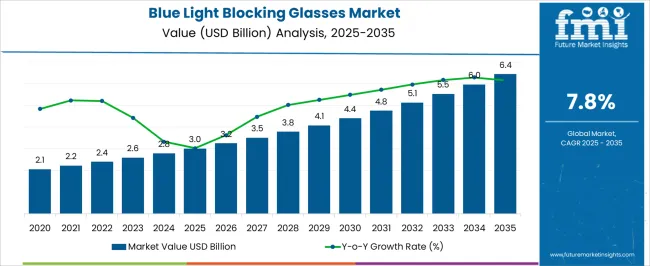

The Blue Light Blocking Glasses Market is estimated to be valued at USD 3.0 billion in 2025 and is projected to reach USD 6.4 billion by 2035, registering a compound annual growth rate (CAGR) of 7.8% over the forecast period.

| Metric | Value |

|---|---|

| Blue Light Blocking Glasses Market Estimated Value in (2025 E) | USD 3.0 billion |

| Blue Light Blocking Glasses Market Forecast Value in (2035 F) | USD 6.4 billion |

| Forecast CAGR (2025 to 2035) | 7.8% |

The blue light blocking glasses market is expanding steadily, shaped by rising digital screen exposure and growing awareness of ocular health. Industry announcements and optometry reports have underlined the increasing concern about digital eye strain and its link to prolonged use of smartphones, laptops, and other devices. Employers and institutions have begun emphasizing preventive eye care, further driving demand for protective eyewear.

Advancements in lens coatings and frame design have improved comfort and aesthetics, encouraging broader adoption across both prescription and non-prescription categories. Press releases from eyewear companies have highlighted strategic product launches with anti-glare and scratch-resistant features, enhancing value propositions for consumers.

The market outlook is also supported by growth in online eyewear retail channels, which have expanded access and affordability. Looking forward, demand is expected to rise with greater digitalization of workplaces and education systems, as well as increasing consumer focus on preventive healthcare. Segmental momentum is anticipated to be led by Prescription Glasses, Clear Lenses, and Computer Users due to their practicality, accessibility, and direct response to modern screen-intensive lifestyles.

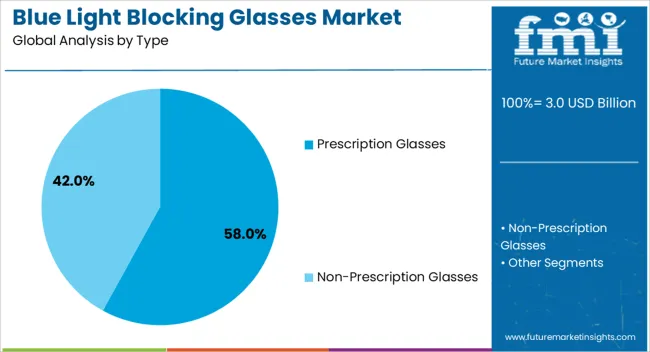

The Prescription Glasses segment is projected to hold 58.0% of the blue light blocking glasses market revenue in 2025, making it the leading type category. Growth of this segment has been driven by the integration of blue light protection into corrective eyewear, which allows consumers to address vision correction and digital eye protection simultaneously.

Optometry associations have reported a rising prevalence of myopia and other vision issues due to prolonged screen exposure, strengthening demand for prescription solutions. Eye care professionals have increasingly recommended prescription glasses with blue light blocking coatings as a preventive measure, reinforcing consumer trust in this segment.

Furthermore, prescription-based eyewear offers opportunities for customization in terms of lens power, coatings, and frame design, making it a practical and versatile choice for diverse demographics. With increasing consumer emphasis on long-term eye health, the Prescription Glasses segment is expected to maintain its leadership position.

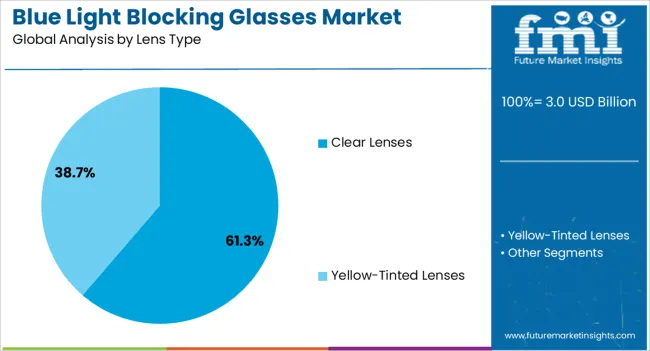

The Clear Lenses segment is projected to contribute 61.3% of the blue light blocking glasses market revenue in 2025, maintaining its dominance in lens type preference. This segment’s strength has been influenced by consumer demand for all-day wearability without noticeable lens tint, making clear lenses more appealing for professional and casual settings.

Advancements in lens coating technologies have enabled high transmission of natural light while effectively filtering harmful blue light wavelengths, providing both comfort and functionality. Clear lenses have gained wider acceptance among office workers and students, as they do not alter color perception or aesthetics.

Additionally, eyewear companies have promoted clear lens products in their marketing campaigns, emphasizing convenience and versatility. With continuous innovations in coating durability and scratch resistance, the Clear Lenses segment is expected to remain the preferred choice among consumers prioritizing both eye health and visual clarity.

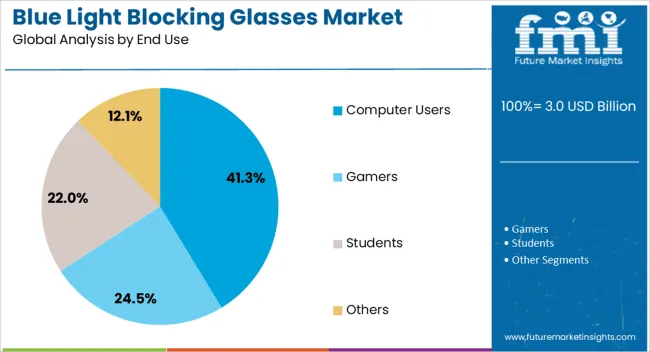

The Computer Users segment is projected to account for 41.3% of the blue light blocking glasses market revenue in 2025, securing its position as the leading end-use category. The segment’s growth has been propelled by the surge in screen time associated with remote work, online education, and entertainment consumption.

Workplace wellness initiatives have underscored the importance of protective eyewear for employees spending extended hours at computer terminals, boosting adoption. Consumer health surveys have highlighted growing awareness of symptoms such as headaches, eye fatigue, and disrupted sleep patterns linked to blue light exposure, particularly among frequent computer users.

Employers and educational institutions have supported wider distribution of protective eyewear to mitigate productivity loss and improve comfort. As hybrid work and digital learning models continue to expand globally, the Computer Users segment is expected to sustain its leadership role, reinforced by the necessity of visual comfort in daily digital interactions.

Historically, the blue light blocking glasses market growth was occurring at a moderate CAGR of 7.3%. Due to this advancement rate, the blue light blocking glasses market size inflated from USD 2.1 billion to USD 2.6 billion from 2020 to 2025.

The rising prevalence of consumers’ complaints of irregular sleep schedules, eye strain, etc., pointed toward the side effects of digital rays. Due to this, medical professionals started recommending protective eyewear, fueling the blue light blocking glasses market growth.

| Historical CAGR from 2020 to 2025 | 7.3% |

|---|---|

| Forecast CAGR from 2025 to 2035 | 7.9% |

The growing technological infrastructure will assist leading blue light blocking glasses manufacturers in innovating and expanding the market reach. Due to this, consumer demand will surge, enhancing the blue light blocking glasses market size.

The growing demand for customizable products will likely benefit the market as products can be manufactured based on consumer requirements. The growing premium product segment will also govern the market growth.

Technological advancements will likely assist leading blue light blocking glasses manufacturers in North America to innovate and expand. Due to this, the region will likely lead the global market.

The changing fashion trends in Europe will likely govern the blue light blocking glasses market growth. Also, a vast competitive landscape will be created due to changing consumer fashion trends.

Countries in the Asia-Pacific region focus on local development, creating several opportunities for the regional players. They actively participate in the expansion of the market, fueling the blue light blocking glasses market size enlargement.

Forecast CAGRs from 2025 to 2035

| Countries | Forecasted CAGR |

|---|---|

| Spain | 5.7% |

| Canada | 8.9% |

| Japan | 9.1% |

| China | 9.3% |

| India | 9.9% |

The blue light blocking glasses market size in Spain will increase at a decent 5.7% CAGR through 2035. Consumer trends in Spain are rapidly changing, shifting toward upgradation and integration of different trend styles.

Spanish consumers prefer a bold look with thick frames. Such trends help leading blue light blocking glasses manufacturers integrate the relevant technology in these frames easily, attracting consumers. Blue light blocking glasses are considered emerging fashion icons in the eyewear market, fueling the market demand.

The Canadian blue light blocking glasses market growth will be occurring at 8.9% through 2035. The corporate culture in Canada has started to shift to hybrid working modes or completely remote working modes.

Due to this, consumers are required to spend more time on digital instruments, exposing themselves to digital screens more. This generates more demand for protective eyewear, driving the market.

Technological advancements in Japan are augmenting the eyewear industry. The recent developments indicate toward changing landscape of the sector due to the developments in lens technology.

Leading blue light blocking glasses manufacturers produce recyclable lenses that will augment the industry, driving the product demand. Due to these factors, the Japanese blue light blocking glasses market size will be increasing at a promising CAGR of 9.1%.

The growing e-commerce network in the country assists in the distribution and contact touchpoints for customers. A strong bridge between manufacturers and customers can be established through this.

Also, consumers get more product choices, which fuels the market progress at a rising rate. Furthermore, the dominance of the D2C network in the country enhances the brand image through elevated customer service. Thus, the Chinese blue light blocking glasses market growth will accelerate at 9.3%.

The Indian blue light blocking glasses market size will increase the fastest, at the highest CAGR of 9.9% through 2035. The Indian government has designed regulatory policies to maintain employee wellness.

Employers are encouraged to prevail over all the protective measures for employees. Blue light blocking glasses are an integral part of any workplace. So, this drives the market. Also, the growing smartphone market in the country will surge the demand for blue light blocking glasses, fueling the market advancement.

The blue light blocking glasses market growth is governed by the prescription type and computer user segments. Digital transformation and the growing prevalence of health disorders are two major drivers for these two segments.

| Category | Type (Prescription) |

|---|---|

| Market Share in 2025 | 58.00% |

| Market Segment Drivers |

|

| Category | End Use (Computer Users) |

|---|---|

| Market Share in 2025 | 41.30% |

| Market Segment Drivers |

|

Leading blue light blocking glasses manufacturers find a market niche through their innovation. A substantial market share is occupied using different modes of expansion, which avails a competitive edge to them. The highly cluttered competitive space is expanded using partnerships, collaborations, acquisitions, mergers, and international expansions.

New entrants possess significantly lesser negotiating power due to their lesser market occupancy. However, they can expand using innovation as a key market penetration mode. They can also form strategic alliances with key competitors. This ecosystem creates growth prospects, fueling the blue light blocking glasses market size.

Key Market Developments

| Attributes | Details |

|---|---|

| Estimated Market Size in 2025 | USD 3.0 billion |

| Projected Market Valuation in 2035 | USD 6.4 billion |

| Value-based CAGR 2025 to 2035 | 7.8% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | Value in USD billion |

| Key Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; The Middle East and Africa |

| Key Market Segments Covered | Type, Lens Type, End Use, Consumer Orientation, Sales Channel, Region |

| Key Countries Profiled | The United States, Canada, Brazil, Mexico, Germany, The United Kingdom, France, Spain, Italy, Poland, Russia, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC Countries, South Africa, Israel |

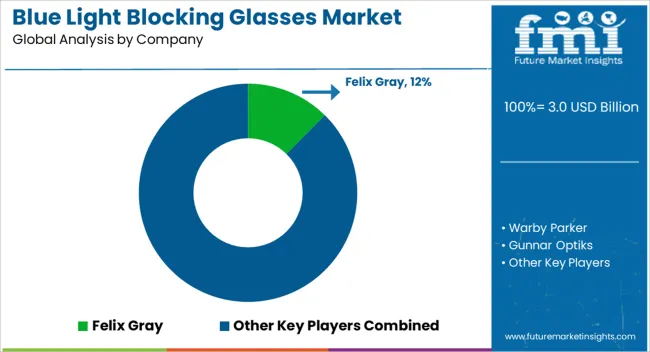

| Key Companies Profiled | Felix Gray; Warby Parker; Gunnar Optiks; EyeBuyDirect; Pixel Eyewear; Zenni Optical; Swanwick Sleep; Spectra479; Prospek; Baxter Blue; Quay Australia; TIJN Eyewear; Swanwick; Blue Planet Eyewear; Cyxus |

The global blue light blocking glasses market is estimated to be valued at USD 3.0 billion in 2025.

The market size for the blue light blocking glasses market is projected to reach USD 6.4 billion by 2035.

The blue light blocking glasses market is expected to grow at a 7.8% CAGR between 2025 and 2035.

The key product types in blue light blocking glasses market are prescription glasses and non-prescription glasses.

In terms of lens type, clear lenses segment to command 61.3% share in the blue light blocking glasses market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Analyzing Blue Light Blocking Glasses Market Share & Industry Leaders

Blue Light Protection Ingredient Market Size and Share Forecast Outlook 2025 to 2035

Blue Light Protection Skincare Market Size and Share Forecast Outlook 2025 to 2035

Competitive Landscape of Blue Light Protection Ingredient Providers

Light Pipe Mould Market Size and Share Forecast Outlook 2025 to 2035

Lightning Surge Protector Market Size and Share Forecast Outlook 2025 to 2035

Light Therapy Market Forecast and Outlook 2025 to 2035

Light Rail Traction Converter Market Size and Share Forecast Outlook 2025 to 2035

Light Management System Market Size and Share Forecast Outlook 2025 to 2035

Lightweight Corrugator Modules Market Size and Share Forecast Outlook 2025 to 2035

Lightening and Whitening Creams Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Lightweight Automotive Body Panels Market Size and Share Forecast Outlook 2025 to 2035

Lightening / Whitening Agents Market Size and Share Forecast Outlook 2025 to 2035

Blue Ceramic Abrasive Market Size and Share Forecast Outlook 2025 to 2035

Light Control Switch Market Size and Share Forecast Outlook 2025 to 2035

Lightweight Handheld Cordless Vacuum Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Light Setting Spray Market Size and Share Forecast Outlook 2025 to 2035

Light-Activated Anti-Pollution Skincare Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Lighting As A Service Market Size and Share Forecast Outlook 2025 to 2035

Light Duty Truck Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA