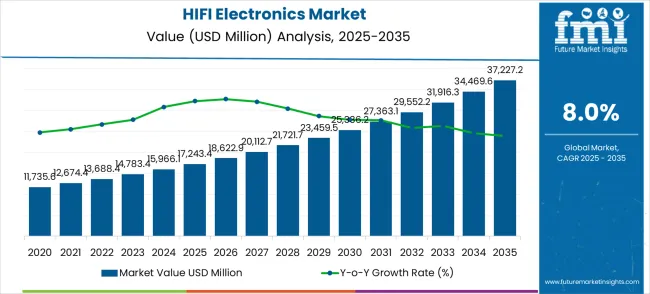

The global HIFI electronics market is valued at USD 17,243.4 million in 2025 and is slated to reach USD 37,227.2 million by 2035, recording an absolute increase of USD 19,983.8 million over the forecast period. This translates into a total growth of 115.9%, with the market forecast to expand at a compound annual growth rate (CAGR) of 8% between 2025 and 2035. The overall market size is expected to grow by nearly 2.16X during the same period, supported by increasing demand for premium audio experiences, growing adoption of high-resolution audio technologies, and rising focus on audiophile-quality sound reproduction across diverse consumer and professional audio applications.

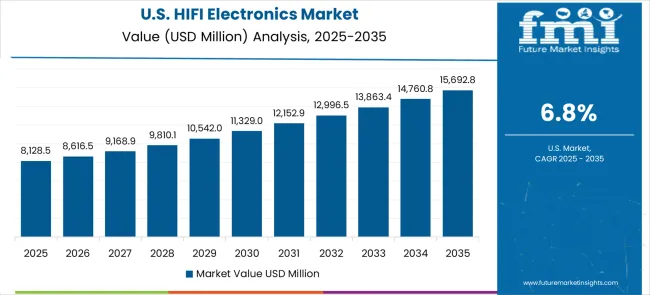

Between 2025 and 2030, the HIFI electronics market is projected to expand from USD 17,243.4 million to USD 25,336.2 million, resulting in a value increase of USD 8,092.8 million, which represents 40.5% of the total forecast growth for the decade. This phase of development will be shaped by increasing consumer appreciation for high-quality audio, rising adoption of vinyl records and analog audio formats, and growing demand for premium audio equipment that delivers exceptional sound reproduction and listening experiences. Audio enthusiasts and professional users are expanding their HIFI electronics investments to address the growing demand for superior audio quality and authentic sound reproduction.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 17,243.4 million |

| Forecast Value in (2035F) | USD 37,227.2 million |

| Forecast CAGR (2025 to 2035) | 8 % |

The portable audio devices segment holds around 15%, driven by the rise of wireless Bluetooth speakers that cater to the on-the-go consumer, with companies like JBL, Bose, and Ultimate Ears leading the charge. Car audio systems account for approximately 12%, as premium audio solutions become increasingly integrated into luxury vehicles, enhancing the driving experience with high-fidelity sound systems. The streaming and software contribute about 10% to the market, with consumers flocking to high-definition audio streaming platforms like Tidal, Apple Music, and Amazon Music for access to lossless, high-quality audio content.

The global HIFI electronics market is poised for meaningful upside as it scales from USD 17.24B (2025) to USD 37.23B (2035). Growth is being driven by a resurgent interest in analog formats (turntables), the premiumization of home audio, rising high-resolution streaming adoption, and rapid consumer upgrades in the Asia-Pacific. Winners will be firms that combine premium hardware (DACs, amps, speakers) with smart connectivity, AI-driven personalization, and strong regional go-to-market execution. Below are practical pathways - who benefits, why it matters, and directional revenue pools (based on the ~USD 19.98B incremental upside through 2035).

Pathway A - Turntables & Analog Resurgence Vinyl and analog playback remain a cultural driver for audiophiles. Producers that offer premium turntables, tonearms, cartridges, and well-engineered analog packages (plus certified bundles) capture high ASPs and brand loyalty. Expected revenue pool: USD 3.0-4.0 billion.

Pathway B - Wireless, Streaming & Smart Integration Seamless high-res streaming, multiroom wireless protocols, and integrated smart assistants lower adoption friction for premium audio. Companies that combine audiophile-grade wireless modules and platform partnerships (Tidal, Qobuz, hi-res kits) can access the largest addressable segment. Expected revenue pool: USD 5.0-7.0 billion.

Pathway C - Premium Components & High-Resolution Signal Chain High-end DACs, precision amplifiers, premium speakers, and modular upgrade paths drive upgrade cycles among enthusiasts and professionals. Component makers and boutique brands can realize strong margins by delivering measurable fidelity improvements. Expected revenue pool: USD 2.5-3.5 billion.

Pathway D - AI, Personalization & Room Correction Services AI-driven sound tuning, automatic room correction, and personalized listening profiles turn complex systems into turnkey experiences for non-technical buyers - increasing conversion and reducing returns. Software + hardware bundles also enable recurring revenue. Expected revenue pool: USD 1.5-2.5 billion.

Pathway E - Asia-Pacific Expansion & Localized Offerings China and India are the fastest growth engines. Local manufacturing, tailored price tiers, and regional distribution partnerships unlock volume while protecting margins through lower logistics and faster time-to-market. Expected revenue pool: USD 2.0-2.8 billion.

Pathway F - Installation, White-Glove & After-Sales Ecosystems High-end systems often require installation, calibration, and maintenance. Companies that offer premium installation, subscription-based calibration services, and extended warranties convert one-time buyers into recurring customers. Expected revenue pool: USD 1.0-1.5 billion.

Pathway G - Pro/Commercial Audio & Studio Equipment Professional audio, boutique studios, and high-end hospitality venues require specialized HIFI gear and long lead OEM relationships. Targeting this vertical yields steady, higher-value contracts and helps validate consumer-grade innovations. Expected revenue pool: USD 0.8-1.5 billion.

Pathway H - Accessories, Vinyl Supply Chain & Consumables Cartridges, records, cables, isolation gear, and premium accessories are high-margin, lower-capex plays that extend brand ecosystems and drive repeat purchases. Expected revenue pool: USD 0.3-0.8 billion.

Market expansion is being supported by the increasing global appreciation for high-quality audio experiences and the corresponding need for premium audio equipment that can deliver exceptional sound reproduction, support diverse audio formats, and provide authentic listening experiences across various consumer and professional audio applications. Modern audio enthusiasts and professional users are increasingly focused on implementing audio solutions that can reproduce music with precision, support high-resolution audio formats, and provide immersive listening experiences that capture the original recording quality. HIFI electronics' proven ability to deliver superior audio fidelity, support premium audio standards, and enhance listening experiences makes them essential components for contemporary audio systems and music appreciation.

The growing focus on audio quality and authentic music reproduction is driving demand for HIFI electronics that can support high-resolution audio, preserve musical detail, and enable premium listening experiences. Audio consumers' preference for equipment that combines exceptional sound quality with build quality and aesthetic appeal is creating opportunities for innovative HIFI electronics implementations. The rising influence of streaming services and digital music platforms is also contributing to increased adoption of HIFI electronics that can enhance digital audio reproduction without compromising sound quality or musical authenticity.

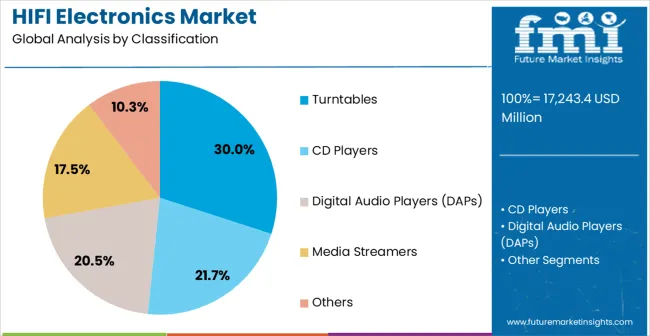

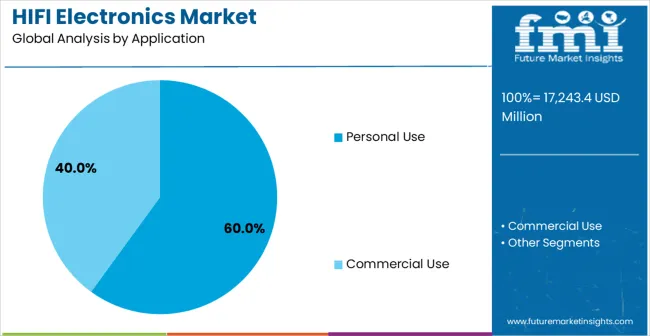

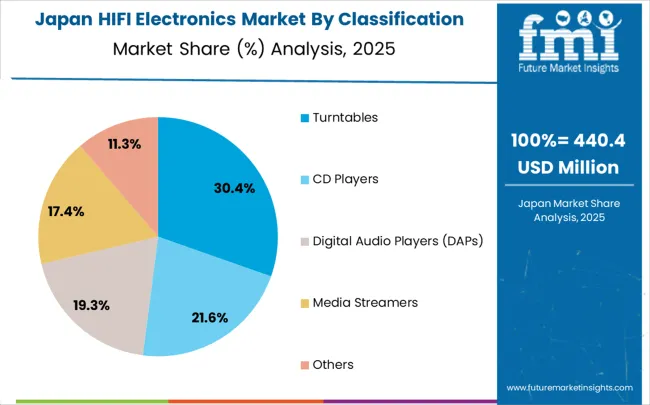

The market is segmented by device type, application, and region. By device type, the market is divided into turntables, CD players, digital audio players (DAPs), media streamers, and others. Based on application, the market is categorized into personal use and commercial use. Regionally, the market is divided into Asia Pacific, North America, Europe, Latin America, and the Middle East & Africa.

The turntables segment is projected to maintain its leading position in the HIFI electronics market in 2025, capturing 30% of the market share. Audio enthusiasts and professionals increasingly rely on turntables for their authentic analog sound reproduction, superior audio fidelity, and versatile capabilities across various music genres and listening environments. Turntable technology delivers proven audio performance and analog authenticity, meeting the audiophile demands for genuine music reproduction and premium listening experiences. As the cornerstone of modern HIFI audio systems, turntables offer unmatched sound quality and have become central to high-performance audio setups. Investments in turntable systems by audio enthusiasts and music professionals continue to drive adoption, making them an essential component of comprehensive Hi-Fi audio strategies.

The personal use application segment is projected to represent the largest share of HIFI electronics demand in 2025, with 60% of the market. Audio consumers prefer HIFI electronics for personal use due to their superior sound quality, comprehensive audio format support, and ability to enhance music enjoyment across various listening preferences and musical styles. This segment is crucial in driving the adoption of premium audio equipment for home audio systems, personal listening setups, and individual music appreciation. With continuous innovation in personal audio technologies and the growing availability of high-resolution audio content, consumers are investing in sophisticated personal audio systems to support diverse music collections. As expectations for audio quality continue to rise, the personal use application will remain dominant in the market, ensuring advanced audio utilization and a premium listening experience.

The HIFI electronics market is advancing rapidly due to increasing consumer demand for premium audio experiences and growing adoption of high-resolution audio technologies that provide enhanced sound reproduction and authentic music listening across diverse audio applications. The market faces challenges, including high equipment costs and premium pricing, competition from mainstream audio devices, and the need for specialized knowledge in audio system setup and optimization. Innovation in wireless audio technologies and smart connectivity continues to influence product development and market expansion patterns.

The growing adoption of wireless connectivity and streaming audio technologies is enabling audio users to achieve superior convenience, enhanced flexibility, and comprehensive audio format support for improved listening experiences. Wireless audio systems provide improved user convenience while allowing more flexible system configurations and consistent audio quality across various streaming sources and digital platforms. Manufacturers are increasingly recognizing the competitive advantages of wireless audio capabilities for user experience differentiation and system integration optimization.

Modern HIFI electronics manufacturers are incorporating artificial intelligence technologies and smart audio features to enhance sound optimization, enable personalized listening experiences, and provide intelligent audio processing for superior sound reproduction. These technologies improve audio performance while enabling new applications, including room acoustic optimization and personalized sound profiles. Advanced AI integration also allows users to support comprehensive audio customization and listening optimization beyond traditional manual audio adjustment approaches.

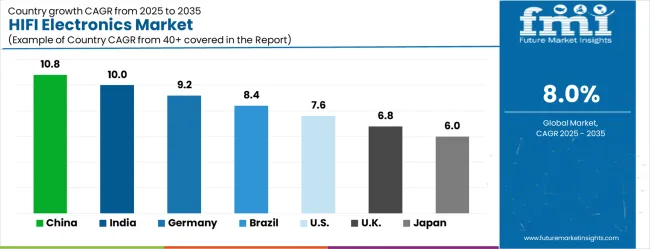

| Country | CAGR (2025-2035) |

|---|---|

| China | 10.8% |

| India | 10.0% |

| Germany | 9.2% |

| Brazil | 8.4% |

| USA | 7.6% |

| UK | 6.8% |

| Japan | 6.0% |

The HIFI electronics market is experiencing exceptional growth globally, with China leading at a 10.8% CAGR through 2035, driven by the expanding consumer electronics market, growing middle-class purchasing power, and significant investment in premium audio technology adoption and music appreciation culture development. India follows at 10.0%, supported by rapid economic growth, increasing disposable income, and growing appreciation for high-quality audio experiences among urban consumers. Germany shows growth at 9.2%, emphasizing precision engineering and audiophile culture traditions. Brazil records 8.4%, focusing on consumer electronics market expansion and premium audio adoption. The USA demonstrates 7.6% growth, supported by an established audiophile community and an focus on premium audio experiences. The UK exhibits 6.8% growth, emphasizing music culture and high-quality audio appreciation. Japan shows 6.0% growth, supported by advanced audio technologies and precision manufacturing expertise.

The report provides an in-depth analysis of 40+ countries, with top-performing countries highlighted below.

The HIFI electronics market is projected to grow at a CAGR of 10.8% from 2025 to 2035. As the demand for high-quality audio systems soars, China continues to lead as the largest producer and consumer of HIFI electronics. With advancements in technology, there has been an increasing shift toward smart home audio systems, combining high fidelity with IoT integration. China’s strong presence in the manufacturing of components like amplifiers, speakers, and subwoofers provides an edge in meeting domestic and global demand. The rise in live-streaming platforms, entertainment, and content creation has increased the consumption of high-fidelity audio devices. International brands continue to invest in China due to its enormous consumer base and technological advancements. The country’s robust retail infrastructure, coupled with a growing e-commerce trend, is amplifying product availability, making premium audio systems more accessible to the middle-class population.

Demand for HIFI electronics is growing at a CAGR of 10.0% during the forecast period. The increasing disposable income and shift toward premium products in India are key contributors to this growth. As the middle class expands, there is a growing demand for quality audio equipment in both urban and suburban areas. Consumers are gravitating towards wireless audio solutions, particularly Bluetooth speakers and headphones, which are becoming an integral part of the tech-savvy lifestyle. With the proliferation of streaming services, people are prioritizing sound quality, propelling the market further. The rise of local audio brands offering cost-effective and high-quality solutions has intensified competition, driving innovation in the sector. There is also a growing adoption of high-end audio solutions in the entertainment and retail sectors, leading to increased penetration in the commercial space.

Germany, with a projected CAGR of 9.2%, is emerging as a key player in Europe’s HIFI electronics market. Known for its high-quality engineering, Germany has a strong demand for precision-crafted audio products, particularly in the audiophile segment. The country’s affinity for superior sound quality, coupled with a rich culture of music and entertainment, drives the steady adoption of HIFI systems. As consumers seek more personalized and immersive listening experiences, the demand for premium audio equipment such as speakers, amplifiers, and noise-canceling headphones continues to rise. Germany also serves as a critical manufacturing hub for high-performance audio equipment, with many global brands sourcing components from the region. With increased investment in R&D, German companies are pushing the boundaries of audio technology, leading to innovations like 3D sound and integration with smart home systems.

The HIFI electronics market in Brazil, with a CAGR of 8.4%, is driven by the rise in consumer spending and the growing appeal of high-quality entertainment systems. With a large, diverse population and increasing access to global products, there is a heightened interest in premium audio solutions, especially in the middle and upper-income segments. Brazil’s vibrant music culture and social events, including live performances and festivals, have heightened the demand for high-fidelity audio equipment. Cost remains a critical factor, with consumers seeking a balance between price and performance. Local manufacturers are responding by producing affordable yet reliable options, while international brands continue to expand their presence in the region. The ongoing growth of streaming services, including music and video content, further fuels demand for premium home audio and mobile devices.

The United States holds a significant share of the global HIFI electronics market, with a CAGR of 7.6%. The USA remains a leader in the adoption of premium audio systems, particularly in the home entertainment and consumer electronics sectors. Increasing investment in home automation and entertainment systems is pushing the demand for HIFI audio solutions, including high-end speakers, amplifiers, and wireless systems. The rapid growth of music streaming services like Spotify, Apple Music, and others contributes to the rising demand for high-fidelity audio, as consumers seek superior sound quality. Consumer interest in high-definition video content and gaming has prompted innovation in gaming headphones and soundbars. The USA is also witnessing the rise of smart audio devices that integrate seamlessly with voice assistants, making it easier for users to enjoy high-quality audio experiences in smart homes.

The UK market for HIFI electronics is expected to grow at a CAGR of 6.8%, supported by a strong culture of music and audio appreciation. The demand for premium audio systems is particularly high in urban areas, where consumers seek high-quality audio for home entertainment, personal use, and gaming. The UK is witnessing a shift toward wireless and Bluetooth-enabled device, offering greater flexibility and portability. Streaming services have accelerated the adoption of high-fidelity audio systems, with consumers upgrading their sound systems to match the quality of the content they consume. The UK is also a significant market for high-end audiophile equipment, with a growing number of enthusiasts investing in specialized systems for optimal sound quality.

The HIFI electronics market in Japan is expanding at a CAGR of 6.0%. As one of the most technologically advanced nations, Japan has a deep-rooted culture of music and entertainment, where high-quality audio is integral to the experience. The demand for premium audio equipment, especially headphones and portable speakers, is strong, driven by Japan's love for personal music consumption and high-quality home entertainment. With a high level of technology integration, many Japanese consumers are investing in smart audio systems that seamlessly integrate with their daily lives. The Japanese market is witnessing a growing interest in noise-canceling technology, particularly in high-end headphones and personal audio devices.

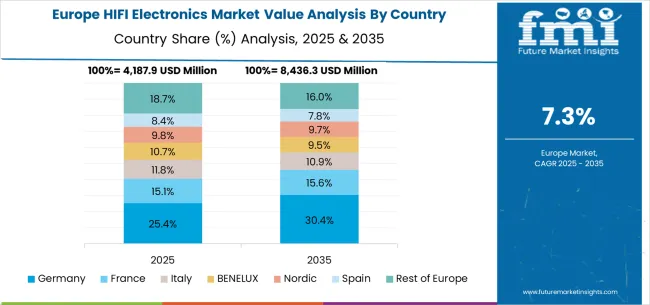

The HIFI electronics market in Europe is projected to grow from USD 6,136.9 million in 2025 to USD 12,589.4 million by 2035, registering a CAGR of 7.5% over the forecast period. Germany is expected to maintain its leadership position with a 28.0% market share in 2025, moderating slightly to 27.8% by 2035, supported by its strong audiophile culture, advanced audio engineering sector, and comprehensive premium audio retail infrastructure serving major European markets.

The United Kingdom follows with 22.0% in 2025, projected to reach 21.8% by 2035, driven by established music culture, comprehensive audio heritage, and advanced premium audio appreciation programs. France holds 18.0% in 2025, rising to 18.2% by 2035, supported by the development of the luxury consumer goods market and the growing adoption of premium audio technologies. Italy commands 13.0% in 2025, projected to reach 13.1% by 2035, while Spain accounts for 8.5% in 2025, expected to reach 8.6% by 2035. The Netherlands maintains a 4.0% share in 2025, growing to 4.1% by 2035. The Rest of Europe region, including Nordic countries, Eastern Europe, and other markets, is anticipated to maintain its position, holding its collective share at 6.5% by 2035, attributed to increasing consumer electronics modernization and growing premium audio adoption across emerging consumer markets implementing advanced audio standards.

The HIFI electronics market is characterized by competition among established consumer electronics companies, specialized audio equipment manufacturers, and integrated premium audio solution providers. Companies are investing in advanced audio technology research, product innovation, brand development, and comprehensive product portfolios to deliver superior, innovative, and premium Hi-Fi electronics solutions. Innovation in wireless audio technologies, smart connectivity, and precision audio engineering is central to strengthening market position and competitive advantage.

Sony leads the market with comprehensive consumer electronics solutions, offering advanced Hi-Fi products with a focus on audio innovation and premium sound reproduction across diverse consumer applications. Bose provides specialized audio equipment with an focus on acoustic engineering and premium audio experiences. Samsung delivers innovative consumer electronics with a focus on digital integration and smart audio features. LG Electronics specializes in consumer electronics and audio technology with an focus on connectivity and user experience. Yamaha focuses on audio equipment and musical instruments with focus on audio authenticity and performance. Panasonic offers comprehensive consumer electronics with an focus on audio quality and technological innovation.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD million |

| Device Type | Turntables, CD Players, Digital Audio Players (DAPs), Media Streamers, Others |

| Application | Personal Use, Commercial Use |

| Regions Covered | Asia Pacific, North America, Europe, Latin America, Middle East & Africa |

| Countries Covered | China, India, Germany, Brazil, the United States, the United Kingdom, Japan, and 40+ countries |

| Key Companies Profiled | Sony, Bose, Samsung, LG Electronics, Yamaha, and Panasonic |

| Additional Attributes | Dollar sales by device type and application category, regional demand trends, competitive landscape, technological advancements in audio systems, wireless connectivity development, smart audio innovation, and premium experience optimization |

Asia Pacific

North America

Europe

Latin America

Middle East & Africa

The global HiFi electronics market is estimated to be valued at USD 17,243.4 million in 2025.

The market size for the HiFi electronics market is projected to reach USD 37,227.2 million by 2035.

The HiFi electronics market is expected to grow at a 8.0% CAGR between 2025 and 2035.

The key product types in HiFi electronics market are turntables, cd players, digital audio players (daps), media streamers and others.

In terms of application, personal use segment to command 60.0% share in the HiFi electronics market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Electronics Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Electronics Retailing Market Size and Share Forecast Outlook 2025 to 2035

Electronics Films Market Size and Share Forecast Outlook 2025 to 2035

Electronics Cleaning Solvents Market - Growth & Demand 2025 to 2035

Electronics Accessories Market Report – Trends & Forecast 2015-2025

2D Electronics Market

Power Electronics Market Size and Share Forecast Outlook 2025 to 2035

Green Electronics Manufacturing Market – Sustainability & Trends 2025 to 2035

Marine Electronics Market Size and Share Forecast Outlook 2025 to 2035

Marine Electronics Tester Market Size and Share Forecast Outlook 2025 to 2035

Printed Electronics Market Size and Share Forecast Outlook 2025 to 2035

Organic Electronics Market Size and Share Forecast Outlook 2025 to 2035

Defense Electronics Obsolescence Market Size and Share Forecast Outlook 2025 to 2035

Printed Electronics Devices Market Size and Share Forecast Outlook 2025 to 2035

Consumer Electronics Packaging Market Size and Share Forecast Outlook 2025 to 2035

Wearable Electronics Market Size and Share Forecast Outlook 2025 to 2035

Consumer Electronics High Voltage Electric Capacitor Market Size and Share Forecast Outlook 2025 to 2035

Graphene Electronics Market Size and Share Forecast Outlook 2025 to 2035

Consumer Electronics Market - Trends, Growth & Forecast 2025 to 2035

Market Share Insights for Consumer Electronics Packaging Manufacturers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA