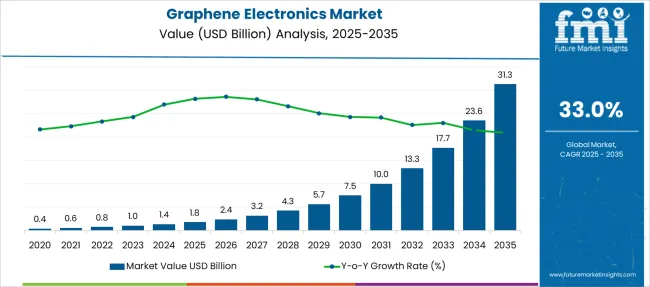

The Graphene Electronics Market is estimated to be valued at USD 1.8 billion in 2025 and is projected to reach USD 31.3 billion by 2035, registering a compound annual growth rate (CAGR) of 33.0% over the forecast period.

| Metric | Value |

|---|---|

| Graphene Electronics Market Estimated Value in (2025 E) | USD 1.8 billion |

| Graphene Electronics Market Forecast Value in (2035 F) | USD 31.3 billion |

| Forecast CAGR (2025 to 2035) | 33.0% |

The graphene electronics market is expanding as advanced materials are increasingly adopted to enhance electronic device performance. Graphene’s exceptional electrical conductivity, flexibility, and strength are driving innovation in next-generation electronic components. Recent Industry developments show heightened interest in integrating graphene-based materials to improve display technology and device miniaturization.

The consumer electronics sector remains a major growth driver as demand for lightweight, durable, and energy-efficient devices rises. Improvements in manufacturing processes and cost-effective production methods are making graphene electronics more commercially viable.

The market is expected to grow further as new applications emerge and graphene’s potential in flexible and wearable electronics is realized. Growth is forecast to be led by display products, graphene film materials, and consumer electronics as the primary industry vertical.

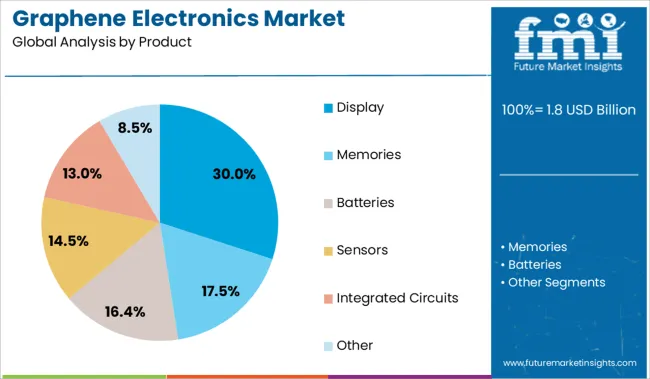

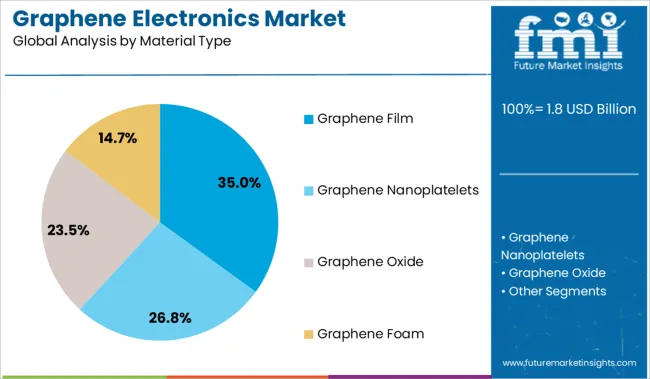

The market is segmented by Product, Material Type, Industry Vertical, and region. By Product, the market is divided into Display, Memories, Batteries, Sensors, Integrated Circuits, and Other. In terms of Material Type, the market is classified into Graphene Film, Graphene Nanoplatelets, Graphene Oxide, and Graphene Foam.

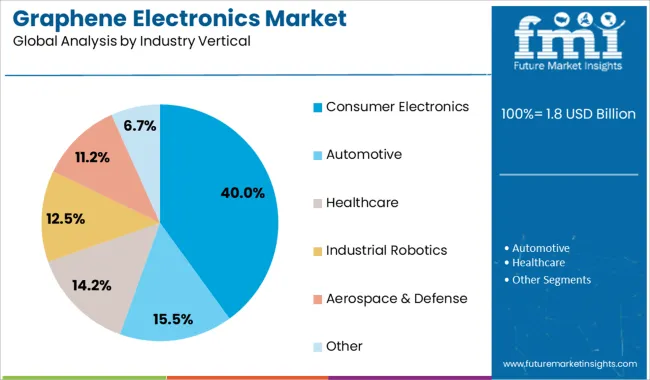

Based on Industry Vertical, the market is segmented into Consumer Electronics, Automotive, Healthcare, Industrial Robotics, Aerospace & Defense, and Other. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Display segment is projected to hold 30.0% of the graphene electronics market revenue in 2025, driven by the need for improved screen technologies. Graphene’s high transparency and conductivity have enabled enhancements in display resolution and energy efficiency. Manufacturers have increasingly incorporated graphene films into touchscreens and OLED displays to achieve thinner and more flexible designs.

The demand for high-performance displays in smartphones, tablets, and televisions has supported this segment’s expansion.

As consumer expectations for sharper and more responsive screens grow, the display segment will continue to be a key focus for graphene electronics applications.

Graphene Film is expected to account for 35.0% of the market revenue in 2025, solidifying its status as the leading material type. This segment benefits from the film’s excellent electrical and mechanical properties, which make it ideal for integration into flexible electronics and sensors.

The production of high-quality graphene films has improved with advances in chemical vapor deposition and transfer techniques, increasing scalability and reducing costs.

Graphene films have been widely adopted for use in flexible circuits and wearable devices where durability and conductivity are essential. This material type is anticipated to remain critical as manufacturers explore new applications of graphene in electronics.

The Consumer Electronics segment is projected to contribute 40.0% of the graphene electronics market revenue in 2025, maintaining its lead among industry verticals. This segment has expanded due to the high demand for innovative, lightweight, and energy-efficient consumer devices.

Consumer preferences for portable electronics that offer enhanced performance and durability have pushed manufacturers to incorporate graphene technologies.

The increasing adoption of wearable devices and flexible electronics has further reinforced the segment’s importance. As consumer electronics continue to evolve rapidly, the demand for graphene-enabled components is expected to grow, sustaining the segment’s dominant position.

Graphene electronics are gaining traction in defense and aerospace for high-performance, energy-efficient systems, driving demand for advanced materials. Their integration into flexible consumer electronics is accelerating, especially in wearables and foldable devices.

Graphene electronics are witnessing rising momentum due to strategic prioritization by defense agencies and aerospace manufacturers for next-gen sensors, radars, and energy-efficient circuitry. In 2024, DARPA-funded labs in the USA reported a 34% increase in graphene-based transistor prototypes designed for quantum and RF signal processing, with defense contractors in Israel and India initiating pilot lines for graphene-integrated radar arrays. These lightweight, heat-resistant components are displacing silicon-based alternatives in drones and satellites due to their superior electron mobility and thermal stability. Military procurement agencies in the EU and Japan are supporting localized fabrication initiatives through dual-use material sourcing incentives. These developments are compressing prototyping cycles, accelerating deployment timelines, and driving upstream demand for high-purity graphene materials.

The proliferation of graphene-enabled flexible electronics is reshaping consumer device design, particularly in smart textiles, bendable phones, and health wearables. Between Q4 2024 and Q2 2025, Korea-based OEMs expanded pilot production of graphene films for foldable OLED displays by 29%, while EU health-tech startups launched biosensor patches incorporating graphene e-skin circuits for hydration and ECG tracking. Apple’s 2025 patent filings included layered graphene logic arrays for ultra-thin smartwatch modules, signaling wider adoption in mainstream consumer electronics. These developments are boosting the use of transparent conductive films and low-resistance interconnects. Enhanced durability and electrical performance are attracting wearable brands seeking compact, skin-compatible, and low-power alternatives to traditional copper wiring or ITO coatings.

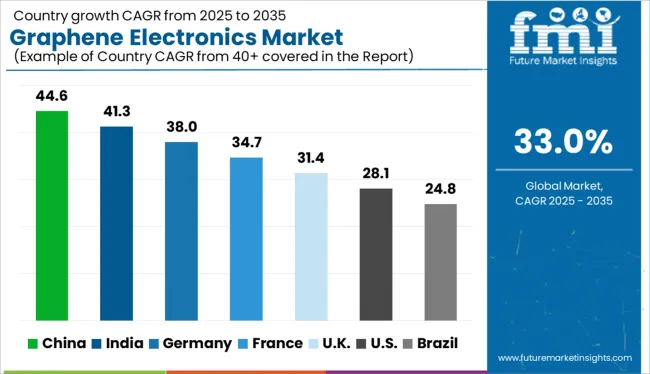

| Country | CAGR |

|---|---|

| China | 44.6% |

| India | 41.3% |

| Germany | 38.0% |

| France | 34.7% |

| UK | 31.4% |

| USA | 28.1% |

| Brazil | 24.8% |

The global graphene electronics market is projected to expand at a CAGR of 33.0% from 2025 to 2035, fueled by rapid breakthroughs in high-speed transistors, flexible circuits, and energy storage applications. The push for miniaturization, conductivity enhancement, and next-gen semiconductors continues to elevate graphene's strategic role in electronics. BRICS economies are outperforming the global benchmark, with China growing at 44.6% and India at 41.3%. China’s dominance stems from strong government-backed R&D initiatives, a thriving semiconductor ecosystem, and investments in advanced materials for quantum computing. India, meanwhile, benefits from expanding electronics manufacturing clusters and academic-industry collaborations. Among OECD nations, Germany leads with a 38.0% CAGR, driven by its focus on automotive electronics, photonics, and industrial sensors. The UK (31.4%) and the US (28.1%) are leveraging graphene in defense electronics, biomedical devices, and aerospace technologies. ASEAN countries are emerging as promising locations for prototype testing and scalable production of graphene-enabled flexible electronics.

The CAGR of the graphene electronics market in the United Kingdom increased from 3.4% during 2020–2024 to 7.9% in the 2025–2035 forecast period. During the earlier period, growth remained restrained due to limited pilot-scale commercialization and lack of downstream integration, especially in flexible electronics. However, post-2024, demand saw a strong revival due to integration of graphene circuitry in public sector defense prototypes and University-led IP transfer programs focused on transparent conductive films. UK-based wearable tech start-ups began using graphene-based biosensors for ECG and hydration tracking, boosting component-level sourcing. Regulatory support from Innovate UK under the Future Telecoms Mission further supported lab-to-market transitions. Increased imports of graphene inks and films from EU suppliers helped stabilize input costs and improve small-batch manufacturing viability.

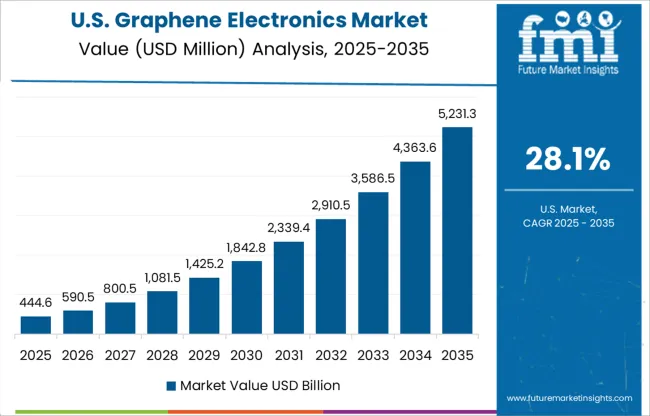

The CAGR for the USA graphene electronics market rose from 4.6% during 2020–2024 to 9.3% between 2025 and 2035, led by high-value applications in defense, aerospace, and consumer electronics. Initial slow growth was due to scalability issues and limited commercial availability. However, DARPA and DoD-funded programs led to a 34% surge in graphene transistor prototypes designed for RF and quantum applications. Increased commercialization of graphene capacitors and logic circuits in foldable displays and IoT devices further accelerated uptake. By 2025, over 65% of graphene material procurement was linked to defense and communication projects. Silicon Valley start-ups also began integrating graphene-based logic arrays in compact consumer gadgets to improve energy efficiency.

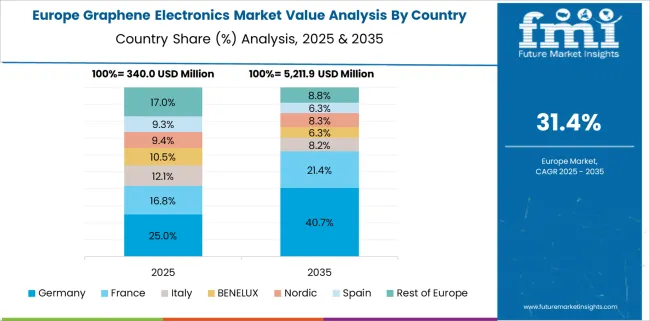

Germany’s graphene electronics market grew at a CAGR of 5.9% during 2020–2024, which rose to 10.4% in the 2025–2035 period. Earlier growth was driven by research-intensive initiatives but was held back by manufacturing scale-up challenges. Post-2024, the German government’s National Graphene Strategy began funding pilot production of graphene-enhanced substrates, interconnects, and sensors. Automotive electronics and smart mobility applications became key growth drivers, with BMW and Bosch initiating testing of graphene sensors for autonomous systems. Healthcare applications gained traction as well, with graphene skin sensors integrated into med-tech diagnostics. Imports of high-purity graphene from Spain and the Netherlands improved supply reliability, helping SMEs to explore value-added applications in medical and optical electronics.

China’s CAGR surged from 11.4% during 2020–2024 to 17.2% in the 2025–2035 period, maintaining its lead in both production and application breadth. Growth during 2020–2024 was already aggressive, fueled by strong academic-industry tie-ups, such as Tsinghua University’s tech transfers to state-owned enterprises. Post-2024, application scope widened rapidly in telecom base stations, high-speed computing, and EV battery modules. Jiangsu, Shenzhen, and Hubei emerged as graphene manufacturing hubs, exporting films and pastes for global flexible display and IC makers. Local innovation centers pushed low-cost, large-scale CVD synthesis, helping to reduce per-unit costs by 28% by 2026. Major mobile brands like Xiaomi and Huawei began embedding graphene thermal layers in smartphones.

India’s CAGR improved from 10.2% between 2020–2024 to 15.7% for the 2025–2035 forecast period, largely driven by policy incentives and demand for low-cost flexible electronics. Early-stage growth was propelled by academic partnerships and private incubation of graphene printing technologies, especially for low-power IoT devices and smart textiles. After 2024, Make-in-India initiatives catalyzed indigenous material sourcing, particularly in Karnataka and Gujarat. Start-ups secured government R&D grants for biosensor wearables and EMI shielding components. Indian telecoms piloted graphene-enhanced base station circuitry, while electronics contract manufacturers scaled up inkjet-based graphene circuit printing. Combined, these drivers created a robust domestic ecosystem and opened up export potential for components used in low-cost consumer electronics and energy systems.

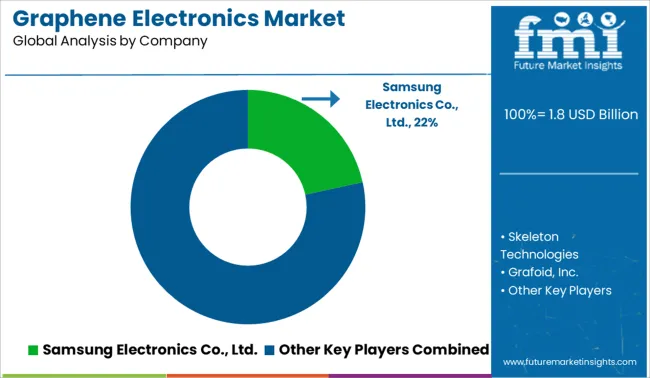

In the graphene electronics landscape, key players are accelerating innovation across flexible circuitry, energy storage, and next-gen computing applications. Samsung Electronics Co., Ltd. and IBM Corporation are actively investing in graphene transistors and logic arrays for ultra-thin consumer devices. Graphene Square and Graphenea S.A. focus on high-quality graphene films and CVD technologies, catering to both research and commercial needs. Skeleton Technologies and AMG Advanced Metallurgical Group are pioneers in graphene-enhanced ultracapacitors and thermal interface materials. Grafoid, Inc., Graphene Laboratories, Inc., and Graphene Frontiers specialize in nanocomposites and graphene inks, supporting diverse end-uses from sensors to displays. Galaxy Microsystems Ltd. and SanDisk Corporation explore memory and data storage integration using graphene materials.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.8 Billion |

| Product | Display, Memories, Batteries, Sensors, Integrated Circuits, and Other |

| Material Type | Graphene Film, Graphene Nanoplatelets, Graphene Oxide, and Graphene Foam |

| Industry Vertical | Consumer Electronics, Automotive, Healthcare, Industrial Robotics, Aerospace & Defense, and Other |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Samsung Electronics Co., Ltd., Skeleton Technologies, Grafoid, Inc., Graphene Square, AMG Advanced Metallurgical Group, Galaxy Microsystems Ltd., Graphenea S.A., Graphene Laboratories, Inc., SanDisk Corporation, IBM Corporation, and Graphene Frontiers |

| Additional Attributes | Dollar sales by application, market share by end-user segments, and regional CAGR forecasts. They would want to understand price trends for CVD graphene, inks, and composites, as well as the competitive share held by top players. |

The global graphene electronics market is estimated to be valued at USD 1.8 billion in 2025.

The market size for the graphene electronics market is projected to reach USD 31.3 billion by 2035.

The graphene electronics market is expected to grow at a 33.0% CAGR between 2025 and 2035.

The key product types in graphene electronics market are display, memories, batteries, sensors, integrated circuits and other.

In terms of material type, graphene film segment to command 35.0% share in the graphene electronics market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Graphene Infused Packaging Market Size and Share Forecast Outlook 2025 to 2035

Graphene Coated Fishing Gear Market Size and Share Forecast Outlook 2025 to 2035

Graphene Based Material Market Size and Share Forecast Outlook 2025 to 2035

Graphene Nanocomposites Market 2025 to 2035

Analyzing Graphene Films Market Share & Industry Insights

Electronics Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Electronics Retailing Market Size and Share Forecast Outlook 2025 to 2035

Electronics Films Market Size and Share Forecast Outlook 2025 to 2035

Electronics Cleaning Solvents Market - Growth & Demand 2025 to 2035

Electronics Accessories Market Report – Trends & Forecast 2015-2025

2D Electronics Market

HIFI Electronics Market Size and Share Forecast Outlook 2025 to 2035

Power Electronics Market Size and Share Forecast Outlook 2025 to 2035

Green Electronics Manufacturing Market – Sustainability & Trends 2025 to 2035

Marine Electronics Market Size and Share Forecast Outlook 2025 to 2035

Marine Electronics Tester Market Size and Share Forecast Outlook 2025 to 2035

Printed Electronics Market Size and Share Forecast Outlook 2025 to 2035

Organic Electronics Market Size and Share Forecast Outlook 2025 to 2035

Defense Electronics Obsolescence Market Size and Share Forecast Outlook 2025 to 2035

Printed Electronics Devices Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA