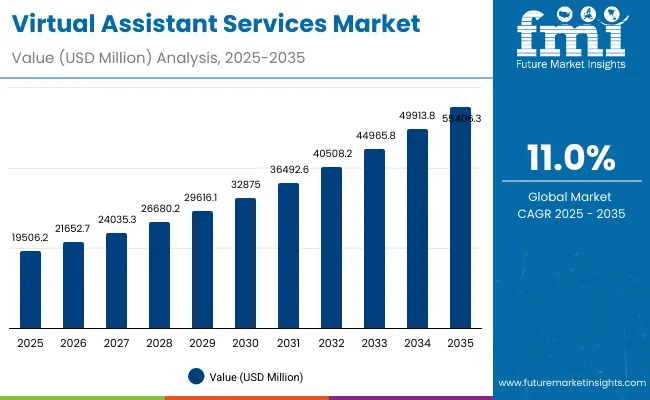

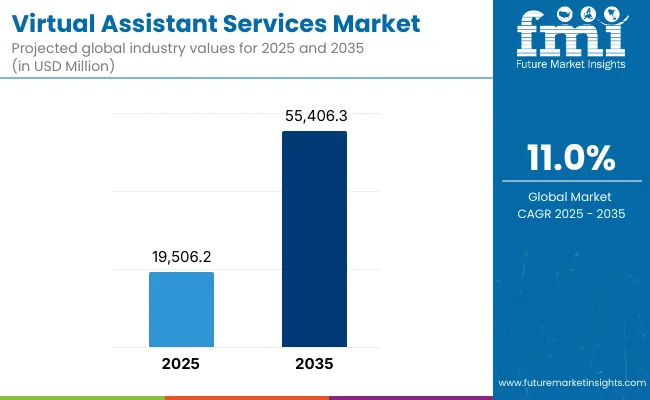

The Global Virtual Assistant Services Market is expected to record a valuation of USD 19,506.2 million in 2025 and USD 55,406.3 million in 2035, with an increase of USD 35,900.1 million, which equals a growth of 184% over the decade. The overall expansion represents a CAGR of 11.0% and a ~2.8X increase in market size.

Global Virtual Assistant Services Market Key Takeaways

| Metric | Value |

|---|---|

| Global Virtual Assistant Services Market Estimated Value in (2025E) | USD 19,506.2 million |

| Global Virtual Assistant Services Market Forecast Value in (2035F) | USD 55,406.3 million |

| Forecast CAGR (2025 to 2035) | 11.0% |

During the first five-year period from 2025 to 2030, the market increases from USD 19,506.2 million to USD 32,875.0 million, adding USD 13,368.8 million, which accounts for 37.2% of the total decade growth. This phase records steady adoption in administrative support, customer service operations, and finance/accounting tasks, driven by the need for cost-efficient, reliable remote workforce solutions. Dedicated monthly VAs dominate this period as they cater to over 53% of businesses requiring long-term, consistent engagement.

The second half from 2030 to 2035 contributes USD 22,531.3 million, equal to 62.8% of total growth, as the market jumps from USD 32,875.0 million to USD 55,406.3 million. This acceleration is powered by widespread deployment of AI-orchestrated workflows, agency-managed VA teams, and hybrid human+automation models.

Creative/design and technical VAs together capture a larger share above 60% by the end of the decade. Platform-led analytics and cloud collaboration add recurring revenue, increasing subscription and managed-services share beyond 50% in total value.

From 2020 to 2024, the Global Virtual Assistant Services Market grew from USD 12,300 million to USD 18,100 million, driven by service-centric adoption. During this period, the competitive landscape was dominated by established VA providers controlling nearly 70% of revenue, with leaders such as BELAY, Time etc, and Boldly focusing on premium, dedicated monthly VA models for operational support across SMBs and enterprises.

Competitive differentiation relied on quality, specialization, responsiveness, and cost efficiency, while pure gig marketplaces were often positioned as auxiliary sourcing rather than primary, recurring revenue streams. Agency-managed teams saw rising attention but still contributed less than 10% of the total market value.

Demand for virtual assistant services will expand to USD 19,506.2 million in 2025, and the revenue mix will shift as platform software and managed services grow to over 40% share. Traditional service leaders face rising competition from digital-first players offering AI-driven task automation, workflow integration, and subscription-based operating models.

Major providers are pivoting to hybrid models, integrating analytics and remote workflow capabilities to retain relevance. Emerging entrants specializing in tool interoperability, AI copilots, and industry-specific VA stacks are gaining share. The competitive advantage is moving away from labor scale alone to ecosystem strength, scalability, and recurring subscription revenues.

Advances in remote work infrastructure and AI-assisted task management have improved productivity and speed, allowing for more efficient support across diverse applications. Dedicated monthly VA subscriptions have gained popularity due to their suitability for continuous operations and role coverage.

The rise of AI-enabled orchestration has contributed to enhanced responsiveness and real-time workflow execution. SMBs, startups, and enterprises are driving demand for VA solutions that integrate seamlessly with existing tools and processes. Expansion of process outsourcing in customer service, admin operations, and finance workflows has fueled market growth.

Innovations in freelance sourcing, managed teams, and platform enhancements are expected to open new application areas. Segment growth is expected to be led by dedicated monthly VA models, SMB client base, and administrative VAs due to their precision in execution, adaptability, and broad applicability.

The market is segmented by type, client base, service model, and region. Types include administrative VA, customer service VA, creative/design VA, technical VA, and finance/accounting VA, highlighting the core roles driving adoption. Client base covers SMBs, startups, enterprises, and individuals to cater to different operational requirements.

Based on service model, the segmentation includes hourly freelance VA, dedicated monthly VA, and agency-managed teams. Regionally, the scope spans North America, Latin America, Western and Eastern Europe, Balkan and Baltic countries, Russia and Belarus, Central Asia, East Asia, South Asia and Pacific, and the Middle East and Africa.

| Service Model Segment | Market Value Share, 2025 |

|---|---|

| Dedicated Monthly VAs | 53.5% |

| Others | 46.5 % |

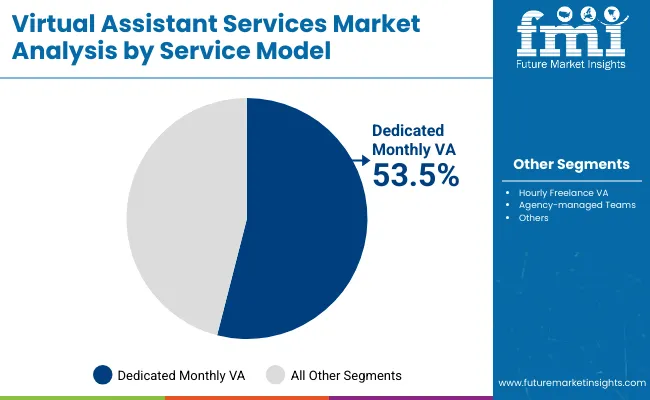

The dedicated monthly VA segment is projected to contribute 53.5% of the Global Virtual Assistant Services Market revenue in 2025, maintaining its lead as the dominant service model. This is driven by ongoing demand for long-term, reliable support with clear SLAs and role continuity. Subscription commitments have been prioritized by users seeking consistency and high-quality outcomes across functions.

The segment’s growth is also supported by the development of integrated platforms and playbooks that enhance scalability. As AI and automation become more prevalent, providers are upgrading capabilities to support workflow orchestration and analytics. The dedicated monthly VA segment is expected to retain its position as the backbone of VA programs.

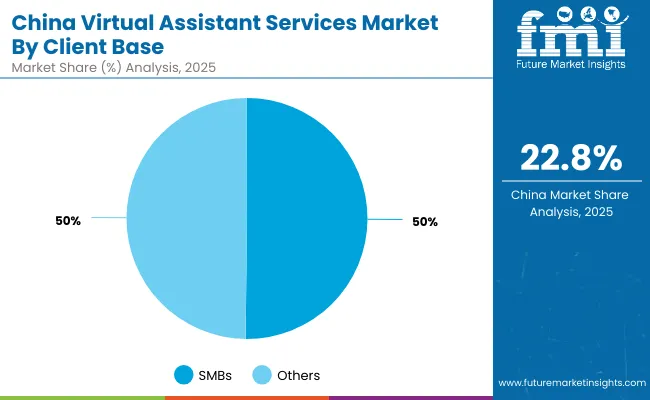

| Client Base Segment | Market Value Share, 2025 |

|---|---|

| SMBs | 44.4% |

| Others | 55.6 % |

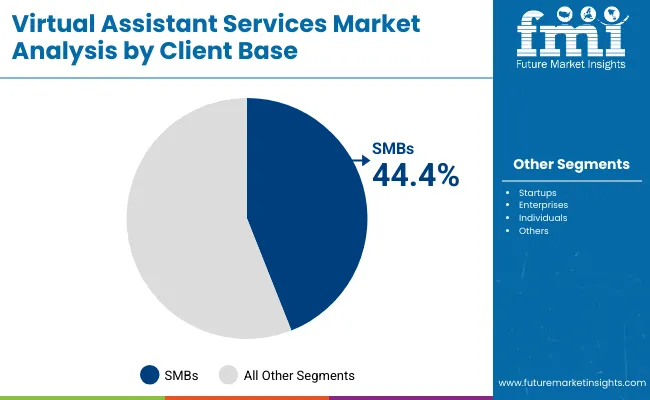

The SMB segment is forecasted to hold 44.4% of the market share in 2025, led by its application in cost-optimized outsourcing and flexible headcount strategies. SMBs are favored clients for their high adoption of recurring VA subscriptions, making them a cornerstone of demand.Their adoption has been facilitated by easy onboarding, bundled tool stacks, and predictable pricing. The segment’s growth is bolstered by e-commerce expansion and digitization that increase task volumes. As organizations increasingly require operational leverage without full-time hires, SMBs are expected to continue their strong contribution.

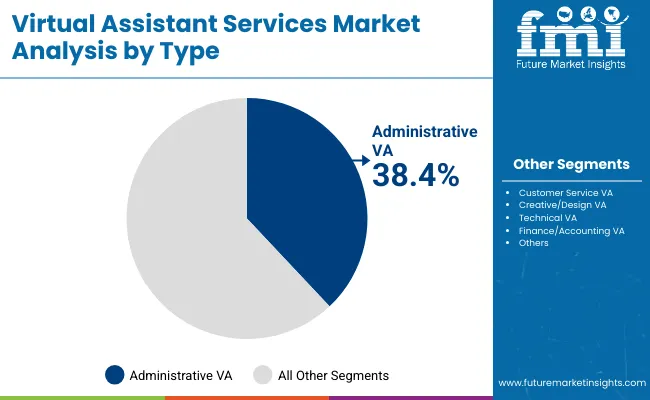

| Type Segment | Market Value Share, 2025 |

|---|---|

| Administrative VAs | 38.4% |

| Others | 61.6 % |

The administrative VA segment is projected to account for 38.4% of the Global Virtual Assistant Services Market revenue in 2025, establishing it as the leading role category. Administrative VAs are preferred for calendar, inbox, documentation, and coordination tasks that form the largest share of outsourcing demand.

Their suitability for startups, SMBs, and enterprises and affordability have made them the most widely adopted option. Developments in collaboration suites, communication platforms, and workflow integrations have improved outcomes and visibility. Given its balance of high demand and wide applicability, the administrative VA segment is expected to maintain its leading role in the Global Virtual Assistant Services Market.

SMB and Startup Adoption of Cost-Effective Workforce Solutions

The most significant driver of the global virtual assistant services market is the rapid adoption among small and medium-sized businesses (SMBs) and startups. These organizations operate under tighter budgets than large enterprises and often lack the resources to hire full-time employees for administrative, customer service, or finance functions.

Virtual assistants (VAs) provide a scalable, cost-efficient solution that helps bridge this resource gap. In 2025, SMBs are estimated to account for 44.4% of total market revenue, representing a critical backbone of the industry. With the growth of e-commerce platforms, digital entrepreneurship, and remote-first companies, outsourcing repetitive yet essential tasks to VAs has become an operational necessity. Startups, in particular, benefit from the flexibility of VA services, which allow them to scale up or down without the liabilities of permanent contracts.

The rise of SaaS ecosystems and collaboration platforms has further enabled VAs to seamlessly integrate into workflows, offering instant value without infrastructure investments. Additionally, the growing demand for 24/7 customer support in highly competitive industries like retail, logistics, and digital services is driving more SMBs to outsource to virtual assistants located across time zones. As this demand continues, SMB and startup outsourcing will serve as the foundation for sustained market expansion, especially in emerging economies where entrepreneurial ecosystems are flourishing.

Shift Toward Dedicated Subscription Models

Another powerful growth driver is the increasing shift toward dedicated monthly VA services, which already represent 53.5% of the global market share in 2025. Businesses prefer this service model because it ensures continuity, accountability, and reliability compared to one-time freelance arrangements. Dedicated subscription models enable companies to align VAs with internal processes, improving efficiency and consistency in service delivery.

From the provider’s perspective, subscription-based models also generate recurring revenue streams, ensuring stability and allowing firms to scale sustainably. Enterprises, in particular, are drawn to dedicated VA services for complex functions like finance, technical support, or content creation, where training and consistency matter more than short-term cost savings.

This preference aligns with the broader trend in global business toward subscription-based ecosystems, where predictability of expenses and service quality are paramount. Moreover, the dedicated model supports long-term collaboration, enabling VAs to acquire domain-specific expertise over time, which further enhances productivity and trust.

As clients increasingly demand value-added services, providers offering structured packages, productivity tracking, and performance reporting within the subscription framework are becoming more competitive. Over the next decade, this driver will continue to accelerate market consolidation toward subscription models, making them the dominant pillar of the global VA services industry.

Data Security and Privacy Concerns

One of the biggest restraints for the virtual assistant services market is the issue of data security and privacy compliance. By outsourcing administrative, finance, or customer-facing functions, businesses expose themselves to risks of data breaches, misuse, and compliance violations. Sensitive tasks, such as managing financial transactions, handling confidential client information, or accessing proprietary databases, create vulnerabilities when performed by third-party virtual assistants.

Regulatory complexities add another layer of concernwhile the EU enforces stringent GDPR standards, the USA, Asia-Pacific, and Middle East regions operate with fragmented or less robust frameworks, making cross-border outsourcing riskier. For enterprises in sectors like healthcare, finance, and government, even a minor breach can result in reputational damage, heavy fines, and loss of customer trust.

Smaller businesses, although less regulated, also hesitate to outsource highly sensitive functions due to fear of losing control over data. Despite the emergence of secure collaboration platforms and identity verification tools, the lack of standardized global protocols remains a challenge.

Providers that cannot guarantee secure workflows and compliance certification are likely to struggle with client acquisition, particularly in data-sensitive industries. Therefore, unless the market develops stronger frameworks for cybersecurity and privacy, this restraint will continue to limit adoption at enterprise scale.

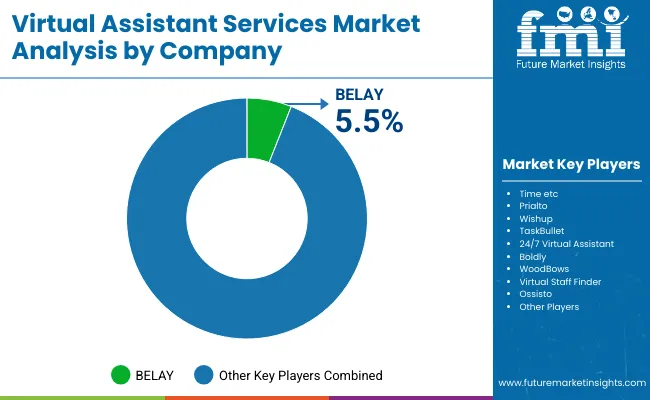

High Market Fragmentation and Lack of Standardization

The global virtual assistant services market is highly fragmented, with even the leading player, BELAY, holding just 5.5% of global market share in 2025. This fragmentation creates difficulties for clients in evaluating quality, pricing, and reliability across thousands of small and mid-sized providers.

Unlike industries with standardized skill certifications or quality benchmarks, VA services often vary widely in training, specialization, and technological integration. For enterprises that seek scalable, multi-location outsourcing solutions, this lack of standardization becomes a major barrier. High fragmentation also suppresses pricing power, as competition drives down service rates without corresponding improvements in quality.

The absence of globally recognized professional certifications for VAs exacerbates the issue, resulting in inconsistent client experiences. While boutique agencies may thrive by catering to niche needs, the lack of standardization prevents the industry from scaling at the same pace as other outsourcing markets like IT or BPO.

This restraint also reduces investor confidence in smaller VA providers, limiting their ability to grow beyond regional strongholds. For the market to mature, consolidation and the development of common service quality benchmarks will be necessary. Until then, fragmentation will continue to cap growth potential and contribute to client hesitancy in adopting VA services for mission-critical functions.

AI-Enhanced VA Services and Hybrid Models

A defining trend in the market is the integration of artificial intelligence (AI) and automation into virtual assistant services. Providers are increasingly adopting AI-powered tools such as natural language processing, workflow automation, and predictive analytics to augment human VAs. These hybrid models deliver efficiency by combining the empathy and judgment of human assistants with the speed and scalability of AI. For example, AI tools can handle repetitive tasks like scheduling, data entry, or chatbot-based customer interactions, while human VAs manage complex, judgment-based functions.

This not only improves cost efficiency for clients but also enhances service quality by providing 24/7 coverage and reducing response times. Over the decade, AI-enabled VA platforms are expected to evolve into comprehensive ecosystems, integrating task management, analytics dashboards, and collaboration tools. Clients are also demanding hybrid services that can scale quickly, especially in high-growth markets like China and India, where demand for affordable yet reliable solutions is surging. This trend reflects a broader shift from manpower-centric outsourcing to technology-augmented ecosystems, where scalability, security, and efficiency form the new competitive advantage.

Rising Demand for Specialized VAs

While administrative VAs currently dominate with 38.4% market share in 2025, the future growth trajectory points toward specialized services. Businesses are increasingly outsourcing creative/design, technical, and finance/accounting tasks that require domain expertise beyond general administrative work. For instance, startups in tech hubs such as India and Japan are leveraging technical VAs for coding support, testing, and IT operations, while creative VAs are in high demand across digital marketing, content creation, and e-commerce industries.

Japan (CAGR 16.9%) and India (CAGR 23.6%) exemplify this trend, as both countries are seeing accelerated demand for domain-specific skills. Specialized VAs also command premium pricing, making this segment more lucrative for providers.

The trend is reinforced by the rise of SaaS platforms and global freelancing ecosystems, which enable clients to find highly skilled assistants for niche roles at competitive rates. This shift from generic administrative outsourcing toward specialized services demonstrates the market’s maturation and indicates a future where providers differentiate less by cost and more by expertise and value creation.

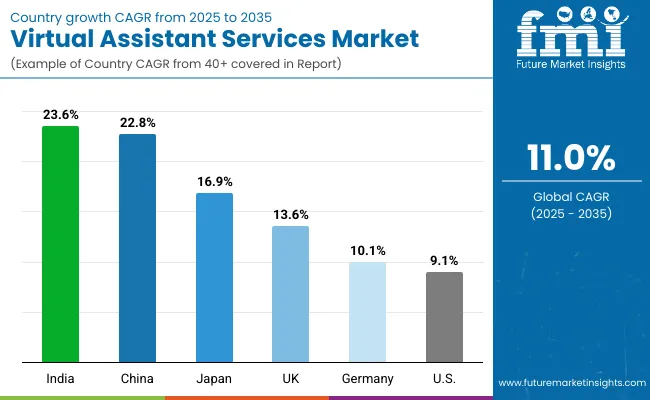

| Country | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 22.8% |

| USA | 9.1% |

| India | 23.6% |

| UK | 13.6% |

| Germany | 10.1% |

| Japan | 16.9% |

Between 2025 and 2035, the global virtual assistant services market is set to experience divergent growth rates across key countries, reflecting differences in digital adoption, outsourcing maturity, and workforce trends. India and China emerge as the fastest-growing markets with CAGRs of 23.6% and 22.8%, respectively. This surge is supported by a large base of SMBs, rapid digitalization, and strong entrepreneurial ecosystems seeking affordable operational support.

Japan also records a high CAGR of 16.9%, driven by demand for specialized creative and technical VAs as the country embraces hybrid work models and invests heavily in digital workforce integration. These fast-growth regions indicate a strong shift in market momentum toward Asia, where businesses are rapidly scaling and cost efficiencies are paramount. In contrast, mature Western markets show steady but slower expansion.

The USA, the current leader with over 24% global share in 2025, is expected to grow at a 9.1% CAGR, reflecting saturation and strong competition, though subscription-based dedicated VA models keep demand resilient. Germany (10.1%) and the UK (13.6%) illustrate Europe’s gradual adoption, with demand concentrated in SMEs and enterprises seeking efficiency in customer-facing and administrative tasks. Overall, while North America and Europe remain influential in market size, the higher CAGRs in Asia underscore a geographical shift in growth opportunities, with India, China, and Japan poised to define the next decade of expansion.

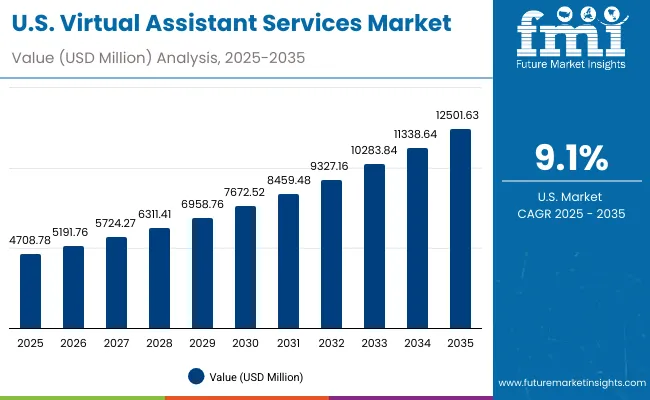

| Year | USA Market (USD Million) |

|---|---|

| 2025 | 4708.8 |

| 2026 | 5191.8 |

| 2027 | 5724.3 |

| 2028 | 6311.4 |

| 2029 | 6958.8 |

| 2030 | 7672.5 |

| 2031 | 8459.5 |

| 2032 | 9327.2 |

| 2033 | 10283.8 |

| 2034 | 11338.6 |

| 2035 | 12501.6 |

The Virtual Assistant Services Market in the United States is projected to grow at a CAGR of 9.1%, supported by the rising adoption of dedicated subscription-based VA models. Enterprises are focusing on administrative and finance/accounting assistants to streamline operations, while SMBs are expanding outsourcing for customer service and digital support roles. Increasing reliance on subscription-driven virtual staffing is shaping USA demand, particularly among professional services firms. The market is also witnessing integration of automation into VA workflows, creating opportunities for hybrid models.

The Virtual Assistant Services Market in the United Kingdom is expected to grow at a CAGR of 13.6%, supported by increasing adoption among SMEs and the professional services sector. The U.K. market is characterized by strong outsourcing demand for administrative and creative VAs, particularly in consulting, marketing, and design firms. Enterprises are outsourcing technical support roles, while individuals are increasingly using personal VAs for lifestyle management. A combination of remote-first work adoption and strong freelance culture continues to fuel market growth.

India is witnessing the fastest growth globally, with the market forecast to expand at a CAGR of 23.6% through 2035. Rapid digital adoption by MSMEs and startups is fueling outsourcing demand across administrative, finance, and technical roles. The rise of tier-2 city businesses has accelerated adoption, supported by lower service costs and availability of skilled English-speaking talent. Educational institutions are also contributing to supply-side growth by training talent in virtual assistance and remote work tools. India is emerging as both a demand and supply hub for virtual assistant services.

The Virtual Assistant Services Market in China is projected to grow at a CAGR of 22.8%, among the highest globally. Strong digitization programs, a rapidly expanding SMB base, and government support for entrepreneurship are driving growth. Local tech firms are creating competitive VA platforms that blend automation and human assistants, making services more accessible. Chinese enterprises are increasingly outsourcing customer service and creative roles, while SMBs are scaling with affordable monthly subscription packages. E-commerce, fintech, and logistics companies are leading adoption.

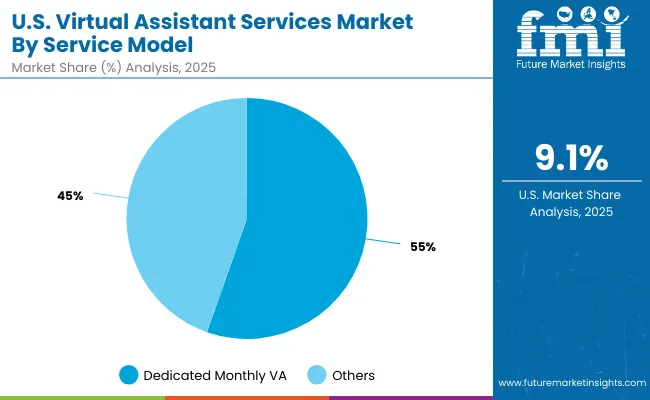

| Service Model Segment | Market Value Share, 2025 |

|---|---|

| Dedicated monthly VA | 55.4% |

| Others | 44.6 % |

The Virtual Assistant Services Market in the United States is valued at USD 4,708.78 million in 2025, with dedicated monthly VA services leading at 55.4%, followed by freelance and agency-managed models at 44.6%. The dominance of dedicated monthly services is a direct outcome of the USA enterprise landscape, where continuity, compliance, and quality assurance are prioritized. Enterprises and SMBs increasingly adopt subscription-based VAs for finance, administrative, and customer-facing roles, ensuring structured workflows and measurable ROI.

This advantage positions dedicated monthly models as the backbone of the USA outsourcing ecosystem, particularly for sectors like professional services, finance, and healthcare, where reliability and domain-specific expertise are non-negotiable. Freelance and agency-managed options remain relevant for creative and project-based work but are secondary compared to recurring subscription services. As hybrid human-AI models expand, the USA will see continued demand for dedicated services integrated with automation and analytics tools.

| Client Base Segment | Market Value Share, 2025 |

|---|---|

| SMBs | 50.2% |

| Others | 49.8 % |

The Virtual Assistant Services Market in China is valued at USD 7,269 million in 2025 (12.9% of global share), with SMBs leading at 50.2%, followed by startups, enterprises, and individuals at 49.8%. The dominance of SMBs reflects China’s dynamic entrepreneurial ecosystem, where small businesses and online retailers rely heavily on outsourced customer service, creative design, and administrative support to scale efficiently.

SMBs benefit from cost-effective packages offered by domestic VA providers, and the integration of AI-powered platforms has made these services even more accessible. The combination of low-cost subscription models, government-backed digitalization initiatives, and competitive offerings from local firms positions SMB-focused services as the largest driver of growth. Enterprises are gradually adopting agency-managed VA teams, but SMBs remain the fastest-growing segment as they align with China’s booming e-commerce and startup economy.

| Company | Global Value Share 2025 |

|---|---|

| BELAY | 5.5% |

| Others | 94.5% |

The Virtual Assistant Services Market is highly fragmented, with global leaders, mid-sized agencies, and niche-focused providers competing across diverse client segments. Global leaders such as BELAY, Time etc, and Boldly hold notable market share, driven by strong branding, premium positioning, and subscription-focused offerings.

Their strategies increasingly emphasize dedicated monthly models, hybrid AI-human workflows, and enterprise-level service packages for professional industries.Mid-sized players, including Prialto, Wishup, and TaskBullet, are expanding by focusing on startups and SMBs, offering affordable subscription services and specialized VAs in areas like customer support, finance, and creative tasks.

These providers combine human outsourcing with platform-driven tools to enhance accessibility and integration.Specialized and niche providers such as WoodBows, Virtual Staff Finder, and Ossisto focus on regional and industry-specific markets, offering flexibility and tailored solutions.

Their strength lies in customization, affordability, and adaptability rather than global dominance. Competitive differentiation is shifting away from manpower scale toward integrated ecosystems that combine automation, project management platforms, and analytics dashboards. Providers investing in hybrid AI-VA solutions, multi-lingual support, and industry-specific expertise are gaining long-term advantage.

Key Developments in Global Virtual Assistant Services Market

| Item | Value |

|---|---|

| Quantitative Units | USD 19,506.2 million |

| Type | Administrative VA, Customer Service VA, Creative/Design VA, Technical VA, Finance/Accounting VA |

| Client Base | SMBs, Startups, Enterprises, Individuals |

| Service Model | Hourly Freelance VA, Dedicated Monthly VA, Agency-Managed Teams |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BELAY, Time etc , Prialto , Wishup , TaskBullet , 24/7 Virtual Assistant, Boldly, WoodBows , Virtual Staff Finder, Ossisto |

| Additional Attributes | Dollar sales by service model and client base, adoption trends in SMB outsourcing and enterprise cost-optimization, rising demand for administrative and customer service VAs, sector-specific growth in startups, e-commerce, and enterprises, subscription-based revenue segmentation, integration with AI-driven workflow automation, regional trends influenced by digitization initiatives, and innovations in hybrid VA models (human + automation). |

The Global Virtual Assistant Services Market is estimated to be valued at USD 19,506.2 million in 2025.

The market size for the Global Virtual Assistant Services Market is projected to reach USD 55,406.3 million by 2035.

The Global Virtual Assistant Services Market is expected to grow at a 11.0% CAGR between 2025 and 2035.

The key product types in the Global Virtual Assistant Services Market are Administrative VA, Customer Service VA, Creative/Design VA, Technical VA, and Finance/Accounting VA.

In terms of service model, the Dedicated Monthly VA segment is expected to command 53.5% share in the Global Virtual Assistant Services Market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Virtual Pipeline Market Size and Share Forecast Outlook 2025 to 2035

Virtual Customer Premises Equipment Market Size and Share Forecast Outlook 2025 to 2035

Virtual Infrastructure Manager Market Size and Share Forecast Outlook 2025 to 2035

Virtual Companion Care Market Size and Share Forecast Outlook 2025 to 2035

Virtualized Radio Access Network Market Size and Share Forecast Outlook 2025 to 2035

Virtual Workspace Solutions Market Size and Share Forecast Outlook 2025 to 2035

Virtual Prototype Market Size and Share Forecast Outlook 2025 to 2035

Virtual Power Plant (VPP) and V2G Orchestration Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Virtual Power Plant Market Size and Share Forecast Outlook 2025 to 2035

Virtual Machines Market by Type, by Enterprise Size, by Industry & Region Forecast till 2035

Virtual Extensible LAN (VXLAN) Market Size and Share Forecast Outlook 2025 to 2035

Virtual Private Cloud Market Size and Share Forecast Outlook 2025 to 2035

Virtual PLC and Soft PLC Market Size and Share Forecast Outlook 2025 to 2035

Virtual Private Network VPN Market Size and Share Forecast Outlook 2025 to 2035

Virtualized Evolved Packet Core (vEPC) Market Size and Share Forecast Outlook 2025 to 2035

Virtual Cards Market Size and Share Forecast Outlook 2025 to 2035

Virtual Try-On Platform Market Analysis Size and Share Forecast Outlook 2025 to 2035

Virtual Private Server Market Size and Share Forecast Outlook 2025 to 2035

Virtual Client Computing Market Size and Share Forecast Outlook 2025 to 2035

Virtual Event Platforms Market Trends - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA