The heat seal film market is experiencing robust expansion driven by rising demand for efficient packaging materials across the food, pharmaceutical, and consumer goods industries. Growth is being supported by advancements in polymer technology, enhanced sealing performance, and increasing adoption of sustainable materials. The current market environment reflects strong utilization in flexible packaging, where attributes such as durability, clarity, and barrier protection are highly valued.

Manufacturers are focusing on improving thermal resistance and seal integrity to meet diverse end-use requirements. The future outlook indicates continued expansion as e-commerce growth, changing consumer lifestyles, and the preference for convenient, ready-to-use products stimulate demand. Regulatory focus on recyclable and eco-friendly films is expected to influence material selection and production innovation.

Growth rationale rests on the industry’s ability to balance performance, cost efficiency, and sustainability while maintaining high operational throughput As a result, heat seal films are expected to remain integral to modern packaging applications across multiple sectors.

| Metric | Value |

|---|---|

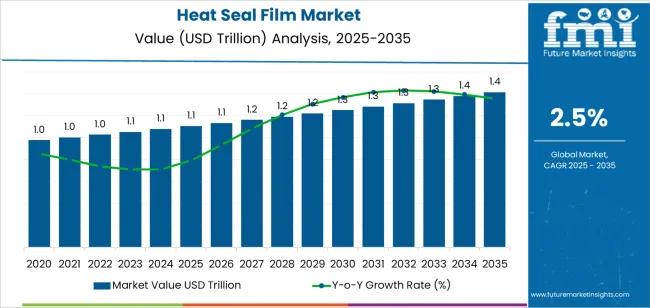

| Heat Seal Film Market Estimated Value in (2025 E) | USD 1.1 trillion |

| Heat Seal Film Market Forecast Value in (2035 F) | USD 1.4 trillion |

| Forecast CAGR (2025 to 2035) | 2.5% |

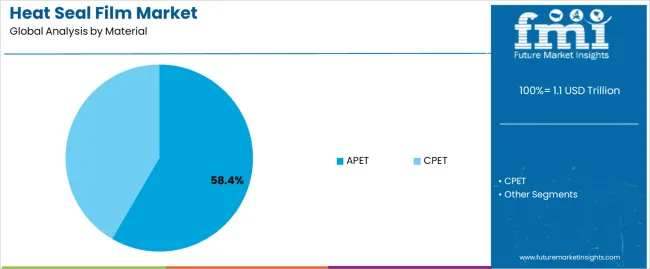

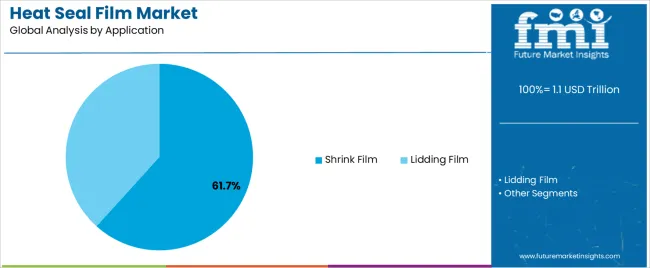

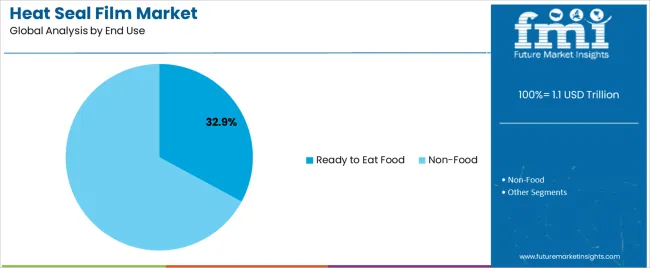

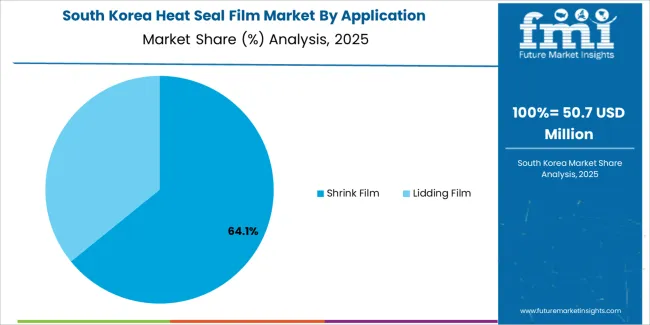

The market is segmented by Material, Application, End Use, and Layer Structure and region. By Material, the market is divided into APET and CPET. In terms of Application, the market is classified into Shrink Film and Lidding Film. Based on End Use, the market is segmented into Ready to Eat Food and Non-Food. By Layer Structure, the market is divided into Multilayer Films and Monolayer Films. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The APET segment, accounting for 58.40% of the material category, has emerged as the dominant material due to its excellent clarity, thermal stability, and sealing properties. Its widespread adoption has been driven by superior performance in forming tight seals, maintaining product freshness, and providing high barrier protection.

Manufacturers prefer APET for its recyclability and compatibility with sustainable packaging objectives, aligning with evolving regulatory and consumer trends. Its high strength-to-weight ratio supports efficient material usage and transportation economics.

Continuous process optimization and improvements in extrusion technology have further enhanced its cost-effectiveness and sealing reliability With increasing emphasis on premium packaging quality, the APET segment is expected to maintain its leading position, supported by strong penetration across both food and industrial packaging applications.

The shrink film segment, representing 61.70% of the application category, has achieved leading status owing to its versatility, adaptability to automated packaging lines, and capability to provide tamper-evident sealing. Its extensive use in food and beverage packaging, pharmaceuticals, and logistics has strengthened its market share. Demand is being supported by the growing need for secure and visually appealing packaging that enhances shelf presence.

Improved heat distribution and sealing performance have made shrink films suitable for high-speed manufacturing environments. Moreover, advances in multilayer film design have increased their protective strength and clarity.

Ongoing adoption in retail-ready packaging and bundle wrapping further reinforces growth The segment’s continued dominance is expected as manufacturers optimize shrink film formulations to balance performance, sustainability, and cost efficiency in large-scale applications.

The ready-to-eat food segment, holding 32.90% of the end-use category, has been driving market growth due to changing dietary habits and expanding demand for convenient meal solutions. Increasing urbanization and busy lifestyles have accelerated the shift toward packaged, ready-to-consume products that require durable and hygienic sealing.

Heat seal films are being favored for their ability to preserve freshness, prevent contamination, and ensure extended shelf life. The segment’s growth is further supported by the rise of quick-service restaurants and online food delivery platforms that depend on secure packaging solutions.

Continuous innovation in barrier technologies and microwave-compatible materials has expanded their application in this domain With ongoing consumer preference for convenience and food safety, the ready-to-eat food segment is expected to remain a primary driver of demand in the heat seal film market.

| Attributes | Details |

|---|---|

| Top Layer Structure | Monolayer Films |

| Market Share in 2025 | 69.4% |

| Attributes | Details |

|---|---|

| Top End Use | Meat, poultry and Seafood |

| Market Share in 2025 | 51.4% |

| Countries | CAGR through 2035 |

|---|---|

| China | 4.4% |

| India | 5.3% |

| Thailand | 4.0% |

| South Korea | 2.3% |

| Spain | 2.3% |

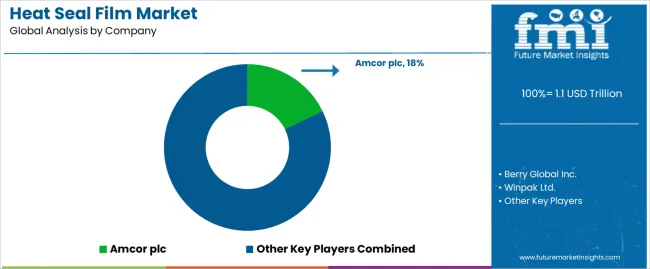

The market is highly fragmented due to the presence of several players. For instance, Amcor Limited has a strong focus on sustainability and offers several eco-friendly heat seal films made from bio-based materials. Similarly, Berry Global Inc. has a strong focus on innovation and has developed several patented heat seal film technologies.

Stakeholders are focusing on expanding their product portfolios and developing innovative heat seal film solutions to meet the evolving needs of customers. They are focusing on sustainability and are investing in the development of eco-friendly heat seal film solutions to meet the growing demand for sustainable packaging solutions. Additionally, they are also focusing on expanding their global presence through strategic partnerships and acquisitions.

Recent Development

The global heat seal film market is estimated to be valued at USD 1.1 trillion in 2025.

The market size for the heat seal film market is projected to reach USD 1.4 trillion by 2035.

The heat seal film market is expected to grow at a 2.5% CAGR between 2025 and 2035.

The key product types in heat seal film market are apet and cpet.

In terms of application, shrink film segment to command 61.7% share in the heat seal film market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Non Heat Sealable Film Market

Heated Sampling Composite Tube Market Size and Share Forecast Outlook 2025 to 2035

Heat Shrink Fitting Machines Market Size and Share Forecast Outlook 2025 to 2035

Heat Detachable Tape Market Size and Share Forecast Outlook 2025 to 2035

Heat Induction Cap Liner Market Size and Share Forecast Outlook 2025 to 2035

Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Heater-Cooler Devices Market Size and Share Forecast Outlook 2025 to 2035

Heat Treating Market Size and Share Forecast Outlook 2025 to 2035

Heating Agents Market Size and Share Forecast Outlook 2025 to 2035

Heat Diffuser Market Size and Share Forecast Outlook 2025 to 2035

Heat Pump Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Heat Pump Compressors Market Size and Share Forecast Outlook 2025 to 2035

Heat-Activated Beauty Masks Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Heat Exchanger Market Size and Share Forecast Outlook 2025 to 2035

Heat Recovery System Generator Market Size and Share Forecast Outlook 2025 to 2035

Heat Shrink Tubes Market Size and Share Forecast Outlook 2025 to 2035

Heat Pump Laundry Dryer Rotary Compressors Market Size and Share Forecast Outlook 2025 to 2035

Heating and Cooling Market Size and Share Forecast Outlook 2025 to 2035

Heated Eyelash Curler Market Size and Share Forecast Outlook 2025 to 2035

Heated Jacket Market Trends & Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA