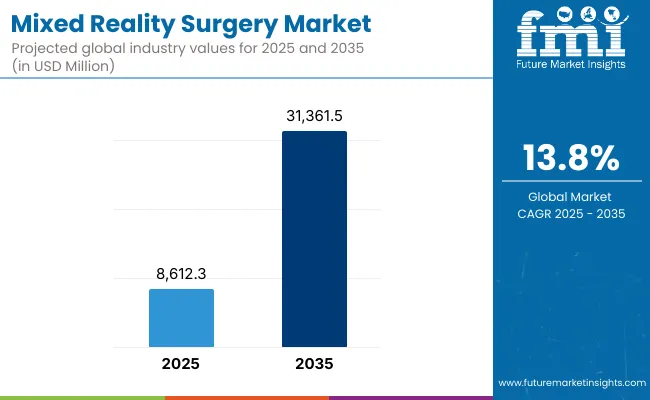

The mixed reality surgery has been forecasted to attain a valuation of USD 8,612.3 million in 2025, rising to USD 31,361.5 million by 2035, representing an incremental gain of USD 22,749.2 million and a total growth of approximately 27.5% over the forecast period. A compound annual growth rate (CAGR) of 13.8% is expected to be recorded, indicating a rapid expansion trajectory for the Mixed Reality Surgery Market.

Mixed Reality Surgery Market Key Takeaways

| Metric | Value |

|---|---|

| Mixed Reality Surgery Market Estimated Value in (2025E) | USD 8,612.3 million |

| Mixed Reality Surgery Market Forecast Value in (2035F) | USD 31,361.5 million |

| Forecast CAGR (2025 to 2035) | 13.8% |

Between 2025 and 2030, the Mixed Reality Surgery Market will gain broader adoption across hospitals, surgical centers, and medical universities, as surgeons and clinicians increasingly rely on immersive technologies for surgical planning, intraoperative guidance, and advanced training. Market value is projected to rise from USD 8,612.3 million in 2025 to USD 17178.5 million in 2030, reflecting accelerating demand for augmented and virtual reality solutions in operating rooms.

Growth is supported by improvements in headset design, integration of real-time imaging, and AI-driven simulation software, which make mixed reality tools more accessible to both large hospitals and mid-tier medical institutions. Broader applications in surgical interventions, coupled with heightened investment in digital health infrastructure, are anticipated to boost mixed reality adoption over the forecast period.

Between 2030 and 2035, the Mixed Reality Surgery Market is projected to expand further from grow from USD 17,178.5 million to USD 31,361.5 million, contributing USD 14183.0 million, which equals 62.3% of the total decade growth. This acceleration deepens across advanced hospitals, surgical training centers, and specialized clinics. Market value is expected to increase by USD 17,178.5 million over this period, advances in lightweight headsets, AI-powered visualization, and real-time surgical navigation will define the next generation of MR platforms, making them indispensable for precision surgery and immersive medical education.

From 2020 to 2024, the Mixed Reality Surgery Market advanced from early pilot deployments to wider adoption in leading hospitals and medical universities, growing from USD 4,886.0 million to USD 7,535.0 million. This phase was marked by the integration of mixed reality platforms into surgical training, preoperative planning, and simulation-based education. Healthcare technology providers have collaborated with medical institutions to enhance headset ergonomics, optimize real-time visualization, and refine system functionality, paving the way for wider clinical adoption.

Going forward, the global mixed reality surgery ecosystem will integrate AI-driven surgical guidance, real-time 3D visualization, and interoperability with robotic and imaging systems. These innovations will lower adoption barriers, expand applications across complex procedures, and improve surgical precision positioning mixed reality as a core technology in operating rooms, surgical training, and immersive medical education.

The growth of the Mixed Reality Surgery Market is reinforced by its ability to transform surgical workflows through immersive visualization, simulation, and real-time guidance. Unlike conventional imaging or training methods, mixed reality enables precise anatomical mapping, enhanced intraoperative navigation, and simulation-based surgical education making it an essential technology for advancing complex procedures and improving patient outcomes.

Over the last decade, the scope of mixed reality in surgery has expanded beyond early training demonstrations. It is now a critical tool in preoperative planning, intraoperative visualization, and immersive surgical education. Mixed reality enables surgeons to interact with 3D anatomical models, align imaging data with patient anatomy, and simulate complex procedures with high accuracy. With rising demand for accuracy in surgical interventions, mixed reality is increasingly adopted as a critical technology in leading hospitals, specialty surgical centers, and academic medical institutions.

Another factor driving adoption is the shift from pilot-stage deployments to fully integrated mixed reality surgical platforms. With vendors now offering turnkey solutions that combine head-mounted displays, real-time imaging overlays, haptic feedback, and AI-driven guidance systems, surgeons can achieve advanced visualization and precision directly in the operating room. This decentralization is transforming accessibility, particularly in healthcare systems expanding their digital infrastructure and surgical innovation capacity.

Moreover, increasing demand from interdisciplinary fields including robotic-assisted surgery, AI-driven diagnostics, and surgical navigation systems is fostering the development of hybrid mixed reality platforms that combine visualization, real-time data integration, and tactile simulation.

The market is segmented by product, application, technology, end user, sales channel, and region. Component include software, hardware, and services. Technology type classification covers Augmented Reality (AR), Virtual Reality (VR). Based on end user, the segmentation includes hospitals, research organizations, ambulatory surgical centers, specialty clinics and others. Regionally, the scope spans North America, Latin America, Western and Eastern Europe, East Asia, South Asia and Pacific, and the Middle East and Africa.

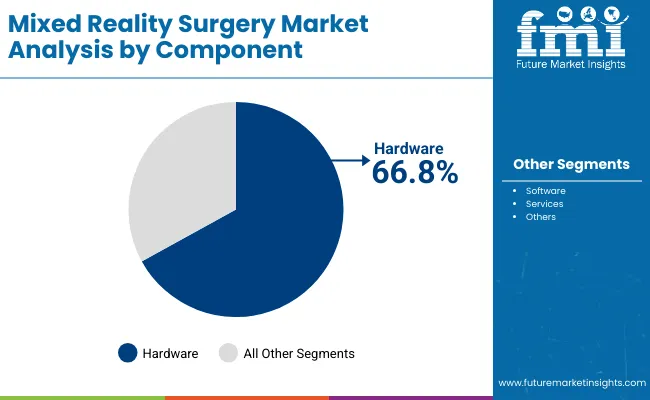

| By Component | Market Value Share, 2025 |

|---|---|

| Software | 22.0% |

| Hardware | 66.8% |

| Services | 11.2% |

Hardware is projected to lead the component category with a 66.8% market share in 2025, and is expected to maintain this position due to its ability to deliver immersive visualization and high surgical precision in compact, clinically adaptable systems. Unlike Software, hardware provides real-time 3D overlays and interactive feedback, enabling surgeons to navigate complex procedures with unprecedented accuracy. This technological edge firmly positions hardware as the backbone of adoption across hospitals, ambulatory surgical centers, and specialty clinics.

Recent advances in head-mounted displays, AI-enhanced imaging overlays, and haptic simulation platforms, combined with innovations in surgical navigation and cloud-based integration, have enabled MR (Mixed Reality) surgery systems to operate near the theoretical limits of surgical precision. Moreover, integration with robotic-assisted platforms and intraoperative imaging modalities allows surgeons to perform highly complex procedures such as neurosurgery, orthopedic reconstruction, and cardiovascular interventions making hardware indispensable for frontier surgical applications.

A key factor behind its dominance is the growing presence of MR (Mixed Reality) surgery systems hardware in hospitals, ambulatory surgical centers, and medical universities. With commercial vendors now offering turnkey solutions that require minimal calibration, hardware platforms are becoming more accessible to a wider range of healthcare institutions. Their relatively lower infrastructure requirements compared to traditional robotic surgery suites further position them as the go-to component for digital surgery, minimally invasive procedures, and immersive medical training.

As demand for personalized medicine, advanced surgical training, and minimally invasive procedures continues to rise, the ease of deployment and outcome-enhancing capabilities of MR (Mixed Reality) surgery systems ensure that it remains the backbone of next-generation surgical ecosystems across clinical and academic settings worldwide.

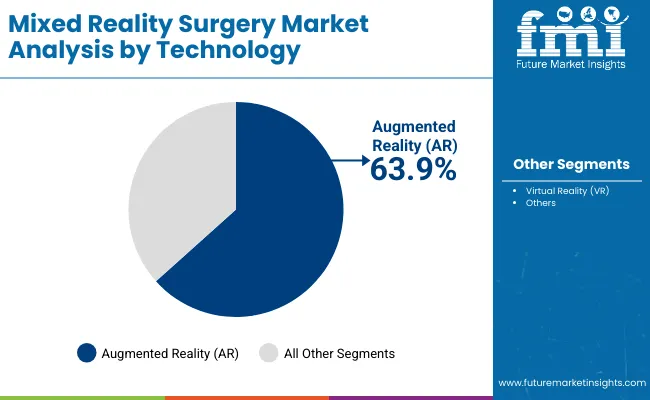

| Technology Type | Market Value Share, 2025 |

|---|---|

| Augmented Reality (AR) | 63.9% |

| Virtual Reality (VR) | 36.1% |

Augmented Reality (AR) continues to dominate the technology landscape in mixed reality (MR) surgery, accounting for 63.9% of total market value in 2025. This technology remains the foundation of next-generation surgical systems due to its proven ability to overlay critical anatomical information, provide real-time 3D guidance, and enhance intraoperative decision-making. As an essential tool across hospitals, ambulatory surgical centers, and medical training institutions, AR offers unmatched support for complex procedures, minimally invasive surgeries, and immersive surgical education.

What makes AR irreplaceable is its seamless integration with surgical workflows, mature software platforms, and advanced hardware ecosystems. Many hospitals and academic institutions have developed long-standing expertise using AR-enabled head-mounted displays, AI-enhanced visualization tools, and cloud-integrated surgical navigation systems. These platforms create a robust framework for precise surgical planning, rehearsal, and execution. AR technology is particularly effective in neurosurgery, orthopedic reconstruction, and cardiovascular interventions, where real-time overlays and interactive guidance significantly improve procedural accuracy.

Recent improvements in display resolution, tracking precision, and software algorithms have further enhanced the usability and adoption of AR, making systems increasingly practical for routine surgical use. Moreover, ongoing investment in training programs, academic curricula, and hospital implementation initiatives ensures a sustained pipeline of skilled users and continued market growth.

While Virtual Reality (VR) is gaining traction in niche applications such as fully immersive surgical simulation and remote collaboration, AR remains the mainstay of the global MR surgery market, largely due to its real-time applicability, versatility across procedures, and broad compatibility with diverse clinical settings.

The adoption of Mixed Reality (MR) surgery is accelerating across clinical, academic, and training environments as hardware, software, and AI capabilities converge to enhance surgical precision and procedural efficiency. While growth momentum is strong, the market faces structural challenges tied to cost, training requirements, and integration complexity.

Clinical Significance of MR Surgery Systems

MR systems are becoming essential in complex procedures such as neurosurgery, orthopedic reconstruction, and cardiovascular interventions. By overlaying real-time 3D anatomical visualizations onto the surgical field, MR provides surgeons with interactive guidance that conventional surgical tools cannot replicate. Hospitals, academic medical centers, and specialty clinics are increasingly adopting MR platforms to improve patient outcomes, reduce intraoperative errors, and enhance procedural confidence.

Shift Toward Compact, Integrated, and Accessible MR Systems

The MR market is expanding as manufacturers offer lab-ready solutions that are easier to deploy across hospitals and training centers. Modern MR platforms combine head-mounted displays, haptic feedback, AI-powered guidance, and cloud-based surgical navigation into compact, clinically adaptable systems. These innovations reduce infrastructure requirements compared with traditional robotic or simulation suites, enabling broader adoption in clinical and academic settings.

Adoption Challenges for MR Surgery Systems

MR surgery systems require significant investment in hardware, software, and personnel training, creating adoption barriers for smaller hospitals or centers with limited budgets. Integration into existing surgical workflows demands technical expertise, and staff must be trained to operate the systems effectively. Additionally, ensuring sterile environments, compatibility with imaging modalities, and regulatory compliance adds layers of complexity.

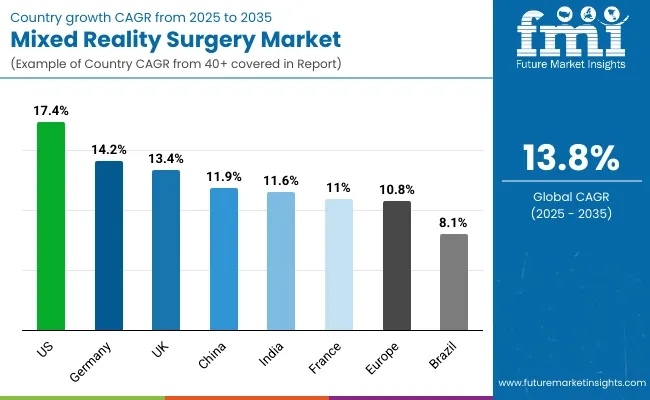

| Countries | CAGR |

|---|---|

| USA | 17.4% |

| Brazil | 8.1% |

| China | 11.9% |

| India | 11.6% |

| Europe | 10.8% |

| Germany | 14.2% |

| France | 11.0% |

| UK | 13.4% |

The adoption and growth patterns of Mixed Reality (MR) surgery systems vary significantly across regions, influenced by healthcare infrastructure maturity, government support for advanced medical technologies, and specialized clinical application demand.

In the United States, the MR surgery market is characterized by rapid growth, driven by advanced hospitals, research universities, and medical technology companies investing in AR- and VR-enabled surgical systems. Widespread adoption is supported by access to cutting-edge imaging modalities, integration with robotic-assisted platforms, and early adoption of AI-enhanced surgical planning tools. Continuous investment in digital surgery, clinical training programs, and procedural innovation is propelling the market, with a projected CAGR of 17.4%.

In Europe, countries such as Germany, France, and the UK lead in MR surgery adoption due to strong governmental backing, robust healthcare infrastructure, and established medical research networks. Hospitals and specialty clinics are increasingly integrating MR platforms for neurosurgery, orthopedic reconstruction, and minimally invasive procedures. Regulatory support for advanced medical technologies, combined with national funding for digital surgery initiatives, enables widespread deployment, while ongoing training programs cultivate skilled personnel for MR-assisted procedures. The market is expected to expand at a CAGR of 14.2% in Germany, 11.0% in France, and 13.4% in the UK

In emerging markets such as China, India, and Brazil, growth is driven by improving healthcare infrastructure, rising adoption of advanced surgical technologies, and increasing investment in medical training and research. Hospitals in metropolitan centers are increasingly leveraging MR systems to enhance surgical outcomes and reduce procedural risks, with projected CAGRs of 11.9% in China, 11.6% in India, and 8.1% in Brazil.

Overall, the global MR surgery market reflects a strategic combination of technological advancement, healthcare investment, and policy support, which together shape the pace and scale of adoption across different countries. Regional infrastructure, clinician training, and integration into surgical workflows remain key determinants of market grow

The Mixed Reality (MR) surgery market in the United States is projected to expand at a CAGR of 17.4% between 2025 and 2035, reflecting rapid adoption across hospitals, surgical centers, and academic medical institutions. The USA remains the most mature and research-intensive market for MR-assisted surgery, with early integration into complex surgical programs, digital surgery initiatives, and medical training curricula. Leading institutions such as Johns Hopkins Hospital, Mayo Clinic, and Cleveland Clinic, alongside top medical universities and research centers, are setting benchmarks for MR applications. The USA also hosts several of the world’s most advanced surgical simulation and robotic-assisted surgery platforms, providing widespread access to MR-enabled systems.

The adoption of Mixed Reality (MR) and immersive surgical technologies in India is gradually increasing, driven by growing interest in digital surgery, surgical training, and advanced procedural tools. While specific MR-assisted surgical platforms are not widely documented in Indian hospitals, leading institutions are exploring AR/VR technologies for surgical education and procedural simulation. Overall adoption remains limited, largely due to high setup costs, specialized training requirements, and reliance on both private and government funding.

| Europe Countries | 2025 |

|---|---|

| Germany | 23.5% |

| UK | 18.9% |

| France | 14.2% |

| Italy | 13.5% |

| Spain | 15.0% |

| BENELUX | 6.9% |

| Nordic Countries | 5.9% |

| Rest of Western Europe | 2.1% |

| Europe Countries | 2035 |

|---|---|

| Germany | 24.2% |

| UK | 19.5% |

| France | 14.6% |

| Italy | 13.9% |

| Spain | 15.5% |

| BENELUX | 5.7% |

| Nordic Countries | 4.9% |

| Rest of Western Europe | 1.5% |

China’s adoption of Mixed Reality (MR) in surgery is gradually expanding, supported by growing investment in digital healthcare, advanced surgical technologies, and training infrastructure. Institutions such as Peking Union Medical College Hospital, Shanghai Ruij in Hospital, and West China Hospital are at the forefront of integrating digital and immersive surgical solutions, including AR and VR, into training programs and advanced procedures. National and provincial healthcare initiatives are promoting the use of AR/VR technologies to enhance surgical education, procedural planning, and clinical outcomes.

The Mixed Reality (MR) surgery market in the United Kingdom is projected to grow at a CAGR of 13.4% between 2025 and 2035, supported by strong public investment in digital healthcare, surgical innovation, and medical education. Institutions including Guy’s and St Thomas’ NHS Foundation Trust, University College London Hospitals, and Oxford University Hospitals are integrating MR-enabled platforms to complement robotic systems and AI-guided navigation. The country benefits from coordinated adoption programs, where MR-assisted surgery systems are deployed in teaching hospitals and clinical training centers nationwide.

In 2021 to 2025, the UK has seen increased deployment of hospital- and lab-based MR systems, often supported by National Health Service (NHS) funding and collaborative programs with technology vendors. These platforms are increasingly used alongside robotic-assisted surgery, advanced imaging modalities, and AI-driven surgical guidance, enabling more precise and immersive procedural workflows.

The Mixed Reality (MR) surgery market in Germany is anticipated to grow at a CAGR of 14.2% between 2025 and 2035. Germany is positioning itself as a key industrial and clinical hub for high-precision MR-assisted surgical applications, particularly in neurosurgery, orthopedic reconstruction, and minimally invasive cardiovascular procedures. While academic adoption remains strong, much of the current growth is driven by collaborations between leading hospitals, medical technology firms, and surgical training centers. German companies are playing a strategic role in developing MR subsystems including head-mounted displays, haptic feedback devices, and AI-assisted guidance software which are now being integrated into both domestic and international surgical platforms.

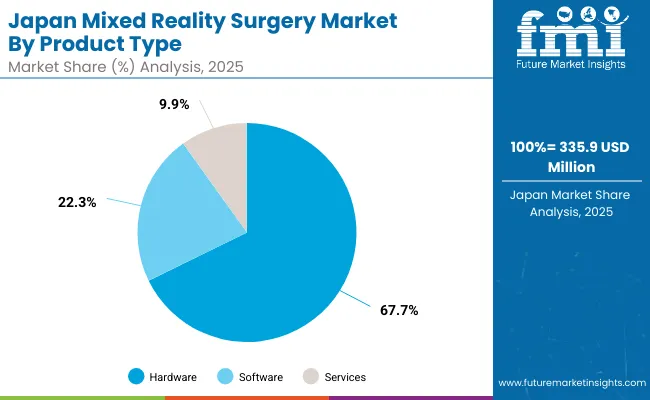

| Product | Market Value Share, 2025 |

|---|---|

| Software | 22.3% |

| Hardware | 67.7% |

| Services | 9.9% |

The Mixed Reality (MR) surgery market in Japan is projected to reach USD 335.9 million by 2025. Hardware will lead the product landscape with a 67.7% share, followed by software at 22.3%. Japan’s MR surgery market is shaped by a long-standing focus on surgical innovation, medical simulation, and minimally invasive procedures. The University of Tokyo Hospital, Osaka University Hospital, and Kyoto University Hospital, are integrating MR hardware and software platforms specialty procedures. Many institutions operate both standalone MR systems and fully integrated platforms, enabling a range of applications from preoperative planning to intraoperative guidance and surgical training.

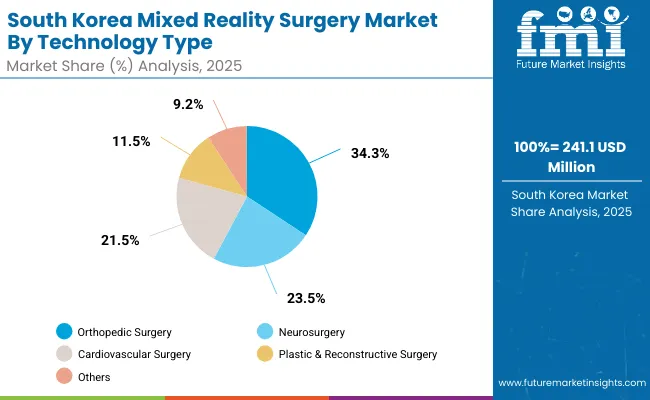

| Technology Type | Market Value Share, 2025 |

|---|---|

| Orthopedic Surgery | 34.3% |

| Neurosurgery | 23.5% |

| Cardiovascular Surgery | 21.5% |

| Plastic & Reconstructive Surgery | 11.5% |

| Others | 9.2% |

The Mixed Reality (MR) surgery market in South Korea is projected to reach USD 241.1 million by 2025. Orthopedic surgery is expected to lead the technology type with a 34.3% share, followed by neurosurgery at 23.5%. South Korea’s MR surgery market is evolving from early adoption in academic hospitals toward broad clinical integration in specialized surgical centers. Adoption is extending beyond academic hospitals into specialized surgical centers, driven by government-backed modernization programs and investments in hybrid operating rooms.

Institutions such as Severance Hospital, Bundang Seoul National University Hospital, and Samsung Changwon Hospital are utilizing MR technology to improve intraoperative visualization and procedural accuracy. A key differentiator for South Korea is its rapid integration of MR with robotic-assisted surgery and AI-driven intraoperative guidance, enhancing precision and reducing procedural risks.

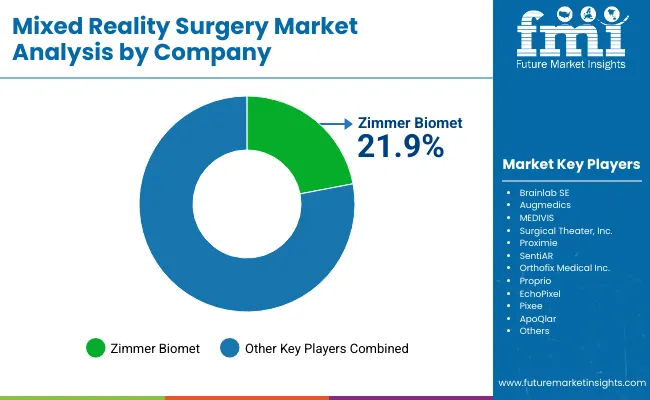

The MR surgery market is moderately concentrated, with Zimmer Biomet holding a leading global position due to its specialization in orthopedic and neurosurgical MR-assisted platforms. The company’s dominance is driven by its integrated systems approach offering complete hardware, software, and simulation solutions with AI-enhanced guidance and intraoperative visualization. Zimmer Biomet also provides robust support for surgical training, preoperative planning, and robotic-assisted integrations, positioning itself as a go-to vendor for high-precision clinical applications.

The other key players, collectively accounting for 78.1% of the market, include Brainlab SE, Augmedics, MEDIVIS, Surgical Theater, Inc., Proximie, SentiAR, Orthofix Medical Inc., Proprio, EchoPixel, Pixee, and ApoQlar. The other key players are active across various MR-assisted applications, including orthopedic, neurosurgical, cardiovascular, and training-focused platforms. Together, they expand the competitive landscape and foster innovation in surgical visualization, intraoperative guidance, and immersive medical training.

Key Developments in Mixed Reality Surgery Market

| Item | Value |

|---|---|

| Quantitative Units | USD 8612.3 million |

| Component Type | Hardware, Software and services |

| Technology Type | Augmented Reality (AR), Virtual Reality (VR) |

| End User | Hospitals, Ambulatory Surgical Centers, Specialty Clinics, Research Organizations, Others |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | USA, Brazil, China, India, Europe, Germany, France and UK |

| Key Companies Profiled | Zimmer Biomet, Brainlab SE, Augmedics, MEDIVIS, Surgical Theater, Inc., Proximie, SentiAR, Orthofix Medical Inc., Proprio, EchoPixel, Pixee, ApoQlar and others |

The Mixed Reality Surgery Market is estimated to be valued at USD 8,612.3 million in 2025.

The market size for the Mixed Reality Surgery Market is projected to reach approximately USD 31,361.50 million by 2035.

The Mixed Reality Surgery Market is expected to grow at a CAGR of 13.8% between 2025 and 2035.

The key product formats in the Mixed Reality Surgery Market include Hardware, Software and services

In terms of technology, Augmented Reality (AR) is projected to command the highest share at 63.9% in the Mixed Reality Surgery Market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Mixed Signal IC Market Size and Share Forecast Outlook 2025 to 2035

Mixed Xylene Market Trends - Demand, Innovations & Forecast 2025 to 2035

Mixed Acetic and Tartaric Acid Esters of Mono and Diglycerides of Fatty Acids Market

Mixed Reality Navigation Platforms Market Forecast and Outlook 2025 to 2035

Premixed Cocktail Shots Market Growth - Consumer Trends 2024 to 2034

Pre-mixed/RTD Alcoholic Drink Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Extended Reality (XR) Market Trends – Growth & Forecast 2025 to 2035

Augmented Reality (AR) Shopping Market Size and Share Forecast Outlook 2025 to 2035

Augmented Reality Glasses Market Size and Share Forecast Outlook 2025 to 2035

Augmented Reality Market Size and Share Forecast Outlook 2025 to 2035

Augmented Reality for Retail Market

AR & VR Market Trends – Growth & Forecast 2017-2025

Mobile Augmented Reality Market Analysis by Solution, Application, and Region Through 2035

Tourists Virtual Reality Headsets Market Insights - Growth & Forecast 2025 to 2035

Augmented and Virtual Reality in Education Market - Growth & Forecast 2025 to 2035

Biosurgery Equipment Market Size and Share Forecast Outlook 2025 to 2035

Post-Surgery Skin Repair Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Neurosurgery Surgical Power Tools Market Analysis – Growth & Forecast 2022-2032

Electrosurgery Accessories Market Size and Share Forecast Outlook 2025 to 2035

Guided Surgery Kits Market Size, Growth, and Forecast for 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA