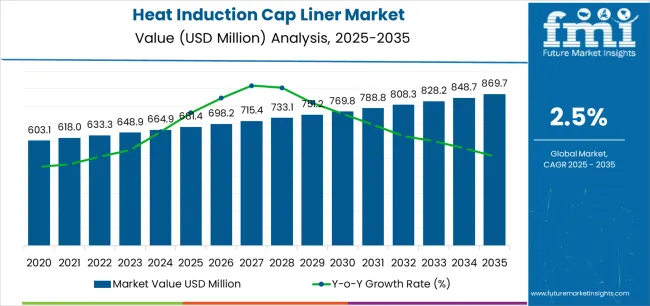

The Heat Induction Cap Liner Market is estimated to be valued at USD 681.4 million in 2025 and is projected to reach USD 869.7 million by 2035, registering a compound annual growth rate (CAGR) of 2.5% over the forecast period.

The heat induction cap liner market is experiencing steady growth driven by the expanding packaging industry, increased demand for product safety, and growing adoption of tamper-evident sealing solutions across various sectors. Current market dynamics reflect rising utilization of induction liners in food, beverage, pharmaceutical, and cosmetic packaging to enhance shelf life and prevent leakage or contamination. Manufacturers are focusing on material innovation and sustainability, with recyclable and high-barrier liners gaining traction.

Regulatory compliance related to packaging safety and product integrity is further encouraging market adoption. The future outlook indicates continuous expansion due to the proliferation of e-commerce and the growing importance of secure packaging in logistics and distribution.

Growth rationale is supported by the integration of advanced sealing technologies, improved production efficiency, and increased customization for diverse container types These factors are expected to maintain consistent market expansion, reinforcing the role of induction cap liners as a critical component in modern packaging systems.

| Metric | Value |

|---|---|

| Heat Induction Cap Liner Market Estimated Value in (2025 E) | USD 681.4 million |

| Heat Induction Cap Liner Market Forecast Value in (2035 F) | USD 869.7 million |

| Forecast CAGR (2025 to 2035) | 2.5% |

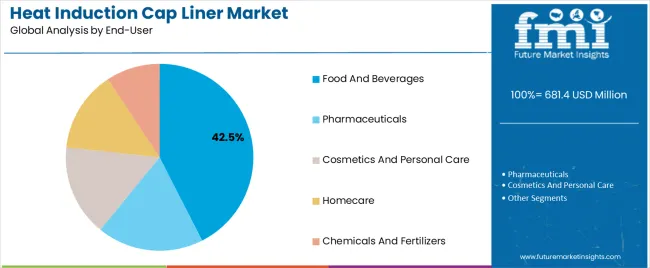

The market is segmented by Material, Application, and End-User and region. By Material, the market is divided into Rubber, Metal (foil), Plastic, and Paper. In terms of Application, the market is classified into Bottles and Jars. Based on End-User, the market is segmented into Food And Beverages, Pharmaceuticals, Cosmetics And Personal Care, Homecare, and Chemicals And Fertilizers. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The rubber segment, accounting for 36.40% of the material category, has been leading the market due to its superior sealing properties, flexibility, and compatibility with a wide range of container materials. The segment’s dominance is driven by its ability to provide an airtight and leak-proof seal, ensuring product preservation and safety during storage and transportation.

Consistent demand from industries requiring high durability and chemical resistance has reinforced the use of rubber-based liners. Production advancements have enhanced liner performance under varying temperature and pressure conditions, supporting their suitability across multiple packaging formats.

The material’s cost-effectiveness and adaptability to automated sealing systems have further contributed to its broad market acceptance Continued innovation in formulation and manufacturing processes is expected to sustain the rubber segment’s leading position throughout the forecast period.

The bottles segment, representing 58.70% of the application category, has been dominating the market due to extensive use in food, beverage, pharmaceutical, and personal care packaging. Its strong position is attributed to increasing global consumption of packaged liquids and the necessity for secure, tamper-evident closures.

Manufacturers are focusing on enhancing liner compatibility with various bottle neck materials, including glass and plastic, to ensure optimal sealing performance. The rise of convenience packaging, combined with regulatory emphasis on product safety, has supported continued adoption.

Technological improvements in induction sealing machinery have increased production speed and reliability, reinforcing the preference for bottle applications The segment’s share is expected to remain stable as the packaging industry continues to expand across both developed and emerging markets.

The food and beverages segment, holding 42.50% of the end-user category, has emerged as the leading consumer of heat induction cap liners due to stringent safety standards and the need to maintain product freshness. Growth is supported by increasing demand for packaged foods and ready-to-drink beverages, which require secure sealing solutions to prevent spoilage and contamination.

Regulatory compliance and consumer preference for hygienic packaging have reinforced the segment’s dominance. Continuous innovation in liner materials to enhance barrier properties and recyclability has improved overall sustainability and performance.

Expanding global trade of packaged consumables and the rise of private-label brands are further stimulating demand As manufacturers prioritize safety, convenience, and extended shelf life, the food and beverages segment is expected to retain its leadership position in the coming years.

| Leading Application | Bottles |

|---|---|

| Value Share (2025) | 51.30% |

Bottles are expected to dominate the application segment by achieving a share of 51.30% in 2025. Key factors that are driving the growth of the bottles segment are as follows:

| Leading End Use | Food |

|---|---|

| Value Share (2025) | 23.80% |

The food segment is expected to lead the heat induction cap liner market. The segment is expected to acquire 23.80% in 2025. Key factors that are promoting the segment’s growth are as follows:

| Countries | Forecast CAGR (2025 to 2035) |

|---|---|

| The United States | 1.70% |

| Spain | 2.50% |

| India | 4.70% |

| China | 3.70% |

| Thailand | 2.90% |

The heat induction cap liner market in the United States is expected to register a CAGR of 1.7% through 2035. The market dynamics are impacted by following factors:

The heat induction cap liner industry in Spain is projected to be propelled by a 2.5% CAGR from 2025 to 2035. Growth in Spain is driven by:

Heat induction cap liner market in India is expected to hold a high potential for leading manufacturers. The market in India is estimated to record a CAGR of 4.7% through 2035. Following factors propel the market:

Demand for heat induction cap liners in China is estimated to register a CAGR of 3.7% over the forecast period. Key factors that are compelling market growth are:

Sales of heat induction cap liners in Thailand are rising at a CAGR of 2.9% through 2035. Over the forecast period, the market is driven by following factors:

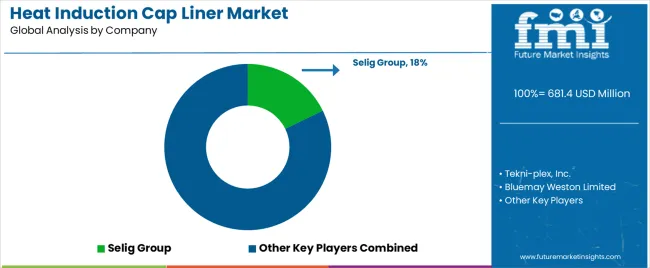

Manufacturers of heat induction cap liners are increasing and upgrading their line of induction cap liners to meet the rising demand for hygienic and sanitized product packaging from on-the-go customers. Players are also focusing on design to drive optimum customer convenience.

Market participants are targeting end use industries like food and beverages where demand for heat induction cap liners is high. As a result, they are raising their production capability to produce heat induction cap liners developed to be compatible with the altering requirements of end users.

Constant progress made in induction sealing technology has also paved the way for smart and more advanced induction cap liners. Heat induction cap liner manufacturers are focusing on high growth countries in South East Asia, like India and China, where appetite of millennial population is significantly high for on-the-go food and beverage products. By focusing on consumer convenience, players can boost wider adoption.

The global heat induction cap liner market is estimated to be valued at USD 681.4 million in 2025.

The market size for the heat induction cap liner market is projected to reach USD 869.7 million by 2035.

The heat induction cap liner market is expected to grow at a 2.5% CAGR between 2025 and 2035.

The key product types in heat induction cap liner market are rubber, metal (foil), plastic and paper.

In terms of application, bottles segment to command 58.7% share in the heat induction cap liner market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cap Liner Market Size and Share Forecast Outlook 2025 to 2035

Examining Market Share Trends in the Cap Liner Industry

Cap Liner Films Market

Foam Cap Liners Market Size and Share Forecast Outlook 2025 to 2035

Understanding Market Share Trends in Foam Cap Liners

Market Share Insights of PVC-Free Cap Liner Manufacturers

PVC-free Cap Liners Market

Heat Exchanger Inspection Service Market Size and Share Forecast Outlook 2025 to 2035

Capacitor Bushing Market Size and Share Forecast Outlook 2025 to 2035

Induction Brazing Services Market Size and Share Forecast Outlook 2025 to 2035

Heat-Treated NiTi Endodontic File Market Size and Share Forecast Outlook 2025 to 2035

Heated Sampling Composite Tube Market Size and Share Forecast Outlook 2025 to 2035

Caprolactam Market Size and Share Forecast Outlook 2025 to 2035

Capacitor Film Slitter Market Size and Share Forecast Outlook 2025 to 2035

Capsule Vision Inspection Solution Market Size and Share Forecast Outlook 2025 to 2035

Heat Seal Film Market Size and Share Forecast Outlook 2025 to 2035

Heat Shrink Fitting Machines Market Size and Share Forecast Outlook 2025 to 2035

Induction Cooktop Market Forecast and Outlook 2025 to 2035

Heat Detachable Tape Market Size and Share Forecast Outlook 2025 to 2035

Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA