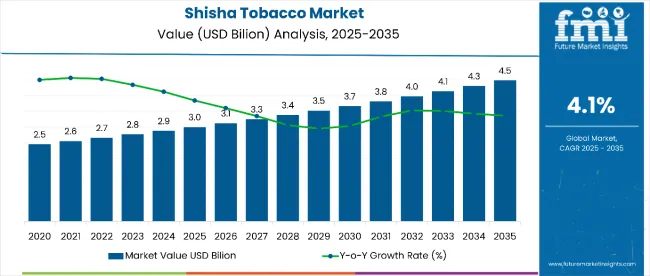

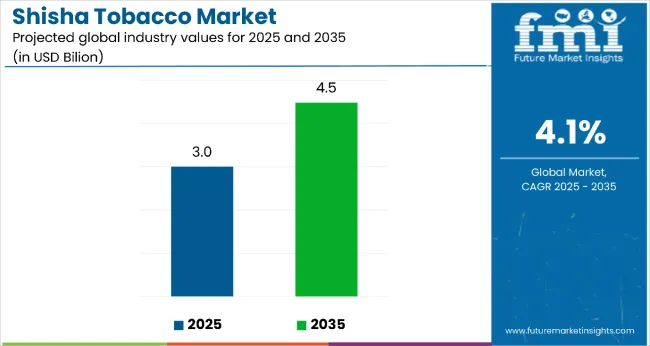

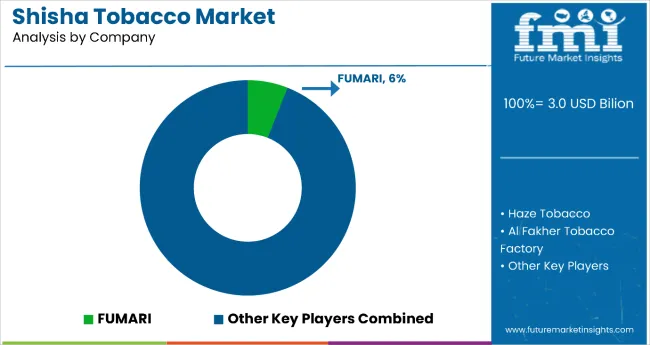

The shisha tobacco market is estimated to be valued at USD 3.0 billion in 2025 and is projected to reach USD 4.5 billion by 2035, registering a compound annual growth rate (CAGR) of 4.1% over the forecast period. The market is projected to add an absolute dollar opportunity of USD 1.5 billion over the forecast period.

| Metric | Value |

|---|---|

| Shisha Tobacco Market Value (2025) | USD 3.0 billion |

| Shisha Tobacco Market Value (2035) | USD 4.5 billion |

| Forecast CAGR (2025 to 2035) | 4.1% |

This reflects a 1.5 times growth at a compound annual growth rate of 4.1%. The market’s evolution is expected to be shaped by rising demand for flavored tobacco products, increasing social acceptance of hookah culture, and the growing popularity of premium and herbal shisha blends, particularly in urban leisure settings and emerging markets.

By 2030, the market is projected to reach USD 3.71 billion, highlighting steady mid-term growth. This progression reflects sustained global interest as shisha tobacco remains a popular choice for social smoking experiences worldwide. The market benefits from flavor innovations, expanded retail channels, and gradual penetration in emerging regions. From 2025 to 2035, the sector will achieve absolute growth of USD 1.5 billion, reflecting strong consumer preference for flavored tobacco and a dynamic product landscape enhancing appeal and market resilience globally.

Leading companies in the shisha tobacco market such as FUMARI, Haze Tobacco, Al Fakher Tobacco Factory, SOCIALSMOKE, and Japan Tobacco Inc. are consolidating their positions by expanding product portfolios and introducing innovative flavors and blends. Their focus includes developing unique flavor profiles, improving tobacco quality, and enhancing packaging appeal to attract diverse consumer segments across both mature and emerging markets. By investing in flavor innovation, product differentiation, and wider distribution channels, these players are capturing growth opportunities in a dynamic and competitive tobacco segment.

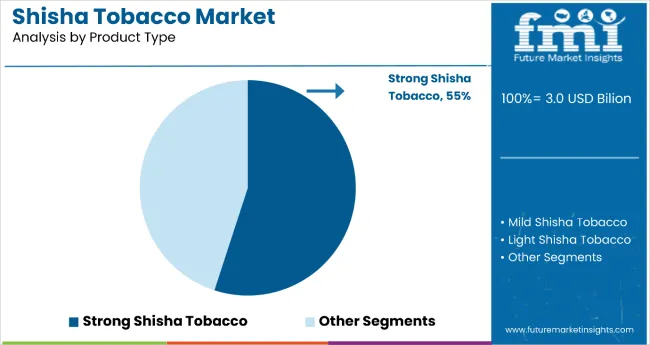

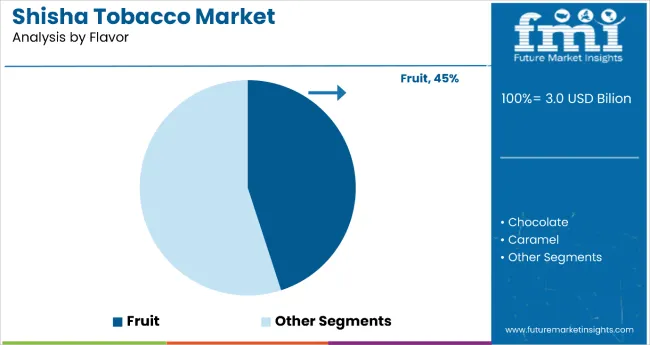

The market holds a critical position in the flavored tobacco industry, with strong shisha tobacco representing about 55% of product consumption in 2025, favored for its intense flavor and smoking experience. Fruit flavors, accounting for around 45% of market share, remain central to consumer preference, supplemented by chocolate, caramel, mint, and blended varieties that cater to evolving tastes. This segment contributes substantially to the broader tobacco market, driven by the rising popularity of social and cultural smoking practices and increased acceptance in urban areas worldwide.

The market is evolving with continuous flavor innovations, improved tobacco blending techniques, and appealing packaging that enhance consumer experience and loyalty. Companies are strengthening portfolios with diverse flavor offerings and sustainable production processes, aiming to reduce environmental impacts and comply with regulatory requirements. Strategic collaborations with distributors, cafes, lounges, and online retailers are reshaping market accessibility and positioning shisha tobacco as a preferred choice for social smoking across different age groups and regions globally.

The market is growing due to several key drivers. First, the rising popularity of the hookah culture and social smoking, particularly among younger demographics like millennials and Generation Z, has made shisha lounges and cafes trendy social gathering spots. This has significantly increased demand for shisha tobacco as a social activity.

Second, the wide variety of innovative flavors including fruit, mint, blended, and other exotic options enhances the sensory experience, attracting a broader consumer base seeking unique and enjoyable smoking experiences. Third, urbanization and increasing disposable incomes in regions such as the Middle East, Asia-Pacific, and North America have contributed to the growth of hookah lounges and boosted consumption.

Moreover, manufacturers are focusing on premium, low-nicotine, and organic shisha tobacco products to cater to health-conscious consumers, helping expand the market further. The market also benefits from the perception held by some consumers that shisha smoking is a less harmful alternative to cigarettes, although health authorities are increasingly challenging this. Globalization and marketing efforts, including influencer endorsements, have broadened the appeal of shisha tobacco beyond traditional regions, increasing accessibility and brand loyalty worldwide.

The market is segmented by product type, flavor, sales channel, and region. By product type, the market is divided into strong shisha tobacco, mild shisha tobacco, and light shisha tobacco. Based on flavor, the market is categorized into fruit, chocolate, caramel, mint, blended, and others (herbal, floral, and exotic flavor varieties).

In terms of sales channel, the market is segmented into direct sales, hypermarket/supermarkets, specialty stores, convenience stores, independent small stores, online retailers, and other sales channels (tobacco shops and tobacco lounges). Regionally, the market is classified into North America, Latin America, Europe, South Asia, East Asia, Oceania, and the Middle East & Africa.

The most lucrative segment is strong shisha tobacco, dominating with a 55% share in 2025. This segment's robust growth is fueled by increasing consumer preference for intense and long-lasting smoking experiences, making it the favored choice among both traditional and new users. Strong shisha tobacco offers a richer flavor profile and higher nicotine content, which appeals to enthusiasts who seek a more authentic and satisfying hookah session.

The segment benefits from continuous innovation in flavor offerings and improvements in product quality, including the development of premium, low-nicotine strong shisha options catering to health-conscious smokers. Geographically, the Middle East and Africa region drive significant demand for strong shisha tobacco due to cultural affinity and the widespread prevalence of hookah lounges. Meanwhile, Asia-Pacific and North America are emerging as key markets with increasing urbanization and social acceptance. The segment's sustained dominance reflects the market's reliance on traditional smoking habits combined with modern consumer trends, positioning strong shisha tobacco as the primary revenue generator and growth driver within the industry.

The fruit flavor segment captures 45% of the market share in 2025, remaining the dominant category. Its popularity stems from a wide range of appealing options like apple, citrus, grape, and mixed berry blends that attract a broad consumer base, especially younger generations. Fruit flavors are favored because they provide a refreshing and smoother smoking experience, masking the harshness of tobacco and offering a more enjoyable social activity. These flavors cater to both novice smokers and seasoned users seeking variety and innovation.

This segment benefits from continuous innovation with the introduction of exotic and seasonal fruit blends, enhancing consumer interest and loyalty. The flavor versatility allows smokers to customize their experience by mixing different fruit flavors or combining them with mint for added freshness. Additionally, fruit flavors often serve as entry points for many new shisha users, expanding the overall market. The segment’s steady growth is projected to sustain from 2025 to 2035, driven by changing social trends, product innovation, and expanding shisha lounge culture worldwide.

The market from 2025 to 2035 is driven by increasing consumer demand for flavored tobacco products, expanding social smoking culture, especially among millennials and Gen Z, and growing urbanization and disposable incomes in emerging markets. Continuous product innovations in flavor variety, packaging, and tobacco blends enhance user experience and widen the consumer base.

However, stringent government regulations and rising health awareness may restrain market growth in some regions. Expanding retail and e-commerce distribution channels globally support market expansion, especially in Asia-Pacific, Middle East, and North America.

Flavor Innovation and Social Culture Boost Shisha Tobacco Market Growth

Growing popularity of hookah lounges and social smoking occasions plays a key role in driving the shisha tobacco market. Innovative flavor profiles, including fruit, mint, and blended varieties, attract diverse consumer segments. Increasing adoption of premium and organic shisha tobacco caters to health-conscious consumers. Marketing efforts via influencers and social platforms increase brand visibility. The shift toward online sales and specialty retail stores expands accessibility, fueling market growth.

Innovation and Sustainability Expanding Shisha Tobacco Market Opportunities

Innovation in flavor development, natural and low-nicotine tobacco variants, and premium packaging broadens market opportunities. Manufacturers focus on sustainable sourcing, eco-friendly production, and compliance with regulatory standards to meet changing consumer preferences and legal requirements.

The rise of personalized flavor blends and organic products appeals to evolving tastes, while efforts to reduce harmful constituents improve product safety perception. Strategic collaborations with lounges, cafes, and distributors enhance market reach and consumer engagement. These advancements position the shisha tobacco market for sustained growth from 2025 to 2035.

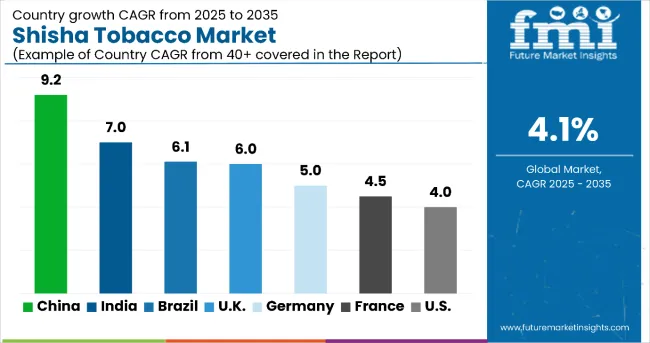

| Country | CAGR (%) |

|---|---|

| China | 9.2 |

| India | 7.0 |

| UK | 6.0 |

| Brazil | 6.1 |

| Germany | 5.0 |

| France | 4.5 |

| USA | 4.0 |

The shisha tobacco market shows varied growth across key countries. China leads with a 9.2% CAGR due to urbanization, rising incomes, and flavor innovations. India follows at 7.0%, driven by urban youth and café culture. The UK grows at 6.0%, benefiting from multicultural demand and influencer marketing. Brazil’s 6.1% growth reflects expanding lounges and social acceptance.

Germany’s moderate 5.0% CAGR stems from health-conscious consumers seeking premium products. France grows at 4.5%, supported by social smoking traditions and regulations. The USA shows steady 4.0% growth amid premium demand and regulatory challenges. These variations underline cultural, economic, and innovation impacts on market dynamics.

The report covers an in-depth analysis of 40+ countries; seven top-performing OECD countries are highlighted below.

Revenue from shisha tobacco in China is expanding rapidly with a CAGR of 9.2%. This growth is propelled by rapid urbanization, rising disposable incomes, and a flourishing social smoking culture. The café and lounge industry is booming in metropolitan areas, popularizing flavored shisha products. Manufacturers are introducing localized and exotic fruit blends suited to Chinese tastes.

Traditional retail channels are complemented by growing online sales, enhancing accessibility. Regulatory adjustments balance cultural practices with health concerns. The younger demographic, particularly millennials and Gen Z, are embracing social smoking, accelerating demand. Expanding flavor varieties and broad distribution networks support sustained market momentum. Collaborations between local distributors and international brands further enhance market penetration and consumer variety.

Demand for shisha tobacco in the United States is growing steadily at a CAGR of 4.0%. Driven by rising demand for premium and diverse flavored tobacco products, the market benefits from increased social smoking venues like hookah bars and lounges. Health-conscious consumers stimulate the development of organic and low-nicotine variants with continuous safety compliance improvements fostering trust.

Expanding e-commerce platforms increase product accessibility. Market players focus on robust flavor innovation and brand differentiation to meet evolving tastes. The synergy between online marketing and physical retail enhances consumer engagement. The market faces regulatory challenges but maintains resilience and steady expansion.

Demand for shisha tobacco in the UK is growing with a CAGR of 6.0%, reflecting robust structural development fueled by demand for localized and innovative flavor profiles. A multicultural population drives interest in diverse blends, especially fruit and mint flavors. Boutique retail outlets and specialty shisha lounges flourish in urban areas.

The market leverages social media and influencer marketing to boost brand visibility and adoption. Regulatory compliance ensures product quality and consumer trust. Flavored shisha tobacco becomes increasingly accepted as a social activity among young adults. Innovations and premiumization strategies attract diverse consumers. A balanced mix of online and offline sales channels supports broad market penetration.

Revenue from shisha tobacco in Germany exhibits steady growth with a CAGR of 5.0%, driven by health-conscious consumers seeking premium and organic products. Demand for low-nicotine and sustainably sourced shisha tobacco rises. Specialized hookah cafés growing in metropolitan areas nurture consumer engagement. Regulatory policies promote high safety and quality standards.

Manufacturers invest in advanced packaging and filtration to enhance user experience. Collaboration between producers and retailers extends market reach. Sustainability and ethical sourcing emerge as significant differentiators. Ongoing flavor and product design innovation sustain market adoption.

Revenue from shisha tobacco in India registers a CAGR of 7.0%, marked by rapid output expansion driven by a rising urban youth population and widespread café culture. Significant online retail penetration complements traditional retail outlets. Popularity of flavored tobacco, particularly fruit and mint blends, is rising sharply. Increasing disposable incomes and evolving lifestyle preferences propel adoption.

Regional manufacturers collaborate with international brands to match local tastes. Shisha smoking gains growing social acceptance. Consumer awareness around safety and quality improves. Aggressive marketing campaigns effectively target younger demographics.

Revenue from shisha tobacco in France grows moderately at a CAGR of 4.5%, supported by a strong social smoking and nightlife culture. The market favors fruit and blended flavors. Specialty tobacco and hookah shops are well-rooted in many cities. Strict regulatory compliance coexists with product diversity. Healthier, low-nicotine alternatives gain traction. Marketing emphasizes social and premium experiences. Consumer education ensures regulatory adherence and trust. Emerging regions see gradual market expansion maintaining momentum.

Demand for shisha tobacco in Brazil experiences rapid demand growth with a CAGR of 6.1%, driven by an expanding hookah lounge culture and increasing consumer curiosity for diverse and exotic flavors. Urban centers lead adoption with growing social acceptance of hookah use.

Digital and social media marketing campaigns amplify brand visibility. Expansion of online retail facilitates access to shisha products. Market transparency improves with evolving regulations. Flavor innovation thrives, particularly in fruit and blended categories. Local-global brand collaborations strengthen market presence.

The market is characterized by intense rivalry among established global players and emerging regional brands striving to capture growing consumer demand. Key companies such as FUMARI, Haze Tobacco, Al Fakher Tobacco Factory, SOCIALSMOKE, and Japan Tobacco Inc. dominate the market, collectively holding a significant share.

These players focus on product innovation, flavor diversification, and premiumization strategies to maintain and expand their market presence. Extensive R&D efforts enable the development of unique flavor blends, organic and low-nicotine options, and appealing packaging to attract health-conscious and trend-savvy consumers.

Market leaders invest heavily in branding, marketing, and distribution networks, leveraging omnichannel strategies that include specialty tobacco shops, lounges, and increasingly, online platforms. Geographic expansion into emerging markets like Asia-Pacific, the Middle East, and Latin America also forms a core growth strategy, addressing rising urbanization and disposable incomes.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 3.0 billion |

| Product Type | Strong Shisha Tobacco, Mild Shisha Tobacco, Light Shisha Tobacco |

| Flavor | Fruit, Chocolate, Caramel, Mint, Blended, Others (Herbal, Floral, Exotic blends) |

| Sales Channel | Direct Sales, Hypermarkets/Supermarkets, Specialty Stores, Convenience Stores, Independent Small Stores, Online Retailers, Others (Tobacco Shops, Lounges) |

| Regions Covered | North America, Latin America, Europe, the Middle East and Africa, East Asia, South Asia |

| Countries Covered | China, United States, United Kingdom, Germany, India, France, Brazil, South Korea, Australia, UAE, and 40+ countries |

| Key Companies Profiled | FUMARI, Haze Tobacco, Al Fakher Tobacco Factory, SOCIALSMOKE, Japan Tobacco Inc., SOEX, Prince Molasses, Romman Shisha, Mazaya, Cloud Tobacco, Flavors of Americas S.A., Al Amir Tobacco, STARBUZZTOBACCO, Nakhla, Godfrey Phillips India Ltd., The Eastern Company, ALWAHA-TOBACCO |

| Additional Attributes | Revenue by product type and flavor; regional demand trends; competitive landscape; adoption of organic and low-nicotine variants; flavored product portfolio expansion; online retail growth; packaging and blend innovations; social acceptance; health-conscious trends; influencer marketing |

The global shisha tobacco market is estimated to be valued at USD 3.0 billion in 2025.

The market size for shisha tobacco is projected to reach USD 4.5 billion by 2035.

The shisha tobacco market is expected to grow at a 4.1% CAGR between 2025 and 2035.

Strong shisha tobacco is projected to lead the shisha tobacco market with 55% market share in 2025.

Fruit flavors are projected to dominate the shisha tobacco market with 45% market share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Trends, Growth, and Opportunity Analysis of Shisha Tobacco in GCC Countries Forecast and Outlook 2025 to 2035

Tobacco Packaging Market Size and Share Forecast Outlook 2025 to 2035

Tobacco Films Market Size and Share Forecast Outlook 2025 to 2035

Tobacco Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Tobacco Pouch Market

Organic Tobacco Market

Roll-Your-Own Tobacco Products Market Trends - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA