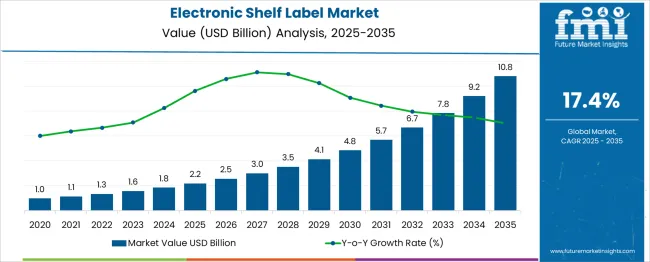

The global electronic shelf label market is expected to grow from USD 2.17 billion in 2025 to approximately USD 10.8 billion by 2035, recording an absolute increase of USD 8.6 billion over the forecast period. This translates into a total growth of 397.2%, with the market forecast to expand at a compound annual growth rate (CAGR) of 17.4% between 2025 and 2035. The overall market size is expected to grow by nearly 4.98X during the same period, supported by increasing retail digitization, growing demand for real-time pricing updates, and rising adoption of IoT technologies in retail environments.

Between 2025 and 2030, the electronic shelf label market is projected to expand from USD 2.17 billion to USD 4.8 billion, resulting in a value increase of USD 2.6 billion, which represents 30.4% of the total forecast growth for the decade. This phase of growth will be shaped by increasing retail automation, growing demand for omnichannel retail solutions, and rising penetration of smart retail technologies in emerging markets. Retail chains are expanding their digital transformation initiatives to address the growing demand for efficient inventory management and dynamic pricing solutions.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 2.17 billion |

| Forecast Value in (2035F) | USD 10.8 billion |

| Forecast CAGR (2025 to 2035) | 17.4% |

Market expansion is being supported by the increasing demand for retail automation and the corresponding need for real-time pricing management systems. Modern retailers are increasingly focused on operational efficiency measures that can reduce labor costs, minimize pricing errors, and enable dynamic pricing strategies. Electronic shelf labels' proven efficacy in automating price updates and supporting inventory management makes them a preferred solution in digital retail transformations.

The growing emphasis on omnichannel retail experiences and sustainable operations is driving demand for electronic shelf label systems that integrate seamlessly with existing retail infrastructure. Retailer preference for solutions that combine real-time pricing updates with inventory tracking and customer engagement capabilities is creating opportunities for innovative electronic shelf label implementations. The rising influence of e-commerce pricing dynamics and competitive pricing strategies is also contributing to increased product adoption across different retail segments and store formats.

The market is segmented by component, type, communication technology, size, application, and region. By component, the market is divided into displays, batteries, transceivers, microprocessors, and others. Based on type, the market is categorized into E-paper displays, graphic E-paper displays, LCDs, and others. In terms of communication technology, the market is segmented into radio frequency, infrared, and near-field communications. By size, the market is classified into ≤ 3 inches, 3 to 7 inches, 7 to 10 inches, and ≥ 10 inches. By application, the market is divided into retail and industrial. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

The displays component is projected to account for 44% of the electronic shelf label market in 2025, reaffirming its position as the category's most critical element. Retailers increasingly understand the importance of clear, readable displays for effective price communication and customer engagement. Electronic shelf label displays' well-documented performance in various lighting conditions and their ability to maintain clarity while consuming minimal power directly address operational efficiency concerns.

This component forms the foundation of most electronic shelf label systems, as it represents the primary interface between retailers and customers for price information display. Technology advancements and ongoing display quality improvements continue to strengthen retailer confidence in electronic shelf label implementations. With retail environments requiring reliable and energy-efficient display solutions, the display component aligns with both operational efficiency and customer experience goals. Its critical role in system functionality ensures sustained dominance, making it the central growth driver of the electronic shelf label market demand.

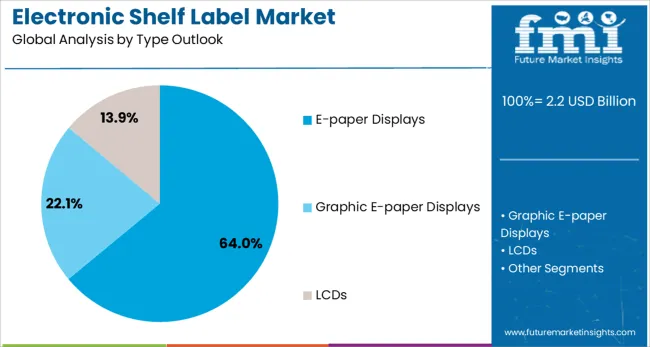

E-paper displays are projected to represent 64.0% of electronic shelf label demand in 2025, underscoring their role as the preferred display technology for retail price management applications. Retailers gravitate toward e-paper displays for their ultra-low power consumption, excellent readability in various lighting conditions, and the ability to maintain displayed information without a continuous power supply. Positioned as the optimal technology for retail environments, e-paper displays offer both operational benefits, such as extended battery life, and performance benefits, including clear price visibility and professional appearance.

The segment is supported by the rising adoption of sustainable retail technologies, where e-paper displays play a central role in energy-efficient operations. Additionally, manufacturers are increasingly combining e-paper technology with advanced communication protocols and enhanced durability features, improving appeal and justifying implementation costs. As retailers prioritize operational efficiency and sustainability, e-paper display-based electronic shelf labels will continue to dominate demand, reinforcing their position as the preferred technology within the digital retail infrastructure market.

The radio frequency communication technology is forecasted to contribute 67.0% of the electronic shelf label market in 2025, reflecting its superior performance in retail environments requiring reliable wireless communication. Retailers are increasingly focused on communication reliability, preferring radio frequency technology for its ability to maintain consistent connectivity across large retail spaces and through various physical obstacles. This aligns with the need for dependable price update systems that can operate effectively in complex retail environments.

Radio frequency technology provides the range and reliability necessary for comprehensive store coverage, reassuring retailers about system performance and data transmission accuracy. The segment also benefits from retailers willingness to invest in proven communication technologies that combine performance with operational reliability. With established infrastructure compatibility and demonstrated effectiveness in retail applications, radio frequency communication serves as a powerful differentiator, making it a critical driver of trust and system adoption in the electronic shelf label category.

The electronic shelf label market is advancing rapidly due to increasing retail digitization and growing demand for automated pricing solutions. However, the market faces challenges including high initial implementation costs, technology integration complexities, and competition from traditional paper labels. Innovation in display technologies and wireless communication systems continue to influence product development and market expansion patterns.

The growing adoption of Internet of Things (IoT) technologies is enabling retailers to integrate electronic shelf labels with comprehensive inventory management and customer analytics systems. Smart retail infrastructure offers real-time data collection, automated inventory tracking, and personalized customer engagement capabilities that influence operational decisions. Advanced analytics and machine learning integration are driving system sophistication and operational efficiency, particularly among retailers who prefer integrated digital solutions.

Modern electronic shelf label manufacturers are incorporating advanced display technologies such as color e-paper, flexible displays, and enhanced refresh rate capabilities to improve visual appeal and functionality. These technologies improve the customer experience while extending battery life and providing better operational performance. Advanced energy management techniques also enable longer deployment cycles and reduced maintenance requirements for large-scale retail implementations.

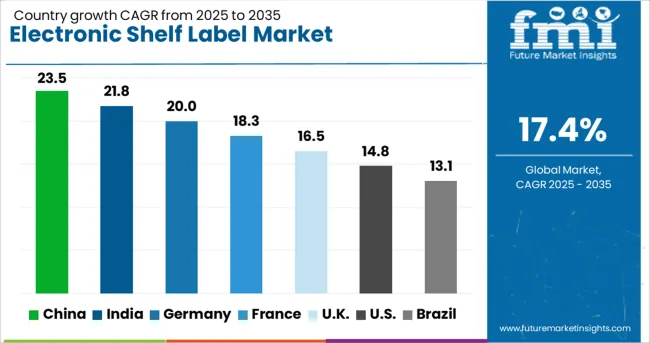

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 23.5% |

| India | 21.8% |

| Germany | 20.0% |

| France | 18.3% |

| UK | 16.5% |

| USA | 14.8% |

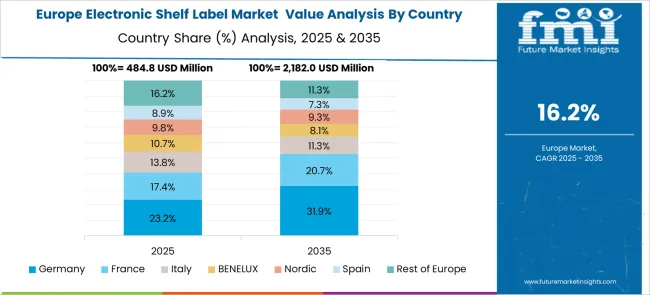

The electronic shelf label market is experiencing robust growth globally, with China leading at a 23.5% CAGR through 2035, driven by rapid retail modernization, increasing adoption of smart retail technologies, and growing penetration of automated retail solutions. India follows closely at 21.8%, supported by expanding retail infrastructure, rising consumer electronics adoption, and increasing demand for retail efficiency solutions. Germany shows strong growth at 20.0%, emphasizing advanced retail technologies and automated pricing systems. France records 18.3%, focusing on retail innovation and digital commerce integration. The UK shows 16.5% growth, prioritizing omnichannel retail strategies and technology-driven customer experiences.

The report covers an in-depth analysis of 40+ countries; six top-performing countries are highlighted below.

Revenue from electronic shelf labels in China is projected to exhibit strong growth with a CAGR of 23.5% through 2035, driven by rapid adoption of retail automation among major retail chains and increasing influence of digital commerce integration. The country's expanding retail infrastructure and growing technology adoption are creating significant demand for advanced electronic shelf label systems. Major international and domestic technology providers are establishing comprehensive distribution networks to serve the growing population of retailers seeking automated pricing solutions across tier-1 and tier-2 cities.

Revenue from electronic shelf labels in India is expanding at a CAGR of 21.8%, supported by increasing retail infrastructure development, growing technology adoption, and rising penetration of modern retail formats. The country's expanding retail sector and increasing exposure to global retail technologies are driving demand for efficient automated pricing solutions. International technology providers and domestic system integrators are establishing implementation capabilities to serve the growing demand for retail automation technologies.

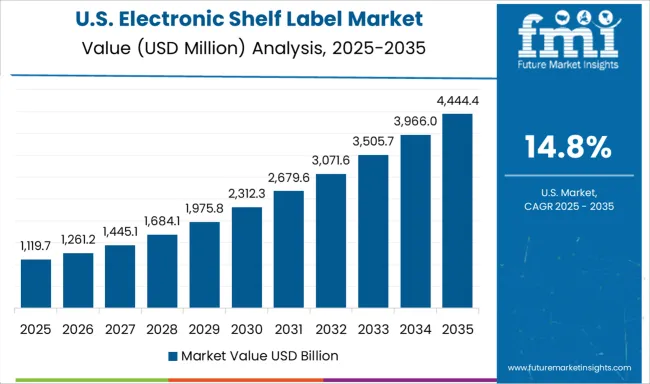

Demand for electronic shelf labels in the USA is projected to grow at a CAGR of 14.8%, supported by retailer preference for proven technology solutions and comprehensive retail automation strategies. American retailers are increasingly focused on operational efficiency, competitive pricing capabilities, and integrated retail technology ecosystems. The market is characterized by strong demand for advanced systems that combine electronic shelf labels with inventory management and customer analytics capabilities.

Revenue from electronic shelf labels in Germany is projected to grow at a CAGR of 20.0% through 2035, driven by the country's strong focus on retail technology, operational efficiency, and retailer preference for proven automated solutions. German retailers consistently demand high-quality, reliable systems that deliver measurable operational improvements while maintaining system stability.

Revenue from electronic shelf labels in the UK is projected to grow at a CAGR of 16.5% through 2035, supported by rising retailer interest in omnichannel strategies and integrated retail technology solutions. British retailers value system reliability, operational efficiency, and proven technology performance, positioning electronic shelf labels as a core component of modern retail operations.

Revenue from electronic shelf labels in France is projected to grow at a CAGR of 18.3% through 2035, supported by the country's strong emphasis on retail innovation, operational excellence, and technology-driven customer experiences. French retailers prioritize system reliability and comprehensive functionality, making electronic shelf labels a trusted choice in the advanced retail technology segment.

The electronic shelf label market is characterized by competition among established technology providers, specialty retail solution companies, and emerging smart retail players. Companies are investing in advanced display technologies, wireless communication systems, comprehensive software platforms, and retail integration services to deliver effective, reliable, and scalable electronic shelf label solutions. Technology innovation, system reliability, and retail partnership development are central to strengthening product portfolios and market presence.

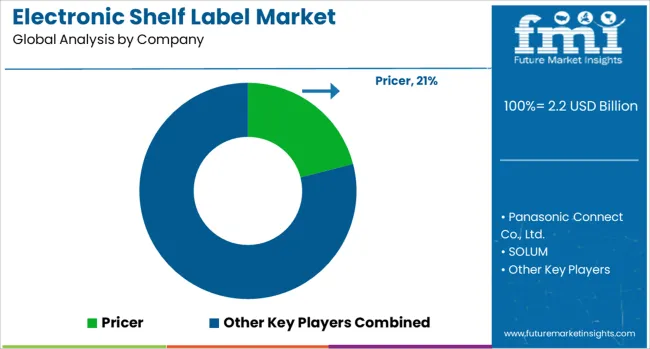

Pricer, globally operating, leads the market with 21.0% global value share, offering comprehensive electronic shelf label solutions with a focus on retail automation and operational efficiency. Panasonic Connect Co., Ltd., Japan-based, provides reliable, technology-integrated electronic shelf label systems with transparent system performance and robust hardware design. SOLUM, South Korea, delivers advanced electronic shelf label platforms with emphasis on system scalability and retailer partnership development. VusionGroup, France, focuses on comprehensive retail technology solutions that combine electronic shelf labels with integrated retail management systems.

Hangzhou Zkong Networks Co., Ltd. and Shanghai SUNMI Technology Co., Ltd., operating in Asia, provide specialized electronic shelf label solutions across multiple retail segments and implementation scales. Teraoka (Pty) Ltd, South Africa, emphasizes reliable retail technology integration with proven implementation methodologies. Displaydata Ltd, UK, offers technology-focused electronic shelf label products with emphasis on system performance and energy efficiency. M2COMM and Opticon provide specialized retail automation solutions with focus on specific market segments and customized implementation approaches.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 2.17 Billion |

| Component | Displays, Batteries, Transceivers, Microprocessors, Others |

| Type | E-paper Displays, Graphic E-paper Displays, LCDs, Others |

| Communication Technology | Radio Frequency, Infrared, Near-field Communications |

| Size | ≤ 3 inches, 3 to 7 inches, 7 to 10 inches, ≥ 10 inches |

| Application | Retail, Industrial |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Pricer, Panasonic Connect Co., Ltd., SOLUM, VusionGroup, Hangzhou Zkong Networks Co., Ltd., Teraoka (Pty) Ltd, Displaydata Ltd, M2COMM, Opticon, Shanghai SUNMI Technology Co., Ltd., and others |

| Additional Attributes | Dollar sales by display technology and communication protocol, regional deployment trends, competitive landscape, retailer preferences for wireless versus wired systems, integration with inventory management and POS systems, innovations in battery technology, display durability, and sustainable technology practices |

The global electronic shelf label market is estimated to be valued at USD 2.2 billion in 2025.

The market size for the electronic shelf label market is projected to reach USD 10.8 billion by 2035.

The electronic shelf label market is expected to grow at a 17.4% CAGR between 2025 and 2035.

The key product types in electronic shelf label market are displays, batteries, transceivers, microprocessors and others.

In terms of type outlook, e-paper displays segment to command 64.0% share in the electronic shelf label market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Electronic Circulation Pump Market Size and Share Forecast Outlook 2025 to 2035

Electronic Lab Notebook (ELN) Market Size and Share Forecast Outlook 2025 to 2035

Electronic Control Unit in Automotive Systems Market Size and Share Forecast Outlook 2025 to 2035

Electronic Film Market Size and Share Forecast Outlook 2025 to 2035

Electronic Weighing Scale Market Size and Share Forecast Outlook 2025 to 2035

Electronic Packaging Adhesives Market Forecast and Outlook 2025 to 2035

Electronic Sealants Market Size and Share Forecast Outlook 2025 to 2035

Electronic Nasal Spray Devices Market Size and Share Forecast Outlook 2025 to 2035

Electronic Expansion Valves Market Size and Share Forecast Outlook 2025 to 2035

Electronics Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Electronic Tactile Tester Market Size and Share Forecast Outlook 2025 to 2035

Electronic Trial Master File (eTMF) System Market Size and Share Forecast Outlook 2025 to 2035

Electronic Wipes Market Size and Share Forecast Outlook 2025 to 2035

Electronic Grade Trisilylamine Market Size and Share Forecast Outlook 2025 to 2035

Electronically Scanned Arrays System Market Size and Share Forecast Outlook 2025 to 2035

Electronics Retailing Market Size and Share Forecast Outlook 2025 to 2035

Electronic Dictionary Market Size and Share Forecast Outlook 2025 to 2035

Electronics Films Market Size and Share Forecast Outlook 2025 to 2035

Electronic Payment System For Transportation Market Size and Share Forecast Outlook 2025 to 2035

Electronic Skin Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA