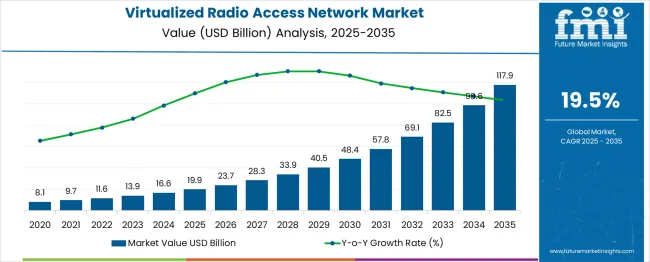

The global virtualized radio access network (vRAN) market is expected to expand from USD 19.9 billion in 2025 to USD 117.9 billion by 2035, reflecting a 20% CAGR and generating an absolute dollar opportunity of USD 98.0 billion. Market growth is driven by increasing deployment of 5G networks, demand for flexible and scalable network architectures, and adoption of software-defined networking solutions that enable reduced operational costs and improved performance. Network operators are investing in virtualized infrastructure to handle growing data traffic, improve service quality, and support emerging applications such as IoT, autonomous systems, and cloud-based services.

Quick Stats for Virtualized Radio Access Network Market

The long-term value accumulation curve illustrates how revenue builds over the forecast period. From 2025 to 2028, the curve rises steadily as early adoption occurs in North America, Europe, and East Asia, supported by 5G rollouts and pilot deployments of virtualized networks. Between 2029 and 2032, the curve steepens as large-scale adoption accelerates in emerging markets, driven by increased network modernization projects and private enterprise deployments. From 2033 to 2035, value accumulation continues at a high pace, reflecting expansion into mature markets, upgrades of initial deployments, and integration with advanced AI-driven network management. The cumulative trajectory demonstrates compounding growth, with early investments setting the foundation for exponential revenue gains in later years, prioritizing the strategic importance of vRAN in global telecom infrastructure.

| Metric | Value |

| Estimated Value in (2025E) | USD 19.9 billion |

| Forecast Value in (2035F) | USD 117.9 billion |

| Forecast CAGR (2025 to 2035) | 20% |

Recent developments in the virtualized radio access network market focus on 5G deployment, automation, and open architecture adoption. Operators are integrating AI and machine learning for network optimization, predictive maintenance, and energy efficiency. Open RAN standards and multi-vendor interoperability are accelerating deployment flexibility and reducing dependency on proprietary equipment.

Edge computing integration is enhancing low-latency services and real-time analytics. Telecom infrastructure expansion, increasing mobile data traffic, and rising adoption of private and enterprise networks are driving growth. These trends are fostering innovation, improving operational efficiency, and enabling scalable, flexible, and cost-effective vRAN solutions globally.

The virtualized radio access network (vRAN) market is driven by five primary parent markets with specific shares. Telecommunications operators lead with 40%, deploying vRAN to reduce infrastructure costs and increase network flexibility. Cloud computing and data centers contribute 25%, providing scalable virtualization platforms and centralized network management. Enterprise and industrial applications account for 15%, leveraging vRAN for private networks and IoT connectivity. Government and defense represent 10%, using virtualized networks for secure and resilient communications. Equipment vendors hold 10%, supplying software, hardware, and integration services to support vRAN deployments.

Market expansion is being supported by the accelerating deployment of 5G networks and the corresponding demand for flexible and scalable radio access network architectures that can support diverse use cases and service requirements. Modern telecommunications operators are increasingly focused on achieving network agility and operational efficiency while reducing the total cost of ownership through software-defined and cloud-native network solutions. Virtualized RAN's proven ability to enable rapid service deployment, network optimization, and multi-vendor interoperability makes it essential infrastructure for next-generation mobile networks.

The growing prioritization of Open RAN architectures and vendor ecosystem diversification is driving demand for virtualized RAN solutions that can provide greater flexibility in network design and supplier selection. Telecommunications operators' preference for solutions that combine performance optimization with operational simplicity is creating opportunities for innovative vRAN implementations. The rising influence of edge computing and IoT applications is also contributing to increased adoption of virtualized RAN technologies that can support distributed computing and low-latency service delivery.

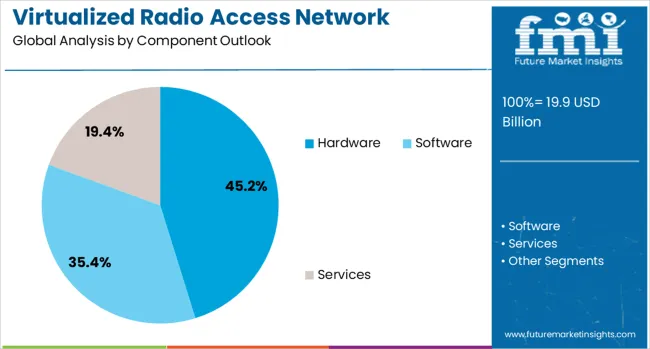

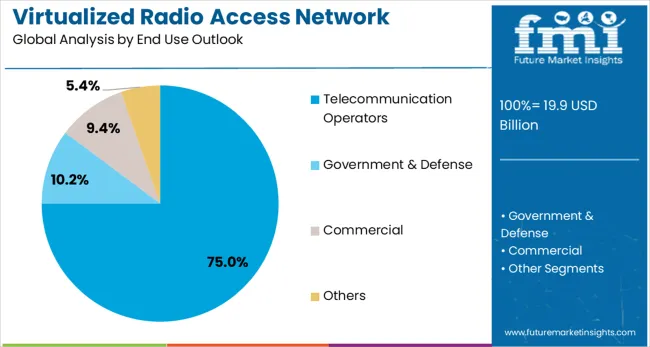

The market is segmented by component, deployment type, network type, end use, and region. By component, the market is divided into hardware, software, and services. Based on deployment type, the market is categorized into public, private, and hybrid. In terms of network type, the market is segmented into 5G, 2G/3G, 4G/LTE, and others. By end use, the market is classified into telecommunication operators, government & defense, and commercial. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and the Middle East & Africa.

The hardware component segment is projected to account for 45% of the virtualized radio access network market in 2025, reaffirming its position as the dominant component category. Telecommunications operators increasingly require specialized hardware platforms, including servers, accelerators, and radio units that can support virtualized network functions and cloud-native applications. Hardware components' critical role in enabling high-performance computing and real-time processing directly addresses vRAN deployment requirements for reliable and efficient network operation.

This component category forms the foundation of virtualized RAN infrastructure, as it represents the physical platform required for running virtualized network functions and supporting diverse network services. Vendor investments in hardware optimization and specialized processing capabilities continue to strengthen market adoption. With telecommunications operators prioritizing performance and reliability in network infrastructure, hardware components align with both technical requirements and operational objectives, making them the central element of vRAN deployment strategies.

Public deployment is projected to represent 52% of virtualized RAN demand in 2025, underscoring its critical role in mobile network operator infrastructure serving consumer and enterprise markets. Telecommunications operators prefer public vRAN deployments for their ability to serve broad coverage areas and large subscriber bases with cost-effective and scalable network solutions. Positioned as essential infrastructure for mobile network services, public vRAN deployments offer both operational efficiency benefits and service delivery advantages.

The segment is supported by ongoing mobile network expansion and increasing demand for enhanced mobile broadband services across urban and rural areas. The public vRAN deployments enable operators to achieve economies of scale while providing flexible service delivery capabilities. As mobile operators prioritize network coverage and service quality, public vRAN deployments will continue to dominate the market while supporting comprehensive mobile service delivery strategies.

The 5G network type segment is forecasted to contribute 45% of the virtualized radio access network market in 2025, reflecting the primary driver of vRAN technology adoption. Telecommunications operators increasingly deploy virtualized RAN solutions to support 5G network requirements, including enhanced mobile broadband, ultra-reliable low-latency communications, and massive machine-type communications. This aligns with 5G deployment strategies that focus on network flexibility and software-defined architectures for diverse service delivery.

The segment benefits from continuous 5G network rollouts and growing enterprise adoption of 5G services requiring customized network configurations. With established 5G use cases and expanding application requirements, 5G serves as the primary catalyst for virtualized RAN adoption, making it a critical component of next-generation mobile network infrastructure and service innovation.

The telecommunication operators ' end-use segment is forecasted to contribute 75% of the virtualized radio access network market in 2025, reflecting the primary role of mobile network operators in driving vRAN adoption. Telecommunications operators increasingly invest in virtualized RAN solutions to modernize network infrastructure while achieving operational efficiency and service differentiation. This aligns with operator transformation strategies that focus on software-defined networking and cloud-native architectures.

The segment benefits from ongoing network modernization initiatives and growing competitive pressure requiring enhanced service capabilities and operational agility. With established network infrastructure and service delivery requirements, telecommunication operators serve as the primary market for virtualized RAN solutions, making them the critical foundation for market growth and technology advancement.

The virtualized radio access network market is advancing rapidly due to accelerating 5G deployments and growing demand for network flexibility and operational efficiency in telecommunications infrastructure. The market faces challenges including integration complexity, performance optimization requirements, and concerns about network reliability and security. Innovation in cloud-native architectures and AI-driven network management continues to influence product development and market expansion patterns.

The growing adoption of Open RAN architectures is enabling telecommunications operators to deploy multi-vendor vRAN solutions that provide greater flexibility in network design and supplier selection. Open RAN standards facilitate interoperability between different vendor components while reducing vendor lock-in and promoting innovation and competition. Operators are increasingly recognizing the strategic advantages of open and disaggregated network architectures for achieving operational flexibility.

Modern vRAN solutions are incorporating edge computing capabilities and artificial intelligence for real-time network optimization and autonomous network management. These technologies improve network performance while enabling new service delivery models, including ultra-low latency applications and distributed computing services. Advanced AI integration also enables predictive network management and automated optimization for enhanced operational efficiency.

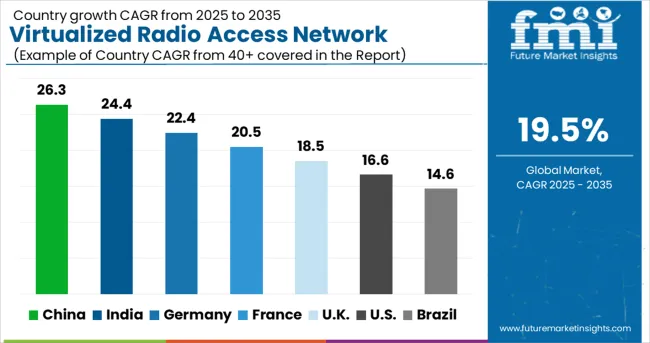

| Country | CAGR (2025-2035) |

| China | 26.3% |

| India | 24.4% |

| Germany | 22.4% |

| France | 20.5% |

| UK | 18.5% |

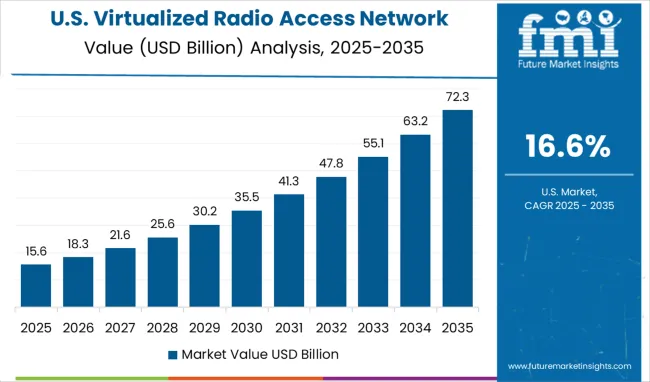

| U.S. | 16.6% |

| Brazil | 14.6% |

The global virtualized radio access network (vRAN) market is projected to grow at a robust CAGR of 19.5% from 2025 to 2035, reflecting increasing adoption of 5G networks, network virtualization, and cloud-native telecom infrastructure. China, leading BRICS nations, is growing at 26.3%, driven by aggressive 5G rollout, government-backed digital infrastructure programs, and high mobile data consumption. India follows at 24.4%, supported by expanding telecom networks, rising mobile broadband penetration, and ASEAN-linked regional collaborations in telecom technology. Germany, at 22.4%, exemplifies OECD-driven growth, leveraging advanced telecom R&D, early adoption of network virtualization, and strong regulatory frameworks. France grows at 20.5%, aided by investments in 5G infrastructure and cloud-native network trials. The United Kingdom, at 18.5%, shows steady expansion from private and public sector network modernization. The United States, at 16.6%, reflects mature market adoption with focus on efficiency and scalability. Brazil, at 14.6%, demonstrates emerging BRICS-driven demand in urban connectivity and mobile networks.

This report includes insights on 40+ countries; the top markets are shown here for reference.

China is leading the virtualized radio access network (vRAN) market with a CAGR of 26.3%, supported by rapid 5G rollout and government initiatives to upgrade network infrastructure. Telecom operators are deploying cloud-native architectures, software-defined networks, and open RAN solutions to improve network efficiency and reduce operational costs. Domestic vendors are collaborating with global equipment providers to develop scalable, high-performance vRAN solutions, enhancing connectivity in urban and semi-urban areas. Analysts anticipate strong demand from major telecom operators investing in next-generation radio access networks to support high-speed mobile services, IoT integration, and enterprise connectivity. Edge computing deployment in metro areas is accelerating adoption, while R&D centers are focusing on AI-driven network optimization. The expansion of fiber backhaul infrastructure further complements the vRAN ecosystem, enabling low-latency performance and seamless deployment across multiple regions.

India is advancing at a CAGR of 24.4%, driven by expanding mobile broadband penetration and growing telecom investments. Major operators are upgrading traditional RAN infrastructure with virtualized solutions to improve scalability, energy efficiency, and service reliability. Partnerships with international vRAN technology providers facilitate deployment of multi-vendor networks and cost-effective cloud-native operations. Analysts note that increasing smartphone adoption and data traffic are supporting robust growth, while private networks in industrial and enterprise sectors are adopting vRAN for secure, high-performance connectivity. Tier 1 and tier 2 cities show the highest adoption rates, with ongoing trials in rural regions to expand coverage. Investment in spectrum allocation and fiber backhaul further accelerates market demand, enabling high-speed mobile connectivity, low-latency applications, and smart city implementations.

Germany is growing at a CAGR of 22.4%, supported by advanced network infrastructure and early adoption of cloud-native RAN technologies. Telecom operators are deploying vRAN to improve scalability, network resilience, and integration of 5G services. Collaborations between local vendors and international technology providers are facilitating multi-vendor networks and accelerating innovation. Analysts highlight that industrial IoT adoption, smart factory connectivity, and urban high-speed mobile services are driving demand. Edge computing integration and AI-driven network management further enhance efficiency and reduce operational complexity. Germany’s regulatory framework for telecommunications supports accelerated deployment, enabling operators to experiment with flexible architectures and virtualized solutions in urban and suburban regions.

France is advancing at a CAGR of 20.5%, driven by telecom modernization initiatives and cloud-native RAN adoption. Major operators are integrating virtualized solutions to improve network flexibility, reduce costs, and enhance service quality. Analysts note that increasing mobile data demand, urban smart city projects, and enterprise private network adoption are creating growth opportunities. Collaborative research with international technology providers accelerates innovation in AI-based network optimization and energy-efficient vRAN deployment. Telecom infrastructure expansion in metropolitan areas supports seamless high-speed coverage, while regulatory support encourages open RAN and multi-vendor implementations.

The UK is growing at a CAGR of 18.5%, supported by 5G network expansion and virtualized RAN deployment in major urban centers. Operators are focusing on software-defined and cloud-native architectures to enhance coverage, reduce operating costs, and support IoT and enterprise networks. Analysts anticipate continued adoption driven by demand for low-latency services and flexible network operations. Edge computing, AI-driven traffic management, and multi-vendor collaboration accelerate the implementation of virtualized RAN solutions. Trials in semi-urban regions and private enterprise networks are expanding the market, while government incentives encourage technological innovation and integration.

The US is advancing at a CAGR of 16.6%, driven by widespread 5G adoption, increasing data consumption, and deployment of virtualized RAN architectures. Telecom operators focus on scalable, cloud-native solutions to reduce operational expenses, enhance coverage, and support enterprise connectivity. Analysts project that the US market will grow due to multi-vendor network adoption, edge computing deployment, and AI-based network automation. High-density urban regions are early adopters, while rural and suburban areas gradually integrate vRAN solutions. Collaboration between domestic technology providers and international vendors accelerates innovation and adoption of next-generation mobile network solutions.

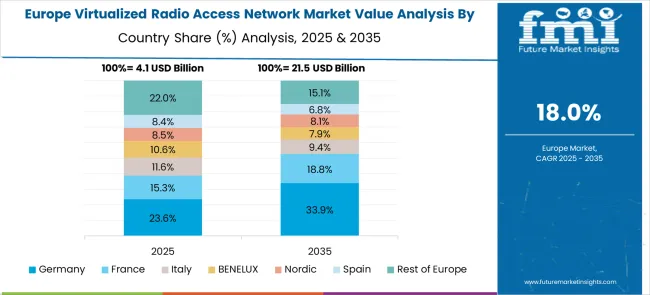

The virtualized radio access network market in Europe demonstrates advanced development across major economies, with Germany showing a strong presence through its telecommunications industry leadership and importance on 5G network modernization, supported by operators leveraging advanced engineering to implement sophisticated vRAN solutions that focus performance, reliability, and integration with existing network infrastructure. France represents a significant market driven by its telecommunications sector innovation and refined understanding of software-defined networking requirements, with companies focusing on advanced vRAN solutions that combine French telecommunications expertise with cutting-edge virtualization technologies for enhanced network flexibility and service delivery capabilities.

The UK exhibits considerable growth through its focus on telecommunications innovation and 5G deployment leadership, with strong adoption of virtualized RAN solutions among mobile network operators and technology companies. Germany and France show expanding interest in Open RAN implementations, particularly in multi-vendor deployments and cloud-native network architectures. BENELUX countries contribute through their focus on telecommunications innovation and advanced network technologies. At the same time, Eastern Europe and Nordic regions display growing potential driven by increasing 5G investments and expanding adoption of software-defined networking solutions.

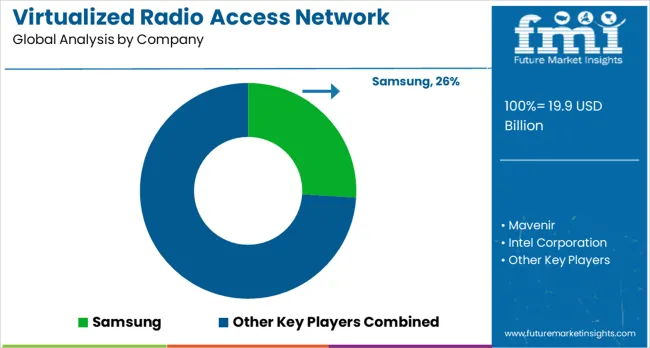

The virtualized radio access network (vRAN) market is driven by telecommunications companies, network equipment providers, and IT solutions firms aiming to optimize mobile network performance and flexibility. Samsung Electronics leads with advanced 5G-ready vRAN solutions designed to enhance network efficiency and support high-capacity mobile traffic. Mavenir specializes in cloud-native vRAN software, enabling operators to reduce deployment costs and improve scalability, while Intel Corporation provides critical processing hardware and accelerators essential for high-performance virtualized network functions. NEC Corporation contributes integrated solutions that combine radio, cloud, and orchestration technologies to facilitate seamless network modernization.

Network flexibility and automation are further advanced by companies such as Parallel Wireless, offering open, software-driven vRAN solutions that simplify deployment across urban and rural areas. Nokia Corporation and Ericsson focus on end-to-end mobile network infrastructure, integrating vRAN into broader 4G and 5G ecosystem services, while Capgemini provides consulting and implementation support to help operators navigate complex network transformations. VMware enhances network virtualization capabilities with cloud-based management and orchestration tools, supporting dynamic scaling and centralized control of radio access networks. Cisco Systems, Inc. strengthens the market with solutions that unify hardware, software, and cloud infrastructure, allowing operators to improve reliability and reduce operational overhead.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 19.9 Billion |

| Component | Hardware, Software, Services |

| Deployment Type | Public, Private, Hybrid |

| Network Type | 5G, 2G/3G, 4G/LTE, Others |

| End Use | Telecommunication Operators, Government & Defense, Commercial |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Samsung Electronics, Mavenir, Intel Corporation, NEC Corporation, Parallel Wireless, Nokia Corporation, Capgemini, Ericsson, VMware, Cisco Systems Inc |

| Additional Attributes | Dollar sales by component type and network type category, regional demand trends, competitive landscape, buyer preferences for public versus private deployments, integration with cloud platforms, innovations in Open RAN architecture, AI-driven optimization, and edge computing advancement |

The global virtualized radio access network market is estimated to be valued at USD 19.9 billion in 2025.

The market size for the virtualized radio access network market is projected to reach USD 117.9 billion by 2035.

The virtualized radio access network market is expected to grow at a 19.5% CAGR between 2025 and 2035.

The key product types in virtualized radio access network market are hardware, software and services.

In terms of deployment type outlook , public segment to command 52.0% share in the virtualized radio access network market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Virtualized Evolved Packet Core (vEPC) Market Size and Share Forecast Outlook 2025 to 2035

Radiopharmaceutical Dispensing System Market Size and Share Forecast Outlook 2025 to 2035

Radiopharmaceutical Market Forecast and Outlook 2025 to 2035

Radio Frequency Identification Market Size and Share Forecast Outlook 2025 to 2035

Radio-Fluoroscopy Systems Market Size and Share Forecast Outlook 2025 to 2035

Radiosynthesis Equipment Market Size and Share Forecast Outlook 2025 to 2035

Radio Frequency Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Radiotherapy Positioning Devices Market Size and Share Forecast Outlook 2025 to 2035

Radioactive Iodine Ablation Therapy Market Size and Share Forecast Outlook 2025 to 2035

Radiometric Detectors Market Size and Share Forecast Outlook 2025 to 2035

Radio Frequency Front End Module Market Size and Share Forecast Outlook 2025 to 2035

Radiofrequency (RF) Ablation System Market Size and Share Forecast Outlook 2025 to 2035

Radiopharmaceutical Logistics Market Analysis Size and Share Forecast Outlook 2025 to 2035

Radiofrequency Balloon Catheter Market Size and Share Forecast Outlook 2025 to 2035

Radiography Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Radiology Information System RIS Market Size and Share Forecast Outlook 2025 to 2035

Radioimmunoassay Market Growth - Trends & Forecast 2025 to 2035

Radio Frequency Beauty Equipment Market is segmented by product, application, technology, and end user from 2025 to 2035

Radiographic Film Processor Market Analysis – Size, Share & Forecast 2025 to 2035

Radio Frequency Integrated Circuit (RFIC) Market Analysis by Product, Application and Region Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA