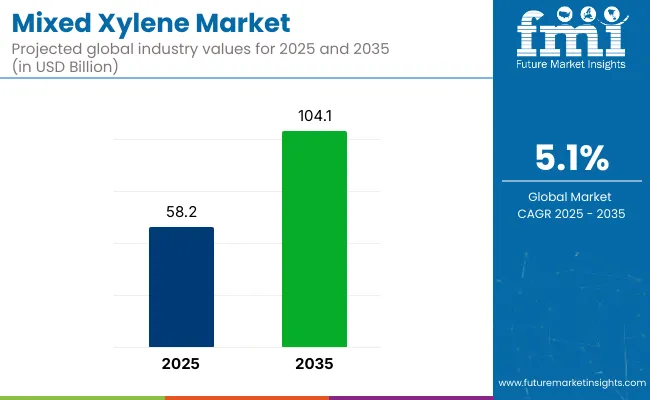

The global mixed xylene market is estimated at USD 58.2 billion in 2025 and is forecast to expand to USD 104.1 billion by 2035, registering a CAGR of 5.1%.

| Attribute | Values |

|---|---|

| Estimated Industry Size (2025E) | USD 58.2 Billion |

| Projected Industry Value (2035F) | USD 104.1 Billion |

| CAGR (2025 to 2035) | 5.1% |

Market growth is driven by rising demand for mixed xylene as a feedstock in the production of ethylbenzene, solvents, and fuel additives. The increasing use of mixed xylene in paints, coatings, and as an octane booster in gasoline is expected to propel consumption across industrial and consumer markets.

This growth is supported by increased consumption across packaging, fuel blending, and industrial solvent sectors. Mixed xylene is a key raw material in the production of para-xylene, which is further used to manufacture polyethylene terephthalate (PET). The demand for PET continues to grow, especially in the food and beverage sector where PET bottles and containers are widely used due to their lightweight, recyclable nature and suitability for packaging.

In construction and automotive industries, mixed xylene-based formulations are used in coatings, sealants, and adhesives. For instance, manufacturers use it in quick-drying paints for vehicle bodies and construction materials.

Its solvency and evaporation characteristics make it suitable for surface coatings that require uniform application. In gasoline blending, mixed xylene is added to enhance fuel octane levels, especially in markets like the United States and Japan, where high-octane fuel is required for performance and emission standards. This role remains relevant as countries implement stricter fuel quality norms.

The market faces challenges linked to feedstock volatility. Mixed xylene is produced through processes involving crude oil and naphtha, and shifts in global oil prices or refining capacity directly affect production costs. In addition, regulatory scrutiny over volatile organic compounds (VOCs), including xylene, has resulted in limitations on usage and emissions in regions like the European Union. Manufacturers are responding with investments in closed-loop recovery systems and low-emission processing methods.

Regionally, Asia continues to dominate demand. China and India have made investments in downstream capacities for purified terephthalic acid (PTA) and polyester, strengthening the role of mixed xylene in the value chain.

In 2023, Reliance Industries expanded para-xylene production in Jamnagar to meet this demand. Similarly, refiners in South Korea are optimizing catalytic reforming units to increase mixed xylene yields, supporting domestic and export markets.

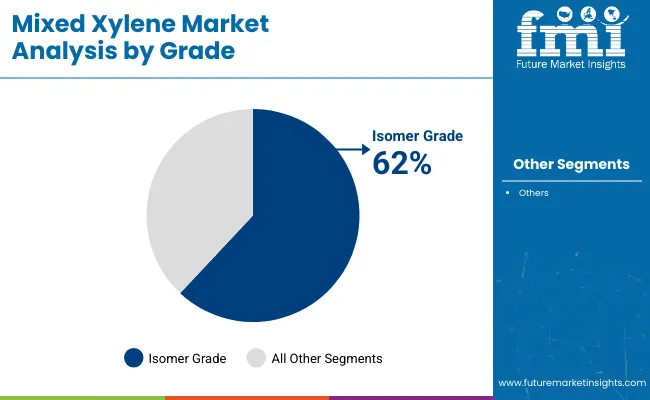

Isomer grade mixed xylene accounted for an estimated 62% of the global market share in 2025, supported by its role in the production of para-xylene, ortho-xylene, and meta-xylene. The CAGR for isomer grade mixed xylene is projected at 4.8% from 2025 to 2035. Among these, para-xylene holds the highest demand due to its use in synthesizing terephthalic acid (TPA) and dimethyl terephthalate (DMT), precursors for polyester manufacturing.

Global consumption is driven by increasing demand for polyester fibers and PET resins in packaging, apparel, and industrial applications. In response, integrated refinery-petrochemical complexes in China, India, and South Korea have increased capacity and are deploying crystallization and adsorption technologies to boost para-xylene yield. Demand for high-purity xylene derivatives in Asia-Pacific continues to shape supply chain decisions. Producers focus on optimizing feedstock quality and investing in technologies to improve product recovery, especially in regions where textile and PET demand remains strong.

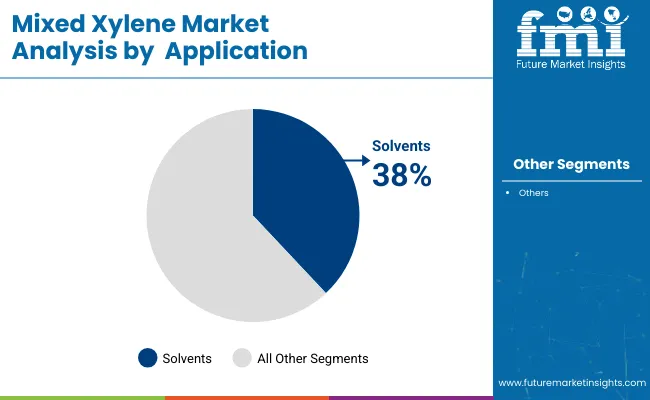

The solvent application segment is estimated to represent around 38% of the global mixed xylene market in 2025 and is projected to grow at a CAGR of approximately 5.6% from 2025 to 2035. Mixed xylene is widely used as a solvent in manufacturing paints, printing inks, adhesives, varnishes, pesticides, and degreasing agents.

It offers desirable solvency for resin systems and rapid evaporation, making it ideal for surface coatings and cleaning formulations. As construction and manufacturing activities increase in the Asia-Pacific region-especially in China, India, and Southeast Asia-demand for solvent-grade xylene continues to rise.

Regulatory constraints on VOCs have led to changes in solvent formulations, yet mixed xylene maintains a significant share due to its functional compatibility. Growth is also supported by the printing and packaging industries, where solvent-based inks remain in use for flexible films and labels. Industrial cleaning applications in automotive, electronics, and machinery maintenance further drive this segment’s expansion.

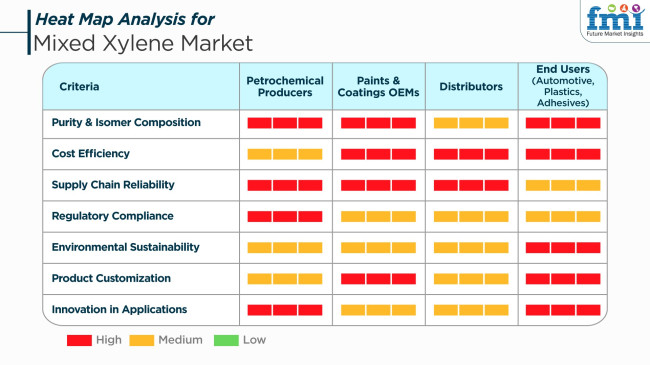

The industry is an essential building block in several industries like petrochemicals, paints and coatings, adhesives, and plastics.

Petrochemical producers target attaining high purity and accurate isomer composition to satisfy the demanding specifications of downstream products. They invest in environmentally friendly manufacturing processes and strive to achieve a secure supply chain to meet increasing worldwide demand.

Distributors highlight cost and supply chain effectiveness to address the requirements of various end-users. They serve a vital purpose to fill the gap between producers and industries needing mixed xylene for diverse uses.

End Users, such as those in automotive, plastics, and adhesives industries, appreciate it for its performance properties and environmental advantages. In the auto industry, it's applied in fuel blending to enhance octane levels; in plastics, it's a raw material used to make polyethylene terephthalate (PET); and in adhesives, it's a solvent to improve product performance.

Stakeholder Priorities

The industry is prone to some threats such as the volatility in raw material costs, especially naphtha. The fall in naphtha prices in 2024 contributed to lower production expenses. This was countered by sluggish demand from downstream industries such as construction and auto, which impacted the stability of the overall industry.

Strict environmental and safety regulations are also huge risks. Blended xylene is classified as a hazardous substance, which upon exposure will result in health problems such as respiratory system irritation and impact on the central nervous system. Compliance with varied regional requirements is therefore a matter of constantly keeping an eye on and adapting, introducing operational intricacies and costs.

Supply chain interruptions, such as transportation disruptions and geopolitical issues, can slow the delivery of raw materials and finished goods. In 2024, international shipping difficulties and port congestions impacted the transportation, causing inventory imbalances and price volatility.

The sector is under threat from increasing competition and technology changes. Companies need to invest in research and development to innovate and add new products to the portfolio on a regular basis. They could lose industry share to quicker-moving rivals if they don't.

Overall, the industry is exposed to the risks of raw material price fluctuation, regulatory issues, supply chain interruption, technological advancements, and industry-specific economic slowdown. Preemptive measures in dealing with these considerations are crucial for maintaining growth and competitiveness in this fast-moving sector.

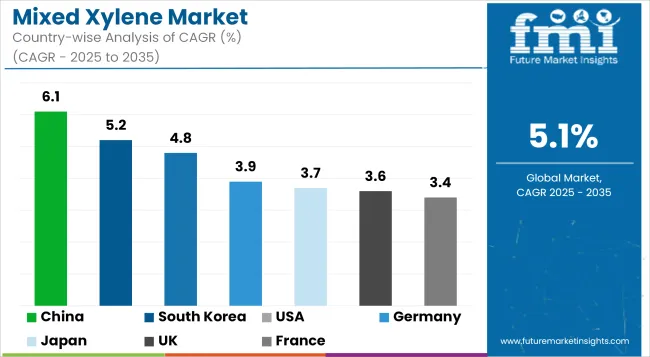

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 4.8% |

| UK | 3.6% |

| France | 3.4% |

| Germany | 3.9% |

| Italy | 3.2% |

| South Korea | 5.2% |

| Japan | 3.7% |

| China | 6.1% |

| Australia | 2.9% |

| New Zealand | 2.5% |

The USA industry is expected to grow at a CAGR of 4.8% over the forecast period, led by increasing demand in the petrochemical and automotive sectors. The strong manufacturing base and growing investments in refinery modernization are expected to continue driving industry momentum. Growth is also aided by the high production capacities of paraxylene and the ongoing incorporation in ethylene and other derivative synthesis.

Leading players like ExxonMobil, Chevron Phillips Chemical and LyondellBasell remain engaged in process improvement and diversification of feedstock, which supports the competitive scenario. Increasing the use of solvents and coatings also supports industry stability. Alignment with environmental regulations towards eco-friendly operations further encourages innovation in production technologies, thus strengthening the long-term scenario.

The UKindustry size is anticipated to register a CAGR of 3.6% from 2025 to 2035. It is supported by moderate growth due to restorative industrial production and increased investments in chemical infrastructure. Shifts towards cleaner fuels and environmentally efficient manufacturing processes will contribute to making it increasingly valuable as an intermediate in specialty chemical synthesis.

Leading players like INEOS and BP are emphasizing the optimization of downstream petrochemical operations to catch up with increasing demand. Strategic imports and alliances throughout Europe complement the domestic supply-demand equilibrium. Policy structures favoring circular chemical economies also enhance demand indirectly for efficient and multifunctional aromatic compounds.

France is also expected to record a CAGR of 3.4% in the industry between 2025 and 2035. Development is driven primarily by relentless innovation in car coatings, combined with growth in the regional petrochemical industry. Strategic focus on low-emission chemical processing and energy efficiency drives continued industry development.

Key players like Total Energies and Arkema are investing in high-performance solvent innovation, directly enhancing the consumption. Demand for derivatives, such as isomers that find applications in high-purity uses, contributes to the growth path. Conformity with EU sustainability objectives further stimulates investment confidence in the chemical division.

Germany's industry is projected to advance at a CAGR of 3.9% until 2035. Robust industry infrastructure, particularly in the automobile and coatings segments, supports industry growth. Demand is supported by the increasing use of mixed xylene in phthalic anhydride production and other downstream chemicals.

Major manufacturers like BASF and Covestro are keenly involved in capacity expansion and next-generation separation technologies. Value-added chemical derivatives and innovation in processing aromatic compounds are key. Supportive industrial policies and investments in green chemistry projects create a favorable ecosystem for long-term industry stability.

The Italian industry is expected to register a CAGR of 3.2% through the forecast period. Demand is driven by moderate manufacturing sector recovery and growing applications in the paint, adhesives, and sealants industries. Emphasis on low-VOC (volatile organic compounds) formulations has contributed positively to mixed xylene usage as a solvent.

Major players like Versalis and Eni are seeking improvements in refining capacity and feedstock flexibility to promote stable supply chains. Cross-border partnerships also drive expansion focused on enhancing regional trade flows of aromatic hydrocarbons. Responsible production practices remain in favor with regulators and the industry.

South Korea is expected to record a CAGR of 5.2% in the industry during the period 2025 to 2035, which is the highest among the developed world. Expansion in the industry is supported by strong petrochemical exports as well as mature refinery infrastructure. Increasing demand for xylene derivatives, particularly polyester production, largely drives growth.

Firms like LG Chem, SK Global Chemical, and Lotte Chemical are investing in capacity increase and R&D efforts to enhance product purity and efficiency in the process. Export-driven production strategies and integration with international value chains strengthen the country's leadership in the industry.

The Japanese industry is forecasted to grow at a CAGR of 3.7% during the forecast period. While the domestic demand remains relatively stable, strategic investments in refining and petrochemical processing technologies support the industry trend. Advanced coatings and packaging industries are still driving consumption.

Industry players such as Mitsubishi Chemical and Idemitsu Kosan sustain competitiveness through innovation and international collaborations. Rising emphasis on high-value isomer separation and green chemical manufacturing drives industry differentiation. Overall, consistent industry production and export buoyancy support industry performance.

China is projected to drive world growth at a CAGR of 6.1% in the industry during 2025 to 2035. Growth is driven by huge infrastructure schemes, increasing demand for paraxylene, and growing polyester production. Huge refinery complexes and integrated petrochemical areas facilitate extensive production.

Industry leaders like Sinopec, CNPC, and Hengli Petrochemical drive the industry with massive investments in technology and capacity. Large operations combined with domestic demand support China's position as a global hub. Forward integration and innovation in feedstock further support the nation's competitive advantage.

Australia's industry is predicted to expand at a CAGR of 2.9% for the forecast period. Industrial growth is moderated, affects industry dynamics, and changes regulation compliance for chemical usage. Imports are critical in satisfying demand, especially in solvent-based applications.

Local distributors and refiners like Viva Energy and Ampol are rationalizing supply chains to supply niche industrial needs. The industry is slowly embracing international best practices in chemical safety and sustainability, which underpins selective growth in specialized uses.

New Zealand is expected to witness a CAGR of 2.5% in the industry during 2025 to 2035. The growth in the industry is modest, mainly influenced by a small-scale industrial economy and minimal domestic production. The dependence on imports for chemical inputs remains the hallmark of supply patterns.

Local demand is mainly focused on construction paints and small-scale manufacturing industries. International standard regulation to encourage the safe use and application of aromatic solvents stimulates continued and improved demand. Even though the industry size is modest, sustained industrial activities trigger stable demand for purified chemical feeds.

The mixed xylene market is undergoing realignment due to evolving downstream demand, regulatory changes, and regional production strategies. Producers are adapting operations to integrate upstream aromatics production with downstream processing, especially in regions where polyester and solvent consumption is increasing.

There is a shift toward optimization of feedstock usage in integrated refinery and petrochemical complexes. This includes adjustments in catalytic reforming and aromatics extraction processes to improve yield and meet specific isomer requirements.

By grade, the industry is segmented into isomer grade and solvent grade,

By application, the industry includes fuel blending, solvents, thinners, and raw materials.

By end-use industries are paints & coatings, pesticides, chemicals, gasoline, and printing, rubber & leather.

Regionally, the industry is divided into North America, Latin America, Europe, Asia Pacific, and the Middle East & Africa.

The industry is estimated to be worth USD 58.2 billion in 2025.

Sales are projected to reach USD 104.1 billion by 2035, fueled by rising demand for petrochemicals and solvents in the automotive and construction industries.

China is expected to see a CAGR of 6.1%.

Isomer grade xylene is leading the industry, owing to its widespread use in the production of terephthalic acid and other petrochemical applications.

Prominent companies include Exxon Mobil Corporation, TOTAL S.A., GS Caltex Corporation, Idemitsu Kosan Co. Ltd., LOTTE Chemical Corporation, Royal Dutch Shell plc, China National Petroleum Corporation, Chevron Phillips Chemical Company LLC, China Petroleum & Chemical Corporation, Flint Hills Resources LLC, YPF Sociedad Anónima, and SK Global Chemical Co. Ltd.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Mixed Reality Navigation Platforms Market Forecast and Outlook 2025 to 2035

Mixed Reality Surgery Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Mixed Signal IC Market Size and Share Forecast Outlook 2025 to 2035

Mixed Acetic and Tartaric Acid Esters of Mono and Diglycerides of Fatty Acids Market

Premixed Cocktail Shots Market Growth - Consumer Trends 2024 to 2034

Pre-mixed/RTD Alcoholic Drink Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Hexylene Glycol Market Trends 2025 to 2035

Ortho-Xylene Market Growth - Trends & Forecast 2025 to 2035

Bio Based Paraxylene Market Size and Share Forecast Outlook 2025 to 2035

5-Isopropyl-m-Xylene Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA