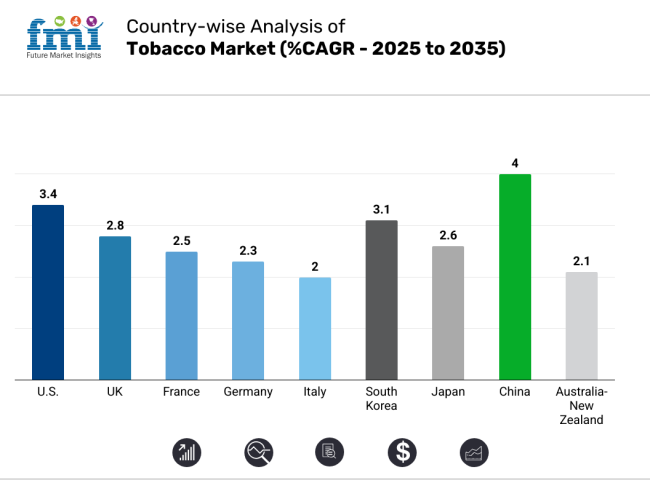

The USA industry is anticipated to increase at 3.4% CAGR throughout the research period. The nation has a mature but strong position globally, underpinned by stable demand for substitute products and a rising inclination toward smokeless forms.

Regulatory trends, including flavor prohibitions and marketing limitations, have stimulated innovation among the leading players, resulting in the growth of product portfolios in e-cigarettes, heated formats, and nicotine pouches. Trends among consumers also show a movement away from traditional smoking towards reduced-risk options, a shift that still drives buying behavior.

Additionally, premiumization of the segment, where customers express a preference for brand and higher-end offerings, has helped sustain revenue generation amidst declines in traditional volume. The growing popularity of newer nicotine delivery systems among younger segments is also altering industry dynamics.

In addition to that, consolidation of participants and technological alignment of distribution channels have enabled effective penetration and consumer interaction. This dynamic transformation in the USA places it on track for modest but consistent growth over the forecast period.

The UK will grow at 2.8% CAGR over the study period. The industry continues to evolve through the faster-than-expected uptake of reduced-risk products. UK regulatory regimes are Europe's most advanced, most notably in the realm of vaping products as an aid for quitting smoking. Such a benign policy environment has spurred investment and innovation, which has fueled the growth of e-cigarettes and vaping products. Sales channels have also evolved to meet this demand by deepening convenience stores and online offerings.

In addition, public health programs and educational campaigns have led to an increasingly educated consumer population tending towards harm-reduction options. Defying declining traditional tobacco sales, the nation's status as a pioneer of regulatory innovation has stabilized industry performance. Ongoing product diversification, fueled by consumer demand for flavored and technology-enabled nicotine products, is likely to sustain consumer engagement and secure sustainability in the long term.

France is anticipated to grow at a rate of 2.5% CAGR throughout the study. Pressure from regulations and an increase in health awareness have contributed to the decreasing traditional cigarette use, but consumption of new-generation products is increasing steadily. The public health authorities have further heightened campaigns against smoking, yet demand for e-cigarettes and nicotine replacement therapy continues to rise.

There is support from well-established retail infrastructure and online retailers, providing access to both traditional and new forms. Government initiatives to regulate tobacco use through taxation and plain packaging legislation have compelled companies to diversify product portfolios and launch less harmful alternatives.

There is an increased consumer awareness and experimentation with reduced-risk products. Withstand regulatory headwinds notwithstanding, the pipeline of innovation in the industry and growing acceptance of non-combustible offerings are expected to drive stable performance over the forecast period.

Germany is forecasted to expand at 2.3% CAGR during the study period. The industry has traditionally been bolstered by the widespread availability of international brands and loyal consumers for roll-your-own tobacco offerings. Yet, trends in consumption are changing as more consumers start using vaping devices and heat-not-burn products.

The regulatory environment has begun to change as governments initiated measures to limit youth access and control advertising, leading companies to modify marketing and distribution strategies. Opportunities for growth exist in the growing popularity of smoke-free products, particularly in urban areas.

Though volumes for cigarettes are slowly decreasing, the value sales are being supported by premium brand pricing power and the development of new formats. Moreover, the widespread retail and logistics network in the country ensures extensive coverage, driving sales penetration. Evolving customer preference toward lifestyle-oriented products and healthy alternatives will fuel innovation, stabilizing the growth path during the next ten years.

Italy is expected to grow at 2.0% CAGR during the study period. A combination of rising health concerns and increasing regulatory restrictions has contributed to a long-term decline in traditional product usage. However, Italy has shown steady growth in the adoption of electronic nicotine delivery systems (ENDS), driven by urban consumers seeking harm-reduction alternatives. The government has imposed high excise duties and graphic warnings to cut down on smoking, and thus, a shift in consumer attitudes.

In addition, local players and multinational brands also keep investing in product innovation to capture emerging demand in areas such as heat-not-burn and flavored vaping. Despite the issues with the regulatory landscape, the shift to modern tobacco products and the digitalization of distribution channels have provided avenues of growth. Demand in the premium and mid-price segments also underpins industry resilience. The industry is set to grow moderately, led by increasing consumer acceptance of alternatives.

South Korea will grow at 3.1% CAGR over the forecast period. The growth rate is high due to a quick shift away from traditional cigarettes towards modern solutions like vaping products. South Korea has become a leading innovation base in the Asia-Pacific, with the adoption of high-tech products fueled by an educated, tech-literate population and an infrastructure-friendly environment. Companies have introduced premium and technologically advanced products that appeal to urban-based consumers who value convenience and discreet consumption.

Regulation and taxation have dampened sales considerably. Greater demand for smokeless products and alternative nicotine products is driving consumer trends, causing established brands to branch out. Additionally, online and convenience stores drive product availability and awareness, and hence sustained demand. South Korea's emergence as an adopter of innovations and its receptiveness to alternative modes of use makes it an important driver in regional expansion.

Japan's industry is likely to expand at 2.6% CAGR throughout the study. The country led the adoption of heated products, primarily as a result of a favorable regulatory environment and high demand from consumers for smoke-free options. Large players in the industry have opted for Japan to trial and introduce their products early, with extensive penetration of next-generation formats. Conventional cigarette volumes remain in recession, but growth within the heat-not-burn space has countered revenue decline within the combustible segment.

Retail innovation and manufacturer-distributor strategic partnerships also have increased consumer interaction and availability. Whereas public health policy is becoming progressively more restrictive, it remains less prohibitive than within other developed nations, providing more scope for product innovation flexibility.

Urban regions have greater adoption levels of premium and flavored offerings, further enhancing the segment's stable outlook. The nation's distinct product preferences and readiness to move towards new technologies underpin long-term growth opportunities.

China will grow at 4.0% CAGR over the study period. Even with decreasing smoking prevalence, the sheer population guarantees continued demand. The development of local brands with competitive pricing and localized attractiveness continues to stimulate volume sales. Over the last few years, China has experienced strong growth in the e-cigarette and vaping category, driven by urban consumer demand and growing awareness of harm-reduction products.

Regulatory reform has also influenced the industry through the introduction of quality standards and e-cigarette licensing. Government-owned players retain strong control, but innovation is flourishing with private-sector involvement and foreign investment. Distribution channels are spreading to online platforms, bringing products closer to a digitally connected consumer base. Modernization and consumer receptiveness to reduced-risk options are anticipated to be major drivers of growth throughout the forecast period.

The Australia-New Zealand region is expected to expand by 2.1% CAGR throughout the study. Both nations have established regulatory environments aimed at reducing tobacco consumption in the form of high excise duties, plain packaging requirements, and prohibitions on advertising. These policies have contributed significantly to the reduction of smoking consumption, especially among the youth.

There is a gradual and constant increase in the consumption of nicotine pouches, e-cigarettes, and heat-not-burn products. While regulatory uncertainty remains to challenge the rate of product innovation, consumer demand for smoke-free alternatives is slowly rising. The focus on public health has not entirely dissuaded industry expansion, as companies have responded by shifting their attention to harm-reduction and wellness-focused marketing strategies.

The function of pharmacies and online platforms is growing, providing discreet access to nicotine delivery systems. Industry resilience is bolstered by the trend of premiumization, wherein customers lean toward technologically superior and high-quality products. The shifting regulatory approach and consumer demands will define the growth of Australia and New Zealand in the forecast period.

In 2025, the industry is projected to see strong competition between various product types, with smokeless tobacco leading with 22.5% of the total share, followed by cigarettes at 21.8%.

The share held by smokeless tobacco is expected to be the largest at 22.5% in 2025. This category covers various products that are consumed without combustion, such as chewable tobacco, snuff or dipping tobacco, and dissolvable tobacco. Increased consumption of smokeless tobacco is further stressed by transforming attitudes among consumers-they have taken a preference toward products that are seen to be less harmful than traditional smoking, especially in the Asia-Pacific region and North America.

Increasing public health awareness concerning the ill effects of cigarette smoking, alongside its convenient use coupled with reduced social stigma, further boosts consumerism. Brands like Grizzly, Skoal, and Marlboro Snus will continue to drive oil demand in smokeless tobacco consumption.

Smokeless type will take the lead, but it will be followed by cigarettes, which will contribute 21.8% to the total. Despite health concerns and government efforts in developing countries to inhibit smoking behaviors, cigarettes have continued to represent a large portion of the industry. Similarly, there is a culture of tobacco reimbursement in consumption in most countries.

For example, countries in the Asia-Pacific region tend to maintain good growth in the demand for cigarettes. An example is China, which consumes a large portion of what the world produces. In addition, there have been and will continue to be demands for the premium segment of cigarettes, as some consumers are willing to spend money to obtain a quality-to-customize experience. The trends indicate reduced-risk products like e-cigarettes and heated tobacco, which are likely to keep growth in the conventional cigarette arena moving forward.

The tobacco market is expected to project a lot of action through various channels in 2025, which should account for Supermarkets & Hypermarkets' major share of 37%. In contrast, Convenience Stores acquired 22.3%.

In 2025, Supermarkets and Hypermarkets are expected to be the key distributing channels for tobacco products, with 37% of the share due to their wide consumer base, which includes large retailers such as Walmart, Tesco, and Carrefour selling tobacco products along with several other everyday products. Consumers can locate tobacco while shopping for groceries or other household products.

Thus, a lot of consumers would prefer this channel. Competitive prices, promotions, and loyalty programs continue to encourage repeat purchases in this channel. With tobacco products already selling from the extended checkout counters of these well-established networks, Supermarkets and Hypermarkets are expected to continue capturing a considerable share of the industry.

Convenience stores, which command 22.3% of the revenue, are yet another important distribution channel. These stores serve the needs of consumers expecting tobacco products to be picked up without delay and with little effort. Their odd hours of operation, preferably located in urban centers, residential areas, and near major highways, make them prime establishments for time-sensitive tobacco consumers.

Well-known chains like 7-Eleven, Circle K, and Casey's General Store are prime sellers of tobacco products, including cigarettes, smokeless tobacco, and e-cigarettes. Their role in convenience and accessibility makes them the trusted go-to option for tobacco consumers who value speed and ease of purchase.

The industry is concentrated among a handful of multinational corporations, each exercising strong brand equity, distribution power, and diversification into reduced-risk products. s regulatory pressures and public health scrutiny intensify, key leaders are aggressively pivoting toward smoke-free alternatives and emerging markets to sustain profitability.

Philip Morris International holds a commanding position globally, driven by its IQOS platform, which has redefined the category of heated products. British American continues to assert a strong cross-segment presence through both combustible and non-combustible portfolios, including Vuse and glo. Altria Group, while heavily USA-centric, has deepened its innovation pipeline via strategic investments in oral nicotine and vapor products, maintaining a solid domestic footprint.

Japan Tobacco International is leveraging its international licensing and M&A strategies, especially in Europe and Southeast Asia. At the same time, KT&G Corp. continues expanding internationally through OEM partnerships and its Lil heat-not-burn devices. China remains the largest player by volume but is largely confined to the domestic Chinese market despite incremental global forays. Meanwhile, the Scandinavian Group leads the cigar and pipe niche, and ITC Ltd. dominates India with its integration into agricultural sourcing and retail networks.

Market Share Analysis by Company

| Company | Estimated Market Share (%) |

|---|---|

| Philip Morris Products S.A. | 22-26% |

| British American Tobacco | 19-23% |

| China Tobacco | 16-20% |

| Japan Tobacco Inc. | 11-14% |

| Altria Group, Inc. | 9-12% |

| Other Players | 10-13% |

Key Company Insights

Philip Morris Products S.A. boasts an estimated share of 22-26% and is currently the leading company that has promoted the use of its IQOS platform in various geographical markets. This company has been declared a transformational leader in the tobacco industry because of its increased commitment to the smoke-free vision and capitalizing on R&D for regulatory engagement.

British American Tobacco commands an industry share of about 19 to 23% due to its extended global reach and wide product differentiation from combustibles to vaporizers and oral nicotine. tsglo and Vuse brands are increasingly popular across Europe, Asia, and America.

China Tobacco possesses an estimated 16-20% of the global pie, with a heavy volume concentrated in China. It lacks a degree of international exposure; however, the sheer scale keeps it as one of the top three worldwide. Japan Tobacco Inc. covers a successful range of 11-14% share, buoyed by even growth in Russia and Southeast Asia and an aggressive acquisition strategy.

Altria Group has only 9-12% of the total share, which is mainly generated from the USA, where the company dominates in leading brands of cigarettes and smokeless products. Its investments in JUUL and Helix Innovations indicate a long-term strategy toward transformation into less harmful products.

The segmentation is into smokeless tobacco, cigarettes, cigars & cigarillos, next-generation products, kretek, and others.

The segmentation is into supermarkets & hypermarkets, convenience stores, tobacco shops, online, and other distribution channels.

The report covers North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and the Middle East and Africa.

The industry is expected to reach USD 954.3 billion in 2025.

The market is projected to grow to USD 1,198.4 billion by 2035.

The market is expected to grow at a CAGR of 2.3% during the forecast period.

Smokeless tobacco is a prominent segment of the tobacco market.

Key players include ITC Ltd., Swedish Match AB, Altria Group, Inc., KT&G Corp., Imperial Brands, Philip Morris Products S.A., British American Tobacco, Japan Tobacco Inc., China Tobacco, and Scandinavian Tobacco Group A/S.

Table 1: Global Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Volume (Tons) Forecast by Region, 2019 to 2034

Table 3: Global Value (US$ Million) Forecast by Product, 2019 to 2034

Table 4: Global Volume (Tons) Forecast by Product, 2019 to 2034

Table 5: Global Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 6: Global Volume (Tons) Forecast by Distribution Channel, 2019 to 2034

Table 7: North America Value (US$ Million) Forecast by Country, 2019 to 2034

Table 8: North America Volume (Tons) Forecast by Country, 2019 to 2034

Table 9: North America Value (US$ Million) Forecast by Product, 2019 to 2034

Table 10: North America Volume (Tons) Forecast by Product, 2019 to 2034

Table 11: North America Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 12: North America Volume (Tons) Forecast by Distribution Channel, 2019 to 2034

Table 13: Latin America Value (US$ Million) Forecast by Country, 2019 to 2034

Table 14: Latin America Volume (Tons) Forecast by Country, 2019 to 2034

Table 15: Latin America Value (US$ Million) Forecast by Product, 2019 to 2034

Table 16: Latin America Volume (Tons) Forecast by Product, 2019 to 2034

Table 17: Latin America Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 18: Latin America Volume (Tons) Forecast by Distribution Channel, 2019 to 2034

Table 19: Western Europe Value (US$ Million) Forecast by Country, 2019 to 2034

Table 20: Western Europe Volume (Tons) Forecast by Country, 2019 to 2034

Table 21: Western Europe Value (US$ Million) Forecast by Product, 2019 to 2034

Table 22: Western Europe Volume (Tons) Forecast by Product, 2019 to 2034

Table 23: Western Europe Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 24: Western Europe Volume (Tons) Forecast by Distribution Channel, 2019 to 2034

Table 25: Eastern Europe Value (US$ Million) Forecast by Country, 2019 to 2034

Table 26: Eastern Europe Volume (Tons) Forecast by Country, 2019 to 2034

Table 27: Eastern Europe Value (US$ Million) Forecast by Product, 2019 to 2034

Table 28: Eastern Europe Volume (Tons) Forecast by Product, 2019 to 2034

Table 29: Eastern Europe Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 30: Eastern Europe Volume (Tons) Forecast by Distribution Channel, 2019 to 2034

Table 31: South Asia and Pacific Value (US$ Million) Forecast by Country, 2019 to 2034

Table 32: South Asia and Pacific Volume (Tons) Forecast by Country, 2019 to 2034

Table 33: South Asia and Pacific Value (US$ Million) Forecast by Product, 2019 to 2034

Table 34: South Asia and Pacific Volume (Tons) Forecast by Product, 2019 to 2034

Table 35: South Asia and Pacific Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 36: South Asia and Pacific Volume (Tons) Forecast by Distribution Channel, 2019 to 2034

Table 37: East Asia Value (US$ Million) Forecast by Country, 2019 to 2034

Table 38: East Asia Volume (Tons) Forecast by Country, 2019 to 2034

Table 39: East Asia Value (US$ Million) Forecast by Product, 2019 to 2034

Table 40: East Asia Volume (Tons) Forecast by Product, 2019 to 2034

Table 41: East Asia Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 42: East Asia Volume (Tons) Forecast by Distribution Channel, 2019 to 2034

Table 43: Middle East and Africa Value (US$ Million) Forecast by Country, 2019 to 2034

Table 44: Middle East and Africa Volume (Tons) Forecast by Country, 2019 to 2034

Table 45: Middle East and Africa Value (US$ Million) Forecast by Product, 2019 to 2034

Table 46: Middle East and Africa Volume (Tons) Forecast by Product, 2019 to 2034

Table 47: Middle East and Africa Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 48: Middle East and Africa Volume (Tons) Forecast by Distribution Channel, 2019 to 2034

Figure 1: Global Value (US$ Million) by Product, 2024 to 2034

Figure 2: Global Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 3: Global Value (US$ Million) by Region, 2024 to 2034

Figure 4: Global Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 5: Global Volume (Tons) Analysis by Region, 2019 to 2034

Figure 6: Global Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 7: Global Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 8: Global Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 9: Global Volume (Tons) Analysis by Product, 2019 to 2034

Figure 10: Global Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 11: Global Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 12: Global Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 13: Global Volume (Tons) Analysis by Distribution Channel, 2019 to 2034

Figure 14: Global Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 15: Global Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 16: Global Attractiveness by Product, 2024 to 2034

Figure 17: Global Attractiveness by Distribution Channel, 2024 to 2034

Figure 18: Global Attractiveness by Region, 2024 to 2034

Figure 19: North America Value (US$ Million) by Product, 2024 to 2034

Figure 20: North America Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 21: North America Value (US$ Million) by Country, 2024 to 2034

Figure 22: North America Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 23: North America Volume (Tons) Analysis by Country, 2019 to 2034

Figure 24: North America Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 25: North America Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 26: North America Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 27: North America Volume (Tons) Analysis by Product, 2019 to 2034

Figure 28: North America Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 29: North America Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 30: North America Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 31: North America Volume (Tons) Analysis by Distribution Channel, 2019 to 2034

Figure 32: North America Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 33: North America Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 34: North America Attractiveness by Product, 2024 to 2034

Figure 35: North America Attractiveness by Distribution Channel, 2024 to 2034

Figure 36: North America Attractiveness by Country, 2024 to 2034

Figure 37: Latin America Value (US$ Million) by Product, 2024 to 2034

Figure 38: Latin America Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 39: Latin America Value (US$ Million) by Country, 2024 to 2034

Figure 40: Latin America Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 41: Latin America Volume (Tons) Analysis by Country, 2019 to 2034

Figure 42: Latin America Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 43: Latin America Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 44: Latin America Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 45: Latin America Volume (Tons) Analysis by Product, 2019 to 2034

Figure 46: Latin America Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 47: Latin America Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 48: Latin America Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 49: Latin America Volume (Tons) Analysis by Distribution Channel, 2019 to 2034

Figure 50: Latin America Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 51: Latin America Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 52: Latin America Attractiveness by Product, 2024 to 2034

Figure 53: Latin America Attractiveness by Distribution Channel, 2024 to 2034

Figure 54: Latin America Attractiveness by Country, 2024 to 2034

Figure 55: Western Europe Value (US$ Million) by Product, 2024 to 2034

Figure 56: Western Europe Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 57: Western Europe Value (US$ Million) by Country, 2024 to 2034

Figure 58: Western Europe Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 59: Western Europe Volume (Tons) Analysis by Country, 2019 to 2034

Figure 60: Western Europe Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 61: Western Europe Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 62: Western Europe Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 63: Western Europe Volume (Tons) Analysis by Product, 2019 to 2034

Figure 64: Western Europe Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 65: Western Europe Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 66: Western Europe Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 67: Western Europe Volume (Tons) Analysis by Distribution Channel, 2019 to 2034

Figure 68: Western Europe Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 69: Western Europe Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 70: Western Europe Attractiveness by Product, 2024 to 2034

Figure 71: Western Europe Attractiveness by Distribution Channel, 2024 to 2034

Figure 72: Western Europe Attractiveness by Country, 2024 to 2034

Figure 73: Eastern Europe Value (US$ Million) by Product, 2024 to 2034

Figure 74: Eastern Europe Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 75: Eastern Europe Value (US$ Million) by Country, 2024 to 2034

Figure 76: Eastern Europe Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 77: Eastern Europe Volume (Tons) Analysis by Country, 2019 to 2034

Figure 78: Eastern Europe Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 79: Eastern Europe Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 80: Eastern Europe Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 81: Eastern Europe Volume (Tons) Analysis by Product, 2019 to 2034

Figure 82: Eastern Europe Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 83: Eastern Europe Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 84: Eastern Europe Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 85: Eastern Europe Volume (Tons) Analysis by Distribution Channel, 2019 to 2034

Figure 86: Eastern Europe Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 87: Eastern Europe Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 88: Eastern Europe Attractiveness by Product, 2024 to 2034

Figure 89: Eastern Europe Attractiveness by Distribution Channel, 2024 to 2034

Figure 90: Eastern Europe Attractiveness by Country, 2024 to 2034

Figure 91: South Asia and Pacific Value (US$ Million) by Product, 2024 to 2034

Figure 92: South Asia and Pacific Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 93: South Asia and Pacific Value (US$ Million) by Country, 2024 to 2034

Figure 94: South Asia and Pacific Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 95: South Asia and Pacific Volume (Tons) Analysis by Country, 2019 to 2034

Figure 96: South Asia and Pacific Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 97: South Asia and Pacific Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 98: South Asia and Pacific Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 99: South Asia and Pacific Volume (Tons) Analysis by Product, 2019 to 2034

Figure 100: South Asia and Pacific Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 101: South Asia and Pacific Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 102: South Asia and Pacific Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 103: South Asia and Pacific Volume (Tons) Analysis by Distribution Channel, 2019 to 2034

Figure 104: South Asia and Pacific Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 105: South Asia and Pacific Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 106: South Asia and Pacific Attractiveness by Product, 2024 to 2034

Figure 107: South Asia and Pacific Attractiveness by Distribution Channel, 2024 to 2034

Figure 108: South Asia and Pacific Attractiveness by Country, 2024 to 2034

Figure 109: East Asia Value (US$ Million) by Product, 2024 to 2034

Figure 110: East Asia Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 111: East Asia Value (US$ Million) by Country, 2024 to 2034

Figure 112: East Asia Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 113: East Asia Volume (Tons) Analysis by Country, 2019 to 2034

Figure 114: East Asia Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 115: East Asia Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 116: East Asia Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 117: East Asia Volume (Tons) Analysis by Product, 2019 to 2034

Figure 118: East Asia Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 119: East Asia Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 120: East Asia Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 121: East Asia Volume (Tons) Analysis by Distribution Channel, 2019 to 2034

Figure 122: East Asia Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 123: East Asia Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 124: East Asia Attractiveness by Product, 2024 to 2034

Figure 125: East Asia Attractiveness by Distribution Channel, 2024 to 2034

Figure 126: East Asia Attractiveness by Country, 2024 to 2034

Figure 127: Middle East and Africa Value (US$ Million) by Product, 2024 to 2034

Figure 128: Middle East and Africa Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 129: Middle East and Africa Value (US$ Million) by Country, 2024 to 2034

Figure 130: Middle East and Africa Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 131: Middle East and Africa Volume (Tons) Analysis by Country, 2019 to 2034

Figure 132: Middle East and Africa Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 133: Middle East and Africa Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 134: Middle East and Africa Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 135: Middle East and Africa Volume (Tons) Analysis by Product, 2019 to 2034

Figure 136: Middle East and Africa Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 137: Middle East and Africa Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 138: Middle East and Africa Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 139: Middle East and Africa Volume (Tons) Analysis by Distribution Channel, 2019 to 2034

Figure 140: Middle East and Africa Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 141: Middle East and Africa Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 142: Middle East and Africa Attractiveness by Product, 2024 to 2034

Figure 143: Middle East and Africa Attractiveness by Distribution Channel, 2024 to 2034

Figure 144: Middle East and Africa Attractiveness by Country, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Tobacco Packaging Market Size and Share Forecast Outlook 2025 to 2035

Tobacco Films Market Size and Share Forecast Outlook 2025 to 2035

Tobacco Pouch Market

Shisha Tobacco Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Organic Tobacco Market

Roll-Your-Own Tobacco Products Market Trends - Growth & Forecast 2025 to 2035

Trends, Growth, and Opportunity Analysis of Shisha Tobacco in GCC Countries Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA