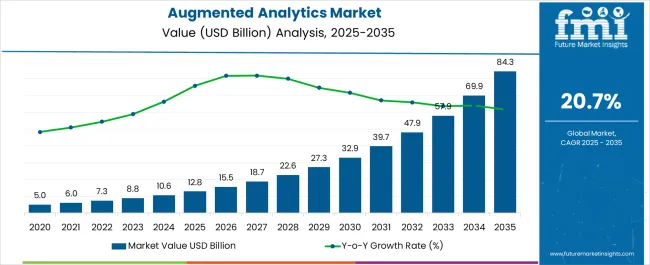

The Augmented Analytics Market is estimated to be valued at USD 12.8 billion in 2025 and is projected to reach USD 84.3 billion by 2035, registering a compound annual growth rate (CAGR) of 20.7% over the forecast period.

| Metric | Value |

|---|---|

| Augmented Analytics Market Estimated Value in (2025 E) | USD 12.8 billion |

| Augmented Analytics Market Forecast Value in (2035 F) | USD 84.3 billion |

| Forecast CAGR (2025 to 2035) | 20.7% |

The augmented analytics market is gaining traction as enterprises increasingly adopt artificial intelligence and machine learning-driven tools to enhance data-driven decision-making. Industry publications and corporate disclosures have emphasized the importance of augmented analytics in enabling organizations to automate data preparation, generate predictive insights, and democratize access to analytics across business units. Rising volumes of structured and unstructured data, coupled with pressure to accelerate digital transformation initiatives, have supported adoption.

Investor briefings from technology providers have also outlined significant investments in developing natural language processing capabilities and self-service analytics platforms, making advanced analytics accessible to non-technical users. Furthermore, regulatory requirements for compliance reporting and risk assessment have encouraged the integration of augmented analytics solutions across regulated industries.

As enterprises seek to improve operational efficiency and gain competitive advantage, the market is expected to expand, with strong momentum in software deployment, large enterprise adoption, and BFSI sector applications.

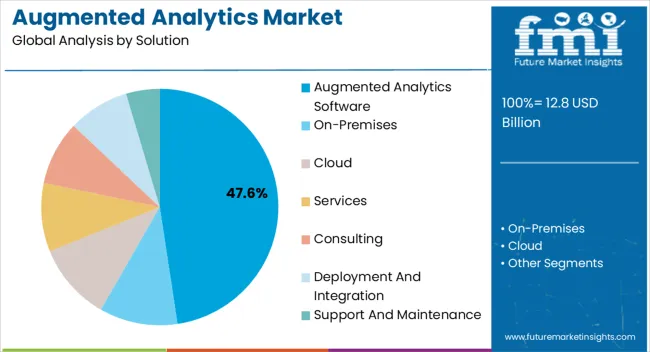

The augmented analytics software segment is projected to account for 47.60% of the market revenue in 2025, underscoring its leadership in the solution category. Growth has been reinforced by enterprises prioritizing software platforms that integrate machine learning algorithms with intuitive dashboards and automated reporting capabilities.

Software providers have consistently introduced enhancements that allow users to generate insights without reliance on complex coding or statistical expertise, broadening user adoption. The segment has also benefitted from subscription-based and cloud-native delivery models, which reduce upfront costs and provide scalability for organizations of all sizes.

Continuous upgrades, integration with existing enterprise systems, and embedded analytics in business applications have sustained the software segment’s leadership. As organizations continue to focus on real-time insights and actionable intelligence, augmented analytics software is expected to remain the cornerstone of market demand.

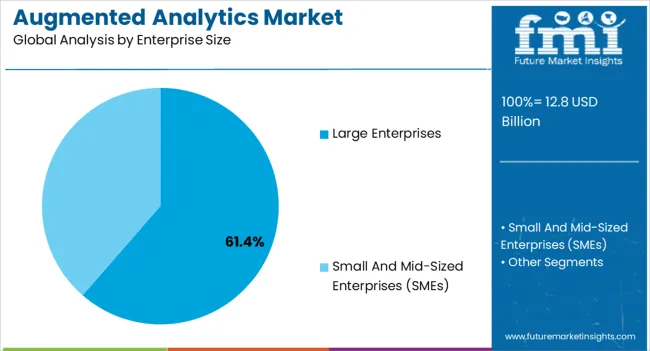

The large enterprises segment is expected to contribute 61.40% of the market revenue in 2025, maintaining its dominance in enterprise size. This leadership has been driven by large organizations’ capacity to invest in advanced analytics infrastructure and their pressing need to manage vast and diverse data sets.

Industry updates and annual reports have noted that large enterprises are at the forefront of digital transformation, deploying augmented analytics to optimize processes, improve customer experience, and enhance strategic planning. Their greater IT budgets and established data governance frameworks have facilitated rapid adoption compared to smaller organizations.

Additionally, large enterprises often operate across multiple geographies and industries, requiring scalable solutions capable of handling complex data ecosystems. With growing emphasis on predictive modeling, regulatory compliance, and competitive differentiation, large enterprises are projected to sustain their role as the primary adopters of augmented analytics solutions.

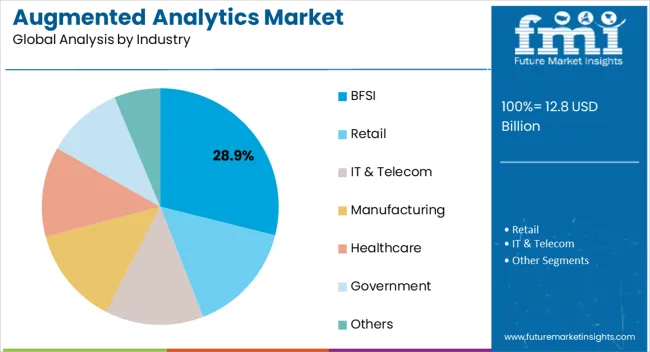

The BFSI segment is projected to account for 28.90% of the augmented analytics market revenue in 2025, leading the industry verticals in adoption. Growth in this segment has been supported by the sector’s reliance on data for risk assessment, fraud detection, regulatory compliance, and customer analytics.

Financial institutions have increasingly deployed augmented analytics to enhance decision-making accuracy and to streamline operations in areas such as credit scoring and portfolio management. Annual filings and industry analyses have highlighted that BFSI organizations value augmented analytics for its ability to automate reporting processes and ensure compliance with evolving regulatory standards.

Furthermore, customer-facing applications such as personalized banking services and targeted financial products have benefitted from AI-driven analytics. As financial institutions continue to contend with digital disruption and heightened competition from fintech firms, the BFSI segment is expected to remain a significant driver of augmented analytics adoption, reinforcing its market-leading position.

The augmented analytics market recorded a 19% CAGR between 2020 and 2025. The global demand for augmented analytics is expected to expand at a moderate CAGR of 21.8% over the forecast period 2025 to 2035.

With machine learning and natural language processing in combination with augmented analytics, business users and operational workers can automate data preparation. Platform capabilities are being incorporated into augmented analytics by data professionals.

A number of industries are embracing augmented analytics to address industry-specific challenges and opportunities, including finance, healthcare, retail, and manufacturing. In 2025, retailers will be able to solve customer problems, optimize their operations, and drive growth with advanced business intelligence and augmented analytics.

| Historical CAGR from 2020 to 2025 | 19% |

|---|---|

| Forecast CAGR from 2025 to 2035 | 21.8% |

As organizations realize the potential of augmented analytics to democratize data analysis, it is likely to become more mainstream. As companies gain insights from their data, augmented analytics tools will be adopted by more small and medium-sized enterprises.

As augmented analytics becomes more integrated with other emerging technologies such as natural language processing (NLP), artificial intelligence (AI), and the IoT (Internet of Things), it will become even more powerful. Data sources and types will be more diverse and can be analyzed more easily.

The below table showcases revenues in terms of the top 5 leading countries, spearheaded by Germany and India. These two countries are expected to lead the market through 2035, with sizes of USD 174 million and USD 160 billion.

Expected Market Values in 2035

| Germany | USD 84.3 million |

|---|---|

| India | USD 160 million |

| United States | USD 258 million |

| China | USD 195 million |

| United Kingdom | USD 178 million |

Forecast CAGRs from 2025 to 2035

| Germany | 7.6% |

|---|---|

| India | 6.5% |

| United States | 16.5% |

| China | 9.6% |

| United Kingdom | 9.9% |

Among the markets for augmented analytics, Germany offers the highest returns. According to augmented analytics market reports Germany is expected to reach USD 84.3 million by 2035, growing at a CAGR of 7.6%. Augmented analytics will likely be most prevalent in industries like automotive and finance.

As organizations become more adept at using these tools, they are gaining more insight into their data. A growing investment in business intelligence and data analytics that include augmented analytics to grow the market.

Increasing privacy concerns and regulatory frameworks are driving companies to develop augmented analytics solutions in order to be compliant with GDPR and other privacy laws.

Several initiatives led by the German government to promote data analytics, artificial intelligence, and digital transformation contributed to the growth of augmented analytics in Germany. Funding, incentives, and resources are often provided by these initiatives with the aim of enhancing the adoption of advanced analytics. In addition to these factors, the market will continue to grow in the future.

The augmented analytics market in India is expected to reach USD 160 million by 2035. A CAGR of 6.5% is predicted for the market over the next ten years. Many industries in India generated significant amounts of data, including e-commerce, healthcare, finance, and telecommunications. Digital transformation initiatives are being undertaken by many businesses in order to stay competitive in the global market.

Customer behavior analysis has become crucial to businesses due to the rise of e-commerce and digital platforms. Companies are enhancing customer experiences and better understand their customers' preferences through augmented analytics. Increasing internet use and Industry 4.0 growth are expected to expand the market.

Augmented analytics is set to grow at a rapid pace in China, reaching USD 195 million by 2035. The region is expected to register a 9.6% CAGR from 2025 to 2035. China has experienced a tremendous growth in data generation.

Data analytics is one of the key features of the Chinese government's "Made in China 2025" initiative, which promotes the adoption of new technologies. Analytics solutions were made more affordable by this support.

China has one of the world's largest and most dynamic e-commerce sectors. Data-driven decisions were made and companies in this sector using augmented analytics optimized operations. Precision medicine and healthcare data analytics were important innovations in China's healthcare sector. Healthcare management, drug discovery, and patient care were improved by augmented analytics.

Fintech and data-driven approaches were being adopted in China's financial sector for fraud detection, risk assessment, and customer service. A new generation of augmented analytics offers financial institutions more insights into consumer behavior.

A growing number of companies are researching and developing artificial intelligence (AI) and machine learning in China. Data privacy and security have become increasingly important as data usage has increased. To gain a competitive edge in domestic and global markets, Chinese businesses have adopted data analytics and augmented analytics.

Increasing research and development activities in the market, as well as cloud adoption, are expected to support growth in demand for augmented analytics. As cloud adoption and solutions continue to increase, the market will thrive. A 16.5% CAGR is predicted for the region between 2025 and 2035. By the end of this forecast period, the United States augmented analytics is likely to total USD 258 million.

Software and services that offer augmented analytics are gaining popularity due to modern infrastructure, an expanding funding market, and diverse customer bases. The United States market is expected to witness rapid growth in the next few years. Business in the United States is shifting toward data-driven business, which will increase market growth.

The augmented analytics market in the United Kingdom is predicted to expand at a CAGR of 9.9% from 2025 to 2035. The business is expected to be valued at USD 178 million by the end of the forecast period.

Augmented analytics research has been widely implemented in the United Kingdom, and the country has a thriving AI and analytics ecosystem as well. Both startups and established companies developed innovative solutions in response to the growing need for data-driven insights.

Because the United Kingdom is home to a variety of small and large businesses, augmented analytics is expected to grow in demand. There was also a significant role played by the broader digital transformation trend. For improved decision-making, customer engagement, and operational efficiency, organizations have turned to augmented analytics as they seek to modernize their operations.

As depicted in the table below, augmented analytics software is projected to lead the market in terms of solutions, accumulating a 62.2% share in 2025. The large enterprise segment is likely to accumulate a revenue share of 67.4% through 2025.

| Category | Market Share in 2025 |

|---|---|

| Augmented Analytics Software | 62.2% |

| Large Enterprises | 67.4% |

Based on the solution, the augmented analytics software segment is expected to continue dominating the augmented analytics industry. A market share of 62.2% is expected in 2025.

Traditional data analysis methods were becoming inadequate as organizations generated more, more varied, and faster data. Business users benefit from augmented analytics software by automating a great deal of data processing in the market.

Organizations can access and analyze data using augmented analytics, which is empowering for non-technical users. As the use of data analytics becomes more democratized, there will be a greater need for user-friendly tools.

Making better decisions is facilitated by being able to generate insights rapidly and accurately from data. A heightened understanding of analytics is enabling businesses to gain a competitive edge through augmented analytics. Data professionals and business users can save time by automating data preparation and analysis tasks. With organizations seeking to make faster decisions, this efficiency becomes more important.

Integrated analytics software with seamless integration with existing tools and systems, such as analytics systems and data warehouses, is highly sought after. Investing in technology is a key part of a business's strategy.

By enterprise size, large enterprises are expected to emerge as a prominent segment. A revenue share of 67.4% is projected in 2025. Over the past few years, the demand for the augmented analytics market has increased in popularity in large-scale industries. Market research indicates that large enterprises are highly interested in augmented analytics.

These organizations are increasingly turning to augmented analytics to analyze and make decisions, offering a revolution in decision-making. Massive volumes of data are generated by large enterprises from a variety of sources. Augmented analytics tools that automate data preparation, cleansing, and integration processes can handle this complexity.

As a result, organizations are able to gain insights more easily and efficiently. Self-service analytics capabilities are enabled by augmented analytics for business users.

Data analysis can be democratized across departments since it does not require deep technical expertise, which reduces the need for data specialists within large corporations. The ability to analyze data in real-time or near-real-time can help large enterprises react quickly to changes in the market, customer preferences, or operational challenges.

New products and services from leading vendors in emerging markets are addressing new needs and upgrading technology in augmented analytics. As top players in the augmented analytics industry seek competitive advantage, they are forming partnerships, acquiring companies, and expanding their operations.

| Attributes | Details |

|---|---|

| Estimated Market Size in 2025 | USD 12.8 billion |

| Projected Market Valuation in 2035 | USD 84.3 billion |

| Value-based CAGR 2025 to 2035 | 20.7% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | Value in USD billion |

| Key Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; The Middle East & Africa |

| Key Market Segments Covered | Solution, Enterprise Size, Industry |

| Key Countries Profiled | The United States, Canada, Brazil, Mexico, The United States, Canada, Brazil, Mexico, Germany, The United Kingdom, France, Spain, Italy, Russia, Poland, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC countries, South Africa, Israel |

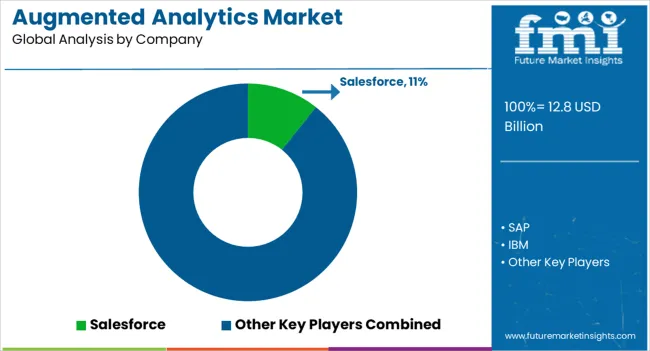

| Key Companies Profiled | Salesforce; SAP; IBM; Microsoft; Oracle; Softengi; MicroStrategy; SAS; Qlik; TIBCO Software; Sisense; Pyramid Analytics; Yellowfin; ThoughtSpot; Domo |

The global augmented analytics market is estimated to be valued at USD 12.8 billion in 2025.

The market size for the augmented analytics market is projected to reach USD 84.3 billion by 2035.

The augmented analytics market is expected to grow at a 20.7% CAGR between 2025 and 2035.

The key product types in augmented analytics market are augmented analytics software, on-premises, cloud, services, consulting, deployment and integration and support and maintenance.

In terms of enterprise size, large enterprises segment to command 61.4% share in the augmented analytics market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Augmented Reality (AR) Shopping Market Size and Share Forecast Outlook 2025 to 2035

Analytics Of Things Market Size and Share Forecast Outlook 2025 to 2035

Augmented Reality Glasses Market Size and Share Forecast Outlook 2025 to 2035

Augmented Reality Market Size and Share Forecast Outlook 2025 to 2035

Augmented and Virtual Reality in Education Market - Growth & Forecast 2025 to 2035

Analytics as a Service (AaaS) Market - Growth & Forecast 2025 to 2035

Analytics Sandbox Market

Augmented Reality for Retail Market

Augmented Learning Market

AR & VR Market Trends – Growth & Forecast 2017-2025

Ad Analytics Market Growth - Trends & Forecast 2025 to 2035

HR Analytics Market

AI-Powered Analytics – Transforming Business Intelligence

NFT Analytics Tools Market Size and Share Forecast Outlook 2025 to 2035

App Analytics Market Trends – Growth & Industry Forecast 2023-2033

Dark Analytics Market Size and Share Forecast Outlook 2025 to 2035

Text Analytics Market Size and Share Forecast Outlook 2025 to 2035

Cloud Analytics Market Size and Share Forecast Outlook 2025 to 2035

Drone Analytics Market Size and Share Forecast Outlook 2025 to 2035

Video Analytics Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA