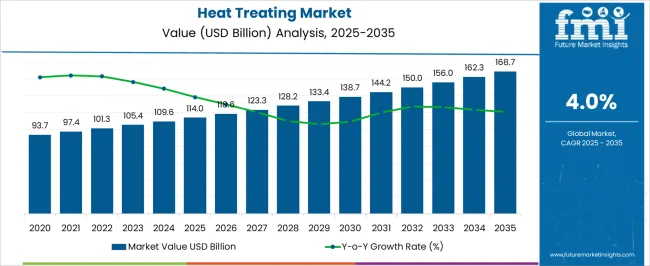

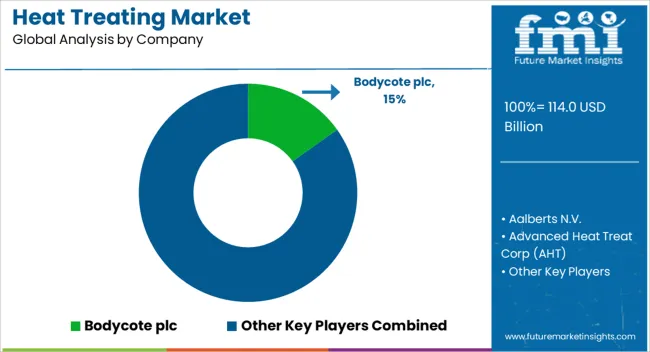

The heat treating market is valued at USD 114.0 billion in 2025 and is anticipated to reach USD 168.7 billion by 2035, registering a CAGR of 4.0%. A breakpoint analysis highlights the critical inflection points in market growth, where annual increments shift in pace and signify changing demand dynamics. From 2021 to 2025, the market grows from USD 93.7 billion to 114.0 billion, passing through intermediate values of USD 97.4 billion, 101.3 billion, 105.4 billion, and 109.6 billion.

The first notable breakpoint occurs in 2025, marking the transition from gradual early-stage adoption to stronger industrial integration, driven by increasing requirements in automotive, aerospace, and heavy machinery applications. Between 2026 and 2030, the market rises from USD 114.0 billion to 138.7 billion, with intermediate values of USD 118.6 billion, 123.3 billion, 128.2 billion, and 133.4 billion. This phase represents a second breakpoint where expansion accelerates, reflecting rising demand for advanced heat-treating technologies, precision engineering, and regulatory emphasis on product performance and safety. From 2031 to 2035, the market progresses from USD 144.2 billion to 168.7 billion, passing through USD 150.0 billion, 156.0 billion, and 162.3 billion.

| Metric | Value |

|---|---|

| Heat Treating Market Estimated Value in (2025 E) | USD 114.0 billion |

| Heat Treating Market Forecast Value in (2035 F) | USD 168.7 billion |

| Forecast CAGR (2025 to 2035) | 4.0% |

The heat treating market is driven by five parent markets that collectively define its growth, adoption, and applications across industrial and manufacturing sectors. The metal and alloy manufacturing market contributes the largest share, about 28-32%, as heat treatment processes such as annealing, quenching, and tempering enhance the mechanical properties, hardness, and wear resistance of steel, aluminum, and other alloys.

The automotive and transportation market adds approximately 20-24%, since components like gears, shafts, engine parts, and suspension systems undergo heat treatment to improve strength, fatigue resistance, and durability under high-stress conditions. The aerospace and defense market contributes around 15-18%, with critical structural components, turbine blades, and landing gear requiring precise thermal processes to maintain reliability, safety, and long-term performance in extreme environments. The industrial machinery and heavy equipment market accounts for roughly 12-15%, where tools, dies, molds, and production machinery are heat treated to extend service life and maintain dimensional stability.

The heat treating market is showing consistent growth, driven by the increasing demand for high-strength, durable materials across automotive, aerospace, energy, and heavy machinery sectors. Industry publications and manufacturing reports highlight that technological advancements in furnace design, temperature control systems, and automation are enhancing process precision and efficiency.

The expanding use of heat treatment for improving mechanical properties, extending component life, and meeting stringent quality standards has also contributed to market expansion. Environmental regulations and sustainability initiatives are pushing manufacturers toward energy-efficient equipment and cleaner processes.

Additionally, the rise of advanced alloys and specialized steel grades in industrial production is supporting further adoption of tailored heat treating techniques. Looking ahead, market growth is expected to be reinforced by increased investments in industrial infrastructure, continued innovation in surface hardening processes, and integration of digital monitoring for real-time quality assurance.

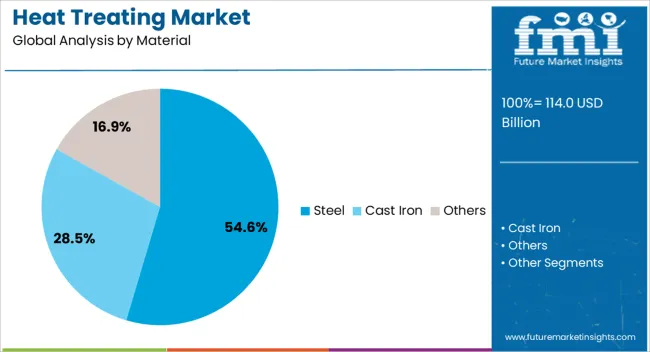

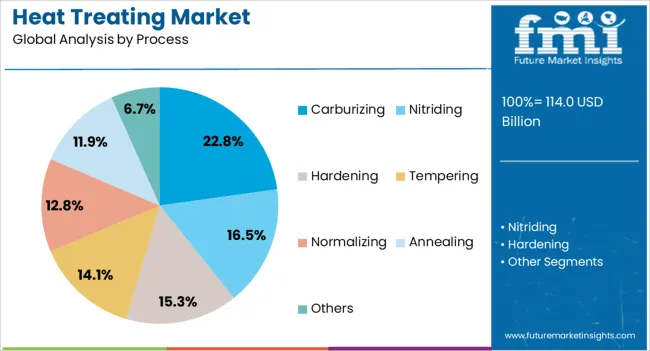

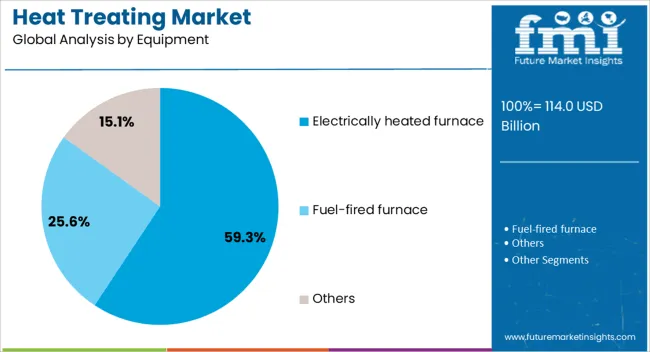

The heat treating market is segmented by material, process, equipment, application, and geographic regions. By material, heat treating market is divided into Steel, Cast Iron, and Others. In terms of process, heat treating market is classified into Carburizing, Nitriding, Hardening, Tempering, Normalizing, Annealing, and Others. Based on equipment, heat treating market is segmented into Electrically heated furnace, Fuel-fired furnace, and Others. By application, heat treating market is segmented into Automotive, Aerospace & defense, Machinery, Construction, Metallurgy, and Others. Regionally, the heat treating industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Steel segment is projected to account for 54.6% of the heat treating market revenue in 2025, holding its position as the dominant material. This growth is largely supported by steel’s extensive use in automotive parts, construction machinery, tools, and industrial equipment where high tensile strength and wear resistance are essential.

Manufacturers have relied on heat treatment to enhance the hardness, durability, and fatigue resistance of steel components, ensuring they meet performance requirements under heavy operational loads. Global infrastructure development and industrial expansion have further boosted demand for heat-treated steel.

Additionally, alloy steel’s adaptability to multiple heat treatment processes, combined with its relatively lower cost compared to exotic alloys, has cemented its position in large-scale manufacturing. With ongoing advancements in metallurgical engineering and a steady rise in steel consumption, this segment is expected to maintain its leadership in the market.

The Carburizing segment is expected to capture 22.8% of the heat treating market revenue in 2025, making it a key process category. Its growth has been driven by its ability to impart a hard, wear-resistant surface layer while retaining a tough and ductile core, which is critical for components subject to high surface stress.

Automotive gears, bearings, and transmission parts are frequent beneficiaries of carburizing, enhancing operational longevity. Industry developments have focused on refining atmosphere control, improving case depth uniformity, and integrating low-pressure carburizing systems to reduce cycle times and energy consumption.

As industries demand higher-performance components that withstand extreme conditions, carburizing remains a preferred choice among manufacturers. Its balance of cost-effectiveness, repeatability, and performance enhancement continues to sustain its importance in the broader heat treating process mix.

The Electrically Heated Furnace segment is projected to hold 59.3% of the heat treating market revenue in 2025, securing its position as the leading equipment type. Its dominance stems from its precision temperature control, clean operation, and suitability for both batch and continuous heat treating applications.

Electrically heated furnaces have gained favor in industries aiming to reduce emissions and improve energy efficiency, aligning with stricter environmental regulations. They offer uniform heating, faster start-up times, and reduced maintenance compared to fuel-fired alternatives.

Technological improvements in heating element materials, insulation, and digital process controls have further improved efficiency and product quality. Additionally, their compatibility with automation and Industry 4.0 integration makes them highly adaptable for modern manufacturing environments. As the push for sustainable industrial operations grows, electrically heated furnaces are expected to remain at the forefront of equipment investment in the heat treating sector.

The heat treating market is growing due to rising demand from automotive, aerospace, energy, and industrial manufacturing sectors for high-strength, wear-resistant, and durable components. Processes such as annealing, quenching, and carburizing improve mechanical properties and component lifespan. Challenges include high capital investment, energy-intensive operations, and compliance with safety and environmental regulations. Opportunities lie in automation, vacuum and induction heat treatment, digital monitoring, and customized process solutions. Manufacturers providing precise, certified, and digitally integrated heat treating services are best positioned to capture global growth. Asia-Pacific, North America, and Europe are key regions driving market expansion.

The heat treating market is expanding as industries seek enhanced mechanical properties, hardness, and durability in metals and alloys. Automotive, aerospace, tooling, and heavy machinery sectors increasingly adopt heat treating processes, including annealing, quenching, tempering, and carburizing, to improve strength and wear resistance. Growth is driven by rising demand for high-performance components, complex geometries, and lightweight materials. Manufacturers focus on precision, process control, and repeatability to meet strict quality standards. Expanding industrialization and modernization of production facilities in Asia-Pacific, Europe, and North America further support market growth. Advancements in automated furnaces, vacuum heat treatment, and induction heating technologies enhance efficiency and energy utilization.

Advanced processes such as vacuum and cryogenic heat treatment require specialized equipment and precise control, increasing production expenses. Compliance with safety regulations, emissions standards, and environmental requirements adds operational complexity, especially in Europe and North America. Variability in raw materials, including steel, aluminum, and specialty alloys, can affect process consistency and product quality. Customers increasingly demand certified heat-treated components with traceability, process documentation, and adherence to industrial standards. Manufacturers investing in automation, monitoring systems, and energy-efficient technologies are better positioned to address technical, operational, and regulatory constraints while delivering consistent and high-quality heat-treated components globally.

The growing demand for high-strength, wear-resistant, and fatigue-resistant components creates opportunities for the heat treating market. Aerospace and defense industries require advanced heat-treated alloys for critical components, while automotive manufacturers adopt heat treating to enhance engine parts, gears, and suspension systems. Energy and power generation sectors utilize heat-treated materials in turbines, pipelines, and drilling equipment. Asia-Pacific, led by China, India, and Japan, exhibits strong growth due to industrial expansion, infrastructure projects, and increasing manufacturing output. Suppliers providing process optimization, customized heat treatment cycles, and technical support gain a competitive advantage. Retrofitting existing furnaces, integrating digital control systems, and offering maintenance services further enhance operational efficiency and market presence globally.

Technological trends in the heat treating market include the adoption of automated furnaces, vacuum and atmosphere-controlled systems, and induction heating for precision control. Digital monitoring, IoT-enabled sensors, and predictive maintenance improve process reliability and energy efficiency. Advanced heat treatment solutions enable uniform material properties, reduced cycle times, and improved surface integrity. Manufacturers are focusing on modular, energy-efficient equipment to meet diverse industrial needs while reducing operational costs. Integration with Industry 4.0 platforms allows real-time monitoring, quality control, and process optimization. Companies providing high-precision, digitally monitored, and certified heat treating solutions are well-positioned to capture growing demand from aerospace, automotive, and industrial manufacturing sectors globally.

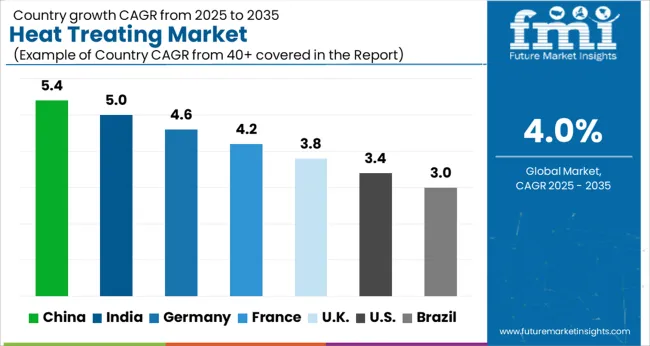

| Country | CAGR |

|---|---|

| China | 5.4% |

| India | 5.0% |

| Germany | 4.6% |

| France | 4.2% |

| UK | 3.8% |

| USA | 3.4% |

| Brazil | 3.0% |

The global heat treating market is projected to expand at a CAGR of 4.0% from 2025 to 2035. China (5.4%) and India (5.0%) are the fastest-growing markets, supported by industrial modernization, automotive production, and heavy machinery demand. France (4.2%) emphasizes precision processes and regulatory compliance, while the UK (3.8%) and USA (3.4%) show steady adoption across aerospace, automotive, and industrial sectors. Growth drivers include demand for high-performance metal components, automation, predictive maintenance, and energy-efficient heat treatment technologies. Manufacturers focus on advanced furnaces, induction heating, surface hardening, and IoT-enabled monitoring solutions to capture market share. The analysis spans over 40+ countries, with the leading markets shown below.

The heat treating market in China is projected to grow at a CAGR of 5.4% from 2025 to 2035, driven by the country’s expanding industrial base, automotive production, and machinery manufacturing. The demand for precision-engineered components, durable tools, and high-performance metals is boosting adoption of advanced heat treatment processes. Manufacturers are increasingly investing in automated furnaces, induction heating systems, and surface hardening technologies to improve efficiency and throughput. Rapid urbanization, infrastructure development, and growth in the energy and aerospace sectors are further supporting market expansion. China’s strong focus on R&D and technological innovation enables local producers to offer cost-effective, high-quality heat treating solutions.

The heat treating market in India is expected to grow at a CAGR of 5.0% from 2025 to 2035, fueled by industrial modernization and increasing demand for high-performance metals in automotive, defense, and heavy machinery sectors. Manufacturers are investing in advanced furnaces, quenching systems, and surface hardening technologies to meet growing quality requirements. The adoption of automated and IoT-enabled heat treatment solutions supports process control, consistency, and energy efficiency. Industrial expansion, infrastructure development, and government initiatives to enhance manufacturing capabilities further support growth. Local producers are focusing on cost-effective solutions with scalable capacities to serve small and medium enterprises.

The heat treating market in France is projected to expand at a CAGR of 4.2% from 2025 to 2035, driven by the aerospace, automotive, and industrial machinery sectors. High-quality standards and strict regulations encourage adoption of precise heat treatment processes to ensure component durability and performance. Manufacturers focus on advanced furnaces, induction heating, and surface hardening techniques to meet industrial requirements. Integration of automation and real-time monitoring systems is improving process efficiency and minimizing defects. The market benefits from replacement of aging industrial equipment, technological innovation, and increased demand for high-performance components in energy and defense applications. Service providers offering turnkey heat treatment solutions further enhance adoption.

The UK heat treating market is expected to grow at a CAGR of 3.8% from 2025 to 2035, supported by automotive, aerospace, and industrial machinery industries. Demand is driven by requirements for improved component performance, extended lifespan, and compliance with industry standards. Manufacturers are adopting induction heating, quenching, and automated furnace technologies to enhance operational efficiency and product quality. Modernization of industrial plants, growth in manufacturing activities, and adoption of process monitoring systems support market expansion. Small and medium-scale manufacturers are increasingly investing in compact, energy-efficient heat treating equipment. Service providers offering maintenance, calibration, and consulting further strengthen market adoption.

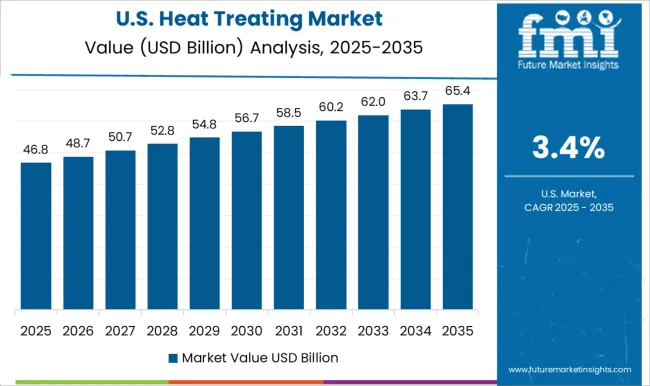

The USA heat treating market is projected to grow at a CAGR of 3.4% from 2025 to 2035, driven by automotive, aerospace, and heavy machinery applications. Manufacturers are increasingly adopting advanced furnaces, surface hardening, and quenching technologies to improve metal performance and component durability. Industrial modernization, replacement of aging equipment, and focus on operational efficiency support market growth. The integration of automated and IoT-enabled heat treatment solutions allows real-time monitoring, predictive maintenance, and quality assurance. Growing demand for precision-engineered components, lightweight metals, and high-strength alloys further drives adoption. Distribution through specialized industrial suppliers and service providers ensures widespread market reach and support.

Competition in the dissolved gas analyzer (DGA) market is defined by accuracy, detection speed, and integration with transformer monitoring systems. General Electric (GE) Grid Solutions competes with online and portable DGA solutions offering multi-gas detection, predictive analytics, and real-time transformer health monitoring for utilities and industrial clients. ABB Ltd. differentiates through compact and modular analyzers that integrate with digital substation architectures, emphasizing reliability and remote diagnostics. Doble Engineering Company focuses on precision and lab-grade performance, providing portable and online DGA instruments tailored for condition assessment, fault identification, and preventive maintenance. LumaSense Technologies, Inc. (now part of Advanced Energy) delivers fiber-optic and infrared-based solutions, targeting continuous monitoring, fast response, and high-sensitivity detection for transformers and high-voltage assets. Qualitrol Company LLC provides on-line DGA sensors with cloud connectivity, enabling predictive maintenance and integration with SCADA systems, emphasizing ease of installation and actionable insights. Siemens AG leverages industrial automation expertise to offer DGA analyzers that combine robust hardware with digital analytics, supporting large-scale utility networks. Weidmann Electrical Technology AG emphasizes high-precision gas detection for both laboratory and field applications, focusing on transformer insulation diagnostics and dielectric oil assessment. Strategies in the market focus on enhancing sensitivity to low-concentration gases, reducing maintenance requirements, and integrating DGA analyzers with condition monitoring platforms and IoT-enabled asset management systems. Product brochures highlight multi-gas measurement (hydrogen, methane, ethylene, acetylene, carbon monoxide, and carbon dioxide), online and portable analyzers, predictive diagnostic software, remote monitoring capability, calibration services, and compatibility with IEC and IEEE standards. Collectively, these offerings show a market where technological innovation, reliability, and data-driven insights define competitiveness, supporting utilities and industrial operators in maintaining transformer health and preventing costly failures.

| Item | Value |

|---|---|

| Quantitative Units | USD 114.0 Billion |

| Material | Steel, Cast Iron, and Others |

| Process | Carburizing, Nitriding, Hardening, Tempering, Normalizing, Annealing, and Others |

| Equipment | Electrically heated furnace, Fuel-fired furnace, and Others |

| Application | Automotive, Aerospace & defense, Machinery, Construction, Metallurgy, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Bodycote plc, Aalberts N.V., Advanced Heat Treat Corp (AHT), Aichelin Group, ALD Vacuum Technologies, Bluewater Thermal Solutions, BMI Fours Industrials, ECM Technologies, Furnace and Industrial Services BV (FIS), Harterei Gerster, Heat Treatment Services (HTS), Huisman Group, Parker Trutec Group, Paulo, and ThermTech |

| Additional Attributes | Dollar sales by process type (vacuum, carburizing, nitriding, induction, tempering), application (automotive, aerospace, industrial machinery, tooling), and furnace type (batch, continuous, vacuum). Demand is driven by high-performance material requirements, industrial modernization, and adoption of energy-efficient processes. Regional trends indicate strong growth in North America, Europe, and Asia-Pacific, with expanding aerospace, automotive, and heavy machinery manufacturing. |

The global heat treating market is estimated to be valued at USD 114.0 billion in 2025.

The market size for the heat treating market is projected to reach USD 168.7 billion by 2035.

The heat treating market is expected to grow at a 4.0% CAGR between 2025 and 2035.

The key product types in heat treating market are steel, cast iron and others.

In terms of process, carburizing segment to command 22.8% share in the heat treating market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Heat Exchanger Inspection Service Market Size and Share Forecast Outlook 2025 to 2035

Heat-Treated NiTi Endodontic File Market Size and Share Forecast Outlook 2025 to 2035

Heated Sampling Composite Tube Market Size and Share Forecast Outlook 2025 to 2035

Heat Seal Film Market Size and Share Forecast Outlook 2025 to 2035

Heat Shrink Fitting Machines Market Size and Share Forecast Outlook 2025 to 2035

Heat Detachable Tape Market Size and Share Forecast Outlook 2025 to 2035

Heat Induction Cap Liner Market Size and Share Forecast Outlook 2025 to 2035

Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Heat Transfer Film Market Size and Share Forecast Outlook 2025 to 2035

Heater-Cooler Devices Market Size and Share Forecast Outlook 2025 to 2035

Heat Sealing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Heating Agents Market Size and Share Forecast Outlook 2025 to 2035

Heat Diffuser Market Size and Share Forecast Outlook 2025 to 2035

Heat Pump Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Heat Pump Compressors Market Size and Share Forecast Outlook 2025 to 2035

Heat-Activated Beauty Masks Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Heat Exchanger Market Size and Share Forecast Outlook 2025 to 2035

Heat Sealable Packaging Market Size and Share Forecast Outlook 2025 to 2035

Heat Recovery System Generator Market Size and Share Forecast Outlook 2025 to 2035

Heat Shrink Tubes Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA